|

查看: 15022|回复: 122

|

【GREENYB 0136 交流专区】永合

[复制链接]

[复制链接]

|

|

|

本帖最后由 icy97 于 30-9-2011 02:27 AM 编辑

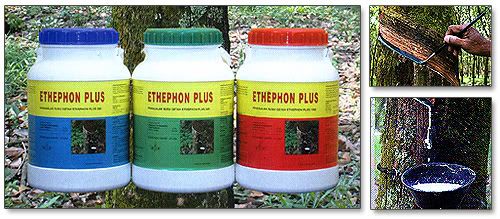

如今全球的原产品一直地继续攀高,尤其近几个月胶价屡次地创高峰,因此在大马股市里有一只刚从創業板里冒出头的未来慧星股,它就是从事农业科技方案供应商的-永合GREENYB。最近它即将有机会转板晉身主要板。

大家可能对此股感到陌生,如果想多了解,可以查寻它的网站:

http://www.greenyield.com.my/index.php

另外以下是它去年十二月的公司消息报导

展望更佳業績

永合冀轉至主要板

(萬宜22日訊)隨著經濟環境改善,永合(GREENYB,0136,創業板工業股)冀重返金融危機前的獲利水平,並放眼本財年結束前晉身馬股主要板。

儘管原產品價格在景氣蕭條時起伏不定,永合集團董事經理覃富強認為,若整體環境繼續好轉,公司有望達到08財年630萬令吉的淨利水平。

他在出席年度股東大會后的記者會上指出,公司為新財年設下目標,希望本財年結束前能夠成功晉身馬股主要板。

“目前,公司股項上市本地創業板,若一切過程得以順利進行,希望能夠成功申請轉板。”

惟他補充,一切都將視經濟復甦走勢和程度而定。

今日列席者尚有執行董事陸梓敬、西瓦古瑪蘭、副董事經理覃富權及總經理覃建煒等。

截至目前,永合超過75%營業額來自出口業務,覃富強透露,未來將協合橡膠種植領域,作出多元化發展。

“除了種植,公司也將放眼拓展橡膠廠、加工科技等相關業務,近期與 Melati Aman 的合作,即是多元化業務的發展之一。”

他指出,公司將在未來數年內,繼續改善現有產品,並陸續推出新產品。

“公司每年撥出營業額逾2%作為產品研發費用,新產品已在研發中,惟尚需時間測試。”

截至7月底09財年,永合全年派息1.5仙,平均每年撥出淨利約50%至61%,作為公司派息用途。 |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 18-10-2010 11:18 PM

|

显示全部楼层

本帖最后由 yatlokfatt 于 19-10-2010 07:32 AM 编辑

马来西亚天然橡胶(SMR)胶价飙涨,创下史上新高,每公斤达RM12.02。相关的行业,全都被看高一线。

这也是GREENYB近来的国外业务上的一些商业报导

KUALA LUMPUR, Sept 23,2009 (Bernama) -- Greenyield Bhd is expanding its capacity in Vietnam with the construction of a factory to manufacture plantation-related products like stimulation systems. It said the new factory would also produce non plantation-related products like Artstone plant pots, which is mainly exported to the United States, Australia and Europe, as the manufacturing capacity in Malaysia was running low. The venture undertaken by Givnflow Co. Ltd, a wholly owned subsidiary of Gim Triple Seven Sdn Bhd, is 100 per cent-owned of Greenyield.

The factory, built on a piece of land leased by Givnflow from Vietnam Singapore Industrial Park JV Co. Ltd, for US204,000, is located in the township of Binh Duong, about 40km from Ho Chi Minh City. The lease will expire in 2055. The construction of the RM2.1 million factory, which includes a gas decanting plant, will enable Greenyield to service its customers from Vietnam in a more effective and efficient manner, it added.KUALA LUMPUR, Sept 23 (Bernama) -- Greenyield Bhd is expanding its capacity in Vietnam with the construction of a factory to manufacture plantation-related products like stimulation systems.

It said the new factory would also produce non plantation-related products like Artstone plant pots, which is mainly exported to the United States, Australia and Europe, as the manufacturing capacity in Malaysia was running low. The venture undertaken by Givnflow Co. Ltd, a wholly owned subsidiary of Gim Triple Seven Sdn Bhd, is 100 per cent-owned of Greenyield.

