|

|

发表于 23-2-2016 02:21 AM

|

显示全部楼层

发表于 23-2-2016 02:21 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2015 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2015 | 31 Dec 2014 | 31 Dec 2015 | 31 Dec 2014 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 42,432 | 40,552 | 161,198 | 153,507 | | 2 | Profit/(loss) before tax | 6,255 | 4,696 | 18,605 | 16,244 | | 3 | Profit/(loss) for the period | 5,238 | 3,898 | 14,210 | 12,371 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 5,238 | 3,898 | 14,210 | 12,371 | | 5 | Basic earnings/(loss) per share (Subunit) | 4.77 | 3.55 | 12.93 | 11.26 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.5600 | 1.4300

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 2-6-2016 02:53 AM

|

显示全部楼层

发表于 2-6-2016 02:53 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2016 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2016 | 31 Mar 2015 | 31 Mar 2016 | 31 Mar 2015 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 40,062 | 38,977 | 40,062 | 38,977 | | 2 | Profit/(loss) before tax | 5,649 | 5,643 | 5,649 | 5,643 | | 3 | Profit/(loss) for the period | 3,972 | 3,986 | 3,972 | 3,986 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 3,972 | 3,986 | 3,972 | 3,986 | | 5 | Basic earnings/(loss) per share (Subunit) | 3.61 | 3.63 | 3.61 | 3.63 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.6000 | 1.5600

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 13-7-2016 03:45 PM

|

显示全部楼层

发表于 13-7-2016 03:45 PM

|

显示全部楼层

本帖最后由 icy97 于 13-7-2016 11:06 PM 编辑

技术买进PPHB

Wednesday, July 13, 2016

http://bblifediary.blogspot.my/2016/07/pphb.html

当前股价:RM0.92

价量齐升,等待突破下一道阻力RM0.93,有望试探RM0.96。

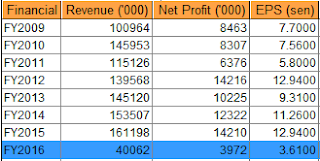

PPHB(大众包装,8273,主板工业产品股)这家公司的基本面还算不错的,该公司成立于1976年,并于1991年上市大马交易所主板。

PPHB是一家小型资本包装供应公司,核心业务是发展、设计、印刷及制造纸包装产品。

除了包装工业务外,该公司涉及销售点展示(Point of Purchase Display,简称POP)业务,也为一些消费者品牌,如Maybelline、Energizer、Twisties及Fisher-Price,制造销售点展示。

2013年,该公司将业务多元化至酒店业和商用产业租赁业务。

PPHB业绩自2014年以来每股净利都一直维持在11仙以上,今年首季则是3.61仙。

如果公司继续把每股净利维持在3.6仙以上,那么今年的每股净利将可达到14仙,以目前股价来计算,本益比6.5倍左右。

此外,PPHB的每股净资产(NTA)为RM1.60,股价对账面值比例(P/BV)只有0.57倍,整体来说属于被低估的公司。

缺点是公司自2012年以来就不曾再派股息。

免责声明:

以上投资分析,纯属本人个人意见和观点。

在买进一家公司的股份前,请先做功课并了解该公司,任何人因看此文章而造成任何投资损失,本人恕不负责。切记,买卖自负! |

|

|

|

|

|

|

|

|

|

|

|

发表于 1-9-2016 02:35 AM

|

显示全部楼层

发表于 1-9-2016 02:35 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2016 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2016 | 30 Jun 2015 | 30 Jun 2016 | 30 Jun 2015 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 41,868 | 39,324 | 81,930 | 78,301 | | 2 | Profit/(loss) before tax | 3,924 | 3,883 | 9,573 | 9,526 | | 3 | Profit/(loss) for the period | 3,547 | 3,406 | 7,519 | 7,392 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 3,547 | 3,406 | 7,519 | 7,392 | | 5 | Basic earnings/(loss) per share (Subunit) | 3.23 | 3.10 | 6.84 | 6.73 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.6300 | 1.5600

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 1-11-2016 02:53 AM

|

显示全部楼层

发表于 1-11-2016 02:53 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | PUBLIC PACKAGES HOLDINGS BERHAD ("PPHB" OR "THE COMPANY")INVESTMENT AGREEMENT BETWEEN PPHR, KYAW THA CO., LTD, MARUICHI CO., LTD AND T&R CO., LTD | The Board of Directors of Public Packages Holdings Berhad (162413-K) (“PPHB” and the “the Company”) wishes to announce that PPH Resources Sdn Bhd (“PPHR”), a wholly-owned subsidiary of PPHB, had entered into an Investment Agreement (“IA”) with Kyaw Tha Co., Ltd (“KT”), Maruichi Co., Ltd (“MARUICHI”), and T&R Co., Ltd (“T&R”) (“hereinafter referred to as “the Parties”) to jointly collaborate and carry out the business of manufacturing, sale and export of paper products and packaging materials, through KT PPH Company Limited (“KTPPH”), a company incorporated in the Republic of the Union of Myanmar.

