|

|

【PERISAI 0047 交流专区】柏利赛石油

[复制链接]

[复制链接]

|

|

|

发表于 20-12-2017 06:53 AM

|

显示全部楼层

发表于 20-12-2017 06:53 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | PERISAI PETROLEUM TEKNOLOGI BHD ("PERISAI" OR "THE COMPANY") - NOTIFICATION OF CHANGE OF SHARIAH STATUS | The Board of Directors of Perisai wishes to announce that the Company has received a letter from the Securities Commission (“SC”) dated 18 December 2017 notifying the change of Shariah status of the Company.

Based on the Audited Financial Statements of the Company for the financial period ended 30 June 2017, the percentage of total conventional debts over the total assets of Perisai has exceeded the bench mark of 33% fixed by the SC’s Shariah Advisory Council (“SC SAC”), the computation of the percentage is as follows:-

| RM | Total Conventional Debts | 658,238,551 | Total Assets | 1,718,670,339 | Percentage | 38.30% |

SC SAC will not proceed with the listing of Perisai securities as Shariah Compliance Securities with effect from 25 May 2018.

A copy of the letter from SC dated 18 December 2017 is attached herewith.

This announcement is dated 18 December 2017. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5640933

|

|

|

|

|

|

|

|

|

|

|

|

发表于 16-1-2018 04:09 AM

|

显示全部楼层

发表于 16-1-2018 04:09 AM

|

显示全部楼层

PERISAI石科 終止Emas Offshore合約

2018年1月15日

(吉隆坡15日訊)PERISAI石油科技(PERISAI,0047,主要板貿服)宣佈終止與離岸承包商Emas Offshore,以及Emas Victoria有限公司簽署的合約。

PERISAI石油科技向馬證交所報備,子公司PERISAI生產控股私人有限公司已致函Emas Victoria有限公司,宣佈終止簽署的合約。

同時,PERISAI生產控股私人有限公司要求Emas Offshore將所持有Emas Victoria有限公司的3733萬3604股股份,在一個月內,以1美元(約3.96令吉)價格全數售予前者。

PERISAI石油科技與Emas Offshore于2016年底陷入糾紛,因后者嘗試擺脫較早前一項交易中的4300萬美元(約1.7億令吉)支付義務。【中国报财经】

Type | Announcement | Subject | OTHERS | Description | PERISAI PETROLEUM TEKNOLOGI BHD ("PERISAI" OR "THE COMPANY") - TERMINATION OF SHAREHOLDERS' AGREEMENT DATED 21 AUGUST 2013 BETWEEN PERISAI PRODUCTION HOLDINGS SDN BHD ("PPHSB"), EMAS OFFSHORE LIMITED ("EOL") AND EMAS VICTORIA (L) BHD ("EVLB") - [EVLB SHA] | Unless otherwise defined in this announcement, all terms used herein shall have the same meanings as those defined in the earlier announcement in relation to the Proposed Settlement Agreement dated 23 December 2016.

We refer to our announcements dated 23 December 2016, 2 March 2017, 21 April 2017, 17 May 2017, 24 May 2017, 10 July 2017, 17 August 2017 and 27 September 2017 respectively.

The Board of Directors of Perisai wishes to announce that on 15 January 2018, PPHSB, a wholly-owned subsidiary of Perisai has written to the Company Secretary of EVLB to serve a notice that a termination event (details of which are as set out in the ensuing paragraph) has occurred enabling PPHSB to terminate the EVLB SHA. EOL has released two (2) public announcements dated 31 August 2017, which stated as follows: - EOL entered into a binding term sheet with certain potential investors as part of the financial restructuring of EOL and its subsidiaries (“the Group”)

- In connection with the restructuring, EOL voluntarily applied to the High Court under Section 211B(1) of the Companies Act (Cap. 50)

- EOL intends to undertake the restructuring to substantially deleverage the Group’s balance sheet and strengthen its working capital position to enable its business to continue as a going concern

EOL’s ongoing efforts to restructure its debts coupled with EOL’s application in OS997/2017 under Section 211B(1) of the Companies Act (Cap. 50) show that EOL has resolved to enter into a scheme of arrangement or compromise for the benefit of its creditors or any class of them. This amounted to an event of default under clause 14.1(c) of the EVLB SHA.

In light of the default, pursuant to PPHSB’s rights under Clause 14 of the EVLB SHA, PPHSB requires EOL to sell 37,333,604 ordinary shares held by EOL in EVLB to PPHSB on the 30th day from the date of the termination notice at 10.00 a.m. on 14 February 2018 (Malaysia time) at the price of USD1.00, which completion shall take place at the registered office of EVLB.

