|

|

【FIHB 8605 交流专区】(前名 FFHB)

[复制链接]

|

|

|

发表于 28-5-2015 12:58 AM

|

显示全部楼层

发表于 28-5-2015 12:58 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2015 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2015 | 31 Mar 2014 | 31 Mar 2015 | 31 Mar 2014 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 18,720 | 16,231 | 18,720 | 16,231 | | 2 | Profit/(loss) before tax | 1,101 | 687 | 1,101 | 687 | | 3 | Profit/(loss) for the period | 836 | 687 | 836 | 687 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 813 | 679 | 813 | 679 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.98 | 0.82 | 0.98 | 0.82 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.4847 | 0.3802

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 30-8-2015 03:40 PM

|

显示全部楼层

发表于 30-8-2015 03:40 PM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2015 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2015 | 30 Jun 2014 | 30 Jun 2015 | 30 Jun 2014 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 21,922 | 10,978 | 40,642 | 27,209 | | 2 | Profit/(loss) before tax | 1,571 | 1,152 | 2,672 | 1,839 | | 3 | Profit/(loss) for the period | 958 | 462 | 1,794 | 1,149 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 920 | 458 | 1,733 | 1,137 | | 5 | Basic earnings/(loss) per share (Subunit) | 1.11 | 0.55 | 2.10 | 1.37 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.4963 | 0.3857

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 1-12-2015 12:34 AM

|

显示全部楼层

发表于 1-12-2015 12:34 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2015 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2015 | 30 Sep 2014 | 30 Sep 2015 | 30 Sep 2014 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 28,245 | 16,507 | 68,887 | 43,716 | | 2 | Profit/(loss) before tax | 3,597 | 471 | 6,269 | 2,310 | | 3 | Profit/(loss) for the period | 2,237 | 174 | 4,031 | 1,323 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 2,259 | 97 | 3,992 | 1,234 | | 5 | Basic earnings/(loss) per share (Subunit) | 2.73 | 0.12 | 4.83 | 1.49 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.5233 | 0.3878

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 6-12-2015 08:04 PM

|

显示全部楼层

发表于 6-12-2015 08:04 PM

|

显示全部楼层

聯邦家私爭取星巴克中國合約

2015-12-06 09:31

(吉隆坡5日訊)很少人知道,亞洲星巴克連鎖咖啡店內部裝置由聯邦家私(FFHB,8605,主板消費品組)位於雪蘭莪萬津工廠所生產。

該公司是星巴克亞太區11個國家的獨家店面裝置供應商,但中國市場除外,現在正為獲取星巴克全球最大市場――中國店面內部裝置鋪路。

聯邦家私董事經理蔡偉興表示,正在與星巴克洽談,探討一些數據,相信另一波成長將來臨,因星巴克平均一年要在中國增設600間店。

星巴克中國店面

4年欲增至3400間

星巴克有意拓增中國店面,未來4年料從目前1千400間增至3千400間,料讓該公司從中國市場獲取巨大成長機會。

他相信,以聯邦家私強穩紀錄及與星巴克良好關係,可從中國拓展計劃中受惠。

該公司計劃在青島租工廠,已獲當地執法單位批准,可在12個月內投運,目前僅需投資1千萬至1千500萬令吉於機械器材。

2007年該公司曾暫停中國拓展計劃,取得製造執照及在青島設立公司,但卻在最後一刻因未準備好而喊停。

他預計,中國市場最早可在2017年第三季開始貢獻,從一年供應約100間店開始,數量料隨星巴克迅速擴展增加,未來銷量料至少增加50%,放眼5年15%至20%營業額及淨利成長。

目前該公司每年輸出300至400件星巴克裝置至亞太國家,包括韓國、日本、印尼及泰國。(星洲日報/財經‧TheEdge專頁) |

|

|

|

|

|

|

|

|

|

|

|

发表于 6-1-2016 12:02 AM

|

显示全部楼层

发表于 6-1-2016 12:02 AM

|

显示全部楼层

本帖最后由 icy97 于 6-1-2016 12:56 AM 编辑

Tradeview - 2016 Value Pick No.4 (Federal Furniture Holdings Berhad)

Author: tradeview | Publish date: Tue, 5 Jan 2016, 08:31 PM

http://klse.i3investor.com/blogs/tradeview/88631.jsp

Dear fellow traders,

I meant to write FFHB for some time now. In fact, it was done half way in my draft as I never expected it to move anytime soon. With such a volatile day 1 trading for 2016, my concentration was on understanding the macros of the world (be it whether China plunge was due to the moratorium lift or truly growth concern). I have shared 3 picks so far namely : 1. Magni 2. UPA 3. Apollo

Once again, these writings are just my humble highlights (not recommendation), feel free to have some intellectual discourse on this.

