|

|

发表于 29-10-2015 08:50 PM

|

显示全部楼层

发表于 29-10-2015 08:50 PM

|

显示全部楼层

本帖最后由 icy97 于 30-10-2015 02:37 AM 编辑

美特工業再寫52週新高 券商促趁高套利

財經股市29 Oct 2015 22:32

http://www.chinapress.com.my/node/667244

(吉隆坡29日訊)美特工業(MAGNI,7087,主要板消費)派紅股利好延燒,早盤一度再衝高至5.99令吉,再寫52週新高;由于股價自宣佈紅股計劃后已激增32%,肯納格證券研究建議投資者套現此股。

美特工業開市起4仙至5.90令吉,承接昨日漲勢,開市不久即衝上5.99令吉新高,勁揚13仙,但隨著投資者陸續趁高套利,該股近休市時開始回吐漲幅,一度跌10仙至5.76令吉。

休市時,該股重返正面區間,起3仙至5.89令吉,成交量24萬1200股。

閉市時,美特工業報5.82令吉,跌4仙,成交量26萬100股。

前景仍穩健

肯納格證券研究指出,今年8月6日至今,美特工業從4.34令吉的價位一路飆升了35%,宣佈紅股計劃后的漲幅達32%。

隨著股價已大幅攀升,該行相信市場已反映這些紅股利好,但盈利前景並無重大改變。

肯納格證券研究認為,美特工業前景依然穩健,預計2016至17財年的營業額料按年增5%,核心盈利將成長介于3%至7%,主要因美元升值、棉花價格穩定,這些因素將能保住未來兩個財年的賺幅在7.4%至7.3%。

該行把合理價上修至6.30令吉,派紅股后的合理價為4.20令吉,盈利預測不變。由于最新合理價的揚升空間有限,該行相信其股價已處于合理價位,建議投資者趁機套利。

美特工業每2股送1紅股計劃將在11月6日除權,這項計劃料在今年第4季完成。

肯納格建議轉移至寶翔

肯納格證券研究建議投資者,轉至另一家成衣製造業者寶翔(PRLEXUS,8966,主要板消費),給予“短線買入”建議,目標價3.15令吉。

該行指出,寶翔2016至17財年的營業額料成長18%,比較美特工業的營業額成長率為7%;其次,寶翔也在大馬和中國擴增產能,保守估計可提高這兩個財年的成衣產量12%至16%,並帶動盈利成長15%至26%。

寶翔週四(29日)股價窄幅波動于正負區間,閉市時該股報2.48令吉,跌2仙,成交量26萬1500股。 |

|

|

|

|

|

|

|

|

|

|

|

发表于 5-11-2015 12:19 PM

|

显示全部楼层

发表于 5-11-2015 12:19 PM

|

显示全部楼层

今天拿了股息10仙,又涨了15仙!!!rm5.85....... m m |

|

|

|

|

|

|

|

|

|

|

|

发表于 23-11-2015 03:39 PM

|

显示全部楼层

发表于 23-11-2015 03:39 PM

|

显示全部楼层

|

Rm4.00.........= 红股前的rm6.00...... |

|

|

|

|

|

|

|

|

|

|

|

发表于 23-11-2015 06:17 PM

|

显示全部楼层

发表于 23-11-2015 06:17 PM

|

显示全部楼层

恭喜...

|

|

|

|

|

|

|

|

|

|

|

|

发表于 9-12-2015 11:07 PM

|

显示全部楼层

发表于 9-12-2015 11:07 PM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 9-12-2015 11:33 PM

|

显示全部楼层

发表于 9-12-2015 11:33 PM

|

显示全部楼层

RM4.21>>>>.gif) .gif)

|

|

|

|

|

|

|

|

|

|

|

|

发表于 17-12-2015 10:50 PM

|

显示全部楼层

发表于 17-12-2015 10:50 PM

|

显示全部楼层

业绩几时出?

