|

查看: 11350|回复: 69

|

【AMVERTON 5959 交流专区】(前名 A&M)

[复制链接]

|

|

|

本帖最后由 icy97 于 25-11-2017 06:33 AM 编辑

Announcement

Date | Financial

Year | Quarter

Number | Financial

Quarter | Revenue

(RM,000) | Profit Before

Tax (RM,000) | Net Profit

(RM,000) | Earning

Per Share (Cent) | Dividend

(Cent) | NTA (RM) | | 30/05/2012 | 31/12/2012 | 1 | 31/03/2012 | 32,507 | 6,521 | 4,537 | 1.24 | 0.00 | 1.350 | | 29/02/2012 | 31/12/2011 | 4 | 31/12/2011 | 42,617 | 12,293 | 8,928 | 2.45 | 0.00 | 1.340 | | 23/11/2011 | 31/12/2011 | 3 | 30/09/2011 | 39,446 | 7,092 | 4,949 | 1.36 | 0.00 | 1.320 | | 23/08/2011 | 31/12/2011 | 2 | 30/06/2011 | 28,226 | 9,314 | 8,578 | 2.35 | 0.00 | 1.340 | | 27/05/2011 | 31/12/2011 | 1 | 31/03/2011 | 29,451 | 5,053 | 3,286 | 0.90 | 0.00 | 1.280 | | 25/02/2011 | 31/12/2010 | 4 | 31/12/2010 | 24,748 | 3,872 | 2,408 | 0.66 | 0.00 | 1.270 |

| Date | Financial

Year | Ex-Date | Entitlement

Date | Payment

Date | Entitlement Type | Dividend

(Cent) | Dividend

(%) | | 26/06/2008 | 31/12/2007 | 29/08/2008 | 03/09/2008 | 18/09/2008 | First and Final Dividend | 1.500 | 0.00 | | 20/06/2007 | 31/12/2006 | 29/08/2007 | 03/09/2007 | 18/09/2007 | First and Final Dividend | 0.000 | 3.00 | | 20/06/2006 | 31/12/2005 | 29/08/2006 | 01/09/2006 | 18/09/2006 | First and Final Dividend | 0.000 | 2.50 |

官网:www.amrealty.com.my/

一家很冷门的公司。。。不错的。。。可以研究。。 |

|

|

|

|

|

|

|

|

|

|

|

发表于 3-7-2012 10:48 PM

|

显示全部楼层

发表于 3-7-2012 10:48 PM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 4-7-2012 03:46 PM

|

显示全部楼层

回复 2# xiaomao

还好啦。。。重要是价格低估。。 希望大股东忽然private 那就很好哈哈。。。 |

|

|

|

|

|

|

|

|

|

|

|

发表于 29-8-2012 10:09 PM

|

显示全部楼层

发表于 29-8-2012 10:09 PM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30/06/2012 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30/06/2012 | 30/06/2011 | 30/06/2012 | 30/06/2011 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 32,090 | 28,226 | 64,597 | 57,677 | | 2 | Profit/(loss) before tax | 7,328 | 9,314 | 13,849 | 14,367 | | 3 | Profit/(loss) for the period | 5,275 | 9,058 | 10,299 | 12,900 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 4,833 | 8,578 | 9,370 | 11,864 | | 5 | Basic earnings/(loss) per share (Subunit) | 1.32 | 2.35 | 2.57 | 3.25 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.3700 | 1.3400 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 29-11-2012 01:34 AM

|

显示全部楼层

发表于 29-11-2012 01:34 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30/09/2012 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30/09/2012 | 30/09/2011 | 30/09/2012 | 30/09/2012 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 36,535 | 39,446 | 101,132 | 97,123 | | 2 | Profit/(loss) before tax | 10,600 | 7,092 | 24,449 | 21,459 | | 3 | Profit/(loss) for the period | 8,001 | 5,352 | 18,300 | 18,252 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 7,675 | 4,949 | 17,045 | 16,813 | | 5 | Basic earnings/(loss) per share (Subunit) | 2.10 | 1.36 | 4.67 | 4.61 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.3900 | 1.3400 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 26-1-2013 01:26 AM

|

显示全部楼层

发表于 26-1-2013 01:26 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | Acquisition of New Subsidiary – Farming Hub Sdn Bhd | The Board of Directors of A&M Realty Berhad ("A&M" or "the Company") wishes to announce that Ladang YS (Selangor) Sdn Bhd, a wholly-owned subsidiary of A&M, has on 25th January 2013 acquired two (2) ordinary shares of RM1.00 each representing 100% of the issued and paid-up share capital of Farming Hub Sdn Bhd ("Farming Hub") for a total consideration of RM2.00. Farming Hub was incorporated on 20th December 2012 and has an authorised share capital of RM100,000.00 of which 2 shares of RM1.00 each have been issued and fully paid-up.