_____________________________________________________________________________

Value Pick No. 4: Federal Furniture Holdings Bhd (TP RM1.20)

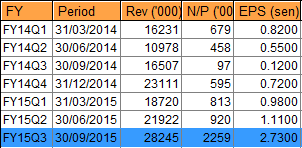

Q3 Results of FFHB which was released on 30 Nov 2015 exceeded expecatations of many. Most would know by now many counters that has run up are export counters such as glove makers / wood / furniture / E&E. Simply because of the weak MYR, these companies are making supernormal profit margins which were nowhere to be seen over the past few years. Q3 has shown that the EPS increased from 0.12 sens to 2.73 sens. which is a 23 times increase in net profit YoY. The NTA also increased to RM0.52. Looking at the immediate past 3 quarters, the revenue and EPS increased respectively each quarter at an alarming rate:

There are many ways to look at this counter to arrive at a fair value. My method usually is to rely on trailing EPS and apply historical average PE to arrive at a fair value. I believe a simple analysis of the quarterly results coupled with macro outlook will help reach a more accurate result because only earnings of shares can drive share price upwards in less favourable market condition.

Most furniture company has shot up and most would think there are no more opportunities for counters like this. Think again. Gems are in the market waiting to discovered. This is one of it. FFHB is not a conventional furniture maker. Apart from it being a furniture play, it is in actual fact, a Starbucks play. As the sole exclusive licensee of the Starbucks supplier of furniures / ID / fitting for Asia Pacific (excluding China), the potential of this counter is tied to Starbucks growth strategy which is to continue expanding the presence in South East Asia and China as the growth driver. If you believe in the potential growth of Starbucks, then dont hesistate to jump in.

Global and Channel Expansion

Starbucks China and Asia-Pacific region represent enormous, immediate, high-value opportunities for the company, and Starbucks today announced plans to double its store count in China – to over 3,000 stores – by 2019. When completed in the second quarter of 2015, Starbucks acquisition of Starbucks Japan – the company’s first international market outside of North America and with more than 1,000 stores its second largest market overall in retail store sales – will position Starbucks to further accelerate growth in the dynamic, rapidly-growing CAP region.

Starbucks is the industry leader in premium single serve, premium packaged roast and ground coffee, and Ready-to-Drink products served outside the company’s retail stores and is ideally positioned to grow its share of these markets both in the U.S. and globally. At Investor Day 2014, company leaders will share that over the next five years Starbucks Channel Development segment will grow its revenue by 60%, nearly double its operating income, and more than double its RTD business outside of the U.S. with a specific focus on unlocking untapped opportunities across the company’s China and Asia-Pacific region.

Based on a trailing EPS of last 4Q of 5.54 sens, at current price of 91 sens, it is trading at 16x PE. This would appear fairly valued. However, this is only on the surface. With one more quarter for the financial year, in terms of revenue and net profit, FFHB is only behind the best financial year results in 2012 by a mere RM12million and RM300k respectively. It is almost 100% set in stone that FFHB will exceed 2012's full years revenue and net profit based on the latest quarterly results.

With this in mind, the potential for FFHB to deliver a record results within the past 5 years is almost certainty. Against its peers (furniture exporters), PoHuat / Hevea / SHH is trading at an average of 12x. Moving forward, I am confident the next 2 Quarters EPS will be at least 3 sens each. This is a very conservative stance as FFHB is not a pure furniture exporter. With a total forward full year EPS of 9.84, applying a multiple of 10, the fair value of FFHB should be RM0.98. However, as FFHB is now starting to reap the rewards from entering China on top of being the sole exclusive licensed supplier to Starbucks for Asia Pacific, I think continue applying a multiple of 10 is unfair. This is coupled with the fact the company is mulling to formulate dividend policy to reward loyal shareholders. As such, I raise the multiple to 12x and conservatively forecast the next 4Q EPS to be at 10 sens, this would bring the FV to RM1.20 which in my opinion is reasonable. I will likely revised my TP upwards should the next quarter results exceeds my expectation of 3 sens EPS.

