|

|

【NHFATT 7060 交流专区】新鸿发集团

[复制链接]

[复制链接]

|

|

|

发表于 31-12-2010 08:58 AM

|

显示全部楼层

发表于 31-12-2010 08:58 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 2-1-2011 12:34 AM

|

显示全部楼层

回复 21# 文慧

我个人觉得现在这个价位还是值得加码!

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 8-1-2011 11:56 PM

|

显示全部楼层

一则出现在一家北马报章公司的新闻。

扩充产能迎更大市场 新鸿发控股前景看俏

二零一一年一月七日 晚上六时四十二分

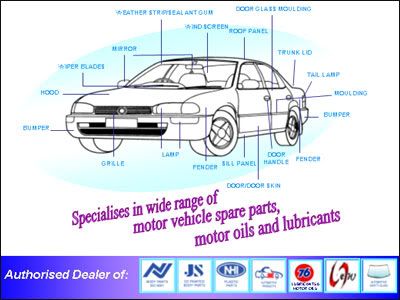

(吉隆坡7日讯)由于业务与大马轿车市场密切联系,国内以市场份额计最大替代零件制造商新鸿发控股有限公司(NHFATT,7060,消费产品组),展望将受到关注。

新鸿发控股董事经理陈日新表示:“鉴于国内拥有庞大的年轻人口,汽车市场成长趋势未来将可能持续。”

根据陆路交通局的数据,每年约有50万新车注册。

经济复苏及东盟自由贸易区于2010年实行后,汽车与零件关税解除,已令得本地汽车零件业受惠。

这已从2010首半年达到比一年前同时期19.8%的整体行业成长反映出来。这些成长主要是来自轿车。

不过,新鸿发控股主要是专注于替代设备市场,不会受到新车销售的波动所冲击。

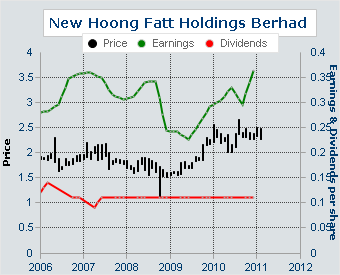

在截至2003至2009年12月31日止财政年度里,新鸿发控股录得了5%的常年净盈利增长率。

在2008和2009环球金融危机期间,该替代零件制造仍成功维持了其收益和盈利成长。

新鸿发控股的净盈利于2009财政年成长了21.7%至2225万令吉,比较一年前只有1828万令吉,主要是收益增长和较低制造成本。

不过,该股股价仍然落后富时隆综指和其他同业。

股价落后同业

今年迄今,其股价已经扬升了约4%,比较上APM汽车控股(APM,5015)挺109%、立罗股份(DELLOYD,6505)涨35%、及喜乐大可控股(HIRO,9644)锐增93%。

其跑输大市的表现也可能是因为该股流通量不足,及钢铁与塑胶树脂原料价格不稳定所致。

它也是显示着替代零件市场的竞争越来越强烈。虽然东盟自由贸易区计划下的关税解除,可能为汽车和汽车零件业者带来新途径,但它也将造成彼此之间的威胁。

不像原厂设备制造市场,替代零件制造商并没有基础客户群,买家趋势将会选择最廉宜产品。

割喉竞争是其中一个侵蚀新鸿发控股高周息率的因素。

该公司享有同业之中最高的周息率,过去6年都支付每股11仙的终期股息。

这相等于了4.7%的周息率,高于行业平均的4%。

在面对激烈竞争的同时,陈日新称,新鸿发控股将在2011财政年拨出约3000万令吉的资本开销,其中1000万令吉将用作产品发展,及余额为其塑胶制造部门购买新机械。

该公司在2010年的资本开销约为3600万令吉,包括800万令吉在昔加末购买地段兴建办公室和仓库。这些建筑工程预料会在2011年杪完成。

另外800万令吉则拨作在巴生谷现有工厂毗邻兴建一座新工厂,及余额为金属和塑胶生产单位的产品发展用途。

陈日新称,该公司现是以80%产能操作,而扩充活动将增加产能超过15%。

“除了协助我们减少成本,扩充活动也让我们作好准备,迎接东盟自由贸易区的更大市场。”

