|

|

楼主 |

发表于 31-5-2018 07:43 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | MENANG CORPORATION (M) BERHAD ("Menang" OR "the Company")- UPDATE ON JOINT DEVELOPMENT OF KLANG LANDS UNDER CONSORTIUM AGREEMENT DATED 26 MARCH 2010 | Reference is made to the disclosures of the Company's joint venture of the Company's Klang Properties in the Company's Fourth Quarterly Report for the financial period ended 30 June 2016 and Annual Report 2016 which were announced on 30 August 2016 and 31 October 2016 respectively, and the announcements dated 22 June 2017, 25 July 2017, 16 August 2017, 27 September 2017, 13 October 2017, 23 February 2018 and 17 April 2018. The term herein shall bear the same meaning as defined in the said disclosures and announcements. The Board of Directors of the Company is pleased to announce and provide information and update and details on the status of the Company's Joint Venture of the Company's Klang Properties. Pursuant to a Consortium Agreement dated 26 March 2010 ("Consortium Agreement"), the Company, Prosper Commodity Group Sdn Bhd ("PCGSB") and Runding Waja Sdn Bhd ("RWSB") (deemed as an original party to the Consortium Agreement by way of a Novation Agreement dated 3 June 2010) (collectively "the Consortium Parties") agreed to enter into a joint venture to commercially exploit the land for the development of Private Financial Initiative ("PFI") project in the usual course of land development business ("the J/V") with regards to the following 7 pieces of land:- (i) Geran 27917 Lot No. 48, Mukim Kapar, Daerah Kelang, Negeri Selangor; (ii) HS(D) 97332 PT 25008, Mukim Kapar, Daerah Klang, Negeri Selangor; (iii) HS(D) 97333 PT 50718, Mukim Kapar, Daerah Klang, Negeri Selangor; (iv) Geran 27973 Lot No. 2596, Mukim Kapar, Daerah Kelang, Negeri Selangor; (v) Geran 27974 Lot No. 2597, Mukim Kapar, Daerah Kelang, Negeri Selangor; (vi) Geran 27975 Lot No. 2615, Mukim Kapar, Daerah Kelang, Negeri Selangor; and (vii) Geran 27976 Lot No. 2616, Mukim Kapar, Daerah Kelang, Negeri Selangor. (collectively "the Said Lands").

Please refer to the attached file for the details of the announcement.

This announcement is dated 28 May 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5807005

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 19-7-2018 04:35 AM

|

显示全部楼层

本帖最后由 icy97 于 20-7-2018 05:43 AM 编辑

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

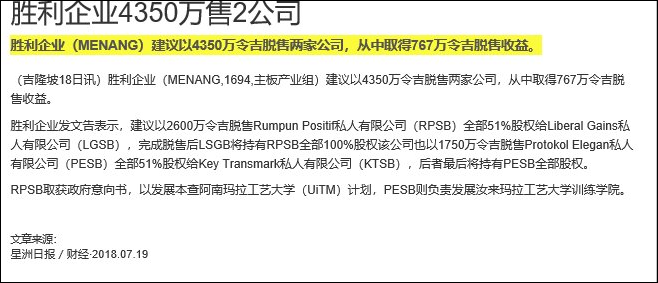

NON RELATED PARTY TRANSACTIONS | Description | MENANG CORPORATION (M) BERHAD ("MENANG" OR THE "COMPANY")(I) PROPOSED RPSB DISPOSAL; AND(II) PROPOSED PESB DISPOSAL(COLLECTIVELY, THE "PROPOSALS") | On behalf of the Board of Directors of Menang, KAF Investment Bank Berhad wishes to announce that the Company is proposing to undertake the following proposals:- (i) proposed disposal by Menang Development (M) Sdn Bhd (“MDSB”), a wholly-owned subsidiary of Menang, of its entire 51% equity interest in Rumpun Positif Sdn. Bhd. (“RPSB”) for a cash consideration of RM26,000,000 (“Proposed RPSB Disposal”); and

(ii) proposed disposal by MDSB of its entire 51% equity interest in Protokol Elegan Sdn. Bhd. (“PESB”) for a cash consideration of RM17,500,000 (“Proposed PESB Disposal”),

and the settlement of the respective net outstanding inter-company balances owing by RPSB and PESB to Menang and/or its subsidiaries (“Menang Group” or “Group”) as at the completion date of the Proposed RPSB Disposal and the Proposed PESB Disposal (“Proposals”).