Food for thought: The top is never in sight if vitiated by hope.

May good fortune come your way!

Disclaimer: This is not a recommendation to trade. It is merely the expression of the author's personal opinion and shall not be held responsbile for potential gains or losses executed by readers. |

|

|

|

|

|

|

|

|

|

|

|

发表于 6-1-2016 06:31 PM

|

显示全部楼层

发表于 6-1-2016 06:31 PM

|

显示全部楼层

本帖最后由 icy97 于 6-1-2016 06:57 PM 编辑

浅谈 FFHB

Wednesday, January 6, 2016

http://bblifediary.blogspot.tw/2016/01/ffhb.html

业务

- 家具

FFHB(联邦家私,8605,主板消费产品股),成立于1962年,并于1983年上市大马交易所主板。

FFHB旗下有三个主要的营运部本,分别是内部装修部门、制造业和出口部门,以及零售部门。

制造业和出口 (Manufacturing Division)

负责设计、制造和出口高品质的商店装置(shop fixtures)和组合台柜(modular casework),产品出口至超过15个国家。

内部装修部门 (Interior Fitout Division)

涉及室内设计和装修,并且供应定制家具和灯具等,主要的客户包括酒店、公寓、企业办公楼和商店等。

零售 (Retail Division)

负责从欧洲进口厨柜和衣柜系统,然后在国内销售。

看中FFHB的第一个原因,是该公司的业绩已经连续4个季度出现增长:

第二个原因,则是Starbucks。

除了刚刚提到的以上这些业务外, FFHB其实还有一个其他家具业者所没有的强项,那就是它是Starbucks Coffee连锁店亚太区11个国家的独家店面装置供应商。这些国家的Starbucks Coffee连锁店的内部装置,都出于FFHB位于雪兰莪万津的工厂。

当这些国家的Starbucks Coffee连锁店逐渐增加的同时,FFHB也会跟着受惠。

此外,目前FFHB也积极争取Starbucks中国的所有连锁店的内部装置。如果成功争取到中国这个庞大的市场,相信将会对FFHB未来数年的业绩带来另一波的成长势头。根据报道,中国Starbucks Coffee计划在未来4年从1400家连锁店扩展至3400家。

FFHB的董事经理蔡伟兴预料中国Starbucks将会在2017年开始对该公司做出贡献。

以FFHB最新一季的每股净利来计算,个人认为其合理价应该处于RM1.09。

但是如果市场愿意给它15倍本益比的估值,那么其合理价可进一步提高到RM1.62。

免责声明:

以上投资分析,纯属本人个人意见和观点。

在买进一家公司的股份前,请先做功课并了解该公司,任何人因看此文章而造成任何投资损失,本人恕不负责。切记,买卖自负! |

|

|

|

|

|

|

|

|

|

|

|

发表于 6-1-2016 06:56 PM

|

显示全部楼层

发表于 6-1-2016 06:56 PM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 6-1-2016 09:11 PM

|

显示全部楼层

发表于 6-1-2016 09:11 PM

|

显示全部楼层

不必客气

|

|

|

|

|

|

|

|

|

|

|

|

发表于 1-3-2016 02:00 AM

|

显示全部楼层

发表于 1-3-2016 02:00 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2015 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2015 | 31 Dec 2014 | 31 Dec 2015 | 31 Dec 2014 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 32,879 | 23,111 | 101,766 | 66,827 | | 2 | Profit/(loss) before tax | 3,003 | 896 | 9,272 | 3,206 | | 3 | Profit/(loss) for the period | 2,314 | 645 | 6,345 | 1,968 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 2,231 | 595 | 6,223 | 1,829 | | 5 | Basic earnings/(loss) per share (Subunit) | 2.70 | 0.72 | 7.53 | 2.21 | | 6 | Proposed/Declared dividend per share (Subunit) | 1.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.5514 | 0.4737