http://www.kwongwah.com.my/news/2011/01/07/122.html |

|

|

|

|

|

|

|

|

|

|

|

发表于 12-1-2011 10:47 PM

|

显示全部楼层

发表于 12-1-2011 10:47 PM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 12-1-2011 11:26 PM

|

显示全部楼层

|

新鸿发:做中国汽车覆盖件行业的“老大”

十五年前,一位汽车配件行业的台商,从上海驱车赶往一个陌生地方宣城,准备在那里布点设厂。一路颠簸,目的地还是遥遥无期,到这样落后的地方投资,有什么前途?中途,这位商人拿起手机给宣城的朋友打了个电话:“我不想去你那里,回去了。”宣城朋友的回答是:“你不来,以后肯定会后悔的。”

这样,这位叫黄木的台商还是来到了宣城。如今,已经执掌中国汽车覆盖件市场的大半江山,位于宣城经济开发区的新鸿发交通工业有限公司董事长会毫不犹豫地说:我们的选择完全是正确的。

布点宣城的成功

在汽车零部件行业的布阵图中,宣城确是一个战略要地。北面,有合肥的江淮,东边不远,江苏、浙江一带分布着吉利、永源等多家汽车生产厂,近在咫尺还有新近崛起的芜湖奇瑞。——宣城则处在这些汽车制造厂的中间位置,更何况,这里还有本土的汽车产业基础。

新鸿发登陆内地之时,面对的近乎是一张白纸。广阔的中国汽车维修市场上,尚没有一家专业的汽车覆盖件生产厂家,产品全靠进口。与许多成功的商业案例一样,抢占了先机,是新鸿发的起点。

不仅如此。1995年10月,新鸿发落户之时,当时的飞彩已经为其准备好了厂房,还送来了一批技术骨干,起步可谓异常顺利。

在租用的厂房里,新鸿发公司开始了最初孵育的过程。虽然母公司是台湾一家老资历的汽车零部件生产厂家,产品覆盖台湾省,并向东南亚一带出口,但对于在宣城的新鸿发来说,从台湾带过来的只有一样现成的东西——“南吉”品牌。不过在我国内地,这个牌子还是一张生面孔。

1996年8月,新鸿发公司响起隆隆开工声的时候,宣城经济开发区才刚刚成立,这里还只是山坡和农舍。第一年获得的产值如今不值一提,1千多万元,在全国也只有北京、上海等地少数几个销售点。但企业的目光已经锁定“中国最大的汽车覆盖件生产企业”。

在市场上打响“南吉”这块牌子,是新鸿发确定的第一步。上个世纪的几年间,都是在打基础。应该说,新鸿发的运气不错,这个时候,正赶上我国汽车产业开始步入快车道,汽车维修市场也随之不断放大。在几无对手的市场上,“南吉”逐渐打出了牌子,销售网点随之一年年跟进扩大。

在世纪翻开新的一页之际,新鸿发也发现,几年的基本功练出了成果:在汽车市场上,“南吉”已经成为汽车覆盖件的主导品牌;销售网点密布全国各地,直到雪域高原西藏,大中城市无一遗漏,达200余家。

一步一个台阶

业内人士分析说,新鸿发的发展路线图,与我国整个汽车产业的发展历程非常相似。主攻汽车维修市场,意味着企业发展十分依赖汽车产业的进程。令新鸿发没有想到的是,落户之时,全国汽车保有量只有几百万辆,但从这以后,竟以每年一千万辆的速度在增加,迎来了广阔的市场。

