|

|

【SUNWAY 5211 交流专区】双威 (Sunway+Suncity)

[复制链接]

[复制链接]

|

|

|

发表于 8-8-2018 01:47 AM

|

显示全部楼层

发表于 8-8-2018 01:47 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | SUNWAY BERHAD ("SUNWAY")- TARGETED DATE OF RELEASE OF UNAUDITED FINANCIAL RESULTS FOR THE SECOND QUARTER ENDED 30 JUNE 2018 | We wish to announce that Sunway targets to release its unaudited financial results for the second quarter ended 30 June 2018 after 5.00 p.m. on Tuesday, 21 August 2018.

This announcement is dated 7 August 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 22-8-2018 03:57 AM

|

显示全部楼层

发表于 22-8-2018 03:57 AM

|

显示全部楼层

EX-date | 24 Sep 2018 | Entitlement date | 26 Sep 2018 | Entitlement time | 05:00 PM | Entitlement subject | First Interim Dividend | Entitlement description | First interim single tier dividend of 3.5 sen per ordinary share for financial year ending 31 December 2018 | Period of interest payment | to | Financial Year End | 31 Dec 2018 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | SUNWAY MANAGEMENT SDN BHDLevel 16, Menara SunwayJalan Lagoon TimurBandar Sunway47500 Subang JayaSelangor Darul EhsanTel:03-56398889Fax:03-56399507 | Payment date | 18 Oct 2018 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 26 Sep 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.035 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 22-8-2018 04:22 AM

|

显示全部楼层

发表于 22-8-2018 04:22 AM

|

显示全部楼层

本帖最后由 icy97 于 22-8-2018 05:01 AM 编辑

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2018 | 30 Jun 2017 | 30 Jun 2018 | 30 Jun 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

