|

查看: 55771|回复: 324

|

【COASTAL 5071 交流专区】沿海工程

[复制链接]

[复制链接]

|

|

|

本帖最后由 icy97 于 25-11-2011 12:43 PM 编辑

我不知道之前有沒有專區

懶惰打字和整理資料,直接來一套快餐,全部Copy&Paste送給你們

Coastal book order hits record RM1.2bil

PETALING JAYA: Coastal Contracts Bhd has secured the sale of two offshore support vessels (OSVs) valued at US$62mil (RM201.5mil).

This brings the total value of orders clinched for the year to RM518mil, comprising OSVs, tugboats and barges.

“To date, the value of Coastal group's outstanding vessels order book stands at a record of RM1.2bil, with deliveries stretching to 2010,'' executive chairman Ng Chin Heng said in a statement yesterday.

“We maintain optimism for further roll-in of regional and international orders for our vessels not only for the remainder of this year but also beyond,'' he added.

On Wednesday, Coastal announced plans to acquire a 22-acre site beside its existing facilities in Sandakan for RM4mil for its fabrication yard expansion.

The acquisition would expand Coastal's fabrication yard by 32% to 91 acres from 69 acres, AmResearch said in an update to clients yesterday.

Ng noted that with lack of fabrication yard space and high costs of operating older vessels, the OSV market was tight with demand chasing lagging supply.

This whole supply-demand disparity scenario is tipping in the favour of shipbuilders like Coastal.

“Given that we have successfully ascended the OSV value chain, we expect the group's revenue and earnings not just only to hold ground but to pace up several notches, moving forward,'' Ng said

http://biz.thestar.com.my/news/story.asp?file=/2008/5/16/business/21270775&sec=business

[ 本帖最后由 blackcat98 于 14-8-2008 08:50 PM 编辑 ] |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 21-5-2008 11:05 PM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 21-5-2008 11:06 PM

|

显示全部楼层

|

------------------------------------保留----------------------------------------- |

|

|

|

|

|

|

|

|

|

|

|

发表于 21-5-2008 11:17 PM

|

显示全部楼层

发表于 21-5-2008 11:17 PM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 21-5-2008 11:23 PM

|

显示全部楼层

回复 4# 股友 的帖子

我遇到周公一定拜託他幫你問神!我要睡覺了,88!! |

|

|

|

|

|

|

|

|

|

|

|

发表于 21-5-2008 11:25 PM

|

显示全部楼层

发表于 21-5-2008 11:25 PM

|

显示全部楼层

回复 5# blackcat98 的帖子

|

猫哥哥介绍的都是好货,就说买不买行了。太多字我看了晕。 |

|

|

|

|

|

|

|

|

|

|

|

发表于 22-5-2008 09:43 AM

|

显示全部楼层

发表于 22-5-2008 09:43 AM

|

显示全部楼层

|

如果大家有看中国和香港的一些文章的话,大家应该知道从2003年开始是船运业和造船业的大景气期,全球的船运股都起得很高,中国的造船业也已经是世界第一。也许大景气期太长了,大家忘记船运业和造船业是周期行业。也不是说她们不好,只是在行业最景气时买进,价钱似乎不便宜,万一节下来行业景气结束,那就很麻烦了 (没有safety of margin)。而且造船业要跟世界其他同行竞争,因为现在行业景气,本国企业一样有生意做,可当行业不景气时,本国企业有竞争力吗??? |

|

|

|

|

|

|

|

|

|

|

|

发表于 22-5-2008 05:50 PM

|

显示全部楼层

发表于 22-5-2008 05:50 PM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION | 31/03/2008 |

