|

|

发表于 10-8-2018 03:21 AM

|

显示全部楼层

发表于 10-8-2018 03:21 AM

|

显示全部楼层

Name | MR KOON YEW YIN | Nationality/Country of incorporation | Malaysia | Descriptions (Class) | Ordinary Shares |

Details of changesNo | Date of change | No of securities | Type of Transaction | Nature of Interest | | 1 | 03 Aug 2018 | 2,711,100 | Disposed | Direct Interest | Name of registered holder | KOON YEW YIN | Address of registered holder | 65, LINGKARAN MERU VALLEY, MERU GOLF RESORT, JELAPANG, 30200 IPOH | Description of "Others" Type of Transaction | | | 2 | 06 Aug 2018 | 1,356,800 | Disposed | Direct Interest | Name of registered holder | KOON YEW YIN | Address of registered holder | 65, LINGKARAN MERU VALLEY, MERU GOLF RESORT, JELAPANG, 30200 IPOH | Description of "Others" Type of Transaction | | | 3 | 07 Aug 2018 | 6,850,300 | Disposed | Direct Interest | Name of registered holder | KOON YEW YIN | Address of registered holder | 65, LINGKARAN MERU VALLEY, MERU GOLF RESORT, JELAPANG, 30200 IPOH | Description of "Others" Type of Transaction | | | 4 | 08 Aug 2018 | 6,872,000 | Disposed | Direct Interest | Name of registered holder | KOON YEW YIN | Address of registered holder | 65, LINGKARAN MERU VALLEY, MERU GOLF RESORT, JELAPANG, 30200 IPOH | Description of "Others" Type of Transaction | |

Circumstances by reason of which change has occurred | Disposal of shares under various accounts | Nature of interest | Direct Interest | Direct (units) | 80,340,900 | Direct (%) | 14.716 | Indirect/deemed interest (units) |

| | Indirect/deemed interest (%) |

| | Total no of securities after change | 80,340,900 | Date of notice | 09 Aug 2018 | Date notice received by Listed Issuer | 09 Aug 2018 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 25-8-2018 06:47 AM

|

显示全部楼层

发表于 25-8-2018 06:47 AM

|

显示全部楼层

Name | MR KOON YEW YIN | Nationality/Country of incorporation | Malaysia | Descriptions (Class) | Ordinary Shares |

Details of changesNo | Date of change | No of securities | Type of Transaction | Nature of Interest | | 1 | 17 Aug 2018 | 3,200,000 | Disposed | Direct Interest | Name of registered holder | KOON YEW YIN | Address of registered holder | 65, LINGKARAN MERU VALLEY, MERU GOLF RESORT, JELAPANG, 30020 IPOH | Description of "Others" Type of Transaction | | | 2 | 20 Aug 2018 | 5,697,700 | Disposed | Direct Interest | Name of registered holder | KOON YEW YIN | Address of registered holder | 65, LINGKARAN MERU VALLEY, MERU GOLF RESORT, JELAPANG, 30020 IPOH | Description of "Others" Type of Transaction | | | 3 | 21 Aug 2018 | 1,950,000 | Disposed | Direct Interest | Name of registered holder | KOON YEW YIN | Address of registered holder | 65, LINGKARAN MERU VALLEY, MERU GOLF RESORT, JELAPANG, 30020 IPOH | Description of "Others" Type of Transaction | | | 4 | 23 Aug 2018 | 909,000 | Disposed | Direct Interest | Name of registered holder | KOON YEW YIN | Address of registered holder | 65, LINGKARAN MERU VALLEY, MERU GOLF RESORT, JELAPANG, 30020 IPOH | Description of "Others" Type of Transaction | |

