|

|

【MAYBULK 5077 交流专区】大型散装货轮

[复制链接]

[复制链接]

|

|

|

发表于 23-8-2017 03:41 AM

|

显示全部楼层

发表于 23-8-2017 03:41 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2017 | 30 Jun 2016 | 30 Jun 2017 | 30 Jun 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 70,694 | 55,351 | 135,655 | 108,851 | | 2 | Profit/(loss) before tax | -9,388 | -40,149 | -41,977 | -64,853 | | 3 | Profit/(loss) for the period | -9,662 | -40,526 | -42,501 | -65,480 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -10,754 | -40,331 | -43,960 | -64,413 | | 5 | Basic earnings/(loss) per share (Subunit) | -1.08 | -4.03 | -4.40 | -6.44 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.6299 | 0.7089

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 22-10-2017 02:50 PM

|

显示全部楼层

发表于 22-10-2017 02:50 PM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 22-11-2017 06:09 AM

|

显示全部楼层

发表于 22-11-2017 06:09 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2017 | 30 Sep 2016 | 30 Sep 2017 | 30 Sep 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 65,408 | 52,498 | 201,063 | 161,349 | | 2 | Profit/(loss) before tax | -17,373 | -31,260 | -59,350 | -96,113 | | 3 | Profit/(loss) for the period | -17,593 | -31,218 | -60,094 | -96,698 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -17,821 | -30,807 | -61,781 | -95,220 | | 5 | Basic earnings/(loss) per share (Subunit) | -1.78 | -3.08 | -6.18 | -9.52 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.6072 | 0.7089

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 17-1-2018 12:56 AM

|

显示全部楼层

发表于 17-1-2018 12:56 AM

|

显示全部楼层

本帖最后由 icy97 于 18-1-2018 05:01 AM 编辑

Date of change | 16 Jan 2018 | Name | MR GOVIND RAMANATHAN | Age | 50 | Gender | Male | Nationality | India | Designation | Executive Director | Directorate | Executive | Type of change | Resignation | Reason | To pursue his personal interests | Details of any disagreement that he/she has with the Board of Directors | No | Whether there are any matters that need to be brought to the attention of shareholders | No | Qualifications | - | Working experience and occupation | - | Family relationship with any director and/or major shareholder of the listed issuer | - | Any conflict of interests that he/she has with the listed issuer | - | Details of any interest in the securities of the listed issuer or its subsidiaries | Direct interest - 447,700 ordinary shares in Malaysian Bulk Carriers Berhad |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 17-1-2018 12:59 AM

|

显示全部楼层

发表于 17-1-2018 12:59 AM

|

显示全部楼层

Date of change | 16 Jan 2018 | Name | MR HOR WENG YEW | Age | 51 | Gender | Male | Nationality | Malaysia | Designation | Executive Director | Directorate | Executive | Type of change | Appointment | Qualifications | - Bachelor of Arts (Economics) Degree from National University of Singapore- MSc in Shipping, Trade & Finance (Distinction) from City University Business School, London. | Working experience and occupation | Mr Hor Weng Yew is the Chief Operating Officer of Pacific Carriers Limited Group. Prior to his current appointment, he was Senior Director, Tanker and Strategic Business Development for the Kuok (Singapore) Limited Group.He was the President/ Chief Executive Officer of American Eagle Tanker Inc. Ltd. (AET) Tanker Holdings Sdn. Bhd. from 1 January 2009. Mr Hor Weng Yew began his career with Neptune Orient Lines Limited (NOL) in 1989 and was involved in the commercial operations and chartering, project management, strategy and business planning initiatives for NOL and AET, a subsidiary of NOL, since its inception in 1994. Prior to that he joined MISC Berhad in July 2003 following the acquisition of AET by MISC, holding various senior positions. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 28-2-2018 02:55 AM

|

显示全部楼层

发表于 28-2-2018 02:55 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2017 | 31 Dec 2016 | 31 Dec 2017 | 31 Dec 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 71,519 | 64,156 | 272,582 | 225,505 | | 2 | Profit/(loss) before tax | -69,642 | -400,185 | -128,992 | -496,298 | | 3 | Profit/(loss) for the period | -70,004 | -400,422 | -130,098 | -497,120 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -73,173 | -396,086 | -134,954 | -491,306 | | 5 | Basic earnings/(loss) per share (Subunit) | -7.32 | -39.61 | -13.50 | -49.13 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.5258 | 0.7089

