|

|

【FINTEC 0150 交流专区】(前名 ASIABIO)

[复制链接]

[复制链接]

|

|

|

发表于 15-11-2017 07:44 PM

|

显示全部楼层

发表于 15-11-2017 07:44 PM

|

显示全部楼层

本帖最后由 icy97 于 16-11-2017 04:17 AM 编辑

| 0150 ASIABIO ASIA BIOENERGY TECH BHD | | Quarterly Rpt for the Financial Period Ended 30/06/2017 (Amended) | | Quarter: | 1st Quarter | | Financial Year End: | 31/03/2018 | | Report Status: | Unaudited | | Submitted By: |

|

| | | Current Year Quarter | Preceding Year Corresponding Quarter | Current Year to Date | Preceding Year Corresponding Period | | | 30/06/2017 | 30/06/2016 | 30/06/2017 | 30/06/2016 | | | RM '000 | RM '000 | RM '000 | RM '000 | | 1 | Revenue | 1,909 | 1,507 | 1,909 | 1,507 | | 2 | Profit/Loss Before Tax | 39,073 | (7,689) | 39,073 | (7,689) | | 3 | Profit/(loss) attributable to ordinary equity holders of the parent | 39,088 | (7,683) | 39,088 | (7,683) | | 4 | Net Profit/Loss For The Period | 39,073 | (7,689) | 39,073 | (7,689) | | 5 | Basic Earnings/Loss Per Shares (sen) | 10.09 | (0.86) | 10.09 | (0.86) | | 6 | Dividend Per Share (sen) | 0.00 | 0.00 | 0.00 | 0.00 | | | | | As At End of Current Quarter | As At Preceding Financial Year End | | 7 | Net Assets Per Share (RM) | | | 0.2422 | 0.0476 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 14-12-2017 04:29 AM

|

显示全部楼层

发表于 14-12-2017 04:29 AM

|

显示全部楼层

Type | Announcement | Subject | NEW ISSUE OF SECURITIES (CHAPTER 6 OF LISTING REQUIREMENTS)

FUND RAISING | Description | RIGHTS ISSUE OF ICPS WITH WARRANTS | (For consistency purposes, the abbreviations and definitions used throughout this announcement shall have the same meanings as those previously defined in the Abridged Prospectus of the Company dated 2 November 2017 in relation to the Rights Issue of ICPS with Warrants.)

We refer to the Abridged Prospectus dated 2 November 2017.

On behalf of the Board, Mercury Securities wishes to announce that pursuant to the close of acceptance, excess applications and payment for the ICPS with Warrants B at 5.00 p.m. on 24 November 2017, the Company had received valid acceptances and excess applications for a total of 899,284,472 ICPS, representing 99.85% subscription of the total number of ICPS available for subscription under the Rights Issue of ICPS with Warrants.

Details of such valid acceptances and excess applications received are as follows:- | No. of ICPS | % of total ICPS available for subscription | | Total valid acceptances | 461,874,636 | 51.28 | | Total valid excess applications | 437,409,836 | 48.57 | | Total valid acceptances and excess applications | 899,284,472 | 99.85 | | Total ICPS available for subscription | 900,617,550 | 100.00 | | Remaining ICPS not subscribed for | 1,333,078 | 0.15 |

Successful applicants of the ICPS will be given Warrants B on the basis of 1 Warrant B for every 10 ICPS successfully subscribed for.

The ICPS and Warrants B are expected to be listed on the ACE Market of Bursa Securities on 11 December 2017.

This announcement is dated 4 December 2017. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 15-12-2017 07:46 AM

|

显示全部楼层

发表于 15-12-2017 07:46 AM

|

显示全部楼层

Profile for Securities of PLC| ASIA BIOENERGY TECHNOLOGIES BERHAD |

Instrument Category | Securities of PLC | Instrument Type | Preference Shares | Description | ISSUANCE OF 899,284,472 NEW IRREDEEMABLE CONVERTIBLE PREFERENCE SHARES IN FINTEC GLOBAL BERHAD (FORMERLY KNOWN AS ASIA BIOENERGY TECHNOLOGIES BERHAD) ("FINTEC") ("ICPS") PURSUANT TO THE RENOUNCEABLE RIGHTS ISSUE OF UP TO 1,163,208,800 ICPS AT AN ISSUE PRICE OF RM0.08 PER ICPS TOGETHER WITH UP TO 116,320,880 FREE DETACHABLE WARRANTS IN FINTEC ("WARRANTS B") ON THE BASIS OF 10 ICPS TOGETHER WITH 1 FREE WARRANT B FOR EVERY 5 EXISTING ORDINARY SHARES HELD BY THE ENTITLED SHAREHOLDERS OF FINTEC AT 5.00 P.M. ON 2 NOVEMBER 2017 |

