|

|

【RGB 0037 交流专区】RGB国际(DGATE 0037)

[复制链接]

[复制链接]

|

|

|

发表于 29-11-2016 10:45 PM

|

显示全部楼层

发表于 29-11-2016 10:45 PM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 2-12-2016 07:10 PM

|

显示全部楼层

发表于 2-12-2016 07:10 PM

|

显示全部楼层

本帖最后由 icy97 于 2-12-2016 11:52 PM 编辑

RGB: Earnings Continued To Rise

Friday, December 02, 2016

http://nexttrade.blogspot.my/2016/12/rgb-earnings-continued-to-rise.html

Result Update

For QE30/9/2016, RGB's net profit rose 34% q-o-q or 63% y-o-y to RM9.3 million while revenue rose 63% q-o-q or 19% y-o-y to RM95 million. Revenue increased q-o-q due to higher revenue from Sales & Marketing (SSM) division while revenue from Technical Support & Management (TSM) division was unchanged. PBT rose q-o-q due to higher profit from SSM division (an increase of RM3 million) which more than offset the drop in PBT for TSM division (of RM0.4 million) as well as forex losses of RM0.9 million.

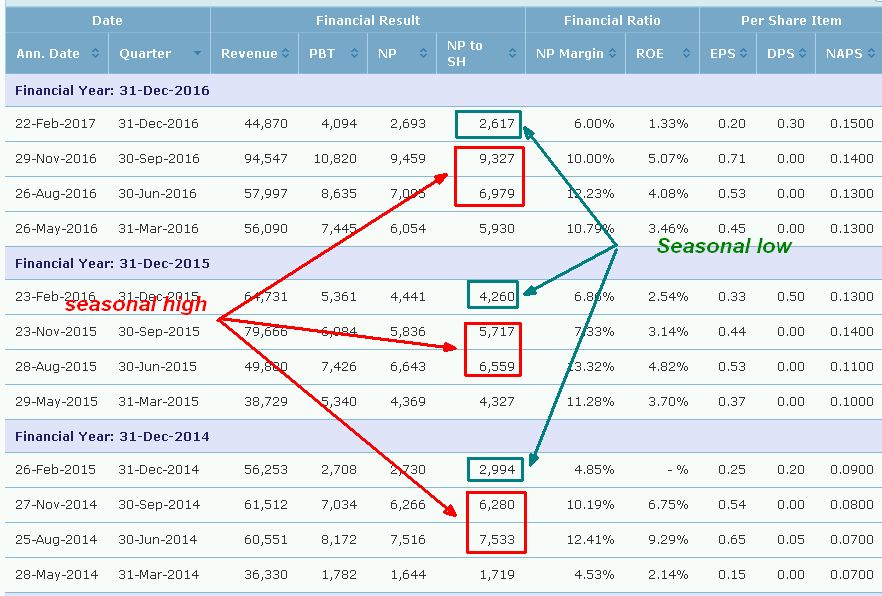

Table: RGB's last 8 quarters' P&L

Chart 1: RGB's last 13 quarters' P&L

Valuation

RGB (closed at RM0.235 yesterday) is now trading at a PER of 12x (based on last 4 quarters' adjusted EPS of 2 sen). Based on CAGR of 25% over the past 2 years, PEG ratio is still comfortably below 1x. At this PER & PEG ratio, RGB is deemed attractively valued.

Conclusion

Based on good financial performance, attractive valuation and positive technical outlook, RGB is rated a BUY.

Note:

I hereby confirm that I do not have any direct interest in the security orsecurities mentioned in this post.However, I could have an indirect interest in the security or securitiesmentioned as some of my clients may have an interest in the acquisition ordisposal of the aforementioned security or securities. As investor, you should fully research anysecurity before making an investment decision.

|

|

|

|

|

|

|

|

|

|

|

|

发表于 14-12-2016 12:26 AM

|

显示全部楼层

发表于 14-12-2016 12:26 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 16-12-2016 11:40 AM

|

显示全部楼层

发表于 16-12-2016 11:40 AM

|

显示全部楼层

本帖最后由 icy97 于 17-12-2016 02:02 AM 编辑

冷眼推荐股(二十四):RGB

Friday, December 16, 2016

http://bblifediary.blogspot.my/2016/12/rgb.html

业务

- 制造和维修老虎机(slot machine)

