|

|

【RCECAP 9296 交流专区】RCE资本

[复制链接]

[复制链接]

|

|

|

发表于 6-8-2007 10:33 AM

|

显示全部楼层

发表于 6-8-2007 10:33 AM

|

显示全部楼层

原帖由 piao2 于 6-8-2007 10:23 AM 发表

现在期指是1268点,呵呵。

沒辨法,因為大家心里還是今晚美股是否會再軟腳了,今天丟好過明天變成小虫了。 |

|

|

|

|

|

|

|

|

|

|

|

发表于 6-8-2007 01:39 PM

|

显示全部楼层

发表于 6-8-2007 01:39 PM

|

显示全部楼层

|

风险已经计算在16%里面,这种生意长期还是可以做的. |

|

|

|

|

|

|

|

|

|

|

|

发表于 6-8-2007 01:48 PM

|

显示全部楼层

发表于 6-8-2007 01:48 PM

|

显示全部楼层

RCECAP再跌了.... RCECAP再跌了.... |

|

|

|

|

|

|

|

|

|

|

|

发表于 6-8-2007 02:14 PM

|

显示全部楼层

发表于 6-8-2007 02:14 PM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 6-8-2007 04:18 PM

|

显示全部楼层

发表于 6-8-2007 04:18 PM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 6-8-2007 08:09 PM

|

显示全部楼层

发表于 6-8-2007 08:09 PM

|

显示全部楼层

刚刚研究了RCE的2007年的Annual Audited Account。。。

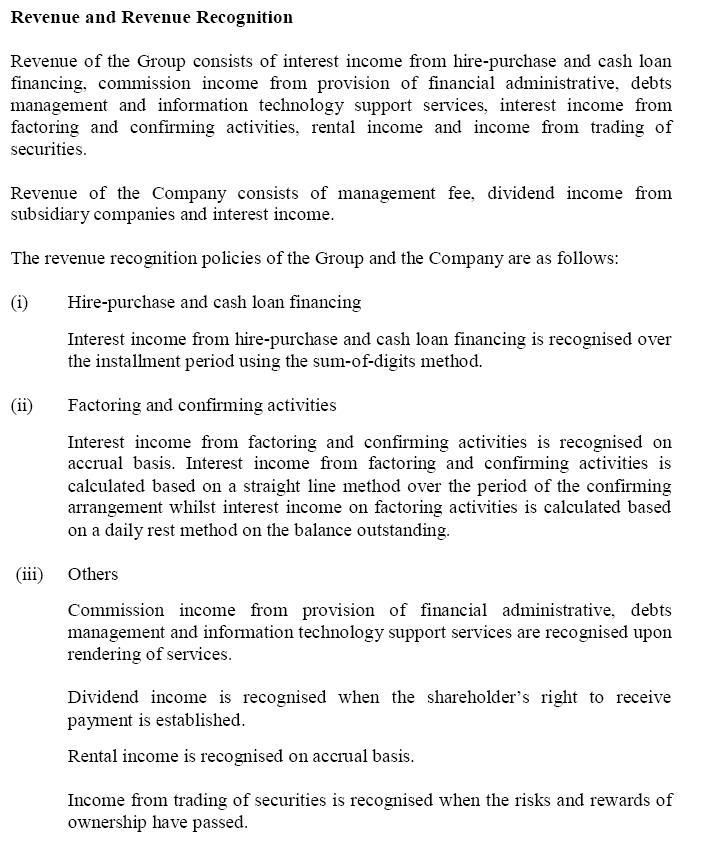

"Interest income from hire-purchase and cash loan financing is recognised over the installment period using the sum-of-digits method."

RCE的利息是用"sum-of-digits"的方法来计算,同样的方法也用来计算一般车贷的利息。这利息计算的方法的重点是除非欠债人一次过还完整笔贷款,不然他并不会节省利息。

PS:如果我没记错的话,很多银行的个人贷款也是用"sum-of-digits"的方法来计算利息,例如Anytime Money。至于有多少欠债人清楚他们得还的利息是用这方法计算的,我就不肯定了。。。

Rule of 78 Loan

Some creditors use tables based on a method called the Rule of 78, also known as the sum of the digits method to determine how much interest you have paid at any point in a loan.

