|

|

发表于 20-10-2017 05:08 AM

|

显示全部楼层

发表于 20-10-2017 05:08 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | PUNCAK NIAGA HOLDINGS BERHAD (416087-U) ("PUNCAK" OR THE "COMPANY") ACCEPTANCE OF RM290 MILLION ISLAMIC BANKING FACILITIES BY SUB-SUBSIDIARY, DANUM SINAR SDN BHD | The Board of Directors of the Company wishes to announce to the Exchange that the Company’s sub-subsidiary, Danum Sinar Sdn Bhd (Company No. 653853-X) (“DSSB”) had on 19 October 2017 executed the agreements relating to the acceptance of a RM290 million Islamic Banking Facilities (“the Facilities”) from Affin Islamic Bank Berhad.

Please refer to the attachment for further details on the Facilities.

This announcement is dated 19 October 2017. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5575997

|

|

|

|

|

|

|

|

|

|

|

|

发表于 25-10-2017 04:54 AM

|

显示全部楼层

发表于 25-10-2017 04:54 AM

|

显示全部楼层

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

RELATED PARTY TRANSACTIONS | Description | PUNCAK NIAGA HOLDINGS BERHAD ("PNHB" OR THE "COMPANY") PROPOSED ACQUISITION OF LAND FOR A TOTAL CASH CONSIDERATION OF RM40,732,956.00 ("PROPOSED ACQUISITION") | Reference is made to the Company’s earlier announcement dated 28 September 2017 in relation to the Proposed Acquisition.

The Company would like to update the Exchange that upon fulfillment of the Conditions Precedent of the SPA dated 28 September 2017 between the Company’s wholly-owned subsidiary, Puncak Niaga Management Services Sdn Bhd (the “Buyer”) and Puncak Alam Housing Sdn Bhd (the “Seller”), the Proposed Acquisition has been completed on 24 October 2017.

This Announcement is dated 24 October 2017. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 13-11-2017 04:14 AM

|

显示全部楼层

发表于 13-11-2017 04:14 AM

|

显示全部楼层

現有業務未生錢 商業高峰資金大縮水!

2017年11月12日

(吉隆坡12日訊)商業高峰(PUNCAK,6807,主要板建築)脫售水務資產后,現有業務卻暫無法使公司獲利。再加上營運成本高昂,商業高峰在“只花不賺”狀態下資金大縮水,股價更大跌!

根據商業高峰2015年年報,在以15.5億令吉脫售水務資產予雪州水供管理有限公司(Air Selangor)后,淨收14.4億令吉。不過,公司股價卻自那年起開始走下坡。

“彭博社”資料顯示,商業高峰自從2012年1月以后,股價水平便從未低于70仙。上週五(10日)以70.5仙掛收,勉強穩在水平線上。該股年初至今共跌21.2%,但與2015年11月12日的2.83令吉閉市價相比,則是慘跌75%。

這一跌,商業高峰市值縮至3億1500萬令吉,相當于截至今年6月底,5億6680萬令吉未經審計儲備金的55.6%。加上4億2070萬令吉的短期投資資金,該公司現有9億8750萬令吉資金,對比2015年12月底的13億令吉,縮水近四分之一。

或需財務支持

商業高峰目前業務包括水源和污水管理、建築外,同時還涉足種植和油氣領域。然而,除了水源和污水管理有利可圖外,其他業務均陷虧損。加上高達1億3934萬令吉的營運成本,該公司2017財年首半年淨虧7336萬令吉。

今年7月,商業高峰再燒錢,以2億4893萬令吉,收購種植公司Danum Sinar私人有限公司。

該公司10月份文告指出,后者僅有20.9%土地種植了油棕樹,其中只有四分之一樹齡達18個月。基于油棕業務只有在樹齡介于8年至18年時才可收穫回酬,所以商業高峰或許還需等上好幾年光景才有望從中獲利。

財經周刊《The Edge》 指出,在這期間,該公司可能需要借助財務支持,且料再陷虧損。【中国报财经】 |

|

|

|

|

|

|

|

|

|

|

|

发表于 23-11-2017 05:21 AM

|

显示全部楼层

发表于 23-11-2017 05:21 AM

|

显示全部楼层

本帖最后由 icy97 于 29-11-2017 03:37 AM 编辑

商峰起诉卡立、阿兹敏与雪州政府 索偿140亿

Supriya Surendran/The Edge Financial Daily

November 22, 2017 13:35 pm +08

(吉隆坡22日讯)由Tan Sri Rozali Ismail控有的商峰(Puncak Niaga Holdings Bhd)就雪兰莪州水务领域被接管,起诉雪州州务大臣拿督斯里阿兹敏、前州务大臣丹斯里卡立,以及雪州政府,并索偿140亿令吉。

