|

|

发表于 14-2-2018 06:03 AM

|

显示全部楼层

发表于 14-2-2018 06:03 AM

|

显示全部楼层

去年转亏为盈.许甲明财测上调

(吉隆坡12日讯)许甲明工程(KKB,9466,主板工业产品组)2017财政年成功转亏为盈,表现胜于预期,让大众研究喜出望外,并上调其2018和2019财政年财测5至11%。

盈利表现胜预期,带动许甲明工程周一高开高走,开盘即跳开4仙或4.55%至92仙,盘中最高见96仙,起8仙或9.09%,但后涨势遭套利活动稀释,最终收在91.5仙,涨3.5仙或3.98%。

大众研究表示,许甲明工程2017财政年第四季净利按年大涨231%至530万令吉,带动全年录得160万令吉净利,比较前期为净亏损580万令吉,归功于油井平台制造工程改善,以及联号公司盈利好转。

建筑臂膀(特别是泛婆罗洲大道工程)则是营业额最大动力来源,其中制造与工程业务贡献许甲明工程总营业额的79%,钢铁制造业务则因主要工程几近竣工年减38%。

该行补充,许甲明工程现竞标约3亿2200万令吉合约,其中多数为石油与天然气,以及工程与制造合约,而现有工程则达10亿令吉,可确保公司持续忙碌至2020年第四季。

综合上述原因,以及入账预期,大众研究决定上调许甲明工程2018和2019财政年盈利目标11%和5%,但维持“中和”评级和95仙目标价不变。

文章来源:

星洲日报‧财经‧2018.02.13 |

|

|

|

|

|

|

|

|

|

|

|

发表于 31-3-2018 03:04 AM

|

显示全部楼层

发表于 31-3-2018 03:04 AM

|

显示全部楼层

本帖最后由 icy97 于 1-4-2018 06:51 AM 编辑

Type | Announcement | Subject | OTHERS | Description | AWARD OF CONTRACT FOR PROVISION OF ENGINEERING, PROCUREMENT, CONSTRUCTION AND COMMISSIONING OF WELLHEAD PLATFORMS FOR D18 PHASE 2 PROJECT AND D28 PHASE 1 PROJECT (CONTRACT NO: CHO/2017/D18/1002) | 1. INTRODUCTION The Board of Directors (“the Board”) of KKB Engineering Berhad (“KKB”) is pleased to announce that its subsidiary company, OceanMight Sdn Bhd (“OMSB”) (approved PETRONAS Licensed Company for Offshore Facilities Const-Major Fabrication-Offshore Facilities) has been awarded a contract on 14 March 2018 from PETRONAS Carigali Sdn Bhd (“PETRONAS Carigali”) for the Provision of Engineering, Procurement, Construction and Commissioning of Wellhead Platforms for D18 Phase 2 Project and D28 Phase 1 Project (“the Contract”).

2. DURATION OF CONTRACT The Contract duration is approximately 21 months, in which 9 months are for the work execution for D28 Phase 1 Project while another 12 months are the warranty period. The Contract will commence in March 2018.

The scope for D28 Phase 1 Project shall be Engineering, Procurement, Construction, Transportation, Installation and Commissioning. The detailed scope of works is specified in the Contract document between OMSB and PETRONAS Carigali.

3. FINANCIAL EFFECTS The Contract will have no effect on the Issued and Paid-up Capital of the Company and is expected to contribute positively towards the earnings and net assets of the Company for the duration of the Contract.

4. RISK FACTORS Risk factors affecting the award include execution risks such as changes in the basis of design, availability of skilled manpower, delays in material deliveries, changes in prices of materials, changes in political, economic and regulatory conditions.

5. DIRECTORS’ AND MAJOR SHAREHOLDERS’ INTERESTS None of the Directors and/or major shareholders and/or person connected with them has any interest, direct or indirect in the abovementioned Contract.

6. DIRECTORS’ STATEMENT The Board is of the opinion that the abovementioned Contract is in the best interest of KKB and its Group.

