|

|

发表于 22-10-2017 05:32 AM

|

显示全部楼层

发表于 22-10-2017 05:32 AM

|

显示全部楼层

利好已反映.戴乐评级下调

(吉隆坡19日讯)戴乐集团(DIALOG,7277,主板贸服组)刚完成大型并购、业务及管理保持良好,同时吉利地储油项目也将在2020年竣工,惟股价已反映上述利好,分析员调高目标价和财测之余,将评级降至“持有”。

马银行研究调高该公司2018至2020财年3%每股盈利,以纳入该公司收购国际船务(MISC,3816,主板贸服组)所持有Centralised Terminal(CTSB)的45%股权后的估值。

早前,戴乐集团以1亿9300万令吉收购国际船务持有CTSB剩余股权,CTSB拥有Langsat第一终站和第二终站80%股权。

马银行分析,在增持CTSB股权后,预测会为该公司每年带来800万至1300万令吉获利及每股7仙净现值(NPV)。

目前戴乐集团有两大成长推动力,分别是边佳兰业务及Langsat等两处工程。在拥有充足土地情况下,该公司仍可对现在边佳兰的310万立方公尺及Langsat的70万立方公尺储油设备进行扩张。

尽管马银行对戴乐集团管理层和业务营运表现十分有信心,但截至目前该公司利好已经全面反映股价上,因此把该公司评级从“买进”降至“持有”,目标价调高3%,至2令吉33仙。

文章来源:

星洲日报/财经‧2017.10.20

|

|

|

|

|

|

|

|

|

|

|

|

发表于 25-10-2017 06:53 AM

|

显示全部楼层

发表于 25-10-2017 06:53 AM

|

显示全部楼层

EX-date | 29 Nov 2017 | Entitlement date | 04 Dec 2017 | Entitlement time | 05:00 PM | Entitlement subject | Final Dividend | Entitlement description | Payment of a Final Single Tier Cash Dividend of 1.45 sen per ordinary share held in DIALOG Group Berhad in respect of the financial year ended 30 June 2017 | Period of interest payment | to | Financial Year End | 30 Jun 2017 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | SYMPHONY SHARE REGISTRARS SDN BHDLevel 6, Symphony HousePusat Dagangan Dana 1Jalan PJU 1A/4647301Petaling JayaTel:0378490777Fax:0378418151 | Payment date | 20 Dec 2017 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 04 Dec 2017 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.0145 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 11-11-2017 05:42 AM

|

显示全部楼层

发表于 11-11-2017 05:42 AM

|

显示全部楼层

本帖最后由 icy97 于 11-11-2017 06:27 AM 编辑

扩大朗塞终站营运

戴乐1.5亿租地买设施

2017年11月10日

(吉隆坡10日讯)戴乐集团(DIALOG,7277,主板贸服股)以约6200万令吉,向柔佛机构租用位于柔佛丹绒朗刹地皮,同时也以9100万令吉收购储存终站设施。

戴乐集团向交易所报备,独资子公司DIALOG Terminals私人有限公司(DTSB),与柔佛机构签署租赁及买卖设备协议。

根据租赁协议,该集团将向柔佛机构分别租用约18英亩及17英亩的地皮,租约为期30年。

同时,该集团将以9100万令吉,向柔佛机构收购储存终站设施,包括处理、存储、隔离、混合及分销石油与相关产品,以及石化产品的设备、机械及资产;储存容量大约10万立方米(cbm)。

这项交易让DTSB可扩展位于丹绒朗刹储存终站的容量及营运,所租用的地皮与现有储存终站设施相邻。同时,总储存容量将会增加至超过90万立方米。

DTSB持有浪塞终站1(LGT1)及浪塞终站2(LGT2)私人有限公司的80%股权,主要活动是提供集中储藏槽及储存终站设施给油气及石化工业。

自2009年开始营运以来,LGT1和LGT2的总储存产能为64万7000立方米,目前因为期合约而被全面使用。

有助推高净利

因此,这为戴乐集团带来扩展储存容量的机会。

同时,预计也将为戴乐集团未来净利带来贡献。

配合扩展储存终站业务,该集团也宣布在10月委任张孝凌(译音)为该项业务及DTSB总执行长,负责推动公司表现及未来增长和新发展。【e南洋】

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

NON RELATED PARTY TRANSACTIONS | Description | PROPOSED ACQUISITION BY DIALOG TERMINALS SDN BHD VIA WHOLLY OWNED SUBSIDIARY LANGSAT TERMINAL (THREE) SDN BHD | The Board of Directors of DIALOG Group Berhad (“DIALOG” or “the Company”) is pleased to announce that its wholly owned subsidiary, DIALOG Terminals Sdn Bhd (formerly known as Centralised Terminals Sdn Bhd) (“DTSB”), via DTSB’s wholly owned subsidiary, Langsat Terminal (Three) Sdn Bhd (“LGT 3”), has entered into a Lease Agreement and Sale of Facilities Agreement with Johor Corporation respectively on 10 November 2017. The agreements entered into are as follows:- (1) Lease Agreement with Johor Corporation (“JCorp”) to lease two parcels of land at Tanjung Langsat, Johor, Malaysia from JCorp for a term of thirty (30) years for a total lease rental of approximately RM62 million (“Lease Payment”) comprising of the following:- (a) Plot A measuring approximately 18 acres; and (b) Plot B measuring approximately 17 acres;

(2) Sale of Facilities Agreement (“SFA”) with JCorp for the purchase of a tank terminal facility located on Plot A consisting of equipment, machinery and assets for the handling, storing, separating, blending and distributing petroleum by vessel and petroleum related products, petrochemical products and such chemical products and other substances of blending components of approximately 100,000 cubic metre (“cbm”) in storage capacity for RM91 million (“Purchase Consideration”); and collectively known as the Proposed Transactions.