商峰声称,卡立和阿兹敏滥权,通过威胁或企图使中央政府援引2006年水务业法令,强制接管该州水务领域。

根据商峰昨日向大马交易所报备,雪州政府对卡立和阿兹敏的行为转承责任。

商峰亦索偿损害赔偿金、利息,以及PNSB Water私人有限公司(前称Puncak Niaga(马)私人有限公司)与Syarikat Bekalan Air Selangor私人有限公司(Syabas)之间的20亿8000万至23亿5000万令吉差价。

根据商峰与Pengurusan Air Selangor私人有限公司于2014年11月11日签署的售股协议,实际购价为15亿5000万令吉。

该公司也要求赔偿失去国内外的商业机会,总额达135亿令吉。

商峰指出,自10月31日以来,经过多次尝试直接送达,代表律师终送达志期10月27日的传票和诉状。

根据文告,卡立于11月2日通过律师、阿兹敏11月21日,以及雪州政府11月6日收到。

莎阿南高庭将于本月28日进行案件管理。

作为雪州水务重组的一部分,以15亿5000万令吉脱售PNSB和Syabas的交易于2015年10月15日完成。根据商峰2015年的年度报告,脱售净现金流为14亿4000万令吉。

水务资产整合仍在进行中,因收购Syarikat Pengeluar Air Selangor私人有限公司(SPLASH)尚未完成。

(编译:陈慧珊)

Type | Announcement | Subject | MATERIAL LITIGATION | Description | PUNCAK NIAGA HOLDINGS BERHAD ("PUNCAK")SHAH ALAM HIGH COURT SUIT NO. BA-21NCvC-72-10/2017PUNCAK NIAGA HOLDINGS BERHAD ("PLAINTIFF") V1. TAN SRI DATO' SERI KHALID BIN IBRAHIM2. DATO' SERI MOHAMED AZMIN BIN ALI3. SELANGOR STATE GOVERNMENT ("COLLECTIVELY DEFENDANTS") | After several attempts to effect personal service since 31 October 2017, the solicitors of Puncak Niaga Holdings Berhad (“Puncak”) as the Plaintiff (“Plaintiff”) served the sealed Writ of Summons vide Shah Alam High Court Suit No. BA-21NCvC-72-10/2017 together with the Statement of Claim dated 27 October 2017 on:- 1. the solicitors of Tan Sri Dato’ Seri Abdul Khalid bin Ibrahim (“Tan Sri Khalid”), as the former Menteri Besar of Selangor on 2 November 2017;

2. Dato’ Seri Mohamed Azmin bin Ali (“Dato’ Seri Azmin”), as the present Menteri Besar of Selangor on 21 November 2017; and

3. The Selangor State Government (“Selangor State Government”) on 6 November 2017; collectively “the Defendants”.

The suit is initiated by Puncak against the Defendants including the Selangor State Government, who Puncak asserts is vicariously liable for the tortious acts of Tan Sri Khalid and Dato’ Seri Azmin in abusing their powers in public office/misfeasance by threatening to cause and/or requesting or attempting to cause the Federal Government to invoke use of the Water Services Industry Act 2006 (“WSIA”) to force a take-over of the State’s water industry.

Puncak claims damages, interest on damages and costs of:-

(a) the difference between the value of PNSB Water Sdn Bhd (formerly known as Puncak Niaga (M) Sdn Bhd) ("PNSB") and Syarikat Bekalan Air Selangor Sdn Bhd ("SYABAS") at the range of RM2,081,000,000.00 to RM2,353,000,000.00 and the actual purchase consideration of RM1,555,300,000.00 under the Share Purchase Agreement dated 11 November 2014 between Puncak and Pengurusan Air Selangor Sdn Bhd; and

(b) Loss of business opportunities (local and foreign) totalling RM13,496,009,000.00.

The matter is fixed for case management at the Shah Alam High Court on 28 November 2017.

