|

|

【IFCAMSC 0023 交流专区】 IFCA多媒体

[复制链接]

[复制链接]

|

|

|

发表于 27-8-2014 01:38 AM

|

显示全部楼层

发表于 27-8-2014 01:38 AM

|

显示全部楼层

竞优国际无法解释股票大热原因

财经 2014年8月26日

(吉隆坡26日讯)针对竞优国际集团(IFCAMSC,0023,创业板)交投异常炙热,大马交易所周一向该公司发出了不寻常交易活动(UMA)询问;惟,竞优国际集团在週二答覆交易所的文告中指出,对股票交投异常大热的原因並不知情。

竞优国际集团股价从7月开始节节攀升,该股在昨天午盘大涨,全天起8.5仙或32.075%,至0.35令吉,而成交量高达1亿3887万7200股,为週一第3大热门股。

由於成交量在近日异常大热,大马交易所昨天向竞优国际集团发出UMA。

然而,竞优国际集团在週二才向交易所做出答覆。

该公司在文告中表示,对成交量异常大起的原因,並不知情。

该公司董事局和大股东通过文告指出,该公司並没有还未公布的企业发展活动,而导致股票的成交量大起;与此同时,他们也对导致股票交投大热的任何传言或报导不知情。

另外,今天闭市时,该股以35仙平盘掛收,成交量达4170万2300股,显著低於昨天的1亿3887万股。【东方网财经】

Type | Reply to query | Reply to Bursa Malaysia's Query Letter - Reference ID | YL-140825-61297 | Subject | Unusual Market Activity | Description | IFCA MSC BERHAD (“IFCA” or “THE COMPANY”)

- Reply to Query |

|

| Reference is made to the letter from Bursa Malaysia Securities Berhad (“Bursa Securities”) dated 25 August 2014 querying the Company on the recent rise in the price and volume of the Company’s shares (“Trading Activity”)

The Board of Directors (“Board”) of IFCA wishes to inform that to the best of their knowledge and after making due enquiry with the directors and major shareholders of the Company, IFCA is:

This announcement is dated 26 August 2014 |

本帖最后由 icy97 于 27-8-2014 03:59 AM 编辑

|

|

|

|

|

|

|

|

|

|

|

|

发表于 29-8-2014 05:44 AM

|

显示全部楼层

发表于 29-8-2014 05:44 AM

|

显示全部楼层

Notice of Interest Sub. S-hldr (29A)

Particulars of Substantial Securities HolderName | BRAHMAL VASUDEVAN | Address | Lot 8.02B, 8th Floor, Menara BRDB,

No. 285, Jalan Ma'arof, Bukit Bandar Raya,

59000 Kuala Lumpur. | NRIC/Passport No/Company No. | 681016-10-5461 | Nationality/Country of incorporation | Malaysian | Descriptions (Class & nominal value) | Ordinary Shares of RM0.10 each in IFCA MSC Berhad ("IFCA Shares") | Name & address of registered holder | 1. BRAHMAL VASUDEVAN - 1,000,000 IFCA Shares

Lot 8.02B, 8th Floor, Menara BRDB,

No. 285, Jalan Ma'arof, Bukit Bandar Raya,

59000 Kuala Lumpur.

2. CIMSEC NOMINEES (TEMPATAN) SDN. BHD.

CIMB Bank for BRAHMAL VASUDEVAN - 9,000,000 IFCA Shares

Level 13, Menara CIMB,

Jalan Stesen Sentral 2,

Kuala Lumpur Sentral,

50470 Kuala Lumpur.

3. PACIFIC STRAITS HOLDINGS LTD. - 15,000,000 IFCA Shares

Vanterpol Plaza, 2nd Floor Wickhams Cay 1,

Road Town, Tortola,

British Virgin Islands

(Indirect interest by virtue of his interest in Pacific Straits Holdings Ltd. pursuant to section 6A of the Companies Act, 1965) |

| Date interest acquired & no of securities acquired | Currency | Malaysian Ringgit (MYR) | Date interest acquired | 26/08/2014 | No of securities | 25,000,000 | Circumstances by reason of which Securities Holder has interest | Acquisition of shares | Nature of interest | Direct/ Indirect | Price Transacted ($$) |

|  | | Total no of securities after change | Direct (units) | 10,000,000 | Direct (%) | 2.22 | Indirect/deemed interest (units) | 15,000,000 | Indirect/deemed interest (%) | 3.33 | Date of notice | 27/08/2014 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 30-8-2014 03:15 AM

|

显示全部楼层

发表于 30-8-2014 03:15 AM

|

显示全部楼层

布拉马晋竞优国际大股东 激励股价创8年高点

财经新闻 财经 2014-08-29 09:35

(吉隆坡28日讯)著名私募基金经理布拉马瓦苏德万(Brahmal Vasudevan),购入竞优国际(IFCAMSC,0023,自动报价股)5.55%股权,激励股价再度走高。

根据马交所股权记录显示,布拉马瓦苏德万是在8月26日购入竞优国际2500万股,或相等于5.55%股权,晋升成为大股东。

布拉马瓦苏德万是私募基金公司Creador的创办人和总执行长,该公司近期也入股SMRT控股(SMRT,0117,创业板)成大股东,并持有MYEG服务(MYEG,0138,主板贸服股)2.2%股权。