The intended principal activity of Farming Hub shall be tourism related activities and agriculture.

None of the Directors and/or major shareholders of the Company or persons connected to them, has any interest, direct or indirect, in the above acquisition.

This announcement is dated 25th January 2013.

|

Type | Announcement | Subject | OTHERS | Description | Acquisition of New Subsidiary – Jetpalms Sdn Bhd | The Board of Directors of A&M Realty Berhad ("A&M" or "the Company") wishes to announce that Ladang YS (Selangor) Sdn Bhd, a wholly-owned subsidiary of A&M, has on 25th January 2013 acquired two (2) ordinary shares of RM1.00 each representing 100% of the issued and paid-up share capital of Jetpalms Sdn Bhd ("Jetpalms") for a total consideration of RM2.00. Jetpalms was incorporated on 27th December 2012 and has an authorised share capital of RM100,000.00 of which 2 shares of RM1.00 each have been issued and fully paid-up. The intended principal activity of Jetpalms shall be tourism related activities and agriculture.

None of the Directors and/or major shareholders of the Company or persons connected to them, has any interest, direct or indirect, in the above acquisition.

This announcement is dated 25th January 2013.

|

Type | Announcement | Subject | OTHERS | Description | Acquisition of New Subsidiary – Ladang Seri Permai Sdn Bhd | The Board of Directors of A&M Realty Berhad ("A&M" or "the Company") wishes to announce that Ladang YS (Selangor) Sdn Bhd, a wholly-owned subsidiary of A&M, has on 25th January 2013 acquired two (2) ordinary shares of RM1.00 each representing 100% of the issued and paid-up share capital of Ladang Seri Permai Sdn Bhd ("Ladang Seri Permai") for a total consideration of RM2.00. Ladang Seri Permai was incorporated on 27th December 2012 and has an authorised share capital of RM100,000.00 of which 2 shares of RM1.00 each have been issued and fully paid-up. The intended principal activity of Ladang Seri Permai shall be tourism related activities and agriculture.

None of the Directors and/or major shareholders of the Company or persons connected to them, has any interest, direct or indirect, in the above acquisition.

This announcement is dated 25th January 2013.

|

Type | Announcement | Subject | OTHERS | Description | Acquisition of New Subsidiary – Total Wellbeing Sdn Bhd | The Board of Directors of A&M Realty Berhad ("A&M" or "the Company") wishes to announce that Ladang YS (Selangor) Sdn Bhd, a wholly-owned subsidiary of A&M, has on 25th January 2013 acquired two (2) ordinary shares of RM1.00 each representing 100% of the issued and paid-up share capital of Total Wellbeing Sdn Bhd ("Total Wellbeing") for a total consideration of RM2.00. Total Wellbeing was incorporated on 6th December 2012 and has an authorised share capital of RM100,000.00 of which 2 shares of RM1.00 each have been issued and fully paid-up. The intended principal activity of Total Wellbeing shall be tourism related activities and agriculture.

None of the Directors and/or major shareholders of the Company or persons connected to them, has any interest, direct or indirect, in the above acquisition.

This announcement is dated 25th January 2013.

|

Type | Announcement | Subject | OTHERS | Description | Acquisition of New Subsidiary – Jewelacres Sdn Bhd | The Board of Directors of A&M Realty Berhad ("A&M" or "the Company") wishes to announce that Ladang YS (Selangor) Sdn Bhd, a wholly-owned subsidiary of A&M, has on 25th January 2013 acquired two (2) ordinary shares of RM1.00 each representing 100% of the issued and paid-up share capital of Jewelacres Sdn Bhd ("Jewelacres") for a total consideration of RM2.00. Jewelacres was incorporated on 27th December 2012 and has an authorised share capital of RM100,000.00 of which 2 shares of RM1.00 each have been issued and fully paid-up. The intended principal activity of Jewelacres shall be tourism related activities and agriculture.

None of the Directors and/or major shareholders of the Company or persons connected to them, has any interest, direct or indirect, in the above acquisition.

