|

|

发表于 28-3-2017 03:48 AM

|

显示全部楼层

发表于 28-3-2017 03:48 AM

|

显示全部楼层

本帖最后由 icy97 于 28-3-2017 05:04 AM 编辑

必達石油獲海船服務合約

2017年3月27日

(吉隆坡27日訊)必達石油(PERDANA,7108,主要板貿服)獲馬石油勘探(Petronas Carigali)私人有限公司頒發海船服務合約。

必達石油向馬證交所報備,獨資子公司Perdana Nautika私人有限公司,收到來自馬石油勘探發出的意向書(LOI),以提供錨作拖船(Anchor Handling Tug)或供應船、工作船及勞動駁船。

這項3年期合約,同時擁有選擇權額外續約2年。

根據報備文件,上述合約價值將取決于船舶租用的實際天數。

必達石油相信,是項合約將貢獻公司2017至2020財年的盈利和淨資產。【中国报财经】

Type | Announcement | Subject | OTHERS | Description | PERDANA PETROLEUM BERHAD ("the Company" or "PPB")- AWARD OF AN UMBRELLA CONTRACT FOR THE PROVISION OF SPOT CHARTER MARINE VESSEL SERVICES FOR PETRONAS CARIGALI SDN BHD | The Board of Directors of Perdana Petroleum Berhad ("PPB") wishes to announce that its wholly-owned subsidiary, Perdana Nautika Sdn Bhd ("PNSB"), has accepted the Letter of Award from PETRONAS Carigali Sdn Bhd (“PCSB”) for the provision of spot charter marine vessels services (“the Contract”) on 17 March 2017.

Further details are in the attached file.

This announcement is dated 27 March 2017 |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5376993

|

|

|

|

|

|

|

|

|

|

|

|

发表于 29-3-2017 06:28 AM

|

显示全部楼层

发表于 29-3-2017 06:28 AM

|

显示全部楼层

柏达纳

新合约激励净利

2017年3月29日

分析:大众投行研究

目标价:92仙

最新进展:

柏达纳(PERDANA,7108,主板贸服股)独资子公司Perdana Nautika有限公司,宣布获得国油勘探颁发一揽子合约,提供现租船服务。

该合约为期3年,从本月15日至2020年3月14日,另可选择延长2年。

据上述合约,该子公司需全天候,准备为国油勘探提供船只、船员和相关设备。

不过,这项合约总额,是依据国油在未来发出特定工作通知的规模而定,因此,柏达纳没有提供合约总值。

行家建议:

我们对柏达纳获颁合约感到高兴,这证实了我们对该公司未来的新增合约预测,同时,会在合约期限为公司带来净利。

根据4种不同船只类别的一揽子条款,上述合约可灵活使用柏达纳旗下的船只。

虽然油市场逐步上升,不过考虑到船只使用率仍低,再加上未来缺乏积极的扩展计划,我们的预测依然保守。

我们继续给予“中和”评级,目标价为92仙。

目前,柏达纳仍然暂停交易,等待重组计划完成。

【e南洋】 |

|

|

|

|

|

|

|

|

|

|

|

发表于 19-5-2017 02:46 AM

|

显示全部楼层

发表于 19-5-2017 02:46 AM

|

显示全部楼层

本帖最后由 icy97 于 22-5-2017 12:33 AM 编辑

筹1亿营运资本

柏达纳拟私配10%

2017年5月20日

(吉隆坡19日讯)柏达纳(PERDANA,7108,主板贸服股)计划私下配售高达10%的股本,以提升公众持股率,并筹集营运资本和及偿还银行贷款。

柏达纳日前向交易所报备,假设配售价为每股1.40令吉,根据私下配售最多7785万股,估计可筹得约1亿900万令吉。

每股1.40令吉的配售价,相等于柏达纳最后交易价1.54令吉10%的折价。

不过,由于大众持股率低于10%,该公司自2015年9月起,就开始暂停交易。

柏达纳称,最后交易价及配售价,可能无法反映出该公司目前的交易价。

一旦大众持股率符合上市标准,并恢复至25%以上,交易所才会允许柏达纳恢复交易。

本月8日,柏达纳向交易所提出申请,延长期限直到11月30日,让该公司有更多的时间,以符合大众持股率标准。

本月12日,柏达纳的母公司达洋企业(DAYANG,5141,主板贸服股)宣布,该公司计划派送高达2亿9222万9202股的柏达纳股票,除了以股代息回馈股东,也可提高后者的公众持股。【e南洋】

