|

|

发表于 26-7-2016 09:38 PM

|

显示全部楼层

发表于 26-7-2016 09:38 PM

|

显示全部楼层

本帖最后由 icy97 于 27-7-2016 01:19 AM 编辑

脱售子公司获益

亿成第3季净利飙8倍

2016年7月27日

http://www.enanyang.my/news/20160727/脱售子公司获益br-亿成第3季净利飙8倍/

(吉隆坡26日讯)归功于脱售收益,亿成控股(MELATI,5129,主板建筑股)截至5月31日第三季,净利激增8倍以上,至764万7000令吉。

不过,同期营业额则是大挫71.3%,报1325万7000令吉。

累计首9个月,净利涨209%,达1703万令吉;营业额跌67.5%,报5015万8000令吉。

根据文告,当季净利走高归功于脱售子公司所得到的一笔收益。

然而,旗下的建筑和房产发展业务的表现则不尽理想,不仅营业额双双下滑,更由盈转亏。

亿成控股解释,建筑营业额滑落,是因为建筑活动减少。

而房产发展业务的表现转弱,则归咎于Bukit Bayu @ U10 Shah Alam的项目竣工后,没有新楼盘推出。

惟该公司表示,目前进行中的项目仍可在经济前景放缓之际,贡献营业额和净利。

| 5129 MELATI MELATI EHSAN HOLDINGS BHD | | Quarterly rpt on consolidated results for the financial period ended 31/05/2016 | | Quarter: | 3rd Quarter | | Financial Year End: | 31/08/2016 | | Report Status: | Unaudited | | Submitted By: |

|

| | | Current Year Quarter | Preceding Year Corresponding Quarter | Current Year to Date | Preceding Year Corresponding Period | | | 31/05/2016 | 31/05/2015 | 31/05/2016 | 31/05/2015 | | | RM '000 | RM '000 | RM '000 | RM '000 | | 1 | Revenue | 13,257 | 46,264 | 50,158 | 154,325 | | 2 | Profit/Loss Before Tax | 7,662 | 1,594 | 17,285 | 8,080 | | 3 | Profit/(loss) attributable to ordinary equity holders of the parent | 7,647 | 827 | 17,030 | 5,508 | | 4 | Net Profit/Loss For The Period | 7,647 | 827 | 17,030 | 5,508 | | 5 | Basic Earnings/Loss Per Shares (sen) | 6.40 | 0.69 | 14.25 | 4.61 | | 6 | Dividend Per Share (sen) | 0.00 | 0.00 | 0.00 | 0.00 | | | | | As At End of Current Quarter | As At Preceding Financial Year End | | 7 | Net Assets Per Share (RM) | | | 1.6500 | 1.4800 |

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 31-8-2016 02:50 AM

|

显示全部楼层

发表于 31-8-2016 02:50 AM

|

显示全部楼层

本帖最后由 icy97 于 1-9-2016 02:47 AM 编辑

亿成控股获颁9900万合约

2016年8月30日

(吉隆坡29日讯)亿成控股(MELATI,5129,主板建筑股)宣布,获得大马公共工程局(JKR)颁发总值9900万令吉的中枢大道工程(Central Spine Road)第三工程配套。

根据文告,亿成控股独资子公司Kery建筑私人有限公司,获得该项道路建筑工程,从吉兰丹话望生(Gua Musang)至彭亨甘榜热隆(Kg Relong)。

该合约为期156周,预计会在2019年9月15日完成。

虽然该项工程预计不会对亿成控股截至8月31日财年的每股净利带来任何实际影响,但预计对未来净利带来贡献。【e南洋】

Type | Announcement | Subject | OTHERS | Description | MELATI EHSAN HOLDINGS BERHAD ("MELATI") LETTER OF AWARD FROM JABATAN KERJA RAYA MALAYSIA | The Board of Directors of Melati wishes to announce that its wholly-owned subsidiary, Pembinaan Kery Sdn. Bhd. ("Kery") had on 29 August 2016 accepted a Letter of Award from Jabatan Kerja Raya Malaysia ("JKR") for the road construction project entitled "Central Spine Road, Pakej 3: Gua Musang, Kelantan Ke Kg. Relong, Pahang (Seksyen 3E1: Mentara ke Merapoh) [“the Project”].