Kindly refer to the attached document for the complete announcement.

This announcement is dated 18 July 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5858193

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 1-9-2018 06:09 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2018 | 30 Jun 2017 | 30 Jun 2018 | 30 Jun 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 10,651 | 18,719 | 42,764 | 53,625 | | 2 | Profit/(loss) before tax | 23,348 | 8,033 | 28,542 | 23,622 | | 3 | Profit/(loss) for the period | 1,876 | 946 | 12,642 | 7,495 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 8,290 | 1,617 | 13,642 | 11,313 | | 5 | Basic earnings/(loss) per share (Subunit) | 1.72 | 0.61 | 2.84 | 4.24 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.6600 | 1.1400

|

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 18-11-2018 05:15 AM

|

显示全部楼层

本帖最后由 icy97 于 2-1-2019 06:37 AM 编辑

Notice of Interest Sub. S-hldr (Section 137 of CA 2016)| MENANG CORPORATION (M) BERHAD |

Particulars of Substantial Securities HolderName | DATO LEE CHIN HWA | Nationality/Country of incorporation | Malaysia | Descriptions (Class) | Ordinary Shares | Name & address of registered holder | Dato' Lee Chin HwaNo. 6890 Vision HeightJalan Tok Ungku70100 Seremban Negeri Sembilan |

| Date interest acquired & no of securities acquired | Date interest acquired | 05 Nov 2018 | No of securities | 24,074,300 | Circumstances by reason of which Securities Holder has interest | Acquired from market | Nature of interest | Direct and Indirect Interest |  | | Total no of securities after change | Direct (units) | 22,812,940 | Direct (%) | 4.745 | Indirect/deemed interest (units) | 1,261,360 | Indirect/deemed interest (%) | 0.262 | Date of notice | 08 Nov 2018 | Date notice received by Listed Issuer | 08 Nov 2018Notice of Interest Sub. S-hldr (Section 137 of CA 2016)| MENANG CORPORATION (M) BERHAD |

Particulars of Substantial Securities HolderName | DATO LEE CHIN HWA | Nationality/Country of incorporation | Malaysia | Descriptions (Class) | Ordinary Shares | Name & address of registered holder | Dato' Lee Chin HwaNo. 6890 Vision HeightJalan Tok Ungku70100 Seremban Negeri Sembilan |

| Date interest acquired & no of securities acquired | Date interest acquired | 05 Nov 2018 | No of securities | 24,074,300 | Circumstances by reason of which Securities Holder has interest | Acquired from market | Nature of interest | Direct and Indirect Interest |  | | Total no of securities after change | Direct (units) | 22,812,940 | Direct (%) | 4.745 | Indirect/deemed interest (units) | 1,261,360 | Indirect/deemed interest (%) | 0.262 | Date of notice | 08 Nov 2018 | Date notice received by Listed Issuer | 08 Nov 2018 |

|

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 2-1-2019 06:36 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2018 | 30 Sep 2017 | 30 Sep 2018 | 30 Sep 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 10,617 | 10,821 | 10,617 | 10,821 | | 2 | Profit/(loss) before tax | 1,852 | 644 | 1,852 | 644 | | 3 | Profit/(loss) for the period | 2,087 | 754 | 2,087 | 754 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 970 | 162 | 970 | 162 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.20 | 0.03 | 0.20 | 0.03 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.6600 | 0.6600

|

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 24-1-2019 04:53 AM

|

显示全部楼层

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

RELATED PARTY TRANSACTIONS | Description | MENANG CORPORATION (M) BERHAD ("MENANG" OR THE "COMPANY")- RESCISSION AND REVOCATION OF THE JOINT VENTURE AGREEMENT ("JVA") DATED 28 DECEMBER 2009 | (For consistency purposes, the abbreviations and definitions used throughout this announcement shall have the same meanings as those previously defined in the Company’s announcement dated 28 May 2018 in relation to the JVA.)