This announcement is dated 30th March 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 6-4-2018 06:38 AM

|

显示全部楼层

发表于 6-4-2018 06:38 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 11-4-2018 02:45 AM

|

显示全部楼层

发表于 11-4-2018 02:45 AM

|

显示全部楼层

EX-date | 17 May 2018 | Entitlement date | 21 May 2018 | Entitlement time | 04:00 PM | Entitlement subject | First and Final Dividend | Entitlement description | A First and Final Single Tier Dividend of two (2) sen per ordinary share | Period of interest payment | to | Financial Year End | 31 Dec 2017 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | SYMPHONY SHARE REGISTRARS SDN BHDLevel 6, Symphony HousePusat Dagangan Dana 1Jalan PJU 1A/4647301 Petaling JayaSelangor Darul EhsanTel:0378418000Fax:0378418151 | Payment date | 12 Jun 2018 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 21 May 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.02 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 17-5-2018 04:00 AM

|

显示全部楼层

发表于 17-5-2018 04:00 AM

|

显示全部楼层

本帖最后由 icy97 于 20-5-2018 05:05 AM 编辑

Type | Announcement | Subject | OTHERS | Description | Letter of Award (LOA) from SAPURA FABRICATION SDN BHD (SFSB) for the Provision of Procurement and Construction for Wellhead Deck, Piles and Conductors | INTRODUCTION The Board of Directors (“the Board”) of KKB Engineering Berhad (“KKB”) is pleased to announce that its subsidiary company, OceanMight Sdn Bhd has accepted and signed a Letter of Award (“LOA)”from SAPURA FABRICATION SDN BHD (“SFSB”) for the Provision of Procurement and Construction for Wellhead Deck, Piles and Conductors AND subject to Terms and Conditions pending the signing of the Sub-Contract Agreement.

INFORMATION ON THE CONTRACT This LOA is part of the SFSB’s engineering, procurement, construction, installation and commissioning (“EPCIC”) for the Pegaga Development Project (Mubadala Petroleum) in Block SK320, offshore waters of Sarawak. The said Sub-Contract shall commence in April 2018.

FINANCIAL EFFECTS The above award is expected to contribute positively to the earnings and net assets of the KKB Group for the financial years ending 31 December 2018 to 31 December 2019.

RISK FACTORS Risk factors affecting the Sub-Contract include execution risks such as availability of skilled manpower and materials, changes in pricing, weather conditions and/or political, economic and/or regulatory conditions.

DIRECTORS’ AND MAJOR SHAREHOLDERS’ INTERESTS To the best of our knowledge, none of the Directors or major shareholders or person connected with them has any interest, direct or indirect in the abovementioned award. The Board is of the opinion that the abovementioned award is in the best interest of KKB and its Group.

This announcement is dated 15 May 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 17-5-2018 06:03 AM

|

显示全部楼层

发表于 17-5-2018 06:03 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2018 | 31 Mar 2017 | 31 Mar 2018 | 31 Mar 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 64,558 | 42,924 | 64,558 | 42,924 | | 2 | Profit/(loss) before tax | 2,422 | -1,489 | 2,422 | -1,489 | | 3 | Profit/(loss) for the period | 1,371 | -1,228 | 1,371 | -1,228 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 1,345 | -1,475 | 1,345 | -1,475 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.52 | -0.57 | 0.52 | -0.57 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.1200 | 1.1100

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 20-5-2018 05:31 AM

|

显示全部楼层

发表于 20-5-2018 05:31 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 7-8-2018 02:39 AM

