|

查看: 29254|回复: 321

|

【NCT 0056 交流专区】(前名 GRANFLO )

[复制链接]

[复制链接]

|

|

|

本帖最后由 icy97 于 29-12-2021 07:26 AM 编辑

Grand-Flo Solution Berhad is engaged in the provision of informationtechnology (IT) solutions and investment holding. Its subsidiariesinclude Grand-Flo Electronic System Sdn. Bhd., which is engaged in thesupply and installation of enterprise data collection and collationsystems and hardwares, information technology solution,computer-related accessories, integrating computer system and hardware;Grand-Flo Systems (S) Pte. Ltd., which is engaged in the provision ofintegrated enterprise data collection and collation system solutions;Spritvest Sdn. Bhd, which is engaged in the provision of IT solutionsspecializing in automated data collection processes and mobilecomputing, and Data Centrix Sdn. Bhd., which is engaged in the researchand development of software application. On September 29, 2006, itacquired Spritvest Sdn. Bhd. and Data Centrix Sdn. Bhd. On March 14,2007, it acquired the remaining 50% in Grand-Flo RFID Sdn. Bhd.

[ 本帖最后由 tan81 于 14-8-2008 06:26 PM 编辑 ] |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 21-2-2008 10:11 AM

|

显示全部楼层

Wednesday December 19, 2007

Grand-Flo pins hope on downstream activities

By SHANNEN WONG

PETALING JAYA: Mesdaq-listed Grand-Flo Solution Bhd expects its downstream division, which will be producing barcode ribbons and labels, to contribute at least 25% to group revenue for the financial year ending Dec 31, 2008 (FY08).

“We hope to double the revenue from the downstream division to 50% in FY09, and in subsequent years,” managing director Derrick Tan said.

Speaking after the company signed an agreement to buy a 55% stake in Labels Network Sdn Bhd for RM4mil cash yesterday, Tan said the downstream activities in Malaysia and Thailand would add substantially to the group's revenue, on top of the bid it had submitted for a project to supply tracking systems to an airport in Thailand.

Labels Network was represented by chief executive officer Wan Kok Weng.

Derrick Tan

“We expect to finalise the airport deal by next year, after the Thai election this month,” Tan said.

Yesterday's acquisition deal involves Labels Network providing a minimum profit guarantee of RM2.25mil in two years.

“Labels Network's technological know-how and experience will provide us with an ideal platform for product development efforts into a wider range of barcode labels and new technologies, such as Radio Frequency Identification.

“We will focus on the industries of fast moving consumer goods, retail and healthcare for our Thailand market,” he added.

Yesterday, Grand-Flo's Thai associate, Simat Technologies, also signed an agreement to set up 60:40 joint-venture company in Bangkok with Labels Network to produce barcode labels.

The two companies would jointly invest 12 million baht in the plant, Tan said, adding that Grand-Flo hoped to cater to its existing as well as new customers in Malaysia and Thailand.

Labels Network manufactures a wide range of self-adhesive label stickers in Malaysia, including barcode, thermal transfer and security labels.

It has customers from multinational companies in various industries, such as food and beverage, consumer goods and electric and electronics sectors.

On its regional expansion plans, Grand-Flo sees Indonesia and Vietnam as potential markets. It currently has a presence in Singapore and Thailand, and a distribution network in Indonesia.

For the nine months ended Sept 30, it registered a net profit of RM4.24mil on revenue of RM47.87mil. |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 21-2-2008 10:11 AM

|

显示全部楼层

[December 12, 2007]

GRAND-FLO SET TO EXPAND REGIONALLY WITH THAI LISTING

KUALA LUMPUR, Dec 12 (Bernama) -- Integrated IT-based tracking solutions provider Grand-Flo Solution Bhd is set to expand regionally following the listing of its unit, Simat Technologies Public Co Ltd, on the Market of Alternative Investment of the Thai Stock Exchange today

