|

|

发表于 19-1-2011 11:58 PM

|

显示全部楼层

发表于 19-1-2011 11:58 PM

|

显示全部楼层

|

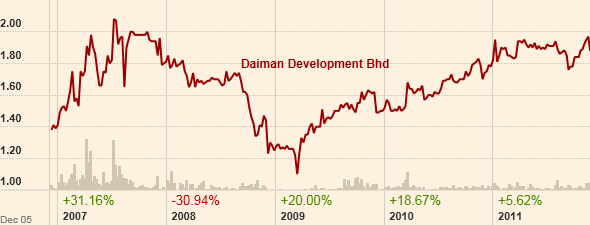

去年三月时候才1块半。如今不知道是否还有多少上升的空间? |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 19-5-2011 11:18 PM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 22-5-2011 07:31 PM

|

显示全部楼层

发表于 22-5-2011 07:31 PM

|

显示全部楼层

这股不错 |

|

|

|

|

|

|

|

|

|

|

|

发表于 22-5-2011 10:18 PM

|

显示全部楼层

发表于 22-5-2011 10:18 PM

|

显示全部楼层

产业股给人的感觉通常是有高资产。却是低股价。

鹏尼迪,daiman,asas.bdb,绿野集团,吉星,汇华产业等等

...

乔巴登 发表于 14-3-2010 01:35 PM

为什么摇头? |

|

|

|

|

|

|

|

|

|

|

|

发表于 22-5-2011 11:09 PM

|

显示全部楼层

发表于 22-5-2011 11:09 PM

|

显示全部楼层

我有两只 |

|

|

|

|

|

|

|

|

|

|

|

发表于 22-5-2011 11:24 PM

|

显示全部楼层

发表于 22-5-2011 11:24 PM

|

显示全部楼层

|

这支股不是今时今日才被低估,他已经被低估了20年! |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 25-5-2011 11:36 PM

|

显示全部楼层

本帖最后由 yatlokfatt 于 25-5-2011 11:38 PM 编辑

第三季度财报已出炉,首三季公司每股合计赚得21.58sen,净资产高达RM4.58。

以下是它的业绩分析:

Revenue Review

The revenue of the Group for the current financial quarter under review was RM33,466,000 compared to

RM28,042,000 in the preceding year's corresponding financial quarter.

The revenue of the Group for the 9-month financial period ended 31 March 2011 was RM123,548,000 compared to RM95,700,000 in the corresponding preceding 9-month financial period ended 31 March 2010.

The higher revenues for the 9-month financial period under review was mainly from property sales.The higher revenue was derived from sales at Vila Bintang Indah which comprise of bungalow lots and completed bungalow units. Sales at Zone 3C of double-storey terrace house and Zone1C of 3-storey shop office at Taman Gaya also contributed to higher revenue.

Profit Review

The profit before tax of the Group for the current financial quarter under review was RM13,150,000 compared to

RM6,388,000 in the preceding year's corresponding financial quarter.

The profit before tax of the Group for the 9-month financial period ended 31 March 2011 was RM57,540,000

compared to RM31,041,000 in the corresponding preceding 9-month financial period ended 31 March 2010

The increases for both periods were mainly from property sales, gain on disposal of financia linvestments and fair value gains on investment properties and financial investments. |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 15-6-2011 05:19 PM

|

显示全部楼层

Credit Suisse Research: 79% of Bursa-listed property stocks below book value

Written by theedgemalaysia.com

Wednesday, 15 June 2011 15:40

KUALA LUMPUR: Credit Suisse Research said 79% of the property stocks listed on Bursa Malaysia are below book value with PASDEC HOLDINGS BHD [] is trading at the steepest discount of 76%while SP SETIA BHD [] is trading at the highest at 235%.

In its research note on Tuesday, June 14, it said the sector price-to-book had been relatively flat at 0.98 time from 1.0 times in January this year. As for their performance, the stocks had performed in-line with the market in the last three months.

“79% of Bursa-listed property companies are trading below book value. This, we believe, had sparked mergers and acquisition (M&A) activities, such as OSK Property and AP Land, and press anticipation on M&A activities in the sector,” it said.

According to its table, Pasdec is trading at the steepest discount at 76% where the price to book value (PBV) is at RM1.87 while its June 13 closing price was 46 sen.

The others are Nilai Resources Group Bhd, which traded at a 74% discount, South Malaysia Industries 74%, Eupe Corp Bhd 73%, Focal Aims Holdings 73% and SBC Corp Bhd 70%.

On the other side of the spectrum, SP Setia is trading at a 235% above its book value, UEM LAND HOLDINGS BHD [] 187% and YTL Land Bhd 153% followed by MAH SING GROUP BHD [] at 124%.

“Although there is value to be found, book values are not totally comparable. Newly listed companies have book values with land valued at more current market prices. ‘Old’ property companies have book values reflecting acquisition prices from years ago,” it said.