The contract sum for the Project is RM99,000,000/-, excluding 6% Goods and Services Tax. The contract is for a period of 156 weeks and the expected date of completion is on 15 September 2019 and subject to the terms and conditions of the Letter of Award.

The Project is not expected to have any material effects on the earnings per share of Melati for the financial year ending 31 August 2016. However, the Project is expected to contribute positively to the future earnings of the Melati group.

The Project is also not expected to have any material effects on the net assets, share capital and substantial shareholdings of Melati.

None of the directors or substantial shareholders of Melati or persons connected to such directors or substantial shareholders of Melati have any direct or indirect interest in the aforesaid Project.

This announcement is dated 29 August 2016. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 28-10-2016 02:32 AM

|

显示全部楼层

发表于 28-10-2016 02:32 AM

|

显示全部楼层

本帖最后由 icy97 于 29-10-2016 02:54 AM 编辑

亿成末季净利飙4倍

2016年10月27日

(吉隆坡26日讯)亿成控股(MELATI,5129,主板建筑股)截至8月31日末季,净利激增逾4倍,达1314万令吉;并建议派息1.75仙。

该公司向马交所报备,同期,营业额走高119%,报5370万5000令吉。

全年而言,净利飙涨约3倍,达3017万令吉;惟营业额跌42%,报1亿386万3000令吉。

亿成控股解释,全年净利取得强劲增长,归功于脱售子公司所得到的收益。

末季出色的净利表现,因一项住宅项目贡献已全数入账。

展望未来,虽然经济前景因油价低迷和令吉疲弱而缓和,但动工中的建筑项目,如东海岸经济特区(ECER)和人民房屋(PPR),料可贡献公司的营业额和净利。【e南洋】

SUMMARY OF KEY FINANCIAL INFORMATION

31 Aug 2016 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Aug 2016 | 31 Aug 2015 | 31 Aug 2016 | 31 Aug 2015 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 53,705 | 24,487 | 103,863 | 178,813 | | 2 | Profit/(loss) before tax | 13,051 | 2,779 | 30,336 | 10,859 | | 3 | Profit/(loss) for the period | 13,140 | 2,297 | 30,170 | 7,804 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 13,140 | 2,297 | 30,170 | 7,804 | | 5 | Basic earnings/(loss) per share (Subunit) | 11.00 | 1.92 | 25.25 | 6.53 | | 6 | Proposed/Declared dividend per share (Subunit) | 1.75 | 1.75 | 1.75 | 1.75 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.7600 | 1.4800

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 1-11-2016 07:59 PM

|

显示全部楼层

发表于 1-11-2016 07:59 PM

|

显示全部楼层

本帖最后由 kongsenger 于 18-11-2016 04:44 PM 编辑

2016年10月29日星期六億成控股 MELATI 5129 Rm 1.13 是否被低估?

--2016年 8月止财政年赚3017万,eps= 25.2sen, pe=8,价位=rm2.01

现股价rm1.13sen只是本益比(pe) 4.4倍在交易,明显被低估了.

--以建築股平均6~8倍本益比看,沒实在反应价值,rm1.50~2.00

--公可过去9年(2008 至2016年)都象征性派息,股息从1.5sen-7.5sen之间.

並从2007至2016年都取得净利,

--于31-8-2016 公司现金有3110万,nta达 rm1.76 ,借款为132万 ,每股净现金达24.8 sen

--[size=14.8571px]公司于2007年3月19日上市,发售价为RM1.28 ,今年己连续9年净利, 为何资本 没取得大增长,是否要发红股了?于31-8-2016 公司累计盈利达rm1.64亿,随时有

能力派发1送2红股或特别息.

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5241777

--Melati没有股利政策,但自上市以来每年支付其利润的25%(平均)。,取最少的一次17.7%算,

今年2016年赚3017万,须付出534万,股息为4.45sen ,己建议1.75sen ,另外2.7sen是否等发给?