|

显示全部楼层

发表于 7-8-2018 02:39 AM

|

显示全部楼层

本帖最后由 icy97 于 7-8-2018 05:35 AM 编辑

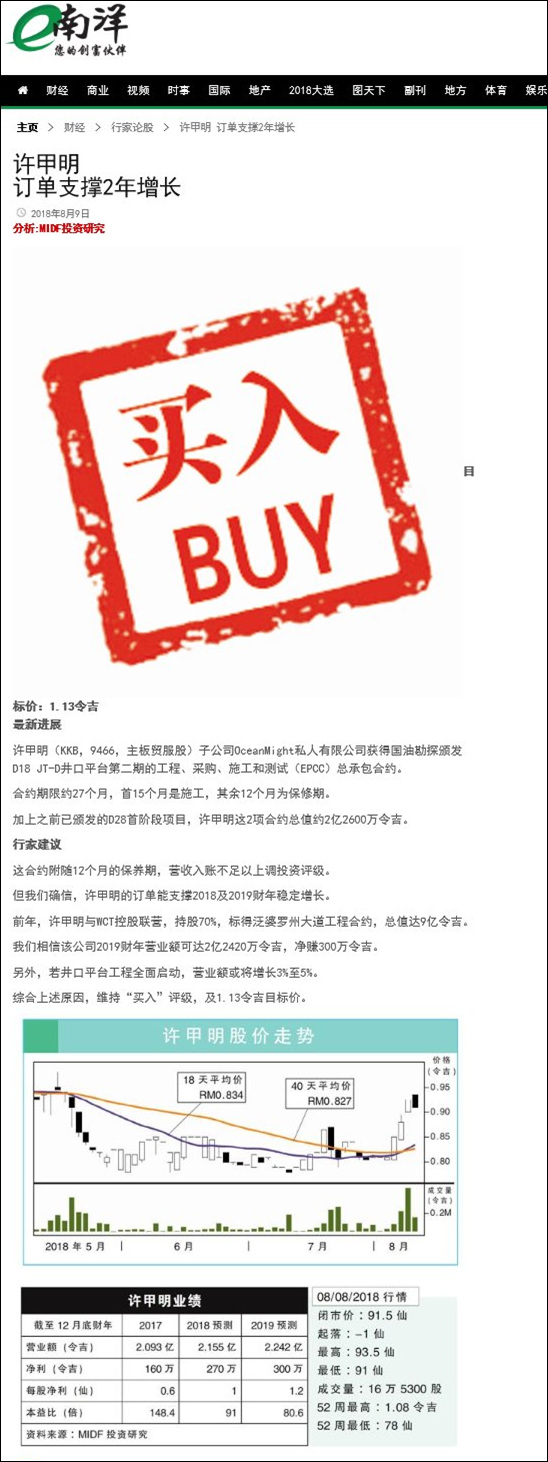

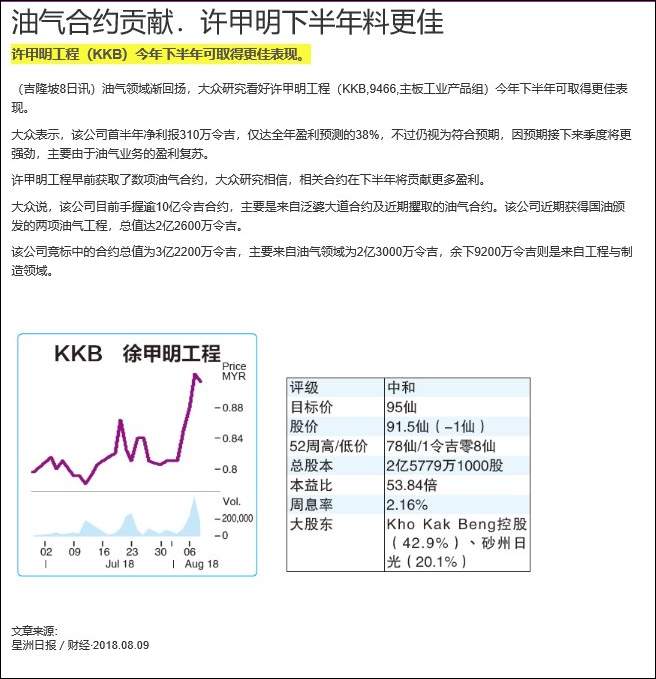

Type | Announcement | Subject | OTHERS | Description | AWARD OF CONTRACT FOR THE PROVISION OF ENGINEERING, PROCUREMENT, CONSTRUCTION, COMMISSIONING OF WELLHEAD PLATFORMS FOR D18 PHASE 2 PROJECT AND D28 PHASE 1 PROJECT (CONTRACT NO.: CHO/2017/D18/1002) | 1. INTRODUCTION Further to the announcement made on 30 March 2018, the Board of Directors (“the Board”) of KKB Engineering Berhad (“KKB”) is pleased to announce that PETRONAS Carigali Sdn Bhd (“PETRONAS Carigali”) has awarded OceanMight Sdn Bhd (“OMSB”), a subsidiary of KKB, an award of contract for the Provision of Engineering, Procurement, Construction, Commissioning of Wellhead Platforms for D18 Phase 2 project via a Letter of Award dated 19 July 2018 (“the Contract”).