| INDIVIDUAL PERIOD | CUMULATIVE PERIOD | | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | | 31/03/2008 | 31/03/2007 | 31/03/2008 | 31/03/2007 | | RM'000 | RM'000 | RM'000 | RM'000 | | 1 | Revenue | 90,866 | 68,410 | 90,866 | 68,410 | | 2 | Profit/(loss) before tax | 20,977 | 16,980 | 20,977 | 16,980 | | 3 | Profit/(loss) for the period | 20,954 | 15,130 | 20,954 | 15,130 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 20,954 | 15,130 | 20,954 | 15,130 | | 5 | Basic earnings/(loss) per share (sen) | 5.98 | 4.46 | 5.98 | 4.46 | | 6 | Proposed/Declared dividend per share (sen) | 0.00 | 0.00 | 0.00 | 0.00 |

|

|

|

|

|

|

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent (RM) | 0.6629 | 0.6133 |

Note: For full text of the above announcement, please access Bursa Malaysia website at www.bursamalaysia.com

http://announcements.bursamalaysia.com/EDMS/edmsweb.nsf/LsvAllByID/48256E5D00102DF4482574510034CFD6?OpenDocument |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 26-5-2008 10:21 PM

|

显示全部楼层

Coastal can cope with steel prices, says CEO COASTAL Contracts Bhd reported a record net profit of RM20.9mil in its first quarter (Q1) ended March 31, up 38% from the corresponding quarter last year, in spite of higher costs for steel plates. Prices of steel have shot up, as reflected in the earnings surge in steel-making companies, and are expected to rise further, according to news reports.

Ng Chin Heng A Sandakan-based builder of offshore vessels mainly for the oil and gas (O&G) industry, Coastal buys marine steel plates from Russia and Eastern Europe as this product is not made in this country. “Of course, steel prices are a problem but it's not a big problem for us,” executive chairman Ng Chin Heng told StarBiz over the phone on Friday. Steel accounts for less than 15% of total costs for the company's anchor handling tugs (AHTs) that sell for RM40mil to RM100mil each. Ng had observed since last August that steel prices were rising but the rate of increase surprised him. “Steel prices went up like share prices in a bull run,” he said. Even so, “no matter what the steel price, we have to move forward,” he said, adding that steel plates could be bought – there's no shortage. Furthermore, prices of AHTs have been rising faster than that of steel. Coastal also builds tugs and barges in which steel accounts for more than 70% of total costs. It's also possible to pass on the steel costs for barges because that too is a “seller's market,” he said. While AHTs are built for the O&G industry, barges are in demand to transport coal. Some 80% of Coastal's barges are sold to Indonesian buyers. Coastal has a sizeable order book of RM1.2bil, including an order announced earlier this month to supply two vessels of about RM100mil each. In Q1, the company delivered one AHT and 15 barges. In subsequent quarters, it is scheduled to deliver more AHTs, which is positive for the company because AHTs command much higher prices and profit margins. The company is scheduled to deliver nine AHTs over the next three quarters, or about three AHTs per quarter. Demand for barges continues to be firm. “We planned to sell 20 barges for the whole of this year, but we sold 15 in just the first quarter,” he said

http://biz.thestar.com.my/news/story.asp?file=/2008/5/26/business/21352868&sec=business

Coastal Contracts

KENANGA Research reiterates a “buy” call on Coastal Contracts Bhd, underpinned by a solid order book and strong future earnings growth in the shipbuilding sector. “Strong earnings visibility of up to 2010 with order book of RM1.2bil and a strong management team with hands-on experience are key drivers behind our recommendation,” it said. “There is potential for the company to be reporting vessel sales of higher value due to the buoyant environment,” it added. The brokerage has a target price of RM3.48 for the stock.

http://biz.thestar.com.my/news/story.asp?file=/2008/5/26/business/21359300&sec=business

[ 本帖最后由 blackcat98 于 26-5-2008 10:24 PM 编辑 ] |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 26-5-2008 10:45 PM

|

显示全部楼层

回复 7# Mr.Business 的帖子

版主分析很詳細,提醒我一直忽列的重點,謝謝!!主題我改景氣循環股妥當些

回复 6# 股友 的帖子

我介紹的未必是好貨啦! 拿出你的技術分析給大家

[ 本帖最后由 blackcat98 于 26-5-2008 10:56 PM 编辑 ] |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 19-7-2008 11:44 PM

|

显示全部楼层

Coastal Contracts order book at record high

KUALA LUMPUR:

Coastal Contracts Bhd’s sales order book has touched a record RM1.4bil, with deliveries stretching into 2010 after the latest order for four vessels, the company said. In a statement, Coastal said its unit, Coastal Offshore (Labuan) Pte Ltd, sealed the sales of four units of offshore support vessels (OSV) to a world-renowned multinational corporation. However, Coastal did not disclose the value of the latest sale but said deals worth RM781mil were secured in 2008, comprising a variety of OSV and marine transportation vessels. “With these new deals under our belt, Coastal is sitting on a comfortable vessel sales order book. These latest sales to a top tier international support services player are significant, indicating we are now even more established in the global OSV market,” it said. The company believed the current pace of expansion in OSV orders would not be short-lived, as elevated crude oil prices would continue to fuel more offshore oil and gas exploration, development and production, which would provide the OSV market with further growth opportunities. “The current world fleet of OSV is insufficient to cover the growth in demand that has gained momentum in recent years. The scarcity, in turn, translates into heightened order for new-builds,” executive chairman Ng Chin Heng said. – Bernama

http://biz.thestar.com.my/news/story.asp?file=/2008/7/19/business/21868506&sec=business

[ 本帖最后由 blackcat98 于 21-7-2008 12:22 AM 编辑 ] |

|

|

|

|

|

|

|

|

|

|

|

发表于 20-7-2008 11:31 AM

|

显示全部楼层

发表于 20-7-2008 11:31 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 20-7-2008 11:37 AM

|

显示全部楼层

原帖由 90765119 于 20-7-2008 11:31 AM 发表

maybulk跟它哪个好?

maybulk是做船的嗎?我所知道是船運輸,

coastal是製造船工業,兩者是不同的. |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 25-8-2008 09:35 PM

|

显示全部楼层

INDIVIDUAL PERIOD | CUMULATIVE PERIOD | | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | | 30/06/2008 | 30/06/2007 | 30/06/2008 | 30/06/2007 | | RM'000 | RM'000 | RM'000 | RM'000 | | 1 | Revenue | 79,354 | 67,926 | 170,220 | 136,336 | | 2 | Profit/(loss) before tax | 22,006 | 19,057 | 42,983 | 36,037 | | 3 | Profit/(loss) for the period | 21,875 | 19,685 | 42,829 | 34,815 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 21,875 | 19,685 | 42,829 | 34,815 | | 5 | Basic earnings/(loss) per share (sen) | 6.23 | 5.68 | 12.21 | 10.15 | | 6 | Proposed/Declared dividend per share (sen) | 3.50 | 2.00 | 3.50 | 2.00 |

|

|

|

|

|

|

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent (RM) | 0.7334 |

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 8-9-2008 09:32 PM

|

显示全部楼层

| Coastal Contracts Securing of Sales Worth USD86.5 Million | | Coastal Contracts Bhd ("Coastal" or "Company")

Securing of Sales Worth USD86.5 Million (Approximately RM299.1 Million)

Coastal is pleased to announce that its wholly-owned subsidiary, Coastal

Offshore (Labuan) Pte Ltd, had secured the sales of six units of offshore

support vessels for an aggregate value of USD86.5 million (approximately

RM299.1 million).

Including these latest sales, the aggregate value of vessel orders clinched by

Coastal Group so far in 2008 has topped RM1.1 billion, comprising a variety of

offshore support vessels, tugboats and barges. As of to date, the value of

Coastal Group's outstanding vessel sales order book stands at a record high of

RM1.7 billion, with deliveries stretching into 2011.

The revenue stream from the latest deals is expected to contribute positively

to the earnings per share and net assets per share of Coastal Group from the

financial year ending 31 December 2009 to 31 December 2011.