如总发给4.45sen,现股价rm1.13 ,dy=3.9%

-- 该公司的建筑业务净赚幅约6%。

--亿成控股联营公司———B.H.O.Melati(简称BHOME),被授权在沙巴亚庇,发展沙巴大学教 学医院项目,包括规划、设计、融资、开发、建设、安装基建及设备等。

“此特许经营协议为期30年,总建筑成本高达6亿5298万1402令吉。 亿成控股在BHOME持股49%,该特许经营协议料可贡献未来净利。 --建築訂單以政府合約為主。公司從德國進口滑模式混凝土鋪路機,連續配筋混泥土技術(CRCP),

預料將為公司建築業務帶來更有利的地位。

--目前該公司有近100英畝地庫,分別位於巴生及沙亞南。

--產業發展業務貢獻約70%獲利及20%營業額,建築業務則貢獻約37%獲利及74%營業額。

--于31-12-2015 的30大股东共持有 106859 ,000股(89.44%),总股票数量为120000,000股

http://www.bursamalaysia.com/market/listed-companies/company-announcements/4989473

市流量低,股价易动,趁rm1.13sen低继续加码,丰衣足食。

自由市场,进出随意

http://www.melatiehsan.com.my/

网友分享(2014)--http://klse.i3investor.com/blogs/icon8888/51630.jsp

|

|

|

|

|

|

|

|

|

|

|

|

发表于 30-12-2016 06:48 AM

|

显示全部楼层

发表于 30-12-2016 06:48 AM

|

显示全部楼层

| MELATI EHSAN HOLDINGS BERHAD |

EX-date | 08 Mar 2017 | Entitlement date | 10 Mar 2017 | Entitlement time | 04:00 PM | Entitlement subject | First and Final Dividend | Entitlement description | First and Final Single Tier Dividend of 1.75 sen in respect of the year ended 31 August 2016 | Period of interest payment | to | Financial Year End | 31 Aug 2016 | Share transfer book & register of members will be | 10 Mar 2017 to 10 Mar 2017 closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | INSURBAN CORPORATE SERVICES SDN BHD149 Jalan Aminuddin BakiTaman Tun Dr Ismail60000Kuala LumpurTel:0377295529Fax:0377285948 | Payment date | 17 Mar 2017 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 10 Mar 2017 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit | 10 Mar 2017 | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.0175 | Par Value | Malaysian Ringgit (MYR) 0.500 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 3-1-2017 06:53 PM

|

显示全部楼层

发表于 3-1-2017 06:53 PM

|

显示全部楼层

本帖最后由 icy97 于 4-1-2017 02:41 AM 编辑

melati 5129 rm 0.915是否值得買入?

2017年1月3日星期二

http://kongsenger.blogspot.my/2017/01/melati-5129-rm-0915.html

melati 股价于2016年10月底冲至rm1.27,现回跌至rm0.915,

从成交量看盤整近完成,呈现買入机会.

比较最新年報30-11-2016与31-12-2015中的14大股东情况,

股份无大变动,表示大家对公司仍有信心,而于31-08-2016的

土地帳面价值达7千5百多万,只要下来公司开发新的房产项目,

对未来贡献将显著,那时又是一个漲停板日了,

目前公司建筑业仍继续支撑净利.

于31-8-2016 公司现金有3110万,nta达 rm1.76 ,借款为132万 ,每股净现金达24.8 sen

只供参考,投资自负.

|

|

|

|

|

|

|

|

|

|

|

|

发表于 20-1-2017 06:07 AM

|

显示全部楼层

发表于 20-1-2017 06:07 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Nov 2016 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Nov 2016 | 30 Nov 2015 | 30 Nov 2016 | 30 Nov 2015 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 21,808 | 19,706 | 21,808 | 19,706 | | 2 | Profit/(loss) before tax | 958 | 1,502 | 958 | 1,502 | | 3 | Profit/(loss) for the period | 504 | 1,067 | 504 | 1,067 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 504 | 1,067 | 504 | 1,067 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.42 | 0.89 | 0.42 | 0.89 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.7600 | 1.7600