The Proposed Transactions paves the way for DTSB to expand its tank terminal storage capacity and operations at Tanjung Langsat, Johor. The combined land area of Plot A and Plot B which are situated next to DTSB’s existing tank terminal facilities can support development of additional storage tanks capacity of approximately 300,000 cbm (including existing 100,000 cbm on Plot A), bringing the aggregate tank terminal storage capacity for DTSB at Tanjung Langsat to more than 900,000 cbm.

Earlier in September 2017, DIALOG had completed the acquisition of MISC Berhad’s 45% interest in DTSB resulting in full ownership and control of DTSB by DIALOG. DTSB also owns 80% equity interest in Langsat Terminal (One) Sdn Bhd (“LGT 1”) and Langsat Terminal (Two) Sdn Bhd (“LGT 2”). Both LGT 1 and LGT 2 are engaged in the provision of centralised tankage and tank terminal facilities to the oil, gas and petrochemical industry. Operational since 2009, LGT 1 and LGT 2 with total storage capacity of 647,000 cubic metres (m3), are currently fully utilised on term contracts. Hence, the Proposed Transactions present opportunity for DIALOG to expand its storage tanks capacity at Tanjung Langsat.

LGT 1 and LGT 2 are strategically located at Tanjung Langsat, Johor which are easily accessible and close to the busiest international shipping lane between Middle East and Asia. Both terminals are part of the storage and trading hub for oil and gas in Johor and are also within vicinity to one of the largest refining and petrochemicals, trading and storage centre in Asia. The LGT 1 and LGT 2 terminals have been included by oil agency Platts for its FOB Straits oil price assessment process. Plot A and Plot B are located next to LGT 1 and LGT 2.

DIALOG’s other ownerships of tank terminals are in Pengerang Deepwater Terminal (“PDT”) and Kertih Terminal:

(i) Phase 1 of PDT - 46% shareholding in Pengerang Independent Terminals Sdn Bhd, a completed and operational independent deepwater petroleum terminal with initial storage capacity of 1.3 million m3 together with six deepwater berths, and is operational since 2014. The terminal is currently expanding an additional storage capacity of 430,000 m3 and the engineering, procurement, construction and commissioning (“EPCC”) works is undertaken by DIALOG’s wholly owned subsidiary, DIALOG Plant Services Sdn Bhd. The expansion is expected to be commissioned progressively from 2019.

(ii) Phase 2 of PDT - 25% shareholding in Pengerang Terminals (Two) Sdn Bhd, a dedicated terminal for PETRONAS Refinery and Petrochemical Integrated Development (“RAPID”) complex with storage capacity of approximately 2.0 million m3 and a deepwater jetty with twelve berths, and its construction is progressing within schedule and expected to be operational in 2019.

(iii) Phase 2 of PDT – 25% shareholding in Pengerang LNG (Two) Sdn Bhd, a LNG regasification facilities comprising of a regasification unit and two units of LNG storage tanks with combined capacity of 400,000 m3 mainly to serve Pengerang Integrated Petroleum Complex for their fuel requirement, and is partially operational.

(iv) 30% shareholdings in Kertih Terminals Sdn Bhd which owns and operates a petroleum and petrochemical storage terminal in Kertih with combined capacity of 400,000 m3 and is operational since year 2000.

Together with the development of Phase 3 and future phases of Pengerang Deepwater Terminal, the expansion of Tanjung Langsat storage capacity is in line with DIALOG’s strategy to grow sustainable and recurring income thereby further enhancing shareholders’ value in the long term.

With the expansion in the terminal business, DIALOG is also pleased to announce the appointment of Mr Teo Seow Ling to the position of Chief Executive Officer (CEO) – Terminals Business and DIALOG Terminals Sdn Bhd in October 2017, responsible for the performance of the DIALOG Group’s Terminals and its future growth in both the existing terminals business as well as new developments.

Mr Teo holds a Bachelor of Engineering (B.Eng) Degree in Mechanical Engineering and a Masters of Science Degree in Industrial Engineering from the National University of Singapore. He has more than 19 years of extensive experience in both operation and general management of bulk liquid terminals of which he spent close to 17 years with Vopak where he held a variety of operational and senior management positions. Prior to joining DIALOG, he was the Vice-President of Operations at SLNG – Singapore LNG Corporation Pte Ltd for 2 years.

Please refer to the attachment for further details of the announcement.

This announcement is dated 10 November 2017. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5599785

|

|

|

|

|

|

|

|

|

|

|

|

发表于 14-11-2017 06:53 AM

|

显示全部楼层

发表于 14-11-2017 06:53 AM

|

显示全部楼层

柔州储油设施扩增47%.戴乐财测目标价上修

(吉隆坡13日讯)戴乐集团(DIALOG,7277,主板贸服组)与柔佛机构达成1亿5300万令吉的租地和收购储油终站协议。

该公司间接独资子公司浪沙第三终站(Langsat Terminal Three)签下两块土地的30年租约,面积各达18英亩和17英亩,总租金为6200万令吉。

同时,浪沙第三终站也签署买卖协议,以9100万令吉收购其中一片土地的储油设施。

交易完成后,该公司的丹绒浪沙储油空间将提高近30万立方公尺或约47%,至超过90万立方公尺。

分析

戴乐集团最新扩张行动受看好,分析员纷纷上调财测和目标价。

马银行研究对此交易持正面看法,收购价相等于每立方公尺910令吉,和早前收购国际船务(MISC,3816,主板贸服组)储油终站的每立方公尺825令吉价格相近。

此外,据了解戴乐集团也计划扩张其边佳兰的储油业务,下一个扩张阶段即将展开。该业务将可增加额外500万立方公尺储油设施。

该行在纳入丹绒浪沙及和边佳兰分别新增的30万和125万立方公尺新产能后,将2018-2020年财测上调4%,以及上修目标价13%和调高评级。

联昌研究也对此消息感到正面惊喜,基于浪沙第三终站带来额外30万立方公尺储存量,因此将目标价上调6仙。

长期料为重估主要催化剂

肯纳格研究表示,新增的30万立方公尺储备空间,估值相等于每股13仙,因此上调该公司目标价,并相信第三期发展计划长期而言将是该股重估的主要催化动力。

艾芬黄氏研究指出,此企业行动将在3个月内完成,因此新增的储油终站预料在2018财年贡献至多5个月盈利。

该行假设净赚幅8%,预料戴乐集团未来两年可从EPCC建筑工程中取得1200万令吉净利,加上新增产能和折旧,因此将2018-2020年财测上调8%、8%和6%。

文章来源:

星洲日报‧财经‧2017.11.13 |

|

|

|

|

|

|

|

|

|

|

|

发表于 21-11-2017 09:29 PM

|

显示全部楼层

发表于 21-11-2017 09:29 PM

|

显示全部楼层

本帖最后由 icy97 于 23-11-2017 02:53 AM 编辑

联营公司贡献增加

戴乐集团首季净利飙98%

2017年11月22日

http://www.enanyang.my/news/20171122/联营公司贡献增加br-戴乐集团首季净利飙98/

(吉隆坡21日讯)联营及联号公司的盈利贡献增加,且获得一笔可观的合理价收益,带动戴乐集团(DIALOG,7277,主板贸服股)截至9月30日首季,净利按年激增97.85%。

该集团首季净赚1亿6093万令吉或每股2.86仙,上财年同季则为8133万6000令吉或每股1.54仙,归功于边佳兰、丹绒朗刹和吉利地的终站营运贡献增加。

同时,集团收购Centralised Terminals(简称CTSB)剩余45%股权之后,录得6560万令吉的合理收益。

戴乐集团首季营业额按年增19.14%至7亿7866万令吉,因国内外营运表现佳。

大马业务营业额按年增24.4%,归功于中下游活动,特别是各项计划的工程与建筑,还有厂房维修活动。

国际业务营业额则按年增7.9%,印尼、泰国及印度销售特别产品及技术服务,贡献更高营业额。

戴乐将继续发展持续性收入的核心业务,特别是扩展物流业,包括储存终站及供应基地。

集团乐观看待截至6月30日的2018财年,可保持强劲业绩。

| 7277 DIALOG DIALOG GROUP BHD | | Quarterly rpt on consolidated results for the financial period ended 30/09/2017 | | Quarter: | 1st Quarter | | Financial Year End: | 30/06/2018 | | Report Status: | Unaudited | | Submitted By: |

|

| | | Current Year Quarter | Preceding Year Corresponding Quarter | Current Year to Date | Preceding Year Corresponding Period | | | 30/09/2017 | 30/09/2016 | 30/09/2017 | 30/09/2016 | | | RM '000 | RM '000 | RM '000 | RM '000 | | 1 | Revenue | 778,656 | 653,551 | 778,656 | 653,551 | | 2 | Profit/Loss Before Tax | 186,356 | 95,656 | 186,356 | 95,656 | | 3 | Profit/(loss) attributable to ordinary equity holders of the parent | 160,925 | 81,336 | 160,925 | 81,336 | | 4 | Net Profit/Loss For The Period | 164,208 | 81,306 | 164,208 | 81,306 | | 5 | Basic Earnings/Loss Per Shares (sen) | 2.86 | 1.54 | 2.86 | 1.54 | | 6 | Dividend Per Share (sen) | 0.00 | 0.00 | 0.00 | 0.00 | | | | | As At End of Current Quarter | As At Preceding Financial Year End | | 7 | Net Assets Per Share (RM) | | | 0.5950 | 0.5780 |

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 24-11-2017 07:09 AM

|

显示全部楼层

发表于 24-11-2017 07:09 AM

|

显示全部楼层

边佳兰项目箭在弦上.戴乐前景乐观

(吉隆坡22日讯)戴乐集团(DIALOG,7277,主板贸服组)业绩符合预期,边佳兰深水终站第三期项目也箭在弦上,分析员继续乐观看待该公司业务展望。

该公司第一季营业额增长19.1%至7亿7865万6000令吉,在新资产重估价提高之下,净利走高97.85%至1亿6092万5000令吉。

大马投行指出,排除资产重估利多,该公司第一季核心净利增加50%,主要是边佳兰深水终站的第二期工程进账,以及联号公司的边佳兰第一期贡献增加,抵销了新加坡营收减少的影响。

该行认为,戴乐集团积极物色边佳兰第三期项目的联营伙伴,可能透过填海等扩增800英亩发展面积,以支援国家石油的边佳兰综合炼油中心(RAPID)。

肯纳格研究说,该公司的边佳兰第一期项目顺利推进,第二期项目进展也符合预期,目前正为第三期项目寻找合作伙伴。

该行补充,该公司待开发土地达200至300英亩,预期将在未来5至10年内分阶段建造500万立方公尺的储油设备。

联昌研究表示,虽然该公司储油业务表现强劲,但其他业务依然疲弱,包括设计、采购、施工及启用(EPCC),以及厂房维修、催化剂处理、专业产品等。

不过,该行强调,该公司储油业务进度稳定,相信足以带动股价上扬。

出炉业绩提振买气,推动戴乐集团今日走高13仙,收报2令吉43仙。

文章来源:

星洲日报‧财经‧2017.11.22 |

|

|

|

|

|

|

|

|

|

|

|

发表于 30-11-2017 06:33 AM

|

显示全部楼层

发表于 30-11-2017 06:33 AM

|

显示全部楼层

戴樂集團物色聯營夥伴

2017年11月24日

(吉隆坡24日訊)戴樂集團(DIALOG,7277,主要板貿服)正與潛在夥伴洽談,聯合開發邊佳蘭(Pengerang)深水碼頭第3階段項目。

戴樂集團執行主席丹斯里饒文傑昨日在公司常年股東大會結束后指出:“我們正在尋找能為公司帶來潛在客戶的合作夥伴。(邊佳蘭深水碼頭第3階段項目)可能為公司帶來額外儲油量。”