RGB(RGB国际,0037,主板贸服股),成立于1986年,并于2004年1月13日上市当年的MESDAQ,过后于2008年转至主板。

RGB的前生为DGATE(Dream Gate,梦城机构),于2010年6月4日易名RGB。

总部设在槟城的RGB,其创办人为拿督蔡金城,核心业务主要集中在角子机(俗称老虎机)及相关设备的销售、市场行销和生产。它也为游戏机提供特许经营项目,以及技术支援管理服务。

该公司的收入来源主要有两种:-

- 代理销售老虎机给予娱乐中心、俱乐部或赌场,以及提供维修服务

- 出租老虎机或将老虎机置放在俱乐部或赌场内,以收取租金或分享利润

目前该公司的市场主要以东盟国家为主,如马来西亚、柬埔寨、菲律宾和寮国。该公司也有意进军印度和斯里兰卡。

RGB自2004年上市至今,有过一段大起大落、可歌可泣的悲壮经历。曾遇受到重大挫折由盛转衰,过后又站稳脚步一路走到现在。

2003年,RGB进军柬埔寨,把所有主力都集中在当地,当时可说是该公司最鼎盛的时期是2007年,当年的净利达到3830万令吉。

之后,传来噩耗。

2009年2月,柬埔寨政府禁止在该国的娱乐场所设置老虎机,RGB顿时从天堂掉到地狱。

公司当时在柬埔拥有超过2000部老虎机,这一项禁令除了让该公司收入减少外,还需要任列减值费用,甚至还需要承担大笔借贷利息,进而使得公司面对亏损。2009年,RGB由盈转亏,面对高达5800万令吉的巨额亏损。

这对RGB简直就是致命打击,让RGB泥足深陷了3年。2011年,公司的累计亏损已经扩大到4833万令吉,净负债也高达7367万令吉。

之后,公司转移阵地至菲律宾,把所有闲置的老虎机都搬到当地,并与有菲律宾政府支持的企业和赌场合作,终于取得了成果。

2012年,RGB终于转亏为盈,此后该公司年年写下佳绩,而且其净利已经连续5年取得增长(如下图)。

如今,RGB已经蜕变成一家净现金公司,拥有6760万令吉的净现金。此外,该公司已经注销所有的累计亏损,并且拥有1479万令吉累计盈利。

以目前的股价计算,本益比12倍,属于合理。但是如果公司未来能够继续成长,或者恢复到2007年的鼎盛水平,那么以目前的价格来看,的确相当吸引人。

免责声明:

以上投资分析,纯属本人个人意见和观点。

文章所提做出的数据与价格仅供参考,建议大家在买进一家公司的股份前,请先做功课并了解该公司,并衡量应何时进场和离场,任何人因看此文章而造成任何投资损失,本人恕不负责。切记,买卖自负!

|

|

|

|

|

|

|

|

|

|

|

|

发表于 18-12-2016 06:30 AM

|

显示全部楼层

发表于 18-12-2016 06:30 AM

|

显示全部楼层

RGB国际

料明年营收双位数增

2016年12月13日

(吉隆坡12日讯)随着开拓其他区域的市场,RGB国际(RGB,0037,主板贸服股)预计2017财年的业务表现将获得双位数增长及重复现财年表现。

《星报》报道,该公司发言人称,RGB国际开始积极探索现有市场外的区域市场,能提升销售额和特许经营,推动明年表现获双位数提升。

“我们已在今年开始开拓亚洲以外的新市场,包括南美洲和欧洲。”

另外,消息人士透露,公司也达到内部关键绩效指标(KPI),今年表现将取得亮眼成绩。

“公司在首9个月的净利为2220万令吉,高于去年同期表现,因此我们很有信心今年能够得按年双位数增长。”

他也提到:“公司的基本面仍稳健,预料明财年也能取得双位数增长。”

