|

|

发表于 12-1-2016 01:30 AM

|

显示全部楼层

发表于 12-1-2016 01:30 AM

|

显示全部楼层

本帖最后由 icy97 于 12-1-2016 02:28 PM 编辑

華陽斥5千萬購依特區土地‧發展3.4億房產

2016-01-12 09:26

(吉隆坡11日訊)近期“胃口大開”的華陽(HUAYANG,5062,主板產業組),今日再斥資超過5千萬令吉買下依斯干達東部走廊土地,以期發展成為總值3億4千640萬令吉的房產計劃,趁機當地房市疲弱之際逆勢出擊。

根據華陽文告,該公司與GrandView Realty私人公司(GVSB)11名股東簽署股權買賣協議,將以5千290萬令吉收購後者100%股權。

GVSB是產業發展公司,擁有柔佛依斯干達東部走廊區域內8塊永久地契空地,總面積為73.156英畝。

GVSB的依斯干達地段已獲有關當局批准規劃,將用以發展有地房產、半獨立式房子、商店辦公室、可負擔房產等。

華陽表示,該空地的房產項目發展總值為3億4千640萬令吉。

華陽在近期內頻頻收購地庫,在2015年12月時曾宣佈以1千655萬2千339令吉,全權收購G地發展私人公司(GLDSB),進而再以2千500萬令吉收購檳城大山腳6塊總面積8.59英畝的永久地契空地。

根據華陽文告,該公司已完成GLDSB的收購活動,下一步將收購大山腳空地。

較早前,華陽曾嘗試以1億2千萬令吉買入一塊位於吉隆坡的地段,但後來因華陽無法滿足一項條件而告吹。(星洲日報/財經)

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

NON RELATED PARTY TRANSACTIONS | Description | HUA YANG BERHAD ("HYB" or "the Company")-Proposed acquisition of Development Company by Hua Yang Berhad | The Board of Directors of HYB wishes to announce that HYB had today entered into a conditional Share Sale Agreement (SSA) with Yeo Ann Seck, Loh Wui Tek, Sim Cher Chuan, Phun Chin Tung, Loh Ah Kow, Chew Seng Guan, Tiew Siang Yong, Lee Ah Kong, Lee Choon Phooi, Yeo Ann Ling and Ting Chu Huat (collectively known as the “Vendors”) to acquire 1,000,000 ordinary shares of RM1.00 each being the entire paid up share capital of Grand View Realty Sdn Bhd (“GVSB” ), a company incorporated in Malaysia with its registered office at No. 48A & 49A, Jalan Mohd Salleh, 83000 Batu Pahat, Johor and its business address at No. 117, Jalan Mutiara Emas 10/19, Taman Mount Austin, 81100 Johor Bahru, Johor for a total cash consideration of RM52,900,000.00 (“Purchase Price”) (the “Proposed Acquisition”).

Details of the Proposed Acquisition are set out in the enclosed file.

This announcement is dated 11 January 2016 |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/4972397

|

|

|

|

|

|

|

|

|

|

|

|

发表于 13-1-2016 12:03 AM

|

显示全部楼层

发表于 13-1-2016 12:03 AM

|

显示全部楼层

柔發展3.46億房產‧華陽購地合時宜

2016-01-12 16:47

(吉隆坡12日訊)華陽(HUAYANG,5062,主板產業組)宣佈以7千560萬令吉買下柔佛依斯干達東部走廊73.2英畝土地,以發展成為總值3億4千640萬令吉的房產計劃。