Please refer to the attachment for the full details of the announcement.

This announcement is dated 28 October 2016. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5244993

|

|

|

|

|

|

|

|

|

|

|

|

发表于 1-12-2016 04:32 AM

|

显示全部楼层

发表于 1-12-2016 04:32 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | PUBLIC PACKAGES HOLDINGS BERHAD (COMPANY NO. 162413-K) ("PPHB" OR "THE COMPANY") INVESTMENT AGREEMENT BETWEEN PPHB, KYAW THA CO., LTD, MARUICHI CO., LTD AND T&R CO., LTD | We refer to the announcement dated 28 October 2016 in respect of the Investment Agreement ("IA") between Public Packages Holdings Berhad (Company No. 162413-K) ("PPHB" and "the Company"), Kyaw Tha Co., Ltd, Maruichi Co., Ltd and T&R Co., Ltd.

The Board of Director of PPHB wishes to annonce that the final payment of US$125,000 for the Investment has been completed on 23 November 2016.

This announcement is dated 24 November 2016. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 2-12-2016 03:42 AM

|

显示全部楼层

发表于 2-12-2016 03:42 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2016 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2016 | 30 Sep 2015 | 30 Sep 2016 | 30 Sep 2015 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 40,810 | 40,465 | 122,740 | 118,766 | | 2 | Profit/(loss) before tax | 4,201 | 2,824 | 13,774 | 12,350 | | 3 | Profit/(loss) for the period | 3,176 | 1,580 | 10,695 | 8,972 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 3,176 | 1,580 | 10,695 | 8,972 | | 5 | Basic earnings/(loss) per share (Subunit) | 2.89 | 1.44 | 9.73 | 8.16 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.6600 | 1.5600

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 1-3-2017 02:36 AM

|

显示全部楼层

发表于 1-3-2017 02:36 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2016 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2016 | 31 Dec 2015 | 31 Dec 2016 | 31 Dec 2015 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 43,808 | 42,432 | 166,548 | 161,198 | | 2 | Profit/(loss) before tax | 7,753 | 6,256 | 21,527 | 18,606 | | 3 | Profit/(loss) for the period | 5,814 | 5,239 | 16,509 | 14,211 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 5,814 | 5,239 | 16,509 | 14,211 | | 5 | Basic earnings/(loss) per share (Subunit) | 5.29 | 4.77 | 15.02 | 12.93 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.7100 | 1.5600

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 13-6-2017 02:28 AM

|

显示全部楼层

发表于 13-6-2017 02:28 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2017 | 31 Mar 2016 | 31 Mar 2017 | 31 Mar 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 41,885 | 40,062 | 41,885 | 40,062 | | 2 | Profit/(loss) before tax | 6,103 | 5,649 | 6,103 | 5,649 | | 3 | Profit/(loss) for the period | 5,311 | 3,972 | 5,311 | 3,972 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 5,311 | 3,972 | 5,311 | 3,972 | | 5 | Basic earnings/(loss) per share (Subunit) | 4.83 | 3.61 | 4.83 | 3.61 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.7600 | 1.7100

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 22-6-2017 12:32 AM

|

显示全部楼层

发表于 22-6-2017 12:32 AM

|

显示全部楼层

本帖最后由 icy97 于 23-6-2017 03:46 AM 编辑

大众包装7送5红股

(吉隆坡19日讯)大众包装(PPHB,8273,主板工业产品组)建议以7送5比例发送至多7849万7499股红股,此外,该公司也建议扩大雇员认购(ESOS)比例,认购比例最高达15%。

该公司透过文告指出,发行红股主要是为了透过扩大股本来反映公司现有运作规模及改善公司股票的流通量。

红股计划将从公司的股票溢价户头和保留盈利户头中融资。

红股计划及雇员认购计划全面完成后,大众包装股本预计将从1亿989万6498股扩大至2亿1665万3096股。

上述计划预期在今年第三季可完成。

文章来源:

星洲日报‧财经‧2017.06.20

Type | Announcement | Subject | NEW ISSUE OF SECURITIES (CHAPTER 6 OF LISTING REQUIREMENTS)