Circumstances by reason of which change has occurred | Disposal of shares under various accounts | Nature of interest | Direct Interest | Direct (units) | 59,227,800 | Direct (%) | 10.849 | Indirect/deemed interest (units) |

| | Indirect/deemed interest (%) |

| | Total no of securities after change | 59,227,800 | Date of notice | 24 Aug 2018 | Date notice received by Listed Issuer | 24 Aug 2018 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 31-8-2018 02:10 AM

|

显示全部楼层

发表于 31-8-2018 02:10 AM

|

显示全部楼层

本帖最后由 icy97 于 4-9-2018 04:36 AM 编辑

单次售地收益带动 JAKS次季净利激增5倍

Justin Lim/theedgemarkets.com

August 28, 2018 20:34 pm +08

(吉隆坡28日讯)JAKS资源(JAKS Resources Bhd)第二季净利激增逾5倍,归功于脱售梳邦再也的土地获利580万令吉,以及越南的工程、采购与建设(EPC)合约的按进度入账提高。

该集团今日向大马交易所报备,截至6月杪次季净利达1274万令吉,或每股2.44仙,上财年同期报198万令吉,或每股0.44仙。

季度营业额从1亿7094万令吉,升4.32%至1亿7834万令吉。

累积两季度的净利跳涨221.11%至3058万令吉,同期为952万令吉;营业额由3亿2573万令吉,扬19.28%至3亿8853万令吉。

JAKS指出,建筑业务的税前盈利劲升64%至4464万令吉,而产业发展与投资业务的税前亏损扩大至2500万令吉。

(编译:陈慧珊)

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2018 | 30 Jun 2017 | 30 Jun 2018 | 30 Jun 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 178,336 | 170,945 | 388,533 | 325,733 | | 2 | Profit/(loss) before tax | 6,028 | -4,559 | 16,809 | -1,601 | | 3 | Profit/(loss) for the period | 4,992 | -4,809 | 15,335 | -2,187 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 12,737 | 1,979 | 30,579 | 9,523 | | 5 | Basic earnings/(loss) per share (Subunit) | 2.44 | 0.44 | 5.87 | 2.12 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.4700 | 1.4200

