|

|

【KEINHIN 7199 交流专区】建兴国际

[复制链接]

[复制链接]

|

|

|

楼主 |

发表于 28-3-2011 01:55 PM

|

显示全部楼层

建兴国际净利增16%

2011/03/26 10:38:55 AM

●南洋商报

(吉隆坡25日讯)截至2011财年1月31日,建兴国际(KeinHin,7199,主板工业产品股)第三季净利增长16.9%至155万6000令吉,上财年净利则录得133万令吉。

营业额方面,第三季营业额报4131万6000令吉,上财年则为3759万3000令吉,年增9.9%。 |

|

|

|

|

|

|

|

|

|

|

|

发表于 28-3-2011 08:35 PM

|

显示全部楼层

发表于 28-3-2011 08:35 PM

|

显示全部楼层

回复 21# yatlokfatt

這公司的量非常地少。。看来很难从股价上赚到钱。。 |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 28-3-2011 11:58 PM

|

显示全部楼层

回复 yatlokfatt

這公司的量非常地少。。看来很难从股价上赚到钱。。

azera 发表于 28-3-2011 08:35 PM

我只认同一半你的说法,因为有些股少一点儿耐性,总是看不到成果的。

我始终相信"价值决定在于公司的收益表现,短期可能跟股市市场脱节。但长期来说,股价谅必反映其价值"。 |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 2-4-2011 01:14 AM

|

显示全部楼层

本帖最后由 yatlokfatt 于 2-4-2011 01:16 AM 编辑

Kein Hing International Bhd Reports Unaudited Consolidated Earnings Results for the Third Quarter and Nine Months Ended January 31, 2011

03/25/2011

Kein Hing International Bhd reported unaudited consolidated earnings results for the third quarter and nine months ended January 31, 2011. For the quarter, the company reported profit attributable to owners of the company of MYR 1.6 million or 1.57 sen per basic and diluted share on revenue of MYR 41.3 million compared to profit attributable to owners of the company of MYR 1.3 million or 1.34 sen per basic and diluted share on revenue of MYR 37.6 million for the same period of last year.

Operating profit was MYR 2.4 million compared to MYR 2 million for the same period of last year. Profit before tax was MYR 2.1 million compared to MYR 1.7 million for the same period of last year. The increase in revenue was mainly attributed to stronger customer demand in both Malaysia and Vietnam. The decrease in PBT was mainly due to initial costs incurred for new production lines. For the nine months, the company reported profit attributable to owners of the company of MYR 6.7 million or 6.78 sen per basic and diluted share on revenue of MYR 122.8 million compared to profit attributable to owners of the company of MYR 5.4 million or 5.41 sen per basic and diluted share on revenue of MYR 105.6 million for the same period of last year.

Operating profit was MYR 9.3 million compared to MYR 7.6 million for the same period of last year. Profit before tax was MYR 8.5 million compared to MYR 6.6 million for the same period of last year. Net cash generated from operating activities was MYR 15.4 million compared to MYR 16.4 million for the same period of last year. Purchase of property, plant and equipment was MYR 5.1 million compared to MYR 3.5 million for the same period of last year.

|

|

|

|

|

|

|

|

|

|

|

|

发表于 6-4-2011 11:59 PM

|

显示全部楼层

发表于 6-4-2011 11:59 PM

|

显示全部楼层

即使再多好,基金经理很少会去注意这样小的公司。

不知道是否值得去投资它? |

|

|

|

|

|

|

|

|

|

|

|

发表于 7-4-2011 09:09 AM

|

显示全部楼层

发表于 7-4-2011 09:09 AM

|

显示全部楼层

|

不错的公司,但是如果没有什么购兴,很难在短时间内赚钱。除非有什么炒作新闻。 |

|

|

|

|

|

|

|

|

|

|

|

发表于 9-4-2011 10:59 AM

|

显示全部楼层

发表于 9-4-2011 10:59 AM

|

显示全部楼层

回复 21# yatlokfatt

谢谢分享,KEINHIN是不错的公司。过去几年的折旧很高。。。。

接下几年还要投入很多资本吗? |

|

|

|

|

|

|

|

|

|

|

|

发表于 9-4-2011 11:18 AM

|

显示全部楼层

发表于 9-4-2011 11:18 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 10-4-2011 02:50 PM