This announcement is dated 21 November 2017. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 6-12-2017 02:10 AM

|

显示全部楼层

发表于 6-12-2017 02:10 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2017 | 30 Sep 2016 | 30 Sep 2017 | 30 Sep 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 37,269 | 29,753 | 87,210 | 53,203 | | 2 | Profit/(loss) before tax | -26,373 | -100,494 | -91,426 | -158,965 | | 3 | Profit/(loss) for the period | -25,738 | -102,392 | -99,096 | -166,329 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -25,384 | 102,375 | -98,485 | -166,179 | | 5 | Basic earnings/(loss) per share (Subunit) | -5.67 | -22.88 | -22.02 | -37.15 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 3.6800 | 3.8900

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 6-12-2017 02:23 AM

|

显示全部楼层

发表于 6-12-2017 02:23 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | PUNCAK NIAGA HOLDINGS BERHAD (416087-U) (PUNCAK OR THE COMPANY)REVALUATION OF CERTAIN INVESTMENT PROPERTIES OF THE GROUP | Pursuant to paragraph 9.19(46) of the Listing Requirements of Bursa Malaysia Securities Berhad, the Board of Directors of the Company wishes to inform the Exchange that the Company has undertaken a revaluation exercise on four lots of leasehold land in Mukim of Ijok, Kuala Selangor and one (1) lot of leasehold land in Mukim of Jeram, Kuala Selangor (“Leasehold Lands in Mukim of Ijok and Jeram”) as at 31 December 2015, 31 December 2016 and 30 August 2017, respectively (“Revaluation”). The new valuations have been incorporated in the 3rd Quarter unaudited results of the Company for the period ended 30 September 2017 and will be incorporated in the Audited Financial Statements of Puncak Group for the financial year ending 31 December 2017. In addition, respective prior year adjustments have also been made to the consolidated financial statements for the financial year ended 31 December 2015 and 2016 accordingly.

For full details of the announcement, please refer to the attached file.

This announcement is dated 29 November 2017. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5620917

|

|

|

|

|

|

|

|

|

|

|

|

发表于 30-1-2018 01:47 AM

|

显示全部楼层

发表于 30-1-2018 01:47 AM

|

显示全部楼层

Date of change | 01 Feb 2018 | Name | DATO' RANDHIR SINGH A/L JASBIR SINGH | Age | 55 | Gender | Male | Nationality | Malaysia | Designation | Executive Director | Directorate | Executive | Type of change | Appointment | Qualifications | - Bachelor of Science (Hons) from University of Malaya 1988- Degree in Bachelor of Law (Hons) from University of London in 1995- Master of Science (Corporate Communications) from Universiti Putra Malaysia in 1999 | Working experience and occupation | YBhg Dato Randhir Singh holds membership in various professional organisations including fellowship for Institute of Professional Managers UK (FIPM), Malaysian Institute of Management (FMIM) and Associate Member for Institute for Personal and Development, United Kingdom (AIPD).He started his career with the Asia Foundation in 1988 as a Program Manager for Malaysia, Singapore and Brunei and later became the Assistant General Manager - Corporate Communications for Indah Water Konsortium. He has previously held positions as Executive Director for National Chambers of Commerce and Industry of Malaysia (NCCIM) and Chief Executive Officer for Yayasan Strategik Social (YSS). He still sits on the Board of Trustees of NCCIM and YSS. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 23-2-2018 07:53 AM

|

显示全部楼层

发表于 23-2-2018 07:53 AM

|

显示全部楼层

索賠不成 商業高峰反需賠7.5萬

2018年2月22日

(莎阿南22日訊)針對雪州水務資產收購訴訟案,莎阿南高等法院今日駁回由商業高峰(PUNCAK,6807,主要板建築)向雪州前州務大臣丹斯里卡立、現任大臣拿督斯里阿茲敏阿里及雪州政府提出的高達143億令吉索賠。

高庭今日駁回控方商業高峰上訴,允許卡立、阿茲敏阿里及雪州政府的駁回申請。同時,法官拿督艾達達希爾下令商業高峰,賠償每位被告2萬5000令吉。

高庭也定在3月13日,決定是否讓阿茲敏阿里對商業高峰提出反訴。

商業高峰聲稱,卡立和阿茲敏阿里濫用職權,威脅或企圖慫恿中央政府援引水供服務工業法令(簡稱WSIA),以強制水務資產收購案進行,于去年10月27日提出此訴訟。

對此,商業高峰索賠高達143億令吉,包括總值134億9601萬令吉的商機賠償金。

商業高峰也尋求,針對PNSB水務私人有限公司與雪州水供公司(Syabas)介于20億8100萬令吉至23億5300萬令吉之間的估值,以及商業高峰和雪州水供管理公司在2014年11月份,與雪州政府簽署的股權買賣協議下的實際收購價15億5530萬令吉之間的價差,索取相關損失的賠償。【中国报财经】