竞优国际今日以42仙开始交易,随即冲上45仙全日最高水平,再创8年新高,为全日第6大热门股。

该股最终以44.5仙结束交易,全日扬升5.5仙或14%。

曾接UMA质询

至于凭单IFCAWA(IFCAMSC-WA,0023,凭单)也追随母股涨势,全日上扬6仙或20%,报35.5仙,为全日第7大热门股竞优国际在之前游走在10仙以下水平,但在最近两个月来开始呈现上扬趋势,在周一(25日)创8年新高水平后,仍节节攀升。

马交所亦在同日对该股发出不寻常市场交易(UMA)质询。

该公司在8月26日回应中表示,除了在8月19日公布的第二季业绩外,对于造成股价波动的原因并不知情,并强调本身符合大马交易所创业板条例,而布拉马瓦苏德万则在当日购入公司股权。【南洋网财经】

受惠消費稅.中國業務強 競優國際續交投熾熱

企業財經28 Aug 2014 21:29

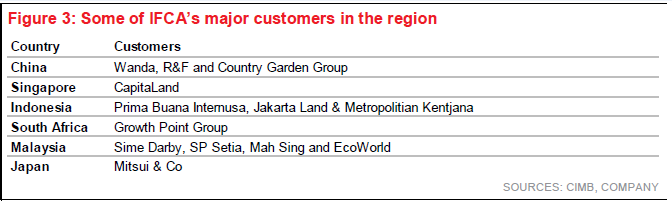

(吉隆坡28日訊)作為國內房產業主要消費稅軟件供應商,競優國際(IFCAMSC,0023,創業板科技)及憑單繼日前大熱遭馬證交所質詢后,今日再度大熱上揚,聯昌證券研究分析師指中國萬達集團為首的中國業務是強勁推動力,未給予評級但相信股項估值達53仙。

競優國際今早甫開市,即以熱烈交投躍居十大熱門股榜,股價揚3仙至42仙,隨后穩步上揚,休市時起5.5仙,掛44.5仙,半日成交量高達4978萬5900股。

該股旗下憑單競優國際-WA(IFCAMSC-WA,0023WA,創業板科技)亦交投熾熱,與母股同列早盤最熱門股項之列,在開市后5分鐘內就衝破千萬股交易,休市時報35仙,揚5.5仙,半日交易5238萬5200股。

中國市場大

閉市時,競優國際揚5.5仙報44.5仙,成交量6604萬8100股;競優國際-WA漲6仙收在35.5仙,全日交易6466萬7100股。

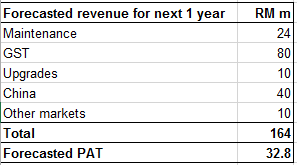

聯昌證券研究指出,國內企業將在未來2年陸續安裝和提升消費稅系統,截至6月底,競優國際已取得高達4210萬令吉銷量合約,比去年同期的3890萬令吉多出8%。

值得一提的是,在我國擁有超過1000個客戶的競優國際,當中只有10%客戶已提升系統,意味著在未來幾個季度,陸續都有機會服務客戶。

該行指出,競優國際也是中國市場主要業者,上半年銷量和營業額不斷走高,相信在2至3年內,中國銷量能超越我國;因中國有超過4萬家房產業者,比較大馬約1000家。

“我們相信競優國際能在今年取得介于800萬至900萬令吉淨利,料在2015年取得1500萬令吉淨利。如果能達標,就有機會在2016年轉到馬股主要板交易。”【中国报财经】 本帖最后由 icy97 于 30-8-2014 05:15 AM 编辑

|

|

|

|

|

|

|

|

|

|

|

|

发表于 30-8-2014 09:02 AM

|

显示全部楼层

发表于 30-8-2014 09:02 AM

|

显示全部楼层

IFCA gets noticed

Published: Saturday August 30, 2014

Software vendor IFCA MSC Bhd’s founder Ken Yong Keang Cheun has never been this busy nor has his stock been this hot.

Yong’s been having meeting after meeting with institutional funds, analysts, investors and the media in recent weeks.

IFCA’s shares, meanwhile, are up a whopping 77% to 49.5 sen from a month ago compared with the benchmark index which is down as investors load up in anticipation of possible better days ahead for the company.

The smallish firm has even caught the attention of savvy investor Brahmal Vasudevan, who had in the past generated a handsome return for his bet on another IT stock, MYEG Services Bhd.

On Tuesday, Brahmal surfaced as a substantial shareholder in IFCA with a 5.55% stake.

Yong, who together with his brother controls over 40% of the company, is optimistic that Brahmal will increase further his stake in the firm.

“I think you will also see some institutional funds on our shareholder list soon,” he says.

Up until now, IFCA, established in the late 1980s has never really been a firm favourite with any investor probably because of a number of reasons.

For some time, the company was bleeding losses on several major write-offs after making some heavy investments and only just returned to the black two years ago, albeit making small profits.

Additionally, the perception of being just another IT firm to jump into the hot IT scene more than a decade ago has seen its share price depressed for most parts of its listed life.

“But what we have now is a stronger IFCA which is a good position for growth, ” Yong says.

It appears IFCA, which makes comprehensive software for property companies does have a couple of fundamental factors going for it at the moment, providing some justification of sorts for the optimism that is surrounding it.

