|

|

【DATAPRP 8338 交流专区】泰达控股

[复制链接]

|

|

|

发表于 14-10-2017 03:11 AM

|

显示全部楼层

发表于 14-10-2017 03:11 AM

|

显示全部楼层

Notice of Interest Sub. S-hldr (Section 137 of CA 2016)Particulars of Substantial Securities HolderName | WARDAH COMMUNICATION SDN BHD | Address | WBG Penthouse, No. 3

Jalan Semantan

Damansara Heights

Kuala Lumpur

50490 Wilayah Persekutuan

Malaysia. | Company No. | 605770-T | Nationality/Country of incorporation | Malaysia | Descriptions (Class) | Ordinary Shares | Name & address of registered holder | Wardah Communication Sdn BhdWBG Penthouse, No. 3Jalan SemantanDamansara Heights50490 Kuala Lumpur |

| Date interest acquired & no of securities acquired | Date interest acquired | 11 Oct 2017 | No of securities | 270,540,800 | Circumstances by reason of which Securities Holder has interest | Ordinary shares representing 64.20% of total issued and paid-up share capital of Dataprep Holdings Bhd entered via Sale of Shares Agreement dated 11 October 2017. | Nature of interest | Direct Interest |  | | Total no of securities after change | Direct (units) | 270,540,800 | Direct (%) | 64.2 | Indirect/deemed interest (units) | 0 | Indirect/deemed interest (%) | 0 | Date of notice | 13 Oct 2017 | Date notice received by Listed Issuer | 13 Oct 2017 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 16-10-2017 02:44 AM

|

显示全部楼层

发表于 16-10-2017 02:44 AM

|

显示全部楼层

李勇坚.泰达大平卖

泰达(DATAPRP,8338,主板科技组)的小股东在上周三午后发出了哀嚎,他们万万没想到,掌控该公司多年的大股东,竟然会以大平卖的方式低价出清手上持股。

该公司大股东卓越控股(VXL HOLDINGS)是以每股16仙售出全部共64.2%股权给丹斯里莫哈末依克玛旗下的Wardah通讯私人有限公司,后者将以同样每股16仙价格作出全面献购。

此献购价比泰达最后闭市价39仙折价23仙或58.97%,显示买卖方认为该公司只值16仙,也导致小股东惊慌抛售,拖累股价周三大跌5.5仙或14%,周四继续直线滑落,以29仙挂收,再跌4.5仙或13.43%,两日成交量都逾2600万股,卖压极为沉重。

卓越控股掌控泰达十多年,尽管该公司一直蒙亏,但始终不离不弃,为何却选择在此刻弃船?

一般上,大股东贱价卖股票,不外乎欠债累累,等钱用,其次就是移情别恋,“拒绝再玩”。

卓控集团是由拿督林致华所控制,他作为云顶集团林氏家族的一分子,有可能手头紧吗?相信没有多少人会认为他急需资金周转。

那么,剩下最可能的原因,就是他对泰达所经营的业务和市场不再眷恋,因此只要有人肯接手,不管价钱多少,只求能卖掉就好,以抛掉沉重包袱。

记得多年前采访过这家公司,该公司负责人曾解说,卓越控股英文名VXL,就是“We Excel”(我们很卓越)的意思。可惜在该公司主导下,泰达多年来表现一直都不卓越,连年亏钱。

或许对林致华而言,泰达就像是鸡肋,食之无味弃之可惜,直到如今出现买家,终于决定放手。

在卖掉亏钱业务后,该集团也可以把资金用于其它前景更佳的投资,例如在中国的滑雪场或其它国家的赌场。

大马股市早前也出现过大股东贱价卖股的例子,就是蚬壳(Shell)海外大股东在去年1月以6千630万美元,或每股1令吉92仙脱售51%股权给中国的恒源国际公司,售价远低于蚬壳当时约5令吉44仙的股价,这导致该股暴跌。