Type | Announcement | Subject | MATERIAL LITIGATION | Description | PUNCAK NIAGA HOLDINGS BERHAD ("PUNCAK")SHAH ALAM HIGH COURT SUIT NO. BA-21NCvC-72-10/2017PUNCAK NIAGA HOLDINGS BERHAD ("PLAINTIFF") V1. TAN SRI DATO' SERI KHALID BIN IBRAHIM2. DATO' SERI MOHAMED AZMIN BIN ALI3. SELANGOR STATE GOVERNMENT (COLLECTIVELY "DEFENDANTS") | Reference is made to the Company's earlier announcements dated 21 November 2017, 28 November 2017, 19 December 2017, 20 December 2017, 15 January 2018, 23 January 2018 and 26 January 2018 in relation to the above matter.

Puncak wishes to announce to the Exchange that today, the Judge allowed the Defendants’ applications and struck out the claim with costs. Accordingly, the Judge vacated all pre-trial directions as well as the trial dates from 28 March 2018 to 30 March .2018. As for the Counterclaim filed by Dato’ Seri Azmin, the Judge directed the parties to file and exchange submissions with a date for delivery of decision on 13 March 2018 in respect of the Counterclaim.

Having consulted our solicitors, Puncak has given instructions to them to lodge an appeal with the Court of Appeal against this decision.

This announcement is dated 22 February 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 4-3-2018 07:41 AM

|

显示全部楼层

发表于 4-3-2018 07:41 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2017 | 31 Dec 2016 | 31 Dec 2017 | 31 Dec 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 13,885 | 20,552 | 101,095 | 73,755 | | 2 | Profit/(loss) before tax | -104,283 | -33,126 | -195,709 | -192,091 | | 3 | Profit/(loss) for the period | -103,447 | -80,525 | -202,543 | -246,854 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -102,797 | -79,568 | -201,282 | -245,747 | | 5 | Basic earnings/(loss) per share (Subunit) | -22.98 | -17.79 | -45.00 | -54.94 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 3.4300 | 3.8900

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 4-3-2018 07:51 AM

|

显示全部楼层

发表于 4-3-2018 07:51 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | PUNCAK NIAGA HOLDINGS BERHAD (416087-U)("PUNCAK" OR "THE COMPANY")REVALUATION OF PROPERTY, PLANT AND EQUIPMENT AND INVESTMENT PROPERTIES | Pursuant to paragraph 9.19(46) of the Listing Requirements of Bursa Malaysia Securities Berhad, the Board of Directors of the Company wishes to inform the Exchange that the Company has undertaken a revaluation exercise on certain Group’s property, plant and equipment and investment properties. The new valuations have been incorporated in the 4th Quarter unaudited results of the Company and will be incorporated in the Audited Financial Statements of Puncak Group for the financial year ended 31 December 2017.

For full details of the announcement, please refer to the attached file.

This announcement is dated 27 February 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5705417