此外,该公司销售和营销领域,已在今年成功售出超过1300架角子机,同时放眼明年销量能增10%。

目前RGB国际市场立足于亚洲数个多国家,如大马、新加坡、澳门、柬埔寨、寮国、菲律宾、越南、缅甸、东帝汶及尼泊尔。

在该公司营业额中,有90%来自国外市场,其中95%来自亚太区域。

在国内,RGB国际的客户有云顶和丽星邮轮(Star Cruises)。【e南洋】 |

|

|

|

|

|

|

|

|

|

|

|

发表于 20-12-2016 01:07 AM

|

显示全部楼层

发表于 20-12-2016 01:07 AM

|

显示全部楼层

本帖最后由 icy97 于 20-12-2016 02:12 AM 编辑

RGB - Siding with the top bookies

Author: Stockify | Publish date: Mon, 19 Dec 2016, 06:42 PM

http://klse.i3investor.com/blogs/stockify/112047.jsp

Introduction

The history of RGB involvement in the gaming industry began way back in 1986 (through RGB Sdn Bhd, its wholly owned subsidiary today). To date, RGB has been in the industry for 30 years, being known as a leading supplier of electronic gaming machines and casino equipment in Asia region (known as SSM in later part of this article). It is also a major machine concession programmes operator in Asia (known as TSM in later part of this article).

RGB, the Group, was incorporated on 16 January 2003, listed on MESDAQ on 13 January 2004, and successfully transferred to the Main Market of BURSA on 31 January 2008. Just when everything seemed to be going well, Cambodian Prime Minister Hun Sen's decision to cease the operations of slot clubs in Cambodia came as a shock to the Group, resulting in its first loss in FY08 ever since listed.

Just like the biography of every great man, their stories would not have been as interesting and inspiring without enduring the hardships. And this is how we would like to tell our story on RGB.

Business

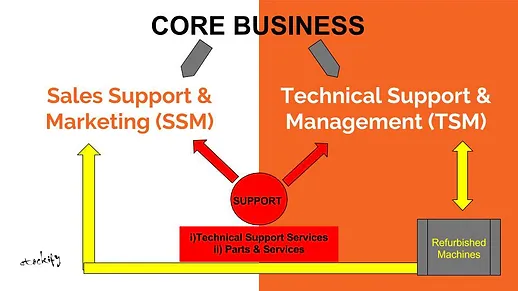

In an industry with relatively few competitors, RGB is one of the industry leader in Asian region. The operations of RGB can be mainly classified into two main segments, i.e Sales Support & Marketing (SSM) and Technical Support & Management (TSM), which is illustrated as below.​

SSM Segment distributes electronic gaming machines, amusement machines, casino equipment accessories & slot management system in Asia including Malaysia, Philippines, Macau, Singapore, Vietnam, Cambodia and Nepal. The brands including in house brand RGBGAMES, R.Franco, Scientific Games, Aristocrat, GPI, IGT and Suzo Happ. In this segment, RGB holds no interest in the gaming machines, only as a distributor to sell the machines. Based on latest trailing twelve month (3QFY16), SSM Segment contributed 66% to the Group total revenue.

TSM Segment partners up with investors & gaming license holders by placing electronic gaming machines at concession venues (slot halls & casinos) mostly in Cambodia & Philippines. Partnership model includes i) Providing lease-to-own packages ii) Gaming machines profit-sharing iii) Providing management services for a fee. As reported in AR FY15, RGB has more than 6,000 units of machines in operation across 37 concession venues in Philippines, Cambodia, Lao PDR and Vietnam. (Timor Leste, Nepal, and Kathmandu). Based on latest trailing twelve month (3QFY16), SSM Segment contributed 33.86% to the Group total revenue.

Going forward, the Group aims to expand its markets by growing geographically as well as through strategic partnership and acquisition. While having presence in more than 8 countries, RGB derives 95% of its revenue from Asia-Pacific region. As published in The Star Online on 1st August 2016, RGB group managing director Datuk Chuah said that the Group is eyeing new markets in Europe and South America. We believe it will be the growth driver for RGB. The Group will also continue to identify viable partners to grow its TSM business.

In the same article, it was mentioned that the group will soon start its first TSM concession in Kathmandu, we see this as the opportunity to tap into a bigger market, as opposed to usual Southeast Asia market by the Group, given Nepal’s close proximity to India also means that it will be able to attract customers from India, the world's second most populous country after China. By expanding the TSM Segment, RGB's revenue and net profit will be more consistent as the income from TSM Segment is on recurring basis. Besides that, the profit margin of the Group will overall be improved, due to the high profit margin in TSM Segment (5 year average of 21.49% in TSM Segment vs 5 year average of 9.54% in SSM Segment, both excluding unallocated expenses).