但在新股东接手和易名为恒源(HENGYUAN,4324,主板工业产品组)之后,该公司有如脱胎换骨,盈利暴涨,带动股价直线飙升,连投资名人官有缘也大手笔投资,写下马股一大奇迹。

至于同样被大股东低价脱售的泰达,在Wardah集团入主后能否也上演翻身奇迹,这仍是一个大问号。

文章来源:

星洲日报‧投资致富‧投资茶室‧文:李勇坚‧2017.10.15 |

|

|

|

|

|

|

|

|

|

|

|

发表于 14-11-2017 02:46 AM

|

显示全部楼层

发表于 14-11-2017 02:46 AM

|

显示全部楼层

本帖最后由 icy97 于 14-11-2017 07:18 AM 编辑

泰达股东受促拒绝不公平且不合理的收购献议

Tan Xue Ying/theedgemarkets.com

November 13, 2017 17:21 pm +08

(吉隆坡13日讯)独立顾问Mercury证券建议泰达(Dataprep Holdings Bhd)股东拒绝由商人Tan Sri Muhammad Ikmal Opat Abdullah提出的收购献议,因不公平且不合理。

Ikmal旗下Widad Business Group的独资子公司Wardah Communication私人有限公司于10月11日,以每股16仙向VXL Holdings私人有限公司,收购泰达的2亿7054万股或64.2%股权。

Wardah之后提出以每股16仙收购未持有股权,较泰达在发布公告前的闭市价39仙,折价23仙或58.97%。

Mercury证券指出,虽然献购价比预估合理价高,但较成交量加权平均价(VWAP)大幅折价。

该证券表示,献购价较泰达截至10月10日的一年VWAP(48仙),低32仙或66.7%。这也比该股在同一年期的76%总市场交易日的收盘价低。

此外,考虑到献购方有意维持泰达的上市地位,以及泰达股票的流动性,每月平均交易量为6644万股,这项收购献议也不合理。

因此,股东应该能够以现行市价,在献议结束在公开市场套现投资,尽管无法保证该股将继续以当前的价格和交易量进行交易。

“有鉴于此,Mercury证券认为这个收购献议不公平且不合理。因此,建议你拒绝。”

该公司的无利害关系董事,即Tan Sri Datuk Adzmi Abdul Wahab、Michael Yee Kim Shing、Yeow Soo Hiang、Datuk Mohamad Rais Zainuddin,以及Tan Hock Chye也认同Mercury证券的评估和建议。

通告指出:“因此,董事部建议你拒绝献议。”

(编译:陈慧珊)

Subject | INDEPENDENT ADVICE CIRCULAR TO THE HOLDERS OF THE OFFER SHARES IN RELATION TO THE UNCONDITIONAL MANDATORY TAKE-OVER OFFER BY WARDAH COMMUNICATION SDN BHD ("OFFEROR") THROUGH KENANGA INVESTMENT BANK BERHAD TO ACQUIRE ALL THE REMAINING ORDINARY SHARES OF DATAPREP HOLDINGS BHD. NOT ALREADY HELD BY THE OFFEROR, JOINT ULTIMATE OFFERORS AND PERSON ACTING IN CONCERT WITH THEM ("OFFER SHARES") AT A CASH OFFER PRICE OF RM0.16 PER OFFER SHARE ("OFFER") |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5600189