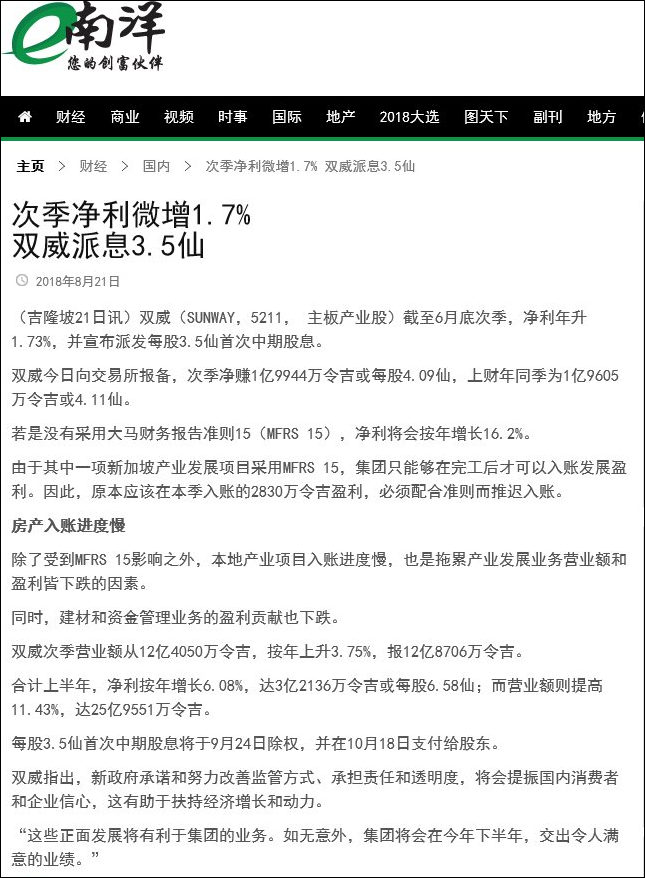

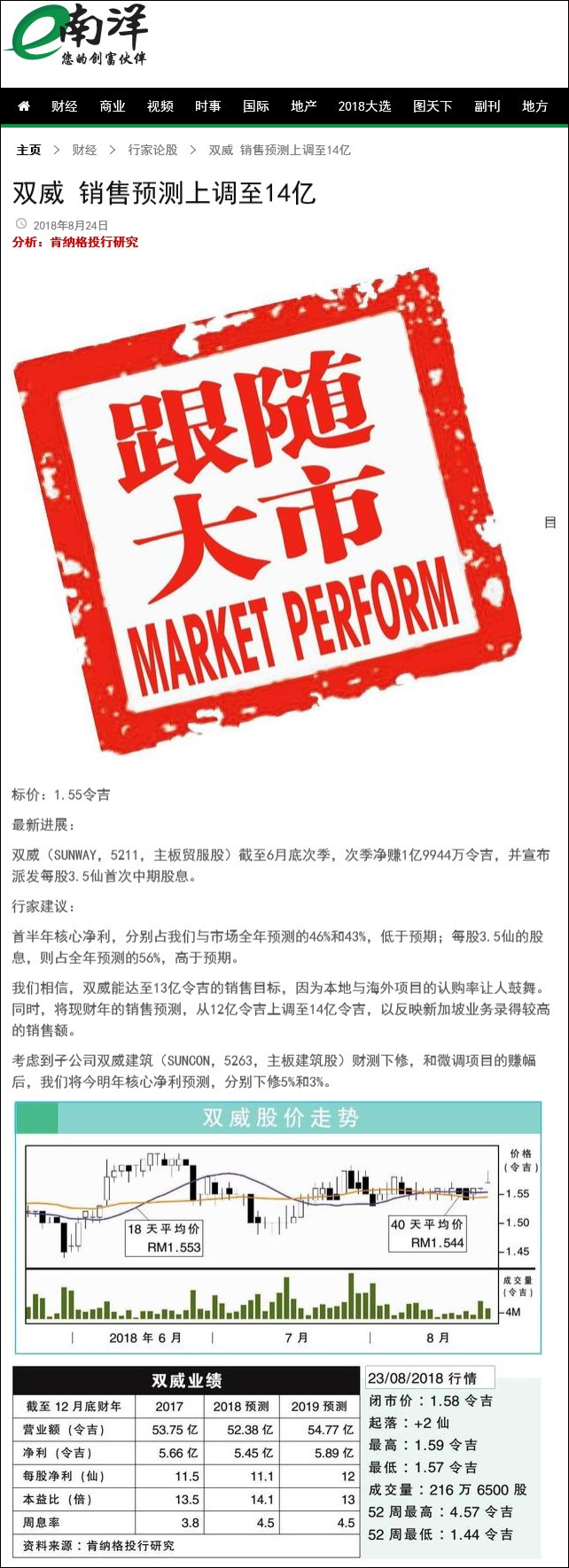

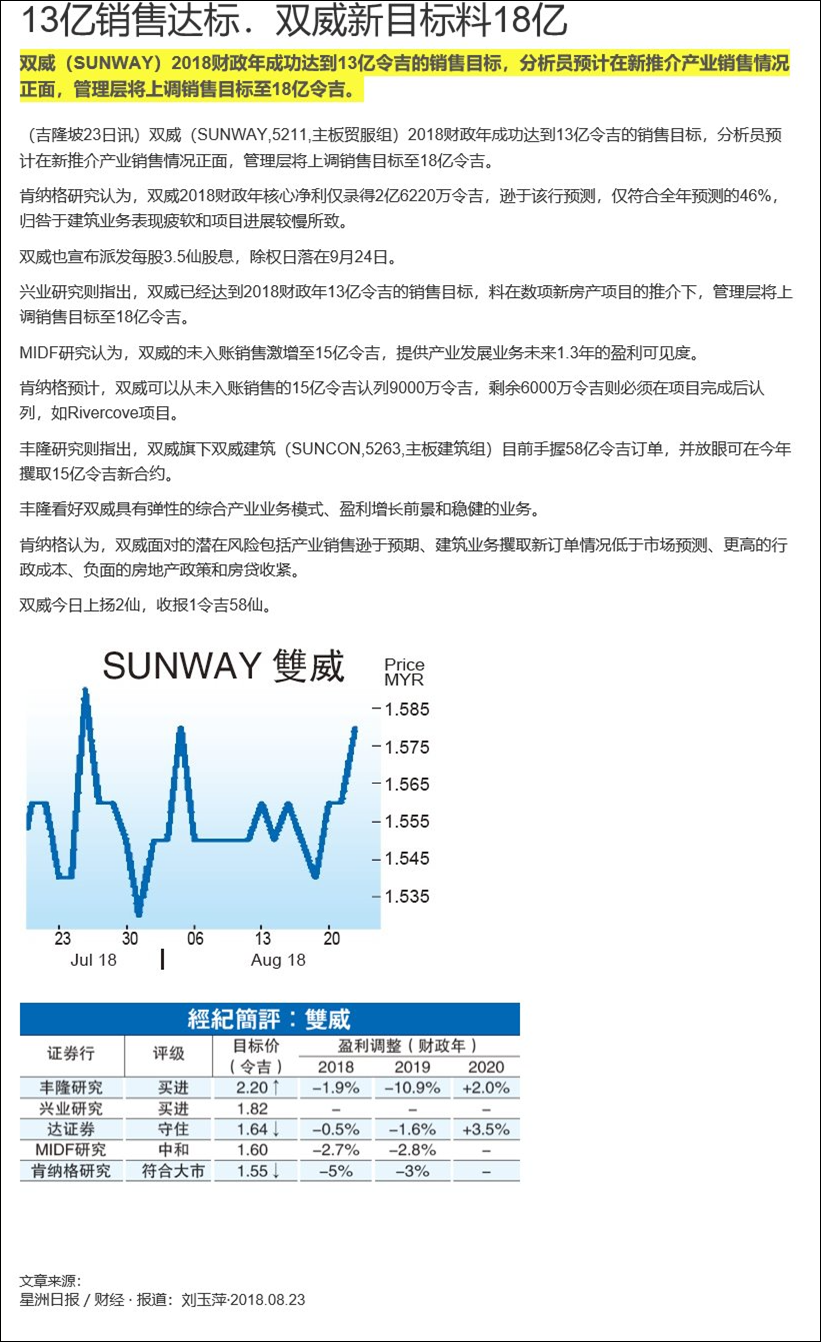

| 1 | Revenue | 1,287,062 | 1,240,501 | 2,595,510 | 2,329,255 | | 2 | Profit/(loss) before tax | 242,219 | 270,153 | 403,108 | 421,750 | | 3 | Profit/(loss) for the period | 215,766 | 232,016 | 353,252 | 356,393 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 199,438 | 196,052 | 321,361 | 302,942 | | 5 | Basic earnings/(loss) per share (Subunit) | 4.09 | 4.11 | 6.58 | 6.39 | | 6 | Proposed/Declared dividend per share (Subunit) | 3.50 | 3.00 | 3.50 | 3.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.6500 | 1.5900

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 22-8-2018 05:58 AM

|

显示全部楼层

发表于 22-8-2018 05:58 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 25-8-2018 01:13 AM

|

显示全部楼层

发表于 25-8-2018 01:13 AM

|

显示全部楼层

本帖最后由 icy97 于 25-8-2018 01:59 AM 编辑

|

|

|

|

|

|

|

|

|

|

|

|

发表于 13-9-2018 05:12 AM

|

显示全部楼层

发表于 13-9-2018 05:12 AM

|

显示全部楼层

本帖最后由 icy97 于 13-9-2018 06:10 AM 编辑