|

|

|

|

|

|

|

|

|

|

|

|

发表于 18-3-2018 04:45 AM

|

显示全部楼层

发表于 18-3-2018 04:45 AM

|

显示全部楼层

本帖最后由 icy97 于 18-3-2018 07:53 AM 编辑

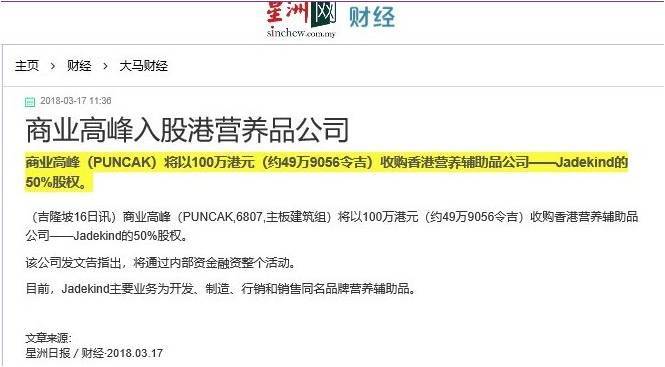

Type | Announcement | Subject | OTHERS | Description | PUNCAK NIAGA HOLDINGS BERHAD (416087-U) (PUNCAK OR THE COMPANY) - SUBSCRIPTION OF ORDINARY SHARES IN JADEKIND LIMITED, A PRIVATE LIMITED COMPANY INCORPORATED IN HONG KONG | The Board of Directors of Puncak wishes to announce that the Company had on 16 March 2018 subscribed for 1,000,000 ordinary shares in Jadekind Limited (Company No. 2596332), a private limited company duly incorporated in Hong Kong (“Jadekind”) at a total cash subscription of HKD1,000,000.00 only (“Shares Subscription”). The Shares Subscription is satisfied wholly in cash from the Company’s internal generated funds.

For full details of the announcement, please refer to the attached file.

This announcement is dated 16 March 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5727125

|

|

|

|

|

|

|

|

|

|

|

|

发表于 11-4-2018 04:27 AM

|

显示全部楼层

发表于 11-4-2018 04:27 AM

|

显示全部楼层

本帖最后由 icy97 于 11-4-2018 07:50 AM 编辑

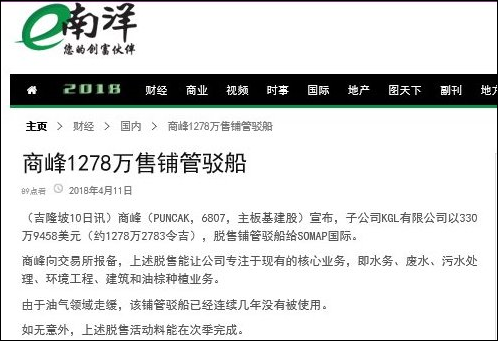

Type | Announcement | Subject | OTHERS | Description | PUNCAK NIAGA HOLDINGS BERHAD (416087-U) ("PUNCAK" OR THE "COMPANY") MEMORANDUM OF AGREEMENT BETWEEN KGL LTD ("KGL") AND SOMAP INTERNATIONAL PTE LTD ("SOMAP") FOR THE PROPOSED DISPOSAL OF KGL'S PIPELAY BARGE - DLB264 TO SOMAP | Pursuant to Paragraph 10.05 of the Main Market Listing Requirements of Bursa Malaysia Securities Berhad, the Board of Directors of Puncak wishes to announce that the Company’s wholly-owned sub-subsidiary, KGL Ltd. (“KGL” or the “Seller”) had on 10 April 2018 entered into a Memorandum of Agreement (“MOA”) with SOMAP International Pte Ltd (“SOMAP” or the “Buyer”) for the proposed disposal of KGL’s pipelay barge - DLB264 (“Vessel”) together with the open yard items by KGL to SOMAP for a total cash consideration of United States Dollars Three Million Three Hundred Nine Thousand Four Hundred Fifty Eight and Cents Fifty (USD3,309,458.50) only including 6% Goods & Services Tax (“GST”) (equivalent to Ringgit Malaysia Twelve Million Seven Hundred Eighty Two Thousand Seven Hundred Eighty Three and Sen Forty Six (RM12,782,783.46) only including 6% GST) (“Purchase Price”) (“Proposed Disposal”).

For full details of the announcement, please refer to the attached file.

This announcement is dated 10 April 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5753993

|

|

|

|

|

|

|

|

|

|

|

|

发表于 27-4-2018 05:29 AM

|

显示全部楼层

发表于 27-4-2018 05:29 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | PUNCAK NIAGA HOLDINGS BERHAD (416087-U) ("PUNCAK" OR THE "COMPANY") MEMORANDUM OF AGREEMENT BETWEEN KGL LTD (KGL) AND SOMAP INTERNATIONAL PTE LTD (SOMAP) FOR THE PROPOSED DISPOSAL OF KGLS PIPELAY BARGE DLB264 TO SOMAP | Reference is made to the Company’s earlier announcement dated 10 April 2018 in relation to the Memorandum of Agreement (“MOA”).

The Company would like to update the Exchange that the Proposed Disposal has been completed on 24 April 2018 pursuant to the terms and conditions of the MOA dated 10 April 2018 between the Company’s wholly-owned sub-subsidiary, KGL Ltd (“KGL” or the “Seller”) and SOMAP International Pte Ltd (“SOMAP” or the “Buyer”).