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 3-4-2018 05:09 AM

|

显示全部楼层

发表于 3-4-2018 05:09 AM

|

显示全部楼层

本帖最后由 icy97 于 3-4-2018 06:32 AM 编辑

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

NON RELATED PARTY TRANSACTIONS | Description | MALAYSIAN BULK CARRIERS BERHAD ("MBC" OR "COMPANY")PROPOSED DISPOSAL OF UP TO 386,385,645 ORDINARY SHARES IN PACC OFFSHORE SERVICES HOLDINGS LTD., WHICH ARE CURRENTLY HELD BY A WHOLLY-OWNED SUBSIDIARY OF MBC KNOWN AS LIGHTWELL SHIPPING INC., TO ALL SHAREHOLDERS OF MBC, AT AN OFFER PRICE, ON AN ENTITLEMENT DATE TO BE DETERMINED LATER ("PROPOSED DISPOSAL") | On behalf of the Board of Directors of MBC, RHB Investment Bank Berhad wishes to announce that the Company intends to undertake the Proposed Disposal. Further details of the Proposed Disposal are set out in the attachment.

This announcement is dated 2 April 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5744641

|

|

|

|

|

|

|

|

|

|

|

|

发表于 11-4-2018 06:52 AM

|

显示全部楼层

发表于 11-4-2018 06:52 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 15-4-2018 03:23 AM

|

显示全部楼层

发表于 15-4-2018 03:23 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 16-5-2018 12:52 AM

|

显示全部楼层

发表于 16-5-2018 12:52 AM

|

显示全部楼层

本帖最后由 icy97 于 22-5-2018 03:25 AM 编辑

Maybulk首季净亏减半至1434万令吉

Neily Syafiqah Eusoff/theedgemarkets.com

May 14, 2018 19:58 pm +08

(吉隆坡14日讯)干散货运业务的租船费改善,加上联号公司PACC Offshore Services Holdings Ltd(POSH)的亏损减少,提振大马散装货运(Malaysian Bulk Carriers Bhd)在截至今年首季(2018财年首季)的净亏收窄逾半至1434万令吉,上财年同期则净亏3321万令吉。

截至今年3月杪首季,其营业额按年滑落17%至5426万令吉,上财年同季为6496万令吉。

尽管船队规模缩小,但租船费提高,让其干散货运业务的亏损从2017财年首季的1288万令吉,减少至2018财年首季的506万令吉。

大马散装货运在现财年首季出售了一艘独资及两艘联营的散货船,而其联营公司也已经签约出售散货船。该集团在去年6月份撤出了油船业务。

POSH在现财年首季的税后亏损也降低至722万美元,上财年同期为1859万美元。因此,大马散装货运所需承担的亏损也从2017财年首季的1737万令吉,减少至现财年首季的607万令吉。

展望未来,该集团谨慎乐观看待今年的干散货市场。

大马散装货运说:“干散货市场的所有细分市场都在年头稳健发展,但季节性因素导致这些市场在今年首季结束时走软。根据国际货币基金组织(IMF)今年4月份的报告,今、明两年全球经济增长料达3.9%。尽管报告令人鼓舞,但由于贸易保护主义政策的威胁日益增加,贸易流量和海运贸易仍面临风险。”

(编译:魏素雯)

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2018 | 31 Mar 2017 | 31 Mar 2018 | 31 Mar 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 54,263 | 64,961 | 54,263 | 64,961 | | 2 | Profit/(loss) before tax | -14,039 | -32,589 | -14,039 | -32,589 | | 3 | Profit/(loss) for the period | -14,208 | -32,839 | -14,208 | -32,839 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -14,343 | -33,206 | -14,343 | -33,206 | | 5 | Basic earnings/(loss) per share (Subunit) | -1.43 | -3.32 | -1.43 | -3.32 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.5028 | 0.5258