1. INTRODUCTION The Board of Directors of the Company (“Board”) wishes to announce that Menang Development (M) Sdn. Bhd. (“MDSB”), a wholly-owned subsidiary of the Company, had on 24 December 2018 entered into a deed of rescission and revocation (“Deed”) with Harasa Abadi Sdn. Bhd. (“Harasa”) and Continuum Sanctuary Commercial Sdn. Bhd. (“Continuum”) to rescind and revoke the JVA (“Rescission”).

Kindly refer to the ensuing sections for further details of the Rescission.

2. DETAILS OF THE RESCISSION On 28 December 2009, MDSB had entered into the JVA with Harasa and Continuum, whereby MDSB grants to and allows Harasa and Continuum to jointly undertake the overall development of the following lands:- (a) HS(D) No. 125732, P.T. No. 6735 in the Mukim of Rantau, District of Seremban, State of Negeri Sembilan; (b) HS(D) No. 125733, P.T. No. 6737 in the Mukim of Rantau, District of Seremban, State of Negeri Sembilan; (c) HS(D) No. 125692, P.T. No. 9548 in the Mukim of Rasah, District of Seremban, State of Negeri Sembilan; (d) HS(D) No. 125693, P.T. No. 9549 in the Mukim of Rasah, District of Seremban, State of Negeri Sembilan; and (e) HS(D) No. 125703, P.T. No. 9559 in the Mukim of Rasah, District of Seremban, State of Negeri Sembilan,

which comprised an area of approximately 25.85 acres in total (collectively referred to as the “Lands”), and construction thereon of the various types of residential, commercial and other buildings together with the infrastructure, conveniences and other amenities as comprised in the development in accordance with the approved lay-out plans and building specifications to be obtained.

However, there has been no progress on the Lands since the execution on the JVA due to market conditions, and therefore, the parties to the JVA have mutually agreed to rescind and revoke the JVA. Through the Deed, the JVA shall be rescinded and revoked with immediate effect and neither MDSB, Harasa nor Continuum shall have any claims and/or bring any proceedings of whatsoever nature against each other in respect of the JVA incurred since the date of execution of the JVA. Further, the parties agreed that all sums of money paid pursuant to the JVA amounting to RM6,000,000.00 shall be refunded, free of interest within twelve (12) months from the date of the Deed or such extension of time as shall be mutually agreed by the parties.

A valuation of the Lands was conducted by a professional valuer on 15 February 2018 and the Lands were valued at RM16,200,000.00

3. RATIONALE OF THE RESCISSION The subject Lands are located in MDSB’s partially developed township in Seremban known as SEREMBAN 3. The revocation and rescission of the JVA would enable MDSB to assume full control and authority on the Lands and to facilitate MDSB’s strategy to replan the balance of the undeveloped lands (including the subject Lands) in the Seremban 3 township for development of housing and commercial units to meet the market conditions and demands.

4. FINANCIAL EFFECTS OF THE RESCISSION The Rescission is not expected to have any material effects on the issued share capital, substantial shareholders’ shareholdings, consolidated NA per share, consolidated gearing, consolidated earnings, earnings per share and convertible securities of Menang for the financial year ending 30 June 2019.

5. INTERESTS OF DIRECTORS, MAJOR SHAREHOLDERS AND PERSONS CONNECTED WITH THEM Dr. Christopher Shun Kong Leng is a Director and a substantial shareholder of Menang and is the son of Dato’ Shun Leong Kwong who is a substantial shareholder of Menang and a Director of MDSB.

Raja Shahruddin Rashid is a Director of Menang and MDSB and is the son-in-law of Dato' Shun Leong Kwong. Marianna Binti Aly Shun, a Director of Menang and MDSB is the sister of Dr. Christopher Shun Kong Leng and the sister in law of Raja Shahruddin Rashid. Only Dr. Christopher Shun Kong Leng and Raja Shahruddin Rashid are deemed interested in the Rescission. Save for the above disclosed, none of the Directors and/or major shareholders of Menang and/or persons connected with them have any interests, direct or indirect, in the Rescission.

6. DIRECTORS’ STATEMENT The Board, having considered all aspect of the Rescission, is of the opinion that the Rescission is in the best interest of the Menang Group.

7. APPROVALS REQUIRED The Rescission does not require approval of the shareholders of Menang and any relevant regulatory bodies.