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 1-3-2016 02:01 AM

|

显示全部楼层

发表于 1-3-2016 02:01 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | PROPOSED FINAL DIVIDEND | The Board of Directors has resolved to recommend the payment of a single tier final dividend of one (1) sen per share in respect of the financial year ended 31 December 2015. This dividend is subject to the approval of shareholders at the forthcoming Annual General Meeting of the Company. The entitlement and payment dates will be determined and announced in due course. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 28-4-2016 08:35 PM

|

显示全部楼层

发表于 28-4-2016 08:35 PM

|

显示全部楼层

本帖最后由 icy97 于 28-4-2016 08:43 PM 编辑

| 8605 FFHB FEDERAL FURNITURE HOLDINGS (M) | | Final Dividend 1 Sen |

| | Entitlement Details: | Final dividend of one (1) sen per ordinary share in respect of the

financial year ended 31 December 2015

|

| | Entitlement Type: | Final Dividend | | Entitlement Date and Time: | 03/06/2016 05:00 AM | | Year Ending/Period Ending/Ended Date: | 31/12/2015 | | EX Date: | 01/06/2016 | | To SCANS Date: |

| | Payment Date: | 17/06/2016 |

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 31-5-2016 12:29 AM

|

显示全部楼层

发表于 31-5-2016 12:29 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2016 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2016 | 31 Mar 2015 | 31 Mar 2016 | 31 Mar 2015 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 27,082 | 18,720 | 27,082 | 18,720 | | 2 | Profit/(loss) before tax | 1,632 | 1,101 | 1,632 | 1,101 | | 3 | Profit/(loss) for the period | 1,222 | 836 | 1,222 | 836 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 1,141 | 813 | 1,141 | 813 | | 5 | Basic earnings/(loss) per share (Subunit) | 1.38 | 0.98 | 1.38 | 0.98 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.5684 | 0.4847

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 9-8-2016 03:45 AM

|

显示全部楼层

发表于 9-8-2016 03:45 AM

|

显示全部楼层

Notice of Interest Sub. S-hldr (29A)| FEDERAL FURNITURE HOLDINGS (M) BERHAD |

Particulars of Substantial Securities HolderName | GV ASIA FUND LIMITED | Address | Room 2002, 20th Floor, Hing Yip Commercial Centre

272-284 Des Voeux Road Central

Hong Kong

Hong Kong. | Company No. | LL09405 | Nationality/Country of incorporation | Malaysia | Descriptions (Class & nominal value) | Ordinary share of RM0.50 each | Name & address of registered holder | Room 2002, 20th Floor, Hing Yip Commercial Centre272-284 Des Voeux Road CentralHong Kong |

| Date interest acquired & no of securities acquired | Currency |

| | Date interest acquired | 05 Aug 2016 | No of securities | 4,291,400 | Circumstances by reason of which Securities Holder has interest | Acquisition via open market transactions | Nature of interest | Direct | Price Transacted ($$) |

|

| | Total no of securities after change | Direct (units) | 4,291,400 | Direct (%) | 5.02 | Indirect/deemed interest (units) |

| | Indirect/deemed interest (%) |

| | Date of notice | 08 Aug 2016 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 13-8-2016 02:14 AM