The factory, built on a piece of land leased by Givnflow from Vietnam Singapore Industrial Park JV Co. Ltd, for US204,000, is located in the township of Binh Duong, about 40km from Ho Chi Minh City. The lease will expire in 2055. The construction of the RM2.1 million factory, which includes a gas decanting plant, will enable Greenyield to service its customers from Vietnam in a more effective and efficient manner, it added.

|

|

|

|

|

|

|

|

|

|

|

|

发表于 19-10-2010 02:04 AM

|

显示全部楼层

发表于 19-10-2010 02:04 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 19-10-2010 03:50 PM

|

显示全部楼层

本帖最后由 yatlokfatt 于 19-10-2010 04:22 PM 编辑

这家公司20/10/2006在当时的Mesdaq市场上市,IPO价格21sen。回头算一算明天刚好是上市4周年纪念。

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 20-10-2010 12:00 AM

|

显示全部楼层

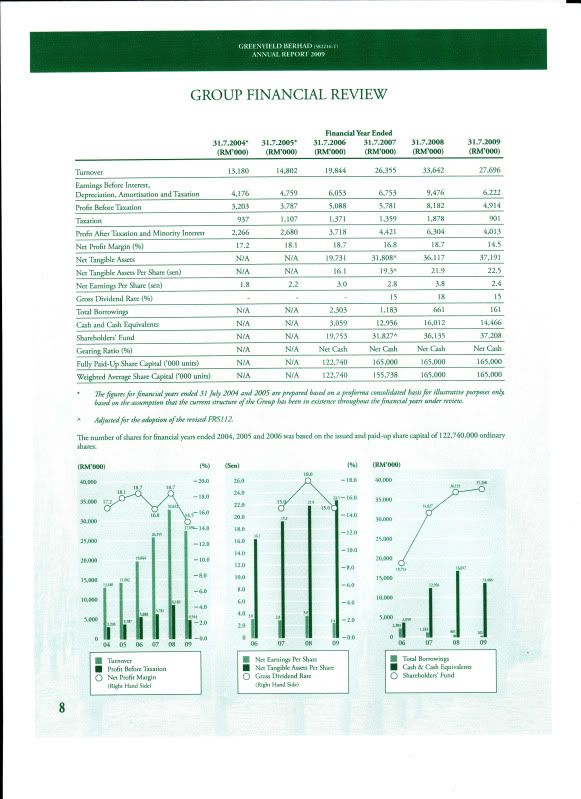

以下是公司集团在2004~2009年度的财政主要数据。

仅是提供给于大家参考。

|

|

|

|

|

|

|

|

|

|

|

|

发表于 2-11-2010 08:22 PM

|

显示全部楼层

发表于 2-11-2010 08:22 PM

|

显示全部楼层

看来不错

yatlokfatt 有没有投资呢? |

|

|

|

|

|

|

|

|

|

|

|

发表于 2-11-2010 09:01 PM

|

显示全部楼层

发表于 2-11-2010 09:01 PM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 2-11-2010 09:02 PM

|

显示全部楼层

发表于 2-11-2010 09:02 PM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 2-11-2010 09:26 PM

|

显示全部楼层

发表于 2-11-2010 09:26 PM

|

显示全部楼层

|

四年前有玩过。跟STEMLIFE同一时期的。去年0.17有买了点后来0.3套利了! |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 3-11-2010 11:51 PM

|

显示全部楼层

回复 6# guangguang

有小量买进当作分散投资。 |

|

|

|

|

|

|

|

|

|

|

|

发表于 4-11-2010 07:09 AM

|

显示全部楼层

发表于 4-11-2010 07:09 AM

|

显示全部楼层

管理层/老板 。。。。。。。。。。

想赚它的钱,难 啰 !:@ |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 9-11-2010 11:45 PM

|

显示全部楼层

永合获有机肥料专利权

2010-04-09 16:16

(吉隆坡)永合(GREENYB,0136,创业板工业產品组)独资子公司Gim Triple Seven,成功攫取一项有机肥料的专利权。文告表示,有机肥料是由有机农业废料製成,专利有效期限截至2026年11月13日为止。

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 10-11-2010 11:35 PM

|

显示全部楼层

本帖最后由 yatlokfatt 于 10-11-2010 11:37 PM 编辑

今天日本东京橡胶期货继续延伸它的涨势而且创下胶价的30年高价位后,上海橡胶期货亦也刷造新高。

这事关买商关注东南亚的几个橡胶生产国家最近严重降雨量将促使供应短缺以及中国车辆销售额数据高涨所造成。另外LA NINA的影响也引起阿根廷与巴西出现干旱的气候,这也是致使胶价高企不下的原因。

所以,那一些与橡胶业务有相关的公司如种植股,这胶价的30年高价位将会为公司带来正面的贡献。另外,我相信GREENYB也不例外,同样将会从此次胶价暴涨中有望大大获益。 |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 4-12-2010 12:54 PM

|

显示全部楼层

本帖最后由 yatlokfatt 于 4-12-2010 05:42 PM 编辑

一则对它有利的消息。

Supply constraints to lift rubber prices

Published: 2010/12/04

The Malaysian rubber market is expected to be firm next week, dealers said.