8. DOCUMENTS AVAILABLE FOR INSPECTION The Deed and JVA are available for inspection at the registered office at Lot 6.05, Level 6, KPMG Tower, 8 First Avenue, Bandar Utama, 47800 Petaling Jaya, Selangor Darul Ehsan, Malaysia during ordinary business hours from Mondays to Fridays (except public holidays) for a period of three (3) months from the date of this announcement.

This announcement is dated 24 December 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 1-3-2019 07:46 AM

|

显示全部楼层

本帖最后由 icy97 于 2-3-2019 06:13 AM 编辑

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2018 | 31 Dec 2017 | 31 Dec 2018 | 31 Dec 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 10,505 | 10,593 | 21,122 | 21,414 | | 2 | Profit/(loss) before tax | -1,109 | 1,572 | 743 | 2,216 | | 3 | Profit/(loss) for the period | 1,742 | 4,722 | 3,829 | 5,476 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -512 | 2,464 | 458 | 2,626 | | 5 | Basic earnings/(loss) per share (Subunit) | -0.11 | 0.51 | 0.10 | 0.55 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.6600 | 0.6600

|

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 4-7-2019 04:27 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2019 | 31 Mar 2018 | 31 Mar 2019 | 31 Mar 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 10,517 | 10,699 | 31,639 | 32,113 | | 2 | Profit/(loss) before tax | 1,504 | 2,978 | 2,247 | 5,194 | | 3 | Profit/(loss) for the period | 496 | 5,290 | 4,325 | 10,766 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -284 | 2,726 | 174 | 5,352 | | 5 | Basic earnings/(loss) per share (Subunit) | -0.06 | 0.57 | 0.04 | 1.11 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.6600 | 0.6600

|

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 5-7-2019 08:51 AM

|

显示全部楼层

Expiry/Maturity of the securities| MENANG CORPORATION (M) BERHAD |

Instrument Category | Securities of PLC | Instrument Type | Warrants | Type Of Expiry | Expiry/Maturity of the securities | Mode of Satisfaction of Exercise/Conversion price | Cash | Exercise/ Strike/ Conversion Price | Malaysian Ringgit (MYR) 0.5500 | Exercise/ Conversion Ratio | 1:1 | Settlement Type / Convertible into | Cash | Last Date & Time of Trading | 21 Jun 2019 05:00 PM | Date & Time of Suspension | 24 Jun 2019 09:00 AM | Last Date & Time for Transfer into Depositor's CDS a/c | 02 Jul 2019 04:00 PM | Date & Time of Expiry | 09 Jul 2019 05:00 PM | Date & Time for Delisting | 10 Jul 2019 09:00 AM |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/6178253

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 25-7-2019 07:10 AM

|

显示全部楼层

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

NON RELATED PARTY TRANSACTIONS | Description | MENANG CORPORATION (M) BERHAD ("MENANG" OR THE "COMPANY")(I) PROPOSED RPSB DISPOSAL; AND(II) PROPOSED PESB DISPOSAL(COLLECTIVELY, THE "PROPOSALS") | For consistency purposes, the abbreviations and definitions used throughout this announcement shall have the same meanings as those previously defined in Menang’s announcement dated 18 July 2018 in relation to the Proposals.

We refer to Menang’s announcements dated 18 July 2018, 17 January 2019 and 25 April 2019 in relation to the Proposals.

On behalf of the Board of Directors of Menang, KAF Investment Bank Berhad wishes to announce that the RPSB SSA and PESB SSA have lapsed on 18 July 2019 and will no longer be in effect due to the non-fulfillment of the conditions precedent to the RPSB SSA and PESB SSA pertaining to the procurement of approvals from UKAS and lenders of both RPSB and PESB with regard to the Proposals.

Pursuant thereto, the Deposit shall be refunded by MDSB pursuant to the RPSB SSA and PESB SSA less deductions allowed therein, and all documents furnished by each party to KTSB and LGSB’s solicitors shall be returned to the originating party and neither party shall have any right or claim against the other in accordance to the RPSB SSA and PESB SSA. As such, the Proposals are deemed terminated.