None of the Directors and/or Substantial Shareholders of the Company and

persons connected with them has any interest, direct or indirect, in the

transactions.

You are advised to read the entire contents of the announcement or attachment.

To read the entire contents of the announcement or attachment, please access

the Bursa website at http://www.bursamalaysia.com . |

08/09/2008 05:25 PM |

Ref Code: 20080908GA05132 |

[ 本帖最后由 blackcat98 于 9-9-2008 12:17 AM 编辑 ] |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 23-9-2008 10:55 PM

|

显示全部楼层

13 Malaysian companies on 'Best Under A Billion' list

Malaysia is ranked seventh in terms of the number of companies represented on this year's list, Forbes says

SINGAPOREThirteen Malaysian companies made the Forbes Asia's fourth annual "Best Under A Billion" list, according to Forbes, the US-based publisher of the leading Asian business magazine.

The companies are CB Industrial Product, Coastal Contracts, Efficient E-Solutions, ETI Tech, Grand-Flo Solution, Hai-O Enterprise, I-Power, JobStreet, Notion Vtec, Pintaras Jaya, Plant Offshore, Sarawak Oil Palms and Success Transformer.

Malaysia was also ranked seventh in terms of the number of companies represented on this year's list, Forbes said in a statement today.

The list features the best 200 companies from among 24,155 listed firms in the Asia-Pacific region.

Forbes said those with less than US$1 billion in sales were vetted for consistent growth of both sales and profits over three years.

The Malaysian companies on the Forbes list deal in a wide range of products and services, from rechargeable batteries, industrial tools, marine vessels, online recruitment, information technology solutions and multi-level marketing to palm oil and construction services for the oil and gas industry.

The net income of the companies ranged between US$2 million and US$33 million with a market value of between US$15 million and US$341 million.

They also recorded sales of between US$17 million and US$132 million, Forbes said.

Forbes explained that more than a quarter of last year's companies made the list again with consumer technology, commercial real estate, clean energy producers and business services sectors leading the way.

All the companies on this year's list increased sales and profits despite major indexes in Hong Kong, Japan, Korea and Australia falling by more than 20 per cent over the past year.

The greater China region outperformed the rest of the Asia Pacific with the most number of firms, with 88 on the list, followed by Japan (23), India (22) and Singapore (14).

The full list will appear in the September 29 issue of Forbes Asia magazine. It will be available in newsstands this week. - Bernama

http://www.btimes.com.my/Current_News/BTIMES/Thursday/Latest/20080918161930/Article/

[ 本帖最后由 blackcat98 于 23-9-2008 10:57 PM 编辑 ] |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 26-9-2008 10:49 PM

|

显示全部楼层

Friday, 26 Sep 2008

5:25PM Lembaga Tabung Haji (1,086,500 Shares Acquired)

Wednesday, 24 Sep 2008

5:25PM Lembaga Tabung Haji (217,200 Shares Acquired)

5:21PM Lembaga Tabung Haji (700,000 Shares Acquired)

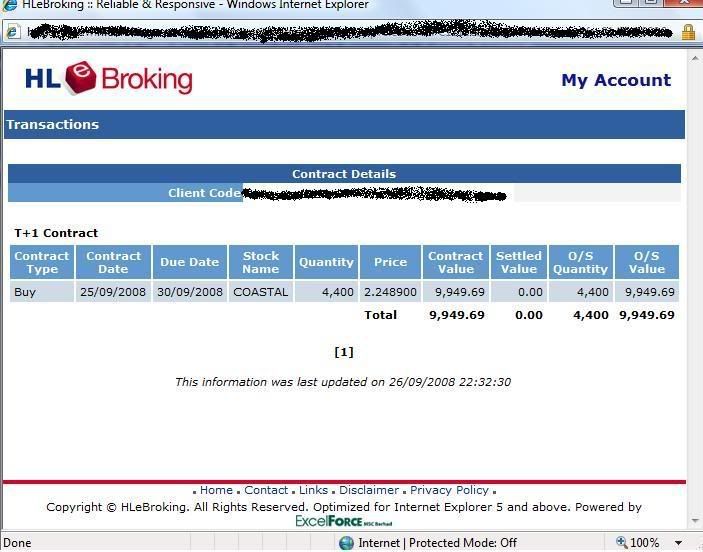

最近LTH買進,我也動用媽媽的戶口買進

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 24-11-2008 08:36 PM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION | 30/09/2008 |

