|

|

发表于 24-2-2017 04:54 AM

|

显示全部楼层

发表于 24-2-2017 04:54 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2016 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2016 | 31 Dec 2015 | 31 Dec 2016 | 31 Dec 2015 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 60,400 | 104,019 | 239,920 | 307,147 | | 2 | Profit/(loss) before tax | 8,409 | 9,143 | 33,348 | 28,998 | | 3 | Profit/(loss) for the period | 4,608 | 5,686 | 21,128 | 18,529 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 4,295 | 5,054 | 20,006 | 18,395 | | 5 | Basic earnings/(loss) per share (Subunit) | 3.39 | 3.98 | 15.77 | 14.50 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 3.2900 | 3.1600

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 3-5-2017 01:38 AM

|

显示全部楼层

发表于 3-5-2017 01:38 AM

|

显示全部楼层

本帖最后由 icy97 于 3-5-2017 02:54 AM 编辑

威达获3.51亿合约

提升砂医院设施

2017年4月29日

(吉隆坡28日讯)威达(WEIDA,7111,主板工业产品股)透过旗下公司,获得卫生部特许协议书(CA),为砂拉越综合医院提供升级服务,建设新日间照顾中心和停车场,规模达3亿5100万令吉。

威达今天向交易所报备,子公司Weida Medic发展私人有限公司持有49%的Asaljuru Weida私人有限公司(简称AW公司),获得上述合约。

AW公司将会为该综合医院,设计、建设以及调试位于砂拉越古晋的新建筑和设备,包括Medi-Hotel日间照顾中心和多层停车场。

建设工程为期3年,成本为3亿5100万令吉。

此外,该公司也会负责管理上述新建筑和设备,并且提供维修服务,为期20年。

AW公司能根据特许协议,规定资产管理服务等相关费用。【e南洋】

Type | Announcement | Subject | OTHERS | Description | WEIDA (M) BHD. ("WEIDA")CONCESSION AGREEMENT BETWEEN THE GOVERNMENT OF MALAYSIA AND ASALJURU WEIDA SDN. BHD., A 49% OWNED ASSOCIATED COMPANY OF WEIDA MEDIC DEVELOPMENT SDN. BHD. | 1. INTRODUCTION The Board of Directors of Weida (“Board”) wishes to announce that Asaljuru Weida Sdn. Bhd. (“AWSB”), a 49% owned associated company of Weida Medic Development Sdn. Bhd. (“WMDSB”), which in turn is a wholly-owned subsidiary of Weida, has on 28 April 2017 entered into a Concession Agreement (the “CA”) with the Government of Malaysia as represented by the Minister of Health in relation to the upgrading of Hospital Umum Sarawak (the “HUS”) by way of development of new buildings and facilities, on a public private partnership by way of private financing initiative under the build, lease, maintain and transfer model.

2. DETAILS OF THE CA 2.1 Subject to the terms and conditions of the CA, the Government of Malaysia grants to AWSB the rights and authorities to undertake: (i) the planning, design, financing, development, construction, landscaping, supply, installation, completion, testing and commissioning of new buildings and facilities comprising the Day Care Centre, the Medi-Hotel and Multi-Storey Car Park and the Multi-Storey Car Park Complex (hereinafter collectively referred to as “New Buildings and Facilities”). The New Buildings and Facilities will be located at Lot 157 and Lot 133, Section 21, Kuching Town Land District, Sarawak; (ii) the asset management services which comprise the asset replacement programme and maintenance services to the New Buildings and Facilities; and (iii) the operations and management services of the Medi-Hotel and Car Park. hereinafter collectively referred to as the “Concession”. 2.2 In conjunction with the completion of item 2.1 above, AWSB shall be entitled to the following as specified in the CA and subject to the terms and conditions therein: (i) availability charges for the completion and availability of the New Buildings and Facilities; (ii) asset management services charges for the provision of the asset management services; and (iii) net third party income arising from the gross third party income after the deduction of all operating costs and expenses related to the Medi-Hotel and Car Park Management services. 2.3 The Concession shall be for a period of twenty (20) years commencing from the date of the fulfilment of the conditions precedent to the CA or the construction commencement date whichever is later and expires on the date ending on the twentieth (20th) anniversary of that date thereof. 2.4 The construction of the New Buildings and Facilities shall be completed within thirty-six (36) months from the construction commencement date or any extended period thereof. 2.5 The construction cost for the New Buildings and Facilities is RM351,000,000.00 only.