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 16-5-2018 04:27 AM

|

显示全部楼层

发表于 16-5-2018 04:27 AM

|

显示全部楼层

本帖最后由 icy97 于 16-5-2018 04:28 AM 编辑

Date of change | 14 May 2018 | Name | MR WU LONG PENG | Age | 64 | Gender | Male | Nationality | Singapore | Type of change | Redesignation | Previous Position | Executive Director | New Position | Non Executive Director | Directorate | Non Independent and Non Executive |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 16-5-2018 04:28 AM

|

显示全部楼层

发表于 16-5-2018 04:28 AM

|

显示全部楼层

Date of change | 14 May 2018 | Name | MR KUOK KHOON KUAN | Age | 70 | Gender | Male | Nationality | Malaysia | Designation | Chief Executive Officer | Directorate | Executive | Type of change | Resignation | Reason | Retirement |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 16-5-2018 04:28 AM

|

显示全部楼层

发表于 16-5-2018 04:28 AM

|

显示全部楼层

Date of change | 14 May 2018 | Name | MR HOR WENG YEW | Age | 51 | Gender | Male | Nationality | Malaysia | Type of change | Redesignation | Previous Position | Executive Director | New Position | Chief Executive Officer | Directorate | Executive | Qualifications | - Bachelor of Arts (Economics) Degree from National University of Singapore- MSc in Shipping, Trade & Finance (Distinction) from City University Business School, London. | Working experience and occupation | Mr Hor Weng Yew is the Chief Operating Officer of Pacific Carriers Limited Group. Prior to his current appointment, he was Senior Director, Tanker and Strategic Business Development for the Kuok (Singapore) Limited Group. | Family relationship with any director and/or major shareholder of the listed issuer | He was the President/ Chief Executive Officer of American Eagle Tanker Inc. Ltd. (AET) Tanker Holdings Sdn. Bhd. from 1 January 2009. Mr Hor Weng Yew began his career with Neptune Orient Lines Limited (NOL) in 1989 and was involved in the commercial operations and chartering, project management, strategy and business planning initiatives for NOL and AET, a subsidiary of NOL, since its inception in 1994. Prior to that he joined MISC Berhad in July 2003 following the acquisition of AET by MISC, holding various senior positions.| Date of change | 14 May 2018 | Name | MR HOR WENG YEW | Age | 51 | Gender | Male | Nationality | Malaysia | Type of change | Redesignation | Previous Position | Executive Director | New Position | Chief Executive Officer | Directorate | Executive | Qualifications | - Bachelor of Arts (Economics) Degree from National University of Singapore- MSc in Shipping, Trade & Finance (Distinction) from City University Business School, London. | Working experience and occupation | Mr Hor Weng Yew is the Chief Operating Officer of Pacific Carriers Limited Group. Prior to his current appointment, he was Senior Director, Tanker and Strategic Business Development for the Kuok (Singapore) Limited Group. | Family relationship with any director and/or major shareholder of the listed issuer | He was the President/ Chief Executive Officer of American Eagle Tanker Inc. Ltd. (AET) Tanker Holdings Sdn. Bhd. from 1 January 2009. Mr Hor Weng Yew began his career with Neptune Orient Lines Limited (NOL) in 1989 and was involved in the commercial operations and chartering, project management, strategy and business planning initiatives for NOL and AET, a subsidiary of NOL, since its inception in 1994. Prior to that he joined MISC Berhad in July 2003 following the acquisition of AET by MISC, holding various senior positions. |

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 16-5-2018 04:29 AM

|

显示全部楼层

发表于 16-5-2018 04:29 AM

|

显示全部楼层

Date of change | 14 May 2018 | Name | CIK THAI KUM FOON | Age | 52 | Gender | Female | Nationality | Singapore | Designation | Executive Director | Directorate | Executive | Type of change | Appointment | Qualifications | - Bachelor of Accountancy Degree from the National University of Singapore- Fellow with the Institute of Singapore Chartered Accountants and Institute of Chartered Accountants Australia | Working experience and occupation | - Ms Thai is currently the Chief Financial Officer of Kuok (Singapore) Limited Group- Chief Financial Officer of PACC Offshore Services Holdings Limited Group from May 2015 to December 2016- Chief Financial Officer of The Straits Trading Company Limited from January 2013 to March 2015- Chief Financial Officer of Jaya Holdings Limited from April 2009 to December 2012 - Ms Thai held senior finance positions in listed and multinational companies in real estate and semiconductor manufacturing. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 9-8-2018 12:18 AM

|

显示全部楼层

发表于 9-8-2018 12:18 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | Incorporation of Subsidiary | Pursuant to Paragraph 9.19(23) of the Main Market Listing Requirements of Bursa Malaysia Securities Berhad, Malaysian Bulk Carriers Berhad (“MBC" or the "Company") wishes to announce that its wholly-owned subsidiary, New Johnson Holdings Limited, has incorporated one (1) wholly-owned subsidiary in Singapore on 8 August 2018.