如果说上个世纪的几年是蓄力,那么进入新的世纪,新鸿发则开始发力了。

外资企业的优势也得到了展现,从台湾带来的质量和品牌意识,让企业一步一个台阶地稳步扩张。企业从台湾等境外请来老师,把员工送到日本、马来西亚等地培训,在管理上也是与国际接轨,设备则是一律从日本、德国等地进口。“产品质量国内一流,与原件几乎相媲美,但价格低了很多。”在市场上,新鸿发逐渐赢得了这样的口碑。服务,也是企业非常看中的一着。客户反馈来的问题,无论何地何种情况,48小时以内答复,这是企业铁的规定。直到今天,从来没有一次超出这个精确到小时的时限。

质量+价格+服务的优势,让新鸿发一路顺风顺水地发展,没有过大起大落,在国内汽车覆盖件市场上,占据的份额逐步上升至60%—70%,并稳定在这一水平,成为无可争议的龙头老大。

2006年元月,这位开发区的“元老”,正式迁入了开发区占地200亩的新厂区,结束了租厂的历史。在企业进入一个新的起点之时,年产值已经上升到1个多亿。实际上,由于企业多年长足的发展,原来租用的50亩面积的厂房,早已拥挤不堪,规模成了约束企业发展的瓶颈。

迁入新的厂区后,一边投产,一边上新的生产线,建成的全市最大单体的钢结构厂房,直到现在还是全市之最。企业的产能也得到了释放:当年产值增加了30%,随后接连迈过两个关口,2007年,产值达到2.1亿元,2008年又增长到3.3亿元。

而经过多年的经营,新鸿发的产品品种已达到700余个,从宝马、奔驰到夏利、QQ,适用国内几乎所有车型。汽车覆盖件的研发周期较长,一个品种一般需要三个月,这也就意味着,在汽车覆盖件市场上,新鸿发已经为自己立起了一道高高的门槛。

对于生产汽车配件的行业来说,模具的研发,犹如企业的“大脑”。随着国内各类新车型的不断亮相,新鸿发以其雄厚的技术实力,紧追市场的脚步,一刻不停地开发各类覆盖件生产模具,最近几年,一年开发出的品种多达一百余个。由于企业较高的技术水准,为汽车制造厂开发整车或配件模具,也是企业的一项“业余工作”,三菱猎豹、武汉得利卡、江淮的现代大巴等整车模具都由新鸿发开发,而配件模具的开发,则包括一汽车大众这样有名的汽车厂。

以前,这项技术研发工作一直在上海进行。2007年底,新鸿发汽车模具研发中心开始运作,此后研发重心逐步向这里转移,现在,中心已拥有技术人员50余名,成为研发的主阵地。

向更高的目标进发

去年底金融危机出现以后,新鸿发刚开始猝不及防,打了一个喷嚏。但随即与国内迅速复苏的汽车市场一道,反而迈上了更快的轨道。

春节前后,正是不少企业萧条之时,新鸿发不仅24小时满负荷生产,没有主动辞退一名工人,还陆续新招了七、八十名员工。而在另一条战线上,企业出口不降反增,并创下了一季度增长30%的新高。——因为是外资企业,企业产品从一开始就出口美洲、欧洲、东南亚等国际市场,近年更是供不应求,只是囿于产能所限,没有急于扩大海外市场。尽管如此,到2008年,出口产值仍达到了800万美元。

今天的新鸿发,不仅是市开发区产值、利税最大的企业,效益也是最好的。

2009年刚刚开始,在世界汽车界发生了一件具有划时代意义的大事:中国汽车销量首次超过美国,成为世界第一。对于新鸿发来说,这意味着无限广阔的市场,但此时它却没有沾沾自喜的理由。

如果说当初抢占先机,是成功的起点,那么,今天面对全新的市场形势,再出先手,是新鸿发的“二次创业”。

由于中国汽车产业的迅猛发展,一直在境外虎视眈眈的汽车配件生产厂家,终于开始进入内地“试水”,重量级对手的到来,对汽车覆盖件的市场版图必将带来冲击。机遇与挑战并存,是对眼下新鸿发最确切的描述。