3. INFORMATION ON AWSB AWSB (Company No. 965800-U), a 49% owned associated company of WMDSB, was incorporated in Malaysia on 27 October 2011 under the Companies Act 2016 (the “Act”) and has its registered office at Lot 8702 & 8703, Green Heights (Phase 3) Commercial Centre, Jalan Lapangan Terbang, 93250 Kuching, Sarawak. AWSB has an issued share capital of RM3,400,000.00 comprising 3,400,000 ordinary shares, out of which 2,440,000 shares have been fully paid-up. AWSB was incorporated for the sole purpose of carrying out the Concession.

The current directors and shareholders of AWSB are as follows: | Name | Designation | No. of ordinary shares held | % | | Dato’ Lee Choon Chin | Director | Nil | Nil | | Suyanto Bin Osman | Director | Nil | Nil | | Datuk Dr. Stalin Hardin | Director | Nil | Nil | | WMDSB | Shareholder | 1,666,000 | 49 | Asaljuru Construction Sdn. Bhd. (Company No. 577898-P) | Shareholder | 1,360,000 | 40 | Cahaya Majestic Sdn. Bhd. (Company No. 960579-H) | Shareholder | 374,000 | 11 |

4. INFORMATION ON WMDSB WMDSB (Company No. 543463-H) is a private limited company and a wholly-owned subsidiary of Weida. WDMSB was incorporated in Malaysia on 30 March 2001 under the Act and has its registered office at Wisma Hock Peng, Ground Floor to 2nd Floor, 123 Green Heights, Jalan Lapangan Terbang, 93250 Kuching, Sarawak. The total issued and paid-up capital of WMDSB is RM460,000.00 comprising 460,000 ordinary shares. WMDSB is principally involved in investment holding activities.

5. EFFECTS OF THE CA The CA is not expected to have any material impact on the earnings per share, net assets per share, gearing, share capital and substantial shareholders’ shareholding of Weida Group for the financial year ending 31 March 2018. However, the Concession is expected to contribute positively to the earnings of Weida Group in future financial years.

6. INTERESTS OF DIRECTORS, MAJOR SHAREHOLDERS AND PERSONS CONNECTED WITH THEM None of the Directors and/or major shareholders of Weida and/or persons connected with them have any interest, direct or indirect in the Concession.

7. DIRECTORS’ STATEMENT The Board, having considered all aspects of the Concession, is of the opinion that the Concession is in the best interest of the Company.

This announcement is dated 28 April 2017. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 13-6-2017 05:28 AM

|

显示全部楼层

发表于 13-6-2017 05:28 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2017 | 31 Mar 2016 | 31 Mar 2017 | 31 Mar 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 61,489 | 77,165 | 301,409 | 384,312 | | 2 | Profit/(loss) before tax | 995 | 13,484 | 34,343 | 42,482 | | 3 | Profit/(loss) for the period | -1,027 | 7,586 | 20,101 | 26,115 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -1,871 | 7,628 | 18,135 | 26,023 | | 5 | Basic earnings/(loss) per share (Subunit) | -1.48 | 6.01 | 14.29 | 20.51 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 3.2700 | 3.1600

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 21-6-2017 11:47 PM

|

显示全部楼层

发表于 21-6-2017 11:47 PM

|

显示全部楼层

EX-date | 05 Oct 2017 | Entitlement date | 09 Oct 2017 | Entitlement time | 05:00 PM | Entitlement subject | First and Final Dividend | Entitlement description | First and Final Single Tier Dividend of 3.00 sen per ordinary share | Period of interest payment | to | Financial Year End | 31 Mar 2017 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | SYMPHONY SHARE REGISTRARS SDN BHDLevel 6, Symphony HousePusat Dagangan Dana 1Jalan PJU 1A/4647301Petaling JayaTel:0378490777Fax:0378418152 | Payment date | 27 Oct 2017 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 09 Oct 2017 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.03 | Par Value (if applicable) | Malaysian Ringgit (MYR) 0.000 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 16-7-2017 12:50 PM

来自手机

|

显示全部楼层

发表于 16-7-2017 12:50 PM

来自手机

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 20-8-2017 07:34 PM

|

显示全部楼层

发表于 20-8-2017 07:34 PM

|

显示全部楼层

本帖最后由 icy97 于 20-8-2017 10:50 PM 编辑

专营储水排污水务产品.威达与基建景气共荣

http://www.sinchew.com.my/node/1674415/

经济成长放缓连带影响建筑领域、特别是私人领域建筑活动的成长,加上贷款难批导致产业销售减少,进而影响市场对威达(WEIDA,7111,主板工业产品组)产品,例如储水槽、化粪槽,以及水管的需求。