However, we would like to remind investors that by involving more in TSM Segment, RGB also increases its risk sharing with the gaming license holders. Speaking of profit margin, in SSM Segment, which RGB acts as a distributor of gaming machines, RGB managed to secure a decent profit margin compared to traditional distributors who always have razor-thin margin. We suppose it is attributable to the on going Technical Support Services and Parts & Services provided by the Group to its customers and investment partners which gives them the peace of mind to buy and partner up with them. The Technical Support Services of the Group renders technical services, system maintenance services and consultation that support all brands under its distributorship as after sales service and service to all its TSM Sites. The Parts & Services department supplies low costs and high quality parts and components to its partners and customers, and even refurbish old machines for future use or sell. Such services can provide peace of mind to the customers and partners, and cost savings on a longer term, therefore manage to have them to prefer sticking with RGB, even maintaining a higher margin.

Management

Back in 2008, RGB was having its greatest time of all time. The business was experiencing tremendous growth, from FY03 to FY07, the Group managed to achieve CAGR of 35.92% in revenue and CAGR of 31.88% in net profit. The share price hit all time high at RM 0.60 in Nov 2007 (after adjustment for bonus issue), and successfully converted to Main Market in 31 January 2008. Intended to ride on the trend, in FY07 alone, the Group has placed additional 2,200 units of machines throughout all locations of operations, an upsurge of 65% from 3,400 machines previous year, funded by the additional borrowings RM 72.5 mil (+106% in borrowings compared to FY06) taken in that year. The Group also spent CAPEX as high as RM 120 mil (+97% compared to FY06), and 90% of the CAPEX was spent in Cambodia.

And just like the myth of Icarus, who flew too high and the sun melted his wings, the sudden regulatory changes in Cambodia towards operations of slot clubs in December 2008 was a nightmare to the Group, forcing 1,500 units of machines were removed from operations in following the closure of 23 clubs. Two months later, following a directive issued on 26 Feburary 2009 which decreed that all slot clubs in Cambodia to cease operations, a further 21 slot clubs with 1,800 units of machines were closed. Given their large exposure to Cambodia during that time (Cambodia segment contributed 37% to the total revenue and 52.62% to total assets in FY07), the regulatory issues in Cambodia caused the Group to incur first losses in FY08 and also subsequent years.

The losses were mainly caused by 3 reasons:

1) Lower revenue contribution from Cambodia (loss of revenue from 3,300 machines)

2) High mobilisation costs i.e. removal, storage, relocation and reinstallation for affected machines to other TSM concessions.

3) Impairment costs of the affected machines that failed to rearrange to new TSM concessions.

With the loss of 3,300 machines from Cambodia, revenue of RGB's TSM segment almost halved in FY09, not to mention still having to serve the interest of more than RM 9 mil on the back of RM 147 mil borrowings, resulting in the Group suffered greatly in their bottom lines. With 3,300 idle machines, the management responded quick and decisively enough to promote the TSM concession arrangement to casino operators in Macau and Philippines, by leveraging their long-standing relationship. The Group managed to refurbish and deploy 58% of the idle machines into new concessions, while this is commendable, the cost of setting up further affected the net profit of the Group. The remaining machines failed to be arranged into new TSM concession subjected to impairment cost that further drag the Group into losses for the consecutive financial years.

We opine that the management did a fantastic job in handling the Group during turbulent times. The management took only 4 years to turn around the company to be profitable again in FY12. In fact, the EBITDA of the Group has always been positive despite in turbulent times, it was only the impairment cost from affected machines turned the Net Profit into red. More importantly, the Group has learned the lesson to be extra careful in managing its CAPEX and debts. RGB made it its first priority to pare down its borrowings in FY11, and the borrowings have been reducing significantly over the past few years, turning into a net cash position in FY15.

We believe that assessing a company's management capability and integrity is as important as assessing its business prospects, financial performance and valuation. Retail investors are always of the opinion that they are not in the position to evaluate the management of a company. The case study of RGB proved that, they can too. A management team that proved to be the veteran in the industry, able to fulfill its promise to the shareholders, did what was necessary during turbulent times and learned from their mistakes, we have no reason not to grade them as one of the top management we have come across.

Risks

Over-concentration in Cambodia back in FY07 has caused the group suffered greatly. Today, the Group seems to have diversified its operations by making its presence in more than 8 countries, but in fact, it hasn't. Based on the latest Annual Report FY15, segment from Philippines and Cambodia contributed 67% and 12% to the total revenue respectively. In terms of geographical non-current assets, Philippines and Cambodia's non-current assets made up 32% and 50% of the Group total non-current assets. When we look into the TSM Segment, where greater risks lie (due to the risk-sharing nature), most of the Group TSM concessions are located at Philippines and Cambodia. To clarify, we don't see geographical diversification as one of our checklists in making our investment decision. However, for a company like RGB that subjects to high regulatory risks, geographical diversification matters.