另外,戴樂集團有信心2018財年繼續取得雙位數成長,全年業績有望創紀錄。【中国报财经】 |

|

|

|

|

|

|

|

|

|

|

|

发表于 29-12-2017 04:33 AM

|

显示全部楼层

发表于 29-12-2017 04:33 AM

|

显示全部楼层

戴乐集团

边佳兰产能料扩大

2017年12月29日

分析:兴业投行

目标价:2.97令吉

最新进展:

戴乐集团(DIALOG,7277,主板贸服股)边佳兰独立终站的首期发展,产能达130万立方米,正在额外扩增产能43万立方米,会从2019年开始逐步投产。

至于第二期发展,即国家石油专用的终端,产能达200万立方米,正在按计划进行,预计2019年杪完工。

行家建议:

我们相信,该集团会进一步扩大边佳兰独立终站的产能,逐步扩增120万立方米,预计2022年开始,这是因为当边佳兰许多石化设施建成后,对石油产品和原油储存空间的需求会走强。

另外,回顾11月,该集团以约6200万令吉,向柔佛机构租用位于柔佛丹绒朗刹2块地皮,同时也以9100万令吉收购储存终站设施。

现有油站终站的产能为10万立方米,若合并土地面积,将能进一步额外扩展油站终站产能20万立方米,这将使该集团在丹绒朗刹的产能超过90万立方米。

从长远来看,我们维持正面看待戴乐集团,因为油站终站设施的扩大,料能支撑净利持续增长。

考虑到该集团整合之前收购Centralised Terminals私人有限公司(CTSB)剩余45%股权、额外扩增丹绒朗刹和边佳兰独立终站的产能,目标价上调至2.97令吉,并维持“买入”评级。

【e南洋】 |

|

|

|

|

|

|

|

|

|

|

|

发表于 31-1-2018 01:35 AM

|

显示全部楼层

发表于 31-1-2018 01:35 AM

|

显示全部楼层

本帖最后由 icy97 于 31-1-2018 03:56 AM 编辑

戴樂集團斥1109萬 加碼2公司優先股

2018年1月30日

(吉隆坡30日訊)戴樂集團(DIALOG,7277,主要板貿服)透過旗下Infodasia私人有限公司,以1109萬令吉收購2家資訊科技臂膀公司的可贖回可轉換優先股(RCPS)和不可贖回可轉換優先股(ICPS)。

Infodasia新購入Dialog創新創投私人有限公司(簡稱DIV)1250萬RCPS,加上去年8月收購的1040萬RCPS,共持有2290萬RCPS,總成本229萬令吉。

該公司另外新購入DIV服務私人有限公司4800萬ICPS,加上去年8月收購的4000萬ICPS,共持有8800萬ICPS,總成本達880萬令吉。

“戴樂集團持有DIV和DIV服務,各17%和60%直接股權。”

該公司指出,作為資訊科技臂膀,這2家公司通過專有軟件,為集團在提升效率、生產力和質量方面,帶來了有形的價值。【中国报财经】

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

RELATED PARTY TRANSACTIONS | Description | SUBSCRIPTION OF SHARES IN DIALOG INNOVATION VENTURES SDN BHD AND DIV SERVICES SDN BHD | The Board of Directors of Dialog Group Berhad (“DIALOG” or “the Company”) is pleased to announce that its wholly owned subsidiary, Infodasia Sdn Bhd (“Infodasia”), has on 30 January 2018 subscribed for the following shares: (1) 12,500,000 redeemable convertible preference shares (“RCPS”) at subscription price of RM0.10 each in Dialog Innovation Ventures Sdn Bhd (formerly known as ePetrol Holding Sdn Bhd) (“DIV”) with total cash consideration of RM1,250,000; and

(2) 48,000,000 irredeemable convertible preference shares (“ICPS”) at subscription price of RM0.10 each in DIV Services Sdn Bhd (formerly known as ePetrol Services Sdn Bhd) (“DIV Services”) with total cash consideration of RM4,800,000;

(Collectively the “Subscriptions 2”)

DIALOG has an effective equity interest of 17% in DIV and 60% in DIV Services, and the above subscriptions are related party transactions by virtue of Tan Sri Dr Ngau Boon Keat, Executive Chairman and major shareholder of DIALOG, and persons connected to him have interest, direct and indirect, in DIV and DIV Services.

DIV and DIV Services represent the information technology arm of DIALOG that has been pivotal in delivering tangible value to the Group in terms of efficiency, productivity and quality through its proprietary software. Alongside the development of applications for the Group’s core business, DIV has also continuously enhanced its cashless payment solutions throughout the years, and have now expanded its cashless payment solutions beyond its signature welfare distribution system, into the education, waste recycling and management sectors. It has achieved the objective of establishing a sound foundation from which it can now start growing and scaling its payments business, hence the requirement for additional working capital.

Infodasia had in August 2017 subscribed for 10,400,000 RCPS at subscription price of RM0.10 each in DIV with total cash consideration of RM1,040,000. Infodasia had also subscribed for 40,000,000 of ICPS at subscription price of RM0.10 each in DIV Services with total cash consideration of RM4,000,000 (“Subscriptions 1”).

The total cash consideration of Subscriptions 1 and Subscriptions 2 (collectively referred to as the “Subscriptions”) is RM11,090,000 and the highest aggregated percentage ratio applicable for the Subscriptions is 0.40%, a percentage ratio of a related party transaction requiring an announcement pursuant to Paragraph 10.08 of Part E of Chapter 10, of the Main Market Listing Requirements of Bursa Malaysia Securities Berhad.

Please refer to the attachment for further details of the announcement.