Type | Announcement | Subject | NEW ISSUE OF SECURITIES (CHAPTER 6 OF LISTING REQUIREMENTS)

FUND RAISING | Description | PERDANA PETROLEUM BERHAD ("PPB" OR "COMPANY")PROPOSED PRIVATE PLACEMENT OF UP TO 10% OF THE TOTAL NUMBER OF ISSUED SHARES OF PPB ("PROPOSAL") | On behalf of the Board of Directors of Perdana Petroleum Berhad (“PPB”), Kenanga Investment Bank Berhad wishes to announce that PPB proposes to undertake a private placement of up to 10% of the total number of issued shares of PPB.

Kindly refer to the attachment for further details.

This announcement is dated 16 May 2017. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5427457

|

|

|

|

|

|

|

|

|

|

|

|

发表于 25-5-2017 05:15 AM

|

显示全部楼层

发表于 25-5-2017 05:15 AM

|

显示全部楼层

本帖最后由 icy97 于 3-6-2017 04:50 AM 编辑

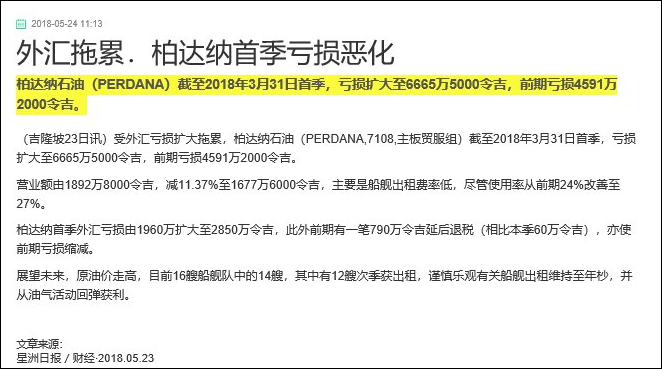

油船使用率低.外汇亏损.柏达纳首季亏损恶化

(吉隆坡22日讯)油气船只使用率低再加上外汇亏损,以致柏达纳石油(PERDANA,7108,主板贸服组)亏损恶化,截至2017年3月31日止第一季,该公司亏损恶化至4591万2000令吉,前期亏损1196万5000令吉。

首季营业额大挫54.95%至1892万8000令吉。

该公司董事部透过文告表示,首季船只使用率仅24%,对比同期使用率为50%,此外,外汇兑现及未兑现亏损各报210万令吉及600万令吉。

展望未来,董事部预期,国际油价依旧动荡,依据国家石油报告显示,未来油气船只需求将趋向稳定,而公司部份船只,已被国油纳入供应方之一,预期使用率可获得改善。

此外,公司将会与大股东达洋企业(DAYANG,5141,主板贸服组)业务达成协同效应。

达洋企业持有柏达纳石油98.014%股权,目前正回退37.5%股权给股东,在公众持股达到目标后,柏达纳石油将恢复交易。

今日,柏达纳石油执行董事许俊祥在股东大会后,向马新社表示,预期公司股票8月中旬可以复牌。

文章来源:

星洲日报‧财经‧2017.05.23

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2017 | 31 Mar 2016 | 31 Mar 2017 | 31 Mar 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 18,928 | 42,013 | 18,928 | 42,013 | | 2 | Profit/(loss) before tax | -45,888 | -11,785 | -45,888 | -11,785 | | 3 | Profit/(loss) for the period | -45,912 | -11,965 | -45,912 | -11,965 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -45,912 | -11,965 | -45,912 | -11,965 | | 5 | Basic earnings/(loss) per share (Subunit) | -5.89 | -1.54 | -5.89 | -1.54 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.8900 | 0.9500