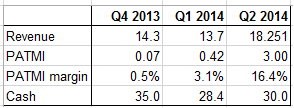

It recently announced that net profit for its latest quarter came in at RM3mil, higher than the RM578,000 for the same period a year earlier.

IFCA has also grown its market share to 70% here in Malaysia and has a growing Chinese business, which currently makes up about 30% of the group’s sales and envisaged to grow further.

Its breakthrough in the Chinese market came about 4 years ago when IFCA managed to strike up a deal with China’s Wanda Group, Asia’s largest commercial real estate developer, Yong says.

“China wasn’t easy for us, we were there for years and years before coming into anything at all.”

Its efforts seem to have paid off with China sales for the first half of this year reaching RM21mil, which is higher than the RM16mil recorded in the whole of the last financial year. “We remain very small in China but hope to grow big, there are over 40,000 property firms in China as opposed to about 1,000 here.”

The impending implementation of the goods and services tax (GST) next April which will require IFCA’s huge local client-base to upgrade their software to meet with new requirements is another major catalyst for growth.

Notably, it counts most of the big boys in the property industry as its clients including SP Setia Bhd, Mah Sing Group Bhd, Berjaya Land Bhd and Sunway City group.

Two analysts who earlier this week released reports on the company have seemingly bought into the prospects of IFCA, believing that it is poised to deliver, at least for the next couple of years.

Maybank Research analyst Wong Wei Sum, whose note to clients came out two days before CIMB Research analyst Nigel Foo’s note, is expecting IFCA’s earnings to leap by over 400% in the current financial year ending Dec 31 (FY14) to RM8.8mil from RM1.7mil in FY 13 and further grow by 50% to RM13.1mil in FY15 on strong contract sales and improving margins.

Meanwhile, Foo is also predicting that IFCA will record RM8mil-RM9mil in FY14 and RM15mil in the following year, boosted by the China and GST factors.

Yong says IFCA has managed to grow its net profit margin to about 17%.

“We hope to increase this as revenue grows and costs are controlled.”

He has other goals, including to grow the company’s market capitalisation to “a few hundred million ringgit” from the current RM222.8mil and get the ACE market company onto the Main Market, as more investors get acquainted with the firm.

With a net cash position of RM30mil and minimal borrowings, Yong says the company is also in a good position to swallow up any of the smaller boys in the industry as well as to reward shareholders.

“But our focus remains to build a solid base from here.

“When we are on the radar, we must make sure we deliver and do not disappoint.”

Yong sold off some 17 million IFCA warrants this week in tandem with the uptrend in the price of the mother share.

He says that he did so to “settle his personal loans and “buy more mother shares.”

IFCA has three research and development centres where its IT software is formulated, two of which are in China and one in Malaysia. It also operates more than 20 sales and service centres locally and in China, with plans to increase the number of these in the near-term as more business flows in.

本帖最后由 icy97 于 30-8-2014 02:23 PM 编辑

|

|

|

|

|

|

|

|

|

|

|

|

发表于 30-8-2014 12:18 PM

|

显示全部楼层

发表于 30-8-2014 12:18 PM

|

显示全部楼层

50 cent   |

|

|

|

|

|

|

|

|

|

|

|

发表于 10-9-2014 03:16 AM

|

显示全部楼层

发表于 10-9-2014 03:16 AM

|

显示全部楼层

Notice of Person Ceasing (29C)

Particulars of substantial Securities HolderName | BRAHMAL VASUDEVAN | Address | Lot 8.02B, 8th Floor, Menara BRDB,

No. 285, Jalan Ma'arof, Bukit Bandar Raya,

59000 Kuala Lumpur | NRIC/Passport No/Company No. | 681016-10-5461 | Nationality/Country of incorporation | Malaysian | Descriptions (Class & nominal value) | Ordinary Shares of RM0.10 each in IFCA MSC Berhad | Date of cessation | 02/09/2014 | Name & address of registered holder | 1. PACIFIC STRAITS HOLDINGS LTD

Vanterpol Plaza, 2nd Floor Wickhams Cay 1,

Road town, Tortola,

British Virgin Islands,

(Indirect interest by virtue of his interest in Pacific Straits Holdings Ltd. pursuant to section 6A of the Companies Act, 1965) | Currency | Malaysian Ringgit (MYR) | Number of securities disposed | 11,250,000 | Price Transacted ($$) |

| | Circumstances by reason of which a person ceases to be a substantial securities Holder | Disposal of shares | Nature of interest | Direct/Indirect | Date of notice | 08/09/2014 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 13-9-2014 02:56 AM

|

显示全部楼层

发表于 13-9-2014 02:56 AM

|

显示全部楼层

股价最近飙升77% IFCA成市场焦点

二零一四年九月十二日 晚上七时三十七分

(吉隆坡12日讯)软件供应商----IFCAMSC有限公司(IFCA,0023,创业板)创办人杨建泉(译音)从来没有这么忙也没有他的股票这么热。

杨氏在过去数周以来,先后会晤了机构基金、分析师、投资者与媒体。

另一方面,与下跌的基准指数比较,IFCA的股价在过去1个月以来已锐涨至39.5仙,因投资者预期该公司今后的日子会更好。

小公司甚至引起了精明的投资者布拉玛尔的注意,他在过去押注另一个股票MYEG服务有限公司(MYEG,0138,贸易服务组),并带来了丰厚的回报。

随着在IFCA持股权增至5.55%后,布拉玛尔已崛起成为该公司的一名大股东。

杨氏与其兄弟控制了该公司的40%股权,并乐观地认为布拉玛尔将进一步增加其在该公司的股份。

他称:“我想,你也会看到一些机构资金会很快在我们的股东名单内。”