OMSB is an approved PETRONAS Licensed Company for Offshore Facilities Construction - Major Fabrication - Offshore Facilities.

2. DURATION OF CONTRACT The Contract duration is approximately 27 months, in which 15 months are for work execution for D18 Phase 2 Project while the other 12 months are the warranty period. The Contract has commenced in July 2018.

The scope for the Contract shall be Engineering, Procurement, Construction, Transportation, Installation and Commissioning of D18 JT-D Wellhead Platform. The detailed scope of works is specified in the Contract documentation between OMSB and PETRONAS Carigali.

With the award of D18 Phase 2 Project, the total combined contract sum for both D28 Phase 1 and D18 Phase 2 Projects is approximately RM226 million.

3. FINANCIAL EFFECTS The Contract will have no effect on the Issued and Paid-up Capital of the Company and is expected to contribute positively towards the earnings and net assets of the Company for the duration of the Contract.

4. RISK FACTORS Risk factors affecting the award include execution risks such as changes in the basis of design, availability of skilled manpower, delays in material deliveries, changes in prices of material, changes in political, economic and regulatory conditions.

5. DIRECTORS’ AND MAJOR SHAREHOLDERS’ INTERESTS None of the Directors and/or major shareholders and/or person connected with them has any interest, direct or indirect in the abovementioned Contract.

6. DIRECTORS’ STATEMENT The Board is of the opinion that the abovementioned Contract is in the best interest of KKB and its Group.

This announcement is dated 6 August 2018 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 8-8-2018 01:45 AM

|

显示全部楼层

发表于 8-8-2018 01:45 AM

|

显示全部楼层

本帖最后由 icy97 于 9-8-2018 05:17 AM 编辑

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2018 | 30 Jun 2017 | 30 Jun 2018 | 30 Jun 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 93,194 | 46,873 | 157,751 | 89,797 | | 2 | Profit/(loss) before tax | 3,294 | -9,240 | 5,716 | -10,730 | | 3 | Profit/(loss) for the period | 2,597 | -6,889 | 3,968 | -8,117 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 1,760 | -7,202 | 3,105 | -8,677 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.68 | -2.79 | 1.20 | -3.37 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.1000 | 1.1100

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 9-8-2018 04:08 AM

|

显示全部楼层

发表于 9-8-2018 04:08 AM

|

显示全部楼层

本帖最后由 icy97 于 10-8-2018 04:45 AM 编辑

|

|

|

|

|

|

|

|

|

|

|

|

发表于 1-12-2018 01:56 AM

|

显示全部楼层

发表于 1-12-2018 01:56 AM

|

显示全部楼层

本帖最后由 icy97 于 17-12-2018 06:52 AM 编辑

建筑和制钢业务带动-许甲明第三季劲扬39%

http://www.enanyang.my/news/20181120/建筑和制钢业务带动br-许甲明第三季劲扬39

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2018 | 30 Sep 2017 | 30 Sep 2018 | 30 Sep 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 112,183 | 49,305 | 269,935 | 139,102 | | 2 | Profit/(loss) before tax | 10,643 | 6,836 | 16,359 | -3,893 | | 3 | Profit/(loss) for the period | 8,587 | 5,217 | 12,555 | -2,900 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 6,932 | 4,973 | 10,036 | -3,704 | | 5 | Basic earnings/(loss) per share (Subunit) | 2.69 | 1.93 | 3.89 | -1.44 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.1300 | 1.1100

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 18-12-2018 05:13 AM

|

显示全部楼层

发表于 18-12-2018 05:13 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 15-1-2019 07:02 AM

|

显示全部楼层

发表于 15-1-2019 07:02 AM

|

显示全部楼层

本帖最后由 icy97 于 21-1-2019 06:51 AM 编辑

许甲明工程获4670万钢管供应补充合约

Syahirah Syed Jaafar/theedgemarkets.com

December 20, 2018 19:07 pm +08

http://www.theedgemarkets.com/article/许甲明工程获4670万钢管供应补充合约

(吉隆坡20日讯)许甲明工程(KKB Engineering Bhd)子公司获得供应和交付混凝土软钢管及机械耦合的补充合约,估计价值4670万令吉。

许甲明工程今日向大马交易所报备,子公司Harum Bidang私人有限公司获得Cahya Mata Sarawak Bhd(CMSB)子公司CMS Infra Trading私人有限公司(CMSIT)颁发的合约,向位于古晋Tanah Puteh的砂拉越公共工程局供应和交付钢管。