不过,政府专注可负担房屋的发展,料将有助于提高该公司产品的销售,此外,政府专注其他领域,例如道路建筑、提供基本设施,如水、电等配备,也有助于带动集团产品的销量。

威达集团执行主席拿督李春进说,对大马的多数企业来说,2016年是深具挑战的一年,宏观经济环境潜在压力、原油价格下跌、以及马币汇率走势波动,包括商品市场疲弱,是主要的不利影响因素。

尽管如此,集团在已结束的财政年,取得3亿零140万令吉营业额,以及3430万令吉的税前盈利,表现令大家欣慰,虽然分别比前期的3亿8430万和4280万令吉稍减。

每股净资产3.27令吉

此外,集团财务状况保持平稳,归股东盈利4亿1490万令吉,银行结存1亿1900万令吉,鉴于集团贷款偏低,目前处于净现金地位,每股资产净值为3令吉27仙。

董事部基于集团表现亮眼,建议分发一次过每股3仙股息,占集团可分配每股净利14.29仙的21%,股息回酬率为1.6%。

威达集团的主要业务分别是:生产与销售高密度聚乙烯工程产品,其他特定与科技工程产品的交易,制造领域生产的产品,包括储水槽、排污系统、交通器材、海事产品、化学品储存设备、量身定制模型产品,以及其他一些环保产品。

大马最大化粪槽制造商

地下排水系统首要制造商

李春进指出,威达在马来西亚和菲律宾共有6家制造厂,生产超过200种类型的产品,目前,威达是大马最大的化粪槽制造商,也是地下排水系统的首要制造商。

威达成为聚乙烯建筑材料制造商已超过25年,可以说是这个领域的先锋,至今仍是大马有关行业的市场领军,在东马占有主导地位。

作为水务与废水工程产品的制造商,威达是水务与废水基本设施、现代环保工程产品与方案的首要供应商。

目前,集团在全国各地拥有5个制造工厂,分别设在:汝莱、古晋、亚庇、美里和斗湖,还有1家是在菲律宾首都马尼拉。

严格来说,进军这领域的门槛相当高,最主要的是:必须有庞大的资本投资、密集的研究与发展计划,以及特定的工艺专才技术,对大型制造商来说,这个行业是资本密集类型,过去一年,市场的主要业者基本没有改变。

与此同时,威达的制造业务继续带来可观业绩,通过供应产品给政府的一些计划,包括乡村居民过滤水、可负担房屋、设立大学与教育学院、铺建较好的道路、桥梁、休闲公园、农业水殖产业设施等等。

他说,截至2017年3月31日,集团制造业营业额1亿6170万,前期为1亿9180万令吉,主要是市场对聚乙烯工程产品需求下跌,税前盈利2060万,前期为2470万令吉。

政府在提呈2017年财政预算案,以及第11大马计划时,为巩固大马经济的成长,加强建筑业的发展,料与基本设施、城市房屋与可负担房屋的发展同步进行。

李春进补充,政府推行的基本设施发展,包括西马西海岸高速大道、东班底大道、巴生河流域捷运2线,这些都需要采购集团的产品。

此外,砂拉越和沙巴今年进入第11大马计划第二年,其中一项大型计划是:兴建泛婆罗洲高速大道,料将全面推行,这些都有利于集团制造组的业务发展。

与此同时,在大马的“一带一路”区域经济扩展计划,中国在大马港口与铁路的大量投资,东海岸双轨铁路计划,预计今年将可衔接半岛东、西海岸的港口,将改变目前的区域贸易路线,带给大马经济利益与商机。

降低运输成本

改善取货便利性

李春进说,虽然马币汇率波动导致进口原料成本上扬,不过,集团保持所需存货,有助缓冲较高原料成本上升的冲击。

在市场紧缩的情况下,提高市占率的竞争无疑升级,不过,威达做好准备,希望通过降低运输成本、改善顾客取货的便利性,以加强竞争实力。

文章来源:

星洲日报‧投资致富‧企业故事‧文:郑碧娥‧2017.08.20 |

|

|

|

|

|

|

|

|

|

|

|

发表于 23-8-2017 12:22 AM

|

显示全部楼层

发表于 23-8-2017 12:22 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2017 | 30 Jun 2016 | 30 Jun 2017 | 30 Jun 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 52,549 | 90,654 | 52,549 | 90,654 | | 2 | Profit/(loss) before tax | 5,121 | 11,822 | 5,121 | 11,822 | | 3 | Profit/(loss) for the period | 3,127 | 7,909 | 3,127 | 7,909 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 2,628 | 7,644 | 2,628 | 7,644 | | 5 | Basic earnings/(loss) per share (Subunit) | 2.07 | 6.02 | 2.07 | 6.02 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 3.2900 | 3.2700

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 1-9-2017 04:30 AM

|

显示全部楼层

发表于 1-9-2017 04:30 AM

|

显示全部楼层

icy97 发表于 3-5-2017 01:38 AM

威达获3.51亿合约

提升砂医院设施

2017年4月29日

(吉隆坡28日讯)威达(WEIDA,7111,主板工业产品股)透过旗下公司,获得卫生部特许协议书(CA),为砂拉越综合医院提供升级服务,建设新日间照顾中心和停车 ...