A dealer said there may be concerns on supply constraints due to bad weather that had disrupted tapping and output.

" Prices are likely to be supported at this level amid concerns over tight supplies," he said.

Last week, the SMR 20 buyers' price breached its record high level of 1,335.0 sen previously, to settle at 1,340.5 sen per kg on Friday.

On a weekly basis, the Malaysian Rubber Board's official sellers' physical price for tyre-grade SMR 20 ended 31.5 sen higher at 1,351.0 sen per kg compared with 1,319.5 sen per kg last Friday, while latex-in-bulk rose 25 sen to 907 sen per kg.

The unofficial sellers' closing price for tyre-grade SMR 20 gained 41 sen to 1,354.0 sen per kg while latex-in-bulk went up 30 sen to 910.0 sen per kg. -- Bernama

Read more: Supply constraints to lift rubber prices http://www.btimes.com.my/Current_News/BTIMES/articles/20101204114601/Article/index_html#ixzz177DmzPSg |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 21-12-2010 11:54 PM

|

显示全部楼层

東京膠價漲2.5%‧觸動暫停交易

(吉隆坡20日訊)雨季影響生產國產量,加上市場盛傳中國可能延緩升息,以支撐原料需求,帶動東京商品交易所橡膠價格今日上漲逾2.5%,更觸動暫停交易(Circuit breaker)機制,一度暫停交易5分鐘。

馬泰印雨季

產能降低

交易商指出,雖然中國和印度因汽車銷售需求上漲,但泰國、印尼和大馬三大橡膠生產國連續大雨導致產能減低,供應短缺問題更可能因泰國明年初進入產能淡季進一步惡化。

“市場因供應吃緊看俏,而期貨價格也因中國可能不會在今年升息消息帶動。”

中國人民銀行行長周小川早前表示,中國政府將把股市走向納入政策決定考量。中國在今年10月因通膨按年成長4.4%,3年來首度升息,隨後更在5週內3次調升銀行存款準備金率,以抑制日趨高漲的通膨壓力。

膠價今年已漲48%

此外,經濟學家看好美國經濟成長可能較預期為強,加上個人消費趨勢開始增強,促使日圓主導的橡膠期貨隨美元漲勢走高,今日東京商品交易所5月結算的橡膠期貨一度上漲2.9%至每公斤410.3日圓(約15令吉23仙)。橡膠價格今年已增長48%。

路透社分析員認為,根據現有的波浪模式,東京商品交易所6個月交割的橡膠期貨有望在未來3個月上漲至每公斤450日圓(約16令吉70仙),但膠價可能在高位進行調整,並回跌至每公斤390日圓水平,約256至450日圓間費氏回退理論(Fibonacci Retracement)的38.2%。

上海5月結算的橡膠期貨上漲4%至每公噸3萬7千580人民幣,是繼今年11月11日創紀錄的每公噸3萬8千920人民幣最高水平。

泰國橡膠研究機構上週五指出,供應短缺和海內外買家需求強勁,導致泰國橡膠現金價延續漲勢至每公斤141.55泰銖(約14令吉40仙)的紀錄新高。

星洲日報/財經‧2010.12.21 |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 22-12-2010 03:02 PM

|

显示全部楼层

公司最新消息

Greenyield eyes 10pc revenue growth

Today, December 22, 2010, 58 minutes ago

Greenyield Bhd, an agrotechnology solutions provider, is aiming for a 10 per cent growth in revenue for its financial year ending July 31,2011. The projection would be driven by its non-plantation related products segment and also full recovery of the United States and European economies, its executive chairman, Tham Foo Keong told reporters at the company's annual general meeting today. -- Bernama

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 23-12-2010 11:44 PM

|

显示全部楼层

展望樂觀 永合營收料成長10%

(吉隆坡22日訊)永合(GREENYB,0136,創業板)相信明年歐美國家的經濟復甦,將帶動該公司2011財政年(截至明年7月31日)的營業額成長10%。該公司也積極伸展觸角至上游種植業務。

永合集團董事經理覃富強在今日舉行的股東常年大會後表示,由於樹膠價格高企,明年公司的展望非常樂觀,他有信心2011年的表現將超越2010年,因為該公司的種植業務和服務皆以樹膠為核心,所以只要SMR20級膠價維持在每公斤8令吉水平,對公司業績將帶來正面效應。