This announcement is dated 30 January 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5681293

|

|

|

|

|

|

|

|

|

|

|

|

发表于 13-2-2018 03:37 AM

|

显示全部楼层

发表于 13-2-2018 03:37 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | PENGERANG CTF SDN BHD | We are pleased to announce that Dialog Terminals Sdn Bhd (formerly known as Centralised Terminals Sdn Bhd), a wholly owned subsidiary of Dialog Group Berhad ("DIALOG") has on 9 February 2018 incorporated a wholly owned subsidiary company, namely Pengerang CTF Sdn Bhd.

Pengerang CTF Sdn Bhd has a share capital of RM1,000.00 divided into 1,000 ordinary shares.

The intended business of Pengerang CTF Sdn Bhd is to build, own and operate common tankage facilities including jetty and shared infrastructure to support the petroleum and petrochemical storage terminals in Pengerang Deepwater Terminal ("PDT").

This annoucement is dated 12 February 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 15-2-2018 04:52 AM

|

显示全部楼层

发表于 15-2-2018 04:52 AM

|

显示全部楼层

本帖最后由 icy97 于 15-2-2018 06:50 AM 编辑

戴乐联号贡献增

次季净利扬27%

2018年2月15日

(吉隆坡14日讯)戴乐集团(DIALOG,7277,主板贸服股)截至12月31日次季,净利扬26.7%,达1亿1576万3000令吉;营业额持平在8亿5742万6000令吉。

累计上半年,净利激增60.2%,达2亿7668万8000令吉;营业额扩大8.3%,报16亿3608万2000令吉。

戴乐集团向交易所报备,当季净利走高归功于大马业务及联营与联号公司贡献增加。

去年11月,该公司旗下联号公司边佳兰液化天然气(二)私人有限公司开始商业营运,并在深水终站迎第一个货船。

不过,国际业务仍充满挑战,且面临营业额减少22.7%,主要归咎于印度、俄罗斯和澳洲专业产品与服务销售额滑落。【e南洋】

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2017 | 31 Dec 2016 | 31 Dec 2017 | 31 Dec 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 857,426 | 856,783 | 1,636,082 | 1,510,334 | | 2 | Profit/(loss) before tax | 144,767 | 111,536 | 331,123 | 207,192 | | 3 | Profit/(loss) for the period | 120,241 | 93,105 | 284,449 | 174,411 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 115,763 | 91,358 | 276,688 | 172,694 | | 5 | Basic earnings/(loss) per share (Subunit) | 2.05 | 1.71 | 4.91 | 3.26 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.5980 | 0.5780

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 20-2-2018 03:31 AM

|

显示全部楼层

发表于 20-2-2018 03:31 AM

|

显示全部楼层

本帖最后由 icy97 于 22-2-2018 06:14 AM 编辑

次季業績標青 戴樂集團有看頭

2018年2月19日

(吉隆坡19日訊)戴樂集團(DIALOG,7277,主要板貿服)最新業績表現取得增長,估計長期成長將由深水碼頭第3階段擴展設施,以及第1階段的額外設施提振。

該公司截至12月底次季,淨利按年攀升26.7%,達1億1576萬令吉,主要獲國內營運表現提振。同期的營業額從8億5678萬令吉,微增至8億5743萬令吉。

戴樂集團上半年淨利大漲60.2%,錄得2億7669萬令吉;營業額起8.3%,達16億3608萬令吉。

大眾投資研究指出,該公司現執行中的邊佳蘭深水碼頭營運有130萬立方公尺,第2階段料增設43萬立方公尺產能,第3階段的潛在夥伴料如期執行。

此外,戴樂集團近期增持丹絨蘭砂(Tanjung Langsat)第1和第2 Langsat 終站持股權,目前為這個中央庫存和終站設施規劃第3終站擴展活動,增設30萬立方公尺的庫存量。

報告指出,該公司有14億令吉儲備金,料尋求收購可行的生產資產,因此看好公司未來表現。

另外,肯納格證券研究持續看好該公司可從庫存終站業務,提高持續行收入表現,而深水碼頭第3階段發展將是該公司的主要重估催化因素。

【中国报财经】

戴乐集团

估值已反映利好

2018年2月22日

分析 :大华继显研究

目标价:2.70令吉

最新进展:

戴乐集团(DIALOG,7277,主板贸服股)截至12月31日次季,净利扬26.7%,达1亿1576万3000令吉;营业额持平在8亿5742万6000令吉。

累计上半年,净利激增60.2%,达2亿7668万8000令吉;营业额扩大8.3%,报16亿3608万2000令吉。

行家建议:

扣除DIALOG Terminals的6600万令吉公允价值收益及脱售资产收益600万令吉,戴乐集团首半年业绩高于我们预测,因为下半年营业额通常更强。

这主要归功于所有业务的赚幅扩大,可能是因为某些工程、采购、施工和调试(EPCC)工程的进一步确认、高价值项目的混合增加,以及油价上涨带动上游营业额的赚幅走高。

此外,也归功于联营公司的贡献,收入增55%,显著提高了项目水平,从运营前成本亏损转为取得收入。

该集团从净现金转为少于0.1倍净负债,但仍符合预期,因为贷款正用于资助存储终站的发展。

我们上调净利预测10至11%,相信更多高价值工程及油价增高对公司有利。

考虑到平均存储率的潜在变动,维持联营收入预测。预计边佳兰第一阶段每月每立方米(cbm)1美元的变动,将调整盈利4%,以及目标价12仙。

维持评级是因为上升空间有限,目前估值已反映出所有可预见扩展,除非该集团持续推高近期净利。

【e南洋】 |

|

|

|

|

|

|

|

|

|

|

|

发表于 11-3-2018 03:39 AM

|

显示全部楼层

发表于 11-3-2018 03:39 AM

|

显示全部楼层

icy97 发表于 11-11-2017 05:42 AM

扩大朗塞终站营运

戴乐1.5亿租地买设施

2017年11月10日

(吉隆坡10日讯)戴乐集团(DIALOG,7277,主板贸服股)以约6200万令吉,向柔佛机构租用位于柔佛丹绒朗刹地皮,同时也以9100万令吉收购储存终站设施。

...