“We maintain our bullish stance on the Malaysia property sector. Our top M&A pick is Sunway City, pending merger with Sunway Holdings, which will create the third largest developer,” it said. |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 17-8-2011 10:33 PM

|

显示全部楼层

大马发展標获5500万地库

大马財经 2011-08-12 10:36

(吉隆坡12日讯)大马发展(DAIMAN, 5355, 主板產业组)透过新山马来亚高庭进行的公眾竞標活动,成功以5千500万令吉標获一块地库,加上当中未脱售的零售商场、办公楼及停车场。

该公司发表文告指出,预计上述活动將在120天內完成,並可籍此扩大在新山商业地带的產业投资活动。

大马发展透过內部融资收购上述產业。(星洲互动) |

|

|

|

|

|

|

|

|

|

|

|

发表于 17-8-2011 10:47 PM

|

显示全部楼层

发表于 17-8-2011 10:47 PM

|

显示全部楼层

产业股多数都是被低估的,轻则被低估到PE只有3年,当然也有被严重高估到PE达90年的!

产业股事实上和自身如何发展和推销有着非常密切的关系,有的发展公司做出来的property根本就是大便可是因为它把自己塑造成打造高尚都市的一个developer,所以就连这些大便产业都卖到贵贵,傻傻的散户有多少个买过房子的,一看到广告打到这么火热,自然都扑着去买,所以profit自然高,更重要的炒家们个个都对他有信心,信心对一个股来讲就是一切!! |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 24-8-2011 10:15 PM

|

显示全部楼层

又是业绩出炉的月份了。

DAIMAN 2011年全年财报今天也已出炉,公司全年每股合计赚得26.82sen,净资产高达RM4.65,同时也建议12sen的股息。

以下是它的业绩分析:

Revenue Review

The revenue of the Group for the current financial quarter under review was RM42,577,000 compared to RM27,619,000 in the preceding year's corresponding financial quarter.

The higher revenue for the current financial quarter under review was mainly from sales of three-storey shop office,Taman Gaya.Higher building material sales in the Trading Division alsocontributed to the increase in revenue.

The revenue of the Group for the 12-month financial year ended 30 June 2011 was RM166,125,000 compared to RM123,319,000 in the corresponding preceding 12-month financial year ended 30 June 2010.

Major contributors to the higher revenue are sales of bungalows and bungalow lots at Vila Bintang Indah; double-storey terrace and cluster houses at Daiman Jaya; double-storey terrace and cluster houses and three-storey shop offices in Taman Gaya; and vacant land and semi-detached factory at Taman Perindustrian Murni Senai.

Profit Review

The profit before tax of the Group for the current financial quarter under review was RM14,648,000 compared to RM5,333,000 in the preceding year's corresponding financial quarter.

The increase was mainly due to higher property sales,higher plantation profit and fair value gains on investment property.

The profit before tax of the Group for the 12-month financial year ended 30 June 2011 was RM72,189,000 compared to RM36,374,000 in the corresponding preceding 12-month financial year ended 30 June 2010.

The increase was mainly from property sales, plantation profit, fair value gains on investment properties and financial investments. |

|

|

|

|

|

|

|

|

|

|

|

发表于 24-8-2011 10:20 PM

|

显示全部楼层

发表于 24-8-2011 10:20 PM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 30-9-2011 04:40 PM

|

显示全部楼层

| Entitlements (Notice of Book Closure) | | Reference No CU-110808-36741 |

| Company Name | : | DAIMAN DEVELOPMENT BHD | | Stock Name | : | DAIMAN | | Date Announced | : | 24/08/2011 |

| EX-date | : | 05/12/2011 | | Entitlement date | : | 07/12/2011 | | Entitlement time | : | 05:00:00 PM | | Entitlement subject | : | First and Final Dividend | | Entitlement description | : | | First and Final Dividend 12% less 25% tax |

| | Period of interest payment | : | to | | Financial Year End | : | 30/06/2011 | | Share transfer book & register of members will be | : | 07/12/2011 to 07/12/2011 closed from (both dates inclusive) for the purpose of determining the entitlements | | Registrar's name ,address, telephone no | : | TRICOR INVESTOR SERVICES SDN. BHD.

LEVEL 17, THE GARDENS NORTH TOWER,

MID VALLEY CITY, LINGKARAN SYED PUTRA,

59200 KUALA LUMPUR

TEL. NO. 03-22643883 |

| | Payment date | : | 06/01/2012 |

a. |

Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers |

| : | 07/12/2011 |

b. |

Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| : | 02/12/2011 | | c. | Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. |

| | Number of new shares/securities issued (units) (If applicable) |

| : | | | Entitlement indicator | : | Percentage | | Entitlement in percentage (%) | : | 12 |

| | Remarks : | | The first and final dividend of 12% less 25% tax is subject to the approval of shareholders at the forthcoming 39th Annual General Meeting. |

|

[table]

[tr][td]

[table=98%]

[tr][td]Entitlements (Notice of Book Closure)[/td][/tr]