This announcement is dated 19 July 2019.

|

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 1-9-2019 04:52 AM

|

显示全部楼层

本帖最后由 icy97 于 17-1-2020 07:53 AM 编辑

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2019 | 30 Jun 2018 | 30 Jun 2019 | 30 Jun 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 10,475 | 10,671 | 42,114 | 42,784 | | 2 | Profit/(loss) before tax | -274 | 21,005 | 1,973 | 26,199 | | 3 | Profit/(loss) for the period | 6,606 | 1,261 | 10,931 | 12,027 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 2,178 | 7,947 | 2,352 | 13,299 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.45 | 1.65 | 0.49 | 2.77 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.6700 | 0.6600

|

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 29-2-2020 08:16 AM

|

显示全部楼层

本帖最后由 icy97 于 19-3-2020 08:16 AM 编辑

Type | Announcement | Subject | OTHERS | Description | MENANG CORPORATION (M) BERHAD ("MENANG" OR "COMPANY")EXECUTION OF HEADS OF AGREEMENT ("HOA") WITH MENANG DEVELOPMENT (M) SDN BHD ("MDSB"), MENANG INDUSTRIES (M) SDN BHD ("MISB") AND WIDAD GROUP BERHAD ("WGB") (FORMERLY KNOWN AS IDEAL JACOBS (MALAYSIA) CORPORATION BHD) IN RESPECT OF THE PROPOSED DISPOSAL OF 71% EQUITY INTEREST IN INNOVATIF MEWAH SDN BHD ("IMSB") | We refer to the Company’s earlier announcement made on 27 November 2019 in respect of the Execution of Heads of Agreement (“HOA”) with Menang Development (M) Sdn Bhd (“MDSB”), Menang Industries (M) Sdn Bhd (“MISB”) and Widad Group Berhad (“WGB”) (Formerly known as Ideal Jacobs (Malaysia) Corporation Bhd) in respect of the proposed disposal of 71% equity interest in Innovatif Mewah Sdn Bhd (“IMSB”).

It was noted that there was a typographical error on item 5 of the attached announcement. The "Proposed Acquisition" should read as "Proposed Disposal" instead.

The Amended details of the Announcement is attached for your easy reference.

This Announcement is dated 29 November 2019. |

https://www.bursamalaysia.com/market_information/announcements/company_announcement/announcement_details?ann_id=3006097

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 19-3-2020 04:49 AM

|

显示全部楼层

| MENANG CORPORATION (M) BERHAD |

Date of change | 01 Dec 2019 | Name | MR TOO KOK LENG | Age | 60 | Gender | Male | Nationality | Malaysia | Type of change | Redesignation | Previous Position | Group Managing Director | New Position | Vice Chairman |

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 19-3-2020 04:49 AM

|

显示全部楼层

| MENANG CORPORATION (M) BERHAD |

Date of change | 01 Dec 2019 | Name | MR TEOH CHOO HUANG | Age | 69 | Gender | Male | Nationality | Malaysia | Type of change | Appointment | Designation | Group Chief Executive Officer |

Qualifications| No | Qualifications | Major/Field of Study | Institute/University | Additional Information | | 1 | Degree | Bachelor in Engineering (Mechanical) | University of Singapore (now National University of Singapore) | Professional Engineer registered with the Board of Engineers Malaysia | | 2 | Degree | LLB (Hons) | University of London. | Qualified as an Advocate & Solicitors of the High Court of Malaya. | | 3 | Masters | Master Degree in Business Administration | University of Michigan, Ann Arbor, U.S.A. | |

| | | Working experience and occupation | Mr. Teoh started his career with Kouk Group in 1975 as an engineer in their Flour and Sugar Manufacturing Plants. Then he joined Malayawata Steel Berhad (now Ann Joo Steel Berhad) as a Mechanical Engineer in their Integrated Steel Mill in Prai, Penang in September 1976. In June 1983, Mr. Teoh joined Heavy Industries Corporation of Malaysia Berhad, (HICOM) (now DRB-HICOM Berhad). In 1997, Mr. Teoh joined the privately held Maymerge (M) Sdn Bhd to help kick-start the planning and development of the extensive landbanks of Maymerge Group situated in Seremban, Mambau, Port Dickson and Melaka respectively. Mr. Teoh was transferred to its public-listed arm viz Menang Corporation (M) Berhad to oversee the various development projects in the housing, commercial and the recreational sectors. |

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 19-3-2020 04:49 AM

|

显示全部楼层

Date of change | 01 Dec 2019 | Name | YAM RAJA SHAHRUDDIN RASHID | Age | 52 | Gender | Male | Nationality | Malaysia | Type of change | Redesignation | Previous Position | Deputy Managing Director | New Position | Chairman | Directorate | Executive |

