|

|

【NHFATT 7060 交流专区】新鸿发集团

[复制链接]

[复制链接]

|

|

|

发表于 21-4-2011 09:41 AM

|

显示全部楼层

发表于 21-4-2011 09:41 AM

|

显示全部楼层

这是两年前公司的MD接受THE Edge的采访的一些片剪

Quarter Earning per Share Comparison

yatlokfatt 发表于 20-4-2011 10:59 PM

大大,你只aim这个股票吗????想买一些咯。 |

|

|

|

|

|

|

|

|

|

|

|

发表于 21-4-2011 10:08 AM

|

显示全部楼层

发表于 21-4-2011 10:08 AM

|

显示全部楼层

一个非常值得乘低累积的股只!

公司已经有足够能力分发最少1:1的红股了,仅是不知道管理层何时才要公布。 ...

yatlokfatt 发表于 30-3-2011 12:09 AM

什么能力呢???? |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 25-4-2011 10:33 PM

|

显示全部楼层

回复 42# Kevlee

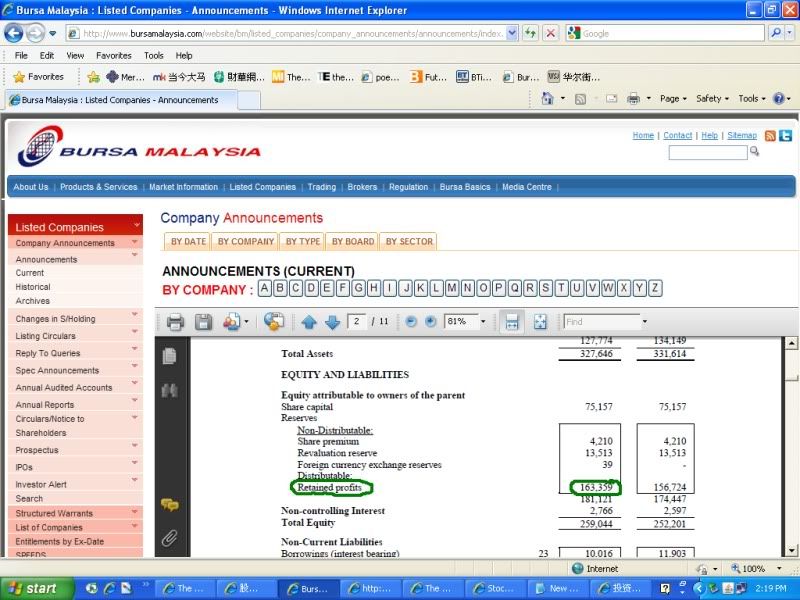

公司最近的2010年财政年业绩报告显示公司里头的可派发RETAINED PROFITS已经高达到RM156.7Mil,足足是公司的缴足资本RM75.15Mil的两倍。

所以我认为公司如今是有派发红股能力了。

另外

今天公司刚刚宣布8sen年终及2sen的特别股息

"Final single tier dividend of eight (8) sen and a special final single tier dividend of two (2) sen per ordinary share of RM1.00 each for the financial year ended 31 December 2010。"

EX-date : 27/05/2011

Entitlement date : 31/05/2011 |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 28-4-2011 11:13 PM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 29-4-2011 07:29 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 29-4-2011 12:34 PM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 2-5-2011 03:36 PM

|

显示全部楼层

发表于 2-5-2011 03:36 PM

|

显示全部楼层

|

三月份在RM2.35买进,已经突破2.50。如果短时间可达到2.60,认为可以收,可能派发红股。 |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 3-5-2011 07:36 AM

|

显示全部楼层

去年的第3&13大股东Tabung Haji & Public Smallcap Fund已经不在30大股东的名单内了。

这可能是目前市场上追踪该股的股票行不多,在缺乏股票行追踪该公司情况,该公司自然无法提高知名度,市场不够了解该公司,自然也较难引起基金经理和投资著青睐。 |

|

|

|

|

|

|

|

|

|

|

|

发表于 4-5-2011 05:56 PM

|

显示全部楼层

发表于 4-5-2011 05:56 PM

|

显示全部楼层

回复 48# yatlokfatt

大大。我上车了。。。。。你有抓票吗?? |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 5-5-2011 05:34 PM

|

显示全部楼层

2011年度首季度的业绩已出。

"Review of performance For the first quarter of 2011, the Group recorded a marginal increase in total revenue of RM53.7 million as compared to RM52.8 million in the corresponding quarter of last year.