分析

肯納格研究對此交易不感意外,華陽管理層已多次強調正積極尋找地庫。該行認為收購南馬地段正合時宜,可填補該集團在當地的現有城鎮計劃。

土地成本方面,該行認為收購價略高,相等於發展總值的22%,超越20%的舒適門檻。但是每方呎價格為23令吉72仙,則遠低於該區平均的36令吉要價。

該行相信華陽未來有能力進一步增加其發展總值。

展望未來,該行仍預期華陽在2016財政年推出約6億5千萬令吉產業計劃,但不排除一些計劃再度展延的可能,視市況而定。

同時,華陽料繼續尋找更多地庫,以便將發展總值從40億令吉提昇至50億令吉。

達證券視收購價具吸引力,目前柔州避蘭東住宅地的詢價為每方呎35至60令吉。雖然總代價佔發展總值21%,但視為合理,因已獲各項批准。

華陽截至去年9月杪的淨負債共1億7千萬令吉或淨負債0.32倍,假設這次收購80%透過借貸,其負債率將升至0.47倍。

達證券認為收購適時,有助華陽補充在柔佛快速減少的地庫,同時將令其產業發展總值增加10%至40億令吉。

達證券保持財測不變,因為有關產業項目只在2018財政年才推出。

(星洲日報/財經) |

|

|

|

|

|

|

|

|

|

|

|

发表于 20-1-2016 09:51 PM

|

显示全部楼层

发表于 20-1-2016 09:51 PM

|

显示全部楼层

本帖最后由 icy97 于 21-1-2016 02:34 AM 编辑

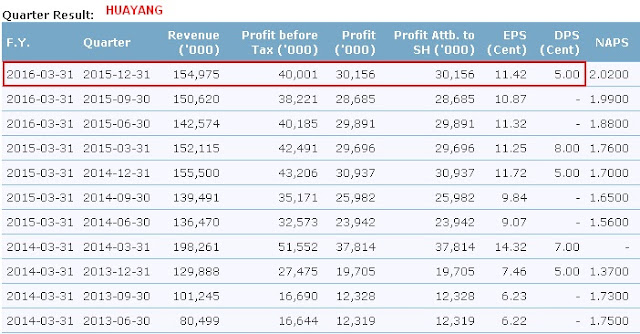

第3季淨利跌 華陽仍派息5仙

2016年1月20日

http://www.chinapress.com.my/20160120/第3季淨利跌-華陽仍派息5仙/

(吉隆坡20日訊)華陽(HUAYANG,5062,主要板房產)截至12月底第3季淨利微跌2.5%至2016萬令吉,仍派發每股5仙股息。

該公司同期期營業額從1億5550萬令吉,微幅減少至1億5498萬令吉,

至于首9個月淨利按年攀升10%,達8873萬令吉;營業額則按年起3.9%,至4億4817萬令吉。

華陽總執行長何文淵發布文告稱:“目前不穩定經濟環境導致房產領域趨軟。不過,我們的發展項目持續吸引購屋者,顯示可負擔房屋需求良好,這也是公司專注發展的領域。”

該公司現階段著重加強主要營運地區的定位,並尋求擴展地庫新商機,為股東提供實際價值。

華陽現有面積達540英畝未發展地庫,潛在總發展值達40億令吉。

| 5062 HUAYANG HUA YANG BHD | | Quarterly rpt on consolidated results for the financial period ended 31/12/2015 | | Quarter: | 3rd Quarter | | Financial Year End: | 31/03/2016 | | Report Status: | Unaudited | | Submitted By: |

|

|

| Current Year Quarter | Preceding Year Corresponding Quarter | Current Year to Date | Preceding Year Corresponding Period |

| 31/12/2015 | 31/12/2014 | 31/12/2015 | 31/12/2014 |

| RM '000 | RM '000 | RM '000 | RM '000 | | 1 | Revenue | 154,975 | 155,500 | 448,169 | 431,461 | | 2 | Profit/Loss Before Tax | 40,001 | 43,206 | 118,407 | 110,950 | | 3 | Profit/Loss After Tax and Minority Interest | 30,156 | 30,937 | 88,732 | 80,861 | | 4 | Net Profit/Loss For The Period | 30,156 | 30,937 | 88,732 | 80,861 | | 5 | Basic Earnings/Loss Per Shares (sen) | 11.42 | 11.72 | 33.61 | 30.63 | | 6 | Dividend Per Share (sen) | 5.00 | 5.00 | 5.00 | 5.00 |

|

|

| As At End of Current Quarter | As At Preceding Financial Year End | | 7 | Net Assets Per Share (RM) |

|

| 2.0200 | 1.7600 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 22-1-2016 02:02 AM