Listing Date | 11 Dec 2017 | Issue Date | 05 Dec 2017 | Issue/ Ask Price | Malaysian Ringgit (MYR) 0.0800 | Issue Size Indicator | Unit | Issue Size in Unit | 899,284,472 | Maturity | Mandatory | Maturity Date | 04 Dec 2027 | Revised Maturity Date |

| | Name of Guarantor | Not Applicable | Name of Trustee | Not Applicable | Coupon/Profit/Interest/Payment Rate | Not Applicable | Coupon/Profit/Interest/Payment Frequency | Not Applicable | Redemption | Not Applicable | Exercise/Conversion Period | 10.00 Year(s) | Revised Exercise/Conversion Period | Not Applicable | Exercise/Strike/Conversion Price | Malaysian Ringgit (MYR) 0.1600 | Revised Exercise/Strike/Conversion Price | Not Applicable | Exercise/Conversion Ratio | 2:1 | Revised Exercise/Conversion Ratio | Not Applicable | Mode of satisfaction of Exercise/ Conversion price | Tendering of securities | Settlement Type/ Convertible into | Physical (Shares) |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 15-12-2017 07:47 AM

|

显示全部楼层

发表于 15-12-2017 07:47 AM

|

显示全部楼层

Profile for Securities of PLC| ASIA BIOENERGY TECHNOLOGIES BERHAD |

Instrument Category | Securities of PLC | Instrument Type | Warrants | Description | ISSUANCE OF 89,928,341 FREE DETACHABLE WARRANTS IN FINTEC GLOBAL BERHAD (FORMERLY KNOWN AS ASIA BIOENERGY TECHNOLOGIES BERHAD) ("FINTEC") ("WARRANTS B") ISSUED PURSUANT TO THE RENOUNCEABLE RIGHTS ISSUE OF UP TO 1,163,208,800 NEW IRREDEEMABLE CONVERTIBLE PREFERENCE SHARES IN FINTEC ("ICPS") AT AN ISSUE PRICE OF RM0.08 PER ICPS TOGETHER WITH UP TO 116,320,880 FREE DETACHABLE WARRANTS B ON THE BASIS OF 10 ICPS TOGETHER WITH 1 FREE WARRANT B FOR EVERY 5 EXISTING ORDINARY SHARES HELD BY THE ENTITLED SHAREHOLDERS OF FINTEC AT 5.00 P.M. ON 2 NOVEMBER 2017 |

Listing Date | 11 Dec 2017 | Issue Date | 05 Dec 2017 | Issue/ Ask Price | Not Applicable | Issue Size Indicator | Unit | Issue Size in Unit | 89,928,341 | Maturity | Mandatory | Maturity Date | 04 Dec 2022 | Revised Maturity Date |

| | Name of Guarantor | Not Applicable | Name of Trustee | Not Applicable | Coupon/Profit/Interest/Payment Rate | Not Applicable | Coupon/Profit/Interest/Payment Frequency | Not Applicable | Redemption | Not Applicable | Exercise/Conversion Period | 5.00 Year(s) | Revised Exercise/Conversion Period | Not Applicable | Exercise/Strike/Conversion Price | Malaysian Ringgit (MYR) 0.1500 | Revised Exercise/Strike/Conversion Price | Not Applicable | Exercise/Conversion Ratio | 1:1 | Revised Exercise/Conversion Ratio | Not Applicable | Mode of satisfaction of Exercise/ Conversion price | Cash | Settlement Type/ Convertible into | Physical (Shares) |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 19-12-2017 03:30 AM

|

显示全部楼层

发表于 19-12-2017 03:30 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | FINTEC GLOBAL BERHAD (Formerly known as Asia Bioenergy Technologies Berhad ("FINTEC" or "the Company")- Clarification on the Article appeared in FocusM, Page 18, Week 9-15 December 2017 entitled "AsiaBios investments bearing fruit" ["Article in FocusM"] | With reference to the Article in FocusM entitled “AsiaBio’s investments bearing fruit”, the Board of Directors of FINTEC wishes to clarify the following:-

i) 8th paragraph in the Article in FocusM – “The parties are expected to enter into a partnership by year-end, says Tan. “We will go into a 50:50 partnership and set up three outlets.” Mr Steve Tan Sik Eek’s statement was referring to the Share Subscription Agreement between NetX Holdings Berhad (“NetX”) and Flavors of Malaysia (“FoM”), which was announced to Bursa Malaysia Securities Berhad (“Bursa Securities”) by NetX on 25 May 2017, where NetX would subscribe equivalent to 51% of the issued and paid-up capital of FoM. The statement was not referring to the Memorandum of Understanding entered between Asiabio Capital Sdn. Bhd., Hong Kong YRZC International Group Co, Ltd, Shan Xi Hong Hui Food Limited Liability Company, and Shan Dong Wang Jia Yuan Zi Halal Food Brewing Co, Ltd. where the business opportunities are still being developed as announced by the Company on 15 November 2017.