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 30-5-2017 07:21 AM

|

显示全部楼层

发表于 30-5-2017 07:21 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | PERDANA PETROLEUM BERHAD ("PPB" OR "COMPANY")- NEWLY CLASSIFIED SHARIAH-COMPLIANT SECURITIES | The Board of Directors of PPB wishes to inform that the PPB shares have been classified by the Securities Commission's Shariah Advisory Council ("SAC") as Shariah-Compliant Securities in the updated list issued by SAC today.

This announcement is dated 25 May 2017. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 2-6-2017 10:40 PM

|

显示全部楼层

发表于 2-6-2017 10:40 PM

|

显示全部楼层

柏达纳完成私配料复牌

2017年5月24日

分析:大众投行研究

目标价:92仙

最新进展:

柏达纳(PERDANA,7108,主板贸服股)在截至今年3月杪首季,净亏扩大至4591万令吉,或每股净亏5.89仙,高于去年同期的净亏1197万令吉。

营业额也从去年的4201万令吉,减少至1893万令吉,跌幅达54.9%。

这是因为碰上季候风季节,加上原油价格下滑,从大型油气领域业者获得项目减少,导致旗下船只使用率从去年同期的50%,减少至24%。

另外,实际和账面上的外汇损失,分别达210万令吉和600万令吉。

行家建议:

柏达纳早前从国油勘探获颁一揽子合约,提供现租船(spot charter)服务,为期3年至2020年,另可延长2年。

随着获得上述合约,我们相信,该公司今年的船只使用率,能提高至60%。

柏达纳因公众持股率不达标,于2015年9月杪开始暂停交易。预测完成现阶段重组,即私下配售后,就能复盘。

基于船只使用率仍低,再加上未来缺乏积极的扩展计划,我们仍对柏达纳做保守预测。

【e南洋】 |

|

|

|

|

|

|

|

|

|

|

|

发表于 22-8-2017 12:35 AM

|

显示全部楼层

发表于 22-8-2017 12:35 AM

|

显示全部楼层

本帖最后由 icy97 于 23-8-2017 05:30 AM 编辑

设备折旧.外汇亏损.柏达纳次季亏7763万

(吉隆坡21日讯)在产业、工厂和设备折旧、外汇亏损双重压力下,柏达纳石油(PERDANA,7108,主板贸服组)截至2017年6月30日第二季亏损扩大,从前期净亏损2674万1000令吉扩大1.9倍,至7763万4000令吉,推高上半年净亏损2.2倍,至1亿2354万6000令吉。

次季营业额下跌8.5%,至4517万8000令吉,拖累首6个月营业额减少29.9%,至6410万6000令吉。

该公司发文告表示,国际油价日趋波动,促使岸外支援船舰市场前景更为不明朗,今年全球岸外支援船舰市场租金料非常严峻,因业者恐难在僧多粥少的情况下获得高船舰使用率。

整体来看,柏达纳石油董事部说,基于营运环境严峻,将对竞逐更长期合约持警惕态度。

文章来源:

星洲日报‧财经‧2017.08.22

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2017 | 30 Jun 2016 | 30 Jun 2017 | 30 Jun 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 45,178 | 49,376 | 64,106 | 91,389 | | 2 | Profit/(loss) before tax | -77,538 | -19,535 | -123,426 | -31,320 | | 3 | Profit/(loss) for the period | -77,635 | -26,742 | -123,547 | -38,707 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -77,634 | -26,741 | -123,546 | -38,706 | | 5 | Basic earnings/(loss) per share (Subunit) | -9.97 | -3.44 | -15.87 | -4.97 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.7600 | 0.9500