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 22-2-2017 04:05 AM

|

显示全部楼层

发表于 22-2-2017 04:05 AM

|

显示全部楼层

本帖最后由 icy97 于 23-2-2017 06:59 AM 编辑

扩大产业业务.亿成与雪发展局洽合作

(吉隆坡21日讯)一向以建筑业务为主的亿成控股(MELATI,5129,主板建筑组),虽然建筑订单总值报53亿令吉,惟赚幅较低而计划扩大其产业业务,目前已与雪州经济发展局(PKNS)洽谈合作。

截至2016年12月31日,该公司建筑业务订单达53亿令吉,以2016财政年全年计,建筑业务、产业业务及建筑原料交易业务分别占营收的74.09%、15.48%及10.43%。

亿成控股董事经理丹斯里拿督叶顺治在股东大会后指出,因产业业务可托高净利,因此希望在下财政年内减低对建筑业务的依赖,并取得建筑及产业参半的营收贡献。

“我们计划将建筑业务所贡献的营收在下财政年内降至约50至60%,其余为产业业务,而建筑原料的交易则将扮演辅助核心业务的角色。”

没参与一马房屋

叶顺治补充,该公司去年收购总占约10英亩的3块士拉央土地,估计可建筑约1500至2000单位的可负担房屋,料可如期在下个月初获批、第三季施工。

目前因尚未获批而无法揭露发展总值,叶顺治表示,该项目房屋普遍标价为每单位40万令吉或以下,但称暂无参与一马房屋计划(PR1MA)的打算。

“除了大马公务房屋计划(PPA1M)及人民组屋(PPR)项目,我们已和雪州经济发展局(PKNS)洽谈发展市镇开发计划,尽管主要接手政府及官联公司合约,不过PR1MA并非其中。”

根据该公司2016年报,该公司接手冼都大马公务房屋的打桩项目正如期进行中,而该区的人民组屋建设,估计可在2017财政年末季竣工。

叶顺治指出,该公司正活跃寻觅巴生谷一代的适合地段,主要以公交导向型(TOD)为主,增添亿成控股坐拥地库。

建筑业务方面,叶顺治表示,该公司因多次接手东海岸经济特区(ECER)建筑项目,因此该公司有信心可获颁中枢大道的合约,而沙巴大学教学医院项目则料可在现财政年末季施工。

询及2017年盈利预测,该公司股财务员林东喜称,排除因脱售子公司所得盈利后,现财政年净利料将维持去年表现,并估计可保持录得至少一亿令吉营收的成绩。

文章来源:

星洲日报‧财经‧2017.02.22 |

|

|

|

|

|

|

|

|

|

|

|

发表于 6-4-2017 04:52 AM

|

显示全部楼层

发表于 6-4-2017 04:52 AM

|

显示全部楼层

Date of change | 28 Mar 2017 | Name | TAN SRI DATO' YAP SUAN CHEE | Age | 65 | Gender | Male | Nationality | Malaysia | Type of change | Redesignation | Previous Position | Managing Director | New Position | Executive Chairman | Directorate | Executive | Qualifications | Not applicaple. | Working experience and occupation | Tan Sri Dato' Yap Suan Chee is the founder of the Group and has over 25 years of working experience in the construction and property development industry. He was appointed to the Board of Directors of the Company on 5 January 2007 and subsequently appointed as Managing Director of the Company on 29 January 2007. He has been involved in numerous successful construction projects such as the French Embassy at Kuala Lumpur and the Football Association of Selangor's Business Avenue. | Family relationship with any director and/or major shareholder of the listed issuer | Nil | Any conflict of interests that he/she has with the listed issuer | Nil | Details of any interest in the securities of the listed issuer or its subsidiaries | Direct Interest: NilIndirect Interest: 59,689,511 shares (49.99%) |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 1-5-2017 05:18 AM

|

显示全部楼层

发表于 1-5-2017 05:18 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

28 Feb 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 28 Feb 2017 | 28 Feb 2016 | 28 Feb 2017 | 28 Feb 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 34,446 | 17,196 | 56,255 | 36,901 | | 2 | Profit/(loss) before tax | 1,264 | 8,121 | 2,222 | 9,622 | | 3 | Profit/(loss) for the period | 509 | 8,317 | 1,013 | 9,383 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 509 | 8,317 | 1,013 | 9,383 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.43 | 6.96 | 0.85 | 7.85 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.7600 | 1.7600