|

|

|

|

|

|

|

|

|

|

|

|

发表于 18-12-2015 11:07 PM

|

显示全部楼层

发表于 18-12-2015 11:07 PM

|

显示全部楼层

2Q........下个星期。。。。.gif)

|

|

|

|

|

|

|

|

|

|

|

|

发表于 18-12-2015 11:08 PM

|

显示全部楼层

发表于 18-12-2015 11:08 PM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 22-12-2015 06:26 PM

|

显示全部楼层

发表于 22-12-2015 06:26 PM

|

显示全部楼层

本帖最后由 icy97 于 22-12-2015 06:31 PM 编辑

| 7087 | | Quarterly rpt on consolidated results for the financial period ended 31/10/2015 | | Quarter: | 2nd Quarter | | Financial Year End: | 30/04/2016 | | Report Status: | Unaudited | | Submitted By: |

|

|

| Current Year Quarter | Preceding Year Corresponding Quarter | Current Year to Date | Preceding Year Corresponding Period |

| 31/10/2015 | 31/10/2014 | 31/10/2015 | 31/10/2014 |

| RM '000 | RM '000 | RM '000 | RM '000 | | 1 | Revenue | 197,342 | 162,036 | 391,160 | 339,276 | | 2 | Profit/Loss Before Tax | 28,675 | 10,822 | 49,157 | 24,271 | | 3 | Profit/Loss After Tax and Minority Interest | 21,631 | 8,002 | 37,204 | 18,086 | | 4 | Net Profit/Loss For The Period | 21,631 | 8,003 | 37,204 | 18,087 | | 5 | Basic Earnings/Loss Per Shares (sen) | 19.94 | 7.38 | 34.29 | 16.67 | | 6 | Dividend Per Share (sen) | 8.00 | 0.00 | 8.00 | 0.00 |

|

|

| As At End of Current Quarter | As At Preceding Financial Year End | | 7 | Net Assets Per Share (RM) |

|

| 2.7600 | 2.5100 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 22-12-2015 06:26 PM

|

显示全部楼层

发表于 22-12-2015 06:26 PM

|

显示全部楼层

本帖最后由 icy97 于 22-12-2015 06:32 PM 编辑

EX-date | 07 Jan 2016 | Entitlement date | 11 Jan 2016 | Entitlement time | 04:00 PM | Entitlement subject | Interim Dividend | Entitlement description | A single tier interim dividend of 5 sen per share for the financial year ending 30 April 2016 | Period of interest payment | to | Financial Year End | 30 Apr 2016 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | PLANTATION AGENCIES SDN BERHAD3rd Floor, Standard Chartered Bank ChambersBeach Street, 10300 PenangTel:042625333Fax:042622018 | Payment date | 26 Jan 2016 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 11 Jan 2016 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.0500 | Par Value | Malaysian Ringgit (MYR) 1.000 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 22-12-2015 06:27 PM

|

显示全部楼层

发表于 22-12-2015 06:27 PM

|

显示全部楼层

本帖最后由 icy97 于 22-12-2015 06:32 PM 编辑

EX-date | 07 Jan 2016 | Entitlement date | 11 Jan 2016 | Entitlement time | 04:00 PM | Entitlement subject | Special Dividend | Entitlement description | A single tier special dividend of 3 sen per share for the financial year ending 30 April 2016 | Period of interest payment | to | Financial Year End | 30 Apr 2016 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | PLANTATION AGENCIES SDN BERHAD3rd Floor, Standard Chartered Bank ChambersBeach Street, 10300 PenangTel:042625333Fax:042622018 | Payment date | 26 Jan 2016 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 11 Jan 2016 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.0300 | Par Value | Malaysian Ringgit (MYR) 1.000 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 22-12-2015 08:26 PM

|

显示全部楼层

发表于 22-12-2015 08:26 PM

|

显示全部楼层

本帖最后由 icy97 于 22-12-2015 10:09 PM 编辑

【美女风光无限好】- 浅谈美女MAGNI(7087), EPS yoy进步170%,派发8仙股息!