Besides that, more people nowadays go online in search of entertainment they used to access in other ways, and gambling is no exception. It is believed that online gambling will be taking more market share from traditional gambling, due to several advantages it offers including convenience, comfortable, anonymity, privacy etc. And compare among few forms of gaming, slotting machines are definitely more replaceable by online gambling due to the gaming nature. This is a risk investors should consider if they are planning to invest in RGB for a very long period.

Conclusion

RGB has got a top management team that is able to navigate the Group through turbulent times, and fulfill its promises to the shareholders. This is the kind of management that value investors would seek. In gambling, there is a saying: "The House Always Win". With TSM Segment expanding, investing in RGB is equivalent to siding with the House in gambling, which is a proxy to invest in typical casino business that often comes with higher valuations. We would like to see RGB to diversify away its TSM Segment from Philippines and Cambodia to mitigate its regulatory risk from these countries. In this post, even though we have quoted some figures to support our analysis, it is mainly the business analysis of RGB, aka qualitative analysis. However, good business is not equivalent to good investment, as valuations of a company plays a bigger part in value investing. In next post, we will further analyze RGB in terms of financial numbers, so that our readers can decide whether RGB is at its right valuation to invest in.

|

|

|

|

|

|

|

|

|

|

|

|

发表于 21-12-2016 04:51 PM

|

显示全部楼层

发表于 21-12-2016 04:51 PM

|

显示全部楼层

本帖最后由 icy97 于 22-12-2016 04:31 AM 编辑

【Rgb international berhad】- 起了这么多还可以买吗?在高点?

今天来谈一谈笔者在几个月前分享过的一只股,这支股也经常上热门股,因为股数很大,也是大家爱叫的仙股。从十月五号的0.175到今天的0.290,足足起了65%,说真的我也没想到,要不然我就买多多了,很可惜,只买了一部分。但是在与我的subscriber 讨论的过程中,就发现大家都认为rgb在高点了,不好买。其实笔者的看法是,rgb还是在低点,因为之前rgb可以说是低估到bursa 排第二便宜了,就算起了个60%,笔者还是认为被低估,而不是起了很多就是在高点了,起的同时,公司的价值也随着盈利一直提升,何来高点之说?

十二月十三日,rgb公司发言人也说公司正积极开拓南美洲和欧洲的新市场,有信心明年也维持双位数的成长。所以在目前还是低估的状况下,我相信就算以目前的价码买进还是能达到我一年20%的目标,当然如果情况有变,我们也是要套利的。

目前笔者计算在没有盈利成长的状况下,rgb五年半左右翻一倍的valuation,所以说离应有的fully valued 十年标准还是有一段距离。长期投资的威力真的很惊人,笔者体会过,所以也鼓励大家长期投资。

最新公布的quater report 显示,营业额达到新高的94mil,盈利也是9.3mil,比去年同期上涨63%,看来管理层不是在随便放话的,是公司业绩真的是很好。RGB之前也是在magic formula list 当中,公司较大的depreciation导致公司很大部分的现金流被盖过了,其实公司现金流很强劲。

Inverted Reverse Umbrella

|

|

|

|

|

|

|

|

|

|

|

|

发表于 11-1-2017 10:39 PM

|

显示全部楼层

发表于 11-1-2017 10:39 PM

|

显示全部楼层

收市0.305..

破52週新高0.325..

|

|

|

|

|

|

|

|

|

|

|

|

发表于 12-1-2017 02:07 PM

|

显示全部楼层

发表于 12-1-2017 02:07 PM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 12-1-2017 08:05 PM

|

显示全部楼层

发表于 12-1-2017 08:05 PM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 14-1-2017 01:57 PM

|

显示全部楼层

发表于 14-1-2017 01:57 PM

|

显示全部楼层

朋友在0.18就call buy鸟 可惜我硬颈不看好 可惜我硬颈不看好 |

|

|

|

|

|

|

|

|

|

|

|

发表于 10-2-2017 12:25 PM

|

显示全部楼层

发表于 10-2-2017 12:25 PM

|

显示全部楼层

0.35,

創新高了..