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 27-7-2017 12:30 AM

|

显示全部楼层

发表于 27-7-2017 12:30 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 May 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 May 2017 | 31 May 2016 | 31 May 2017 | 31 May 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 32,235 | 13,257 | 88,490 | 50,158 | | 2 | Profit/(loss) before tax | 1,408 | 7,662 | 3,630 | 17,285 | | 3 | Profit/(loss) for the period | 514 | 7,647 | 1,527 | 17,030 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 514 | 7,647 | 1,527 | 17,030 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.43 | 6.40 | 1.28 | 14.25 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.7500 | 1.7600

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 6-10-2017 03:13 AM

|

显示全部楼层

发表于 6-10-2017 03:13 AM

|

显示全部楼层

本帖最后由 icy97 于 8-10-2017 03:45 AM 编辑

亿成子公司获贷款执照

2017年10月7日

(吉隆坡6日讯)亿成控股(MELATI,5129,主板建筑股)宣布,独资子公司Melati Ehsan资本私人有限公司,昨天获得来自城市和谐、房屋与地方政府部的有条件批准信函,根据1951年借贷法令下获得贷款许可执照。

该公司向交易所报备,这项有条件批准,取决于Melati Ehsan资本董事及事务所能否达到信函中所列明的条件。

此外,这项批准不会对公司截至2018年8月31日财年每股净利及净资产带来任何实质影响。【e南洋】

Type | Announcement | Subject | OTHERS | Description | MELATI EHSAN CAPITAL SDN. BHD., A WHOLLY-OWNED SUBSIDIARY OF MELATI EHSAN HOLDINGS BERHAD (THE "COMPANY")- MONEY LENDING LICENCE UNDER THE MONEY LENDING ACT 1951 (ACT 400) | The Board of Directors of the Company wish to inform that its wholly-owned subsidiary, Melati Ehsan Capital Sdn. Bhd. (851808-D) (“MECSB”) had on 5 October 2017 obtained a conditional Letter of Approval dated 14 September 2017, from the Ministry of Wellbeing, Housing and Local Government (“Ministry”) for the Money Lending Licence under the Money Lending Act 1951 (Act 400) (“Conditional Approval”).

The Conditional Approval is subject to the Directors of MECSB and the business premises of MECSB complying to and satisfying the prescribed requirements stated in the Ministry’s approval letter.

The Conditional Approval will not have any material effect on the earnings per share and net asset per share of the Company and its subsidiaries for the financial year ending 31 August 2018. It will also not have any effects of the issued shares, gearing and substantial shareholders’ shareholdings of the Company.

None of the Directors and/or major shareholders of the Company as well as persons connected to them have any interest, direct or indirect, in the above matter.

This announcement is dated 5 October 2017. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 26-10-2017 04:51 AM

|

显示全部楼层

发表于 26-10-2017 04:51 AM

|

显示全部楼层

本帖最后由 icy97 于 28-10-2017 03:59 AM 编辑

亿成控股末季净利挫93%

2017年10月27日

(吉隆坡26日讯)亿成控股(MELATI,5129,主板建筑股)截至8月杪末季,净利重挫93.16%,从去年同期的1314万令吉,大跌至89万9000令吉或每股0.75仙。