|

显示全部楼层

发表于 22-1-2016 02:02 AM

|

显示全部楼层

本帖最后由 icy97 于 23-1-2016 01:21 AM 编辑

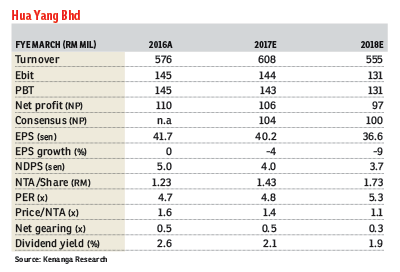

華陽銷售目標‧財測雙降

2016-01-21 16:56

(吉隆坡21日訊)房產市場持續充滿挑戰性,華陽(HUAYANG,5062,主板產業組)降低2016財政年銷售目標,分析員因此下調2017年財測。

在營業額穩健上揚4%的支撐下,華陽截至2015年12月杪的首9個月核心淨利上升10%至8千870萬令吉,符合預期,相等於市場全年財測的76.5%。

營業額增長主要是因為華陽在進行中的項目穩定發展和在進行中的項目已完成部份階段。

根據肯納格研究,華陽在2016財政年首9個月營業額共2億5千540萬令吉,落後於該行預期的4億8千210萬令吉和管理層預期的5億令吉目標。

另外,華陽派發5仙的中期股息符合該行的預測;肯納格研究預測在今年將派發13仙的股息,達到7.1%週息率。

基於房產市場充滿挑戰性,包括可負擔房產市場,華陽將其2016財政年銷售目標由5億令吉,下調20%至4億令吉。

肯納格研究也隨之下調華陽2016至2017財政年銷售預測22至23%,至3億7千210萬至4億零920萬令吉。

基於華陽尚有5億3千零50萬令吉未入賬銷售,該行維持華陽2016財政年淨利預測1億1千160萬令吉,及下調2017財政年淨利8%至1億零610萬令吉。

達證券表示,華陽2016財政年首9個月的32%營業額貢獻來自於大學城有地房產,基於銷售情況不理想,未入賬銷售在2015年12月時,由上一季的6億零700萬令吉下跌至5億3千100萬令吉。

華陽也將Mines South推介禮由2016財政年第四季推遲至2017財政年下半年,達證券不覺意外,因為該公司的銷售比該行預測的4億2千500萬令吉還低。

(星洲日報/財經‧報導:劉玉萍)

华阳 首3季净利达预期

财经 行家论股 2016-01-22 15:22

http://www.nanyang.com/node/745117?tid=462

|

|

|

|

|

|

|

|

|

|

|

|

发表于 29-1-2016 12:31 AM

|

显示全部楼层

发表于 29-1-2016 12:31 AM

|

显示全部楼层

本帖最后由 icy97 于 3-2-2016 03:32 AM 编辑

推高发展总值10% 华阳柔佛购地价格诱人

财经新闻 财经 2016-01-28 13:11

(吉隆坡27日讯)华阳(HUAYANG,5062,主板产业股)日前收购柔佛产业发展公司和8块土地,分析员认为,这项适时的收购计划有助增添地库,同时收购价具有吸引力。

华阳以总额7560万令吉,收购Grand View产业私人有限公司,计划发展总值达3亿4640万令吉的综合发展项目。

Grand View拥有8块面积共73.16英亩的永久地契土地,而华阳计划在相关土地上,推行8个阶段的综合发展项目,包括排屋、半独立洋房、店铺及柔佛可负担房屋计划的产业等。

达证券分析员指出,华阳的收购价相等于每平方尺23.72令吉。

由于该发展计划获得当地监管单位授予规划许可和州行政议会的批准,因此,未能有相似的交易可做出直接比较。

“不过,若和柔州柏兰东住宅用地每平方尺35至60令吉的询问价,我们认为,收购价非常有吸引力。

尽管收购价或占发展总值预估的21%,不过仍视为合理,因已取得所需的批准。”

最新的收购计划,将推高华阳的发展总值10%,至40亿令吉,且认为这项适时的收购,能增加该公司在柔州的地库。

积极寻找购地时机

肯纳格研究分析员对于这项收购计划并不感到意外,因该公司曾提及积极的物色购地时机,认为这项适时的收购,能为现有的新镇计划新增地库。

分析员认为,土地成本稍微偏高,因收购价占发展总值的22%,高于20%的舒适门槛,但是每平方尺的收购价,则低于柔州每平方尺平均36令吉的询问价。

“我们相信,华阳能在未来能进一步提升发展总值,犹如该公司管理其他的项目一样,如One South和Sentrio Suites。”

由于该项目在2018财年才推介,因此分析员纷纷维持财测不变。【南洋网财经】

買進券商心頭好.股息收益高同行 華陽淨利符預期

2016年2月02日

http://www.chinapress.com.my/20160202/買進券商心頭好.股息收益高同行-華陽淨利符預期/

券商:肯納格證券研究

合理價:2.20令吉 |

|

|

|

|

|

|

|

|

|

|

|

发表于 12-2-2016 01:19 AM

|

显示全部楼层

发表于 12-2-2016 01:19 AM

|

显示全部楼层

EX-date | 01 Apr 2016 | Entitlement date | 05 Apr 2016 | Entitlement time | 04:00 PM | Entitlement subject | Interim Dividend | Entitlement description | Interim single tier dividend of 5% per share | Period of interest payment | to | Financial Year End | 31 Mar 2016 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | SYMPHONY SHARE REGISTRARS SDN BHDLevel 6, Symphony HousePusat Dagangan Dana 1Jalan PJU 1A/4647301Petaling JayaTel:0378490777Fax:0378418151 | Payment date | 21 Apr 2016 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 05 Apr 2016 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Percentage | Entitlement in Percentage (%) | 5.0000 | Par Value | Malaysian Ringgit (MYR) 1.000 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 16-2-2016 07:54 PM