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 21-11-2017 03:12 AM

|

显示全部楼层

发表于 21-11-2017 03:12 AM

|

显示全部楼层

本帖最后由 icy97 于 22-11-2017 03:26 AM 编辑

柏达纳第三季亏1885万

2017年11月21日

(吉隆坡20日讯)租船费率下跌,加上蒙受汇兑亏损及应收账项减值亏损,拖累柏达纳(PERDANA,7108,主板贸服股)截至9月30日第三季净亏1885万3000令吉或每股2.42仙。

上财年同季,则净赚623万9000令吉或每股0.80仙。

柏达纳第三季营业额从5295万2000令吉,按年减少6.04%至4975万4000令吉。

虽然船舶使用率达70%,高于去年同季的66%,但是租船费率却减少25%,导致营业额减少及面对亏损。

合计首九个月,该集团净亏1亿4240万令吉或每股18.29仙;而营业额则按年萎缩21.12%至1亿1386万令吉。【e南洋】

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2017 | 30 Sep 2016 | 30 Sep 2017 | 30 Sep 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 49,754 | 52,952 | 113,860 | 144,341 | | 2 | Profit/(loss) before tax | -13,713 | 6,687 | -137,139 | -24,633 | | 3 | Profit/(loss) for the period | -18,853 | 6,239 | -142,400 | -32,468 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -18,853 | 6,239 | -142,399 | -32,467 | | 5 | Basic earnings/(loss) per share (Subunit) | -2.42 | 0.80 | -18.29 | -4.17 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.7200 | 0.9500

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 6-12-2017 06:11 AM

|

显示全部楼层

发表于 6-12-2017 06:11 AM

|

显示全部楼层

Notice of Interest Sub. S-hldr (Section 137 of CA 2016)Particulars of Substantial Securities HolderName | NAIM HOLDINGS BERHAD | Address | 9th Floor, Wisma Naim,

2 1/2 Mile Jalan Rock

Kuching

93200 Sarawak

Malaysia. | Company No. | 585467-M | Nationality/Country of incorporation | Malaysia | Descriptions (Class) | Ordinary Share | Name & address of registered holder | Naim Holdings Berhad9th Floor, Wisma Naim, 2 1/2 Mile Jalan Rock,93200 Kuching, Sarawak |

| Date interest acquired & no of securities acquired | Date interest acquired | 24 Nov 2017 | No of securities | 37,146,000 | Circumstances by reason of which Securities Holder has interest | Distribution of Dividend-In-Specie by Dayang Enterprise Holdings Bhd | Nature of interest | Direct Interest |  | | Total no of securities after change | Direct (units) | 37,146,000 | Direct (%) | 4.772 | Indirect/deemed interest (units) | 0 | Indirect/deemed interest (%) | 0 | Date of notice | 28 Nov 2017 | Date notice received by Listed Issuer | 28 Nov 2017 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 6-12-2017 06:11 AM

|

显示全部楼层

发表于 6-12-2017 06:11 AM

|

显示全部楼层

Name | DAYANG ENTERPRISE HOLDINGS BHD | Address | Sublot 5-10, Lot 46, Block 10,

Jalan Taman Raja, MCLD

Miri

98000 Sarawak

Malaysia. | Company No. | 712243-U | Nationality/Country of incorporation | Malaysia | Descriptions (Class) | Ordinary share |

Details of changesNo | Date of change | No of securities | Type of Transaction | Nature of Interest | | 1 | 24 Nov 2017 | 291,372,038 | Disposed | Direct Interest | Name of registered holder | Dayang Enterprise Holdings Bhd | Address of registered holder | Sublot 5-10, Lot 46, Block 10, Jalan Taman Raja, MCLD, 98000 Miri, Sarawak | Description of "Others" Type of Transaction | |