|

|

|

|

|

|

|

|

|

|

|

|

发表于 10-2-2017 06:07 PM

|

显示全部楼层

发表于 10-2-2017 06:07 PM

|

显示全部楼层

今天达到目标价0.35套利了,业绩提前上涨,业绩公布后保持0.71分或少过,那应该会出现套利回调,若破新高但是相信还是先涨后再出现回调在0.35的水平吧! 总结业绩公布后再看。 总结业绩公布后再看。 |

|

|

|

|

|

|

|

|

|

|

|

发表于 12-2-2017 07:42 AM

|

显示全部楼层

发表于 12-2-2017 07:42 AM

|

显示全部楼层

本帖最后由 icy97 于 12-2-2017 10:27 PM 编辑

0037 RGB国际 Rm 0.35 进入

2017年2月10日星期五

http://kongsenger.blogspot.my/2017/02/0037-rgb-rm-035.html

年全估全全

--估算2016全年EPS=2.3SEN,PE=20,STOCK PRICE=46SEN.

--rgb 浮出台面了,Q4好季报,可能BONUS等,股价难下了.

---公司诚信度是很好的,因此数据造假应该不会发生在这公司上。

---RGB 绝对是投资者的首选股,公司的潜在价值好,成长佳,将会是一只黑马股。

---买股看公司的未来是否成长,净利多少等,当可见度变得清晰,投资风险相对变小,

股价也将呈现上升势头,RGB会是不错的选择。

---公司的赚副有10.7% .

--大股东之前表示,有信心股价在2018年时,回到60仙价位.试目以待吧。

--Rgb 很快成为全民有的股只,買方强,走势向上,Rgb 在天时地利人和下,一一反应价值,

短期40sen,中長期60sen,进入守住待更丰盛的果实。机会不常有,把握吧。

只供参考,投资自负.

|

|

|

|

|

|

|

|

|

|

|

|

发表于 22-2-2017 09:20 PM

|

显示全部楼层

发表于 22-2-2017 09:20 PM

|

显示全部楼层

本帖最后由 icy97 于 23-2-2017 12:21 AM 编辑

| | 0037 | | Quarterly rpt on consolidated results for the financial period ended 31/12/2016 | | Quarter: | 4th Quarter | | Financial Year End: | 31/12/2016 | | Report Status: | Unaudited | | Submitted By: |

|

|

| Current Year Quarter | Preceding Year Corresponding Quarter | Current Year to Date | Preceding Year Corresponding Period |

| 31/12/2016 | 31/12/2015 | 31/12/2016 | 31/12/2015 |

| RM '000 | RM '000 | RM '000 | RM '000 | | 1 | Revenue | 44,870 | 64,731 | 253,504 | 233,006 | | 2 | Profit/Loss Before Tax | 4,094 | 5,361 | 30,994 | 25,111 | | 3 | Profit/Loss After Tax and Minority Interest | 2,617 | 4,260 | 24,853 | 20,863 | | 4 | Net Profit/Loss For The Period | 2,693 | 4,441 | 25,301 | 21,289 | | 5 | Basic Earnings/Loss Per Shares (sen) | 0.20 | 0.33 | 1.89 | 1.66 | | 6 | Dividend Per Share (sen) | 0.30 | 0.50 | 0.30 | 0.50 |

|

|

| As At End of Current Quarter | As At Preceding Financial Year End | | 7 | Net Assets Per Share (RM) |

|

| 0.1500 | 0.1300 |

|

| | |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 22-2-2017 09:20 PM

|

显示全部楼层

发表于 22-2-2017 09:20 PM

|

显示全部楼层

本帖最后由 icy97 于 23-2-2017 12:21 AM 编辑

EX-date | 29 Mar 2017 | Entitlement date | 31 Mar 2017 | Entitlement time | 05:00 PM | Entitlement subject | Interim Dividend | Entitlement description | An Interim Single-Tier Dividend of 0.3 sen per ordinary share | Period of interest payment | to | Financial Year End | 31 Dec 2016 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | AGRITEUM SHARE REGISTRATION SERVICES SDN BHD2nd Floor, Wisma Penang Garden42, Jalan Sultan Ahmad Shah10050 PenangTel:042282321Fax:042272391 | Payment date | 14 Apr 2017 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 31 Mar 2017 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.003 | Par Value | Malaysian Ringgit (MYR) 0.000 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 23-2-2017 09:40 AM

|

显示全部楼层

发表于 23-2-2017 09:40 AM

|

显示全部楼层

本帖最后由 icy97 于 24-2-2017 02:20 AM 编辑

RGB - Over Expectation or Seasonal Norm? (3) - YiStock

Author: YiStock | Publish date: Thu, 23 Feb 2017, 08:41 AM

https://klse.i3investor.com/blogs/RGB/116512.jsp

I have wrote 2 articles in year 2015 about RGB.