|

显示全部楼层

发表于 16-2-2016 07:54 PM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 3-3-2016 11:56 PM

|

显示全部楼层

发表于 3-3-2016 11:56 PM

|

显示全部楼层

Top Dividend Yield Stocks (Cash Cows) Based on Free Cash Flow Per Share

| Company | Share Price | Free Cash Flow Per Share | Dividend per Share | Yield | | JCY | RM0.66 | RM0.0734 | RM0.0675 | 10.23% | | YTLE | RM0.53 | RM0.0432 | RM0.04 | 7.55% | | Cscenic | RM1.33 | RM0.1143 | RM0.1 | 7.52% | | Media | RM1.36 | RM0.0817 | RM0.1 | 7.35% | | Star | RM2.45 | RM0.2648 | RM0.18 | 7.35% | | Huayang | RM1.8 | RM0.282 | RM0.13 | 7.22% | | YTLPowr | RM1.47 | RM0.1005 | RM0.1 | 6.8% | | TienWah | RM2.71 | RM0.2618 | RM0.18 | 6.64% | | Maybank | RM8.79 | RM1.3839 | RM0.57 | 6.48% | | Haio | RM2.38 | RM0.2509 | RM0.15 | 6.3% | | UOADev | RM2.12 | RM0.1664 | RM0.13 | 6.13% | | YTL | RM1.58 | RM0.1204 | RM0.095 | 6.01% | | FLBhd | RM2.43 | RM0.2883 | RM0.15 | 6.17% |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 10-3-2016 12:26 AM

|

显示全部楼层

发表于 10-3-2016 12:26 AM

|

显示全部楼层

本帖最后由 icy97 于 10-3-2016 01:26 AM 编辑

Wednesday, 9 March 2016

http://bursadummy.blogspot.my/2016/03/property-huayang-tambun-matrix.html

HUAYANG

Huayang's FY16Q3's financial result is good as expected.

It posted a PATAMI of RM30.2mil, with cumulative 9-month PATAMI of RM88.7mil which is 10% higher than FY15's corresponding period.

When I bought Huayang's shares in Sep14, even though I was aware of property market slowdown, I predicted that Huayang can post strong financial results for at least FY15 & FY16, and give at least 13sen dividend for 2 years.

This is actually not too hard to predict base on its previous new sales trend and unbilled sales.

If new sales manage to beat market expectation in FY15 & FY16, then the results could be even better.

Now we are at the end of Huayang's FY16 (which ends on Mac16), financial results and dividends are good as expected but there is no surprise in new sales.

EPS average about 11sen a quarter and what should be its fair value base on PE ratio?

Anyway, I failed to predict the PE ratio market would like give it.

This shows that PE ratio is nothing if market sentiment is poor in the sector.

New sales so far after 9MFY16 stands at RM255mil, which is unlikely to reach RM400mil in the whole year of FY16. Huayang achieves new sales of RM460mil for FY15.

So unbilled sales drop from RM733mil a year ago to RM530mil now.

It's not hard to predict that Huayang's FY17 will be poorer.

I have sold all my shares in Huayang at a loss of 13.3%. However, it does not mean that I don't like Huayang or it is a poor company. It's just part of portfolio management.

For FY16, Huayang should be able to give the same 13sen dividends like previous FY. This is a good 7.1% yield at current share price of RM1.82. |

|

|

|

|

|

|

|

|

|

|

|

发表于 21-3-2016 07:48 PM

|

显示全部楼层

发表于 21-3-2016 07:48 PM

|

显示全部楼层

HUAYANG experienced a trendline breakout above the RM1.85 level with higher-than-average volumes. The MACD Indicator expanded positively above zero. The RSI, however, is overbought. Price target will be envisaged around the RM2.05 and RM2.19 levels. Support will be set around the RM1.85 level.

|

|

|

|

|

|

|

|

|

|

|

|

发表于 5-4-2016 05:20 AM

|

显示全部楼层

发表于 5-4-2016 05:20 AM

|

显示全部楼层

本帖最后由 icy97 于 5-4-2016 05:36 AM 编辑

Hua Yang Bhd forms bullish "Two Bar Reversal" chart pattern

Apr 04, 2016

Recognia has detected a "Two Bar Reversal (Bullish)" chart pattern formed on Hua Yang Bhd (HUAYANG:MYX). This bullish signal indicates that the stock price may rise from the close of 1.85.