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 23-9-2018 04:38 AM

|

显示全部楼层

发表于 23-9-2018 04:38 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

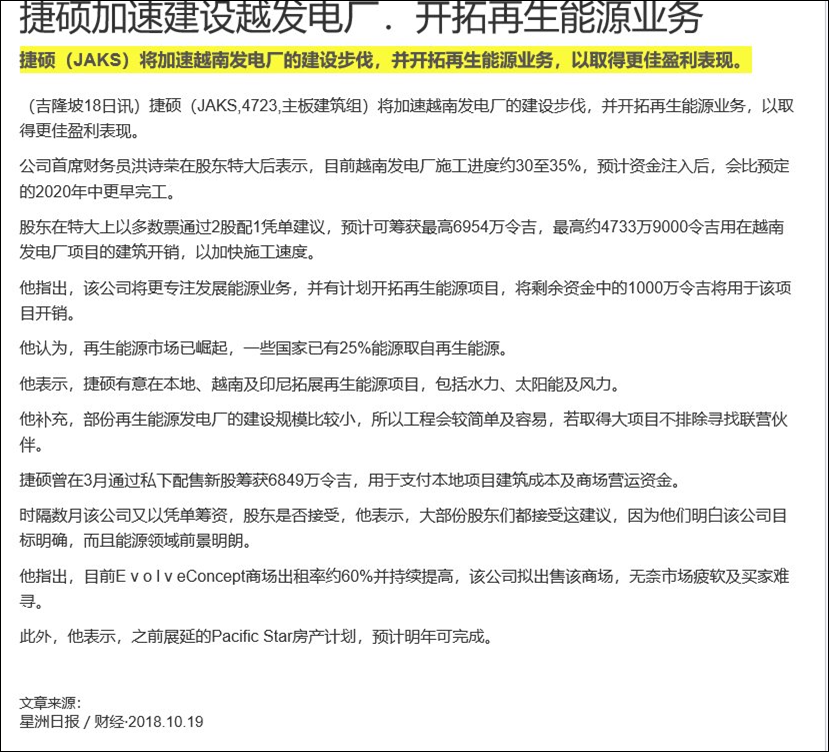

发表于 19-10-2018 07:24 AM

|

显示全部楼层

发表于 19-10-2018 07:24 AM

|

显示全部楼层

本帖最后由 icy97 于 20-10-2018 04:56 AM 编辑

|

|

|

|

|

|

|

|

|

|

|

|

发表于 17-11-2018 08:27 AM

|

显示全部楼层

发表于 17-11-2018 08:27 AM

|

显示全部楼层

EX-date | 16 Nov 2018 | Entitlement date | 21 Nov 2018 | Entitlement time | 05:00 PM | Entitlement subject | Rights Issue | Entitlement description | RENOUNCEABLE RIGHTS ISSUE OF UP TO 278,164,186 WARRANTS ("WARRANT(S)") IN JAKS RESOURCES BERHAD ("JRB") ON THE BASIS OF 1 WARRANT FOR EVERY 2 EXISTING ORDINARY SHARES IN JRB HELD AS AT 5.00 P.M. ON WEDNESDAY, 21 NOVEMBER 2018, AT AN ISSUE PRICE OF RM0.25 PER WARRANT ("RIGHTS ISSUE OF WARRANTS") | Period of interest payment | to | Financial Year End | 31 Dec 2018 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | TRICOR INVESTOR & ISSUING HOUSE SERVICES SDN BHDUnit 32-01, Level 32, Tower A,Vertical Business Suite, Avenue 3, Bangsar South,No. 8, Jalan Kerinchi59200 Kuala LumpurTel: (03) 2783 9299Fax: (03) 2783 9222 | Payment date |

| | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 21 Nov 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Ratio | Ratio | 1 : 2 | Rights Issue/Offer Price | Malaysian Ringgit (MYR) 0.250 |

Despatch date | 23 Nov 2018 | Date for commencement of trading of rights | 22 Nov 2018 | Date for cessation of trading of rights | 29 Nov 2018 | Date for announcement of final subscription result and basis of allotment of excess Rights Securities | 13 Dec 2018 | Listing Date of the Rights Securities | 20 Dec 2018 |

Last date and time for | Date | Time | Sale of provisional allotment of rights | 28 Nov 2018 | | 05:00:00 PM | Transfer of provisional allotment of rights | 03 Dec 2018 | | 04:00:00 PM | Acceptance and payment | 06 Dec 2018 | | 05:00:00 PM | Excess share application and payment | 06 Dec 2018 | | 05:00:00 PM |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 9-12-2018 07:42 PM