Information on Subsidiary

Name of Subsidiary | Issued and Paid-Up Share Capital | Principal Activities | Kukuh Shipping Pte Ltd | US$50,000 | Owner and operator of ships

|

The incorporation of the above subsidiary will not have any effect on the earnings per share, net assets per share and gearing of MBC Group for the financial year ending 31 December 2018. Neither does it have any effect on the share capital and substantial shareholders’ shareholdings in MBC.

None of the Directors or major shareholders of MBC or persons connected with them has any interest, whether direct or indirect, in the said incorporation.

This announcement is dated 8 August 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 14-8-2018 12:51 AM

|

显示全部楼层

发表于 14-8-2018 12:51 AM

|

显示全部楼层

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

NON RELATED PARTY TRANSACTIONS | Description | MALAYSIAN BULK CARRIERS BERHAD ("MBC" OR "COMPANY")RENOUNCEABLE RESTRICTED OFFER FOR SALE OF UP TO 386,385,645 ORDINARY SHARES IN PACC OFFSHORE SERVICES HOLDINGS LTD. ("OFFER SHARES") WHICH ARE CURRENTLY HELD BY A WHOLLY-OWNED SUBSIDIARY OF MBC KNOWN AS LIGHTWELL SHIPPING INC., TO THE ENTITLED SHAREHOLDERS ON A PRO-RATA BASIS OF 386 OFFER SHARES FOR EVERY 1,000 EXISTING ORDINARY SHARES HELD IN MBC ("RESTRICTED OFFER FOR SALE") | We refer to the Company’s announcements dated 2 April 2018, 25 April 2018, 26 April 2018, 11 May 2018, 23 May 2018, 4 June 2018 and 30 July 2018 in relation to the Restricted Offer For Sale (“Announcements”). Unless otherwise defined, the abbreviations and definitions used in the Announcements shall apply herein.

On behalf of the Board, RHBIB wishes to announce that the Company has resolved to fix the offer price at RM0.65 per Offer Share (“Offer Price”) after taking into consideration the following: (i) the discount of approximately 28% to the five (5)-day VWAP of POSH Shares up to and including 10 August 2018 of RM0.9062 (converted from SGD0.3041 based on the middle exchange rate of SGD1:RM2.9799 as quoted by BNM at 5.00 p.m. on 10 August 2018) (“Discount”); (ii) the prevailing market conditions; and (iii) the financial impact of the Restricted Offer For Sale on MBC Group.

The Discount has been determined by the Board after taking into consideration the following: (i) that the Offer Price is deemed sufficiently attractive to encourage the Entitled Shareholders to accept the Offer Shares; and (ii) the funding requirements of MBC Group.

This announcement is dated 13 August 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 14-8-2018 12:52 AM

|

显示全部楼层

发表于 14-8-2018 12:52 AM

|

显示全部楼层

EX-date | 24 Aug 2018 | Entitlement date | 28 Aug 2018 | Entitlement time | 05:00 PM | Entitlement subject | Offer for Sale | Entitlement description | RENOUNCEABLE RESTRICTED OFFER FOR SALE OF UP TO 386,385,645 ORDINARY SHARES IN PACC OFFSHORE SERVICES HOLDINGS LTD. ("OFFER SHARES") WHICH ARE CURRENTLY HELD BY A WHOLLY-OWNED SUBSIDIARY OF MALAYSIAN BULK CARRIERS BERHAD ("MBC") KNOWN AS LIGHTWELL SHIPPING INC. TO THE ENTITLED SHAREHOLDERS AT AN OFFER PRICE OF RM0.65 FOR EACH OFFER SHARE PAYABLE IN FULL UPON ACCEPTANCE, ON A PRO RATA BASIS OF 386 OFFER SHARES FOR EVERY 1,000 EXISTING ORDINARY SHARES OF MBC HELD AS AT 5.00 P.M. ON TUESDAY, 28 AUGUST 2018 ("ENTITLEMENT DATE") ("RESTRICTED OFFER FOR SALE") | Period of interest payment | to | Financial Year End |

| | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | SYMPHONY SHARE REGISTRARS SDN BHDLevel 6, Symphony HousePusat Dagangan Dana 1Jalan PJU 1A/4647301 Petaling JayaTel: 03-7849 0777Fax: 03-7841 8151 | Payment date |

| | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 28 Aug 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Ratio | Ratio | 386 : 1000 | Rights Issue/Offer Price | Malaysian Ringgit (MYR) 0.650 |