|

|

|

|

|

|

|

|

|

|

|

|

发表于 16-11-2017 04:32 AM

|

显示全部楼层

发表于 16-11-2017 04:32 AM

|

显示全部楼层

Date of change | 15 Nov 2017 | Name | ENCIK MOHAMAD SABIR BIN MOHAMAD SABRI | Age | 46 | Gender | Male | Nationality | Malaysia | Designation | Non-Independent Director | Directorate | Executive | Type of change | Appointment | Qualifications | Graduated from MARA University of Technology with a Bachelor of Business Administration (Honours) in Finance in 2000. | Working experience and occupation | Mohamad Sabir Bin Mohamad Sabri started his career in the banking and financial sector in 1994 when he joined Bank Negara Malaysia ("BNM") serving in the Banking and Financial Conglomerates Supervision Department. In 2007, he left BNM to join Labuan Financial Services Authority as the Head of Banking Supervision. Subsequently, in 2011, he joined Small Medium Enterprise Development Bank Malaysia Berhad ("SME Bank") as Vice President of Corporate Planning and Strategy Department. During his tenure in SME Bank, he served in various other capacities namely director of strategic and Risk Management (2012), Director of Group Strategy and Services (2013) and Director of Group Financial Management (2014), In 2015, he joined Widad Business Group Sdn Bhd as a Director of Group Strategy and Corporate Services. |

Date of change | 15 Nov 2017 | Name | DATO MOHD RIZAL BIN MOHD JAAFAR | Age | 43 | Gender | Male | Nationality | Malaysia | Designation | Non-Independent Director | Directorate | Non Independent and Non Executive | Type of change | Appointment | Qualifications | Graduated from Universiti Malaya with a Bachelor of Accountancy (Honours) in 1998. Masters in Business Administration in Islamic Banking and Finance from the International Islamic University of Malaya in 2009. Dato' Mohd Rizal Bin Mohd Jaafar is a Chartered Accountant under the Malaysia Institute of Accountants. | Working experience and occupation | He started his career as a bank supervisor and served for 12 year at Bank Negara Malaysia, supervising the Islamic, Commercial and Investment Banking Institutions Department prior joining Small Medium Enterprise Development Bank Malaysia Berhad ("SME Bank") in 2010. He was involved in developing, driving and implementing transformation strategies and initiatives to rejuvenate and strengthen SME Bank. In 2013, he was promoted to the position of Group Chief Operating Officer of SME Bank, where he was responsible for the overall operations of SME Bank. In 2015, he joined Widad Business Group Sdn Bhd as the Group Chief Executive Officer and is currently responsible for the strategic and day-to-day business direction and performance of WBG Group. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 28-11-2017 04:05 AM

|

显示全部楼层

发表于 28-11-2017 04:05 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2017 | 30 Sep 2016 | 30 Sep 2017 | 30 Sep 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 12,664 | 6,994 | 25,878 | 13,069 | | 2 | Profit/(loss) before tax | 534 | -576 | 327 | -1,846 | | 3 | Profit/(loss) for the period | 534 | -576 | 329 | -1,846 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 37 | -487 | -28 | -1,756 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.01 | -0.12 | -0.01 | -0.42 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 |

| 0.00 |

|

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.0700 | 0.0700

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 29-11-2017 01:37 AM

|

显示全部楼层

发表于 29-11-2017 01:37 AM

|

显示全部楼层

Date of change | 24 Nov 2017 | Name | MR TAN HOCK CHYE | Age | 58 | Gender | Male | Nationality | Malaysia | Designation | Executive Director | Directorate | Executive | Type of change | Resignation | Reason | To pursue other business interest | Details of any disagreement that he/she has with the Board of Directors | No | Whether there are any matters that need to be brought to the attention of shareholders | No | Qualifications | Mr. Tan Hock Chye holds a Master of Business Administration (Honors) from Oklahoma City University (USA) and has attended the Harvard Premier Business Management Program. He is a Fellow of the Chartered Institute of Management Accountants (UK) and a Chartered Accountant with the Malaysian Institute of Accountants. | Working experience and occupation | He has more than 35 years of management and financial experience spanning across several industries including retailing, manufacturing, publishing, offshore marine transportation, fast moving consumer goods, industrial goods and hospitality. Previously, he had held several senior management positions in his former employments. He is also a Council Member of PIKOM, the National ICT Association of Malaysia. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 29-11-2017 01:37 AM