截至目前为止,IFCA这个于80年代杪创立的公司,由于一些因素使到它从未真正获得任何投资者的垂青。

有一段时间,该公司在作出一些重大投资后,而在多项重大注销下蒙受亏损,在过去两年内才止亏,可是赚幅不多。

此外,另人感觉到它由一间乏人问津的科技资讯公司跃升到炙手可热的科技资讯公司,但该公司股价在逾10年来一直在上市日子中疲弱不堪。

杨氏称:“但我们现在是一个强大的公司并拥有一个成长的良机。”

该公司最近宣布其最新季度的净利达300万令吉,并较一年前的57万8000令吉出色。

IFCA在大马的市场占有额增至70%,而在中国业务有所增加,目前中国业务为公司带来约30%的销售额额,并预期会有进一步增长。

杨氏称,公司与亚洲最大商业地产开发商中国万达集团于4年前达致协议后,才在中国市场有所突破。

它的努力似乎得到了回报,而今年在中国销售达到2100万令吉,较上个财政年度的销售额更高。“我们在中国仍然非常小,但希望我们能日益壮大,在中国有超过4万个房地产公司,而不是1000间。”【光华日报财经】 |

|

|

|

|

|

|

|

|

|

|

|

发表于 20-9-2014 02:18 PM

|

显示全部楼层

发表于 20-9-2014 02:18 PM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 20-9-2014 02:39 PM

|

显示全部楼层

发表于 20-9-2014 02:39 PM

|

显示全部楼层

CEO : 46.355 % = 208,604,688 shares

BRAHMAL : 3 % = 13,750,000 shares

OOI BEE BEE : 1.11 % = 4,998,648 shares

DP CAPITAL LIMITED : 5.53% = 24,881,200 shares

Total holding for above shareholders are 252,234,536 shares = 56.0455% of total shares issued

In market only left 200 mil shares only |

|

|

|

|

|

|

|

|

|

|

|

发表于 20-9-2014 11:04 PM

|

显示全部楼层

发表于 20-9-2014 11:04 PM

|

显示全部楼层

我住它的套房很久了。 |

|

|

|

|

|

|

|

|

|

|

|

发表于 5-10-2014 08:37 PM

|

显示全部楼层

发表于 5-10-2014 08:37 PM

|

显示全部楼层

IFCA將續攀高?

2014-10-05 19:23

民都魯讀者陳先生問:

IFCA多媒體(IFCAMSC,0023,創業板科技組)最近都進入二十大熱門股,從8仙起到52仙(最高),有能力再一次上升嗎?可以分析一下該公司的業績和前景如何?該公司跟消費稅(GST)有何關係?

答:

先看該公司最新業績及前景;截至2014年6月30日為止第二季,該公司淨利為300萬2千令吉(每股淨利0.67仙),前期為57萬8千令吉(每股淨利為0.13仙)。次季營業額為1千825萬2千令吉,前期為1千292萬8千令吉。

首6個月的淨利為342萬3千令吉(每股淨利為0.76仙)、前期淨利僅為7萬1千令吉(每股淨利為0.02仙)。首半年的營業額為3千194萬2千令吉,前期為2千271萬1千令吉。

該公司最新季度及首半年的業績表現良好,主要是在軟件銷售取得更高的入賬,特別是中國市場業務,以及在軟件提昇業務也取得更高入賬,主要是即將在2015年4月推出消費稅的推動。

該公司表示,將繼續擴大業務,設立新業務單位及加強行銷活動力度,放眼未來取得更大市場占有率。

談到公司今年未來兩個季度的業務前景時,該公司認為將保持強勁。旗下全部業務動力持續蓬勃,特別是2014年大馬消費稅法令已在今年6月公報,大馬商家將在2015年4月開始推行消費稅時做好準備,該公司預期現有客戶及潛在新客戶,將需要提昇它們的系統以應付消費稅報告需要。

海外業務需求也保持強勁

該公司現財政年度的海外業務需求也保持強勁,銷售訂單取得顯著增長。

馬銀行研究在今年8月杪的報告中指出,該公司將從消費稅活動中受惠,預料盈利將會顯著走高,使該行將該公司的合理價提昇至42仙,或等於2015年財政年預測本益比14.5倍。

IFCA多媒體是家軟件方案公司,特別是專業在產業領域,幾乎壟斷的商業模式,使它占大馬產業軟件領域的70%市場分額,預料它將從政府實施消費稅前後受惠。

馬銀行研究認為,該公司將是大馬產業領域應付消費稅行動的最大贏家。今年首半年單是大馬業務已取得4千210萬令吉的銷售合約(比較去年為3千890萬令吉),以提昇產業發展商公司的資訊工藝系統。由於目前僅有10%現有客戶已經/正在提昇/準備它們的消費稅軟件,這可預期它仍擁有龐大的潛在商機。

料回饋股東

派發股息或免費憑單

馬銀行研究指出,該公司過去10年積極在中國業務的耕耘已開始有成果,預期它的銷售額/盈利將取得強勁的雙位數成長,在2016至2017年甚至可能超越大馬業務的主要盈利催化因素。預料它將準備回饋股東派發股息或免費憑單,及計劃轉板至主板交易。