一向不事张扬的新鸿发,在厚积薄发中,也悄然使出大手笔应对。作为一个新的战场,占地达318亩的新鸿发工业园,将于下月投产,这里主攻汽车模具研发与制造。

这个距现厂区不远的新厂区的意义在于,把模具的研发制造从生产厂区分离出来,并赋予一个更大的平台,这将使企业的技术研发力量发生质的提升。此后,这里不仅为企业主打产品覆盖件,源源不断地提供模具,还将进军模具制造业,直接生产出售模具,闯出一片更大的天地,进而成长为公司的另一主业。而这里的产值也将是令人期待的,投产后,年产值有望达到2亿元,而全部项目完成后,一年将产出5个亿左右。

届时,相隔很近的两个厂区,一个主攻模具研发,一个专司覆盖件的生产。而模具制造生产线移走之后,覆盖件生产又腾出了新的空间,产能可以再翻一番。

新鸿发因此也有了足够的底气,把未来几年目标定位在,巩固国内市场上的“老大”地位,并继续迈向更高的目标——亚洲前茅。

http://www.xcxf.gov.cn/article/view.asp?cid=123&sid=0&vid=16154 |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 28-2-2011 11:34 PM

|

显示全部楼层

2010全年财政报告刚刚今天出炉,公司业绩全体都有所进步,业务全年增长9.4%及税前利润也增进21.8%。

公司亦将会在分发10sen的股息,全财政年合计分发13sen的股息。

以下是它的公司的表现分析:

Review of performance

For the fourth quarter of 2010, the Group recorded total revenue of RM55.3 million which was

4.5% higher as compared to RM52.9 million in the corresponding quarter of last year. For the 12

months period ended 31 December 2010, the Group’s revenue was RM222.5 million which was

9.4% higher compared to RM203.3 million in the previous financial year. The better performance

was mainly driven by greater demand, thus generating higher sales for both domestic and export

market.

The Group recorded a Profit Before Tax of RM7.9 million in the current quarter under review as

compared to RM2.5 million in the corresponding quarter of last year, representing an increase of

216.0%. Total Profit Before Tax for the financial year ended 31 December 2010 was RM31.3

million as compared to RM25.7 million in the previous financial year, an increase of 21.8%. The

increase in profit was mainly due to increase in revenue, higher selling price of certain products

and gain on fair value of investment property of RM2.4 million.

Variation of results against preceding quarter

Compared with the immediate preceding quarter, the Group’s Profit Before Tax increased by

6.8% from RM7.4 million to RM7.9 million. The increase in the Group’s Profit Before Tax was

the result of increase in selling price of certain products, gain on fair value of investment property

of RM2.4 million after deducting impairment of goodwill of RM4.9 million during the quarter

under review.

Current year prospects

The Group envisaged 2011 to be another challenging and competitive year. Rising cost pressures

and margin squeeze will remain a challenge for the Group. However, the Group will continue to

focus on improving its production capabilities in order to improve its operational and cost

efficiencies. Barring unforeseen circumstances, the Group is optimistic that it will continue its

positive performance for 2011. |

|

|

|

|

|

|

|

|

|

|

|

发表于 1-3-2011 10:04 AM

|

显示全部楼层

发表于 1-3-2011 10:04 AM

|

显示全部楼层

2010全年财政报告刚刚今天出炉,公司业绩全体都有所进步,业务全年增长9.4%及税前利润也增进21.8%。

公司 ...

yatlokfatt 发表于 28-2-2011 11:34 PM

大大,latest ROE是多少,你懂吗????NTA好像也高过现在的股价。。。。 |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 2-3-2011 10:50 PM

|

显示全部楼层

本帖最后由 yatlokfatt 于 2-3-2011 10:53 PM 编辑

最近公司的财报显示它的NTA=RM3.32 而且 ROE也有10.95% |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 3-3-2011 11:23 PM

|

显示全部楼层

一些有关公司的报导:

New Hoong Fatt's business is strongly related to malaysian passenger car market. It is the country's largest replacement parts maker by the market share in Malaysia.