Tells Me: Selling pressure showing signs of exhaustion; we may see higher prices at least in the short term. A Two-Bar Reversal (Bullish) forms during a prolonged downtrend and involves two exceptionally wide bars reflecting a change in psychology. The first bar develops strongly in the direction of the downtrend, though developing a wide range hinting at an underlying shift. The second bar opens near the previous low as sellers come into the session expecting more of the same, but they are ultimately disappointed as the price closes up very close to the high of the previous bar.

This bullish pattern can be seen on the following chart and was detected by Recognia proprietary pattern recognition technology.

|

|

|

|

|

|

|

|

|

|

|

|

发表于 28-4-2016 08:22 PM

|

显示全部楼层

发表于 28-4-2016 08:22 PM

|

显示全部楼层

本帖最后由 icy97 于 28-4-2016 08:26 PM 编辑

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

NON RELATED PARTY TRANSACTIONS | Description | HUA YANG BERHAD ("HYB" or "the Company")-Proposed acquisition of Development Company by Hua Yang Berhad | Further to the Company’s announcement dated 11 January 2016 on the acquisition of the entire paid up share capital of Grand View Realty Sdn Bhd (“GVSB”) pursuant to a conditional Share Sale Agreement (SSA) with Yeo Ann Seck, Loh Wui Tek, Sim Cher Chuan, Phun Chin Tung, Loh Ah Kow, Chew Seng Guan, Tiew Siang Yong, Lee Ah Kong, Lee Choon Phooi, Yeo Ann Ling and Ting Chu Huat (collectively known as the “Vendors”) (“the Proposed Acquisition”), the Company wishes to inform that the Proposed Acquisition was completed on 28 April 2016. GVSB will be a wholly-owned subsidiary of the Company upon the registration of the transfer of shares into the Company's name.

Pursuant to the terms of the SSA, the balance of the Purchase price amounting to RM45,340,000.00 is to be paid to the Vendors on completion date together with settlement of the loan due from GVSB to Vendors of RM22,700,000.00.

As subsequent to the execution of the SSA, GVSB had received a notice of claim from a creditor, the Vendors have on 28 April 2016 provided a letter of undertaking to collectively undertake and guarantee that: - in the event GVSB shall fail in defending a potential claim which may be initiated by a creditor for the alleged sum of RM1,602,720.00 (“Alleged Sum”), a sum equivalent to the Alleged Sum which is to be held by HYB’s solicitors as stakeholders and shall be released by the Purchaser’s solicitors in accordance with the terms of the judgment of the Malaysian Court presiding on the said claim by the Creditor. If the judgment sum, costs, expenses, damages, compensation and/or interest awarded by the Court to be payable by GVSB to the Creditor is more than the Alleged Sum, the Vendors shall pay the differential sum to the Company’s solicitors within seven (7) days from the date of the judgment who shall then be authorised by the parties to release the same to the Creditor;

- the legal costs and disbursements in defending the abovementioned potential claim shall be borne by the Vendors collectively and reimbursed to GVSB accordingly; and

- the Vendors shall collectively indemnify and at all times keep HYB indemnified against all claims, action, proceedings, suits, demands, losses, damages, expenses and costs which may be taken against, sustained or incurred by HYB by reason or arising from the failure of GVSB and/or the Vendors to fully discharge and/or pay the Alleged Sum and/or any differential sum thereof pursuant to the terms of judgment of the Malaysian Court presiding on the said claim by the Creditor.

The above undertaking will not have any financial effect on HYB Group as the Alleged Sum forms part of the consideration of RM52,900,000.00 to be paid by HYB for the acquisition of GVSB.

The Directors of HYB are of the view that the above undertaking is in the best interest of the Company.