Type | Announcement | Subject | OTHERS | Description | SHAREHOLDERS' AGREEMENT ENTERED INTO BETWEEN WEIDA MEDIC DEVELOPMENT SDN BHD, ASALJURU CONSTRUCTION SDN BHD, CAHAYA MAJESTIC SDN BHD AND ASALJURU WEIDA SDN BHD | We refer to announcement made on 28 April 2017 in relation to Asaljuru Weida Sdn Bhd (“AWSB”), a 49% owned associated company of Weida Medic Development Sdn Bhd (“WMDSB”), which in turn is a wholly-owned subsidiary of Weida (M) Bhd (“Weida” or “the Company”) entered into the Concession Agreement with the Government of Malaysia as represented by the Ministry of Health in relation for the upgrading of Hospital Umum Sarawak by way of development of new buildings and facilities, on a public private partnership by way of private financing initiative under the build, lease, maintain and transfer model.

The Board of Directors (“Board”) of Weida wishes to announce that WMDSB had on 30 August 2017 entered into a Shareholders’ Agreement with other shareholders of AWSB, namely Asaljuru Construction Sdn Bhd and Cahaya Majestic Sdn Bhd, for the purpose of regulating the responsibilities and obligations of shareholders in AWSB.

Please refer to the attached file for further details of the announcement.

This announcement is dated 30 August 2017. .

|

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5532833

|

|

|

|

|

|

|

|

|

|

|

|

发表于 16-11-2017 04:58 AM

|

显示全部楼层

发表于 16-11-2017 04:58 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | WEIDA (M) BHD. ("WEIDA") CONCESSION AGREEMENT ENTERED INTO BETWEEN THE GOVERNMENT OF MALAYSIA AND ASALJURU WEIDA SDN. BHD., A 49% OWNED SUBSIDIARY OF WEIDA MEDIC DEVELOPMENT SDN. BHD. | We refer to the announcements made on 28 April 2017 and 30 August 2017 respectively in relation to the upgrading of Hospital Umum Sarawak by way of development of new buildings and facilities, on a public private partnership by way of private financing initiative under the build, lease, maintain and transfer model.

The Board of Directors of Weida wishes to announce that Asaljuru Weida Sdn. Bhd. (“AWSB”), a 49% owned subsidiary of Weida Medic Development Sdn. Bhd., has on 15 November 2017 received a letter from the Ministry of Health confirming 15 November 2017 as the Effective Date of the Concession Agreement dated 28 April 2017 entered into between AWSB and the Government of Malaysia, represented by the Ministry of Health.

This announcement is dated 15 November 2017. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 2-12-2017 06:49 AM

|

显示全部楼层

发表于 2-12-2017 06:49 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2017 | 30 Sep 2016 | 30 Sep 2017 | 30 Sep 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 64,721 | 88,866 | 117,270 | 179,520 | | 2 | Profit/(loss) before tax | 10,732 | 13,117 | 15,853 | 24,939 | | 3 | Profit/(loss) for the period | 7,199 | 8,611 | 10,326 | 16,520 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 6,636 | 8,067 | 9,264 | 15,711 | | 5 | Basic earnings/(loss) per share (Subunit) | 5.23 | 6.36 | 7.30 | 12.38 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 3.3100 | 3.2700

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 30-1-2018 01:32 AM

|

显示全部楼层

发表于 30-1-2018 01:32 AM

|

显示全部楼层

本帖最后由 icy97 于 30-1-2018 05:54 AM 编辑

每股2.40令吉 创办人寻求私有化威达

Adam Aziz/theedgemarkets.com

January 29, 2018 19:48 pm +08

(吉隆坡29日讯)威达(Weida (M) Bhd)创办人Datuk Lee Choon Chin向股东提议,以每股2.40令吉私有化这家多元化工程和制造公司。

同时也是该集团执行主席的Lee,正通过持股88%的Weida Management私人有限公司提出献议。根据该提案,Weida Management要求威达进行特定削资和资本回退。