| INDIVIDUAL PERIOD | CUMULATIVE PERIOD | | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | | 30/09/2008 | 30/09/2007 | 30/09/2008 | 30/09/2007 | | RM'000 | RM'000 | RM'000 | RM'000 | | 1 | Revenue | 65,928 | 72,278 | 236,148 | 208,614 | | 2 | Profit/(loss) before tax | 21,975 | 18,013 | 64,958 | 54,050 | | 3 | Profit/(loss) for the period | 22,516 | 17,476 | 65,345 | 52,291 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 22,516 | 17,476 | 65,345 | 52,291 | | 5 | Basic earnings/(loss) per share (sen) | 6.39 | 5.00 | 18.60 | 15.14 | | 6 | Proposed/Declared dividend per share (sen) | 0.00 | 0.00 | 3.50 | 2.00 |

|

|

|

|

|

|

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent (RM) | 0.7846 | 0.6133 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 24-11-2008 10:36 PM

|

显示全部楼层

发表于 24-11-2008 10:36 PM

|

显示全部楼层

回复 18# blackcat98 的帖子

你已经cut loss了吗??买在2.xx....好高的价位   |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 18-2-2009 08:56 PM

|

显示全部楼层

Coastal: Cancelled contract not material

By C.S. TAN

PETALING JAYA: The cancellation of a RM5.5mil contract for a tugboat is “insignificant” in Coastal Contracts Bhd’s order book of about RM1.7bil.

The company told Bursa Malaysia on Tuesday that an Indonesian customer sought arbitration following the latter’s termination of a shipbuilding contract. The customer claimed for refund of a down payment of S$460,920 that it had made to Coastal.

A Coastal Contracts' anchor handling tugboat.

Ng Chin Heng, executive chairman of Coastal, said that was a 20% down payment and so the price of the tugboat was S$2.3mil or about RM5.5mil.

While declining to comment on the arbitration case, he told StarBiz over the phone from his office in Sandakan that the contract involved an insignificant sum. The company had, for instance, deposits of about RM400mil from various customers.

Even so, Ng said, every contract and customer is important. At this time, however, there would inevitably be some deferment or cancellation of orders. It appears the reason Coastal announced the contract cancellation on Tuesday was that it involved an arbitration case, and not because it was a financially material event. Furthermore, the down payment had not been booked into Coastal’s sales yet, so there’s nothing to reverse from the profit and loss account.

Up till this point, the cancellations that have confronted Coastal involved orders for a few tugboats only. These do not make a material impact on the company’s order book. Furthermore, given some time, the company will be able to sell off those tugboats to other customers.

Ng Chin Heng

By far, the most important component in the company’s order book involves its contracts for anchor handling tugs (AHTs) which are offshore rig support vessels. These are priced as much as RM50mil each.

“So far, there are no signals for cancellation of any of the AHTs,” Ng said.

Coastal made a net profit of RM65mil for the nine months ended Sept 30, 2008, when it had a debt-to-equity ratio of just 7%.

Taking a different view, AmResearch said in a report yesterday it was downgrading its call on Coastal from a “buy” to a “hold”.

“We remain cautious on the strength of Coastal’s order book given that its Singapore-listed peers have already faced some order cancellations,” the brokerage said. It lowered its forecast earnings for Coastal by 35% to RM67mil in its current financial year.

油價從去年開始回軟,汽油股在這段非常時期能夠保住盈餘已經能偷笑,不知造船業能否逃過虧損命運? |

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|