Managing director Derrick Tan said the listing will not only provide Grand-Flo's operations in Thailand the much-needed funds in taking it to the next level of growth but also use that country as a springboard into the Indo-China market, particularly Vietnam

"With funds from the IPO (initial public offering) proceeds, Simat will be able to undertake more product development efforts especially in new technologies such as Radio Frequency Identification (RFID) solutions and be eligible to bid for large projects," he said in a statement here

Thailand's Software Industry Promotion Agency recently collaborated with several technological organisations to boost the adoption of RFID in a number of sectors such as logistics, retail, business, animal tracking and near-field communication

A recent market study by Frost & Sullivan indicated that the RFID market in Thailand is projected to be worth RM107.7 million by 2010, from RM54.9 million in 2005, growing at about 14 percent a year

"Armed with the Group's accumulated experience in the Enterprise Data Collection and Collation System sector as well as successfully developing growing markets, we are confident of replicating our Thailand success story in other countries in the region," he added

On its debut, Simat opened at 5.15 baht, 36 percent above its issue price of 3.80 baht a share. Its IPO involved the issuance of 18.75 million new ordinary shares, enlarging Simat's share capital to 75 million baht

Simat raised 71.25 million baht or RM8.28 million from the IPO exercise to be used as working capital and for listing expenses

The flotation results in Grand-Flo's stake in Simat being diluted from 49 percent to 36.75 percent, netting it RM4 million

On top of that, Simat will be paying a final dividend of 0.20 baht a share for its financial year ending Dec 31 2007, amounting to a total dividend payout of 15 million baht (about RM1.53 million)

[ 本帖最后由 Mr.Business 于 10-4-2008 10:45 AM 编辑 ] |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 21-2-2008 10:12 AM

|

显示全部楼层

Company Description

Contact Info

3-5 Block D2 Jalan PJU 1/39

Dataran Prima

Petaling Jaya, 47301

Malaysia

Phone: 60 3 7880 2222

Fax: 60 3 7880 3913

www.grand-flo.com

Grand-Flo Solution Berhad, through its subsidiaries, provides information technology solutions in Malaysia, Singapore, and Thailand. It offers a suite of solutions, ManageSuite, which comprises integrated modules that facilitate asset tracking and sales force automation, and enable automated collation of real-time data to assist enterprises. The ManageSuite includes software products, such as ManageSales, a field force management system that allows mobile workers to perform route sales, direct store deliveries, and market and distribution check; ManageAsset, an asset tracking system; ManageLine, a production floor system used for the management of resources and status of shop floor activities; and ManageWare, which is a raw material and finished goods warehouse system. The company also offers various hardware products, including input devices, such as hand-held scanners, fixed position scanners, and imagers and decoders; barcode verifiers and printers; computers/terminals; application development tools, which include barcode design and printing software; enterprise data collection and collation system; and radio frequency identification (RFID) technology products, such as high frequency readers, antennas, RFID tags, and RFID label printers. It serves corporations, retail chains, and government-related entities of various sectors, including manufacturing, logistics, warehousing, fast moving consumer goods, and healthcare industries. The company was incorporated in 2003 and is headquartered in Petaling Jaya, Malaysia. |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 21-2-2008 10:15 AM

|

显示全部楼层

(Sep '07) Annual(2006)Annual(TTM)

Net Profit Margin 11.17% 11.57% 10.66%

Operating Margin 13.60% 16.14% 13.00%

EBITD Margin - 18.98% 16.21%

Return on Average Assets 16.60% 14.48% 15.35%

Return on Average Equity 20.15% 17.82% 22.38%

Employees 152 - - |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 21-2-2008 10:33 AM

|

显示全部楼层

[ 本帖最后由 Mr.Business 于 10-4-2008 10:46 AM 编辑 ] |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 21-2-2008 10:35 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 21-2-2008 10:38 AM

|

显示全部楼层

发表于 21-2-2008 10:38 AM

|

显示全部楼层

不用看了,看财报简表就知道是坏公司。  |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 21-2-2008 10:49 AM