以每股2.40令吉计算,这较最后收盘的2.05令吉,溢价35仙或17.07%,也比截至上周五(26日)的一年间成交量加权平均价格(VWAP)高出19.94%至23.64%。

然而,这较该集团截至去年9月30日的3.31令吉每股净资产值,折价91仙或27.49%。

这项计划的资本回退额达2亿317万令吉,共计4亿634万股,而威达现有已发行股本为1亿2689万股,相当于6345万令吉。

Weida Management今日向大马交易所报备说:“由于威达注销的股票高于现有已发行股本,因此威达拟发红股,以提高至足以进行削资的水平。”

Weida Management表示,将通过威达内部资金和银行贷款进行削资,并称无意维持威达的上市地位。

Lee、Weida Management及一致行动人士合共持有公司33.29%股权。

文告指出,提出这份计划的原因包括流通量低、分析员关注有限、上市地位的增值不大,以及市价不能反映基本价值。

“鉴于市场环境充满挑战,广大投资者似乎无法给予符合威达净资产的估值,且这情况估计不会很快获得改变。”

(编译:陈慧珊)

Type | Announcement | Subject | OTHERS | Description | Weida (M) Berhad ("Weida" or the "Company") | The Board of Directors of Weida (“Board”) wishes to announce that the Company has today received a letter from Weida Management Sdn Bhd (“WMSB”) requesting the Company to undertake a selective capital reduction and repayment exercise pursuant to Section 116 of the Companies Act 2016 (“SCR Offer Letter”).

The Proposed SCR involves Weida undertaking a selective capital reduction and a corresponding capital repayment of a proposed cash amount of RM2.40 per ordinary share in Weida held by all the shareholders of Weida (other than non-entitled shareholders, as set out in the SCR Offer Letter), whose names appear in the Record of Depositor of Weida as at the close of business on an entitlement date to be determined and announced later by the Board.

Please refer to the attached SCR Offer Letter for further details on the Proposed SCR.

The Board, save for the interested directors namely, Dato’ Lee Choon Chin and Jee Hon Chong, will deliberate on the Proposed SCR and a further announcement will be made in due course after the Board’s deliberation.

This announcement is dated 29 January 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5678685

|

|

|

|

|

|

|

|

|

|

|

|

发表于 14-2-2018 02:52 AM

|

显示全部楼层

发表于 14-2-2018 02:52 AM

|

显示全部楼层

本帖最后由 icy97 于 14-2-2018 06:14 AM 编辑

威达第三季净利翻倍

Adam Aziz/theedgemarkets.com

February 13, 2018 20:19 pm +08

(吉隆坡13日讯)威达(Weida (M) Bhd)第三季净利增长一倍多,得益于产业发展业务除外的所有营运臂膀营业额走高而管理费用降低。

该公司今日向大马交易所公布,截至去年12月杪2018财政年第三季净利报861万令吉,高于上财年同期的430万令吉;营业额从6040万令吉,增10.02%至6645万令吉。

2018财年首9个月的净利则跌10.65%至1788万令吉,同期为2001万令吉,受累于营业额从2亿3992万令吉,跌23.42%至1亿8372万令吉。

威达表示:“营业额较低主要由于工程和产业发展业务的贡献下跌,因这些项目处于完成最后阶段,但被制造业务较高的收入影响所减缓。”

“尽管营业额跌,但盈利赚幅改善,归功于制造和工程业务。”

同时,该公司说,产业发展业务在2018财年首9个月仅从Urbana Residences剩余单位的销售中确认380万令吉的收入,并蒙受损失,包括拟议的满家乐(Mont Kiara)和蕉赖项目的筹备开销。

“鉴于当前产业市场信心疲软,集团在推出其他项目上将采取审慎的态度。”

(编译:陈慧珊)

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2017 | 31 Dec 2016 | 31 Dec 2017 | 31 Dec 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 66,451 | 60,400 | 183,721 | 239,920 | | 2 | Profit/(loss) before tax | 12,185 | 8,409 | 28,038 | 33,348 | | 3 | Profit/(loss) for the period | 9,059 | 4,608 | 19,385 | 21,128 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 8,611 | 4,295 | 17,875 | 20,006 | | 5 | Basic earnings/(loss) per share (Subunit) | 6.79 | 3.39 | 14.09 | 15.77 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 3.3800 | 3.2700

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 13-3-2018 08:06 AM

|

显示全部楼层

发表于 13-3-2018 08:06 AM

|

显示全部楼层

本帖最后由 icy97 于 13-3-2018 08:07 AM 编辑

Common Tower科技 向威達索賠至少1.3億

2018年3月09日

(吉隆坡9日訊)2005年一項訴訟的最新發展,Common Tower科技私人有限公司(簡稱CTT)反訴威達(WEIDA,7111,主要板工業)子公司並索賠,同時還包括一筆1億3180萬令吉利息。