亿成控股昨天向交易所报备,营业额却按年增48.14%,录得7955万8000令吉。

累计全年,净利滑落91.96%至242万6000令吉;营业额则年涨61.8%,报1亿6804万8000令吉。

全年税前盈利从3033万6000令吉,大大减少至390万9000令吉。

亿成控股解释,尽管本财年营业额取得增长,但归咎于其他收入减少及销售成本上涨,拉低盈利表现。

产业发展业务转亏

细分业务来看,产业发展业务由盈转亏,全年税前亏损195万7000令吉。营业额也按年减60.5%至648万3000令吉,归咎于目前市场情绪拖累销售走低。

不过,建筑和贸易业务的营业额和税前盈利皆取得增长。

展望未来,亿成控股称,尽管经济前景谨慎,但动工中的建筑项目,如东海岸经济特区(ECER)和人民房屋(PPR),料可贡献公司的营业额和盈利能力。【e南洋】

SUMMARY OF KEY FINANCIAL INFORMATION

31 Aug 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Aug 2017 | 31 Aug 2016 | 31 Aug 2017 | 31 Aug 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 79,558 | 53,705 | 168,048 | 103,863 | | 2 | Profit/(loss) before tax | 279 | 13,051 | 3,909 | 30,336 | | 3 | Profit/(loss) for the period | 899 | 13,140 | 2,426 | 30,170 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 899 | 13,140 | 2,426 | 30,170 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.75 | 11.00 | 2.03 | 25.25 | | 6 | Proposed/Declared dividend per share (Subunit) | 1.00 | 1.75 | 1.00 | 1.75 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.7600 | 1.7600

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 28-12-2017 05:12 AM

|

显示全部楼层

发表于 28-12-2017 05:12 AM

|

显示全部楼层

| MELATI EHSAN HOLDINGS BERHAD |

EX-date | 08 Mar 2018 | Entitlement date | 12 Mar 2018 | Entitlement time | 04:00 PM | Entitlement subject | First and Final Dividend | Entitlement description | First and Final Single Tier Dividend of 1 sen in respect of the year ended 31 August 2017 | Period of interest payment | to | Financial Year End | 31 Aug 2017 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | INSURBAN CORPORATE SERVICES SDN BHD149 Jalan Aminuddin BakiTaman Tun Dr Ismail60000Kuala LumpurTel:0377295529Fax:0377285948 | Payment date | 19 Mar 2018 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 12 Mar 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.01 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 26-1-2018 04:49 AM

|

显示全部楼层

发表于 26-1-2018 04:49 AM

|

显示全部楼层

本帖最后由 icy97 于 28-3-2018 03:32 AM 编辑

SUMMARY OF KEY FINANCIAL INFORMATION

30 Nov 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Nov 2017 | 30 Nov 2016 | 30 Nov 2017 | 30 Nov 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 44,197 | 21,808 | 44,197 | 21,808 | | 2 | Profit/(loss) before tax | 777 | 958 | 777 | 958 | | 3 | Profit/(loss) for the period | 604 | 504 | 604 | 504 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 604 | 504 | 604 | 504 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.51 | 0.42 | 0.51 | 0.42 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.7600 | 1.7600

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 27-1-2018 05:03 AM

|

显示全部楼层

发表于 27-1-2018 05:03 AM

|

显示全部楼层

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

NON RELATED PARTY TRANSACTIONS | Description | MELATI EHSAN HOLDINGS BERHAD("MEHB" OR THE "COMPANY")PROPOSED DISPOSAL OF FORTY-SEVEN (47) 99-YEAR LEASEHOLD VACANT DETACHED LOTS AND THIRTY (30) 99-YEAR LEASEHOLD BUILDING LOTS (EACH WITH A DOUBLE STOREY DETACHED HOUSES ERECTED THEREON) AT SEKSYEN U10 SHAH ALAM, MUKIM OF BUKIT RAJA, DISTRICT OF PETALING JAYA, STATE OF SELANGOR DARUL EHSAN BY BAYU MELATI SDN. BHD. (415653-V), A WHOLLY OWNED SUBSIDIARY OF MEHB ("PROPOSED DISPOSAL") | The Board of Directors of MEHB wishes to announce that Bayu Melati Sdn. Bhd. (415653-V), a wholly-owned subsidiary of the Company has on 26 January 2018 entered into a Sale and Purchase Agreement with Kimlun Land Sdn. Bhd. (926350-P) to dispose forty-seven (47) 99-year leasehold vacant detached lots (collectively “47 Vacant Lots”) and thirty (30) 99-year leasehold building lots (each with a double storey detached houses erected thereon) (“collectively “30 Detached Houses”) on an “en bloc” and “as is where is” basis, the details of which are tabulated in Appendix A and Appendix B respectively hereinafter, for a total cash consideration of RM68,406,237.92 (“Proposed Disposal”).