|

显示全部楼层

发表于 10-4-2011 02:50 PM

|

显示全部楼层

本帖最后由 jiji88 于 10-4-2011 04:02 PM 编辑

回复 clc689

公司没有详细注明。

不过ZENNE产品在2007年八月开始介入公司后,公司的总营业额从2007财政年的122.3M增加至去年2010年的144.3M。

yatlokfatt 发表于 3-1-2011 11:28 PM

过去的旧新闻有提到~

KUALA LUMPUR: Metal parts manufacturer KeinHing International Bhd has invested RM6mil in its second factory in Vietnam, which should be ready by June 2009.

“We hope to achieve about RM5mil sales monthly from the new factory,”managing director Yap Toon Choy said after the company AGM yesterday.

Construction work would start in June next year, he said.

“The new factory will focus on metal stamping and machining to manufacturing for original equipment manufacturing companies,” he added.

“We believe the two factories in Vietnam will keep us busy for the next 10 to 15 years,” he said, adding that the group,which has five factories in Malaysia,had no plans yet to penetrate new markets.

The group, which also produces “Zenne” gas cookers, has allocated RM20mil to boost production and promotion of this product in the local market, Vietnam and Hong Kong.The gas cookers are also exported to Pakistan.“We hope to achieve about 10% share of the gas cooker market in South-East Asia,” Yap said. The group expected its gas cookers to contribute 20%-30% to group revenue within two years, he said.

For the financial year ended April 30, 2007 (FY07), Kien Hing recorded after-tax profit of RM5.08mil on revenue of RM122.17mil. For the first quarter ended July 31, it had net profit of RM1.49mil on revenue of RM32.3mil.

http://biz.thestar.com.my/news/story.asp?file=/2007/10/10/business/20071010184834&sec=business |

|

|

|

|

|

|

|

|

|

|

|

发表于 10-4-2011 03:44 PM

|

显示全部楼层

发表于 10-4-2011 03:44 PM

|

显示全部楼层

本帖最后由 jiji88 于 10-4-2011 05:44 PM 编辑

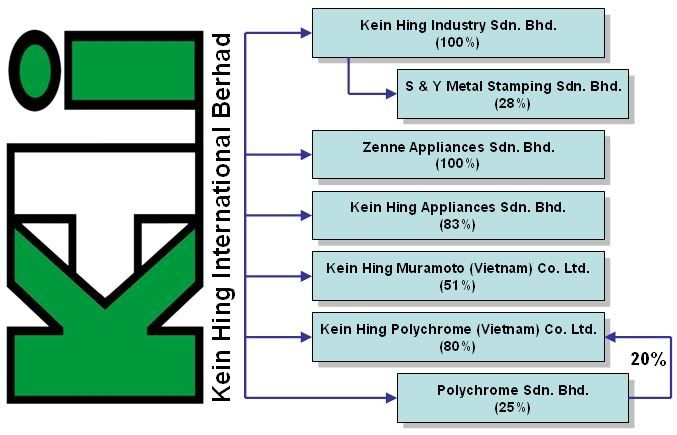

目前它拥有生产自己品牌"ZENNE"的煤气炉。"ZENNE"获得来自本地和海外市场的热烈的销售反应。值得注意的是"ZENNE"也取得了公认的日本气体装置检测协会(JIA)的标准,产品成功地渗透到香港,新加坡、越南以及巴基斯坦市场。

yatlokfatt 发表于 8-1-2011 12:41 AM

以下是我从年报中营业额找出来的数据~

| 2007 | 2008 | 2009 | 2010 | | Geographical Segments | RM,000 | RM,000 | RM,000 | RM,000 | | Malaysia | 93921 | 105633 | 105479 | 102424 | | Vietnam | 12636 | 24126 | 29995 | 29564 | | Singapore | 7813 | 8035 | 8579 | 5963 | | Thailand | 2262 | 1482 | 1827 | 2048 | | Europe | 3985 | 4313 | 3676 | 4331 | | Hong Kong | Nil | Nil | 2923 | 3131 | | Other | 2010 | 1427 | 1787 | 959 |