Circumstances by reason of which change has occurred | Distribution of Dividend-In-Specie by Dayang Enterprise Holdings Bhd | Nature of interest | Direct Interest | Direct (units) | 471,643,210 | Direct (%) | 60.586 | Indirect/deemed interest (units) | 0 | Indirect/deemed interest (%) | 0 | Total no of securities after change | 471,643,210 | Date of notice | 28 Nov 2017 | Date notice received by Listed Issuer | 28 Nov 2017 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 6-12-2017 06:12 AM

|

显示全部楼层

发表于 6-12-2017 06:12 AM

|

显示全部楼层

Notice of Interest Sub. S-hldr (Section 137 of CA 2016)Particulars of Substantial Securities HolderName | NAIM HOLDINGS BERHAD | Address | 9th Floor, Wisma Naim,

2 1/2 Mile Jalan Rock

Kuching

93200 Sarawak

Malaysia. | Company No. | 585467-M | Nationality/Country of incorporation | Malaysia | Descriptions (Class) | Ordinary Share | Name & address of registered holder | CIMSEC Nominees (Tempatan) Sdn. Bhd.17th Floor Menara CIMBJalan Stesen Sentral 2Kuala Lumpur Sentral50470 Kuala Lumpur |

| Date interest acquired & no of securities acquired | Date interest acquired | 24 Nov 2017 | No of securities | 39,840,429 | Circumstances by reason of which Securities Holder has interest | Distribution of Dividend-In-Specie by Dayang Enterprise Holdings Bhd | Nature of interest | Direct Interest |  | | Total no of securities after change | Direct (units) | 39,840,429 | Direct (%) | 5.118 | Indirect/deemed interest (units) | 0 | Indirect/deemed interest (%) | 0 | Date of notice | 28 Nov 2017 | Date notice received by Listed Issuer | 28 Nov 2017 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 19-12-2017 04:27 PM

|

显示全部楼层

发表于 19-12-2017 04:27 PM

|

显示全部楼层

再跌停牌  RM 0.36(-0.30) RM 0.36(-0.30) |

|

|

|

|

|

|

|

|

|

|

|

发表于 19-12-2017 05:13 PM

|

显示全部楼层

发表于 19-12-2017 05:13 PM

|

显示全部楼层

看到它的新闻,好像还会再跌到 0.25 ?

|

|

|

|

|

|

|

|

|

|

|

|

发表于 26-12-2017 03:58 AM

|

显示全部楼层

发表于 26-12-2017 03:58 AM

|

显示全部楼层

李文龙.是祸躲不过

柏达纳石油(PERDANA,7108,主板贸服组)两年前在石油价崩跌危机高峰期暂停交易,当时它是以不符公众持股理由停止交易,原可暂时避过尖锋浪头,惟两年后的油气业依然羸弱,是祸终是躲不过。

柏达纳石油是在大股东──达洋企业(DAYANG,5141,主板贸服组)以股代息分派柏达纳股票予股东后,才符合公众持股条件而于上周一(18日)恢复交易。事隔整整两年,股价补跌实是意料中事。

惟在短短4个交易日,前后股价削减了80%,从当时暂停交易前的1令吉54仙,至周四跌势较为缓和时已仅剩31仙,其中跌至停板的惨重场景,仍然使许多投资者所始料不及。上周闭市,该股收报32.5仙。

归根究底,柏达纳石油在过去两年里,股票虽然没有交易,不过业务依然受到油价危机冲击,前后出现1亿6000万令吉亏损,账面值大幅度缩水。截至今年首9个月内共净亏6200万令吉,前景依然不明朗,实是爆发股价严重补跌主因。

柏达纳石油有意在未来数个月里完成私下配售计划,料将进一步冲淡股东持股及潜在未来盈利,这也可能对股价跌势产生推波助澜效果。

若换个角度看,目前柏达纳石油已跌至市场认为合理水平,与两年前比较显得非常便宜,从低点重新迈向未来,特别是期望其管理层积极整顿业务,相信股东期待它能否极泰来,弥补蒙受钜大的损失。

至今国际油气业危机,比其高峰期已有显著缓和,每桶原油价格也回扬至约60美元水平(较最低约30美元好得多),油气业或公司已恢复一点元气,惟是否雨过天晴,还需时间谨慎观察。无论如何,柏达纳石油股价跌至31仙低位,相信已消除短期内大部份风险。

根据报道,柏达纳石油目前正竞标14项总值2亿7000万至3亿5000万令吉合约,未来旗下油船出租率有望进一步改善及翻身,特别是目前原油价格回扬后,产油财团可望释放出更多船运合约。

任何油气公司包括柏达纳石油能否熬过此难关,还是有待观察,这除了胥视整体油气业前景外,公司管理层是否有本事渡过考验和挑战也是重点。该公司是否绝地重生、或是继续沉沦,大家就拭目以待吧!