Type | Announcement | Subject | OTHERS | Description | SUNWAY BERHAD ("SUNWAY")- LETTER OF AWARD FOR THE TENDER OF LAND PARCEL AT CANBERRA LINK, SEMBAWANG, SINGAPORE | The Board of Directors of Sunway is pleased to announce that the Housing and Development Board of Singapore had on 10 September 2018, awarded a land parcel measuring approximately 4.46 acres at Canberra Link (Lot 4018N, MK19), Sembawang, Singapore (“the Land”) for a 99-year lease term Executive Condominium Housing Development at S$271 million (equivalent to approximately RM817.17 million) to Hoi Hup Realty Pte Ltd (“Hoi Hup”) and Sunway Developments Pte Ltd (“SDPL”) following a successful tender for the Land jointly submitted by the parties.

The Land will be acquired by a proposed new joint venture company to be incorporated (“Proposed JV Company”), in which Hoi Hup or its nominee company(ies) and SDPL will have equity interest in the proportion of 65:35.

The Proposed JV Company will undertake the development of Executive Condominium (“the Proposed Project”) on the Land.

SDPL is a wholly-owned subsidiary of Sunway Holdings Sdn Bhd which in turn is wholly-owned by Sunway. It is incorporated in Singapore with a paid-up capital of S$6,690,002/-. Its principal activity is investment holding.