Here is the link:

https://klse.i3investor.com/blogs/RGB/77353.jsp

https://klse.i3investor.com/blogs/RGB/87146.jsp

I believe I'm among the earliest batch of investors who have experienced the up and down of RGB. To understand more about RGB, you may refer to above links.

Now, the reason i want to write on RGB again is to point out more about "over expectation" and RGB's seasonal behaviour.

The benefit of this articles i hope is given to newbies. If you are old bird, you do not need to care too much about this article.

(1) Over expectation

For a period of time, a "special" formulation become a hot topic in i3. I used RGB Q3 16 result as example. EPS for Q3 2016 is 0.71 sen (RM 0.007).

The "annualized formula therefore,

0.71 sen x 4 = RM 0.028 x PE 10 = RM 0.28 share price, or

0.71 sen x 4 = RM 0.028 x PE15 = RM 0.42 share price.

The end result,

I do not wish to comment this method is right or wrong. Simply because, if it help you make money, it is right. If is make you loss money, it is wrong. That simple!

NOTE:

I hold for 1 year 4 months to get 20% before it surge, you take 3 months to get 94%.

(2) Seasonal Behaviour

RGB seems to have this pattten, the high season is always during 2nd and 3rd quarter.

Now,

If you are already on the "LATE" boat, DO NOT PANIC.

RGB is a pretty good company with healthy balance sheet. At least for me.

Forget about the "OVER EXPECTATION" FORMULA, focus on SEASONAL BEHAVIOUR of RGB.

If you are confident, you should start looking into near future for another SEASONAL HIGH?

Conclusion:

Are you an INVESTOR? Seriously?

Are you a SPECULATOR?

If you want to be investor, look for my sifu KC CHONG.

If you want to be speculator, 90% of forummer in i3 is your sifu.

Make a choice and pick a road, don't keep jumping from one ship to another. Sekejap ni, sekejap tu .....

Hope you grab the POSITIVE MESSAGE of this article.

|

|

|

|

|

|

|

|

|

|

|

|

发表于 23-2-2017 01:35 PM

来自手机

|

显示全部楼层

发表于 23-2-2017 01:35 PM

来自手机

|

显示全部楼层

哭哭鸟 发表于 12-1-2017 08:05 PM

是好事,

可是哭哭失戀了..

抱抱!不哭 |

|

|

|

|

|

|

|

|

|

|

|

发表于 24-2-2017 01:03 AM

|

显示全部楼层

发表于 24-2-2017 01:03 AM

|

显示全部楼层

本帖最后由 icy97 于 24-2-2017 02:22 AM 编辑

RGB国际 – FY16Q4业绩点评

RGB自去年10月起涨,虽然当中有小型的调整,但是股价整体走势节节上升,在5个月内从0.17暴涨至0.35,相等于106%的涨幅。本专页不曾持有任何RGB的股票,但是却对于其业绩的表现感兴趣。希望一些简单的分析可以帮助股友更了解RGB。

RGB的FY16Q4盈利按年按季分别下滑39%和72%,是近两年以来最差的季度。其差劲的表现主要源自于电子游戏机的销售量走软。这部门的销售从FY16Q3的RM70m暴跌至这个季度的RM21m,相等于70%的跌幅。虽然整体销售赚幅获得提升,但是其盈利依然按季暴跌52%。

虽然管理层强调RGB的业务不受季节性影响,但是按过去几年的表现来看,Q3和Q4普遍上是电子游戏机销售量较旺的季度。因此,只以Q3和Q4的表现作比较。翻看RGB近三年电子游戏机部门的Q3和Q4营业额总和:

> FY16Q3&Q4– RM91.8m

> FY15Q3&Q4 – RM99.1m

> FY14Q3&Q4 – RM81.7m

RGB的FY16最后两个季度表现甚至比FY15还差。本专页认为RGB的管理层故意把本来应该属于FY16Q4的销售额,纳入FY16Q3的业绩。换句话说,就是提前把销售量纳入进账,导致其FY16Q3表现暴涨和FY16Q4表现暴跌,起伏非常大。为什么管理层这么做呢?