The outlook of the business seems profitable as it has largest share market in Malaysia with the increase of cars in the country. However due to this reason, the growth of the business will also follow the number of cars in malaysia, which mean about 5%.

Its competitors in the market are APM Automative Holdings Bhd, Delloyd Ventures Bhd, Hirotako Holding Bhd.

Due to competition from the competitors, there is always a competition price war in the market as the buyer tend to buy for the cheapest products. So in order to survive in the price war, production cost is crucial. Any volatile of steel and plastic resin raw-materials prices will effect the company's profit margin.

This year NHFatt will allocate around RM 30 million for capital expenditure, of which RM 10 million will be spent on production development and the balance on buying new machinery for its plastic manufacturing division.

The company currently is running at 80% capacity and there will be a expansion of production capacity more than 15% in end of the year 2011.

OSK research put a BUY call with a target price RM 2.85 based on a forward (year 2011) PE 6.0

MIMB investment Bank also put a BUY call with target price RM 3.00 based on FY 2011 PE 7.9 |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 15-3-2011 11:54 PM

|

显示全部楼层

最近公司的其中一项企业活动:

New Hoong Fatt to expand ops in Indonesia

New Hoong Fatt Holdings Bhd (NHF), the leading automotive replacement parts maker, plans to expand its operations in Indonesia.

In a statement today, NHF said it has identified Indonesia as part of its growth strategy.

"NHF is encouraged by the significant growth and developments within the car industry in Indonesia which includes the launch of new vehicle models and a growing commercial vehicle segment," it said.

It said the recent set-up of PT NHF Auto Supplies Indonesia was another step to bring the company closer to its customers. PT NHF Auto Supplies would focus on marketing, distribution and trading of NHF’s extensive range of products, it said.

According to the Indonesian Automotive Industry Association (Gaikindo), 2010 vehicle sales in Indonesia surged 65 per cent to 764,710 units from 464,816 units in 2009.

Gaikindo is forecasting the total industry volume for this year to reach between 780,000 and 830,000 units.

-- Bernama |

|

|

|

|

|

|

|

|

|

|

|

发表于 16-3-2011 11:46 AM

|

显示全部楼层

发表于 16-3-2011 11:46 AM

|

显示全部楼层

最近公司的财报显示它的NTA=RM3.32 而且 ROE也有10.95%

yatlokfatt 发表于 2-3-2011 10:50 PM

ROE 10.95好像又太低了。但是NTA够好。。。。。 |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 22-3-2011 10:52 PM

|

显示全部楼层

本帖最后由 yatlokfatt 于 22-3-2011 10:58 PM 编辑

最近股价逐渐地企稳,这可能是随着政府将在2011年6月禁止入口二手汽车零件,新鸿发将成为其中一家受惠公司。

在二手原厂零件被禁止入口后,可能增加替换(REM)零件(新鸿发所制造的产品)的吸引力,因为后者较原装零件便宜,两者的价格差距也可能相当大。

公司的业绩在去年表现得不错,并且加上公司将在下个月宣布10sen的年终股息,在五月分发,所以最近可以看到股票买方的购买力有所增加。

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 30-3-2011 12:09 AM

|

显示全部楼层

一个非常值得乘低累积的股只!

公司已经有足够能力分发最少1:1的红股了,仅是不知道管理层何时才要公布。

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 31-3-2011 03:15 PM

|

显示全部楼层

本帖最后由 yatlokfatt 于 31-3-2011 11:05 PM 编辑

一则对消费者听来是坏消息,但切对这家公司属于好消息的报导。

KUALA LUMPUR, March 23 -- The government will gradually phase-out the importof used car parts and components with the first phase starting June 1 this year,said the Ministry of International Trade and Industry's Secretary General Datuk Rebecca Fatima Sta Maria.