The Company will make further announcement on the development as and when necessary.

This announcement is dated 15 January 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 31-1-2018 03:06 AM

|

显示全部楼层

发表于 31-1-2018 03:06 AM

|

显示全部楼层

EOL:没售ELVB.贝利赛纠纷未解

(吉隆坡29日讯)贝利赛(PERISAI,0047,主板贸服组)和EMAS岸外有限公司(EOL)的纷争未结束,该公司宣布收到EOL发出两份关于不接受脱售EMAS Victoria(纳闽)公司(ELVB)的通知。

贝利赛在文告中表示,第一份通知是EOL声称仍是EVLB的股东,认为贝利赛终止该股东协议有争议。

第二份通知则是要求EVLB的公司秘书委任估价师对股票价格估值,因为EOL认为1美元的选择权价格有争议。

在1月15日,贝利赛表示,基于EOL在去年进行重组计划,因此公司终止两造在2013年签署的股权协议,进而要求EOL以1美元价格脱售ELVB的49%股权给该公司。

贝利赛是在2012年11月宣布,以8925万美元收购ELVB的51%股权,再以51令吉收购Victoria生产服务私人有限公司的51%股权,同时以3700万美元脱售SJR海事的51%股权,但后来两家公司却因SJR海事51%股权脱售计划陷入争执。

文章来源:

星洲日报‧财经‧2018.01.30

Type | Announcement | Subject | OTHERS | Description | PERISAI PETROLEUM TEKNOLOGI BHD ("PERISAI" OR "THE COMPANY") - SHAREHOLDERS AGREEMENT DATED 21 AUGUST 2013 BETWEEN PERISAI PRODUCTION HOLDINGS SDN BHD (PPHSB), EMAS OFFSHORE LIMITED (EOL) AND EMAS VICTORIA (L) BHD (EVLB) - EVLB SHA | Unless otherwise defined in this announcement, all terms used herein shall have the same meanings as those defined in the earlier announcement in relation to the Proposed Settlement Agreement dated 23 December 2016.

We refer to our announcements dated 23 December 2016, 2 March 2017, 21 April 2017, 17 May 2017, 24 May 2017, 10 July 2017, 17 August 2017, 27 September 2017 and 15 January 2018.

The Board of Directors of Perisai wishes to announce that on 29 January 2018, PPHSB, a wholly-owned subsidiary of Perisai has received two (2) notices from EOL both dated 29 January 2018.

By the first notice, EOL denies having committed any event of default under Clause 14.1(c) of the EVLB SHA, as alleged or at all and in the premises, EOL asserted that it remains as a shareholder in EVLB. The termination by PPHSB of the EVLB SHA is therefore disputed by EOL.

By the second notice, EOL requires the Company Secretary of EVLB to appoint a Valuer to procure the Valuation Price for the Default Shares as the Option Price of USD1 is also disputed by EOL.

This announcement is dated 29 January 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 3-3-2018 03:23 AM

|

显示全部楼层

发表于 3-3-2018 03:23 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2017 | 31 Dec 2016 | 31 Dec 2017 | 31 Dec 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 27,697 | 38,268 | 67,588 | 77,182 | | 2 | Profit/(loss) before tax | 39,011 | 15,270 | -5,376 | -285,343 | | 3 | Profit/(loss) for the period | 38,911 | 15,187 | -5,637 | -285,546 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 40,776 | 10,249 | -1,393 | -283,054 | | 5 | Basic earnings/(loss) per share (Subunit) | 3.23 | 0.82 | -0.11 | -22.71 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.0600 | 0.1000

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 6-4-2018 10:56 PM

|

显示全部楼层

发表于 6-4-2018 10:56 PM

|

显示全部楼层

Date of change | 05 Apr 2018 | Name | DATO' SERI DIRAJA TUNKU SORAYA SULTAN ABDUL HALIM MU'ADZAM SHAH | Age | 58 | Gender | Female | Nationality | Malaysia | Designation | Independent Director | Directorate | Independent and Non Executive | Type of change | Resignation | Reason | Due to D.Y.A.M. Tunku Soraya Binti Almarhum Sultan Abdul Halim Mu'adzam Shah Raja Puan Muda Perak Darul Ridzuan's commitments and responsibilities as the Raja Puan Muda Perak where the state functions need her presence and she is actively involved with several Non Govermental bodies. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 19-5-2018 07:12 AM