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

NON RELATED PARTY TRANSACTIONS | Description | PROPOSED ACQUISITION BY DIALOG TERMINALS SDN BHD VIA WHOLLY OWNED SUBSIDIARY LANGSAT TERMINAL (THREE) SDN BHD | (The definitions used in this announcement shall have the same meaning as that used in our announcement dated 10 November 2017 unless stated otherwise.)

Dialog Group Berhad (“DIALOG”) is pleased to announce that its wholly owned subsidiary, Langsat Terminal (Three) Sdn Bhd (“LGT 3”), has on 9 March 2018 completed the acquisition of two parcels of lease lands and a tank terminal in Tanjung Langsat, Johor, in reference to the announcement released on 10 November 2017. The total purchase consideration is RM153 million.

The abovesaid acquisitions are pursuant to the following agreements with Johor Corporation (“JCorp”):-

(1) Lease Agreement with JCorp to lease two parcels of land at Tanjung Langsat, Johor, Malaysia from JCorp for a term of thirty (30) years for a total lease rental of approximately RM62 million (“Lease Payment”) comprising of the following:- (a) Plot A measuring approximately 18 acres; and (b) Plot B measuring approximately 17 acres;

(2) Sale of Facilities Agreement (“SFA”) with JCorp for the purchase of a tank terminal facility located on Plot A consisting of equipment, machinery and assets for the handling, storing, separating, blending and distributing petroleum by vessel and petroleum related products, petrochemical products and such chemical products and other substances of blending components of approximately 100,000 cubic metre (“cbm”) in storage capacity for RM91 million.

The abovesaid acquisitions paves the way for DIALOG to expand its tank terminal storage capacity and operations at Tanjung Langsat, Johor. The combined land area of Plot A and Plot B which are situated next to DIALOG’s existing tank terminal facilities can support development of additional storage tanks capacity of approximately 300,000 cbm (including existing 100,000 cbm on Plot A), bringing the aggregate tank terminal storage capacity for DIALOG at Tanjung Langsat to more than 900,000 cbm.

This announcement is dated 9 March 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 6-4-2018 10:53 PM

|

显示全部楼层

发表于 6-4-2018 10:53 PM

|

显示全部楼层

本帖最后由 icy97 于 7-4-2018 04:45 AM 编辑

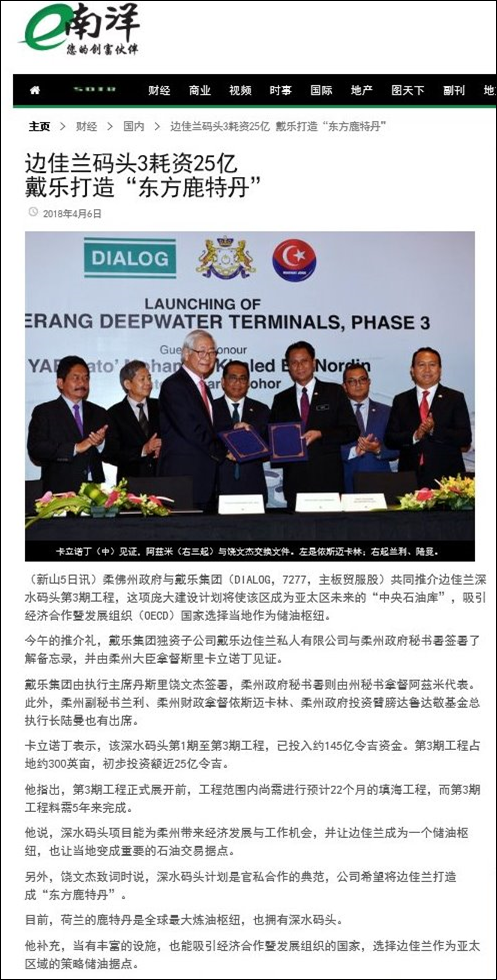

Type | Announcement | Subject | MEMORANDUM OF UNDERSTANDING | Description | (1) MEMORANDUM OF UNDERSTANDING WITH THE STATE GOVERNMENT OF JOHOR DARUL TA'ZIM AND THE STATE SECRETARY, JOHOR (INCORPORATED)(2) LETTER OF AWARD | Dialog Group Berhad (“DIALOG” or “the Company”) is pleased to announce that the following wholly owned subsidiaries have today, 5 April 2018, entered into the following documents:-

(1) Dialog Pengerang Sdn Bhd (“DPgSB”) signed a Memorandum of Understanding with the State Government of Johor Darul Ta’zim and the State Secretary, Johor (Incorporated) (“MOU”) to outline the understanding between the said parties for Pengerang CTF Sdn Bhd (“PCTF”), which is currently an indirect wholly owned subsidiary of DIALOG, to develop common tankage facilities (including shared infrastructure) and dedicated deepwater marine facilities (“Jetty 3”) to support and promote the petroleum and petrochemical storage and handling tank terminal business to be constructed and carried out as Pengerang Deepwater Terminals Phase 3.

(2) Dialog E & C Sdn Bhd (“DECSB”) awarded a Letter of Award to Penta-Ocean (Malaysia) Sdn Bhd (“Penta-Ocean”] for the engineering, procurement and construction works for the reclamation, soil improvement and shore protection works (“LOA”). The land reclamation of approximately 300 acres requires 22 months to complete.

DIALOG will move forward with the development of Pengerang Deepwater Terminals Phase 3 in Pengerang, Johor, southeastern Peninsular Malaysia after having successfully developed Phase 1. Phase 2 is partially completed and operational, and full completion is scheduled in early 2019.