看来"ZENNE"的煤气炉成功地渗透到外国,煤气炉已成为下一个成长动力。

http://www.zenne.com.my/ |

|

|

|

|

|

|

|

|

|

|

|

发表于 25-4-2011 11:26 PM

|

显示全部楼层

发表于 25-4-2011 11:26 PM

|

显示全部楼层

本帖最后由 jiji88 于 25-4-2011 11:38 PM 编辑

Changes in Substantial Shareholder's Interest Pursuant to Form 29B of the Companies Act. 1965

Reference No CC-110425-39248

Company Name

:

KEIN HING INTERNATIONAL BERHAD

Stock Name

:

KEINHIN

Date Announced

:

25/04/2011

Name

:

Yap Toon Choy

Address

:

No. 300-10-20, Block B

OBD Garden Tower Condominium

Jalan Desa Utama

Taman Desa

Off Jalan Kelang Lama

58100 Kuala Lumpur

NRIC/Passport No/Company No.

:

560626-10-6241

Nationality/Country of incorporation

:

Malaysian

Descriptions

(Class & nominal value)

:

Ordinary Shares of RM0.50 each

Name & address

of registered

holder

:

Yap Toon Choy

No. 300-10-20, Block B

OBD Garden Tower Condominium

Jalan Desa Utama

Taman Desa

Off Jalan Kelang Lama

58100 Kuala Lumpur

Yong Elaine

No. 300-10-20, Block B

OBD Garden Tower Condominium

Jalan Desa Utama

Taman Desa

Off Jalan Kelang Lama

58100 Kuala Lumpur

Details of changes

Currency

:

Malaysian Ringgit (MYR)

Type of transaction

Date of change

No of securities

Price Transacted ($$)

Acquired

20/04/2011

867,200

Circumstances

by reason of which change has occurred

:

Acquisition of shares via open market deal

Nature of

interest

:

Direct

Direct (units)

:

36,574,520

Direct (%)

:

36.94

Indirect/deemed interest (units)

:

20,870,070

Indirect/deemed interest (%)

:

21.08

Total no of securities after change

:

57,444,590

Date of notice

:

25/04/2011

大股东趁行情静,买回公司股票。 |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 28-4-2011 11:48 PM

|

显示全部楼层

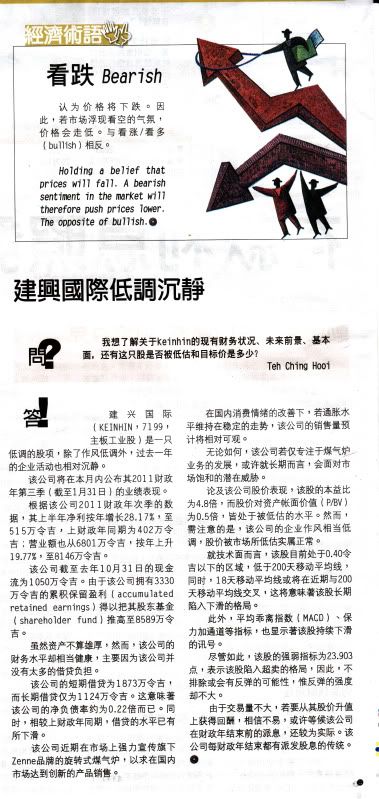

一封询问专家有关于KEINHIN的问题,出现在资汇(THE BUSY WEEKLY)第115期。

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 14-6-2011 03:22 PM

|

显示全部楼层

期待它的2011财政年全年财报,这个月即将出炉。

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 24-6-2011 11:50 PM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 25-6-2011 11:39 PM

|

显示全部楼层

Review of performance For the quarter and financial year ended 30 April 2011 - unaudited

The Group registered revenue of RM41.6 million and RM164.4 million for the current 4th Quarter and financial year as compared to RM38.8 million and RM144.2 million reported in the corresponding quarter and last financial year, representing an increase of RM2.8 million or 7% and RM20.2 million or 14% respectively. The increase was mainly attributed to stronger customer demand in both Malaysia and Vietnam.