|

显示全部楼层

发表于 13-8-2016 02:14 AM

|

显示全部楼层

本帖最后由 icy97 于 13-8-2016 04:15 AM 编辑

3300万买PMSB 60%

联邦家私进军建筑业

2016年8月13日

(吉隆坡12日讯)联邦家私(FFHB,8605,主板消费产品股)建议多元化业务和收购一家建筑公司的60%股权。

根据文告,公司和子公司现有的核心业务为家具制造和贸易、室内装修和翻新,以及投资控股。

展望未来,联邦家私估计涉足新的建筑业务将会增长,并为公司捎来盈利贡献,因此寻求股东放行,多元化业务。

另外,联邦家私昨日和卖方签署有条件买卖合约,以3300万令吉收购Pembinaan Masteron私人有限公司(PMSB)的60%股权。

公司将以600万令吉现金支付,另外2700万令吉则是通过发行每股10仙的2亿7000万的可赎回可转换优先股(RCPS)支付。

持G7护照

PMSB主要的业务是建筑和负责大马产业发展商的建筑工程,同时持有大马建筑工业发展局(CIDB)的G7级别执照,能参与更多高价值的工程。

PMSB目前已完成14项工程,包括住宅、工业和商业项目,共有5项主要工程进行中,截至目前手握3亿5500万令吉的订单。【e南洋】

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

RELATED PARTY TRANSACTIONS | Description | FEDERAL FURNITURE HOLDINGS (M) BERHAD ("FFHB" OR "COMPANY")(I) PROPOSED DIVERSIFICATION;(II) PROPOSED ACQUISITION OF PEMBINAAN MASTERON SDN BHD ("PMSB"); AND(III) PROPOSED AMENDMENTS(COLLECTIVELY REFERRED TO AS THE "PROPOSALS") | On behalf of the Board of Directors of FFHB ("Board"), Mercury Securities Sdn Bhd ("Mercury Securities") wishes to announce that FFHB proposes to undertake the following exercises:- (i) Diversification of FFHB and its subsidiaries' existing core business ("Proposed Diversification"); (ii) An acquisition of 450,000 ordinary shares of RM1.00 each in PMSB (“Sale Shares”) representing sixty percent (60%) of the equity interest in PMSB for a total consideration of RM33.0 million (“Purchase Consideration”) to be satisfied via a combination of cash and issuance of new redeemable convertible preference shares of RM0.10 each in FFHB (“RCPS”) (“Proposed Acquisition”); and (iii) Amendments to the Memorandum and Articles of Association of FFHB (“Proposed Amendments”).

Further information on the Proposals is set out in the attachment.

This announcement is dated 12 August 2016. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5175065

|

|

|

|

|

|

|

|

|

|

|

|

发表于 16-8-2016 04:39 AM

|

显示全部楼层

发表于 16-8-2016 04:39 AM

|

显示全部楼层

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

RELATED PARTY TRANSACTIONS | Description | FEDERAL FURNITURE HOLDINGS (M) BERHAD (FFHB OR COMPANY)(I) PROPOSED DIVERSIFICATION;(II) PROPOSED ACQUISITION OF PEMBINAAN MASTERON SDN BHD (PMSB); AND(III) PROPOSED AMENDMENTS(COLLECTIVELY REFERRED TO AS THE PROPOSALS) | (For consistency, the abbreviations used throughout this announcement shall have the same meanings as defined in the Company’s announcement dated 12 August 2016 in relation to the abovementioned matter, where applicable, unless stated otherwise or defined herein.)

We refer to the Company’s announcement dated 12 August 2016 in relation to the Proposals.

On behalf of the Board, Mercury Securities wishes to provide additional information in relation to the basis of the Purchase Consideration on the Proposed Acquisition of PMSB.

Please refer to the attachment for the above information.

This announcement is dated 15 August 2016. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5176257

|

|

|

|

|

|

|

|

|

|

|

|

发表于 29-8-2016 01:49 AM

|

显示全部楼层

发表于 29-8-2016 01:49 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2016 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2016 | 30 Jun 2015 | 30 Jun 2016 | 30 Jun 2015 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 24,463 | 21,922 | 51,545 | 40,642 | | 2 | Profit/(loss) before tax | 1,433 | 1,571 | 3,065 | 2,672 | | 3 | Profit/(loss) for the period | 1,063 | 958 | 2,285 | 1,794 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 1,057 | 920 | 2,198 | 1,733 | | 5 | Basic earnings/(loss) per share (Subunit) | 1.27 | 1.11 | 2.63 | 2.10 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.5689 | 0.4963

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 25-9-2016 05:09 AM

|

显示全部楼层

发表于 25-9-2016 05:09 AM

|

显示全部楼层

受惠新业务星巴克贡献.联邦家私盈利先跌后起

(吉隆坡23日讯)肯纳格研究认为,联邦家私(FFHB,8605,主板消费品组)2016财政年近期净利虽萎缩,但新收购建筑业务可为室内装修业务带来协同效应,加上主要客户星巴克的全球拓展计划持续,该公司未来净利有望翻倍成长。

肯纳格表示,该公司2015财政年的盈利飙涨229%,基于比较准则高,预期该2016财政年盈利将下挫29.7%。

不过,在营收恢复稳定后,肯纳格看好该公司2017和2018财政年盈利可强力反弹119.6%及35.9%。

PMSB盈利贡献稳定

早前,该公司耗资3300万令吉收购建筑公司Pembinaan Masteron(PMSB)的60%股权。PMSB手握3亿5500万令吉合约,未来2至3年内可贡献稳定的盈利。