RGB在近个月都处于牛市,而且在“名人效应”的光环下,股价显得更容易走高。管理层当然希望借助这一波的行情,乘机把盈利推高及制造出另一项利好消息。这样一来,RGB的股价要继续上涨一点都不难。结果,其FY16Q3标青业绩出炉后,其股价顺势继续从0.25走高至0.35。

值得一提,Q4是整个财年的最后一个季度,企业必须结算一整年的表现。RGB无法把下个财年的销售量纳入,因此唯有交出差劲的表现。这也是为什么Q4往往都出现比较多业绩的“红炸弹”。

RGB的业绩就好像之前的GADANG,其Q1和Q2的盈利相差RM11m。但是,GADANG无法交出稳定的表现是可以理解的,毕竟集团必须依据建筑工程进度来纳入盈利进账。至于RGB,就显得不一样,其背后在卖什么葫芦也不多说了。

目前,RGB的PE为16倍,股价已完全反映出其应有的价值。管理层强调FY17预计可取得成长的表现。RGB的FY16盈利为RM24.9m,假设它可在FY17交出RM30m的盈利,以1.33b股数计算,其每股盈利将会是2.26仙。再以乐观的12-14倍PE推算,RGB的每股潜在价值处于RM0.27-0.32之间。

RH Research |

|

|

|

|

|

|

|

|

|

|

|

发表于 28-3-2017 09:13 PM

|

显示全部楼层

发表于 28-3-2017 09:13 PM

|

显示全部楼层

本帖最后由 icy97 于 29-3-2017 02:13 AM 编辑

RGB eyes US$40mil deliveries

Monday, 27 March 2017

http://www.thestar.com.my/business/business-news/2017/03/27/rgb-eyes-us40mil-deliveries/

BY DAVID TAN

GEORGE TOWN: Electronic gaming machine and equipment maker RGB International Bhd is targeting to deliver about US$40mil worth of gaming machines in 2017, with the largest deliveries to the Philippines, Vietnam, Nepal and Laos, said group managing director Datuk Chuah Kim Seah (pic).

“We are delivering 600 machines to the Philippines, while for Vietnam, Nepal and Laos, we are sending 300, 350 and 200, respectively.

“The payment is done via instalments and through fees for services provided under our technical support and management programme,” he told StarBiz.

The group is projecting a double-digit growth in earnings for 2017, according to Chuah.

The group is currently working with a partner in Nepal to promote its range of gaming machines to South Asia, which includes the markets in India, Nepal, Bangladesh, Pakistan, Bhutan and Sri Lanka.

RGB derives 95% of its sales from the Asia-Pacific region.

On new markets, Chuah said the group has identified a new range of gaming machines for South America, an untapped market.

“We have shipped 10 new gaming machines for a trial run of three to six months to a South American customer.

“We can expect more orders from South America if they turn out to be popular,” Chuah said, adding that the machines would be priced competitively.

“We believe South America can provide for us a sizeable revenue stream,” he said.

On the Vietnam market, Chuah said the Government has allowed two casinos to be built in the North and South, which will allow locals to enter.

“Our objective now is to increase our presence in Vietnam,” he added.

In Malaysia, Chuah said the domestic sales in the country is expected to increase to 100 units from 50 last year.

“The projected sales in Malaysia is US$2.5mil for 2017,” he added.

For the 2016 financial year ended Dec 31, the group posted RM24.8mil in net profit on the back of RM253.5mil in turnover, compared to the RM20.8mil and RM233mil achieved in 2015, respectively.

According to Technavio’s Global Casino Gaming Equipment Market 2017-2021 report, the global casino gaming equipment market is expected to grow at a compounded annual growth rate of 15.25% over the four-year period.

“Many countries, such as Japan, are aiming to legalise casino gaming because of its popularity and the high revenue contribution from casinos globally.

“And an increasing middle-class population and rising disposable income is fuelling market growth,” he said.

“This leads to an increase in the construction of new casino centres across the world.

“For instance, Marina Bay Sands, which opened in April 2010, generated a revenue of US$1.06bil from the casino in 2010 and more than US$2.3bil in 2015,” the report said.

Headquartered in London, Technavio is a leading market research company with global coverage. |

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|