This announcement is dated 25th January 2013.

|

本帖最后由 icy97 于 26-1-2013 01:27 AM 编辑

|

|

|

|

|

|

|

|

|

|

|

|

发表于 27-2-2013 12:40 AM

|

显示全部楼层

发表于 27-2-2013 12:40 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31/12/2012 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31/12/2012 | 31/12/2011 | 31/12/2012 | 31/12/2011 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 39,065 | 42,617 | 140,197 | 139,682 | | 2 | Profit/(loss) before tax | 13,410 | 12,293 | 37,859 | 33,063 | | 3 | Profit/(loss) for the period | 10,300 | 9,238 | 28,600 | 26,988 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 10,088 | 8,928 | 27,133 | 25,208 | | 5 | Basic earnings/(loss) per share (Subunit) | 2.76 | 2.45 | 7.43 | 6.91 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.4200 | 1.3400 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 14-3-2013 11:25 PM

|

显示全部楼层

发表于 14-3-2013 11:25 PM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 17-4-2013 03:58 PM

|

显示全部楼层

发表于 17-4-2013 03:58 PM

|

显示全部楼层

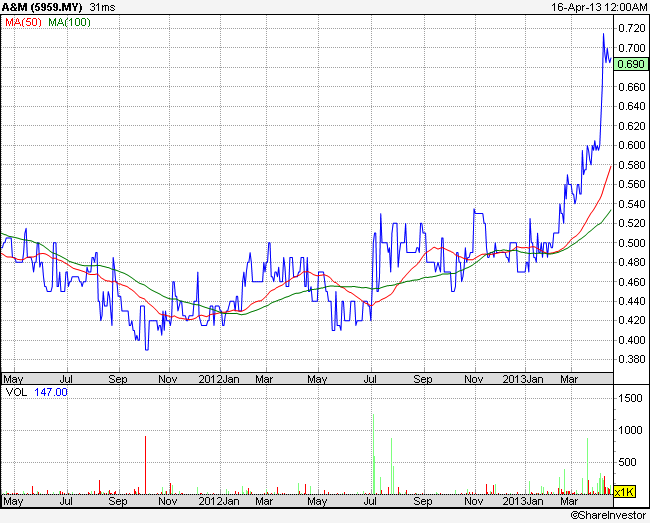

果然是在蠢蠢欲动............

|

|

|

|

|

|

|

|

|

|

|

|

发表于 17-4-2013 10:51 PM

|

显示全部楼层

发表于 17-4-2013 10:51 PM

|

显示全部楼层

yatlokfatt 发表于 17-4-2013 03:58 PM

果然是在蠢蠢欲动............

开始收网了。庆丰收。 |

|

|

|

|

|

|

|

|

|

|

|

发表于 30-5-2013 07:12 PM

|

显示全部楼层

发表于 30-5-2013 07:12 PM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31/03/2013 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31/03/2013 | 31/03/2012 | 31/03/2013 | 31/03/2012 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 26,716 | 32,507 | 26,716 | 32,507 | | 2 | Profit/(loss) before tax | 5,044 | 6,521 | 5,044 | 6,521 | | 3 | Profit/(loss) for the period | 3,649 | 5,024 | 3,649 | 5,024 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 3,317 | 4,537 | 3,317 | 4,537 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.91 | 1.24 | 0.91 | 1.24 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.4200 | 1.4200 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 16-6-2013 10:29 AM

|

显示全部楼层

发表于 16-6-2013 10:29 AM

|

显示全部楼层

无奈的事,尽然起到0.90以上了!

产业股好好hiong!! |

|

|

|

|

|

|

|

|

|

|

|

发表于 17-6-2013 11:46 PM

|

显示全部楼层

发表于 17-6-2013 11:46 PM

|

显示全部楼层

上市以來持續獲利 A&M實業再刷新高

財經17 Jun 2013 17:12

(吉隆坡17日訊)A&M實業(A&M,5959,主要板房產)上市逾20年來持續獲利,近日成散戶追捧目標,股價延續上週漲勢,再度升破52週新高。

該股開市勁起10仙,報1.05令吉,漲幅在10分鐘內擴大至13仙,攀至1.08令吉,刷新上週五始寫下的52週最高紀錄。

休市時,該股報1.05令吉,漲10仙,成交量616萬6100股。截至下午4時,A&M實業報1.05令吉,起10仙,成交量696萬8200股。

JF Apex證券研究在報告指出,A&M實業自1995年上市以來,即使金融危機時期仍持續獲利,3年淨利年複成長率達24%。

報告指出,該公司未來可能透過收購或大股東注入資產的方式擴展地庫,此舉將進一步推升盈利和淨資產值。

截至今年首季,A&M實業淨現金達8000萬令吉或每股22仙,不過從2008年至今並沒有派息。

該公司位于巴生谷的2500英畝地庫,已開發為一系列的Amverton高檔房地產項目,且將與大股東聯營發展位于凱利島(Pulau Carey)、總發展值達100億令吉的Amverton Cove發展計劃。