ii) 10th paragraph in the Article in FocusM (F&B Lifestyle Hub) – “The Company has set aside around RM60mil for the development of The Arch, a food and beverage (“F&B”) and lifestyle hub located on Jalan Tun Razak, adjacent to TREC Kuala Lumpur. Construction will begin early next year.” Mr Edward Leung Kok Keong’s statement was referring to Focus Dynamics Group Berhad (“Focus”)’s Circular to Shareholders dated 16 August 2017, page 22, where Focus has budgeted a funding requirement of RM60 million for the construction of The Arch.

This announcement is dated 11 December 2017. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 20-12-2017 01:32 AM

|

显示全部楼层

发表于 20-12-2017 01:32 AM

|

显示全部楼层

| ASIA BIOENERGY TECHNOLOGIES BERHAD |

Kindly be advised that the aforesaid Company has changed its name to "FINTEC GLOBAL BERHAD”. As such, the Company's securities will be traded and quoted under the new name with effect from 9.00 a.m., Tuesday, 19 December 2017.

The Stock Short Names will be changed as follow:- Old Name | Old Stock Short Name | New Name | New Stock Short Name | ASIA BIOENERGY TECHNOLOGIES BERHAD | ASIABIO | FINTEC GLOBAL BERHAD | FINTEC | ASIA BIOENERGY TECHNOLOGIES BERHAD -Warrants A 2014/2024 | ASIABIO-WA | FINTEC GLOBAL BERHAD - Warrants A 2014/2024 | FINTEC-WA | ASIA BIOENERGY TECHNOLOGIES BERHAD - Warrants B 2017/2022 | ASIABIO-WB | FINTEC GLOBAL BERHAD - Warrants B 2017/2022 | FINTEC-WB | ASIA BIOENERGY TECHNOLOGIES BERHAD – ICPS A 2017/2027 | ASIABIO-PA | FINTEC GLOBAL BERHAD - ICPS A 2017/2027

| FINTEC-PA |

The Stock Numbers remain unchanged.

|

|

|

|

|

|

|

|

|

|

|

|

发表于 27-12-2017 03:04 AM

|

显示全部楼层

发表于 27-12-2017 03:04 AM

|

显示全部楼层

| 1. Details of Corporate Proposal | Involve issuance of new type/class of securities ? | No | Types of corporate proposal | Conversion of Preference Shares | Details of corporate proposal | Conversion of Irredeemable Convertible Preference Shares into Ordinary Shares | No. of shares issued under this corporate proposal | 9,281,266 | Issue price per share ($$) | Malaysian Ringgit (MYR) 0.1600 | Par Value($$) (if applicable) |

| | Latest issued share capital after the above corporate proposal in the following | Units | 461,546,541 | Issued Share Capital ($$) | Malaysian Ringgit (MYR) 71,585,153.660 | Listing Date | 27 Dec 2017 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 28-12-2017 09:47 PM

|

显示全部楼层

发表于 28-12-2017 09:47 PM

|

显示全部楼层

本帖最后由 icy97 于 29-12-2017 12:21 AM 编辑

I PICK THIS CONTRARIAN DEEP UNDERVALUED STOCK FOR 2018

Author: themagicianmerlin | Publish date: Wed, 27 Dec 2017, 12:40 PM

http://klse.i3investor.com/blogs/themagicofmerlin/142511.jsp

Dear investors,

I know if I am saying this, it sounds crazy to you, but that is its fundamental value.

I can say most of investors here don't really understand the model of the Group's operation, that is why the share price has yet react to its fundamental value.

I am quite surprised to see Fintec Global Bhd's latest PE ratio is deep undervalued at only 0.7x after annualising its diluted FY18 EPS and based on current share price of 16sen!

Yes, I noted that its EPS was derived by fair value gain/loss. You would saying that it is not their core or recurring income.