该集团表示,合约将根据CMSIT在必要时发出的采购订单,合约有效期至2020年8月31日。

该集团预计,这将为合约期内的盈利的净资产作出贡献。

(编译:陈慧珊)

Type | Announcement | Subject | OTHERS | Description | LETTER OF AWARD | The Board of Directors (“the Board”) of KKB Engineering Berhad (“KKB”) is pleased to announce that Harum Bidang Sdn Bhd, a subsidiary of KKB, has received a Supplementary Contract from CMS Infra Trading Sdn Bhd (“CMSIT”) for the Supply and Delivery of Concrete-Lined Mild Steel Pipes and Mechanical Couplings to JKR Central Unallocated Stores, Tanah Puteh, Kuching (On “As and When Required” basis).

The estimated value of supply is worth approximately RM46.7 million (Ringgit Malaysia Forty Six Million Seven Hundred Thousand Only).

DURATION OF CONTRACT The supply and delivery will be based on issuance of Purchase Orders by CMSIT on a “As and When Required” basis. The expiry date for this Supplementary Contract is on 31 August 2020.

FINANCIAL EFFECTS The Contract will have no effect on the Share Capital of the Company and is expected to contribute positively towards the earnings and net assets of the Company and Group for the duration of the contract.

RISK FACTORS Risk factors affecting the Contract include execution risks such as availability of skilled manpower and materials, changes in pricing, weather conditions and/or political, economic and regulatory conditions.

DIRECTORS’ AND MAJOR SHAREHOLDERS’ INTEREST Cahya Mata Sarawak Berhad (“CMSB”) is a major shareholder of KKB. CMSIT is a subsidiary of CMSB and accordingly, CMSB is deemed interested in the award. Datuk Syed Ahmad Alwee Alsree is a Director of KKB while Encik Syed Hizam Alsagoff is an alternate director to Datuk Syed Ahmad Alwee Alsree in KKB. Datuk Syed Ahmad Alwee Alsree is also a Director of CMSB and both Datuk Syed Ahmad Alwee Alsree and Encik Syed Hizam Alsagoff are the nominees of CMSB and persons connected with CMSB and accordingly, they are deemed interested in the award.

KKB has obtained the Shareholder Mandate at its Annual General Meeting held on 16 May 2018. Immediate announcement will be made to the Exchange when the actual value of the transaction exceeds the estimated value as disclosed in the circular to shareholders by 10% or more.

Save as aforesaid above, none of the Directors and/or major shareholders and/or persons connected with them has any interest, direct or indirect in the abovementioned contract.

DIRECTORS’ STATEMENT The Board is of the opinion that the abovementioned contract is in the best interest of KKB and its Group.

This announcement is dated 20 December 2018.

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 19-1-2019 03:50 AM

|

显示全部楼层

发表于 19-1-2019 03:50 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 30-1-2019 04:04 AM

|

显示全部楼层

发表于 30-1-2019 04:04 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | LETTER OF AWARD | The Board of Directors (“the Board”) of KKB Engineering Berhad (“KKB”) is pleased to announce that its subsidiary, OceanMight Sdn Bhd (“OMSB”) has accepted and signed a Letter of Award of the PETRONAS Frame Agreement (“Contract”) for The Provision of Engineering, Procurement and Construction (EPC) of Fixed Offshore Structure Works (“Work”) by PETROLIAM NASIONAL BERHAD (“PETRONAS”).

With the award of the Frame Agreement by PETRONAS, OMSB will be qualified as one of PETRONAS’ Contractors to bid for the said Work. A formal contract shall be executed within Three (3) months from acceptance of the said Letter of Award.

DURATION OF CONTRACT The Contract is effective from 12 December 2018 and continue for a period of six (6) years, unless terminated earlier.