In tandem with the increase in revenue and as a result of the gain before tax arising from the assignment of land use rights amounting to approximately RM1.4 million (as further detailed in Note A4 above), the Group achieved profit before tax (“PBT”) of RM3.5 million and RM12.0 million for the current 4th Quarter and financial year, representing an increase of RM1.4 million or 65% and RM3.3 million or 38% as compared to PBT of RM2.1 million and RM8.7 million reported last year respectively.

Variation of results against preceding quarter

The Group registered PBT of RM3.5 million for the current 4th quarter compared to PBT of RM2.1 million reported in the immediate preceding quarter, representing an increase of RM1.4 million or 67%. The increase in PBT was mainly attributed to the gain before tax arising from the assignment of land use rights.

Prospects

The Japan earthquake and Tsunami in March 2011 had to certain extent affected some of our major customers, and as a chain effect reducing demand to the Group. Nevertheless, the Board expects the disruption to the supply chain should not be prolonged and the recovery will gather pace in the 2nd half of the year 2011. Against the above backdrop and barring any unforeseen circumstances, the Board is cautiously optimistic that the Group will achieve a satisfactory performance for the next financial year ending 30 April 2012.

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 28-6-2011 11:38 PM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 29-6-2011 12:53 PM

|

显示全部楼层

大股东一直地在增持公司的股份。

Kein Hing International Berhad Announces Ownership Interest Of Yap Toon Choy

Monday, 25 Apr 2011

Kein Hing International Berhad announced that Yap Toon Choy has an interest of 36,574,520 units, representing 36.9400% of the total shares in the Company. Previously, Yap Toon Choy had 33.1900% interest in the Company.

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 3-7-2011 12:45 AM

|

显示全部楼层

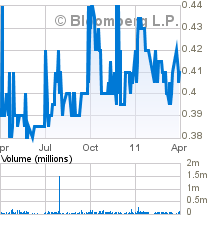

上星期五突然拖高至47.5sen后又跌回,真可惜

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 28-9-2011 11:15 PM

|

显示全部楼层

|

For the first quarter and financial period ended 31 July 2011 - unaudited

B1. Review of performance

The Group registered revenue of RM46.2 million for the current 1st Quarter as compared to RM40.2 million reported in the corresponding quarter last year, representing an increase of RM6.0 million or 15%. The increase was mainly attributed to stronger customer demand in both Malaysia and Vietnam.

In tandem with the increase in revenue, the Group achieved higher profit before tax (“PBT”) of RM4.8 million for the current 1st Quarter, an increase of RM1.7 million or 54% as compared to PBT of RM3.1 million recorded in the corresponding quarter last year.

B2. Variation of results against preceding quarter

The Group registered PBT of RM4.8 million for the current 1st quarter as compared to PBT of RM3.5 million reported in the immediate preceding quarter, representing an increase of RM1.3 million or 37%. The increase in PBT was mainly attributed to the increase in revenue.

B3. Prospects

The Group continues to experience improving customers’ demand in the regions where it operates in. Against this backdrop and barring any unforeseen circumstances, the Board is cautiously optimistic that the Group will achieve a satisfactory performance for the current financial year ending 30 April 2012. |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 28-9-2011 11:28 PM

|

显示全部楼层

2012年度首季度报表非常标青!

首三个月每股收益(EPS)高达3.46sen,NTA=89sen,但股票价格才38.5sen。是否觉得有点离普??? |

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|