肯纳格补充,PMSB可给予联邦家私2016财政年700万令吉的盈利保证,预期2016财政年至2018财政年的盈利可达到2000万令吉。

肯纳格说,PMSB可与该公司原有的室内装修业务达成协同效益,值得一提的是,装修业务近期攫取及完成了包括St Regis酒店在内的合约。此外,在赚幅提高和税率降低之下,该公司净赚幅从2.8%,提高至6%。

此外,肯纳格也表示,联邦家私家具制造与贸易业务90%来自星巴克的贡献,而星巴克积极在中国、印度与柬埔寨进行拓展计划,可让联邦家私从中受惠。

目前,联邦家私已经承包了部份亚洲国家星巴克的厨房装修,此举将会提振联邦家私产能,并在今年第二季投运,预期可增加20至30%的产能。目前,联邦家私工厂的使用率约70%。

股息方面,继2015财政年派发每股1仙后,由于净负债率仅0.05倍,资本开销也不高,肯纳格预期该公司2017和2018财政年可分别派发每股1.2仙和1.5仙股息,周息率报1.7%和2.1%。

综合上述看法,肯纳格以2017财政年的8.8倍本益比为准,给予联邦家私74仙合理价,但没有给予任何评级。

文章来源:

星洲日报/财经‧报道:谢汪潮·2016.09.23 |

|

|

|

|

|

|

|

|

|

|

|

发表于 10-11-2016 02:00 AM

|

显示全部楼层

发表于 10-11-2016 02:00 AM

|

显示全部楼层

| FEDERAL FURNITURE HOLDINGS (M) BERHAD |

| 1. Details of Corporate Proposal | Involve issuance of new type/class of securities ? | No | Types of corporate proposal | Exercise of Warrants | Details of corporate proposal | Exercise of warrants | No. of shares issued under this corporate proposal | 4,215,300 | Issue price per share ($$) | Malaysian Ringgit (MYR) 0.5000 | Par Value ($$) | Malaysian Ringgit (MYR) 0.500 | | Latest issued and paid up share capital after the above corporate proposal in the following | Units | 90,349,900 | Currency | Malaysian Ringgit (MYR) 45,174,950.000 | Listing Date | 10 Nov 2016 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 13-11-2016 04:16 PM

|

显示全部楼层

发表于 13-11-2016 04:16 PM

|

显示全部楼层

Name | CHOY FOOK ON & SONS REALTY SDN BHD | Address | Level P1, Menara Choy Fook On

1B Jalan Yong Shook Lin

Petaling Jaya

46050 Selangor

Malaysia. | Company No. | 103930-K | Nationality/Country of incorporation | Malaysia | Descriptions (Class & nominal value) | Ordinary Share of RM0.50 each | Name & address of registered holder | Choy Fook On & Sons Realty Sdn BhdLevel P1, Menara Choy Fook On1B Jalan Yong Shook Lin46050 Petaling JayaSelangor |

Details of changesCurrency: Malaysian Ringgit (MYR) | Type of transaction | Description of Others | Date of change | No of securities

| Price Transacted ($$)

| | Others | Exercise of warrants | 08 Nov 2016 | 1,900,000

|

|

Circumstances by reason of which change has occurred | Exercise of FFHB warrants into ordinary shares | Nature of interest | Direct | Direct (units) | 13,373,540 | Direct (%) | 14.802 | Indirect/deemed interest (units) |

| | Indirect/deemed interest (%) |

| | Total no of securities after change | 13,373,540 | Date of notice | 08 Nov 2016 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 3-12-2016 06:10 AM

|

显示全部楼层

发表于 3-12-2016 06:10 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2016 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2016 | 30 Sep 2015 | 30 Sep 2016 | 30 Sep 2015 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 27,738 | 28,245 | 79,283 | 68,887 | | 2 | Profit/(loss) before tax | 1,540 | 3,597 | 4,605 | 6,269 | | 3 | Profit/(loss) for the period | 1,095 | 2,237 | 3,380 | 4,031 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 1,067 | 2,259 | 3,265 | 3,902 | | 5 | Basic earnings/(loss) per share (Subunit) | 1.27 | 2.73 | 3.88 | 4.83 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.5812 | 0.5233

|

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|