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 19-3-2020 04:50 AM

|

显示全部楼层

Date of change | 01 Dec 2019 | Name | MR SIMON WEE HOWE YEW | Age | 51 | Gender | Male | Nationality | Malaysia | Type of change | Appointment | Designation | Chief Financial Officer |

Qualifications| No | Qualifications | Major/Field of Study | Institute/University | Additional Information | | 1 | Degree | Bachelor of Business in Accountancy (Distinction) | RMIT University, Australia | Certified Public Accountant of the Malaysian Institute of Certified Public Accountants (MICPA) and a member of the Malaysian Institute of Accountants (MIA). |

| | | Working experience and occupation | Mr. Simon has a total of 25 years experience in the field of auditing, financing reporting, treasury, taxation and corporate finance in various industries ranking from financial services, manufacturing, construction and property investment and development. Prior to joining the Group in January 2018, he has served as Chief Financial Officer and management of several listed companies. |

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 20-3-2020 07:50 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2019 | 30 Sep 2018 | 30 Sep 2019 | 30 Sep 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 22 | 28 | 22 | 28 | | 2 | Profit/(loss) before tax | -4,904 | -1,868 | -4,904 | -1,868 | | 3 | Profit/(loss) for the period | 1,630 | 2,084 | 1,630 | 2,084 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -503 | 967 | -503 | 967 | | 5 | Basic earnings/(loss) per share (Subunit) | -0.10 | 0.20 | -0.10 | 0.20 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.6600 | 0.6700

|

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 27-4-2020 06:55 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2019 | 31 Dec 2018 | 31 Dec 2019 | 31 Dec 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 60 | 20 | 82 | 48 | | 2 | Profit/(loss) before tax | -3,137 | -4,891 | -8,041 | -6,759 | | 3 | Profit/(loss) for the period | 4,179 | 1,740 | 5,809 | 3,824 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 1,671 | -514 | 1,168 | 453 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.34 | -0.11 | 0.24 | 0.10 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.6676 | 0.6652

|

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 20-9-2020 09:33 AM

|

显示全部楼层

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

NON RELATED PARTY TRANSACTIONS | Description | MENANG CORPORATION (M) BERHAD (MENANG OR THE COMPANY) PROPOSED DISPOSAL OF 71% EQUITY INTEREST IN INOVATIF MEWAH SDN BHD (IMSB)(PROPOSED DISPOSAL) | On behalf of the Board of Directors of Menang (“Board”), Affin Hwang Investment Bank Berhad (“Affin Hwang IB”) wishes to announce that on 24 June 2020, Menang Development (M) Sdn Bhd (“MDSB”) and Menang Industries (M) Sdn Bhd (“MISB”) (“collectively referred as “Menang Vendors”), both 100% owned subsidiaries of Menang and together with a minority shareholder of IMSB, Tentu Selesa Sdn Bhd (“TSSB”), had entered into a conditional share sale agreement with Innovative City Holdings Sdn Bhd (“Purchaser” or “ICHSB”), a wholly owned subsidiary of Widad Concession Sdn Bhd (“WCSB”), which in turn is a wholly-owned subsidiary of Widad Group Berhad (“Widad”) for the disposal of 69,300,100 ordinary shares in IMSB for a total cash consideration of RM122,000,000.

The Menang Vendors will be disposing 49,203,071 ordinary shares in IMSB for RM86,620,000 pursuant to the Proposed Disposal.

Please refer to the attachment for further details.

This announcement is dated 25 June 2020. |

https://www.bursamalaysia.com/market_information/announcements/company_announcement/announcement_details?ann_id=3062148

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 4-10-2020 08:11 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2020 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2020 | 31 Mar 2019 | 31 Mar 2020 | 31 Mar 2019 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 10 | 27 | 92 | 75 | | 2 | Profit/(loss) before tax | -2,180 | -2,386 | -10,221 | -9,145 | | 3 | Profit/(loss) for the period | 391 | 498 | 6,200 | 4,322 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 535 | -282 | 1,703 | 171 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.11 | -0.06 | 0.35 | 0.03 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.6687 | 0.6652

|

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|