The Proposed Disposal of the 30 Detached Houses were developed in the ordinary course of business of Bayu Melati Sdn. Bhd. Hence the requirements under the Main Market Listing Requirements to seek shareholders’ approval is not applicable.

Please refer to the attachment for details of the Proposed Disposal.

This announcement is dated on 26 January 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5677821

|

|

|

|

|

|

|

|

|

|

|

|

发表于 25-3-2018 04:40 AM

|

显示全部楼层

发表于 25-3-2018 04:40 AM

|

显示全部楼层

本帖最后由 icy97 于 26-3-2018 02:27 AM 编辑

Type | Announcement | Subject | OTHERS | Description | MELATI EHSAN HOLDINGS BERHAD ("MELATI" OR "THE COMPANY")- ISSUANCE OF MONEYLENDING LICENCE TO MELATI EHSAN CAPITAL SDN. BHD., A WHOLLY-OWNED SUBSIDIARY OF THE COMPANY | 1. INTRODUCTION The Board of Directors of the Company wishes to announce that Melati Ehsan Capital Sdn. Bhd. (Company No. 851808-D) (“MECSB”), a wholly-owned subsidiary of the Company, had obtained a moneylending licence ("the Licence") dated 15 March 2018 issued by Kementerian Perumahan Dan Kerajaan Tempatan (“KPKT”), Bahagian Pemberi Pinjaman Wang Dan Pemegang Pajak Gadai which was received by the Company on 22 March 2018.

2. BACKGROUND INFORMATION ON MECSB MECSB was incorporated on 31 March 2009 in Malaysia under the Companies Act 1965, as a private limited company. The total issued and paid-up capital of MECSB is RM2,000,000.00 comprising 2,000,000 ordinary shares. The Directors of MECSB are Encik Radzulai Bin Yahaya and Mr. Lim Tong Hee. Both of them are also Executive Directors of the Company. MECSB is currently dormant. The proposed nature of business are those of moneylenders, financial agents and financiers in general.

3. DURATION/ VALIDITY OF THE LICENCE The moneylending licence of MECSB dated 15 March 2018, which is governed by the “Akta Pemberi Pinjam Wang 1951” and renewable every two years, is valid for the period commencing from 15 March 2018 to 14 March 2020.

The announcement is dated 23 March 2018. . |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 27-4-2018 01:05 AM

|

显示全部楼层

发表于 27-4-2018 01:05 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

28 Feb 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 28 Feb 2018 | 28 Feb 2017 | 28 Feb 2018 | 28 Feb 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 46,821 | 34,446 | 91,018 | 56,255 | | 2 | Profit/(loss) before tax | 1,017 | 1,264 | 1,794 | 2,222 | | 3 | Profit/(loss) for the period | 416 | 509 | 1,020 | 1,013 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 416 | 509 | 1,020 | 1,013 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.35 | 0.43 | 0.85 | 0.85 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.7700 | 1.7600

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 31-7-2018 03:54 AM

|

显示全部楼层

发表于 31-7-2018 03:54 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 May 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 May 2018 | 31 May 2017 | 31 May 2018 | 31 May 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 127,545 | 32,235 | 218,563 | 88,490 | | 2 | Profit/(loss) before tax | 469 | 1,408 | 2,263 | 3,630 | | 3 | Profit/(loss) for the period | 434 | 514 | 1,454 | 1,527 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 434 | 514 | 1,454 | 1,527 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.36 | 0.43 | 1.22 | 1.28 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.7600 | 1.7600