文章来源:

星洲日报‧投资致富‧投资茶室‧文:李文龙‧2017.12.24 |

|

|

|

|

|

|

|

|

|

|

|

发表于 26-12-2017 04:15 AM

|

显示全部楼层

发表于 26-12-2017 04:15 AM

|

显示全部楼层

柏达纳连挫4天 剩28.5仙‧分析员:2018年可转亏为盈

(吉隆坡21日讯)柏达纳石油(PERDANA,7108,主板贸服组)在停牌逾两年后复牌遭遇滑铁卢,股价连挫4天,今日更一度下跌20.83%,至全日最低的28.5仙。

柏达纳石油周四闭市下挫5仙,收在31仙,有3688万1100股交易。

该公司在本周一复牌,收在66仙,比较停牌前股价为1令吉54仙;周二即跌停板至36仙,下挫幅度高达45%。

MIDF投资银行研究分析员陈艾伦(译音)向theedgemarkets.com指出,柏达纳石油股价急挫,是因为市场预计该公司在2017年将面对巨大亏损,是2015年以来,连续3年亏损。

不过,他预计该公司可在2018年转亏为盈,主要是因为其岸外活动前景正面,并在国油活动前景2018至2020年中获点名。

明年船只使用率料达70%

他指出,柏达纳石油的船只使用率预计在明年可达到70%,主因是其持股60.48%的大股东达洋企业(D A Y A N G,5141,主板贸服组)获得国油勘探私人有限公司颁发的维修、建设及修改的合约。

他表示,柏达纳石油依赖达洋企业,而达洋企业目前手握34亿令吉订单,可供他们忙碌至2022年。

“我预计,柏达纳石油可在2018年录得盈利,表现将比过去3年亏损来得好。”

文章来源:

星洲日报/财经·2017.12.22 |

|

|

|

|

|

|

|

|

|

|

|

发表于 10-1-2018 04:07 AM

|

显示全部楼层

发表于 10-1-2018 04:07 AM

|

显示全部楼层

本帖最后由 icy97 于 10-1-2018 06:10 AM 编辑

船只租大股东达洋

柏达纳获4180万合约

2018年1月10日

(吉隆坡9日讯)柏达纳(PERDANA,7108,主板贸服股)获得大股东达洋企业(DAYANG,5141,主板贸服股),颁发总值4180万令吉合约,以提供4艘船只。

柏达纳今日向交易所报备,独资子公司Perdana Nautika私人有限公司,与达洋企业独资子公司达洋企业私人有限公司(DESB)签署四期租船协议,共为后者提供两艘起居工作驳船及两艘锚处理拖船/供应船。