Tuesday, December 22, 2015

http://harryteo.blogspot.tw/2015/12/1181-magni7087-eps-yoy1708.html

今天是冬至,而MAGNI公布了非常出色的业绩来回馈股东们。这家公司主要的业务是服装纺织业,主要的客户是来自美国的NIKE。受益于马币走低,它的营业额按季上涨了22%,而EPS更是yoy进步了170%。这使到MAGNI的PE从11++再度下跌到现在的9.55,跟竞争对手PRLEXUS(8966)的11.91本益比相比,MAGNI的估值显得非常地诱人。

看看美女过去12个季度的业绩,当中有10个季度是在上升着的而它的Profit Margin更是连续5年进步,从2012财政年的5.7%一直进步到今天的9.5%。而且美女的ROE高达23.79,公司更是在最近4个季度内分别派发了3次股息。经过红股的调整后,MAGNI在1年内一共派发了18仙的股仙。以现在RM4.18的价格计算的话,周息率高达4.3%。

最让人惊叹的是,MAGNI是一家Net Cash Company,公司完全没有债务在手,手上的现金高达69,248 mil, 大约相当于每股42.5仙的现金。公司绝对能力每个季度都派发股息,我相信这是许多小股东的愿望。

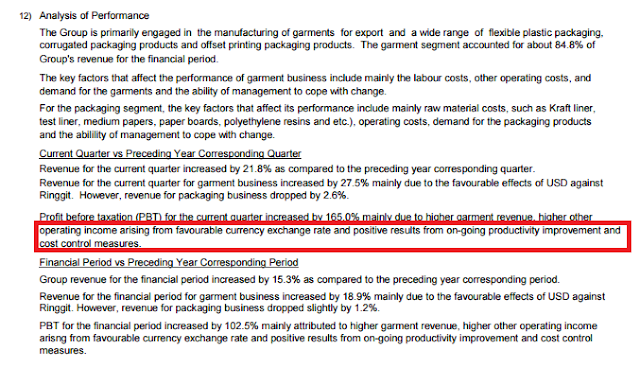

以上是季度报告里的业绩总结,MAGNI盈利走高主要归功于马币走低,产能的增加以及优良的成本控制。从过往的业绩盈利来看,美女可说是一家高速成长,管理层优良(撇除Vincent Tan有持股的因素), 大方派息的好公司。而且美女下个季度报告的月份是今年11月 - 明年1月,以现在居高不下的美金汇率来看,美女下个季度的业绩想必还是会有看头的。笔者认为,这家公司在2016还是会有很大的发展空间。共勉之。

以上纯属分享,买卖自负。

魔法师Harryt30

19.10p.m.

2015.12.22 |

评分

-

查看全部评分

|

|

|

|

|

|

|

|

|

|

|

发表于 22-12-2015 09:51 PM

|

显示全部楼层

发表于 22-12-2015 09:51 PM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 22-12-2015 09:54 PM

|

显示全部楼层

发表于 22-12-2015 09:54 PM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 22-12-2015 10:19 PM

|

显示全部楼层

发表于 22-12-2015 10:19 PM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 22-12-2015 11:57 PM

|

显示全部楼层

发表于 22-12-2015 11:57 PM

|

显示全部楼层

本帖最后由 icy97 于 23-12-2015 02:47 AM 编辑

美特工業派息8仙 次季淨利勁漲1.7倍

2015年12月22日

http://www.chinapress.com.my/20151222/美特工業派息8仙-次季淨利勁漲1-7倍/

(吉隆坡22日訊)美特工業(MAGNI,7087,主要板消費)從匯率中受惠,加上生產力及成本控制措施奏效,次季淨利按年勁漲1.7倍至2163萬令吉,宣布每股共派息8仙。

截至10月底,該公司本財年次季營業額按年增22%至1億9734萬令吉,每股盈利從上財年同期7.38仙,大增至19.94仙。

該公司次季宣布派息5仙及特別派息3仙,合計8仙股息將在明年1月26日支付。

美特工業上半財年業績亦唱好,營業額按年增15%至3億9116萬令吉,淨利則增1.1倍至3720萬令吉,每股盈利34.29仙。

該公司向馬證交所報備,次季營業額主要受惠于美元走挺,服裝業務收入增27.5%,不過包裝業務生意下滑2.6%。

“服裝業務獲利在匯率唱好之下勁增1.65倍,帶動整體增長,期間生產力改善及成本掌控得宜亦是業績唱好原因。” |

评分

-

查看全部评分

|

|

|

|

|

|

|

|

|

|

|

发表于 23-12-2015 12:17 PM

|

显示全部楼层

发表于 23-12-2015 12:17 PM

|

显示全部楼层

Rm4.63 = rm6.9+++.....