Despatch date | 30 Aug 2018 | Date for commencement of trading of rights | 29 Aug 2018 | Date for cessation of trading of rights | 06 Sep 2018 | Date for announcement of final subscription result and basis of allotment of excess Rights Securities | 28 Sep 2018 | Listing Date of the Rights Securities | 21 Dec 2018 |

Last date and time for | Date | Time | Sale of provisional allotment of rights | 05 Sep 2018 | | 05:00:00 PM | Transfer of provisional allotment of rights | 13 Sep 2018 | | 04:00:00 PM | Acceptance and payment | 18 Sep 2018 | | 05:00:00 PM | Excess share application and payment | 18 Sep 2018 | | 05:00:00 PM |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 17-8-2018 11:05 AM

|

显示全部楼层

发表于 17-8-2018 11:05 AM

|

显示全部楼层

|

所以说若是认购,就是直接拥有在星加坡股票交易所上市的POSH,问题是之后要怎样买卖呢?又怎么可以收到股息呢? |

|

|

|

|

|

|

|

|

|

|

|

发表于 24-8-2018 04:48 AM

|

显示全部楼层

发表于 24-8-2018 04:48 AM

|

显示全部楼层

本帖最后由 icy97 于 26-8-2018 05:04 AM 编辑

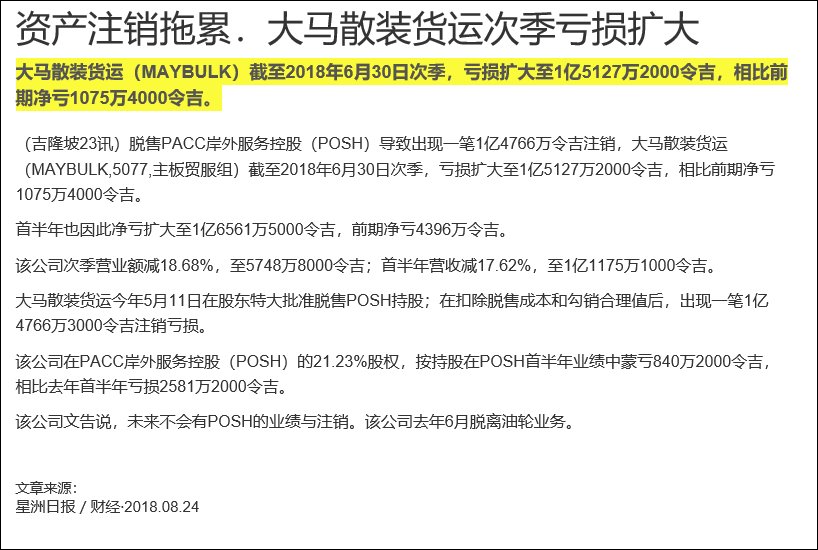

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2018 | 30 Jun 2017 | 30 Jun 2018 | 30 Jun 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 57,488 | 70,694 | 111,751 | 135,655 | | 2 | Profit/(loss) before tax | -151,124 | -9,388 | -165,163 | -41,977 | | 3 | Profit/(loss) for the period | -151,313 | -9,662 | -165,521 | -42,501 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -151,272 | -10,754 | -165,615 | -43,960 | | 5 | Basic earnings/(loss) per share (Subunit) | -15.13 | -1.08 | -16.56 | -4.40 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.3592 | 0.5258

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 4-9-2018 11:08 AM

|

显示全部楼层

发表于 4-9-2018 11:08 AM

|

显示全部楼层

本帖最后由 deity01 于 4-9-2018 11:57 AM 编辑

如果认购,也就是说我们需要一个SGX的CDP Account,可是这CDP account却又不是link to 任何SG的broker。。

到时候,我们有了这CDP account,我们要自己去找SG的broker来link我们的CDP account,然后我们才可以trade SG的股票?

^^^^^^^^^^

读清楚那offer后,看来我误会了。。

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|