|

显示全部楼层

发表于 9-12-2018 07:42 PM

|

显示全部楼层

官友缘JAKS一只股输了6400万令吉

痛心认输:这是人生最贵一堂课

09/12/2018

This is my most expensive lesson in my life

这句话,读起来会不会让你"痛心疾首"呢?如果写这句话的人,在股市输了6400万令吉,那的确是句句血泪。

亿万富豪官友缘坦承,投资捷硕资源(JAKS 4723)是他一生中上的最贵一课,他和妻子的户口总共亏损6400万令吉。

6400万令吉是怎麽输的?官老昨日在部落格撰文,细述前因後果。

他在文中说,当他在二零一七年了解捷硕资源在越南发电厂的项目後,就和妻子开始累积JAKS,他从RM1.10开始买。

他说,平均买进价格是RM1.20,他和妻子动用按揭户口(MARGIN)买进总共1亿6000万股JAKS。

今年二月时,捷硕资源股价冲上RM1.85後,就开始回退,当股价下跌时,官氏和妻子为了平仓,填补MARGIN的缺口,必须一直卖股。

MARGIN户口在赚钱时没有问题,当股价跌得快,却是一个恐怖的问题,户口持有人会越卖走低,但是仍每天会接到股票行电话叫你补仓。

官友缘指出,因为迫仓,他被迫卖出大部份JAKS,这使他避过输更多钱。

如今,他和妻子已沽清所有JAKS,平均卖出价格是80仙,粗略计算,JAKS这一只股他共亏了6400万令吉。

他坦承自已犯了大错,那就是用MARGIN户口买进太多JAKS,这是他一生中最贵的一堂课。

他在文中表示,他相信根据自已的黄金选股原则,仍可在市场赚回一些钱。

「每一天太阳升起时,提醒我们,必定可从黑暗中升起。」

他在文中的一句话,可说直插每个投资者心中,这句话是:「This is my most expensive lesson in my life.」

官友缘的"滑铁卢"是每个投资者的一面镜子,他在投资JAKS时,过於乐观,也不愿听取一些人的建议和劝告。

他更试图通过自已的生花妙笔,试图影响市场和股价,但最後市场先生却给他狠狠打击。

整个过程,让我们想起股市投资之父道氏(DOW)写过的一句金句,所有试图影响市场的力量,最终必遭市场打败。

投资一定有风险,我们绝不能孤注一掷,投进太多资金,凡事留一线,才可进退。

我们相信官友缘仍有能力再从市场赚回一些钱,但是经此一役,肯定是元气大伤。 |

|

|

|

|

|

|

|

|

|

|

|

发表于 14-12-2018 03:10 AM

|

显示全部楼层

发表于 14-12-2018 03:10 AM

|

显示全部楼层

阻星报获5000万保证金-上诉庭驳回捷硕申请

http://www.enanyang.my/news/20181115/阻星报获5000万保证金br-上诉庭驳回捷硕申请/

Type | Announcement | Subject | MATERIAL LITIGATION | Description | JAKS Resources Berhad (JRB or the Company)Injunction on Bank Guarantee issued to Star Media Group Berhad (formerly known as Star Publications (Malaysia) Berhad) (STAR) | Reference is made to the subject matter and the announcement made by the Company on 30 July 2018, 1 August 2018, 26 September 2018 and 7 November 2018. The Court of Appeal has heard and dismissed the appeals of the Company today and upheld the judgement of the High Court issued on 12 July 2018.

The Company has instructed its solicitors to file urgent applications for leave to appeal to the Federal Court against the decision of the Court of Appeal and for injunctive relief pending hearing of said leave application.

This announcement is dated 14 November 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 1-1-2019 03:39 AM

|

显示全部楼层

发表于 1-1-2019 03:39 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2018 | 30 Sep 2017 | 30 Sep 2018 | 30 Sep 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 125,155 | 140,395 | 513,688 | 466,128 | | 2 | Profit/(loss) before tax | -11,901 | 11,213 | 4,908 | 9,612 | | 3 | Profit/(loss) for the period | -12,013 | 9,915 | 3,322 | 7,728 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -2,776 | 9,654 | 27,803 | 19,177 | | 5 | Basic earnings/(loss) per share (Subunit) | -0.52 | 2.09 | 5.25 | 4.16 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.4700 | 1.4200

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 3-1-2019 07:58 AM

|

显示全部楼层

发表于 3-1-2019 07:58 AM

|

显示全部楼层

Name | MR KOON YEW YIN | Nationality/Country of incorporation | Malaysia | Descriptions (Class) | Ordinary Shares |

Details of changesNo | Date of change | No of securities | Type of Transaction | Nature of Interest | | 1 | 28 Nov 2018 | 7,583,600 | Disposed | Direct Interest | Name of registered holder | KOON YEW YIN | Address of registered holder | 65, LINGKARAN MERU VALLEY, MERU GOLF RESORT, JELAPANG, 30020 IPOH | Description of "Others" Type of Transaction | | | 2 | 29 Nov 2018 | 7,610,000 | Disposed | Direct Interest | Name of registered holder | KOON YEW YIN | Address of registered holder | 65, LINGKARAN MERU VALLEY, MERU GOLF RESORT, JELAPANG, 30020 IPOH | Description of "Others" Type of Transaction | |