|

显示全部楼层

发表于 29-11-2017 01:37 AM

|

显示全部楼层

Date of change | 24 Nov 2017 | Name | DATO MOHD RIZAL BIN MOHD JAAFAR | Age | 43 | Gender | Male | Nationality | Malaysia | Type of change | Redesignation | Previous Position | Non-Independent Director | New Position | Chairman | Directorate | Non Independent and Non Executive | Qualifications | Graduated from Universiti Malaya with a Bachelor of Accountancy (Honours) in 1998. Masters in Business Administration in Islamic Banking and Finance from the International Islamic University of Malaya in 2009. Dato' Mohd Rizal Bin Mohd Jaafar is a Chartered Accountant under the Malaysia Institute of Accountants. | Working experience and occupation | He started his career as a bank supervisor and served for 12 years at Bank Negara Malaysia, supervising the Islamic, Commercial and Investment Banking Institutions Department prior joining Small Medium Enterprise Development Bank Malaysia Berhad ("SME Bank") in 2010. He was involved in developing, driving and implementing transformation strategies and initiatives to rejuvenate and strengthen SME Bank. In 2013, he was promoted to the position of Group Chief Operating Officer of SME Bank, where he was responsible for the overall operations of SME Bank. In 2015, he joined Widad Business Group Sdn Bhd as the Group Chief Executive Officer and is currently responsible for the strategic and day-to-day business direction and performance of WBG Group. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 3-12-2017 04:53 AM

|

显示全部楼层

发表于 3-12-2017 04:53 AM

|

显示全部楼层

Date of change | 28 Nov 2017 | Name | ENCIK MOHAMAD SABIR BIN MOHAMAD SABRI | Age | 46 | Gender | Male | Nationality | Malaysia | Type of change | Redesignation | Previous Position | Executive Director | New Position | Managing Director | Directorate | Executive | Qualifications | Graduated from MARA University of Technology with a Bachelor of Business Administration (Honours) in Finance in 2000. | Working experience and occupation | Mohamad Sabir Bin Mohamad Sabri started his career in the banking and financial sector in 1994 when he joined Bank Negara Malaysia ("BNM") serving in the Banking and Financial Conglomerates Supervision Department. In 2007, he left BNM to join Labuan Financial Services Authority as the Head of Banking Supervision. Subsequently, in 2011, he joined Small Medium Enterprise Development Bank Malaysia Berhad ("SME Bank") as Vice President of Corporate Planning and Strategy Department. During his tenure in SME Bank, he served in various other capacities namely director of strategic and Risk Management (2012), Director of Group Strategy and Services (2013) and Director of Group Financial Management (2014), In 2015, he joined Widad Business Group Sdn Bhd as a Director of Group Strategy and Corporate Services. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 18-1-2018 05:03 AM

|

显示全部楼层

发表于 18-1-2018 05:03 AM

|

显示全部楼层

本帖最后由 icy97 于 19-1-2018 07:00 AM 编辑

泰達與URC開發電商方案

2018年1月18日

(吉隆坡18日訊)泰達(DATAPRP,8338,主要板科技)將與URC電商(大馬)私人有限公司合作,協調開發連結阿里巴巴平台Alibaba.com的電商服務和解決方案。

泰達向馬證交所報備,與URC電商(大馬)簽署合作備忘錄,合作協調開發大馬Alibaba.com電商服務和解決方案。

這項計劃行涵蓋可讓泰達與URC電商(大馬)受惠的培訓、諮詢及商業服務領域。

無論如何,是項合作備忘錄不會對泰達2018財年盈利與淨資產帶來重大影響。【e南洋】

Type | Announcement | Subject | OTHERS | Description | MEMORANDUM OF COLLABORATION DATED 17 JANUARY 2018 FOR THE MUTUAL BENEFITS IN CONNECTION WITH THE PROVISION OF E-COMMERCE SERVICES AND SOLUTIONS IN RESPECT OF ALIBABA.COM IN MALAYSIA BETWEEN URC E-COMMERCE (M) SDN BHD AND DATAPREP HOLDINGS BERHAD (MEMORANDUM OF COLLABORATION) | Dataprep Holdings Berhad is pleased to announce that it had on 17 January 2018 entered into a Memorandum of Collaboration with URC E-Commerce (M) Sdn Bhd (“URCE”).