COMBINATION OF NEW ISSUE OF SECURITIES | Description | PUBLIC PACKAGES HOLDINGS BERHAD ("PPH" OR THE "COMPANY")(I) PROPOSED BONUS ISSUE; AND(II) PROPOSED SCHEME(COLLECTIVELY, REFERRED TO AS THE "PROPOSALS") | On behalf of the Board of Directors of PPH, Mercury Securities Sdn Bhd wishes to announce that the Company proposes to undertake the followings: (i) proposed bonus issue of 78,497,499 new ordinary shares in PPH ("PPH Shares" or "Shares") ("Bonus Shares") on the basis of five (5) Bonus Shares for every seven (7) existing PPH Shares held on an entitlement date to be determined later ("Proposed Bonus Issue"); and

(ii) proposed establishment and implementation of a share issuance scheme ("Scheme") of up to fifteen percent (15%) of the Company's total issued share capital (excluding treasury shares) at any one time during the duration of the Scheme for the eligible employees of PPH and its subsidiaries and directors of PPH, comprising an employee share option scheme ("Proposed ESOS") and an employee share grant scheme ("Proposed ESGS") (Collectively, the "Proposed Scheme").

Please refer to the attachment for further details on the Proposals.

This announcement is dated 19 June 2017. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5464925

|

|

|

|

|

|

|

|

|

|

|

|

发表于 30-8-2017 04:33 AM

|

显示全部楼层

发表于 30-8-2017 04:33 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2017 | 30 Jun 2016 | 30 Jun 2017 | 30 Jun 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 46,627 | 41,868 | 88,512 | 81,930 | | 2 | Profit/(loss) before tax | 4,369 | 3,924 | 10,472 | 9,573 | | 3 | Profit/(loss) for the period | 2,896 | 3,547 | 8,207 | 7,519 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 2,896 | 3,547 | 8,207 | 7,519 | | 5 | Basic earnings/(loss) per share (Subunit) | 2.64 | 3.23 | 7.47 | 6.84 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.7900 | 1.7100

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 1-9-2017 05:47 AM

|

显示全部楼层

发表于 1-9-2017 05:47 AM

|

显示全部楼层

| PUBLIC PACKAGES HOLDINGS BHD |

EX-date | 13 Sep 2017 | Entitlement date | 15 Sep 2017 | Entitlement time | 05:00 PM | Entitlement subject | Bonus Issue | Entitlement description | BONUS ISSUE OF 78,497,499 NEW ORDINARY SHARES IN PUBLIC PACKAGES HOLDINGS BERHAD ("PPH") ("PPH SHARE(S)" OR "SHARE(S)") ("BONUS SHARE(S)") ON THE BASIS OF FIVE (5) BONUS SHARES FOR EVERY SEVEN (7) EXISTING PPH SHARES HELD ON 15 SEPTEMBER 2017 ("ENTITLEMENT DATE") ("BONUS ISSUE") | Period of interest payment | to | Financial Year End | 31 Dec 2017 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | TRICOR INVESTOR & ISSUING HOUSE SERVICES SDN BHDUnit 32-01, Level 32, Tower A,Vertical Business Suite, Avenue 3, Bangsar South,No. 8, Jalan Kerinchi59200 Kuala LumpurTel:03 2783 9299Fax:03 2783 9222 | Payment date |

| | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 15 Sep 2017 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Ratio | Ratio | 5 : 7 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 30-9-2017 05:22 AM

|

显示全部楼层

发表于 30-9-2017 05:22 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 4-11-2017 06:21 AM

|

显示全部楼层

发表于 4-11-2017 06:21 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | PUBLIC PACKAGES HOLDINGS BERHAD ("PPHB" and "the Company") REVALUATION OF PROPERTIES | 1. INTRODUCTION Pursuant to paragraph 9.19(46) of the Listing Requirements of Bursa Malaysia Securities Berhad, the Board of Directors of Public Packages Holdings Berhad (162413-K) (“PPHB” and the “the Company”) wishes to announce that the PPHB Group has carried out a revaluation exercise on its properties as detailed in paragraph 3 (“the Revaluation”).

2. PURPOSE The said revaluation exercise was undertaken to reflect the fair value of the Group’s properties in the financial statements of the Group for the financial year ended 31 December 2017. Such revaluation exercise is in compliance with FRS 140 as well as the Group’s Revaluation Policy.