Actually, you are correct as at company level, but at the Group level or as an investment holdings, those fair value are recognisable as part of their net profit because their investments are in position as a business incubator.

Their investment is to help start-up companies they have invested in.

In other words, their operation share similar charateristic with private equity or venture capital but the difference is they also effectively link talent, technology, capital, and know-how in order to leverage entrepreneurial talent and to accelerate the development of companies they have invested in.

This operation is one of kind in local equities market.

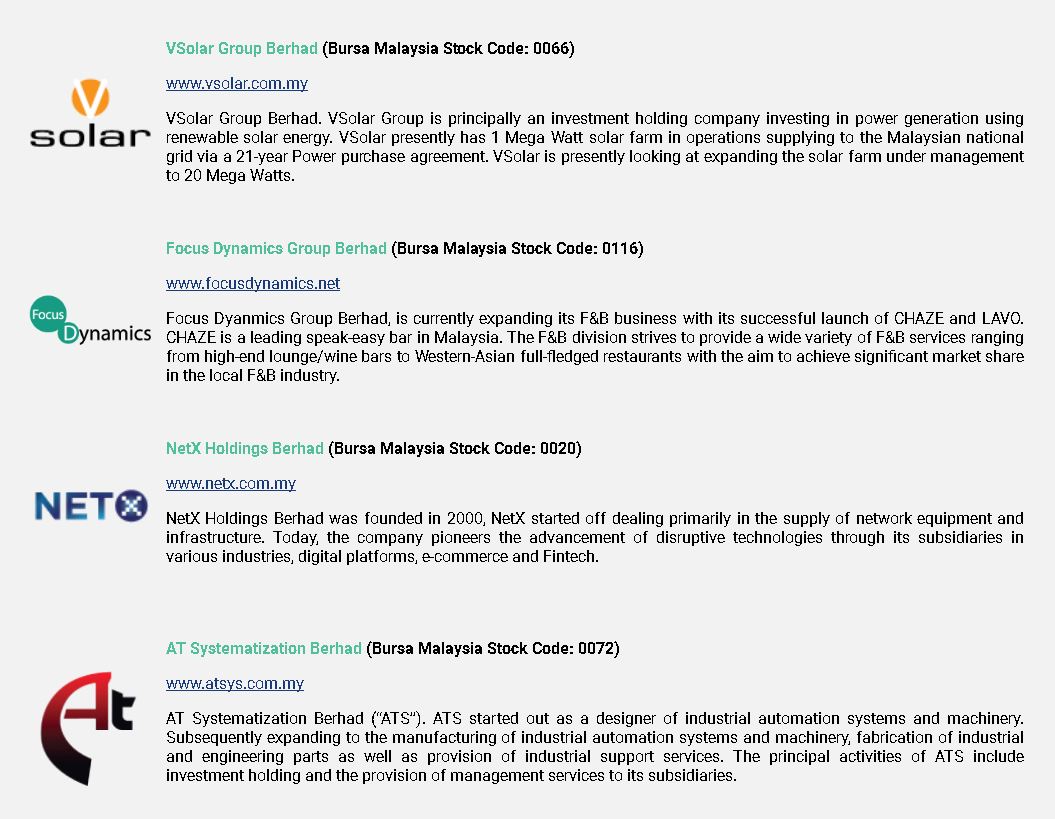

The following are local public listed companies they have invested in or we can call them incubatees:

As those companies or incubatees are now making progress towards generating higher profit, their share prices would reflect as well. Thus, the increase in their share prices would contribute higher fair value gain to Fintec's bottomline.

In fact, if they were to dispose their investments, it will translate huge profit to the Fintec's bottomline.

This also would strengthen further its already healthy balance sheet. The Group is in net cash position as of latest quarter results and also remarkable ROE of 27.3%. Meanwhile, its price-to-book value is being trading only at 0.57x.

Contrarian undervalued stock

Soon or later, people will start realise its potential value. Market has discounted the value of this stock too much and it is unfair to the Company.

If I were to play PE ratio just like Mr Koon Yew Yin has been practicing succesfully, this suits well.

So, let's look below for its indicative valuation based on small-cap PE range and its annualised FY18 EPS of 21.86sen.

Remember, if they can do better in the next quarters, its indicative valuation would be even higher than below:

| Price-to-earnings ratio (PE) | Indicative valuation (RM) | | 1x | 0.22 | | 2x | 0.44 | | 3x | 0.66 | | 4x | 0.87 | | 5x | 1.09 |

ConclusionI have done my own compilation and analysis, and my note here is for your reference. My opinion is neither recommending BUY, HOLD nor SELL. |

|

|

|

|

|

|

|

|

|

|

|

发表于 29-1-2018 02:08 AM

|

显示全部楼层

发表于 29-1-2018 02:08 AM

|

显示全部楼层

金科全球合理价多少?