Circumstances by reason of which change has occurred | Disposal of shares under various accounts | Nature of interest | Direct Interest | Direct (units) | 44,034,200 | Direct (%) | 8.066 | Indirect/deemed interest (units) |

| | Indirect/deemed interest (%) |

| | Total no of securities after change | 44,034,200 | Date of notice | 03 Dec 2018 | Date notice received by Listed Issuer | 03 Dec 2018 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 14-1-2019 06:10 AM

|

显示全部楼层

发表于 14-1-2019 06:10 AM

|

显示全部楼层

本帖最后由 icy97 于 18-1-2019 03:57 AM 编辑

捷硕凭单认购率仅37.5%

http://www.enanyang.my/news/20181216/捷硕凭单认购率仅37-5/

Type | Announcement | Subject | NEW ISSUE OF SECURITIES (CHAPTER 6 OF LISTING REQUIREMENTS)

FUND RAISING | Description | JAKS RESOURCES BERHAD ("JRB" OR THE "COMPANY")RENOUNCEABLE RIGHTS ISSUE OF 102,428,430 WARRANTS ("WARRANT(S)") IN JRB ON THE BASIS OF 1 WARRANT FOR EVERY 2 EXISTING ORDINARY SHARES IN JRB HELD AS AT 5.00 P.M. ON WEDNESDAY, 21 NOVEMBER 2018, AT AN ISSUE PRICE OF RM0.25 PER WARRANT ("RIGHTS ISSUE OF WARRANTS") | We refer to the abridged prospectus dated 21 November 2018 (“Abridged Prospectus”) and the previous announcements in relation to the Rights Issue of Warrants. The terms used herein shall, unless the context otherwise stated, bear the same meaning as those defined in the Abridged Prospectus, where applicable.

On behalf of the Board, UOBKH wishes to announce that as at the close of acceptance, excess application and payment for the Rights Issue of Warrants at 5.00 p.m. on Thursday, 6 December 2018, the total acceptances and excess applications for the Rights Issue of Warrants were 102,428,430 Warrants, which represents an under-subscription of 62.48% over the total number of Warrants available for subscription under the Rights Issue of Warrants. Based on the total acceptances and excess applications, the gross proceeds raised from the Rights Issue of Warrants amounts to RM25.61 million.

The details of the subscription are set out below:-

| No. of Warrants | % | Acceptances | 99,790,399 | 36.56 | | Excess applications | 2,638,031 | 0.96 | | Total acceptances and excess applications | 102,428,430 | 37.52 | | Total Warrants available for subscription | 272,971,686 | 100.00 | | Under-subscription | 170,543,256 | 62.48 |

In this regard, the minimum subscription level of 40,387,551 Warrants for the Rights Issue of Warrants has been achieved.

In view that the Warrants have not been fully subscribed for, the Board has resolved to allot the Warrants to all applicants who have applied for Excess Warrants.

This announcement is dated 13 December 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 15-1-2019 04:48 AM

|

显示全部楼层

发表于 15-1-2019 04:48 AM

|

显示全部楼层

Profile for Securities of PLC

Instrument Category | Securities of PLC | Instrument Type | Warrants | Description | Warrants in JAKS Resources Berhad ("JRB") ("Warrant(s)") issued pursuant to the renounceable rights issue of 102,428,430 Warrants on the basis of 1 Warrant for every 2 existing ordinary shares in JRB held as at 5.00 p.m. on Wednesday, 21 November 2018 at an issue price of RM0.25 per Warrant ("Rights Issue of Warrants") |

Listing Date | 20 Dec 2018 | Issue Date | 14 Dec 2018 | Issue/ Ask Price | Malaysian Ringgit (MYR) 0.2500 | Issue Size Indicator | Unit | Issue Size in Unit | 102,428,430 | Maturity | Mandatory | Maturity Date | 13 Dec 2023 | Revised Maturity Date |