This announcement is dated 25 April 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 9-5-2018 04:30 AM

|

显示全部楼层

发表于 9-5-2018 04:30 AM

|

显示全部楼层

本帖最后由 icy97 于 13-5-2018 05:18 AM 编辑

商峰获4.9亿令吉污水处理厂合约

Sulhi Azman/theedgemarkets.com

May 03, 2018 18:58 pm +08

(吉隆坡3日讯)商峰(Puncak Niaga Holdings Bhd)获得价值4亿8993万令吉的二手承包工程,在彭亨关丹建设一个新的区域污水处理厂。

商峰向大马交易所报备,独资子公司Puncak Niaga Construction私人有限公司(PNCSB)昨日与Jalur Cahaya私人有限公司签署了主要二手承包协议,委任PNCSB为上述项目的主要二手承包商。

合约期限为今年3月5日至2022年2月19日。

根据协议,PNCSB将在第一期建设一个新的区域污水处理厂,处理能力为20万立方英尺(人均当量单位),最终处理能力为40万立方米。

该工程还涉及建设66公里污水输送系统和新网络泵站,以及在政府场所合理化和淘汰100个公共污水处理厂和65个私人污水处理厂。

文告显示:“这份协议将不会对集团截至今年12月31日止财年的每股盈利、每股净资产或负债,造成任何显著影响。”

(编译:魏素雯)

Type | Announcement | Subject | OTHERS | Description | PUNCAK NIAGA HOLDINGS BERHAD (416087-U) ("PUNCAK" OR "THE COMPANY")PRINCIPAL SUB-CONTRACT AGREEMENT BETWEEN JALUR CAHAYA SDN BHD AND THE COMPANY'S WHOLLY-OWNED SUBSIDIARY, PUNCAK NIAGA CONSTRUCTION SDN BHD FOR THE PROJECT, "PROJEK PEMBINAAN LOJI RAWATAN KUMBAHAN SERANTAU DAN RANGKAIAN PAIP PEMBETUNGAN DI BANDAR KUANTAN, PAHANG (REKA DAN BINA)" | Puncak wishes to announce that the Company’s wholly-owned subsidiary, namely Puncak Niaga Construction Sdn Bhd (Company No. 538507-T) (“PNCSB”) had on 2 May 2018 entered into a Principal Sub-Contract Agreement with Jalur Cahaya Sdn Bhd (Company No. 599034-X) (“JCSB”) for JCSB to appoint PNCSB as the principal sub-contractor for the project, “Projek Pembinaan Loji Rawatan Kumbahan Serantau Dan Rangkaian Paip Pembetungan Di Bandar Kuantan, Pahang (Reka Dan Bina)” (“Kuantan Project”) (“Principal Sub-Contract Agreement”).

For full details of the announcement, please refer to the attached file.

This announcement is dated 3 May 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5782781

|

|

|

|

|

|

|

|

|

|

|

|

发表于 12-6-2018 12:50 AM

|

显示全部楼层

发表于 12-6-2018 12:50 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2018 | 31 Mar 2017 | 31 Mar 2018 | 31 Mar 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 29,496 | 20,316 | 29,496 | 20,316 | | 2 | Profit/(loss) before tax | -14,061 | -31,908 | -14,061 | -31,908 | | 3 | Profit/(loss) for the period | -14,497 | -42,968 | -14,497 | -42,968 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -13,692 | -42,721 | -13,692 | -42,721 | | 5 | Basic earnings/(loss) per share (Subunit) | -3.06 | -9.55 | -3.06 | -9.55 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.50 | 0.00 | 0.50 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 3.4000 | 3.4300

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 12-6-2018 12:56 AM

|

显示全部楼层

发表于 12-6-2018 12:56 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | SINGLE TIER INTERIM DIVIDEND FOR THE FINANCIAL YEAR ENDING 31 DECEMBER 2018 | The Board of Directors of Puncak wishes to announce the declaration of a single tier interim dividend of 0.5 sen per ordinary share for the financial year ending 31 December 2018.

The entitlement and payment dates of the interim dividend will be determined and announced in due course.