[tr][td]Reference No CU-110808-36741 [/td |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 30-9-2011 05:36 PM

|

显示全部楼层

大马发展目前握有3亿1千5百万的现金和证卷,或每股 RM1.48现金。

目前,已知的总资产为RM4.65 。扣去现金的RM1.48 ,资产有RM3.28 。

如果,目前的市价为RM1.78。减掉RM1.48的现金 。以 RM0.30 换得 RM3.28的土地、大马大厦、大马公寓等资产,你觉得如何? |

|

|

|

|

|

|

|

|

|

|

|

发表于 30-9-2011 07:57 PM

|

显示全部楼层

发表于 30-9-2011 07:57 PM

|

显示全部楼层

|

严重被低估的公司。。83%是现金,0债务。。。。为什么股价没被拉高?是不是发展只集中在柔佛?还会不会在被低估多20年!!!!人生有几个20年???? |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 13-11-2011 12:55 PM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 25-11-2011 11:17 PM

|

显示全部楼层

发表于 25-11-2011 11:17 PM

|

显示全部楼层

大马发展创造高价值 翻新Landmark大厦

财经新闻 财经 2011-11-25 12:04

(新山24日讯)大马发展(Daiman,5355,主板产业股)以5500万收购新山市区的Landmark大厦及酒店,将换上新装,成为高级商业办公室、零售及酒店为一体的复合式大厦。

该公司执行董事曾贤河今日在股东大会上指出,有关收购也是新山市区房产策略的重要决定。

集团所收购的部分包括Landmark大厦、酒店及停车场,预计将为大厦进行整修,在寻找一个更适合的方向发展大厦,以创造大厦更高的价值。

曾贤河则表示,收购Landmark大厦及酒店是做为新山市区房产策略的重要决定,也是一项值得的投资,同时身为本地的发展商,对于新山还是有特殊的情感。

重新定位

他指出,集团所收购的部分包括Landmark大厦、酒店及停车场,预计将为大厦进行整修,以创造大厦更高的价值。

“我们将会改变现有Landmark大厦的形象,但不会再以科技电子产品为主导,至于顶楼现有的医疗中心将会继续保留,其他细节则在讨论中,尚未有明确的内容。”

另外,该公司总经理谢进隆指出,柔州房地产市场过去一年表现不俗,甚至超标。

他说,目前大多第二次购屋者以提升环境居多,一般选购更高等级的房屋。

他透露,虽然政府推出“我的首间房屋计划”,但这将不会影响房屋市场价格,因为政府仍有调高产业盈利税,以控制想赚快钱的投机客,对于购买首间房屋者还是一定的帮助。

大马发展在截至今年6月30日财年,营业额增加34.7%,税前盈利劲98.49%。

业绩亮眼

该公司全年营业额1亿6613万,税前赚7219万令吉。

产业销售额标青、建材销售、种植收益及投资产业与财政投资的重估收益,令大马发展业绩亮眼。[NanYang] |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 6-12-2011 11:30 PM

|

显示全部楼层

本帖最后由 yatlokfatt 于 6-12-2011 11:32 PM 编辑

|

|

|

|

|

|

|

|

|

|

|

|

发表于 29-2-2012 02:39 AM

|

显示全部楼层

发表于 29-2-2012 02:39 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION | 31/12/2011 |

| INDIVIDUAL PERIOD | CUMULATIVE PERIOD | | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | | 31/12/2011 | 31/12/2010 | 31/12/2011 | 31/12/2010 | | $$'000 | $$'000 | $$'000 | $$'000 | | 1 | Revenue | 33,077 | 54,623 | 75,861 | 90,082 | | 2 | Profit/(loss) before tax | 12,109 | 30,058 | 19,779 | 44,389 | | 3 | Profit/(loss) for the period | 9,603 | 23,559 | 13,501 | 36,345 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 9,603 | 23,560 | 13,501 | 36,349 | | 5 | Basic earnings/(loss) per share (Subunit) | 4.56 | 11.19 | 6.41 | 17.26 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

|

|

|

|

|

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 4.7300 | 4.6500 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 30-5-2012 01:17 AM

|

显示全部楼层

发表于 30-5-2012 01:17 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION | 31/03/2012 |

| INDIVIDUAL PERIOD | CUMULATIVE PERIOD | | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | | 31/03/2012 | 31/03/2011 | 31/03/2012 | 31/03/2011 | | $$'000 | $$'000 | $$'000 | $$'000 | | 1 | Revenue | 41,512 | 33,466 | 117,373 | 123,548 | | 2 | Profit/(loss) before tax | 17,662 | 13,150 | 37,442 | 57,540 | | 3 | Profit/(loss) for the period | 15,010 | 9,084 | 28,511 | 45,430 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 15,010 | 9,093 | 28,511 | 45,443 | | 5 | Basic earnings/(loss) per share (Subunit) | 7.13 | 4.32 | 13.54 | 21.58 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

|

|

|

|

|

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 4.7000 | 4.6500 |

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|