The number 78 comes from the 12 months in a one year period. The sum of those parts (1 + 2 + 3 .. + 12) is 78. Thus, for a one year loan 12/78ths of the interest is considered earned in month one, 11/78ths in month two and so on down to 1/78th in month twelve.

This method was initially used as an approximation of the standard installment loan amortization method. As it doesn't calculate interest on the outstanding balance but simply attributes a predetermined part of the total interest, this has the effect of decreasing the balance more slowly.

If you don't pay off the loan early, you pay the same amount of interest using standard amortization or Rule of 78 amortization. However, if you do pay off early, you will end up paying more interest with a Rule of 78 loan than with a corresponding standard installment loan. For that reason, you should avoid loans that use the Rule of 78 method.

When deciding whether or not to pay off a Rule of 78 loan early, you should know the amount of interest you'll save, you may be better off investing the funds elsewhere rather than paying off the loan.

In 1992, the U.S. Congress outlawed the use of the "Rule of 78" formula in closed-end loans longer than 61 months. Whether a lender can apply the method to installment loans of five years or less is a matter of state law. Many U.S. states prohibit the practice.

......

http://www.paranzasoft.com/help/pages/caRuleOf78.html

Rule of 78

A method of calculating how much interest has been earned by a lender at any stage during the repayment of a loan on which a fixed rate of interest has been agreed in advance. The rule is applied to consumer finance where loans are repaid in instalments. The '78' derives from the twelve monthly parts of a one-year loan - the sum of those parts is 78 (12 + 11 + 10 + 9 etc). The lender earns 12/78ths of total interest in the first month, 11/78ths in the second month, and so on. The effect of the rule is distorted in the longer-term consumer loans common today. People who decide to pay out a loan early in its course are often surprised to discover how little impression their instalment payments have made on the principal. The rule of 78 helps explain why this is so.

http://www.anz.com/edna/dictionary.asp?action=content&content=rule_of_78

Rule of 78 works out how much interest you should have paid at any time during the repayment period of a loan. Its main feature is that the interest is not spread evenly over the payments during the term of the loan. Under rule of 78 you pay more interest in the beginning of a loan and as each repayment is the same size, the part paying off the capital is smaller in the beginning of the loan increasing over time.

The number 78 is based on the 12 months of a one-year period. When the 12 months are added together (12+11+10+9+8+7+6+5+4+3+2+1) you get 78. This means that if you have a loan to be repaid in one-year, the lender will expects you to pay 12/78ths of the interest in the first month and 11/78ths in the second, continuing like this until the final month.

If the loan is paid off early, the lender may use the rule of 78 to determine how much interest you do not have to pay. In many cases, due to the interest element being larger in the repayments at the beginning of the loan, a large amount of capital can remain to be repaid.

......

http://www.moneyfacts.co.uk/loans/guides/rule78.aspx

[ 本帖最后由 Mr.Business 于 6-8-2007 08:17 PM 编辑 ] |

|

|

|

|

|

|

|

|

|

|

|

发表于 6-8-2007 08:11 PM

|

显示全部楼层

发表于 6-8-2007 08:11 PM

|

显示全部楼层

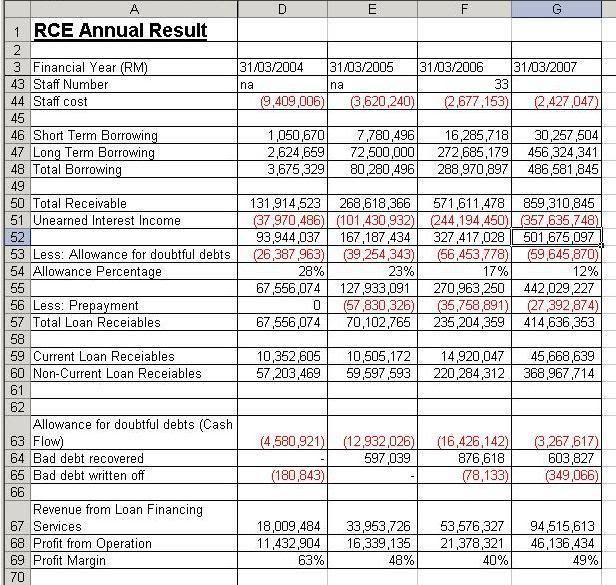

我的功课:

[ 本帖最后由 Mr.Business 于 6-8-2007 09:03 PM 编辑 ] |

|

|

|

|

|

|

|

|

|

|

|

发表于 6-8-2007 08:38 PM

|

显示全部楼层

发表于 6-8-2007 08:38 PM

|

显示全部楼层

回复 #247 Mr.Business 的帖子

谢谢分享:)

请问unearned interest income还有prepayment指的是什么?为什么要扣除呢? |

|

|

|

|

|

|

|

|

|

|

|

发表于 6-8-2007 08:51 PM

|

显示全部楼层

发表于 6-8-2007 08:51 PM

|

显示全部楼层

回复 #248 xzm 的帖子

在Balance Sheet出现的LOANS AND HIRE-PURCHASE RECEIVABLES

= Receivables - Unearned Interest Income - Allowance for doubtful debts - Prepayment

我所理解的Receivables (RM859310845) 是包括借贷出去的款项 (RM501675097)和还没没收到的利息 (RM357635748)。至于Prepayment应是指欠债人多还的款项。

[ 本帖最后由 Mr.Business 于 6-8-2007 09:13 PM 编辑 ] |

|

|

|

|

|

|

|

|

|

|

|

发表于 6-8-2007 09:05 PM

|

显示全部楼层

发表于 6-8-2007 09:05 PM

|

显示全部楼层

回复 #249 Mr.Business 的帖子

是不是就是说,Total Loan Receivables就是将会收到的款项本金(不包括利息)?

而Total Receivables就是所有将会收到的现金(包括本金、利息、prepayment等等),算是asset? |

|

|

|

|

|

|

|

|

|

|

|

发表于 6-8-2007 09:14 PM

|

显示全部楼层

发表于 6-8-2007 09:14 PM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 7-8-2007 09:28 AM

|

显示全部楼层

发表于 7-8-2007 09:28 AM

|

显示全部楼层

市场静淡,看来RCE的ABS在近期内是不会有消息了。

XXXXX

再抵押機構

深信可度過危機

雖然美國次級房貸風暴稍微影響債券需求,但再抵押機構(Cagamas)深信,可度過這個危機。

該機構總執行長蔡啟全告訴《路透社》指出,像這種全球利淡,必定帶來某種形式衝擊,我國不可能完全免受威脅。

“我們發售的債券並非次級房貸,過了一段時間后,投資者最終還是會選購更多我們發售的債券,主要因為我們是有素質的發行商。”

部份分析員認為,美國次級房貸危機將衝擊全球債券市場,促使銀行緊收銀根,最后導致信貸緊縮。

再抵押機構目前為總值高達24億1000萬令吉的住宅房貸債券(CMBS),展開書面競購。

該機構是我國最大的民間企業債券(PDS)發行商,截至去年尾,已發行及未贖回債券總值達214億令吉,佔我國民間企業債市的10分之1。

http://www.chinapress.com.my/con ... mp;art=0807bs02.txt

XXXXX

Cagamas: We can weather US subprime crisis

August 7 2007

DEMAND for bonds sold by Malaysia's national mortgage firm Cagamas Bhd will be slightly affected by the US subprime mortgage fallout, but the company is confident of weathering the crisis, its chief said yesterday.

"Like all these global things, there will always be some form of impact. It's naive to think that we are completely sheltered," Cagamas chief executive Steven Choy said.

"One thing for sure, the papers we have got out there are not subprime.In fact, given a little bit more time, people will even actually come more to us because of the fact that we are a quality issuer."

Cagamas issues debt and uses the funds to buy housing loans from financial institutions and the Government, enabling the lenders to give out more loans. It has the highest rating of AAA from Rating Agency Malaysia and Malaysian Rating Corp.

Some analysts are concerned that the US subprime mortgage problem could hit the global securitisation market, forcing banks to keep loans on their books,which could lead to a possible credit crunch.

But Malaysia's bond market, Southeast Asia's largest, has remained healthy so far,with demand partly driven by expectations of further appreciation in the ringgit currency which has gained about two per cent so far this year.

"The domestic bond market is quite resilient at the moment as players are switching from the battered equity market," said Lum Choong Kuan, head of fixed income at CIMB Investment Bank.