當時,馬銀行研究認為,預料該公司2014年財政年全年淨利將增長406%至880萬令吉,2015年則增長50%至1千310萬令吉,主要是強勁的合約銷售、及淨賺幅改善所推動。截至2014年6月,該公司資產負債表良好,擁有淨現金3千萬令吉或每股6.7仙。

另一方面,根據該公司最新業績顯示,截至2014年6月30日為止,該公司的累積虧損為445萬1千令吉,比較去年同期的953萬1千令吉低得多。

至於該公司股價會不會再一次揚升,這裡難以說得准,而上述一點資料供參考。(星洲日報/投資致富‧投資問診‧文:李文龍) |

|

|

|

|

|

|

|

|

|

|

|

发表于 14-10-2014 03:13 AM

|

显示全部楼层

发表于 14-10-2014 03:13 AM

|

显示全部楼层

券商買進心頭好.競優國際 盈利成長料翻2倍

財經股市13 Oct 2014 22:26

券商 :聯昌證券研究

目標價:78仙

本地和中國銷量及賺幅料上漲,將激勵競優國際(IFCAMSC,0023,創業板科技)未來幾年收益成長,3年盈利年複成長率料高達2.28倍,給予“增持”評級。

競優國際核心業務是為房產商、高爾夫球俱樂部、酒店和建築業者提供企業軟件解決方案。

隨著消費稅將于明年4月1日開征,商家對消費稅軟件升級和培訓課程需求不斷增加,我們預計競優國際能從中獲得介于6000萬至7000萬令吉銷量。

競優國際主要客戶包括森那美(SIME,4197,主要板貿服)、實達集團(SPSETIA,8664,主要板房產)、綠盛世(ECOWLD,8206,主要板房產),以及馬星集團(MAHSING,8583,主要板房產)。

消費稅過后,獲得把軟件從Windows遷移到網絡或移動平台合約,將是支撐競優國際業務的重點。

競優國際同時探討要擴大海外業務,目標市場包括日本、泰國和西亞。

我們認為,競優國際的潛在股價催化劑是,獲得比預期高的消費稅相關合約、可能會驚喜派息、並于2016年從創業板轉移到主要板。

競優國際週一(13日)閉市平盤報48.5仙,成交量1879萬600股。【中国报财经】 |

|

|

|

|

|

|

|

|

|

|

|

发表于 15-10-2014 04:41 AM

|

显示全部楼层

发表于 15-10-2014 04:41 AM

|

显示全部楼层

Date of change | 14/10/2014 | Name | YONG KOK LEONG | Age | 57 | Nationality | Malaysian | Designation | Chairman & Director | Directorate | Independent & Non Executive | Type of change | Resignation | Reason | To pursue an active role in the Company. | Details of any disagreement that he/she has with the Board of Directors | No | Whether there are any matters that need to be brought to the attention of the shareholders | No | Qualifications | Honours Degree in Management Science from the University of Warwick, UK. | Working experience and occupation | Mr. Yong Kok Leong has over 30 years’ experience in the Information, Communications, Technology (ICT) industry in senior management positions with Hewlett Packard Sales Malaysia Sdn Bhd, Fuji Xerox Asia Pacific Pte Ltd and Redtone International Berhad until 2007.

Over the years, he has developed broad skills in leading and managing multi-cultural, multi-national teams in the sales & marketing, technical support and product development areas. He has experience selling business commercial and technical application solutions to a broad range of industries. He was a member of the pioneering entrepreneurial team that built Redtone from start-up, winning multi-year industry awards and successfully listed in 2004 on the Mesdaq market (now known as Ace Market) |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 25-10-2014 10:18 AM

|

显示全部楼层

发表于 25-10-2014 10:18 AM

|

显示全部楼层

分享:

IFCA MSC - Huge Growth AwaitsAuthor: Alpha Trader | Publish date: Tue, 21 Oct 15:47

http://klse.i3investor.com/blogs/klgemseeker/62155.jsp

The FBMSCAP has taken a badly hit, down 18.5% from its peak on Thursday. Is this the time for bottom fishing? Certainly yes, if you have a lot of cash, as I see this as a correction, not a crash, and the worst is that KLCI might fall to 1700 points for the next 1-2weeks. If that did not happen, we will be seeing another rally and KLCI might be possibly hitting 1900 on December 2014.

All the counters I recommended has been underwater except Sentoria. Why? My thoughts are because Sentoria is more a institutional stock rather than a retailer ones. You can see that Seacera, SMRT, Taliworks are badly hit because most of them have not been under the institutional radar yet. Thus, I prefer to be more conservative now and would start to look into some possible institutional darlings for the next 3-6 months. Remember, like the rest, this stock could only outperform if the market sentiment turns better.

I know Maybank and CIMB has a report on IFCA already, but I have to assure you, this is not another Perisai/ Cuscapi, but it is a hidden gem in the making and I have highlighted a lot of times my intention to write a report to it. By looking at all GST counters, only IFCA and YGL manage to hold above 50MA, but to choose between them, IFCA is the solid fundamental-based company, not just based on GST play. Therefore, I am sorry to say that IFCA is a better way than Goodway.