| | Name of Guarantor | Not Applicable | Name of Trustee | Not Applicable | Coupon/Profit/Interest/Payment Rate | Not Applicable | Coupon/Profit/Interest/Payment Frequency | Not Applicable | Redemption | Not Applicable | Exercise/Conversion Period | 5.00 Year(s) | Revised Exercise/Conversion Period | Not Applicable | Exercise/Strike/Conversion Price | Malaysian Ringgit (MYR) 0.6400 | Revised Exercise/Strike/Conversion Price | Not Applicable | Exercise/Conversion Ratio | 1 : 1 | Revised Exercise/Conversion Ratio | Not Applicable | Mode of satisfaction of Exercise/ Conversion price | Cash | Settlement Type/ Convertible into | Physical (Shares) |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 2-2-2019 06:15 AM

|

显示全部楼层

发表于 2-2-2019 06:15 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | JAKS Resources Berhad (JRB or the Company) Payment on Bank Guarantee issued to Star Media Group Berhad (formerly known as Star Publications (Malaysia) Berhad) (STAR) | This announcement is made by JRB pursuant to paragraph 9.03 of the Listing Requirement.

Reference is made to the Company’s announcement on 7 January 2019 and the Board of Directors of the Company wishes to inform that after the dismissal by the Federal Court of JAKS Island Circle Sdn Bhd (“JIC”)’s application and after consultation with its legal advisors, JIC has released the payment on the bank guarantee of RM50.0 million to STAR on 9 January 2019. As JRB has 51% equity interest in JIC, RM25.5 million will be charged off in the financial statements of JRB Group for the quarter ended 31 December 2018.

This announcement is dated 16 January 2019.

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 12-2-2019 06:53 AM

|

显示全部楼层

发表于 12-2-2019 06:53 AM

|

显示全部楼层

| 1. Details of Corporate Proposal | Involve issuance of new type/class of securities ? | No | Types of corporate proposal | Others | Details of corporate proposal | Jaks Resources Berhad (JAKS)'s Long Term Incentive Plan (LTIP): Vesting of ordinary shares of JAKS under the 2018 Restricted Share Plan (RSP) Grant of the LTIP | No. of shares issued under this corporate proposal | 37,395,060 | Issue price per share ($$) | Malaysian Ringgit (MYR) 0.5100 | Par Value($$) (if applicable) |

| | Latest issued share capital after the above corporate proposal in the following | Units | 583,338,432 | Issued Share Capital ($$) | Malaysian Ringgit (MYR) 618,046,064.600 | Listing Date | 08 Feb 2019 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 12-2-2019 08:13 AM

|

显示全部楼层

发表于 12-2-2019 08:13 AM

|

显示全部楼层

Name | MR ANG LAM POAH | Nationality/Country of incorporation | Malaysia | Descriptions (Class) | Ordinary Share |

Details of changesNo | Date of change | No of securities | Type of Transaction | Nature of Interest | | 1 | 08 Feb 2019 | 25,164,960 | Others | Direct Interest | Name of registered holder | Ang Lam Poah | Address of registered holder | 652, Lorong 20, Sg. Jarom, 42600 Jenjarom, Selangor Darul Ehsan | Description of "Others" Type of Transaction | Vesting of RSP |

Circumstances by reason of which change has occurred | Vesting of ordinary shares of JAKS Resources Berhad under the 2018 Restricted Share Plan (RSP) Grant of the Long Term Incentive Plan. | Nature of interest | Direct Interest | Direct (units) | 75,819,062 | Direct (%) | 12.968 | Indirect/deemed interest (units) | 0 | Indirect/deemed interest (%) | 0 | Total no of securities after change | 75,819,062 | Date of notice | 11 Feb 2019 | Date notice received by Listed Issuer | 11 Feb 2019 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 11-3-2019 05:12 AM

|

显示全部楼层

发表于 11-3-2019 05:12 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2018 | 31 Dec 2017 | 31 Dec 2018 | 31 Dec 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 226,762 | 218,787 | 740,450 | 684,915 | | 2 | Profit/(loss) before tax | -48,302 | 102,599 | -43,394 | 112,211 | | 3 | Profit/(loss) for the period | -50,120 | 102,339 | -46,798 | 110,067 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -12,672 | 107,463 | 15,131 | 126,640 | | 5 | Basic earnings/(loss) per share (Subunit) | -2.38 | 22.64 | 2.84 | 26.68 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.5000 | 1.4200