|

显示全部楼层

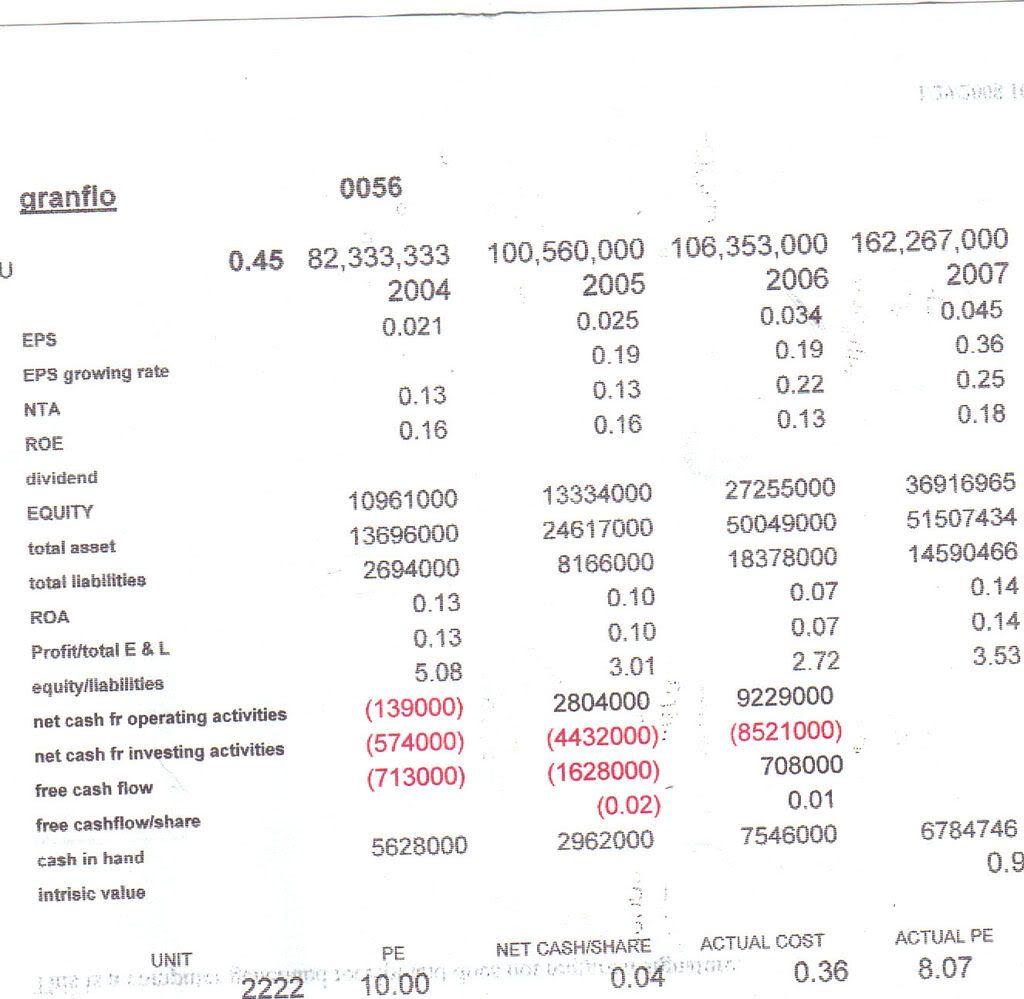

关于这间公司,有几点是要注意的。6#的最顶端是它的ShareCapital。这几年,它一直增加股本来收购别的公司。

4 Feb,2005--Granflo 收购SIMAT(Thailand)49%,RM4 Million。

22 March 2006--Granflo 收购Spritvest和DCSB 100%,RM14 Miilion。

31 JAN 2008 --Granflo 收购Labels Network 55%,RM 4 Million.

2005 年的Goodwill是Rm2.6 Million

2006 年的Goodwill是RM12.5 Million |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 21-2-2008 10:50 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 21-2-2008 10:58 AM