儘管如此,該公司創辦人家族持有公司71.56%股權,股票自由流動率低,為風險之一。

其他風險包括未來業務成長高度依賴凱利島的2000英畝Amverton Cove計劃。

JF Apex證券研究建議“短線買入”,根據房產領域平均12.2倍本益比和該公司2013財年每股9仙的盈利預測,目標價為1.10令吉。[中国报财经] |

|

|

|

|

|

|

|

|

|

|

|

发表于 22-6-2013 12:53 AM

|

显示全部楼层

发表于 22-6-2013 12:53 AM

|

显示全部楼层

热门股 A&M 地产 上挑RM1 . 30

股市 热股技术点评 2013-06-19 12:39

A&M地产(A&M,5959,主板产业股)日线趋势于6于18日显现一段技术反弹趋势,闭市时收1.14令吉,按日涨11仙或10.68%。它于昨日午盘时开始走高。

短期间该股料会上看1.15至1.30令吉水平。

http://www.nanyang.com/node/542493?tid=704

尽管在巴生港推行100亿项目 A&M仍遭严重低估

二零一三年六月二十二日 凌晨十二时

(吉隆坡21日讯)当高谈阔论谈及Amverton湾高尔夫球岛度假村的发展时,A&M实业有限公司(A&M,5959,产业组)主席拿督黃天福有明显的兴奋。

该发展是黃氏在巴生港南部占地2000英亩的Carey岛屿推行100亿令吉工程的其中一部分计划。

黄氏在30多年前在巴生直落布莱买进了其生平首块土地,经过多年的默默耕耘,终于创出一个春天。

他告诉一家英文报馆称:“你一定要亲身前来该处见识,空气是新鲜的,有这么多的绿色植物,这是真的不同于这里。”

这名现年60岁训练有素的工程师,是巴生人士朴实无华。他显得悠闲,无忧无虑的但有商业头脑。

他称:“我是以10万令吉价格购买了10英亩的土地,今日其价格已涨至200万令吉。”

不用说,该交易点燃了他对房地产行业的兴趣,他由公务员离职后,而于1978年创立了A&M实业。

此后,公司以其品牌本身作为一种生活方式的开发,已完成和交付的住宅、商业和工业单位价值高达10亿令吉。

不过,这绝不是非常激进的,因这里的房地产行业在过去的几十年里一直增长迅速。

黃氏称:“我喜欢做一些适当缓慢而稳定的事。”这也许可以解释为什么这个早在1995年上市的公司,从未真正获得分析师的评估。

但事情明显已出现了变化,特别是Carey岛屿的进展。

与家族控制A&M实业71.56%股权的黃氏,最近接受房地产分析师的访问时表示,他正在寻找被低估的地产股。

与此同行看齐,A&M实业股票在大选后节节挺升,并上涨了逾40%至目前的1.16令吉。

尽管如此,它仍然是“严重低估”,如果你将其资产的价值与其股价比较,一位分析师说,虽然这个问题是获得大多数地产公司的认同。

他指称,公司在购买2000英亩的Carey岛屿时,每平方尺少过1令吉,虽然公司从未重新评估该地库的价格,有鉴于目前的市场价来看,该地段的价格,每平方尺将超过50令吉。

换句话说,A&M实业在收购该2000英亩的Carey岛屿时,所支付的款项少过1亿令吉,而现其价值已达42亿令吉。

根据粗略计算,该公司的每股估值为11.50令吉。

黄氏称,有关发展无疑是一个改变游戏规则的公司。

“人们越来越远离城市生活的想法越来越开放。”

http://www.kwongwah.com.my/news/2013/06/22/2.html

被低估的好股 本帖最后由 icy97 于 22-6-2013 02:29 AM 编辑

|

|

|

|

|

|

|

|

|

|

|

|

发表于 23-8-2013 09:30 PM

|

显示全部楼层

发表于 23-8-2013 09:30 PM

|

显示全部楼层

下个星期应该会出6月的财务报告,希望能有好消息  |

|

|

|

|

|

|

|

|

|

|

|

发表于 28-8-2013 08:42 PM

|

显示全部楼层

发表于 28-8-2013 08:42 PM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30/06/2013 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30/06/2013 | 30/06/2012 | 30/06/2013 | 30/06/2012 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 33,138 | 32,090 | 59,854 | 64,597 | | 2 | Profit/(loss) before tax | 7,510 | 7,328 | 12,554 | 13,849 | | 3 | Profit/(loss) for the period | 5,945 | 5,275 | 9,594 | 10,299 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 5,595 | 4,833 | 8,912 | 9,370 | | 5 | Basic earnings/(loss) per share (Subunit) | 1.53 | 1.32 | 2.44 | 2.57 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.4400 | 1.4200 |