Under the Memorandum of Collaboration, Dataprep and URCE will work to coordinate the efforts in developing the connection with the provision of e-commerce services and solutions in respect of Alibaba.com in Malaysia (“the Project”). The Project covers the training, consultancy and business services in areas where DATAPREP and URCE can benefit each other.

Details of the Memorandum of Collaboration is attached herewith.

This announcement is dated 17 January 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5667929

|

|

|

|

|

|

|

|

|

|

|

|

发表于 15-2-2018 05:06 AM

|

显示全部楼层

发表于 15-2-2018 05:06 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | INCORPORATION OF A WHOLLY-OWNED SUBSIDIARY DATAPREP INTERNATIONAL (LABUAN) LTD | 1. INTRODUCTION On behalf of Dataprep Holdings Bhd (“Dataprep” or “the Company”), the Board of Directors wishes to announce that the Company has incorporated a wholly-owned subsidiary, namely Dataprep International (Labuan) Ltd (Company No.LL14504 ) as part of the Business Review Exercise.

2. INFORMATION Dataprep International (Labuan) Ltd was incorporated in Malaysia under the Labuan Companies Act 1990 on 14 February 2018. The total issued and paid-up share capital is USD1.00. The principal business of Dataprep International (Labuan) Ltd is investment holdings.

3. FINANCIAL EFFECTS The incorporation of Dataprep International (Labuan) Ltd as the wholly-owned subsidiary of the Company is not expected to have any material effects on the earnings,net assets or gearing of Dataprep Group for the financial year ending 31 March 2018.

4. DIRECTORS’ AND MAJOR SHAREHOLDERS’ AND/OR PERSONS CONNECTED WITH A DIRECTOR OR MAJOR SHAREHOLDER’S INTEREST None of the Directors and/or major shareholders or persons connected to them have any interest, direct or indirect, in the aforesaid incorporation.

This announcement is dated 14 February 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 20-2-2018 01:04 AM

|

显示全部楼层

发表于 20-2-2018 01:04 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | DATAPREP HOLDINGS BHD ("DATAPREP" OR "THE COMPANY") - ACQUISITION OF NEW INDIRECT SUBSIDIARY | Pursuant to Paragraph 9.19(23) of the Main Market Listing Requirements of Bursa Malaysia Securities Berhad, the Board of Directors of Dataprep wishes to announce that its wholly-owned subsidiary, Dataprep International (Labuan) Ltd has today acquired 51% stake in DP Kyoto Tech Middle East Limited, UAE (the “Acquisition”). As a result of the Acquisition, DP Kyoto Tech Middle East Limited, UAE has become a 51% owned indirect subsidiary of the Company.

The principal business of DP Kyoto Tech Middle East Limited, UAE is providing education technology that delivers technological and logistic support services across the globe and has the necessary infrastructure, technologies network and skill sets to support and team up for a business alliance.

None of the Directors or major shareholders or persons connected with them has any interest, direct and indirect, in the said Acquisition. It does not have any material impact on the net assets and earnings per share of Dataprep Group for the financial year ending 31 March 2018.

This announcement is dated 19 February 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 4-3-2018 06:52 AM

|

显示全部楼层

发表于 4-3-2018 06:52 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2017 | 31 Dec 2016 | 31 Dec 2017 | 31 Dec 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 9,789 | 9,965 | 35,667 | 23,034 | | 2 | Profit/(loss) before tax | -2,741 | -487 | -2,414 | -2,333 | | 3 | Profit/(loss) for the period | -2,741 | -516 | -2,412 | -2,362 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -2,658 | -217 | -2,686 | -1,973 | | 5 | Basic earnings/(loss) per share (Subunit) | -0.63 | -0.05 | -0.64 | -0.47 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.0700 | 0.0700