FINANCIAL EFFECTS The Contract will have no effect on the Share Capital of the Company and is expected to contribute positively towards the earnings and net assets of the Company and Group for the duration of the Contract.

RISK FACTORS Risk factors affecting the Contract include execution risks such as availability of skilled manpower and materials, changes in pricing, weather conditions and/or political, economic and regulatory conditions.

DIRECTORS’ AND MAJOR SHAREHOLDERS’ INTERESTS None of the Directors and/or major shareholders and/or person connected with them has any interest, direct or indirect in the abovementioned Contract.

DIRECTORS’ STATEMENT The Board is of the opinion that the abovementioned Contract is in the best interest of KKB and its Group.

This Announcement is dated 7 January 2019.

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 2-3-2019 05:04 AM

|

显示全部楼层

发表于 2-3-2019 05:04 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2018 | 31 Dec 2017 | 31 Dec 2018 | 31 Dec 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 142,544 | 70,196 | 412,479 | 209,298 | | 2 | Profit/(loss) before tax | 13,129 | 10,267 | 29,488 | 6,374 | | 3 | Profit/(loss) for the period | 10,475 | 6,165 | 23,031 | 3,265 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 7,607 | 5,312 | 17,644 | 1,608 | | 5 | Basic earnings/(loss) per share (Subunit) | 2.95 | 2.06 | 6.84 | 0.62 | | 6 | Proposed/Declared dividend per share (Subunit) | 4.00 | 2.00 | 4.00 | 2.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.1600 | 1.1100

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 2-3-2019 05:07 AM

|

显示全部楼层

发表于 2-3-2019 05:07 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | (1) Recommendation of First and Final Dividend

| The Board of Directors ("Board") of KKB Engineering Berhad ("KKB") wishes to announce that the Board has on 26 February 2019:

(i) recommended a First and Final Single Tier Dividend of 4 sen per ordinary share in respect of the financial year ended 31 December 2018, for approval by shareholders at the forthcoming Forty-Third Annual General Meeting of the Company (“ 43rd AGM”) to be held at a later date. The dates of dividend entitlement and payment will be announced at a later date.

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 8-3-2019 07:08 AM

|

显示全部楼层

发表于 8-3-2019 07:08 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | LETTER OF AWARD | The Board of Directors (“the Board”) of KKB Engineering Berhad (“KKB”) is pleased to announce that KKB has received two (2) Letter of Award from Jabatan Bekalan Air Luar Bandar Sarawak (“JBALB”) for the:- A) Design, Construction, Completion, Testing and Commissioning of Proposed Package SR1 (Southern Region) for Sarawak Water Supply Grid Programme – Stressed Areas (“Contract Package SR1”) AND B) Letter of Award for The Proposed Water Supply from Kota Samarahan to Sebuyau, Samarahan Division, Sarawak - Construction and Completion of MSCL Pipeline and All Associated Works, Sarawak for Sarawak Water Supply Grid Programme – Stressed Areas (“Contract Package 1C”). The total combined contract sum for the abovementioned contracts is worth approximately RM110.8 million (Ringgit Malaysia One Hundred Ten Million Eight Hundred Thousand Only).

DURATION OF CONTRACT The contract period for Contract Package SR1 is Twenty-One (21) Months commencing from March 2019 and scheduled to complete by December 2020 AND For Contract Package 1C is Twelve (12) Months commencing from March 2019 and scheduled to complete by March 2020.

FINANCIAL EFFECTS The contracts will have no effect on the Share Capital of the Company and is expected to contribute positively towards the earnings and net assets of the Company and Group for the duration of the contracts.

RISK FACTORS Risk factors affecting the contracts include execution risks such as availability of skilled manpower and materials, changes in pricing, weather conditions and/or political, economic and regulatory conditions.

DIRECTORS’ AND MAJOR SHAREHOLDERS’ INTEREST None of the Directors and/or major shareholders and/or person connected with them has any interest, direct or indirect in the abovementioned contracts.

DIRECTORS’ STATEMENT The Board is of the opinion that the abovementioned contracts is in the best interest of KKB and its Group.

This announcement is dated 28 February 2019.