另外,他放眼2011財政年營業額可成長10%,而相關的成長將由非種植業務--花盆銷售所帶動。該公司的花盆幾乎100%出口,主要至歐美國家,歐美明年的經濟復甦,對這項業務將有顯著的助益。

覃富強說,「今年令吉升值太過強勢,即使我們有進行對沖,但效果有限。所以目前沒辦法預測淨利表現,直至美元匯率穩定下來。」

出口佔該公司的產品與服務逾80%,且都以美元計價。無論如何,他認為美元在未來將回穩。

覃富強透露,目前正與非洲國家--加納的私人企業洽談提供樹膠相關服務,預計在明年1月或2月將達成協議。而在東盟區域,公司目前圈定在柬埔寨和印尼購地進行種植。

此外,在國內,永合取得吉蘭丹州政府授予一塊1000英畝的森林地使用權。該公司將和富貴集團(NVMULTI,5021,主板貿服股)聯手進行樹膠栽種活動,永合佔該聯營的30%股權。預計明年4月之前將完成樹膠栽種,6年後將可收成。

另外,永合今年10月向大馬交易所建議轉換至主板交易,覃富強表示,目前還在進行準備工作,希望在明年農曆新年前可呈交申請書。永合在今天舉行的第8屆股東常年大會通過所有議程,包括派出2仙的終期股息。

Greenyield sees good returns from rubber planting

LATEX stimulants maker Greenyield Bhd said its upstream venture to manage rubber estates is set to contribute to future earnings as it plants some 400 hectares in Kelantan by April 2011.

"Rather than giving advisory to plantation operators, we believe we can do it for ourselves. Rubber plantations will be our growth focus for the next few years," said Greenyield group managing director Don Tham Foo Keong.

A year ago, Greenyield struck a partnership with funeral services provider NV Multi Bhd to lease 400ha of state land from the Kelantan state government.

They formed a 30:70 joint venture company, namely Melati Aman Sdn Bhd, to lease state land for 50 years to 2059 to plant latex timber clone, a high-yielding variant in Kuala Krai.

Excluding land cost, the joint venture vehicle has set aside RM1 million for the new plantings. Tham views this a worthwhile investment for Greenyield. He said that at current Standard Malaysian Rubber (SMR) 20 price of RM14 per kg, the group can see returns in a decade.

The group is also eyeing neighbouring countries.

"We are looking at Cambodia and Indonesia. We have to look at several factors like stable government, availability of workforce, acceptable inflationary index and suitable and affordable lands," he told reporters after the company's shareholders meeting in Bangi yesterday.

Tham said Greenyield should post good results in the current year ending July 2011 if SMR 20 remains stable at above RM8 per kg. Currently SMR 20 is trading at an all time high of more than RM14 per kg.

Tham, however, warned of the risk of the weakening US dollar and euro impacting Greenyield's bottom line as its exports are in these foreign currencies.

Read more: Greenyield sees good returns from rubber planting http://www.btimes.com.my/articles/gyee/Article/#ixzz18wuvXk6v |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 23-12-2010 11:55 PM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION | 31/10/2010 |

| INDIVIDUAL PERIOD | CUMULATIVE PERIOD | | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | | 31/10/2010 | 31/10/2009 | 31/10/2010 | 31/10/2009 | | $$'000 | $$'000 | $$'000 | $$'000 | | 1 | Revenue | 8,024 | 4,418 | 8,024 | 4,418 | | 2 | Profit/(loss) before tax | 1,115 | 446 | 1,115 | 446 | | 3 | Profit/(loss) for the period | 786 | 309 | 786 | 309 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 786 | 309 | 786 | 309 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.48 | 0.19 | 0.48 | 0.19 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

|

|

|

|

|

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.2597 | 0.2549 |

Definition of Subunit:In a currency system, there is usually a main unit (base) and subunit that is a fraction amount of the main unit.

Example for the subunit as follows:

| Country | Base Unit | Subunit | | Malaysia | Ringgit | Sen | | United States | Dollar | Cent | | United Kingdom | Pound | Pence |

|

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 31-12-2010 12:30 AM

|

显示全部楼层

如今再次重返5年新高了。

|

|

|

|

|

|

|

|

|

|

|

|

发表于 31-12-2010 01:56 PM

|

显示全部楼层

发表于 31-12-2010 01:56 PM

|

显示全部楼层

|

yatlokfatt 你·的目表价多少?可以上到RM0.45五年新高吗? |

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|