|

显示全部楼层

发表于 19-5-2018 07:12 AM

|

显示全部楼层

Type | Announcement | Subject | PRACTICE NOTE 17 / GUIDANCE NOTE 3

REGULARISATION PLAN | Description | PERISAI PETROLEUM TEKNOLOGI BHD ("PPTB" OR THE "COMPANY")(I) PROPOSED SHARE CAPITAL REDUCTION AND CONSOLIDATION;(II) PROPOSED FUND RAISING EXERCISE;(III) PROPOSED DEBT SETTLEMENT;(IV) PROPOSED SHARE ISSUANCE;(V) PROPOSED RCULS ISSUE;(VI) PROPOSED ICULS ISSUE; AND(VII) PROPOSED LIQUIDATION OF SUBSIDIARIES(COLLECTIVELY REFERRED TO AS THE "PROPOSED REGULARISATION PLAN") | We refer to the announcement made by PPTB on 12 October 2016, that the Company is a PN17 Company pursuant to Paragraph 8.04 and Paragraph 2.1(f) of PN17 of the MMLR (“First Announcement”).

On behalf of the Board of Directors of PPTB (“Board”), SJ Securities Sdn Bhd (“SJ Securities”) wishes to make the requisite announcement pursuant to Paragraph 4.2(a) of PN17, which sets out the Company’s Proposed Regularisation Plan comprising the following proposals:- - Proposed Share Capital Reduction and Consolidation;

- Proposed Fund Raising Exercise;

- Proposed Debt Settlement;

- Proposed Share Issuance;

- Proposed RCULS Issue;

- Proposed ICULS Issue; and

- Proposed Liquidation of Subsidiaries.

Please refer to the attached announcement for details of the Proposed Regularisation Plan of the Company.

This announcement is dated 18 May 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5795173

|

|

|

|

|

|

|

|

|

|

|

|

发表于 28-5-2018 06:17 AM

|

显示全部楼层

发表于 28-5-2018 06:17 AM

|

显示全部楼层

本帖最后由 icy97 于 3-6-2018 06:20 AM 编辑

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2018 | 31 Mar 2017 | 31 Mar 2018 | 31 Mar 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 29,361 | 46,129 | 96,949 | 123,311 | | 2 | Profit/(loss) before tax | -246,109 | -60,275 | -251,485 | -345,618 | | 3 | Profit/(loss) for the period | -246,276 | -60,401 | -251,913 | -345,947 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -244,524 | -65,295 | -245,917 | -348,349 | | 5 | Basic earnings/(loss) per share (Subunit) | -19.40 | 5.18 | -19.51 | -27.85 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | -0.1400 | 0.1000

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 13-6-2018 06:40 AM

|

显示全部楼层

发表于 13-6-2018 06:40 AM

|

显示全部楼层

本帖最后由 icy97 于 18-6-2018 01:56 AM 编辑

Type | Announcement | Subject | OTHERS | Description | PERISAI PETROLEUM TEKNOLOGI BHDPRESS STATEMENT: SCHEME OF ARRANGEMENT BETWEEN PERISAI PETROLEUM TEKNOLOGI BHD ("PPTB" OR "COMPANY") AND ITS SCHEME CREDITORS- RESULTS OF COURT CONVENED MEETING | Perisai Petroleum Teknologi Bhd is pleased to attach its press statement dated 8 June 2018 in respect of the above for public information.

This announcement is dated 8 June 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5821381

|

|

|

|

|

|

|

|

|

|

|

|

发表于 30-8-2018 05:32 AM

|

显示全部楼层

发表于 30-8-2018 05:32 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2018 | 30 Jun 2017 | 30 Jun 2018 | 30 Jun 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 30,231 | 44,307 | 127,180 | 167,618 | | 2 | Profit/(loss) before tax | -218,045 | -263,581 | -469,530 | -609,199 | | 3 | Profit/(loss) for the period | -218,153 | -263,762 | -470,066 | -609,709 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -210,519 | -205,354 | -456,436 | -533,703 | | 5 | Basic earnings/(loss) per share (Subunit) | -16.70 | -16.29 | -36.21 | -44.18 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | -0.2800 | 0.1000