威達向馬證交所報備,針對旗下威達Works今年1月提出索賠要求,CTT周一(5日)卻提出反訴訟,指聯營協議在法律上沒有受約束力和/或無效。

CTT也基于Weida Works涉及不正當利益,以及仲裁裁決后的利益和成本,向威達Works要求賠償1億3184萬令吉。

威達Works和CTT雙方是在2005年簽署聯營協議,隨后在2006年簽署首項補充聯營協議,以參與沙巴電訊基礎設施計劃。

在此聯營協議下,威達Works將負責沙巴電訊基礎設施計劃的電訊塔建設。CTT則確保電訊塔站,並提供電訊塔許可證給電訊營運商,從中取得許可證費。

CTT與威達將在雙方同意的比重下,共享此許可證費的收入。

威達去年5月指出,向由吉隆坡區域仲裁中心(KLRCA)發出並提交仲裁通知。

威達當時指控CTT,指后者沒有共享來自新電訊營運商的許可證費收入,而違反聯營協議。

威達Works聲稱,應得來自新電訊營運商的許可證費收入達2343萬令吉。

威達Works也指控CTT,指后者違反了對偉達Works的受託人責任(Fiduciary duty),導致公司失去商機和損失。【中国报财经】

Type | Announcement | Subject | MATERIAL LITIGATION | Description | Arbitration proceedings brought by Weida Works Sdn Bhd, a wholly owned subsidiary of Weida (M) Bhd ("Weida Works" or "Plaintiff"), against Common Tower Technology Sdn Bhd ("CTT" or "Defendant"). | Weida (M) Bhd ("Weida") wishes to announce that a Notice of Arbitration which was issued and filed with the Kuala Lumpur Regional Centre for Arbitration (KLRCA) on 23 May 2017, Weida Works commenced arbitration proceedings against CTT for interalia -

a) breach of the joint venture agreement (“JVA” as described below) entered into between the parties by CTT not paying Weida Works its entitled share of all license income from the new operators for RM 23,435,000.00 which represents Weida Works’ approximate share of the same;

b) an account of all undeclared license income received from the new operators; and

c) for breach of CTT’s fiduciary duty to Weida Works under the JVA causing interalia loss of business opportunities pursuant to a license agreement entered into between CTT and the original operators as well as damages (including aggravated and exemplary damages), interest; and costs.

As a background to the above, Weida Works and CTT had executed a joint venture agreement on 22 June, 2005 and 1st supplementary joint venture agreement on 23 March 2006 (collectively referred to as “JVA”) to undertake the telecommunication infrastructure projects in Sabah (“Projects”).

Under the JVA, Weida Works was to fund and build telecommunication towers in the Projects while CTT would secure the tower sites and licence such that Weida Works built towers on these sites to mobile telecommunication operators for licence fees, to which CTT shall then share such licence fees income received from both the original operators and new operators with Weida at an agreed ratio.

Weida Works had filed its Points of Claim on 3 January 2018 and CTT had filed its reply to the Points of Claim and Counterclaim on 5 March 2018.

CTT’s 2018 Counterclaim seeks declaratory orders that, allegedly the said JVA are not binding and/or void in law and/or allegedly seeks refunds of all monies received from the CTT save for telecommunication towers construction costs as well as to pay RM131,842,529.46 being wrongful interest imposed by Weida Works with pre award and post arbitration award interest and costs. This is despite CTT obtaining the full benefits of the JVA since its inception in 2005 till current date. The arbitration has been fixed for hearing between 18 July 2018 to 21 August 2018.

Weida Works’ solicitors are of the conservative view that Weida Works has basis for the arbitration while in the current circumstances as known to Weida Works’ solicitors todate, CTT seems to have no basis for its allegations in its reply and counterclaim.

Further announcement on the development of the above matter will be made to Bursa Malaysia Securities Berhad in due course.