This announcement is dated 28 April 2016. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 18-5-2016 05:50 PM

|

显示全部楼层

发表于 18-5-2016 05:50 PM

|

显示全部楼层

本帖最后由 icy97 于 19-5-2016 05:17 PM 编辑

銷售跌‧建築進度欠佳‧華陽末季賺2139萬

2016-05-19 09:00

http://biz.sinchew.com.my/node/137161?tid=6

(吉隆坡18日訊)受銷售下跌及建築進度欠佳影響,華陽(HUAYANG,5062,主板產業組)截至2016年3月31日止第四季淨利下滑27.99%至2千139萬令吉。

全年淨利僅微跌0.40%至1億1千零12萬2千令吉。

第四季營業額跌16.14%至1億2千757萬1千令吉,令全年營業額走跌1.34%至5億7千574萬令吉。

該公司在報告中說,截至2016年3月31日止未結賬銷售企於4億6千338萬令吉。

該公司對全年財務表現感到滿意,預見接下來產業市場將持續面臨挑戰,對2017財政年展望謹慎樂觀。(星洲日報/財經)

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2016 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2016 | 31 Mar 2015 | 31 Mar 2016 | 31 Mar 2015 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 127,571 | 152,115 | 575,740 | 583,576 | | 2 | Profit/(loss) before tax | 26,363 | 42,501 | 144,770 | 153,451 | | 3 | Profit/(loss) for the period | 21,390 | 29,706 | 110,122 | 110,567 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 21,390 | 29,706 | 110,122 | 110,567 | | 5 | Basic earnings/(loss) per share (Subunit) | 8.10 | 11.25 | 41.71 | 41.88 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 8.00 | 5.00 | 13.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 2.0500 | 1.7600

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 19-5-2016 01:44 PM

|

显示全部楼层

发表于 19-5-2016 01:44 PM

|

显示全部楼层

本帖最后由 icy97 于 19-5-2016 05:20 PM 编辑

昨天公布退跌第4季业绩的华阳(5062,HUAYANG),宣布3送1红股。

该公司是在业绩报表内的企业活动栏目里,透露这项消息,但并没有另外分开宣布。

涉及的红股总额是8800万股,红股除权日期有待宣布。

华阳在2010年至2013年里,连续3年每年都有分红股。因此,这也是该公司停了2年后,再次分送红股。

该公司昨天公布第4季业绩,营收下滑16%至1亿2757万令吉;净利则急退28%至2139万令吉。

資匯 The busy weekly

|

|

|

|

|

|

|

|

|

|

|

|

发表于 25-5-2016 05:52 AM

|

显示全部楼层

发表于 25-5-2016 05:52 AM

|

显示全部楼层

本帖最后由 icy97 于 25-5-2016 04:44 PM 编辑

Hua Yang targeting RM500m sales for FY17

By Kenanga Research / The Edge Financial Daily | May 23, 2016 : 11:28 AM MYT

http://www.theedgemarkets.com/my/article/hua-yang-targeting-rm500m-sales-fy17

Hua Yang Bhd

(May 20, RM1.82)

Downgrade to market perform with a lower target price (TP) of RM1.94: At its briefing, Hua Yang Bhd’s management highlighted that financial year ended March 31, 2016 (FY16) sales were slower than expected owing to the poor property market sentiment as homebuyers adopted a wait-and-see stance coupled with high loan rejection rates, which prompted the company to delay some initial planned launches to focus on clearing inventories worth a gross development value (GDV) of RM370.7 million from previously launched projects.

While management is seeking to launch up to RM721 million worth of projects — Astetica (GDV: RM368 million), landed residential project in Johor (GDV: RM33 million); Bandar Universiti Seri Iskandar, Perak (GDV: RM100 million); and Prai, Penang (GDV: RM220 million) — it did not rule out potential delays should the poor property market sentiment remain. However, management sounded confident of Astetica and Prai projects as these two particular developments received fairly good response from previous roadshows.

Despite the weak sales performance in FY16, management is targeting RM500 million worth of sales for FY17 backed by planned launches worth RM721 million and unsold projects of RM370.7 million. However, we think that management’s target is slightly too ambitious given the current market condition coupled with potential delays in future launches. Hence, we opt to maintain our FY17 estimate (FY17E) sales of RM409.2 million.