3. DETAILS OF THE REVALUATION Detailed breakdowns of the Revaluation are as follows :-

PUBLIC PACKAGES PROPERTIES SDN. BHD.

| Location | Carrying Amount as at 31.12.16 | Revaluation on 31.10.2017 | Revaluation surplus |

| RM | RM | RM | Lot 5632 Mukim 11 (Nibong Tebal) Seberang Perai Selatan, Penang | 7,700,000 | 12,800,000 | 5,100,000 | 84 Lebuhraya Kapal, Penang | 265,000 | 455,000 | 190,000 | 5-2-4 Edgecumbe Court, Penang | 320,000 | 500,000 | 180,000 | Unit SB15 Block A, No. 1 Persiaran Gurney, Penang | 820,000 | 1,220,000 | 400,000 | Unit I-4-3 Taman Desa Relau, Penang | 170,000 | 260,000 | 90,000 | Unit 368-2-04 Belisa Row Jalan Burma, Penang | 500,000 | 580,000 | 80,000 | No. A-17-02, Verticas Residensi, off Jalan Ceylon, Kuala Lumpur | 1,840,350 | 1,900,000 | 59,650 | Lot15 Jalan Utas 15/7, Section 15, 40000 Shah Alam, Selangor | 4,369,317 | 5,800,000 | 1,430,683 |

|

| Total | 7,530,333 |

|

|

|

|

4. EFFECT ON NET ASSETS (“NA”) PER SHARE Such revaluation surplus will be accounted for and recognized in the financial statements for the financial period ended 31 December 2017. The recognition of revaluation surplus has resulted in an increase in Net Assets (“NA”) per share of the Group of approximately RM0.04 for the financial period ended 31 December 2017.

5. DOCUMENTS AVAILABLE FOR INSPECTIONS Copies of Valuation Report dated 31 October 2017 prepared by Raine & Horne International Zaki + Partners Sdn. Bhd. can be inspected at registered office of PPHB at Wisma Public Packages, Plot 67 Lintang Kampong Jawa, Bayan Lepas Industrial Estate, 11900 Bayan Lepas, Penang, from 9.00 a.m. to 5.00 p.m. during normal business hours for a period of three (3) months the date of this announcement.

This announcement is dated 3 November 2017. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 2-12-2017 06:48 AM

|

显示全部楼层

发表于 2-12-2017 06:48 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2017 | 30 Sep 2016 | 30 Sep 2017 | 30 Sep 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 44,157 | 40,810 | 132,669 | 122,740 | | 2 | Profit/(loss) before tax | 4,633 | 4,201 | 15,105 | 13,774 | | 3 | Profit/(loss) for the period | 3,705 | 3,176 | 11,912 | 10,695 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 3,705 | 3,176 | 11,912 | 10,695 | | 5 | Basic earnings/(loss) per share (Subunit) | 1.97 | 2.89 | 6.32 | 9.73 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.0600 | 1.7100

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 3-3-2018 03:19 AM

|

显示全部楼层

发表于 3-3-2018 03:19 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2017 | 31 Dec 2016 | 31 Dec 2017 | 31 Dec 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 45,035 | 43,808 | 177,704 | 166,548 | | 2 | Profit/(loss) before tax | 5,624 | 7,753 | 20,729 | 21,527 | | 3 | Profit/(loss) for the period | 3,613 | 5,813 | 15,525 | 16,508 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 3,613 | 5,813 | 15,525 | 16,508 | | 5 | Basic earnings/(loss) per share (Subunit) | 1.92 | 5.29 | 8.23 | 15.02 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.0800 | 1.7100

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 1-5-2018 06:32 AM

|

显示全部楼层

发表于 1-5-2018 06:32 AM

|

显示全部楼层

Profile for Securities of PLC| FEDERAL FURNITURE HOLDINGS (M) BERHAD |

Instrument Category | Securities of PLC | Instrument Type | Preference Shares | Description | New class B redeemable convertible preference shares of RM0.10 each in Federal Furniture Holdings (M) Berhad ("FFHB" or the "Company" ("RCPS B" ("RCPS B" |