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 19-5-2019 06:45 AM

|

显示全部楼层

发表于 19-5-2019 06:45 AM

|

显示全部楼层

Type | Announcement | Subject | NEW ISSUE OF SECURITIES (CHAPTER 6 OF LISTING REQUIREMENTS)

FUND RAISING | Description | JAKS RESOURCES BERHAD ("JRB" OR THE "COMPANY")PROPOSED PRIVATE PLACEMENT OF UP TO 10.0% OF THE TOTAL NUMBER OF ISSUED SHARES OF JRB PURSUANT TO SECTION 75 OF THE COMPANIES ACT 2016 ("PROPOSED PRIVATE PLACEMENT") | On behalf of the Board of Directors of JRB, UOB Kay Hian Securities (M) Sdn Bhd wishes to announce that the Company proposes to undertake a proposed private placement of up to 10.0% of the Company’s total number of issued shares.

Further details on the Proposed Private Placement are set out in the attachment below.

This announcement is dated 18 April 2019. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/6130745

|

|

|

|

|

|

|

|

|

|

|

|

发表于 21-6-2019 04:28 AM

|

显示全部楼层

发表于 21-6-2019 04:28 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2019 | 31 Mar 2018 | 31 Mar 2019 | 31 Mar 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 297,798 | 210,197 | 297,798 | 210,197 | | 2 | Profit/(loss) before tax | 22,767 | 10,781 | 22,767 | 10,781 | | 3 | Profit/(loss) for the period | 21,242 | 10,343 | 21,242 | 10,343 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 28,616 | 17,842 | 28,616 | 17,842 | | 5 | Basic earnings/(loss) per share (Subunit) | 5.04 | 3.61 | 5.04 | 3.61 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.4800 | 1.5000

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 22-6-2019 05:38 AM

|

显示全部楼层

发表于 22-6-2019 05:38 AM

|

显示全部楼层

Type | Announcement | Subject | MEMORANDUM OF UNDERSTANDING | Description | JAKS Resources Berhad - Memorandum of Understanding with LICOGI 13 | The Board of Directors of JAKS Resources Berhad ("JRB" or "the Company") wishes to announce that the Company has on 14 May 2019 entered into a Memorandum of Understanding (“MOU”) with LICOGI 13 (the “Vendor”), a joint stock company incorporated in Vietnam to set out the expression of interest of JRB to acquire the Lig-Quang Tri Solar Power Project (“LQT Solar Power Project”) from the Vendor (“Proposed Acquisition”) as well as to set out the intention for the Vendor and JRB (collectively referred to as “Parties”) to enter into joint venture arrangements or sale and purchase transactions in respect of other or future solar and wind energy projects in Vietnam, at the consideration and upon terms and conditions to be mutually agreed between both Parties.

Please refer to the attached file for full details of the MOU.

This announcement is dated 14 May 2019. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/6159625

|

|

|

|

|

|

|

|

|

|

|

|

发表于 28-6-2019 07:47 AM

|

显示全部楼层

发表于 28-6-2019 07:47 AM

|

显示全部楼层

| 1. Details of Corporate Proposal | Involve issuance of new type/class of securities ? | No | Types of corporate proposal | Private Placement | Details of corporate proposal | PRIVATE PLACEMENT OF UP TO 10.0% OF THE TOTAL NUMBER OF ISSUED SHARES OF JAKS RESOURCES BERHAD PURSUANT TO SECTION 75 OF THE COMPANIES ACT 2016 ("PRIVATE PLACEMENT") | No. of shares issued under this corporate proposal | 58,465,313 | Issue price per share ($$) | Malaysian Ringgit (MYR) 0.7000 | Par Value($$) (if applicable) |

| | Latest issued share capital after the above corporate proposal in the following | Units | 643,118,445 | Issued Share Capital ($$) | Malaysian Ringgit (MYR) 659,642,281.000 | Listing Date | 28 May 2019 |

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|