Post briefing, we downgrade Hua Yang to “market perform” with a lower TP of RM1.94 based on a wider revised net asset value (RNAV) discount of 45% (FY15 average discount) to its RNAV of RM3.52, due to unattractive dividend yields coupled with the challenging property market scene. The 45% discount is lower compared with the sector’s average of 56% due to its positioning in the affordable segment, which still provides property projects priced at a range of RM500,000. Our TP implies FY17E/FY18E price-earnings ratios of 4.8 times/5.3 times. Among the risks to our call include: i) weaker-than-expected property sales, ii) higher-than-expected sale and administrative costs, iii) negative real estate policies, iv) tighter lending environment, and v) higher-than-expected dividend payouts. — Kenanga Research, May 20

|

|

|

|

|

|

|

|

|

|

|

|

发表于 2-7-2016 12:23 PM

|

显示全部楼层

发表于 2-7-2016 12:23 PM

|

显示全部楼层

本帖最后由 icy97 于 2-7-2016 10:23 PM 编辑

華陽長期具潛能

2016年07月2日 | The Busy Weekly

華陽2016財政年(截至3月31日止)末季開始出現疲態,淨利按年萎縮28%,至2139萬令吉;營業額則萎縮16%,至1億2757萬令吉。

全年淨利按年持平在1億1012萬令吉,是自2008財政年以來首次停止成長。

儘管如此,管理層對2017財政年銷售表現仍感到樂觀,儘管整體產業市場仍充滿挑戰。截至3月份的未入帳銷售(unbilled sales)為4億6338萬令吉。

董事局沒有如往年般宣布派發終期股息,而是建議以3送1紅股來回饋股東,某程度上影響該股的投資情緒。

有鑑於此,華陽股價在次季下滑了7.5%,稍微跑輸大市。年頭至今,其股價失血6.0%,與吉隆坡產業指數同步。

雖然產業領域短期復甦無望,但政府4月推出的MyDeposit基金,為首購族支付房貸首期,對可負擔產業發展商如華陽有利。

分析員也提醒,雪州政府凍結了興建服務式公寓、SOHO和SOVO的申請,未來該州低於50萬令吉的可負擔房屋供應將大減。在這前提下,於雪州擁有大批地庫,並已取得興建准證的華陽,佔有優勢。

根據《彭博社》的資料,年頭至今共有4名分析員追蹤華陽,其中3名給予「守住」或等同投資建議、1名給予「賣出」。12個月平均目標價1.77令吉。

最新本益比低至4.2倍、股價對賬面價值( P/ BV) 0.8倍。若產業市場沒有出現嚴重衰退,華陽中長期股價上漲潛能仍非常大。

|

|

|

|

|

|

|

|

|

|

|

|

发表于 16-7-2016 02:02 AM

|

显示全部楼层

发表于 16-7-2016 02:02 AM

|

显示全部楼层

本帖最后由 icy97 于 20-7-2016 01:58 AM 编辑

华阳首季销售料跌.盈利或减33%

(吉隆坡15日讯)华阳(HUAYANG,5062,主板产业组)即将出炉的业绩料可符合预期,惟分析员认为由于产业市场买气低迷加上该公司未推新盘,首季销售料下滑,拖累盈利恐走低33%。

业绩下周三出炉

达证券指出,华阳将在下周三(7月20日)公布2017财政年首季业绩,预期该公司净利报2000万至2500万令吉,这占全年财测的23%至27%,由于销售走低,料导致其首季净利按年减少16%至33%。

华阳在2014财年创下7亿3500万令吉销售额新高后,因银行收紧信贷和消费情绪走低,销售表现开始走低,2016年仅录得3亿3700万销售,为5年最差表现。未入账销售也从7亿零200万令吉走低至4亿6300万令吉,仅能支撑未来12个月的盈利能见度。

2016财政年首季及第四季,华阳销售额报8170万令吉及8130万令吉,达证券认为,即将公布的首季销售额将录得按年和按季双双下滑。

华阳管理层早前在汇报会上表示,下半年将在巴生河流域、柔佛、霹雳及槟城推出数项产业项目,发展总值达7亿2100万令吉,产业类型以可负担房屋为主,并放眼营业额可取得48%的成长。

达证券认为,虽然国家银行宣布降息,但银行未必会放宽房贷条件,加上消费情绪低迷,预期华阳2017财政年难达到5亿令吉的销售目标。

达证券说,2017财政年首季,华阳虽然没有推出新的产业计划,但预期华阳在霹雳及柔佛的产业项目可贡献1500万至2000万令吉的营业额。

截至今年3月份为止,华阳的产业库存为3亿7000万令吉。

达证券维持华阳2017及2018年的净利预测,预期2017至2019财年的销售额报3亿7400万、4亿7100万及6亿3000万令吉,以及预测2017年和18年盈利双位数下滑,至9280万和7880万令吉,以及2019年略挫9%。

综合上述看法,达证券维持华阳“卖出”评级及1令吉87仙目标价不变,红股除权后的目标价调整为1令吉40仙。

文章来源:

星洲日报/财经‧报道:谢汪潮‧2016.07.15

华阳首季净利料跌

2016年7月20日

http://www.enanyang.my/news/20160720/华阳首季净利料跌/

|

|

|

|

|

|

|

|

|

|

|

|

发表于 20-7-2016 05:46 PM

|

显示全部楼层

发表于 20-7-2016 05:46 PM

|

显示全部楼层

本帖最后由 icy97 于 21-7-2016 01:56 AM 编辑

产业销量跌

华阳首季净利挫20%

2016年7月21日

http://www.enanyang.my/news/20160721/产业销量跌br-华阳首季净利挫20/

(吉隆坡20日讯)产业销量走跌,拖累华阳(HUAYANG,5062,主板产业股)截至6月30日首季净利,按年下挫20.03%。

该公司净赚2390万5000令吉,逊于去年同季的2989万1000令吉。

营业额则按年跌10.25%,至1亿2796万1000令吉。

其中产业发展业务的营业额和税前盈利,因销量走低而分别下跌10%和20%。

华阳截至次季的未入账销售额,企于4亿1007万令吉。

华阳认为,产业领域的展望依旧充满挑战,因消费者情绪低迷和房贷条例严谨。尽管充斥不确定性,不过,董事部仍正面看待公司今财年的展望。

3送1红股

另一方面,华阳宣布以3送1的比例,派送高达8800万股红股,回馈股东、提高公司的股本及增加股票流通率。

根据文告,华阳将会使用盈利保留户头来派发红股;截至2016年3月31日财年,公司的盈利保留户头拥有1508万2000令吉,在派送红股后将剩下948万2000令吉。【e南洋】

| | 5062 | | Quarterly rpt on consolidated results for the financial period ended 30/06/2016 | | Quarter: | 1st Quarter | | Financial Year End: | 31/03/2017 | | Report Status: | Unaudited | | Submitted By: |

|

|

| Current Year Quarter | Preceding Year Corresponding Quarter | Current Year to Date | Preceding Year Corresponding Period |

| 30/06/2016 | 30/06/2015 | 30/06/2016 | 30/06/2015 |

| RM '000 | RM '000 | RM '000 | RM '000 | | 1 | Revenue | 127,961 | 142,574 | 127,961 | 142,574 | | 2 | Profit/Loss Before Tax | 32,223 | 40,185 | 32,223 | 40,185 | | 3 | Profit/Loss After Tax and Minority Interest | 23,905 | 29,891 | 23,905 | 29,891 | | 4 | Net Profit/Loss For The Period | 23,905 | 29,891 | 23,905 | 29,891 | | 5 | Basic Earnings/Loss Per Shares (sen) | 9.05 | 11.32 | 9.05 | 11.32 | | 6 | Dividend Per Share (sen) | 0.00 | 0.00 | 0.00 | 0.00 |

|

|

| As At End of Current Quarter | As At Preceding Financial Year End | | 7 | Net Assets Per Share (RM) |

|

| 2.1400 | 2.0500 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 21-7-2016 02:34 AM

|

显示全部楼层

发表于 21-7-2016 02:34 AM

|

显示全部楼层

|

No dividends this time😢 |

|

|

|

|

|

|

|

|

|

|

|

发表于 21-7-2016 10:48 PM

|

显示全部楼层

发表于 21-7-2016 10:48 PM

|

显示全部楼层

Type | Announcement | Subject | NEW ISSUE OF SECURITIES (CHAPTER 6 OF LISTING REQUIREMENTS)

BONUS ISSUES | Description | HUA YANG BERHAD ("HUA YANG" OR THE "COMPANY")PROPOSED BONUS ISSUE OF 88,000,000 NEW ORDINARY SHARES OF RM1.00 EACH IN HUA YANG ("BONUS SHARE(S)") ON THE BASIS OF ONE (1) BONUS SHARE FOR EVERY THREE (3) EXISTING ORDINARY SHARES OF RM1.00 EACH HELD IN HUA YANG ("HUA YANG SHARE(S)" OR "SHARE(S)") ON AN ENTITLEMENT DATE TO BE DETERMINED LATER ("PROPOSED BONUS ISSUE") | On behalf of the Board of Directors of Hua Yang, RHB Investment Bank Berhad wishes to announce that the Company proposes to undertake a bonus issue of 88,000,000 Bonus Shares on the basis of one (1) Bonus Share for every three (3) existing Hua Yang Shares held on an entitlement date to be determined and announced later.

Further details on the Proposed Bonus Issue are set out in the attachment below.

This announcement is dated 20 July 2016. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5152537

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|