This announcement is dated 9 March 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 15-3-2018 06:41 AM

|

显示全部楼层

发表于 15-3-2018 06:41 AM

|

显示全部楼层

Type | Reply to Query | Reply to Bursa Malaysia's Query Letter - Reference ID | IQL-13032018-00002 | Subject | Arbitration proceedings brought by Weida Works Sdn Bhd (Weida Works) against Common Tower Technology Sdn Bhd (Arbitration) | Description | ARBITRATION PROCEEDINGS BROUGHT BY WEIDA WORKS SDN BHD, A WHOLLY OWNED SUBSIDIARY OF WEIDA (M) BHD. ("WEIDA WORKS" OR "PLAINTIFF"), AGAINST COMMON TOWER TECHNOLOGY SDN. BHD. ("CTT" OR "DEFENDANT"). | Query Letter Contents | We refer to your Company’s announcement dated 9 March 2018 in respect of the aforesaid matter. In this connection, kindly furnish Bursa Securities with the following additional information for public release:- (a) The particulars of the claim under the counterclaim, including the total amount claimed for under the counterclaim and the interest rate. (b) A confirmation as to whether Weida Works is a major subsidiary. (c) The total cost of investment in Weida Works. (d) The financial and operational impact of the counterclaim and the Arbitration on the Group. (e) The expected losses, if any arising from the counterclaim and the Arbitration. | (Unless otherwise stated, all abbreviations used herein shall have the same meanings as those mentioned in the announcement dated 9 March 2018) Further to the announcement dated 9 March 2018 in relation to the above subject, Weida, wishes to announce additional information as set out below as requested by Bursa Securities via its letter dated 13 March 2018.

(a) The particulars of the claim under the counterclaim, including the total amount claimed for under the counterclaim and the interest rate. CTT’s counterclaim in the arbitration alleges and seeks declaratory orders that the said JVA are not binding and/or void in law and/or seeks refunds of all monies received from CTT save for telecommunication towers construction costs as well as to repay RM131,842,529.46 being “wrongful interest” imposed by Weida Works with pre award and post arbitration award interest and costs. Weida Works’ response is that CTT’s alleged “wrongful interest” is in fact Weida Works’s share of license fees pursuant to the JVA and was treated as “interest “in accordance with the Financial Reporting Standards at that material time. The same manner has been practised since Year 2006 without any objection.

(b) A confirmation as to whether Weida Works is a major subsidiary. Weida Works is not a major subsidiary of Weida.

(c) The total cost of investment in Weida Works. The total cost of investment of Weida in Weida Works amounts to RM621,632.00 as at 9 March 2018.

(d) The financial and operational impact of the counterclaim and the Arbitration on the Group, and (e) The expected losses, if any arising from the counterclaim and the Arbitration. As advised by Weida Works’ solicitors, the Company is of the view that CTT’s counterclaim is not supported with valid grounds and have no legal basis for its allegations in its reply and counterclaim. On the contrary, the Company is of the view that Weida Works has a legal basis for this arbitration of which Weida Works is interalia claiming against CTT for losses suffered by Weida Works in consequence of CTTs breach of the terms of JVA in not paying Weida Works its entitled share of all license fees from new operators using Weida Works built towers for RM 23,435,000.00 which represents Weida Works’ approximate share of the same and/or in breach of CTT’s fiduciary duty towards Weida Works under the JVA. The counter claim and the arbitration proceedings are not expected to have any material financial and operational impact on Weida Group. Weida Group does not expect any losses to arise by reason of the commencement of the said arbitration proceeding other than legal cost and time in defending Weida Works’ claim and CTT’s counter claim.

This announcement is dated 14 March 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 10-6-2018 03:08 AM

|

显示全部楼层

发表于 10-6-2018 03:08 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2018 | 31 Mar 2017 | 31 Mar 2018 | 31 Mar 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 51,171 | 61,489 | 234,892 | 301,409 | | 2 | Profit/(loss) before tax | 7,576 | 995 | 35,614 | 34,343 | | 3 | Profit/(loss) for the period | 2,806 | -1,027 | 22,191 | 20,101 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 2,473 | -1,871 | 20,348 | 18,135 | | 5 | Basic earnings/(loss) per share (Subunit) | 1.94 | -1.48 | 16.03 | 14.29 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 3.4000 | 3.2700

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 31-8-2018 03:14 AM

|

显示全部楼层

发表于 31-8-2018 03:14 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2018 | 30 Jun 2017 | 30 Jun 2018 | 30 Jun 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 67,208 | 52,549 | 67,208 | 52,549 | | 2 | Profit/(loss) before tax | 8,989 | 5,121 | 8,989 | 5,121 | | 3 | Profit/(loss) for the period | 6,134 | 3,127 | 6,134 | 3,127 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 6,237 | 2,628 | 6,237 | 2,628 | | 5 | Basic earnings/(loss) per share (Subunit) | 4.92 | 2.07 | 4.92 | 2.07 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 3.4500 | 3.4000