投资新手问:

金科全球(FINTEC,0150,创业板贸服组)最近好像有点动静,请问前景如何,合理价多少?

答:金科全球的前身为亚洲生物能源(ASIABIO),主要涉及科技培育领域及投资控股,甫于2017年12月14日更换为现在名称。金科全球前景如何,先探探其最新业绩表现及财务情况,以探出一点端倪。

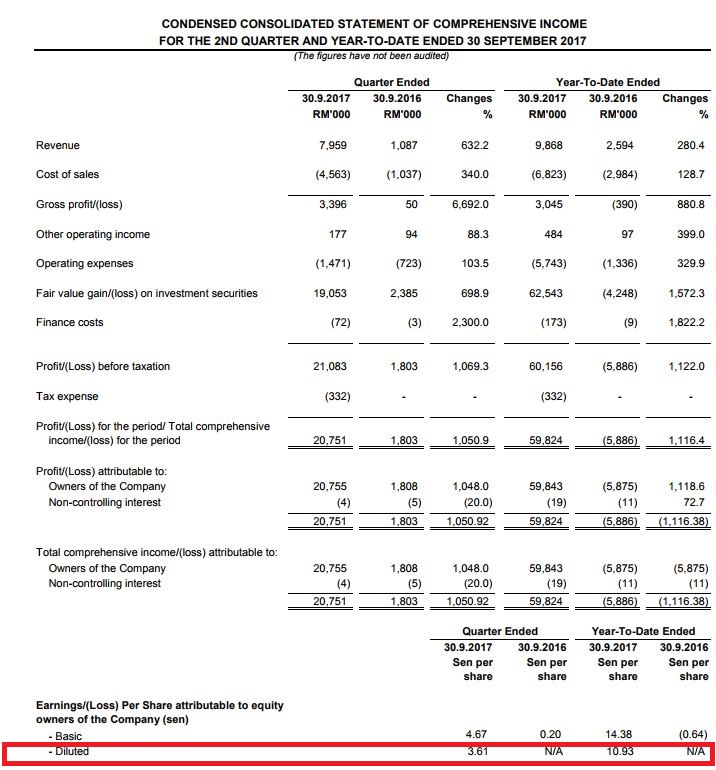

截至2017年9月30日为止第二季,该公司净利达2075万5000令吉(每股净利4.67仙),前期净利则仅为180万8000令吉(每股净利为0.20仙)。营业额为795万9000令吉,前期为108万7000令吉。

首6个月净利为5984万3000令吉(每股净利为14.38仙),前期则是净亏损587万5000令吉(每股净亏0.64仙),营业额则为986万8000令吉,前期为259万4000令吉。

从上述业绩显示,该公司第二季及首6个月的净利远远超越其营业额,看似有点奇怪,如其第二季营业额仅为795万9000令吉。不过,净利却是高达2075万5000令吉!其实,这主要是公司的投资(特别是股票)增值不少,即中长期投资按市价为准,增值至1905万3000令吉。

财务情况方面,该公司的总资产为1亿4899万7000令吉、流动资产下的贸易及其他应收款项及存款/预付款则为974万9000令吉,投资证券则有796万1000令吉。而非流动资产下的投资证券则达到1亿2436万6000令吉。

另一方面,公司总负债为2445万7000令吉,包括贸易及其他应付款项为2111万7000令吉,借贷为300万8000令吉。

该公司股本为6978万7000令吉,保留盈利为5521万4000令吉。截至2018年1月4日收市时,股价为17.5仙,整个公司的市值为8200万令吉。以上述资料为准,特别是其每股净利为准,将显示其估值非常便宜。

不过,该公司在宣布业绩时也指出,就像其他可交易证券,公司的投资将胥视不可预测的市场力量而定。

由于近年来没有证券研究进行剖析,所以没有合理价推荐。

文章来源:

星洲日报‧投资致富‧投资问诊‧文:李文龙‧2018.01.28 |

|

|

|

|

|

|

|

|

|

|

|

发表于 4-2-2018 09:26 PM

|

显示全部楼层

发表于 4-2-2018 09:26 PM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 10-2-2018 03:15 AM

|

显示全部楼层

发表于 10-2-2018 03:15 AM

|

显示全部楼层

| 1. Details of Corporate Proposal | Involve issuance of new type/class of securities ? | No | Types of corporate proposal | Conversion of Preference Shares | Details of corporate proposal | Conversion of Irredeemable Convertible Preference Shares | No. of shares issued under this corporate proposal | 5,865,300 | Issue price per share ($$) | Malaysian Ringgit (MYR) 0.1600 | Par Value($$) (if applicable) |

| | Latest issued share capital after the above corporate proposal in the following | Units | 475,930,772 | Issued Share Capital ($$) | Malaysian Ringgit (MYR) 73,891,486.930 | Listing Date | 12 Feb 2018 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 7-3-2018 06:20 AM

|

显示全部楼层

发表于 7-3-2018 06:20 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2017 | 31 Dec 2016 | 31 Dec 2017 | 31 Dec 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 11,261 | 881 | 21,129 | 3,475 | | 2 | Profit/(loss) before tax | 20,014 | -7,933 | 80,170 | -13,819 | | 3 | Profit/(loss) for the period | 20,014 | -7,933 | 79,838 | -13,819 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 20,063 | -7,926 | 79,906 | -13,801 | | 5 | Basic earnings/(loss) per share (Subunit) | 4.44 | -0.83 | 18.67 | -1.44 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.4703 | 0.0476

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 20-3-2018 02:03 AM

|

显示全部楼层

发表于 20-3-2018 02:03 AM

|

显示全部楼层

Additional Listing Announcement

| 1. Details of Corporate Proposal | Involve issuance of new type/class of securities ? | No | Types of corporate proposal | Conversion of Preference Shares | Details of corporate proposal | Conversion of Irredeemable Convertible Preference Shares | No. of shares issued under this corporate proposal | 14,000,000 | Issue price per share ($$) | Malaysian Ringgit (MYR) 0.1600 | Par Value($$) (if applicable) |

| | Latest issued share capital after the above corporate proposal in the following | Units | 497,819,772 | Issued Share Capital ($$) | Malaysian Ringgit (MYR) 77,393,726.930 | Listing Date | 20 Mar 2018 | | 2. Details of Corporate Proposal | Involve issuance of new type/class of securities ? | No | Types of corporate proposal | Conversion of Preference Shares | Details of corporate proposal | Conversion of Irredeemable Convertible Preference Shares | No. of shares issued under this corporate proposal | 27,240,000 | Issue price per share ($$) | Malaysian Ringgit (MYR) 0.1600 | Par Value($$) (if applicable) |

| | Latest issued share capital after the above corporate proposal in the following | Units | 525,059,772 | Issued Share Capital ($$) | Malaysian Ringgit (MYR) 81,752,126.930 | Listing Date | 20 Mar 2018 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 17-4-2018 06:25 AM

|

显示全部楼层

发表于 17-4-2018 06:25 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | FINTEC GLOBAL BERHAD (f.k.a. Asia Bioenergy Technologies Berhad) ["FINTEC" or "the Company"]- INCORPORATION OF FINTEC GLOBAL (HK) LIMITED, A WHOLLY-OWNED SUBSIDIARY OF THE COMPANY | The Board of Directors of FINTEC wishes to announce that the Company had on 13 April 2018 incorporated a company in Hong Kong under the name of Fintec Global (HK) Limited (“Fintec Global”).

The issued and paid-up capital of Fintec Global is HKD100.00 (Hong Kong Dollars One Hundred), which is equivalent to RM49.42, divided into 100 ordinary shares of HKD1.00 each held entirely by FINTEC.

Fintec Global is intended for the investing and trading in quoted securities and related activities.

The incorporation of Fintec Global will not have any material effects on FINTEC Group’s earnings per share, net assets per share, gearing, share capital and substantial shareholders’ shareholding for the financial year ending 31 March 2019.

None of the Directors and/or major shareholders of the Company and/or persons connected with them have any interest, direct or indirect, in the incorporation.

Having considered all aspects of the incorporation, the Board of Directors of FINTEC is of the opinion that the incorporation is in the best interest of FINTEC.