|

显示全部楼层

发表于 21-2-2008 10:58 AM

|

显示全部楼层

回复 10# tan81 的帖子

先看你的原因,哈哈 |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 21-2-2008 11:06 AM

|

显示全部楼层

目前,Simat 已经在Thai上市。市值RM30 Million。而Granflo持有36.75%的股权。

Spritvest和DCSB的购买合约规定,他们担保在2006和2007 年会达到RM4.5 Miilion的盈利。 2006年有达标,2007年还在等待。 |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 21-2-2008 11:08 AM

|

显示全部楼层

回复 11# 8years 的帖子

其实只是觉得有可能。因为不停的收购,是很容易让大股东卷掉公司的现金的。

可是,我有疑惑的是,他们收购的资产又似乎物超所值。所以我才想听意见。

Granflo的trade Receivabes也很高。

[ 本帖最后由 tan81 于 21-2-2008 11:14 AM 编辑 ] |

|

|

|

|

|

|

|

|

|

|

|

发表于 21-2-2008 11:10 AM

|

显示全部楼层

发表于 21-2-2008 11:10 AM

|

显示全部楼层

回复 12# tan81 的帖子

有这样爽,那么看起来这收购是赚到笑咯。为什么没有现金流的??

Spritvest又如何?? |

|

|

|

|

|

|

|

|

|

|

|

发表于 21-2-2008 11:12 AM

|

显示全部楼层

发表于 21-2-2008 11:12 AM

|

显示全部楼层

回复 13# tan81 的帖子

|

研究一下Spritvest和DCSB的盈利是怎样来的不就知道咯。看他们的asset是如何分配的。 |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 21-2-2008 11:14 AM

|

显示全部楼层

Granflo的主要产品是Bar-Code Scanner。据了解,他们是市场的领航者。Inventories Software Control也是他们的强项。泰国的Simat拥有所有7-11的合约,负责提供Inventories Control的服务。泰国共有1000家 7-11。而他们估计今年的7-11 会再扩张另外1000家分店。而新合约,也是Simat的。

Granflo接下来的主要产品是RFID。应该是以RadioFrequecy来探测存货量。会主攻泰国的汽车市场。2006年的业绩,有60%来自于外国(泰国和新加坡)。 |

|

|

|

|

|

|

|

|

|

|

|

发表于 21-2-2008 11:17 AM

|

显示全部楼层

发表于 21-2-2008 11:17 AM

|

显示全部楼层

“泰国共有1000家 7-11。而他们估计今年的7-11 会再扩张另外1000家分店。”

有什么可能会扩张一倍??1000间用了多少年,现在一年就要double??谁会相信? |

|

|

|

|

|

|

|

|

|

|

|

发表于 21-2-2008 11:18 AM

|

显示全部楼层

发表于 21-2-2008 11:18 AM

|

显示全部楼层

|

我公司也有做barcode和rfid的solution。市场很乱,supplier太多了,低层科技。 |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 21-2-2008 11:19 AM

|

显示全部楼层

不明白15#的意思。希望你解释。Spritvest和DCSB是一起的,他们属于Granflo的Vendor。而整个收购是在Oct06 才完成。

Granflo的Net Cash From Operation 从2005年的RM3Million 上升到RM 9.2 Million。

现金流是有增长。 |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 21-2-2008 11:24 AM

|

显示全部楼层

回复 17# 8years 的帖子

这个是有疑点。不过7-11进入泰国的市场,不比大马的历史悠久。地理和经济条件也不同。当年7-11在台湾扩张时,,曾经引起轰动。

不过,有没有达标,是7-11的风险。Simat只是多做或少做。只要不把这项成长概括在估值里,就会比较保险。

我比较有兴趣知道的是,以这个例子,它是否有再那里做手脚。或者真的是一家积极扩张的好公司? |

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|