|

|

|

|

|

|

|

|

|

|

|

|

发表于 1-1-2016 06:07 PM

|

显示全部楼层

发表于 1-1-2016 06:07 PM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 6-1-2016 12:03 AM

|

显示全部楼层

发表于 6-1-2016 12:03 AM

|

显示全部楼层

本帖最后由 icy97 于 6-1-2016 12:53 AM 编辑

Tradeview - 2016 Value Pick No.1 (Magni-Tech Industries Berhad)

Author: tradeview | Publish date: Mon, 28 Dec 2015, 02:12 PM

http://klse.i3investor.com/blogs/tradeview/88634.jsp

Dear fellow traders,

For 2016, I will be sharing some fundamentally sound counters with upside growth progressively through out the next few months. These are just a few of my humble highlights (not recommendation), feel free to have some intellectual discourse on this.

_____________________________________________________________________________

Value Pick No. 1: Magni Tech Industries Bhd (TP RM.20)

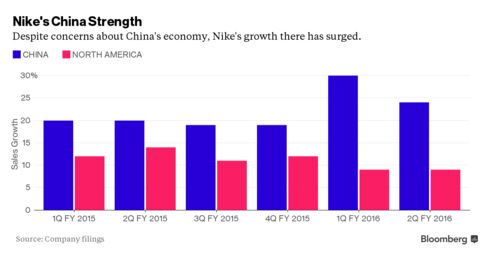

Quarterly Results (2Q) of Magni announced last week was mind blowing. Magni achieved record quarterly results with a jump of 2.7 times EPS from 7.38 sens to 19.94 sens. It is amazing because although many already knew good results was on the way, most were delighted to know there was special dividend of 3 sens on top of the 5 sens interim dividend. Of course, Magni as a garment manufacturer is a strong beneficiary of the export theme. Weak MYR has allowed Magni to achieve supernormal profit margins. However, the key to their continuing profitability is their tie up with Nike. Look below:

Orders for the Nike brand for the next four months rose 20 percent, excluding the effects of currency. Analysts expected a 13.6 percent gain.

Net income increased 20 percent to $785 million.

Sales rose 4.1 percent to $7.69 billion. Analysts estimated $7.81 billion.

Gross margin widened 0.5 percentage point to 45.6 percent.

Most export counters has shot up and the price has ran substantially. Magni was among those that went up a lot and even had a bonus. Yet, I chose to put money in Magni because of the increase in profit comes from beyond just the profit margin. Their revenue is also growing which to me shows that even if the share price has went up, there is still more room as it is not only a profit margin play. If you believe in the potential growth of Nike, then dont hesistate to jump in.

Against its peer, Prolexus which is trading at 11.5x PE, Magni is currently trading at 10x at the closing price of RM4.49 Wednesday. I am confident the next Magni is able to maintain their EPS for the next 2Q due to festive seasons cycle as well as the impending Olympic 2016 which will boost sales for Nike sporting products. The current EPS stands at 22.86 sens for 2 quarters. Taking a forward annualise earnings for 4 quarters amounts to 45.72 sens. At PE 11.5x, the fair value for Magni should be RM5.25 and at PE 14x, the fair value would be RM6.40. In addition, there is also a dividend of 8 sens declared. Conservative individuals can consider multiplying a 10-20% discount. As such, I raise the multiple to x12 and conservatively forecast the full year 2016 EPS at 45 sens, this would bring the FV to RM5.40 which in my opinion is reasonable.

http://www.bloomberg.com/news/ar ... wear-remains-strong

Food for thought: Merry Christmas and Happy Holidays to all

May good fortune come your way!

Disclaimer: This is not a recommendation to trade. It is merely the expression of the author's personal opinion and shall not be held responsbile for potential gains or losses executed by readers. |

评分

-

查看全部评分

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|