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 8-9-2018 03:23 AM

|

显示全部楼层

发表于 8-9-2018 03:23 AM

|

显示全部楼层

本帖最后由 icy97 于 10-9-2018 04:50 AM 编辑

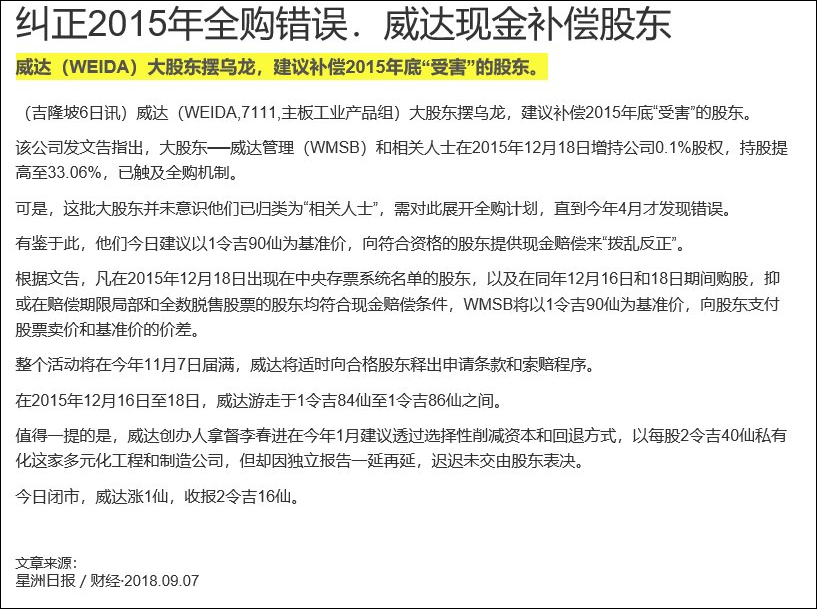

Type | Announcement | Subject | OTHERS | Description | LETTER FROM WEIDA MANAGEMENT SDN BHD ("WMSB") ON NOTICE OF CASH COMPENSATION | On behalf of the Board of Directors of Weida (M) Bhd (“Weida”) (“Board”), RHB Investment Bank Berhad wishes to announce that the Company had on 6 September 2018 received a letter from WMSB (“Letter”) notifying the Board that WMSB is offering a cash compensation scheme to the registered shareholders of Weida whose names appear on the record of depositors of Weida as at 5.00 p.m. on 18 December 2015 and persons who purchased Weida shares between 9.00 a.m. on 16 December 2015 and 5.00 p.m. on 18 December 2015 (both dates inclusive) other than WMSB and its persons acting in concert, who sold their Weida shares partially or fully during the compensation period between 9.00 a.m. on 19 December 2015 and 5.00 p.m. on the date of despatch of the compensation document at a price lower than RM1.90 per Weida share, (“Qualified Shareholders”) (“Cash Compensation Scheme”). WMSB intends to close the Cash Compensation Scheme on 5.00 p.m. on 6 November 2018.

Further details of the terms of the Cash Compensation Scheme and the procedures for claims will be set out in the compensation document to be despatched to the Qualified Shareholders in due course.

The Letter from WMSB is attached herewith for information.

This announcement is dated 6 September 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5907869

|

|

|

|

|

|

|

|

|

|

|

|

发表于 2-12-2018 05:58 AM

|

显示全部楼层

发表于 2-12-2018 05:58 AM

|

显示全部楼层

EX-date | 05 Dec 2018 | Entitlement date | 07 Dec 2018 | Entitlement time | 05:00 PM | Entitlement subject | Others | Entitlement description | Selective capital reduction and repayment exercise pursuant to Section 116 of the Companies Act ("SCR") | Period of interest payment | to | Financial Year End | 31 Mar 2019 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | SYMPHONY SHARE REGISTRARS SDN BHDLevel 6, Symphony HousePusat Dagangan Dana 1Jalan PJU 1A/4647301Petaling JayaTel:0378490777Fax:0378418151 | Payment date | 14 Dec 2018 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 07 Dec 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 2.4 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 26-12-2018 08:07 AM

|

显示全部楼层

发表于 26-12-2018 08:07 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2018 | 30 Sep 2017 | 30 Sep 2018 | 30 Sep 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 138,100 | 64,721 | 205,308 | 117,270 | | 2 | Profit/(loss) before tax | 19,143 | 10,732 | 28,132 | 15,853 | | 3 | Profit/(loss) for the period | 13,733 | 7,199 | 19,866 | 10,326 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 12,448 | 6,636 | 18,684 | 9,264 | | 5 | Basic earnings/(loss) per share (Subunit) | 9.81 | 5.23 | 14.73 | 7.30 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 3.5700 | 3.4200

|

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|