Phase 3 will be developed on the land located next to Phase 2 within Pengerang Deepwater Terminals of approximately 300 acres comprising of 3 main components: (i) common tankage facilities (including shared infrastructure) and dedicated deepwater marine facilities (“Jetty 3”) to be undertaken by Pengerang CTF Sdn Bhd (“PCTF”);

(ii) development of more petroleum and petrochemicals storage terminals for medium to long term customers. These storage terminals will be integrated and supported by PCTF’s owned common tankage facilities (including shared infrastructure) and deepwater marine facilities (“Jetty 3”); and

(iii) development of industrial land for further downstream oil and gas related activities.

The indicative initial cost of investment in Pengerang Deepwater Terminals Phase 3 is approximately RM2.5 billion.

The storage terminals on Phase 3 will be dedicated to multiple users comprising potentially oil traders, multinational oil companies, refinery and petrochemicals plants to facilitate oil trading activities as well as to support various downstream operations including those of refinery and petrochemical plants within the Pengerang Integrated Petroleum Complex (“PIPC”) and in Asia Pacific region.

Pengerang CTF Sdn Bhd (“PCTF”), currently a wholly owned company of Dialog Terminals Sdn Bhd (“DTSB”) (formerly known as Centralised Terminals Sdn Bhd) which is in turn wholly owned by DIALOG, will be structured whereby DTSB will hold 80% equity interests in PCTF and Permodalan Darul Ta’zim Sdn Bhd, a wholly owned company of the State Secretary, Johor (Incorporated) (“SSI”) to hold up to 20%.

Pengerang Deepwater Terminals has the potential to be the downstream oil and gas hub in the region and its development synergises with DIALOG’s investments in tankage facilities in Kertih, Terengganu, eastern Peninsular Malaysia and Tanjung Langsat, Johor, southern Peninsular Malaysia.

Phase 3 project is in line with DIALOG’s strategy to continue increasing long term recurring income to DIALOG. The development of Phase 3 will also provide more opportunities for services to be provided by the group’s engineering, construction, fabrication and plant maintenance divisions.

This announcement is dated 5 April 2018 and a copy of the press release is attached herewith. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5748865

|

|

|

|

|

|

|

|

|

|

|

|

发表于 7-4-2018 06:57 AM

|

显示全部楼层

发表于 7-4-2018 06:57 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 11-4-2018 07:52 AM

|

显示全部楼层

发表于 11-4-2018 07:52 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 18-5-2018 03:45 AM

|

显示全部楼层

发表于 18-5-2018 03:45 AM

|

显示全部楼层

本帖最后由 icy97 于 21-5-2018 07:09 AM 编辑

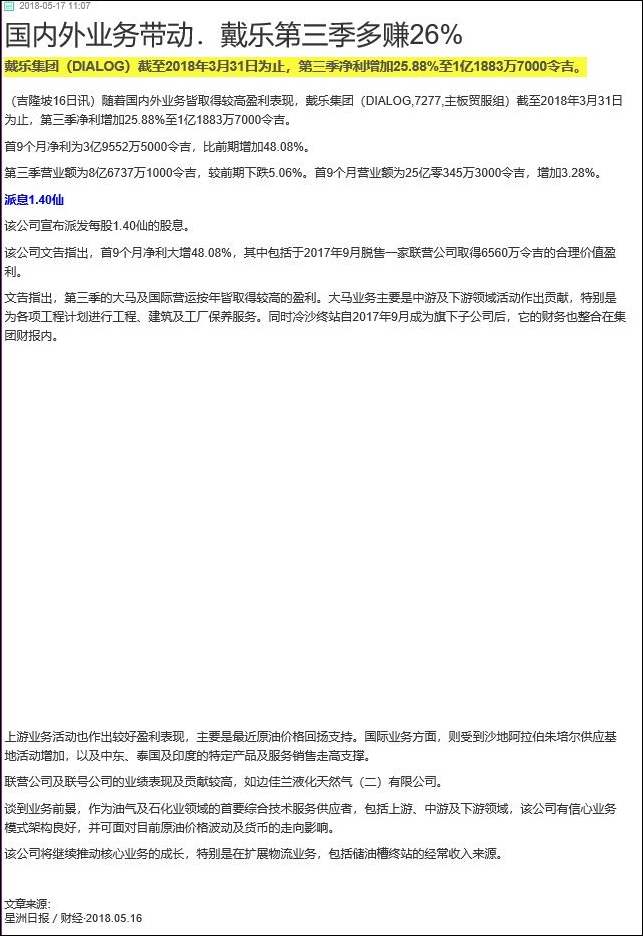

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2018 | 31 Mar 2017 | 31 Mar 2018 | 31 Mar 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 867,371 | 913,605 | 2,503,453 | 2,423,939 | | 2 | Profit/(loss) before tax | 148,140 | 119,688 | 479,263 | 326,880 | | 3 | Profit/(loss) for the period | 122,368 | 97,823 | 406,817 | 272,234 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 118,837 | 94,402 | 395,525 | 267,096 | | 5 | Basic earnings/(loss) per share (Subunit) | 2.11 | 1.74 | 7.02 | 5.00 | | 6 | Proposed/Declared dividend per share (Subunit) | 1.40 | 1.20 | 1.40 | 1.20 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.6180 | 0.5780