The Group recorded a Profit Before Tax of RM7.8 million in the current quarter under review as compared to RM7.2 million in the corresponding quarter of last year, representing an increase of 8.3%. The increase in profit was mainly due to higher income from sale of steel

scrap" |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 6-5-2011 11:13 AM

|

显示全部楼层

本帖最后由 icy97 于 30-9-2011 07:12 PM 编辑

OSK Research表明尽管首季度的业绩只达到20%它早前对此公司设下的预测,不过依然对此股保持着买入的看法。

差强理想的主要的原因是首季较短的工作天数和原料的增长所造成,幸好有较高的钢铁报废出售当作收入。

OSK Research maintains Buy on New Hoong Fatt, FV RM2.85

合理价RM2.85。

KUALA LUMPUR: OSK Research said New Hoong Fatt’s 1QFY11 earnings were slightly weak, accounting for 20% of its full year forecast due to seasonality given the shorter number of working days.

It said on Friday, May 6 that margins were crimped by higher raw material cost but was somewhat cushioned by the higher income contribution from the sale of steel scrap at higher prices.

“While the gradual ban of imported used parts will commence with key critical items which New Hoong Fatt (NHF) does not have exposure to, we remain positive over the longer term as eventually the ban would also include body parts.

“We maintain our earnings forecast as we expect stronger quarters ahead. Our BUY call is maintained as with our FV of RM2.85, premised on 6x FY11 EPS. No dividend was announced,” it said. |

|

|

|

|

|

|

|

|

|

|

|

发表于 7-5-2011 09:21 AM

|

显示全部楼层

发表于 7-5-2011 09:21 AM

|

显示全部楼层

2011年度首季度的业绩已出。

"Review of performance For the first quarter of 2011, the Group recor ...

yatlokfatt 发表于 5-5-2011 05:34 PM

又赚钱了。。。。。。 |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 19-5-2011 11:03 PM

|

显示全部楼层

本帖最后由 yatlokfatt 于 19-5-2011 11:28 PM 编辑

这两天有人在RM2.50左右开始吃票,接下来不知道是否会有什么大动作?

|

|

|

|

|

|

|

|

|

|

|

|

发表于 20-5-2011 01:08 AM

|

显示全部楼层

发表于 20-5-2011 01:08 AM

|

显示全部楼层

这两天有人在RM2.50左右开始吃票,接下来不知道是否会有什么大动作?

yatlokfatt 发表于 19-5-2011 11:03 PM

都是散户(100-299lots)在吃票,应该没大动作  |

|

|

|

|

|

|

|

|

|

|

|

发表于 20-5-2011 01:29 AM

|

显示全部楼层

发表于 20-5-2011 01:29 AM

|

显示全部楼层

yatlokfatt , 谢谢分享。 |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 2-6-2011 02:49 PM

|

显示全部楼层

ESTABLISHMENT OF A WHOLLY FOREIGN OWNED ENTERPRISE IN THE PEOPLE’S REPUBLIC OF CHINA, TO BE WHOLLY-OWNED BY NHF VENTURES SDN BHD

1. Introduction and Rationale

The Board of Directors of New Hoong Fatt Holdings Berhad (“NHFHB” or “the Company”) wishes to announce that its wholly owned subsidiary, NHF Ventures Sdn Bhd has on 17 May 2011 obtained the approval from the Ministry of Commerce in the People’s Republic of China to set up a Wholly Foreign Owned Enterprise by the name of Ampire Auto Parts (Shanghai) Co. Ltd (“Subsidiary”).The certificate of approval dated 30 May 2011 was received on 1 June 2011.

The paid up capital of the Subsidiary will be RMB10.5 million. The Subsidiary will be principally involved in the importing, exporting and trading of automotive spare parts and accessories in the People’s Republic of China with the aim of capturing the automotive spare parts market in this country.