Listing Date | 27 Apr 2018 | Issue Date | 24 Apr 2018 | Issue/ Ask Price | Malaysian Ringgit (MYR) 0.1000 | Issue Size Indicator | Unit | Issue Size in Unit | 170,000,000 | Maturity | Mandatory | Maturity Date | 23 Apr 2028 | Revised Maturity Date |

| | Name of Guarantor | Not Applicable | Name of Trustee | Not Applicable | Coupon/Profit/Interest/Payment Rate | FFHB shall have the sole and absolute discretion to decide whether to annually declare any non-cumulative preferential dividend at the rate to be determined by FFHB provided always a) that such dividend shall not be more than 8% per annum calculated based on the issue price of the RCPS B; and (b) if FFHB shall declare any dividend on the ordinary shares in FFHB ("FFHB Shares" a) that such dividend shall not be more than 8% per annum calculated based on the issue price of the RCPS B; and (b) if FFHB shall declare any dividend on the ordinary shares in FFHB ("FFHB Shares" , no dividend whether in cash, in property or in shares or securities of FFHB, may be paid on any FFHB Shares until after FFHB has fully paid to the holders of the existing 270,000,000 redeemable convertible preference shares at an issue price of RM0.10 each ("RCPS A" , no dividend whether in cash, in property or in shares or securities of FFHB, may be paid on any FFHB Shares until after FFHB has fully paid to the holders of the existing 270,000,000 redeemable convertible preference shares at an issue price of RM0.10 each ("RCPS A" followed by the holders of the RCPS B the dividend payable in respect of the RCPS A and the RCPS B. followed by the holders of the RCPS B the dividend payable in respect of the RCPS A and the RCPS B. | Coupon/Profit/Interest/Payment Frequency | Not Applicable | Redemption | FFHB may at any time from the 3rd anniversary of the Issue Date and up to the Maturity Date (both dates inclusive) give not less than 30 days' prior notice in writing ("Redemption Notice" to the holders of its intention to redeem all or any part of the RCPS B which have been issued on a date which shall be specified in the Redemption Notice ("Redemption Date" to the holders of its intention to redeem all or any part of the RCPS B which have been issued on a date which shall be specified in the Redemption Notice ("Redemption Date" . On the Redemption Date, FFHB shall be entitled and bound to redeem the RCPS B specified in the Redemption Notice at RM0.10 for each RCPS B and to pay the dividend which shall have accrued on them down to the Redemption Date. . On the Redemption Date, FFHB shall be entitled and bound to redeem the RCPS B specified in the Redemption Notice at RM0.10 for each RCPS B and to pay the dividend which shall have accrued on them down to the Redemption Date. | Exercise/Conversion Period | 10.00 Year(s) | Revised Exercise/Conversion Period | Not Applicable | Exercise/Strike/Conversion Price | Malaysian Ringgit (MYR) 0.5000 | Revised Exercise/Strike/Conversion Price | Not Applicable | Exercise/Conversion Ratio | 5:1 | Revised Exercise/Conversion Ratio | Not Applicable | Mode of satisfaction of Exercise/ Conversion price | Tendering of securities | Settlement Type/ Convertible into | Physical (Shares) |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 31-5-2018 06:22 AM

|

显示全部楼层

发表于 31-5-2018 06:22 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2018 | 31 Mar 2017 | 31 Mar 2018 | 31 Mar 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 42,929 | 41,885 | 42,929 | 41,885 | | 2 | Profit/(loss) before tax | 5,229 | 6,103 | 5,229 | 6,103 | | 3 | Profit/(loss) for the period | 3,930 | 5,311 | 3,930 | 5,311 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 3,930 | 5,311 | 3,930 | 5,311 | | 5 | Basic earnings/(loss) per share (Subunit) | 2.08 | 2.82 | 2.08 | 2.82 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.1000 | 1.0800

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 28-8-2018 04:06 AM

|

显示全部楼层

发表于 28-8-2018 04:06 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2018 | 30 Jun 2017 | 30 Jun 2018 | 30 Jun 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 48,503 | 46,627 | 91,432 | 88,512 | | 2 | Profit/(loss) before tax | 5,935 | 4,369 | 11,164 | 10,472 | | 3 | Profit/(loss) for the period | 4,195 | 2,896 | 8,125 | 8,207 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 4,195 | 2,896 | 8,125 | 8,207 | | 5 | Basic earnings/(loss) per share (Subunit) | 2.22 | 1.54 | 4.31 | 4.36 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.1200 | 1.0800

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 5-12-2018 06:53 AM

|

显示全部楼层

发表于 5-12-2018 06:53 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2018 | 30 Sep 2017 | 30 Sep 2018 | 30 Sep 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 52,076 | 44,157 | 143,508 | 132,669 | | 2 | Profit/(loss) before tax | 6,222 | 4,633 | 17,386 | 15,105 | | 3 | Profit/(loss) for the period | 6,207 | 3,705 | 14,332 | 11,912 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 6,207 | 3,705 | 14,332 | 11,912 | | 5 | Basic earnings/(loss) per share (Subunit) | 3.29 | 1.97 | 7.60 | 6.32 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.1600 | 1.0800

|

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|