Hoi Hup is a company incorporated in Singapore with a paid-up capital of S$3,000,000/-. Its principal activity is real estate development.

SDPL’s cost of investment in the joint venture is S$50 million or approximately RM150.78 million.

The completion period of the Proposed Project shall be 60 months or earlier, commencing from 10 September 2018. It is expected to contribute positively to the earnings of Sunway Group from the financial year 2022 onwards.

The Proposed Project is subjected to normal construction risk of materials price fluctuation. However, with the past experiences and expertise of Hoi Hup and SDPL in construction of similar project, this risk could be mitigated.

None of the directors or major shareholders of Sunway or persons connected with them has any interest, whether direct or indirect in the Proposed Project.

This announcement is dated 12 September 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 14-9-2018 03:43 AM

|

显示全部楼层

发表于 14-9-2018 03:43 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | SUNWAY BERHAD ("SUNWAY")- PROPOSED INTERNAL REORGANISATION | We wish to announce that pursuant to Chapter 9, Paragraph 9.19(5) of the Main Market Listing Requirements of Bursa Malaysia Securities Berhad, Sunway City Sdn Bhd (“SunCity”), a wholly-owned subsidiary of the Company has on 13 September 2018, acquired the following ordinary shares, representing the entire issued and paid-up share capital of the undermentioned companies from Sunway Holdings Sdn Bhd for a total cash consideration of RM4/- (“Proposed Reorganisation Exercise”). | Company | No. of ordinary shares | Consideration | | Reptolink Sdn Bhd (“Reptolink”) | 2 | RM2.00 | | Galaxy Avenue Sdn Bhd (“Galaxy”) | 2 | RM2.00 | Total: | 4 | RM4.00 |

Reptolink was incorporated on 26 May 1997 and its issued and paid-up share capital is RM2/- comprising 2 ordinary shares. The principal activity of Reptolink is investment holding.

Galaxy was incorporated on 5 June 1997 and its issued and paid-up share capital is RM2/- comprising 2 ordinary shares. The principal activity of Galaxy is property investment.

Upon completion of the Proposed Reorganisation Exercise, Reptolink and Galaxy have become direct subsidiaries of SunCity.

The Proposed Reorganisation Exercise is not expected to have any effect on the issued and paid-up share capital of Sunway or Sunway’s major shareholders’ shareholdings or any material effect on the earnings, net assets or gearing of Sunway on a consolidated basis.

None of the directors or major shareholders of Sunway or persons connected with them has any interest, whether direct or indirect in the Proposed Reorganisation Exercise.

This announcement is dated 13 September 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 14-9-2018 05:05 AM

|

显示全部楼层

发表于 14-9-2018 05:05 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 19-9-2018 04:13 AM

|

显示全部楼层

发表于 19-9-2018 04:13 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | SUNWAY BERHAD ("SUNWAY") - SHARE SALE AGREEMENT BETWEEN SUNWAY HOLDINGS SDN BHD (A WHOLLY-OWNED SUBSIDIARY OF SUNWAY) AND KHOO AH THIM @ KHOO CHAI THIAM, KHOO CHAI EE, KHOO CHAI HENG, KHOO CHAI KIAT, KHOO CHAI PEK, LEE BANG SING, PENG GAI HOCK, SOH TIAN SONG AND TOH SOON SENG (COLLECTIVELY, "WINSTAR VENDORS") | We refer to our announcements dated 9 April 2015, 15 September 2015, 18 September 2015 and 18 September 2017 in relation to the acquisition of 5,373,983 ordinary shares of Sunway Winstar Sdn Bhd (formerly known as Winstar Trading Sdn Bhd) (“SWSB”) (“Sale Shares”) by Sunway Holdings Sdn Bhd, a wholly-owned subsidiary of Sunway, from the Winstar Vendors.

The acquisition of the third tranche of the Sale Shares comprising 671,750 ordinary shares of SWSB at the consideration of RM8,580,138/- was completed on 18 September 2018. Accordingly, the acquisition of the Sale Shares has been fully completed.