合约为期9个月,从今年3月1日开始,可再延长3个月。

根据文告,DESB向柏达纳租赁4艘船只,是为了满足获得为Baronia Rejuvenation CP3项目,提供这四艘船只的合约。

该合约是DESB与国油勘探私人有限公司,签订的维护、建设和修改合约。

柏达纳称,这项协议是该集团与达洋企业战略联盟的一部分,可最大限度使用其船舶,并有资格竞标更多岸外维护工程。

这项协议预计能贡献集团未来净利。【e南洋】

Type | Announcement | Subject | OTHERS | Description | PERDANA PETROLEUM BERHAD ("PPB" OR THE "COMPANY")TIME CHARTER FOR THE PROVISION OF 4 VESSELS FOR DAYANG ENTERPRISE SDN BHD | The Board of Directors of PPB wishes to announce that the wholly-owned subsidiary of the Company, Perdana Nautika Sdn Bhd (PNSB) has today entered into four (4) time charter party agreements with Dayang Enterprise Sdn Bhd (DESB), a wholly-owned subsidiary of Dayang Enterprise Holdings Berhad (“Dayang Enterprise”) which is the major shareholder of PPB, for the supply of two (2) accommodation workbarges and two (2) anchor handling tug/supply vessels (collectively “the Vessels”) for the duration of nine (9) months with an option of three (3) monthly extension, commencing from 1 March 2018 (the “Vessels Charter”). The Vessels Charter is related to the contract secured by DESB for the provision of two (2) Accommodation Workbarges together with two (2) Anchor Handling Tug/Supply Vessels for Baronia Rejuvenation CP 3 under the DESB contract for Maintenance, Construction and Modification contract with Petronas Carigali Sdn Bhd. The estimated contract value for the Vessels Charter is approximately RM41.8 million.

Please refer to the attached file for full details of the Vessels Charter.

This announcement is dated 9 January 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5659933

|

|

|

|

|

|

|

|

|

|

|

|

发表于 22-2-2018 08:46 PM

|

显示全部楼层

发表于 22-2-2018 08:46 PM

|

显示全部楼层

本帖最后由 icy97 于 23-2-2018 06:21 AM 编辑

船租收入及使用率低

柏达纳末季亏3955万

2018年2月23日

http://www.enanyang.my/news/20180223/船租收入及使用率低br-柏达纳末季亏3955万/

(吉隆坡22日讯)租船租金减30%,加上船队使用率走低至51%,柏达纳(PERDANA,7108,主板贸服股)截至12月杪末季,净亏3954万7000令吉或每股5.08仙。

连亏3年

此外,柏达纳也蒙受外汇亏损1960万令吉,商誉减值亏损1070万令吉。

该公司今日向交易所报备,营业额按年减28%,报3392万7000令吉。

累计全年,柏达纳净亏1亿8194万6000令吉,是连续3年蒙亏。

营业额按年跌23%至1亿4778万7000令吉。

董事部认为,今年船队使用率会改善,因为获得大股东达洋企业(DAYANG,5141,主板贸服股)颁发岸外维修合约,而闲置的船只正竞标国内外岸外支援船合约。

此外,目前油价超过60美元,董事部乐观地相信,未来情绪会改善。

| | | 7108 PERDANA PERDANA PETROLEUM BERHAD | | Quarterly rpt on consolidated results for the financial period ended 31/12/2017 | | Quarter: | 4th Quarter | | Financial Year End: | 31/12/2017 | | Report Status: | Unaudited | | Submitted By: |

|

| | | Current Year Quarter | Preceding Year Corresponding Quarter | Current Year to Date | Preceding Year Corresponding Period | | | 31/12/2017 | 31/12/2016 | 31/12/2017 | 31/12/2016 | | | RM '000 | RM '000 | RM '000 | RM '000 | | 1 | Revenue | 33,927 | 47,370 | 147,787 | 191,711 | | 2 | Profit/Loss Before Tax | (46,296) | (11,315) | (183,435) | (35,948) | | 3 | Profit/(loss) attributable to ordinary equity holders of the parent | (39,547) | 4,427 | (181,946) | (28,040) | | 4 | Net Profit/Loss For The Period | (39,548) | 4,422 | (181,948) | (28,046) | | 5 | Basic Earnings/Loss Per Shares (sen) | (5.08) | 0.57 | (23.37) | (3.60) | | 6 | Dividend Per Share (sen) | 0.00 | 0.00 | 0.00 | 0.00 | | | | | As At End of Current Quarter | As At Preceding Financial Year End | | 7 | Net Assets Per Share (RM) | | | 0.6400 | 0.9500 |