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 20-10-2018 02:00 AM

|

显示全部楼层

发表于 20-10-2018 02:00 AM

|

显示全部楼层

本帖最后由 icy97 于 22-10-2018 05:12 AM 编辑

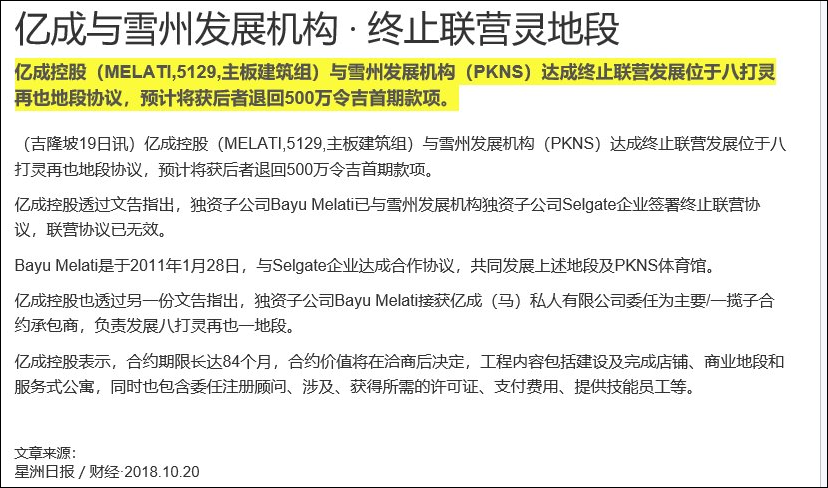

Type | Announcement | Subject | OTHERS | Description | TERMINATION OF JOINT VENTURE AGREEMENT DATED 28 JANUARY 2011 MADE BETWEEN BAYU MELATI SDN. BHD., A WHOLLY-OWNED SUBSIDIARY OF THE COMPANY AND SELGATE CORPORATION SDN. BHD. (FORMERLY KNOWN AS PKNS HOLDINGS SDN. BHD.) FOR THE DEVELOPMENT OF THREE PIECES OF FREEHOLD COMMERCIAL LANDS LOCATED AT BANDAR PETALING JAYA, DAERAH PETALING, NEGERI SELANGOR | Reference is made to the Company’s announcement on 28 January 2011 in relation to the joint venture agreement entered between Bayu Melati Sdn. Bhd. (415653-V) ("Bayu Melati"), a wholly owned subsidiary of the Company and Selgate Corporation Sdn. Bhd. (formerly known as PKNS Holdings Sdn. Bhd.) (190684-D) (“Selgate Corporation”), a wholly owned subsidiary of Perbadanan Kemajuan Negeri Selangor (“JVA”) for the development of the lands under title nos. Geran 102826, Lot 36473, Seksyen 40, Bandar Petaling Jaya, Daerah Petaling, Negeri Selangor; HS(D) 245808, PT 235, Seksyen 40, Bandar Petaling Jaya, Daerah Petaling, Negeri Selangor and Geran 90689, Lot 36471, Seksyen 40, Bandar Petaling Jaya, Daerah Petaling, Negeri Selangor with a Sports Complex known as “Kompleks Sukan PKNS” (hereinafter collectively referred to as “the Lands”).

The Board of Directors of the Company (“the Board”) wishes to announce that Bayu Melati has on 19 October 2018, entered into a Deed of Mutual Termination (“the Deed”) with Selgate Corporation to terminate the joint venture in development of the Lands.

Upon mutual termination, the JVA shall be null and void and of no further effect. Selgate Corporation shall refund to Bayu Melati the initial payment of Ringgit Malaysia Five Million (RM5,000,000.00) immediately from the execution of the Deed.

The mutual termination will not have any effect on the share capital and the shareholding of the substantial shareholders of the Company.

The mutual termination is not expected to have any material effect on the earnings and net assets of the Company for the financial year ending 31 August 2019. None of the directors, major shareholders of the Company and/or persons connected to them has any interest.

The Board, having considered all aspect of the termination of JVA, is of the opinion that the termination of the JVA is in the best interest of the MEHB Group. The Deed is available for inspection by members of the Company at the registered office of the Company at No. 5, Jalan Titiwangsa, 53200 Kuala Lumpur during business hours from Mondays to Fridays (except Public Holidays) for a period of 3 months from the date of this announcement.

This announcement is dated 19 October 2018. |

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|