Cagamas is currently book building for a RM2.41 billion bond issue backed by home mortgages, its largest residential-backed issuance.

The mortgage company would be able to withstand the challenges arising from the crisis at the high-risk end of the US home loans market, Choy said.

"Sometimes you just have to ride through the storm," he said. "If you're a good solid aircraft, even there's a storm, you just ride through it."

There would be ample demand for Cagamas paper from large investors, Choy said.

"Financial institutions still have to hold some paper and you tell me what else there is out there?" he said.

"Deposits are not giving the best yields. So they have to invest in something and, again, flight to quality is very important."

Cagamas is the largest issuer of private debt securities in Malaysia,with total debt securities issued and outstanding stood at RM21.4 billion as at end-December 2006. - Reuters

http://www.btimes.com.my/Current_News/BT/Tuesday/Nation/CAGASUB.xml/Article/

[ 本帖最后由 Mr.Business 于 7-8-2007 09:30 AM 编辑 ] |

|

|

|

|

|

|

|

|

|

|

|

发表于 7-8-2007 09:56 AM

|

显示全部楼层

发表于 7-8-2007 09:56 AM

|

显示全部楼层

|

最怕是RCECAP开始走向下降渠道...那么你可以休息半年-1年时间做RCECAP的功课了. |

|

|

|

|

|

|

|

|

|

|

|

发表于 7-8-2007 10:28 AM

|

显示全部楼层

发表于 7-8-2007 10:28 AM

|

显示全部楼层

AMMB的业绩不好,不知道对RCE有没有影响。

一股兩面:大馬證券銀行亮賣出訊號 - Saturday, August 04, 2007

將于本月底前出爐最新首季業績的大馬證券銀行(AMMB,1015,主板金融股),過去3個交易日,隨著綜合指數下滑之際,股價從4.7令吉左右,直線滑落至4.2令吉水平,唯成交量則保持溫和,這也顯示,大馬證券銀行這輪的跌勢,並不是面對龐大賣壓而走低。

依據大馬證券銀行最新第四季業績(18/5),集團面臨由盈轉虧厄運,從06年的每股盈利2.45仙,變至07年的每股虧損高達25.69仙,每股資產淨值也從2.42令吉,降至2.29令吉;但是,集團仍建議派發5仙終期股息,唯是項建議仍需待有關當局亮綠燈后,方能進行。

分析大馬證券銀行的股價走勢圖,代表短期指標走勢的18及40天移動平均線,現階段已邁入賣出訊號的死亡交叉走勢,短期內,若該股能夠重返並企穩在4.532令吉水平,才有望擺脫下調格局。

該股的14天強弱勢指標,目前已陷入超賣水平19.787%,料盤中走勢會有技術反彈,回彈幅度則需視買盤動力是否夠強大。此外,平均乖離指標,目前也出示賣出訊號的死亡交叉趨勢。

該股的短期阻力水平是在4.26令吉到4.54令吉區間,如在成交量支配下,下道阻力則落在4.58令吉道4.88令吉之間;而當前扶持範圍是4.1令吉到3.8令吉之間。

http://www.orientaldaily.com.my/ |

|

|

|

|

|

|

|

|

|

|

|

发表于 7-8-2007 11:41 AM

|

显示全部楼层

发表于 7-8-2007 11:41 AM

|

显示全部楼层

mr.business兄, 我发现我国有一间分期付款卖家具的court 的生意也是做得不大好。。

aeon credit 和 rcecap 也是做分期付款生意的, 我看应该有点相识 |

|

|

|

|

|

|

|

|

|

|

|

发表于 7-8-2007 12:21 PM

|

显示全部楼层

发表于 7-8-2007 12:21 PM

|

显示全部楼层

回复 #255 江湖 的帖子

Courts, AEON Credit和RCECAP都是做借贷消费的生意的。

Courts - 家具的hire purchase

AEON Credit - 个人贷款和信用卡业务

RCECAP - 专做公务员的个人贷款和hire purchase。

如果你留意RCECAP早期的研究报告,你会发现那时候研究员是拿RCECAP与Courts做比较 (那时候RCECAP主要只做hire purchase的生意,还未涉足公务员的个人贷款业务)。

原帖由 Mr.Business 于 22-7-2007 10:57 AM 发表

RCE的强处:

1. Quick response time/ Short loan disbursement time (24-48 hours);

2. Products are "sold" rather than "bought"/ Its external marketing network consists mainly of highly incentivized cooperative members who may already be customers themselves;

3. Wide-ranging delivery network (60 co-op branches and 300 agents)/ Have established relationship with the cooperatives;

4. The ability to give pre-approved loan advances.

这些feature能为RCE建立强大的moat (不可超越的优势)吗?