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 28-9-2018 05:38 AM

|

显示全部楼层

发表于 28-9-2018 05:38 AM

|

显示全部楼层

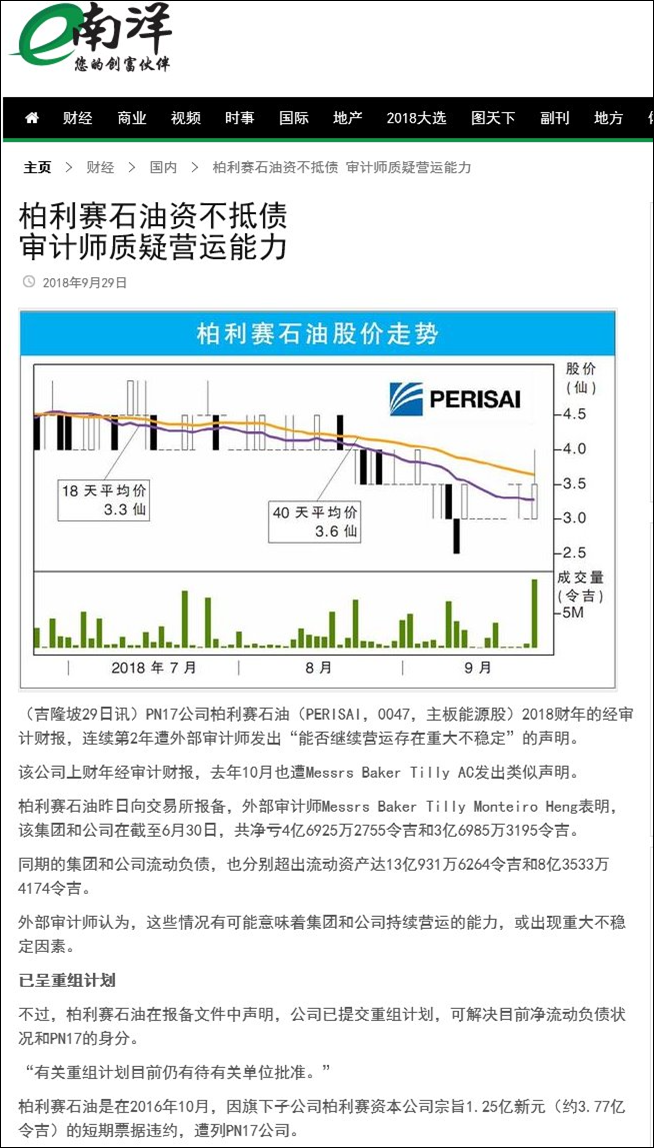

本帖最后由 icy97 于 30-9-2018 07:50 AM 编辑

Type | Announcement | Subject | AUDIT REPORT - MODIFIED OPINION / MATERIAL UNCERTAINTY RELATED TO GOING CONCERN

MATERIAL UNCERTAINTY RELATED TO GOING CONCERN | Description | PERISAI PETROLEUM TEKNOLOGI BHD ("PERISAI" OR "THE COMPANY")Statement of "Material Uncertainly Related to Going Concern" in respect of Perisai's Audited Financial Statements for the financial year ended 30 June 2018 | The Board of Directors of Perisai wishes to announce that its external auditors, Messrs Baker Tilly Monteiro Heng have issued a statement on "Material Uncertainty Related to Going Concern" in respect of Perisai's Audited Financial Statements for the financial year ended 30 June 2018 which is in similar state as of previous financial period ended 30 June 2017.

In relation to the above, the Board of Directors of Perisai wishes to advise on the following:- i) that the Independent Auditors have expressed unqualified opinion of the Audited Financial Statements for the financial year ended 30 June 2018 and that their opinion is not modified in respect of the Statement on the matter; ii) that the process of addressing the key issues by the Group and the Company are as follows: a) The Group has submitted its regularisation plan which would address its net current liabilities positions and PN17 status and is pending approval from the relevant authorities; and b) The right of indemnity of the Company as the corporate guarantor against the borrower/principal debtor is specifically stated under Section 98 of the Contract Acts 1950.

Please refer to the announcement attached for further information.