TP: RM0.80 Current price: RM0.44 Market cap: RM201m Upside: 82% (A) Company Background

-IFCA was founded by the Yong brothers. They have 21 offices in 7 countries, namely;

(i) Malaysia; (ii) China; (iii) Indonesia; (iv) Singapore; (v) Philippines; (vi) Vietnam; and (vii) South Africa.Recently, they also announced they will be moving in Japan market and soon, the Thailand market.

-IFCA is an enterprise software solutions provider that targets mostly property developers/hotels/clubs. They used to offer window-based software to their clients where each software would roughly cost RM150k per client, and it of course depends on the client size as well, if the client is SPSETIA, probably that would cost them up to million of RM.

-2 years ago, IFCA has started to provide upgrades for their clients from Windows-based to cloud-based software, where each upgrade could cost more than RM500k. Currently, less than a hundred or not more than 5% are cloud-based users.

-IFCA has 1500 clients where 1050 of them are Malaysia-based. Any listed property developer, you name it, 90% chances of them are IFCA’s client, eg. SPSETIA, ECOWORLD, IJM, SIME DARBY, MAH SING, TROPICANA, IOI, etc.Some other major clients that IFCA has are as follows:

(i) Cloud-based software upgrade

-What is a cloud-based software? Most of the larger developers have moved to cloud-based software, eg. ECOWORLD. If you have attended their showroom before, their sales representative will have an ipad showing you all the latest projects/designs/prices/layouts all those stuff that windows-based software could not offer.

-What is so great about this software then? As the world is evolving into faster and more efficient way of working environment, those senior managers are able to track their sales through their mobile apps or other stuff like event management/budgeting etc through the software. Although not more than 5% of IFCA’s clients have adopted this software, we could be assure that more and more companies will eventually subscribe to this in the future, and the growth will be fantastic as technology advances. According to CIMB, per upgrade would generate more than RM500k to IFCA. Just 50 additional clients that opt for this software will alone contribute more than RM25m worthof revenue to IFCA, and this number is going to grow by leaps and bounds in the future.

(ii) GST financial accounting solution provider

-They own the products’ Intelligent Property (IP) for all of their software. Of course, they provide GST upgrades for all their clients that has already been using their software, and these clients are sticky.

-The clients have no choice, but to upgrade their financial accounting software into a GST compliant one. Each upgrade will cost more than RM20k to RM300k (dependant on the size of the company). Unlike MYOB accounting software, which Censof has partnered with, only requires RM1000 per software because they only targets micro enterprise (ie, companies that only contributes less than RM500k revenue). The good thing about IFCA is their clients will have to opt for annual maintenance as well, generating 18-20% recurring income of their initial cost of the software, while for Censof/MYOB, due to their customers being the smaller retailers and micro enterprise, will you pay maintenance of 18-20% a year to them for this service? Probably not.

- How many more clients then IFCA has in Malaysia that has not upgraded to GST compliant? According to report by the edge, 90% have not upgraded. That will be close to 900 clients.

- How much revenue that IFCA could generate from here? From the range provided above, we take a median of RM100k per software x 900 clients = RM90million worth of untapped revenues!

(iii) China/Japan markets

-IFCA had ventured into China 9 years ago, and last 2 years, they have been expanding aggressively by opening more offices in China, and client base has increased to more than 100 out of the market size of 45,000 property developers in China. While Japan market, I expect IFCA to expand faster by using the dealership model, and they will get a certain fee based on the sales that its dealers sell, therefore, any revenue from here is consider pure profit to IFCA.

-They would open up more offices and might double their offices to 18 offices in FY2015. You will see at least 40-50% growth in revenue in China for the next 2 years. The big breakthrough actually happened on FY2012 when they successfully secured Wanda as their client. Therefore, securing other smaller property developers will have lower barrier for IFCA!

-Of course, if revenue doubles, PAT would more than double, as software business do practice economies of scale, therefore increasing margins will improve their PAT by leaps and bounds.

(B) Shareholders

Yong brothers (Ken Yong and Yong Kian Keong) – 46.5%

DP Capital – 5.58%

Brahmal Vasudevan ~3% (sold down 2%)

Minority shareholders – 45%

Recently, IFCA’s chairman, Yong Kok Leong (do not be mistaken as one of the Yong brothers as it is highlighted in the annual report, he is not related to the Yong brothers) has resigned from his chairman post and has become the Head of Operation in Malaysia. What does this tells you?

IFCA might have too much business, even Mr Yong have to personally resigned from his Independent Director post to go into the ground to manage the Malaysia’s operation, and maybe his partners are too busy expanding their business in oversea!

(C) Financial analysis

Actually CIMB has covered up most of the important points about IFCA, but it did not really explains how they arrived with the numbers in FY2015.

Revenue

The GST implementation will increase IFCA’s revenue by potentially RM80m for the next 1 year (~RM100k x 900 clients), boosted by China’s forecasted revenue at RM40m (1H 2014 already generated RM21m), with other markets and cloud based upgrades contributing another RM20m, a 18% of recurring income of these revenue will be RM24m, therefore, IFCA’s total revenue for the next 1 year could be easily RM164m.

PAT

Remember IFCA is a MSC status company, which will be expiring in FY2016, if I am not mistaken. Therefore, they will be entitled to full exemption for tax incurred for Malaysia operation, and while in China, they are still enjoying the 50% discount on tax imposed by the government for the next 3 years. IFCA's largest expense is its staff cost and employee benefits. In order to be profitable, they have to hit a certain mark to increase their margins.