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 5-4-2019 04:47 AM

|

显示全部楼层

发表于 5-4-2019 04:47 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | LETTER OF AWARD | INTRODUCTION

The Board of Directors (“the Board”) of KKB Engineering Berhad (“KKB”) is pleased to announce that KKB has received a Letter of Award from PETRONAS Dagangan Berhad (“PETRONAS”) for the Price Agreement For New And Refurbishment Of LPG Cylinders For Petronas Dagangan Berhad: Fabrication, Reconditioning Of LPG Cylinders And To Supply & Delivery Of LPG Compact Valves (“Contract”)

AND

That its associate company, Edisi Optima Sdn Bhd, has also received Letter of Award from PETRONAS Dagangan Berhad (“PETRONAS”) for the Price Agreement For Refurbishment Of LPG Cylinders For PETRONAS Dagangan Berhad: Requalification And Shot-Blast Repainting Of LPG Cylinder (“Contract”).

A formal agreement for the abovementioned Contracts shall be executed in due course.

Thirdly, KKB has also received a Purchase Order from Laras Jaya Engineering Sdn Bhd (“LJE”) for the Supply of Mild Steel Concrete Lined (“MSCL”) Pipes for Sarawak Water Supply Grid Programme – Stressed Areas.

The combined total contract sum for the abovementioned contracts/order is worth approximately RM30.8 million (Ringgit Malaysia Thirty Million Eight Hundred Thousand Only).

DURATION OF CONTRACT

Both PETRONAS Contracts are effective from 15 March 2019 and shall be valid for a period of three (3) years (“Contract Period”), unless terminated earlier with an option to extend the Contract Period for a further period up to two (2) year(s).

The completion date for LJE is scheduled within nine (9) months.

FINANCIAL EFFECTS

The Contracts/Purchase Order(s) will have no effect on Share Capital of the Company and is expected to contribute positively towards the earnings and net assets of the Company and Group for the duration of the supply period.

RISK FACTORS

Risk factors affecting the Contracts/order include execution risks such as availability of skilled manpower and materials, changes in pricing, weather conditions and/or political, economic and regulatory conditions.

DIRECTORS’ AND MAJOR SHAREHOLDERS’ INTERESTS

None of the Directors and/or major shareholders and/or person connected with them has any interest, direct or indirect in the abovementioned Contracts/order.

DIRECTORS’ STATEMENT

The Board is of the opinion that the abovementioned Contracts/order is in the best interest of KKB and its Group.

This Announcement is dated 20 March 2019. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 12-5-2019 08:17 AM

|

显示全部楼层

发表于 12-5-2019 08:17 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | LETTER OF AWARD | INTRODUCTION The Board of Directors (“the Board”) of KKB Engineering Berhad (“the Company” or “KKB”) is pleased to announce that KKB Industries (Sabah) Sdn Bhd, a Subsidiary of the Company has received a Purchase Order from Leadshine Sdn Bhd for the Supply and Delivery of Concrete-Lined Mild Steel Pipes (“Leadshine”). AND KKB has also been awarded the Tender for Annual Supply and Delivery of Steel Products Ref.: DPC53C/18 from Syarikat SESCO Berhad (“SESCO”). The total combined contract sum for the abovementioned two (2) contracts is approximately RM17.75 million (Ringgit Malaysia: Seventeen Million and Seven Hundred and Seventy Five Thousand Only).

DURATION OF CONTRACT The contract duration for Leadshine is approximately ten (10) months whereas the contract duration for SESCO is approximately one (1) year.

FINANCIAL EFFECTS The above contracts are expected to contribute positively to the earnings and net assets of the KKB Group for the financial year ending 31 December 2019.'

RISK FACTORS Risk factors affecting the Contracts/order include execution risks such as availability of skilled manpower and materials, changes in pricing, weather conditions and/or political, economic and regulatory conditions.

DIRECTORS’ AND MAJOR SHAREHOLDERS’ INTERESTS None of the Directors and/or major shareholders and/or person connected with them has any interest, direct or indirect in the abovementioned Contracts/order.

DIRECTORS’ STATEMENT The Board is of the opinion that the abovementioned Contracts/order is in the best interest of KKB and its Group.

This Announcement is dated 15 April 2019.

|

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|