This announcement is dated 27 September 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5925689

|

|

|

|

|

|

|

|

|

|

|

|

发表于 5-10-2018 07:31 AM

|

显示全部楼层

发表于 5-10-2018 07:31 AM

|

显示全部楼层

icy97 发表于 23-8-2017 03:52 AM

柏利赛石油遭索赔1368万

2017年8月22日

(吉隆坡22日讯)柏利赛石油(PERISAI,0047,主板贸服股)接获付款通知书,遭索赔1368万2059令吉。

柏利赛石油向交易所报备,原告为三家公司,分别是Konsortium Pela ...

ype | Announcement | Subject | OTHERS | Description | PERISAI PETROLEUM TEKNOLOGI BHD ("PERISAI" OR "THE COMPANY")- SETTLEMENT AGREEMENT | Further to the Company’s announcement dated 22 August 2017 and 13 October 2017, the Board of Directors of Perisai wishes to announce that Perisai Drilling Sdn Bhd and Perisai Pacific 101 (L) Inc., the Company’s sub-subsidiaries (hereinafter collectively referred to as “Perisai Sub-subsidaries”) had on 3 October 2018 entered into a Settlement Agreement with Konsortium Pelabuhan Kemaman Sdn Bhd, Pangkalan Bekalan Kemaman Sdn Bhd and EPIC Mushtari Engineering Sdn Bhd (hereinafter collectively referred to as “EPIC”).

On behalf of Perisai Sub-subsidiaries, Assuranceforeningen Skuld (Gjensidig) (“Skuld”) agreed to pay to EPIC, an agreed sum as specified in the Settlement Agreement as full and final settlement of any and all claims present and future competent to EPIC or any other party on their behalf against Perisai Sub-subsidiaries or Skuld, their successors and upon all such terms and conditions as stipulated in the Settlement Agreement.

This announcement is dated 3 October 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 30-12-2018 07:49 AM

|

显示全部楼层

发表于 30-12-2018 07:49 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2018 | 30 Sep 2017 | 30 Sep 2018 | 30 Sep 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 32,348 | 39,891 | 32,348 | 39,891 | | 2 | Profit/(loss) before tax | -22,233 | -44,387 | -22,233 | -44,387 | | 3 | Profit/(loss) for the period | -22,411 | -44,548 | -22,411 | -44,548 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -19,881 | -42,169 | -19,881 | -42,169 | | 5 | Basic earnings/(loss) per share (Subunit) | -1.58 | -3.35 | -1.58 | -3.35 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | -0.3100 | -0.2800

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 7-1-2019 02:48 AM

|

显示全部楼层

发表于 7-1-2019 02:48 AM

|

显示全部楼层

柏利赛关联交易提案不过关

http://www.enanyang.my/news/20181202/柏利赛关联交易提案不过关/

Type | Announcement | Subject | OTHERS | Description | PERISAI PETROLEUM TEKNOLOGI BHD ("PERISAI" OR "THE COMPANY") - Fifteenth Annual General Meeting ("15th AGM") | Reference is made to the announcement on 29 November 2018 on the results of polling of 15th AGM held on same date wherein all the resolutions were carried except for Ordinary Resolution 6 on the Proposed Renewal of Shareholders’ Mandate for Recurrent Related Party Transactions of a Revenue or Trading Nature which was not carried.

The Board of Perisai would like to inform that the Board will seek legal advice on the above and further announcement will be made to Bursa Malaysia Securities Berhad in due course.

This announcement is dated 29 November 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 17-1-2019 11:44 AM

|

显示全部楼层

发表于 17-1-2019 11:44 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 18-1-2019 03:05 PM

|

显示全部楼层

发表于 18-1-2019 03:05 PM

|

显示全部楼层

要死了嗎

|

|

|

|

|

|

|

|

|

|

|

|

发表于 1-2-2019 04:38 AM

|

显示全部楼层

发表于 1-2-2019 04:38 AM

|

显示全部楼层

PERISAI - Suspension and De-Listing pursuant to Practice Note 17| PERISAI PETROLEUM TEKNOLOGI BHD |

PERISAI PETROLEUM TEKNOLOGI BERHAD

Bursa Malaysia Securities Berhad (“Bursa Securities”) has rejected PERISAI’s proposed regularisation plan.

In the circumstances, please be informed that:-

1. the trading in the securities of PERISAI will be suspended with effect from 22 January 2019; and

2. the securities of PERISAI will be de-listed on 13 February 2019 unless an appeal against the rejection of the regularisation plan and de-listing is submitted to Bursa Securities on or before 10 February 2019 (“the Appeal Timeframe”). Any appeal submitted after the Appeal Timeframe will not be considered by Bursa Securities.

In the event PERISAI submits an appeal to Bursa Securities within the Appeal Timeframe, the removal of the securities of PERISAI from the Official List of Bursa Securities on 13 February 2019 shall be deferred pending the decision on the company’s appeal.

With respect to the securities of the company which are currently deposited with Bursa Malaysia Depository Sdn Bhd (“Bursa Depository”), the securities may remain deposited with Bursa Depository notwithstanding the de-listing of the securities from the Official List of Bursa Securities. It is not mandatory for the securities of a company which has been de-listed to be withdrawn from Bursa Depository.