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 9-6-2018 07:08 AM

|

显示全部楼层

发表于 9-6-2018 07:08 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2018 | 31 Mar 2017 | 31 Mar 2018 | 31 Mar 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 11,495 | 21,996 | 47,162 | 45,030 | | 2 | Profit/(loss) before tax | -2,365 | -731 | -4,779 | -3,064 | | 3 | Profit/(loss) for the period | -2,367 | -731 | -4,779 | -3,093 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -2,364 | -564 | -5,050 | -2,537 | | 5 | Basic earnings/(loss) per share (Subunit) | -0.56 | -0.05 | -1.20 | -0.61 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.0600 | 0.0700

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 31-8-2018 04:32 AM

|

显示全部楼层

发表于 31-8-2018 04:32 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2018 | 30 Jun 2017 | 30 Jun 2018 | 30 Jun 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 6,269 | 13,214 | 6,269 | 13,214 | | 2 | Profit/(loss) before tax | -2,676 | -207 | -2,676 | -207 | | 3 | Profit/(loss) for the period | -2,676 | -205 | -2,676 | -205 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -2,676 | -65 | -2,676 | -65 | | 5 | Basic earnings/(loss) per share (Subunit) | -0.64 | -0.02 | -0.64 | -0.02 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.0600 | 0.0700

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 15-9-2018 04:57 AM

|

显示全部楼层

发表于 15-9-2018 04:57 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 3-10-2018 03:19 AM

|

显示全部楼层

发表于 3-10-2018 03:19 AM

|

显示全部楼层

本帖最后由 icy97 于 8-10-2018 02:26 AM 编辑

Type | Announcement | Subject | OTHERS | Description | AGREEMENT FOR THE CONTRACT TO PROVIDE DESKTOP SUPPORT AND INFORMATION TECHNOLOGY HELPDESK MANAGEMENT SERVICES TO RHB AND TO MEMBERS OF THE RHB BANKING GROUP EXECUTED BETWEEN RHB BANK BERHAD (RHB) AND SOLSIS (M) SDN BHD (SOLSIS), A WHOLLY-OWNED SUBSIDIARY OF THE COMPANY (THE CONTRACT) | 1. INTRODUCTION Dataprep Holdings Bhd. is pleased to announce that its subsidiary, Solsis, had on 28 September 2018 entered into the Contract with RHB Banking Group to provide desktop support and information technology helpdesk management services to for the duration of 3 years. The total contract value is RM14.2 million.

2.DURATION OF THE CONTRACT The Contract is for a period of three (3) years commencing from 1 October 2018 until 30 September 2021 (“Contract Period”).

3. RISK FACTORS The risks in respect of the project are the normal business / operation risks and are expected to be manageable and not significant to the Group.

4. FINANCIAL EFFECTS The Contract is expected to contribute positively to the Group’s earnings throughout the Contract period. The Contract is not expected to have any material effect on the Group’s Net Assets for the financial year ending 31 March 2019.

5. INTEREST OF MAJOR SHAREHOLDERS AND DIRECTORS None of the major shareholders and/or directors of Dataprep and/or persons connected with them have any interest, direct or indirect, in the Contract.

6. DIRECTORS’ STATEMENT The Board of Directors of Dataprep is of the opinion that the execution of the Contract is in the ordinary course of business and is in the best interest of the Company.

This announcement is dated 1 October 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 30-10-2018 05:51 AM

|

显示全部楼层

发表于 30-10-2018 05:51 AM

|

显示全部楼层

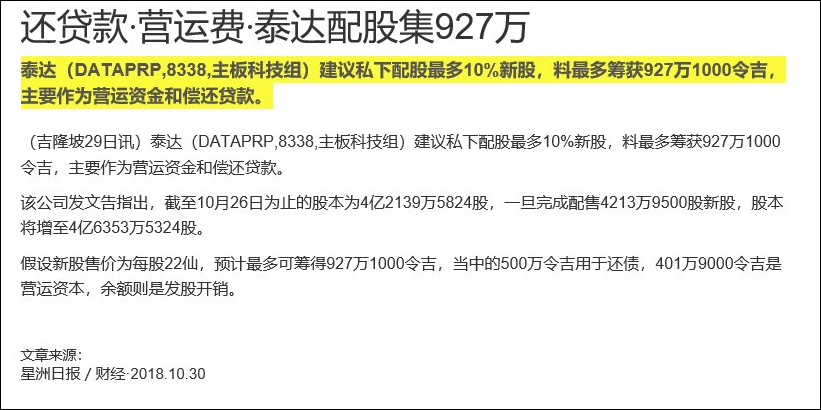

Type | Announcement | Subject | NEW ISSUE OF SECURITIES (CHAPTER 6 OF LISTING REQUIREMENTS)