This announcement is dated 18 September 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 9-10-2018 02:00 AM

|

显示全部楼层

发表于 9-10-2018 02:00 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 11-10-2018 08:44 PM

|

显示全部楼层

发表于 11-10-2018 08:44 PM

|

显示全部楼层

母rm1.39 , 买了wc 0.28  |

|

|

|

|

|

|

|

|

|

|

|

发表于 16-10-2018 04:05 AM

|

显示全部楼层

发表于 16-10-2018 04:05 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 28-10-2018 06:39 AM

|

显示全部楼层

发表于 28-10-2018 06:39 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | SUNWAY BERHAD (SUNWAY)1. SHAREHOLDERS AGREEMENT BETWEEN SUNWAYMAS SDN BHD, PERKASA BERNAS (M) SDN BHD AND DAKSINA HARTA SDN BHD2. SHARE SALE AGREEMENT BETWEEN SUNWAYMAS SDN BHD AND PERKASA BERNAS (M) SDN BHD | The Board of Directors of Sunway wishes to announce that SunwayMas Sdn Bhd (“SunwayMas”), a subsidiary of Sunway has on 26 October 2018, entered into a Shareholders’ Agreement (“SA”) with Perkasa Bernas (M) Sdn Bhd (“Perkasa”), a subsidiary of MKH Berhad and Daksina Harta Sdn Bhd (“Daksina”) with intention to jointly develop a mixed development on the freehold land held under Geran 47813, Lot No. 1, Mukim Kajang Daerah Ulu Langat Negeri Selangor measuring approximately 5.28 acres (“the Land”) as well as to regulate the relationship between SunwayMas and Perkasa as the shareholders of Daksina (“Proposed Joint Venture”).

SunwayMas has on even date, entered into a Share Sale Agreement (“SSA”) with Perkasa, whereby SunwayMas agrees to dispose of 4 ordinary shares in Daksina to Perkasa (“Sale Shares”), representing 40% of the share capital of Daksina, at a total consideration of RM5,000,000/- (“Proposed Disposal”).

Please refer to the attachment below for further details of the Proposed Joint Venture and Proposed Disposal

This announcement is dated 26 October 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5955813

|

|

|

|

|

|

|

|

|

|

|

|

发表于 28-10-2018 06:40 AM

|

显示全部楼层

发表于 28-10-2018 06:40 AM

|

显示全部楼层

本帖最后由 icy97 于 31-10-2018 08:19 AM 编辑

双威与美景联营 在加影打造5亿综合发展项目

Syahirah Syed Jaafar/theedgemarkets.com

October 26, 2018 20:28 pm +08

(吉隆坡26日讯)双威(Sunway Bhd)与美景控股(MKH Bhd)成立联营公司,在加影的5.28英亩地打造价值5亿400万令吉的公共交通导向永久业权综合发展项目。

双威今日在文告指出,该项目将涵盖商业和住宅单位,包括可负担房屋,预计将于明年第四季推出,并在4年内完成。

双威表示,该项目距离加影镇不到一公里,并将通过连接桥与Sg Jernih捷运站直接相连。

双威子公司SunwayMas私人有限公司与美景控股子公司Perkasa Bernas(马)私人有限公司签署股东协议,以500万令吉脱售Daksina Harta私人有限公司的4股予后者。

双威表示,在考虑了Daksina的净资产和盈利前景后,最终确定了出售价格。

双威和美景控股将通过子公司,分别持有Daksina的60%和40%股权。

双威指出,联营公司预计不会对截至今年12月杪本财政年的每股盈利、每股净资产和负债产生任何直接的实质影响。

(编译:陈慧珊)

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

NON RELATED PARTY TRANSACTIONS | Description | SUNWAY BERHAD (SUNWAY)- SHARE SALE AND PURCHASE AGREEMENT BETWEEN SUNWAY TOTALRUBBER LTD, KERLEX PTY LTD, B SPURRELL PTY LTD AND PACIFIC FLOW TECHNOLOGY PTY LTD | 1. INTRODUCTION

The Board of Directors of Sunway wishes to announce that Sunway TotalRubber Ltd (“STRL”), a subsidiary of Sunway has on 26 October 2018, entered into a Share Sale and Purchase Agreement (“SSPA”) with Kerlex Pty Ltd (“KPL”), B Spurrell Pty Ltd (“BSPL”) and Pacific Flow Technology Pty Ltd (“PFTPL”) to dispose of its entire shareholding in PFTPL comprising 80 ordinary shares (“Sale Shares”) which represent 80% of the issued and paid-up share capital of PFTPL to KPL and BSPL for a total consideration of A$220,000, approximately RM646,000 (“Proposed Disposal”).