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 8-4-2018 06:18 AM

|

显示全部楼层

发表于 8-4-2018 06:18 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 26-5-2018 06:56 AM

|

显示全部楼层

发表于 26-5-2018 06:56 AM

|

显示全部楼层

本帖最后由 icy97 于 4-6-2018 05:39 AM 编辑

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2018 | 31 Mar 2017 | 31 Mar 2018 | 31 Mar 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 16,776 | 18,928 | 16,776 | 18,928 | | 2 | Profit/(loss) before tax | -66,050 | -45,888 | -66,050 | -45,888 | | 3 | Profit/(loss) for the period | -66,655 | -45,912 | -66,655 | -45,912 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -66,655 | -45,912 | -66,655 | -45,912 | | 5 | Basic earnings/(loss) per share (Subunit) | -8.56 | -5.89 | -8.56 | -5.89 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.5200 | 0.6400

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 5-7-2018 03:56 AM

|

显示全部楼层

发表于 5-7-2018 03:56 AM

|

显示全部楼层

本帖最后由 icy97 于 6-7-2018 01:48 AM 编辑

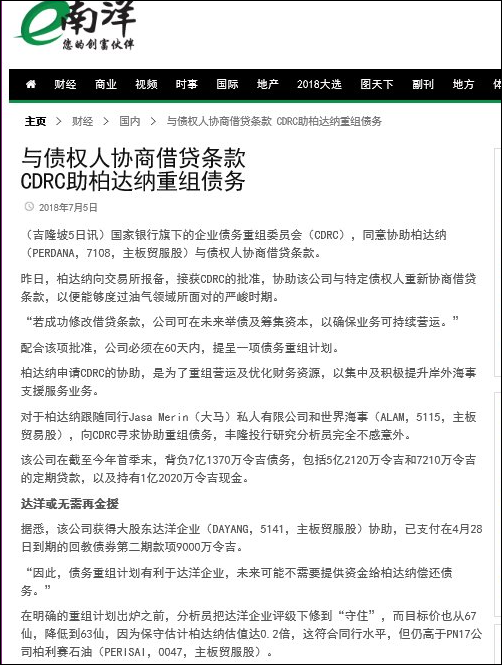

Type | Announcement | Subject | OTHERS | Description | ASSISTANCE TO MEDIATE BY THE CORPORATE DEBT RESTRUCTURING COMMITTEE (CDRC) OF BANK NEGARA MALAYSIA) | The Board of Directors of Perdana Petroleum Berhad ("PPB” or "the Company") wishes to announce that the Company, has received approval from the Corporate Debt Restructuring Committee (the “CDRC”) of Bank Negara Malaysia to the Company’s application for assistance to mediate between the Company and some of its subsidiaries (the “Applicant Company/Companies”) with its financial institutions and Sukukholders (the “Lenders”).

This admission to CDRC is consistent with PPB’s strategy to streamline its operations and optimise its financial resources to focus and proactively enhance its offshore marine support services segment. It is a follow-on from the Company’s previous successful cost rationalised initiative which has had a positive impact on the Company’s financials.

The Company received approval from CDRC on 2 July 2018 (“CDRC Approval Letter”) subject to the following conditions: - PPB is required to submit a Proposed Debt Restructuring Scheme within sixty (60) days from the date of the CDRC Approval Letter;

- PPB’s admission is limited to twelve (12) months or upon signing of a debt restructuring agreement, whichever is earlier; and

- The Proposed Debt Restructuring Scheme must comply with the CDRC’s restructuring principles for PPB to continue to remain under the Standstill arrangement with the Lenders.

The Standstill Letter was issued by CDRC to the Lenders of the Applicant Companies on 2 July 2018.

The CDRC, which is under the purview of Bank Negara Malaysia, will mediate between the Applicant Company and their respective Financiers to renegotiate their respective financing facilities that can be sustained in the face of this challenging period for the oil and gas industry, in line with the above conditions. This successful mediation would enable the Company to be better positioned to raise new financing and capital in the future and ensure its operations and the Applicant Company to easily sustain its underlying viability going forward.

The announcement is dated 4 July 2018. |

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|