This announcement is dated 31 May 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 12-6-2018 02:54 AM

|

显示全部楼层

发表于 12-6-2018 02:54 AM

|

显示全部楼层

Date of change | 01 Jun 2018 | Name | DATO YUSOF BIN BADAWI | Age | 56 | Gender | Male | Nationality | Malaysia | Designation | Executive Director | Directorate | Executive | Type of change | Appointment | Qualifications | Bachelor of Science majoring in Civil Engineering and minoring in Construction and Mathematics from Southern Illinois University, United States of America in 1984. | Working experience and occupation | YBhg Dato' Yusof Badawi has 32 years of experience in the construction industry, where he was involved in the management and implementation of various construction, infrastructure, waterworks and maintenance projects. He is a member of the Board of Engineers Malaysia, the Malaysia Institute of Management and the Malaysian Water Association.He is the Managing Director of TRIplc Berhad. On 1 June 2018, he was appointed to the Board of the Company as Executive Director, Operations Division and Managing Director of Puncak Niaga Construction Sdn Bhd ("PNCSB"). He is a member of the Executive Committee of the Company and PNCSB. | Directorships in public companies and listed issuers (if any) | TRIplc Berhad | Family relationship with any director and/or major shareholder of the listed issuer | None | Any conflict of interests that he/she has with the listed issuer | None | Details of any interest in the securities of the listed issuer or its subsidiaries | 300 ordinary shares and 30 warrants |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 12-6-2018 02:55 AM

|

显示全部楼层

发表于 12-6-2018 02:55 AM

|

显示全部楼层

Date of change | 31 May 2018 | Name | DATO RANDHIR SINGH A/L JASBIR SINGH | Age | 55 | Gender | Male | Nationality | Malaysia | Designation | Executive Director | Directorate | Executive | Type of change | Resignation | Reason | To pursue his personal interests |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 13-6-2018 04:56 AM

|

显示全部楼层

发表于 13-6-2018 04:56 AM

|

显示全部楼层

Expiry/Maturity of the securities| PUNCAK NIAGA HOLDINGS BERHAD |

Instrument Category | Securities of PLC | Instrument Type | Warrants | Type Of Expiry | Expiry/Maturity of the securities | Mode of Satisfaction of Exercise/Conversion price | Cash | Exercise/ Strike/ Conversion Price | Malaysian Ringgit (MYR) 1.0000 | Exercise/ Conversion Ratio | 1:1 | Settlement Type / Convertible into | Physical (Shares) | Last Date & Time of Trading | 04 Jul 2018 05:00 PM | Date & Time of Suspension | 05 Jul 2018 09:00 AM | Last Date & Time for Transfer into Depositor's CDS a/c | 13 Jul 2018 04:00 PM | Date & Time of Expiry | 20 Jul 2018 05:00 PM | Date & Time for Delisting | 23 Jul 2018 09:00 AM |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5819481

|

|

|

|

|

|

|

|

|

|

|

|

发表于 21-6-2018 02:03 AM

|

显示全部楼层

发表于 21-6-2018 02:03 AM

|

显示全部楼层

Type | Announcement | Subject | MATERIAL LITIGATION | Description | PUNCAK NIAGA HOLDINGS BERHAD (416087-U) ("PUNCAK" OR THE "COMPANY") - NOTICE OF ADJUDICATION ISSUED UNDER THE CONSTRUCTION INDUSTRY PAYMENT & ADJUDICATION ACT 2012 ("CIPAA") TO THE COMPANY'S WHOLLY-OWNED SUBSIDIARY, PUNCAK NIAGA CONSTRUCTION SDN BHD | Reference is made to the Company's announcement dated 25 April 2018 in relation to the Notice of Adjudication against its wholly-owned subsidiary, Puncak Niaga Construction Sdn Bhd ("PNCSB") by its former sub-contractor, Genbina Sdn Bhd ("Genbina") wherein Genbina’s adjudication (for the Notice of Adjudication dated 31 July 2017) claim for a principal claim sum of RM25,413,723.45 were dismissed in toto with cost of RM100,000.00 awarded in PNCSB’s favour.

Puncak wishes to announce that on 13 June 2018, Genbina has served on PNCSB’s solicitors its sealed application before the Kuala Lumpur High Court to set-aside the Adjudicator’s decision in part and to consequently seek payment from PNCSB for the sum of RM5,893,032.19 with interest and costs for the adjudication and the application. The application is fixed for case management on 20 June 2018.

PNCSB has instructed its solicitors to contest the matter and Puncak will make the relevant announcements to the Exchange in relation to the same in due course.

This announcement is dated 13 June 2018. |

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|