This announcement is dated 16 April 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 26-4-2018 02:41 AM

|

显示全部楼层

发表于 26-4-2018 02:41 AM

|

显示全部楼层

| 1. Details of Corporate Proposal | Involve issuance of new type/class of securities ? | No | Types of corporate proposal | Conversion of Preference Shares | Details of corporate proposal | Conversion of Irredeemable Convertible Preference Shares | No. of shares issued under this corporate proposal | 1,227,700 | Issue price per share ($$) | Malaysian Ringgit (MYR) 0.1600 | Par Value($$) (if applicable) |

| | Latest issued share capital after the above corporate proposal in the following | Units | 528,819,872 | Issued Share Capital ($$) | Malaysian Ringgit (MYR) 82,353,742.930 | Listing Date | 24 Apr 2018 | | 2. Details of Corporate Proposal | Involve issuance of new type/class of securities ? | No | Types of corporate proposal | Conversion of Preference Shares | Details of corporate proposal | Conversion of Irredeemable Convertible Preference Shares | No. of shares issued under this corporate proposal | 37,200,000 | Issue price per share ($$) | Malaysian Ringgit (MYR) 0.1600 | Par Value($$) (if applicable) |

| | Latest issued share capital after the above corporate proposal in the following | Units | 566,019,872 | Issued Share Capital ($$) | Malaysian Ringgit (MYR) 88,305,742.930 | Listing Date | 24 Apr 2018 | | 3. Details of Corporate Proposal | Involve issuance of new type/class of securities ? | No | Types of corporate proposal | Conversion of Preference Shares | Details of corporate proposal | Conversion of Irredeemable Convertible Preference Shares | No. of shares issued under this corporate proposal | 7,825,600 | Issue price per share ($$) | Malaysian Ringgit (MYR) 0.1600 | Par Value($$) (if applicable) |

| | Latest issued share capital after the above corporate proposal in the following | Units | 573,845,472 | Issued Share Capital ($$) | Malaysian Ringgit (MYR) 89,557,838.930 | Listing Date | 24 Apr 2018 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 24-5-2018 06:22 AM

|

显示全部楼层

发表于 24-5-2018 06:22 AM

|

显示全部楼层

Notice of Person Ceasing (Section 139 of CA 2016)Particulars of Substantial Securities HolderName | PELABURAN MARA BERHAD | Address | Suite C-5-4, Wisma Goshen, Plaza Pantai, Jalan Pantai Baharu

Kuala Lumpur

59200 Wilayah Persekutuan

Malaysia. | Company No. | 7240-P | Nationality/Country of incorporation | Malaysia | Descriptions (Class) | Ordinary Shares | Date of cessation | 18 May 2018 | Name & address of registered holder | Pelaburan MARA BerhadSuite C-5-4, Wisma Goshen,Plaza Pantai, Jalan Pantai Baharu,59200 Kuala Lumpur |

No of securities disposed | 25,740,799 | Circumstances by reason of which a person ceases to be a substantial shareholder | Open market disposal of shares | Nature of interest | Direct Interest |  | Date of notice | 21 May 2018 | Date notice received by Listed Issuer | 21 May 2018 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 27-5-2018 04:35 AM

|

显示全部楼层

发表于 27-5-2018 04:35 AM

|

显示全部楼层

| 1. Details of Corporate Proposal | Involve issuance of new type/class of securities ? | No | Types of corporate proposal | Conversion of Preference Shares | Details of corporate proposal | Conversion of Irredeemable Convertible Preference Shares | No. of shares issued under this corporate proposal | 12,500,000 | Issue price per share ($$) | Malaysian Ringgit (MYR) 0.1600 | Par Value($$) (if applicable) |

| | Latest issued share capital after the above corporate proposal in the following | Units | 587,199,972 | Issued Share Capital ($$) | Malaysian Ringgit (MYR) 91,694,558.930 | Listing Date | 25 May 2018 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 10-6-2018 05:59 AM

|

显示全部楼层

发表于 10-6-2018 05:59 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2018 | 31 Mar 2017 | 31 Mar 2018 | 31 Mar 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 9,759 | 1,879 | 30,888 | 5,354 | | 2 | Profit/(loss) before tax | -36,803 | 15,941 | 43,367 | 2,122 | | 3 | Profit/(loss) for the period | -36,477 | 15,941 | 43,361 | 2,122 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -36,471 | 15,947 | 43,435 | 2,146 | | 5 | Basic earnings/(loss) per share (Subunit) | -7.54 | 1.62 | 9.89 | 0.22 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.3525 | 0.0476