FUND RAISING | Description | DATAPREP HOLDINGS BHD. ("DHB" OR THE "COMPANY") PROPOSED PRIVATE PLACEMENT OF NEW ORDINARY SHARES IN DHB ("DHB SHARES" OR "SHARES"), REPRESENTING NOT MORE THAN 10% OF THE TOTAL NUMBER OF ISSUED SHARES OF DHB ("PROPOSED PRIVATE PLACEMENT") | On behalf of the Board of Directors of DHB (“Board”), Kenanga Investment Bank Berhad (“Kenanga IB”) wishes to announce that the Company proposes to undertake the Proposed Private Placement. Please refer to the attachment below for further details.

This announcement is dated 29 October 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5957085

|

|

|

|

|

|

|

|

|

|

|

|

发表于 3-11-2018 06:35 AM

|

显示全部楼层

发表于 3-11-2018 06:35 AM

|

显示全部楼层

本帖最后由 icy97 于 10-11-2018 06:34 AM 编辑

Type | Announcement | Subject | NEW ISSUE OF SECURITIES (CHAPTER 6 OF LISTING REQUIREMENTS)

FUND RAISING | Description | DATAPREP HOLDINGS BHD. ("DHB" OR THE "COMPANY") PROPOSED PRIVATE PLACEMENT OF NEW ORDINARY SHARES IN DHB ("DHB SHARES" OR "SHARES"), REPRESENTING NOT MORE THAN 10% OF THE TOTAL NUMBER OF ISSUED SHARES OF DHB ("PROPOSED PRIVATE PLACEMENT") | We refer to the announcements made on 29 October 2018 and 30 October 2018 in relation to the Proposed Private Placement (“Announcements”). Unless otherwise defined, the definitions set out in the Announcements shall apply herein.

Further to the Announcements, on behalf of the Board of DHB, Kenanga IB wishes to provide additional information in relation to the Proposed Private Placement. Kindly refer to the attachment below for further details.

This announcement is dated 30 October 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5959989

|

|

|

|

|

|

|

|

|

|

|

|

发表于 1-1-2019 03:34 AM

|

显示全部楼层

发表于 1-1-2019 03:34 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2018 | 30 Sep 2017 | 30 Sep 2018 | 30 Sep 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 6,257 | 12,664 | 12,526 | 25,878 | | 2 | Profit/(loss) before tax | -2,490 | 534 | -5,166 | 327 | | 3 | Profit/(loss) for the period | -2,490 | 534 | -5,166 | 329 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -2,489 | 37 | -5,165 | 28 | | 5 | Basic earnings/(loss) per share (Subunit) | -0.59 | 0.01 | -1.23 | -0.01 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.0500 | 0.0600

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 2-3-2019 07:19 AM

|

显示全部楼层

发表于 2-3-2019 07:19 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2018 | 31 Dec 2017 | 31 Dec 2018 | 31 Dec 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 13,760 | 9,789 | 26,286 | 35,667 | | 2 | Profit/(loss) before tax | -679 | -2,741 | -5,845 | -2,414 | | 3 | Profit/(loss) for the period | -679 | -2,741 | -5,845 | -2,412 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -679 | -2,658 | -5,844 | -2,686 | | 5 | Basic earnings/(loss) per share (Subunit) | -0.16 | -0.63 | -1.39 | -0.64 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 |

| 0.00 |

|

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.0500 | 0.0600

|

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|