If we take a revenue of RM164m multiply by 15% PAT margin, you will easily get RM24.6m for the next 1 year’s profit, and I am only talking about 15% margin, by right, with more offices and economies of scale, the margin should expand beyond Q2 2014’s PAT margin at 16.6%. A merely 20% PAT margin will generate a whopping ofRM33m worth of PAT!

Cash levels

IFCA has no debt totally, only increasing cash levels, and I expect cash to surge to RM45m by next year due to high cash flow from operation and lower capex, as most of the capex has been spent to develop the GST software previously. A potential dividend will be announced soon.

(D) Valuation

Based on CIMB’s forecast, they are using P/E of 21x for FY2016 to derive a price target of RM0.78. I would not be so aggressive to target FY2016 as FY2015 will be sufficient for now. CIMB has forecasted an earnings of RM15m for FY2015, and for me, IFCA might be able to hit number even this year!

Therefore, with an earnings of RM25m for next 1 year, it is unfair to use a P/E to multiply by its earnings because the earnings include GST implementation which is one-off and beyond the one-off, you have 18% maintenance income which might be bundled with the original software.

My valuation will be based on only 18x forward P/E of earnings ex-GST income and plus the net income to be received from GST and a cash of RM45m.

(E) Technical analysis

IFCA has attempted to break the RM0.52 resistance for 3 days consecutively, but the market sentiment for small cap is too bearish, causing the stock to collapse back to previous support at RM0.375, however, it quickly rebounded to RM0.44 and it might test the RM0.52 again soon (only if market sentiment reverse), which I do not see this happening soon.

If market is bullish again. IFCA will break RM0.52 and next stop could possibly be RM0.60 and beyond.

S1: RM0.375, S2: RM0.33

R1: RM0.52, R2: RM0.57, R3: RM0.61

(F) Risk reward ratio

(i) Upside return of 82% - Using its Sum-of-Parts valuation, IFCA should be valued at RM0.80.

(ii) Downside risk of 18% - Watchout for support at RM0.375, if market drops again, it will fall to RM0.33, at this trading environment, be cautious

R/R ratio: 4.5 times. Try to buy as close to RM0.375 if there is opportunity.

(G) Rerating factors/ Catalysts

(i) The greatest GST implementation beneficiary with superb growth story

(ii) More ventures into other markets, Thailand/ Korea etc

(iii) Higher earnings forecast than the streets (and I am fairly certain it will and CIMB might increase their TP again?)

(iv) Main market listing by 2016

(v) Bonus issue/ potential dividends

(vi) Potential venturing into e-commerce/ other scalable business based on its property/ clubs clients’ base

(vii) Even the chairman resigned and become head of operation in Malaysia, and you should know how busy they are!

Cheers. If you name my top picks and play, I would rank as follows: (i) IFCA; (ii) SMRT and (iii) EPMB/Taliworks, and I strongly believe IFCA could hit my TP if the market did not crash. Watch out, and do not buy when the price is close to resistance, practice buy on weakness, etc. I am hoping the market sentiment reverse asap.

本帖最后由 icy97 于 27-10-2014 03:54 PM 编辑

|

|

|

|

|

|

|

|

|

|

|

|

发表于 25-10-2014 08:55 PM

|

显示全部楼层

发表于 25-10-2014 08:55 PM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 26-10-2014 10:58 PM

|

显示全部楼层

发表于 26-10-2014 10:58 PM

|

显示全部楼层

今年已漲15倍 競優國際憑單誰與爭鋒

財經幸運輪專欄26 Oct 2014 15:47

http://www.chinapress.com.my/node/572050

溫世麟-窩輪資本總執行長

www.warrants.com.my

憑單有時候真的能夠為投資者帶來重大的回報。今年馬股市,風頭最盛的公司憑單應該非競優國際-WA(IFCAMSC-WA,0023WA,創業板科技)莫屬。

該憑單今年初還是以3仙至4仙之間交易。雖然當時交易量不算多,但投資者也可每天輕易買到數十萬單位,所以該憑單不是那種在低價買不到量的憑單。

到了上週五該憑單創下最高45仙的新高峰,創下今年最多漲15倍的驕人紀錄,而且股價看來繼續上漲的動力還很大。

競優國際(IFCAMSC,0023,創業板科技)是馬來西亞和亞洲房地產軟件供應商的領航企業,也是全球最大的專業房地產軟件開發及管理咨詢公司之一。

該公司憑單正式受到注目時,應該是在今年7月初公司股東大會結束后。在這個時候投資者突然發現,原來這家專注房地產行業軟件的公司將會是消費稅(GST)實行后的最大贏家之一。

建議直接買母股

競優國際在8月中宣佈公司第2季業績突飛猛進后,便迎來一眾證券行研究部開始推薦該股票,使該公司的母股和憑單更進一步。

之后更有市場著名投資者買進公司股票令競優國際更加出名而使得該公司母股和憑單的成交量經常出現在最活躍的一頁。即使前幾個星期股市回調該股也很快反彈並在上週五創下歷史新高。

競優國際-WA在年初低價時候的估價,無論從溢價或是引申波幅角度來看都是超高的,但漲了15倍后的現在,該憑單就沒什么溢價了,再次顯示溢價並不是買憑單的重要指標。

買進溢價高的憑單很多時候才是最能賺錢的。低溢價的憑單反而不應該是憑單投資者買進的首選。

在競優國際中國市場開發潛能十足的背景下,該股應該是今年最受寵的股項。如果投資者有幸在年頭買進此憑單,回報率自然是非常可觀!