In the first phase, four critical items will be banned from imports namely break lining, break pad, tyre and battery, she said.

23/03/2011 1450ST

禁二手零件入口影響深遠

2011-03-24 19:12

政府以消費人的安全考量為理由,決定從6月1日起,禁止消費人普遍使用的煞車片、煞車皮、電池及輪胎4種汽車二手零件入口。相關部門官員也清楚表明,禁止上述4種零件入口,只是首階段,未來可能逐步擴大到其他部份的二手零件。由於這4種零件乃修車行業最暢銷的零件,佔二手零件銷售量的40%,因此禁令尚未實施,已引起有關領域業者的反彈與憂慮,紛紛要求政府重新檢討有關禁令。

政府實施此禁令,原則上是為了消費人的安全問題,例如二手零件雖然比較便宜,品質卻不如新零件有保障,尤其是煞車片、煞車皮和輪胎,倘若品質欠佳,對行駛在大道上的駕駛人及其他大道使用者,都可能構成潛在危險。從另一個角度而言,禁止二手零件入口,也可以視為是政府保護國產汽車及本地汽車零件製造業的另一項政策。

然而,我國的汽車二手零件業規模並不小,政府在為國產汽車公司提供保障之餘,也必須考慮其他相關行業的利益。根據汽車零件商,本地汽車二手零件市場每年銷售額高達120億令吉,這個龐大數額反映了二手零件在本地汽車市場的普及程度,主要原因在於二手零件與新零件之間的價格相差近10倍。禁止汽車二手零件入口,意味著消費人的車輛一旦出現毛病,必須以昂貴的原裝或新零件取而代之,這對我國普遍擁有10年車齡汽車的車主而言,無疑是一項經濟負擔。 |

|

|

|

|

|

|

|

|

|

|

|

发表于 31-3-2011 09:08 PM

|

显示全部楼层

发表于 31-3-2011 09:08 PM

|

显示全部楼层

|

这股的流通量不高,但赚钱能力一流。如果我有本钱也会买入投资。 |

|

|

|

|

|

|

|

|

|

|

|

发表于 31-3-2011 11:44 PM

|

显示全部楼层

发表于 31-3-2011 11:44 PM

|

显示全部楼层

本帖最后由 hello2009 于 2-4-2011 12:46 AM 编辑

股价与成交量什少见到有大波动,所以让许多人对此股冷淡。

我本人觉得,唯一值得让我考虑购买它的原因是它的高股息,低债务以及公司业务还逐年的在扩大中。 |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 6-4-2011 11:03 PM

|

显示全部楼层

本帖最后由 yatlokfatt 于 6-4-2011 11:11 PM 编辑

Hoong Fatt Auto opens Proton CI dealer outlet to supply parts Posted on March 31, 2011, Thursday

New Hoong Fatt Auto Supplies Sdn Bhd (“New Hoong Fatt Auto”), a wholly owned subsidiary of New Hoong Fatt Holdings Berhad, has opened a parts dealer outlet specializing in Proton OEM parts and decked in Proton's corporate identity.

Traditionally a wholesaler and retailer of automotive spare parts, New Hoong Fatt Auto is expanding its business into the consumer market for the first time with this new outlet, opened under Edaran Otomobil Nasional Bhd (EON). The outlet will be fully managed by New Hoong Fatt Auto, and is stocked with components ranging from body to engine parts.

“We are continuously aiming to provide enhanced customer service and cultivate better relationships. New Hoong Fatt Auto’s new Proton CI dealer outlet enables us to do this and paves the way for new business opportunities. There is certainly a need for genuine automotive parts, especially with over 2.4 million Proton cars on the road. We hope to bridge the gap between us and our customers, particularly the end users. Similarly, this collaboration with EON has been a positive step in a new direction,” said Kam Foong Keng, the Executive Chairman.