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 18-5-2018 03:48 AM

|

显示全部楼层

发表于 18-5-2018 03:48 AM

|

显示全部楼层

EX-date | 12 Jun 2018 | Entitlement date | 14 Jun 2018 | Entitlement time | 05:00 PM | Entitlement subject | Interim Dividend | Entitlement description | Payment of an Interim Cash Dividend of 1.4 sen per ordinary share held in Dialog Group Berhad in respect of the financial year ending 30 June 2018. | Period of interest payment | to | Financial Year End | 30 Jun 2018 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | SYMPHONY SHARE REGISTRARS SDN BHDLevel 6, Symphony HousePusat Dagangan Dana 1Jalan PJU 1A/4647301Petaling JayaTel:0378490777Fax:0378418151 | Payment date | 28 Jun 2018 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 14 Jun 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.014 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 20-5-2018 06:18 AM

|

显示全部楼层

发表于 20-5-2018 06:18 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 13-6-2018 06:29 AM

|

显示全部楼层

发表于 13-6-2018 06:29 AM

|

显示全部楼层

本帖最后由 icy97 于 16-6-2018 05:50 AM 编辑

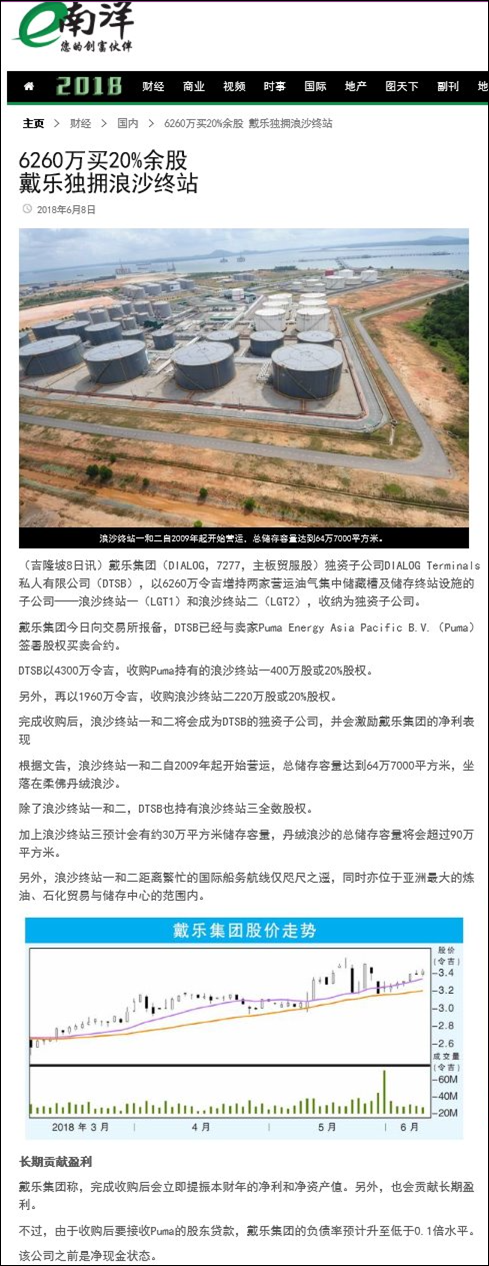

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

NON RELATED PARTY TRANSACTIONS | Description | ACQUISITION OF 20% INTERESTS IN LANGSAT TERMINAL (ONE) SDN BHD AND LANGSAT TERMINAL (TWO) SDN BHD | The Board of Directors of Dialog Group Berhad (“DIALOG” or “the Company”) is pleased to announce that its wholly owned subsidiary, Dialog Terminals Sdn Bhd (formerly known as Centralised Terminals Sdn Bhd) (“DTSB”) has on 7 June 2018, entered into a Share Purchase Agreement (“SPA”) with Puma Energy Asia Pacific B.V. (“PUMA”) to acquire the remaining 20% interests in the Langsat Terminal (One) Sdn Bhd (“LGT 1”) and Langsat Terminal (Two) Sdn Bhd (“LGT 2”) (“Acquisition”) for purchase consideration as below: (a) 4,000,000 ordinary shares of LGT 1 from PUMA which represents 20% of the total issued and paid up ordinary shares of LGT 1 for RM43.0 million; and (b) 2,200,000 ordinary shares of LGT 2 from PUMA which represents 20% of the total issued and paid up ordinary shares of LGT 2 for RM19.6 million. In addition, DTSB will take over PUMA’s portion of shareholder’s loan to LGT1 and LGT2, including principal and accrued interest, amounting to RM24.3 million and RM8.1 million respectively.

The Acquisition has been completed in accordance with the closing obligations of the SPA and, LGT 1 and LGT 2 becomes 100% owned subsidiaries of DTSB. This will enable DIALOG to benefit from higher profit after tax from the additional 20% ownership in the said companies.

Both LGT 1 and LGT 2 are principally engaged in the provision of centralised tankage and tank terminal facilities to the oil, gas and petrochemical industry. DTSB also owns 100% equity interests in Langsat Terminal (Three) Sdn Bhd (“LGT 3”) which in March 2018 acquired two parcels of lease lands and a tank terminal in Tanjung Langsat, Johor for further expansion of DIALOG’s terminal business in Tanjung Langsat (“Langsat Terminals”).

Operational since 2009, LGT 1 and LGT 2 with total storage capacity of 647,000 cubic metres (m3), are currently fully utilised on term contracts. LGT 1 and LGT 2 are strategically located at Tanjung Langsat, Johor which are easily accessible and close to the busiest international shipping lane between Middle East and Asia.

Both terminals are part of the storage and trading hub for oil and gas in Johor and are also within vicinity to one of the largest refining and petrochemicals, trading and storage centre in Asia. The LGT 1 and LGT 2 terminals have been included by oil agency Platts for its FOB Straits oil price assessment process.

Combined with LGT 3 which can support development of storage capacity of approximately 300,000 cbm, the aggregate tank terminal storage capacity for DTSB at Tanjung Langsat would be more than 900,000 cbm.

The Acquisition presents the right opportunity for DIALOG to increase its equity ownership of existing tank terminals built by DIALOG with proven track records.

Together with the potential expansion of Langsat Terminals, and development of Phase 3 and future phases of Pengerang Deepwater Terminals, the Acquisition is in line with DIALOG’s strategy to grow sustainable and recurring income thereby further enhancing shareholders’ value in the long term.

Please refer to the attachment for further details of the announcement.

This announcement is dated 8 June 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5820885

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|