目前價位買憑單的吸引力就在槓槓比率不高的情況下大減。目前看好該公司的朋友應該直接買母股就算了。

本帖最后由 icy97 于 27-10-2014 04:05 PM 编辑

|

|

|

|

|

|

|

|

|

|

|

|

发表于 27-10-2014 09:59 PM

|

显示全部楼层

发表于 27-10-2014 09:59 PM

|

显示全部楼层

赚20仙,够了,我放了, |

|

|

|

|

|

|

|

|

|

|

|

发表于 27-10-2014 10:09 PM

|

显示全部楼层

发表于 27-10-2014 10:09 PM

|

显示全部楼层

yilingchai 发表于 27-10-2014 09:59 PM

赚20仙,够了,我放了,

这个你也有买呀。。。

|

|

|

|

|

|

|

|

|

|

|

|

发表于 6-11-2014 07:46 PM

|

显示全部楼层

发表于 6-11-2014 07:46 PM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30/09/2014 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30/09/2014 | 30/09/2013 | 30/09/2014 | 30/09/2013 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 25,747 | 15,262 | 58,053 | 37,973 | | 2 | Profit/(loss) before tax | 9,358 | 1,950 | 13,722 | 1,964 | | 3 | Profit/(loss) for the period | 8,583 | 1,699 | 12,470 | 1,677 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 8,530 | 1,565 | 11,953 | 1,636 | | 5 | Basic earnings/(loss) per share (Subunit) | 1.90 | 0.35 | 2.66 | 0.36 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.1300 | 0.1100 |

業績表現亮眼 競優國際創1年新高

財經股市6 Nov 2014 17:45

http://www.chinapress.com.my/node/575054

(吉隆坡6日訊)競優國際(IFCAMSC,0023,創業板科技)業績表現亮眼,提振母股憑單大熱雙雙列入十大熱門股榜,並寫下52周新高水平。

競優國際以73仙開市,休市掛75仙,起5.5仙;一度大漲7仙至76.5仙52周新高水平,截至下午4時半報76仙,起6.5仙,成交量5631萬3800股。

該公司憑單競優國際-WA(IFCAMSC-WA)以62.5仙開市,休市報64仙,起4仙,隨后漲5仙至65仙52周新高水平;截至下午4時半,該憑單報64仙,起4仙,成交量6288萬8700股。

競優國際營業額按年漲53%,淨利翻了7倍之多,不過沒有派發股息。第三季淨利增長主要由國內和中國業務成長貢獻。但年初至今,該公司只完成840萬令吉消費稅工程,聯昌證券研究估計今年營業額成長,有80%到90%是來自中國市場。

競優國際截至9月底有3490萬令吉現金,相等于每股7.7仙,以每年研發和資本開銷限制在400萬至600萬來看,該公司現金流將持續成長。

報告指明年料有更多憑單轉換成新股,當中有1億4330萬張憑單將在2016年2月到期,每單位轉換價為10仙,預計能為公司額外集得1430萬令吉。競優國際估計會在2016年轉板至主要板,但以今年強勁淨利表現來看,或會將計劃提前至2015年。

同時,報告維持競優國際“增持”評級,並將合理價從78仙,上修至1.05令吉。

净盈利暴增4倍 IFCA股价挺高

二零一四年十一月六日 晚上七时三十五分

http://www.kwongwah.com.my/news/2014/11/06/96.html

本帖最后由 icy97 于 7-11-2014 01:34 AM 编辑

|

|

|

|

|

|

|

|

|

|

|

|

发表于 6-11-2014 08:57 PM

|

显示全部楼层

发表于 6-11-2014 08:57 PM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | IFCA MSC Berhad

- Acquisition of 2 ordinary shares of RM1.00 each in a Shelf Company, SMARTHR Sdn. Bhd. representing its entire issued and paid-up capital of RM2.00 | The Board of Directors of IFCA MSC Berhad (“IFCA” or “the Company”) wishes to announce that the Company has on 5 November 2014 acquired 2 ordinary shares of RM1.00 each in SMARTHR Sdn. Bhd. (“SmartHR”) representing its entire issued and paid-up capital ("the Acquisition"). Pursuant to the Acquisition, SmartHR has become a wholly owned subsidiary of IFCA.

SmartHR was incorporated as a private limited company in Malaysia on 29 October 2014 with an authorized share capital of RM400,000 comprising 400,000 ordinary shares of RM1.00 each and is presently dormant. The intended principal activity of SmartHR is provision of human resource software solution system.

The Acquisition will not have any effect on the share capital, substantial shareholders’ shareholdings and net assets per share of IFCA as the purchase consideration was fully satisfied in cash.

The Acquisition will not have any material effect on the earnings per share of IFCA for the financial year ending 31 December 2014.

None of the directors, major shareholders and/or persons connected to the directors and/or major shareholders of IFCA have any interest, direct or indirect, in the Acquisition.

This announcement is dated 5 November 2014.

|

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|