The exclusive Proton dealer outlet is located near the new Klang Sentral bus station at:

No. 17-G, Jalan Klang Sentral 6/KU5,

Taman Klang Sentral,

Bukit Raja Meru,

41050 Klang,

Selangor.

|

|

|

|

|

|

|

|

|

|

|

|

发表于 7-4-2011 08:49 PM

|

显示全部楼层

发表于 7-4-2011 08:49 PM

|

显示全部楼层

Hoong Fatt Auto opens Proton CI dealer outlet to supply parts Posted on March 31, 2011, Thursday

...

yatlokfatt 发表于 6-4-2011 11:03 PM

lz还握着?好像没有动静哪。 |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 13-4-2011 11:16 PM

|

显示全部楼层

本帖最后由 yatlokfatt 于 13-8-2011 07:22 AM 编辑

投资此股的投资者,必须长期持有和守住跟踪它的业绩做调动方可看到回酬。

Corporate: New Hoong Fatt gears up for larger market

This article appeared in Corporate, The Edge Malaysia, Issue 839, Jan 3-9, 2011

The recovering economy and the elimination of duties on automobiles and parts under the Asean Free Trade Area (Afta) scheme in 2010 worked in favour of the domestic automotive parts industry.

This was reflected in the 19.8% increase in total industry volume to 301,077 units in the first half of 2010, compared with the same period a year earlier. The rise was attributed particularly to passenger cars.

With its business strongly correlated to the Malaysian passenger car market, New Hoong Fatt Holdings Bhd, which is the country’s largest replacement parts maker by market share, is worth a look.

“The trend (of upward growth in the car market) is likely to continue in future, judging by the country’s favourable young population demography,” New Hoong Fatt’s managing director Chin Jit Sin tells The Edge Malaysia.

Indeed, according to statistics from the Road Transport Department (RTD), some 500,000 new cars are registered annually.

What is more interesting about New Hoong Fatt, however, is its focus on the replacement equipment market, which is not subject to the volatility of new-car sales.

This shows in its earnings — New Hoong Fatt posted a compound annual growth rate of 5% in net profit from the financial year ended Dec 31, 2003 (FY2003) to FY2009.

Notably, the replacement parts maker managed to sustain its revenue and profit growth during the global financial crisis in 2008 and 2009. New Hoong Fatt’s net profit in FY2009 grew 21.7% to RM22.25 million from RM18.28 million a year earlier, mainly owing to an increase in revenue and lower manufacturing costs.

However, the counter remains a laggard, underperforming the FBM KLCI index and its peers. Year-to-date, it has posted a growth of some 4%, in contrast to APM Automotive Holdings Bhd’s 109%, Delloyd Ventures Bhd’s 35%, Hirotako Holdings Bhd’s 93% and the 18.8% growth of the 30-stock benchmark index.

Cut-throat competition

Its underperformance could be due to the tight liquidity of the stock and the volatility of steel and plastic resin raw-material prices.

It is also because of heightened competitiveness in the replacement-parts market. Although the elimination of duties under the Afta scheme may open up new avenues for auto and auto parts players, it can also be a threat to others, with more competitive pricing and a greater number of players in the market. Also, unlike with the original equipment manufacturer or OEM market, replacement parts manufacturers have no cornerstone customers and buyers tend to opt for the cheapest products.

The cut-throat competition is among the factors that outweigh the high dividend yields offered by New Hoong Fatt. It offers the highest dividend yields among its peers, paying out a regular gross dividend per share of 11 sen over the past six years. This translates into a yield of 4.7%, which is higher than the industry average of 4%, according to Bloomberg data.