2. INFORMATION ON STRL, KPL, BSPL and PFTPL

2.1 STRL

STRL is a company incorporated in Australia and having its registered office at Suite 4, 622 Ferntree Gully Road, Wheelers Hill VIC 3150. The issued and paid-up share capital of STRL is A$5,805,159/- comprising 4,937,062 ordinary shares. The principal activity of STRL is import and distribution of industrial rubber and plastics.

2.2 KPL

KPL is a company incorporated in Australia and having its registered office at Suite 4, 622 Ferntree Gully Road, Wheelers Hill VIC 3150. The issued and paid-up share capital of KPL is A$100 comprising 100 ordinary shares. KPL acts as trustee for the Kiro and Alexandra Trust. The trust is set up by the family of Mr Kiro Porjazoski, a present director and shareholder of PFTPL.

2.3 BSPL

BSPL is a company incorporated in Australia and having its registered office at 8 Ridgeview Terrace, Lysterfield VIC 3156. The issued and paid-up share capital of BSPL is A$10 comprising 10 ordinary shares. BSPL acts as trustee for the B Spurrell Family Trust. The trust is set up by Mr Brian Spurrell, a present employee of PFTPL.

2.4 PFTPL

PFTPL is a company incorporated in Australia and having its registered office at Suite 4, 622 Ferntree Gully Road, Wheelers Hill VIC 3150. The issued and paid-up share capital of PFTPL is A$100/- comprising 100 ordinary shares. The principal activity of PFTPL is manufacturing and sale of specialty hoses.

3. SALIENT TERMS OF THE SSPA

Pursuant to the SSPA, STRL will dispose of the Sale Shares which represent 80% of the issued and paid-up share capital of PFTPL to KPL and BSPL for a total consideration of A$220,000, (approximately RM918,720) in the following manners:- | Purchaser | Number of Shares | Consideration (A$) | | Kerlex Pty Ltd | 30 | 82,500 | | B Spurrell Pty Ltd | 50 | 137,500 | | Total | 80 | 220,000 |

4. BASIS OF ARRIVING AT THE DISPOSAL PRICE FOR THE PROPOSED DISPOSAL

The disposal price was arrived at willing buyer, willing seller basis after taking into consideration STRL’s initial cost of investment in PFTPL.

5. LIABILITIES TO BE ASSUMED BY PURCHASER

KPL and BSPL will assume all liabilities as stated in the latest audited accounts of PFTPL as at 31 December 2017.

6. RATIONALE

The Proposed Disposal will enable the Group to streamline its business activities in Australia.

7. RISK FACTORS

Sunway is unaware of any risks arising from the Proposed Disposal which could materially or adversely affect the financial and operating performance of Sunway.

8. ORIGINAL COST OF INVESTMENT AND DATE OF INVESTMENT

STRL’s original investment for the Sale Shares was A$ 218,939 in year 2003.

9. EXPECTED GAINS AND LOSSES TO SUNWAY GROUP

The expected gain from the Proposed Disposal to Sunway Group is immaterial.

10. PROPOSED UTILISATION OF PROCEEDS FROM THE PROPOSED DISPOSAL

The proceeds from the Proposed Disposal will be utilised for repayment of borrowings and working capital of STRL.

11. EFFECTS OF THE PROPOSED DISPOSAL

11.1 On Share Capital and Substantial Shareholders’ Shareholding

The Proposed Disposal will not have any effect on the share capital and substantial shareholders' shareholding of Sunway as they do not involve any allotment or issuance of new shares by Sunway.

11.2 On Earnings Per Share, Net Assets Per Share and Gearing

The Proposed Disposal is not expected to have any immediate material effect on the earnings per share, net assets per share and gearing of Sunway for the financial year ending 31 December 2018.

12. APPROVAL REQUIRED

The Proposed Disposal does not require approval from the shareholders of Sunway or any relevant authorities.