Alternatively, shareholders of the Company who intend to hold their securities in the form of physical certificates, can withdraw these securities from their Central Depository System (CDS) accounts maintained with Bursa Depository at anytime after the securities of the Company have been de-listed from the Official List of Bursa Securities. This can be effected by the shareholders submitting an application form for withdrawal in accordance with the procedures prescribed by Bursa Depository. These shareholders can contact any Participating Organisation of Bursa Securities and/or Bursa Securities’ General Line at 03-2034 7000 for further information on the withdrawal procedures.

Upon the de-listing of PERISAI, the company will continue to exist but as an unlisted entity. PERISAI is still able to continue its operations and business and proceed with its corporate restructuring and its shareholders can still be rewarded by the company’s performance. However, the shareholders will be holding shares which are no longer quoted and traded on Bursa Securities.

|

|

|

|

|

|

|

|

|

|

|

|

发表于 5-3-2019 07:26 AM

|

显示全部楼层

发表于 5-3-2019 07:26 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2018 | 31 Dec 2017 | 31 Dec 2018 | 31 Dec 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 32,472 | 27,697 | 64,820 | 67,588 | | 2 | Profit/(loss) before tax | -26,178 | 39,011 | -48,411 | -5,376 | | 3 | Profit/(loss) for the period | -26,361 | 38,911 | -48,772 | -5,637 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -24,786 | 40,776 | -44,667 | -1,393 | | 5 | Basic earnings/(loss) per share (Subunit) | -1.97 | 3.23 | -3.54 | -0.11 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | -0.3300 | -0.2800

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 3-7-2019 07:00 AM

|

显示全部楼层

发表于 3-7-2019 07:00 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2019 | 31 Mar 2018 | 31 Mar 2019 | 31 Mar 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 32,213 | 29,361 | 97,033 | 96,949 | | 2 | Profit/(loss) before tax | -24,855 | -246,109 | -73,266 | -251,485 | | 3 | Profit/(loss) for the period | -25,049 | -246,276 | -73,821 | -251,913 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -23,120 | -244,524 | -67,787 | -245,917 | | 5 | Basic earnings/(loss) per share (Subunit) | -1.83 | -19.40 | -5.37 | -19.51 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | -0.3400 | -0.2800

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 13-7-2019 04:22 AM

|

显示全部楼层

发表于 13-7-2019 04:22 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 30-8-2019 08:08 AM

|

显示全部楼层

发表于 30-8-2019 08:08 AM

|

显示全部楼层

本帖最后由 icy97 于 31-8-2019 07:22 AM 编辑

减记减少 成本走低‧贝利赛末季亏损收窄

https://www.sinchew.com.my/content/content_2108476.html

(吉隆坡29日讯)基于工厂与设备、应收账款减记减少,以及低直接成本,贝利赛(PERISAI,0047,主板能源组)截至2019年6月30日第四季亏损收窄24.27%至1亿5881万7000令吉,连带全年净亏损也收小至2亿2660万4000令吉。

末季营业额因8艘岸外支援船舰租约到期,按年减少34.26%至1987万3000令吉,拖累全年营业额下滑8.08%至1亿1690万6000令吉。

展望未来,贝利赛发文告表示,中短期石油与天然气资产前景虽有所改善,但总体情况依旧严峻,因此集团将持续审慎管理资本和成本。

“我们在今年6月接获国油勘探钻探机合约,预期将在今年第三季进行部署,同时集团也将为其他资产探索多元机会。”

该公司指出,在今年1月11日接获大马股票交易所停牌和除牌令,公司随后提出的上诉遭交易所驳回,因此已在8月9日获得马来亚高庭颁出为期9个月的禁止令,禁止对公司采取一些程序和行动。

文章来源 : 星洲日报 2019-08-30

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2019 | 30 Jun 2018 | 30 Jun 2019 | 30 Jun 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 19,873 | 30,231 | 116,906 | 127,180 | | 2 | Profit/(loss) before tax | -163,110 | -217,231 | -236,376 | -468,716 | | 3 | Profit/(loss) for the period | -163,232 | -217,339 | -237,053 | -469,252 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -158,817 | -209,705 | -226,604 | -455,622 | | 5 | Basic earnings/(loss) per share (Subunit) | -12.60 | -16.64 | -17.98 | -36.15 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | -0.4700 | -0.2800

|

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|