2. Effects of Incorporation

The incorporation of the Subsidiary (“Incorporation”) is not expected to have any material effects on the issued and paid-up capital, consolidated earnings, net assets per share, gearing and substantial shareholders’ shareholdings of the Company for the financial year ending 31 December 2011.

3. Approvals Required

The Incorporation is not subject to the approval of NHFHB’s shareholders nor any relevant governmental authorities.

4. Interests of the Directors, Major Shareholders and Persons connected with them

None of the Directors or major shareholders of NHFHB or persons connected with them have any interest, direct or indirect, in the Incorporation.

5. Directors’ Opinion

The Directors of the Company are of the opinion that the Incorporation is in the best interest of the NHFHB Group.

This announcement is dated 1 June 2011.

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 10-7-2011 10:53 PM

|

显示全部楼层

2011年首季的业绩

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 28-7-2011 11:13 PM

|

显示全部楼层

2011年第二季的业绩刚出炉。业绩还称得中规中矩。上半年每股取得18.83sen收益。

Review of performance

For the second quarter of 2011, the Group recorded total revenue of RM59.3 million which

was 3.1% higher as compared to RM57.5 million in the corresponding quarter of last year.

Total revenue for the six months was RM113.0 million which was 2.4% higher as compared

to RM110.4 million in the corresponding period of last year. The increase was mainly due to

higher demand for the export market.

The Group recorded a Profit Before Tax of RM8.1 million in the current quarter under review

as compared to RM8.8 million in the corresponding quarter of last year, representing a

decrease of 8.0%. The decrease was a result of higher operating expenses. Total Profit Before

Tax for the cumulative six months was RM16.0 million, which was substantially the same as

the result recorded in the corresponding period last year.

Variation of results against preceding quarter

Compared with the immediate preceding quarter, the Group’s Profit Before Tax increased

slightly by 3.8% from RM7.8 million to RM8.1 million.

Current year prospects

The Group expects the operating conditions for the second half year of 2011 remain

challenging in view of the rising operating costs. Barring unforeseen circumstances, the

Group is optimistic that it will continue its positive performance in the current financial year. |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 2-8-2011 03:16 PM

|

显示全部楼层

Nhfatt的业绩可以说是常胜军,年年都在赚钱。唯是股价有待改进!

公司最新的2011财政年首半年业绩报告里头显示,公司手中握住可派发(Distributable Reserves)的保留收益(RETAINED PROFITS)再次增加至RM163.359Mil,超过公司的缴足资本RM75.15Mil的两倍多。

所以更加强公司派发红股的能力。

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 13-8-2011 07:38 AM

|

显示全部楼层

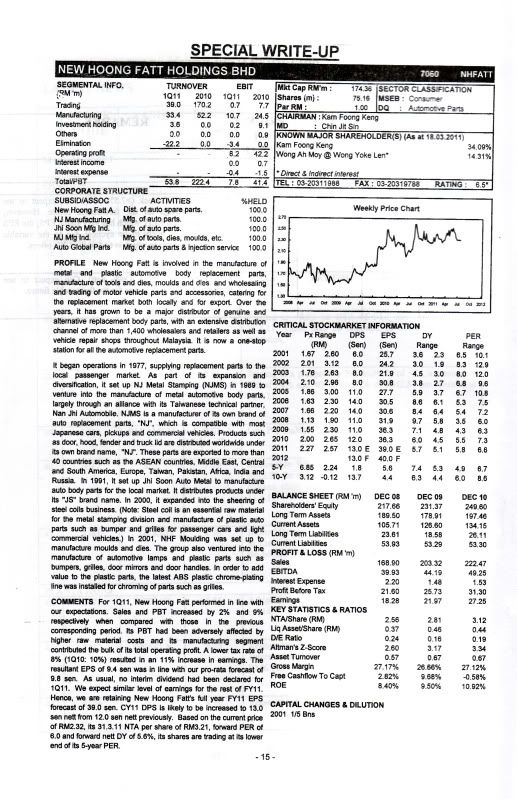

最近一期的梁孙健博士与DYNAQUEST研究组所撰稿的Monthly Digest里头,我们可以看到他们也建议买进 NHFATT。

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|