In the face of heightened competition, Chin says New Hoong Fatt is allocating some RM30 million for capital expenditure (capex) in FY2011, of which RM10 million will be spent on production development and the balance on buying new machinery for its plastic manufacturing division.

The company spent some RM36 million on capex in 2010, of which RM8 million was for the purchase of land in Segambut to build offices and warehouses. Construction on these is expected to be completed by the end of 2011.

Another RM8 million was allocated for the building of a new factory next to its existing plants in Klang, while the balance was for product development at both of its metal and plastic production units.

Chin says the company is running at about 80% capacity currently and the expansion will increase production by more than 15%.

“Besides helping us to reduce cost, this expansion is going to prepare us to tap a bigger market under the Afta scheme,” he says, adding that competition will intensify with the enlarged markets.

According to its financial statement as at Sept 30, 2010, New Hoong Fatt’s net gearing ratio has increased from 1.8% to 5.6% year-on-year. Nonetheless, its net assets per share rose to RM3.27 as at Sept 30, 2010 from RM3.08 as at Dec 31, 2009.

As the impact of New Hoong Fatt’s new production capacity has yet to kick in, there appears to be upside to the stock. Nevertheless, whether it earns a re-rating or not hinges on the ability of the company to develop new export markets to expand its scale of business.

There may be potential upside on the local front with Volkswagen AG finally inking a deal to establish a production partnership in Malaysia with conglomerate DRB-HICOM Bhd. However, production of VW vehicles is expected to commence only at end-2011 and OEM players are more likely to benefit from its presence here.

Nonetheless, the two research houses that cover New Hoong Fatt have “buy” calls on the company. On Nov 30. MIMB Investment Bank initiated a “buy” call on the company, with a target price of RM3 based on a FY2011 price-to-book ratio of 0.9 times and a price-to-earnings ratio (PER) of 7.9 times.

OSK Research, in a research note to clients on Oct 29, 2010, maintains a “buy” call on New Hoong Fatt with a target price of RM2.85, based on a forward (FY2011) PER of six times. The company’s historical PER of 7.79 times is far lower than the industry’s average PER of 14.87 times, according to Bloomberg data.

“We continue to like New Hoong Fatt’s stable organic growth,” says OSK. “We expect it to return to net cash by FY2011 when revenue contribution from the new production plant kicks in.”

新鸿发开拓东盟市场

2011/05/20 11:06:41 AM

●南洋商报

(吉隆坡19日讯)新鸿发(NHFatt,7060,主板消费产品股)放眼开拓东协市场,续进军印尼,该公司也计划开拓越南和菲律宾市场。

集团执行主席金风琼今天在常年股东大会结束后,向记者透露,集团将着重在东协市场,而人口约是大马10倍的印尼是第一站,接下来则将进军同样以高人口著称的越南和菲律宾。

“印尼去年的汽车销售量超过70万辆,加上人口多,可见市场发展潜能大。

目前,我们以小笔资金在雅加达设立了分销处,以测试当地的市场反应。”

她补充,虽然越南和菲律宾的汽车销售量不如印尼高,但市场庞大,且料汽车销售量将随着经济起飞而增加。

问及日本天灾是否对业务造成影响,董事经理陈日新回应道:“天灾影响最大的是原厂代工制造商(OEM),而我们是替代设备制造商(REM),所以没有对业绩构成直接影响。”

根据资料,该集团2010年净利按年上涨24%,营业额也按年增长9.4%。

陈日新表示,净利稳定增长是因为营业额不受外来的因素影响。

“我们对今年的业绩不做任何预估,但我们对上年表现十分满意,并会持续开拓新市场,放眼全球市场。”

派息10仙

此外,新鸿发在股东大会上,通过派发股息的建议,即派发总值750万令吉的单层股息,相等于每股8仙,以及外加2仙特别终期股息。

集团也在稍早前派发共220万令吉或每股3仙的中期股息,使全年总股息达到13仙。 |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 20-4-2011 10:59 PM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|