13. DIRECTORS' AND MAJOR SHAREHOLDERS' INTERESTS

Insofar as the Directors are aware, none of the directors or major shareholders of Sunway or persons connected with them has any interest, whether direct or indirect, in the Proposed Disposal.

14. STATEMENT BY THE BOARD OF DIRECTORS

The Board of Directors of Sunway is of the opinion that the Proposed Disposal is in the best interests of Sunway.

15. ESTIMATED TIMEFRAME FOR COMPLETION OF THE PROPOSED DISPOSAL

Barring any unforeseen circumstances, the Proposed Disposal is expected to be completed by November 2018 or such other date which the parties may agree in writing.

16. DOCUMENTS AVAILABLE FOR INSPECTION

The SSPA is available for inspection at the registered office of Sunway at Level 16, Menara Sunway, Jalan Lagoon Timur, Bandar Sunway, 47500 Subang Jaya, Selangor Darul Ehsan during normal business hours (9.00 a.m. to 6.00 p.m.) from Monday to Friday (except public holidays) for a period of 3 months from the date of this announcement.

This announcement is dated 26 October 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 30-10-2018 06:04 AM

|

显示全部楼层

发表于 30-10-2018 06:04 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | SUNWAY BERHAD (SUNWAY)1) SHAREHOLDERS AGREEMENT BETWEEN SUNWAYMAS SDN BHD, PERKASA BERNAS (M) SDN BHD AND DAKSINA HARTA SDN BHD2) SHARE SALE AGREEMENT BETWEEN SUNWAYMAS SDN BHD AND PERKASA BERNAS (M) SDN BHD | We refer to our announcement dated 26 October 2018 in relation to the execution of the following agreements:

1. Shareholders’ Agreement dated 26 October 2018 between SunwayMas Sdn Bhd (“SunwayMas”) (a subsidiary of Sunway), Perkasa Bernas (M) Sdn Bhd (“Perkasa”) (a subsidiary of MKH Berhad) and Daksina Harta Sdn Bhd (“Daksina”) (a subsidiary of Sunway) in relation to the intention to jointly develop a mixed development on the freehold land held under Geran 47813, Lot No. 1, Mukim Kajang Daerah Ulu Langat Negeri Selangor measuring approximately 5.28 acres (“the Land”) as well as to regulate the relationship between SunwayMas and Perkasa as the shareholders of Daksina (“Proposed Joint Venture”); and

2. Share Sale Agreement dated 26 October 2018 between SunwayMas and Perkasa whereby SunwayMas agrees to dispose of 4 ordinary shares in Daksina to Perkasa (“Sale Shares”), representing 40% of the share capital of Daksina, at a total consideration of RM5,000,000/- (“Proposed Disposal”).

We wish to further clarify as to the basis of the consideration of the Proposed Disposal. Both SunwayMas and Perkasa agree that the current market value of the Land is 15% of the estimated gross development value of the proposed development of RM540 million. The consideration is calculated based on the difference between the revalued land cost and the current net liabilities position of Daksina based on its latest audited financial statements for year ended 31 December 2017 and its latest management account dated 30 September 2018. The initial land acquisition by Daksina was fully financed by an inter-company loan.

This announcement is dated 29 October 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 1-11-2018 06:03 AM

|

显示全部楼层

发表于 1-11-2018 06:03 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 6-11-2018 01:30 AM

|

显示全部楼层

发表于 6-11-2018 01:30 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | SUNWAY BERHAD ("SUNWAY")- INCORPORATION OF A SUBSIDIARY | We wish to announce that pursuant to Chapter 9, Paragraph 9.19(23) of the Main Market Listing Requirements of Bursa Malaysia Securities Berhad, Sunway Holdings Sdn Bhd, a wholly-owned subsidiary of Sunway, has on 1 November 2018, incorporated a private limited company known as Sunway Brands Sdn Bhd (“Sunway Brands”).

Sunway Brands is a company incorporated in Malaysia and has an issued and paid-up share capital of RM2/- comprising 2 ordinary shares. Its intended principal activity is provision of trade mark services.

None of the directors or substantial shareholders of Sunway or persons connected with them has any interest, whether direct or indirect in the aforesaid incorporation.