[ 本帖最后由 Mr.Business 于 7-8-2007 12:34 PM 编辑 ] |

|

|

|

|

|

|

|

|

|

|

|

发表于 7-8-2007 02:28 PM

|

显示全部楼层

发表于 7-8-2007 02:28 PM

|

显示全部楼层

最近人人都想动公务员薪金的主意,哈。。。

XXXXX

公务员欠贷学金直接扣薪 2007/08/06 18:02:00

●南洋商报

(吉隆坡6日讯)国家高等教育基金局将发出最后通牒予拖欠贷学金的7千836名公务员,如果他们仍旧顽固不灵,该局将直接以扣薪方式,迫使他们还钱。

基金局总执行长尤努斯阿都干尼说,扣薪缴还贷款的方法,确实有助于解决拖欠贷款问题。

他向《每日新闻》说,尽管扣薪计划应以借贷人意愿为依归,但若有关公务员接获最后通牒后仍无动于衷,那么该局将向公共服务局申请,通过扣薪方式回收这些人拖欠的贷学金。

他说,今年5月以来,该局已两度发函提醒拖欠贷学金的公务员还钱,随着一些人作出反应后,拖欠人数已减少很多,其中2千101人已自动缴付拖欠的贷款。

http://www.nanyang.com/index.php?ch=7&pg=10&ac=757555

XXXXX

RCE与合作社关系密切。所以合作社的新闻也要注意一下。

Tuesday August 7, 2007

ASM Investment wooing co-ops

It aims for up to RM50m investments in six months

By JACK WONG

KUCHING: ASM Investment Services Bhd is targeting to attract between RM20mil and RM50mil in investments from the country’s cooperatives in the next six months.

Chief executive officer Izaddeen Daud said the company, which currently manages 15 unit trust funds, had started to meet officials of the more than 3,000 cooperatives in the country, beginning with some 50 cooperatives here last week.

The company, formerly ASM Mara Unit Trust Management Bhd, has taken the cue from Prime Minister Datuk Seri Abdullah Ahmad Badawi’s recent call to cooperatives to invest their excess funds with ASM Investment.

“More than 200 cooperatives have already invested in our unit trust funds,” Izaddeen told StarBiz.

He said the meetings with the cooperatives were to understand the types of investment risk they could take and their expected returns.

This would help the company come up with customised products to meet their needs.

Izaddeen said ASM Investment would launch a structured unit trust fund this month and was exploring other investment instruments, like structured notes.

He said a structured unit trust fund differed from the conventional unit trust fund as the former had a maturity date, and gave investors a principal protection and some returns, which should be higher than the banks’ fixed deposit rates.

Izaddeen said ASM Investment, which completed its restructuring exercise three weeks ago, had changed its marketing approach and was now aggressively targeting the corporate sector, in addition to cooperatives.

“We now target 80% of our business to come from the cooperative and corporate sector, and the balance 20% from the retail market, which is saturated,” he said.

http://biz.thestar.com.my/news/story.asp?file=/2007/8/7/business/18498144&sec=business

[ 本帖最后由 Mr.Business 于 7-8-2007 02:34 PM 编辑 ] |

|

|

|

|

|

|

|

|

|

|

|

发表于 7-8-2007 03:04 PM

|

显示全部楼层

发表于 7-8-2007 03:04 PM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 7-8-2007 03:12 PM

|

显示全部楼层

发表于 7-8-2007 03:12 PM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 7-8-2007 04:59 PM

|

显示全部楼层

发表于 7-8-2007 04:59 PM

|

显示全部楼层

哈哈哈!!!

各位 kawan rcecap 近來如何了?

搞不好多兩天爆發坏消息哦。。。 |

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|