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 17-6-2018 11:50 PM

|

显示全部楼层

发表于 17-6-2018 11:50 PM

|

显示全部楼层

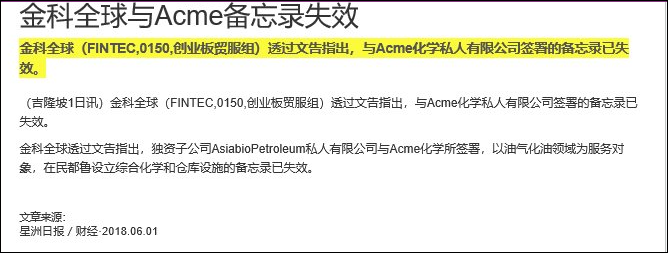

Type | Announcement | Subject | MEMORANDUM OF UNDERSTANDING | Description | FINTEC GLOBAL BERHAD (Formerly known as Asia Bioenergy Technologies Berhad ("FINTEC" or "the Company")- STATUS UPDATE ON MEMORANDUM OF INTENT BETWEEN ASIABIO PETROLEUM SDN. BHD., A WHOLLY OWNED SUBSIDIARY OF FINTEC AND ACME CHEMICALS (MALAYSIA) SDN. BHD. AND SEJAHTERA BUMISAMA SDN. BHD. | We refer to the Company’s announcements made on 15 February 2017, 28 February 2017, 22 May 2017, 23 August 2017, 15 November 2017 and 28 February 2018 pertaining to the Memorandum of Intent (“MOI”) entered between Asiabio Petroleum Sdn. Bhd. (“ABP”), a wholly-owned subsidiary of FINTEC, and Acme Chemicals (Malaysia) Sdn. Bhd. (“ACME”) and Sejahtera Bumisama Sdn. Bhd. (“SBSB”) to cooperate and collaborate to set up an integrated chemical blending and warehousing facilities to be based in Bintulu to specifically target multi-national well service companies supplying oilfield chemicals to Oil & Gas companies operating in Malaysia, which may include production chemicals, well stimulation and cementing chemicals, and drilling fluids (“Toll Blending business”) and to establish collaboration and explore opportunities to develop, support, implement plans and undertake activities to establish the Toll Blending business that is beneficial to ABP, ACME and SBSB, the Board of Directors of FINTEC wishes to announce that the MOI has lapsed.

This announcement is dated 30 May 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 14-7-2018 03:51 AM

|

显示全部楼层

发表于 14-7-2018 03:51 AM

|

显示全部楼层

本帖最后由 icy97 于 18-7-2018 01:54 AM 编辑

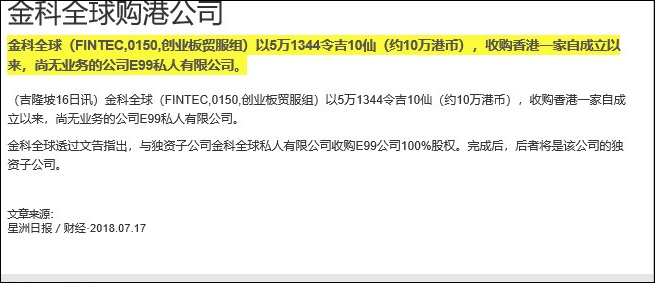

Type | Announcement | Subject | OTHERS | Description | FINTEC GLOBAL BERHAD (f.k.a. Asia Bioenergy Technologies Berhad) ["FINTEC" or "the Company"]- ACQUISITION OF SHARES IN E99 LIMITED | The Board of Directors of FINTEC wishes to announce that the Company and its wholly-owned subsidiary, Fintec Global (HK) Limited (Company No. 2679962) (“FG”), had on 11 July 2018 acquired a total of 100,000 ordinary shares representing 100% of the share capital of E99 Limited (Company No. 2662278) (“E99”) for a total cash consideration of HKD100,000.00 (Hong Kong Dollar One Hundred Thousand), equivalent to RM51,344.10 (Ringgit Malaysia Fifty One Thousand Three Hundred Forty Four and Sen Ten) only [“Acquisition of Shares”].

Consequent to the Acquisition of Shares, E99 shall become a wholly-owned subsidiary of FG, which in turn is a wholly-owned subsidiary of FINTEC.

E99 was incorporated on 6 March 2018 pursuant to the Companies Ordinance (Chapter 622 of the Laws of Hong Kong) as a private limited company and has not commenced business since its incorporation. The issued and paid-up capital of E99 is HKD100,000.00 (Hong Kong Dollar One Hundred Thousand) of 100,000 ordinary shares of HKD1.00 each.

The Acquisition of Shares would not have any material effects on FINTEC Group’s earnings per share, net assets per share, gearing, share capital and substantial shareholders’ shareholding for the financial year ending 31 March 2019.

None of the Directors and/or major shareholders of the Company and/or persons connected with them have any interest, direct or indirect, in the Acquisition of Shares.

Having considered all aspects, the Board of Directors of FINTEC is of the opinion that the Acquisition of Shares is in the best interest of FINTEC.

This announcement is dated 13 July 2018. |

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|