This announcement is dated 1 November 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 18-11-2018 02:49 AM

|

显示全部楼层

发表于 18-11-2018 02:49 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | SUNWAY BERHAD ("SUNWAY")- TARGETED DATE OF RELEASE OF UNAUDITED FINANCIAL RESULTS FOR THE THIRD QUARTER ENDED 30 SEPTEMBER 2018 | We wish to announce that Sunway targets to release its unaudited financial results for the third quarter ended 30 September 2018 after 5.00 p.m. on Wednesday, 21 November 2018.

This announcement is dated 7 November 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 19-11-2018 05:35 AM

|

显示全部楼层

发表于 19-11-2018 05:35 AM

|

显示全部楼层

icy97 发表于 28-10-2018 06:40 AM

双威与美景联营 在加影打造5亿综合发展项目

Syahirah Syed Jaafar/theedgemarkets.com

October 26, 2018 20:28 pm +08

(吉隆坡26日讯)双威(Sunway Bhd)与美景控股(MKH Bhd)成立联营公司,在加影的5.28英 ...

Type | Announcement | Subject | OTHERS | Description | SUNWAY BERHAD ("SUNWAY")1) SHAREHOLDERS' AGREEMENT BETWEEN SUNWAYMAS SDN BHD, PERKASA BERNAS (M) SDN BHD AND DAKSINA HARTA SDN BHD2) SHARE SALE AGREEMENT BETWEEN SUNWAYMAS SDN BHD AND PERKASA BERNAS (M) SDN BHD | We refer to our announcements made on 26 October 2018 and 29 October 2018 in relation to the execution of the following agreements:

a) Shareholders’ Agreement dated 26 October 2018 between SunwayMas Sdn Bhd (“SunwayMas”) (a subsidiary of Sunway), Perkasa Bernas (M) Sdn Bhd (“Perkasa”) (a subsidiary of MKH Berhad) and Daksina Harta Sdn Bhd (“Daksina”) (a subsidiary of Sunway) in relation to the intention to jointly develop a mixed development on the freehold land held under Geran 47813, Lot No. 1, Mukim Kajang Daerah Ulu Langat Negeri Selangor measuring approximately 5.28 acres as well as to regulate the relationship between SunwayMas and Perkasa as the shareholders of Daksina; and

b) Share Sale Agreement dated 26 October 2018 between SunwayMas and Perkasa (“SSA”) whereby SunwayMas agrees to dispose of 4 ordinary shares in Daksina to Perkasa, representing 40% of the share capital of Daksina, at a total consideration of RM5,000,000/- (“Proposed Disposal”).

The Board of Directors of Sunway is pleased to announce that the Proposed Disposal was completed on 9 November 2018 in accordance with the terms and conditions of the SSA.

This announcement is dated 9 November 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 24-11-2018 06:17 AM

|

显示全部楼层

发表于 24-11-2018 06:17 AM

|

显示全部楼层

icy97 发表于 28-10-2018 06:40 AM

双威与美景联营 在加影打造5亿综合发展项目

Syahirah Syed Jaafar/theedgemarkets.com

October 26, 2018 20:28 pm +08

(吉隆坡26日讯)双威(Sunway Bhd)与美景控股(MKH Bhd)成立联营公司,在加影的5.28英 ...

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

NON RELATED PARTY TRANSACTIONS | Description | SUNWAY BERHAD ("SUNWAY")- SHARE SALE AND PURCHASE AGREEMENT BETWEEN SUNWAY TOTALRUBBER LTD, KERLEX PTY LTD, B SPURRELL PTY LTD AND PACIFIC FLOW TECHNOLOGY PTY LTD ("SSPA") | We refer to our announcement made on 26 October 2018 in relation to the disposal of the entire shareholding of Pacific Flow Technology Pty Ltd (“PFTPL”) comprising 80 ordinary shares which represent 80% of the issued and paid-up share capital of PFTPL by Sunway TotalRubber Ltd, a subsidiary of Sunway, to Kerlex Pty Ltd and B Spurrell Pty Ltd for a total consideration of A$220,000, approximately RM646,000 (“Proposed Disposal”).

The Board of Directors of Sunway is pleased to announce that the Proposed Disposal was completed on 9 November 2018 in accordance with the terms and conditions of the SSPA. Following the completion of the Proposed Disposal, PFTPL has ceased to be a subsidiary of Sunway.

This announcement is dated 12 November 2018. |

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|