本帖最后由 icy97 于 28-8-2013 09:03 PM 编辑

|

|

|

|

|

|

|

|

|

|

|

|

发表于 28-8-2013 09:12 PM

|

显示全部楼层

发表于 28-8-2013 09:12 PM

|

显示全部楼层

成绩看来还不错,希望明天可以推着上 .gif) |

|

|

|

|

|

|

|

|

|

|

|

发表于 30-11-2013 01:51 AM

|

显示全部楼层

发表于 30-11-2013 01:51 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30/09/2013 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30/09/2013 | 30/09/2012 | 30/09/2013 | 30/09/2012 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 36,540 | 36,535 | 96,394 | 101,132 | | 2 | Profit/(loss) before tax | 15,322 | 10,600 | 27,876 | 24,449 | | 3 | Profit/(loss) for the period | 10,777 | 8,001 | 20,371 | 18,300 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 10,420 | 7,675 | 19,332 | 17,045 | | 5 | Basic earnings/(loss) per share (Subunit) | 2.85 | 2.10 | 5.30 | 4.67 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.4700 | 1.4200 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 11-1-2014 01:12 AM

|

显示全部楼层

发表于 11-1-2014 01:12 AM

|

显示全部楼层

收购拥庞大地库公司 A&M 拟推介7亿房产

财经新闻 财经 2014-01-12 09:26

(吉隆坡11日讯)A&M地产(A&M,5959,主板产业股)以8500万令吉现金,收购持有庞大地库的公司股权,并预期推介总值7亿令吉的房地产发展计划。

A&M地产向马交所报备,以上述价格向A&M地产执行主席拿督黄天福及家族成员,收购Unik Sejati私人有限公司的92.59%股权。

黄天福目前掌控了A&M地产的61.75%股权。

Unik Sejati目前在雪州双溪毛糯拥有加总约54公顷的两块永久地契土地,市值达1亿7000万令吉。

“这两块土地预期将用于总值7亿令吉的房地产发展计划。”[南洋网财经]

Type | Announcement | Subject | OTHERS | Description | PROPOSED ACQUISITION BY A & M OF TWENTY FIVE (25) ORDINARY SHARES OF RM1.00 EACH IN UNIK SEJATI SDN. BHD. (“UNIK SEJATI”), REPRESENTING 92.59% OF THE TOTAL ISSUED AND PAID-UP SHARE CAPITAL OF UNIK SEJATI, FOR A TOTAL CASH CONSIDERATION OF RM85 MILLION (“PROPOSED ACQUISITION”) | Kindly refer to the attachment for further information. |

本帖最后由 icy97 于 12-1-2014 10:38 PM 编辑

|

|

|

|

|

|

|

|

|

|

|

|

发表于 12-1-2014 10:51 PM

|

显示全部楼层

发表于 12-1-2014 10:51 PM

|

显示全部楼层

A&M Realty’s unexpected gold mine

By Doreen Leong

Friday, 10 Jan 2014, 12:20 AM

http://www.focusmalaysia.my/Mainstream/A-M-Realty-s-unexpected-gold-mine

For more than two decades, property developer A&M Realty Bhd has been sitting on a 775.2ha parcel on remote Carey Island in Jugra, Selangor. The land, purchased by the company in 1990, had been left idle with no development.

Now, the property has become a gold mine with the completion of the Carey Island access interchange of the South Klang Valley Expressway (SKVE) expected in 2015, and A&M stands to reap a windfall.

Plans are afoot to undertake a RM10 bil gross development value integrated property development known as Amverton Cove, comprising a golf course, homesteads, bungalows, service apartments, hotels and theme parks.

“The completion of the Carey Island interchange will boost the value of properties in the surrounding areas, as accessibility will be greatly enhanced. The SKVE, which connects Carey Island to Puchong, will help expedite housing development in nearby townships and will inevitably lead to a spillover effect in property demand on Carey Island,” says an analyst.

A&M’s flagship development, Amverton Cove will be built over at least 15 years. Its maiden project, the Amverton Cove Golf & Island Resort, is already in operation.

A&M also has an 8ha plot in Bukit Kemuning, Shah Alam, 72ha in Morib, Selangor and 1.2ha in Mont’ Kiara. All its recent projects carry the Amverton brand.

For the full story, please subscribe to Focus Malaysia.

本帖最后由 icy97 于 12-1-2014 11:02 PM 编辑

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|