|

|

发表于 28-6-2018 06:59 PM

来自手机

|

显示全部楼层

发表于 28-6-2018 06:59 PM

来自手机

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 4-7-2018 01:18 AM

|

显示全部楼层

发表于 4-7-2018 01:18 AM

|

显示全部楼层

Date of change | 01 Jul 2018 | Name | ENCIK KAMARUDDIN BIN ABD KARIM | Age | 58 | Gender | Male | Nationality | Malaysia | Type of change | Appointment | Designation | Chief Operating Officer | Qualifications | Bachelor of Science in Civil Engineering, Universiti Teknologi Mara (UiTM), Shah Alam, Selangor. | Working experience and occupation | He has more than thirty (30) years experience in construction management. He started his career with Maraputra Sdn Bhd in 1985. Between 1990 and 1996, he served Percon Corporation Sdn Bhd and has held various managerial positions. He later joined Kenneison Brother Sdn Bhd as General Manager in 1996. He then assumed the position of Managing Director of Sureman Sdn Bhd in 1999 before joining HRA Teguh Sdn Bhd in 2004 as Senior Project Manager. He has been with Zelan Berhad ("Zelan" or "Company") since 2009 and had held various positions within Zelan Group. He was assigned as Head of Planning & Monitoring, Head of Business Development and General Manager, Special Projects before he assumed the position of Chief Operating Officer of the Company. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 28-8-2018 04:32 AM

|

显示全部楼层

发表于 28-8-2018 04:32 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2018 | 30 Jun 2017 | 30 Jun 2018 | 30 Jun 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 34,360 | 11,495 | 54,873 | 45,126 | | 2 | Profit/(loss) before tax | -6,818 | -2,408 | -9,495 | 4,762 | | 3 | Profit/(loss) for the period | -6,159 | -5,459 | -9,501 | 1,667 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -6,159 | -5,449 | -9,501 | 1,678 | | 5 | Basic earnings/(loss) per share (Subunit) | -0.73 | -0.64 | -1.12 | 0.20 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.0700 | 0.0800

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 6-10-2018 07:57 AM

|

显示全部楼层

发表于 6-10-2018 07:57 AM

|

显示全部楼层

本帖最后由 icy97 于 9-10-2018 05:04 AM 编辑

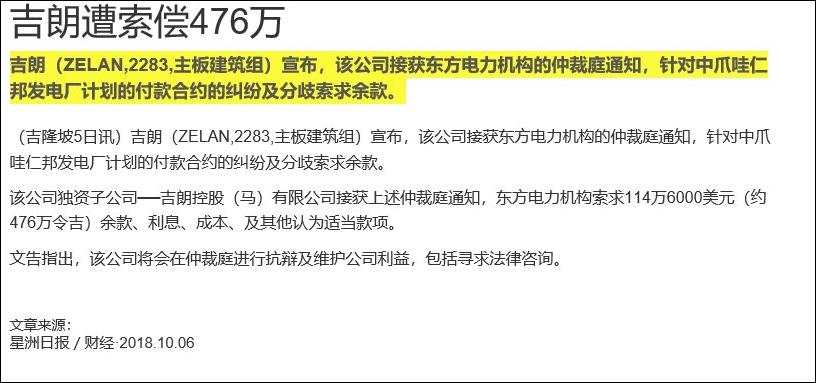

Type | Announcement | Subject | MATERIAL LITIGATION | Description | IN THE MATTER OF ARBITRATION BETWEEN DONGFANG ELECTRIC CORPORATION (AS CLAIMANT) AND ZELAN HOLDINGS (M) SDN BHD (AS RESPONDENT) UNDER THE INTERNATIONAL ARBITRATION ACT AND ARBITRATION RULES OF THE SINGAPORE INTERNATIONAL ARBITRATION CENTRE | Zelan Berhad (“ZB”) wishes to announce that its wholly owned subsidiary, Zelan Holdings (M) Sdn Bhd (“ZHSB”) has on 5 October 2018 received from the Dongfang Electric Corporation (“DEC”) a Notice of Arbitration dated 4 October 2018 issued against ZHSB in respect of disputes and differences arising from the Settlement Agreement dated 30 June 2014, between DEC and ZHSB in relation to the Supplies, the Supervision for Erection, Testing and Commissioning Services, the Power Plant Commissioning, and the Boiler, Turbine, Generator Performance Tests for the 2 x (300-400MW) Coal-Fired Steam Power Plant located at Rembang, Central Java, Indonesia.

DEC is claiming against ZHSB, inter alia, for the following:

(a) the balance outstanding of USD1,146,000.00; (b) interest; (c) cost; and (d) any other reliefs deem fit.

ZHSB shall take all necessary steps to defend or safeguard ZHSB’s interests in the arbitration proceedings, including but not limited to seeking legal advice on the merits of the claims by DEC.

This Announcement is dated 5 October 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 19-12-2018 06:59 AM

|

显示全部楼层

发表于 19-12-2018 06:59 AM

|

显示全部楼层

吉朗败诉需赔cdsb266万

http://www.sinchew.com.my/node/1815450/

Type | Announcement | Subject | MATERIAL LITIGATION | Description | MATERIAL LITIGATION IN THE MATTER OF ARBITRATION PROCEEDING AT ASIAN INTERNATIONAL ARBITRATION CENTRE (AIAC) (FORMERLY KNOWN AS KUALA LUMPUR REGIONAL CENTRE FOR ARBITRATION (KLRCA)) REF. NO.: KLRCA/D/ADM-487-2017 BETWEEN CLAMSHELL DREDGING SDN BHD (AS THE CLAIMANT) AND ZELAN CONSTRUCTION SDN BHD (AS THE RESPONDENT) | Zelan Berhad (“Company”) would like to announce that its wholly owned subsidiary, Zelan Construction Sdn Bhd (“ZCSB or the Respondent”), was informed by its solicitors that on 22 November 2018 the Arbitral Tribunal had issued its award after the full trial of the matter wherein the Arbitral Tribunal ordered as follows:-

(a) It is declared that ZCSB had terminated the Contracts; (b) ZCSB is to pay the Claimant the sum of RM2,664,528.41 including GST of 6% thereon; (c) ZCSB is to pay interest at the rate of 5% per annum on the sum of RM2,664,528.41 from 30.6.2016 until full payment; (d) ZCSB to pay 90% of the costs to be assessed to the Claimant; and (e) ZCSB’s counterclaim is hereby dismissed without costs.

The decision in relation to the assessment of costs in respect of item (d) above will be given after submission of written submission by the respective parties. The Company will make further announcement on any materials development on this matter from time to time.

This Announcement is dated 23 November 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 2-1-2019 07:25 AM

|

显示全部楼层

发表于 2-1-2019 07:25 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2018 | 30 Sep 2017 | 30 Sep 2018 | 30 Sep 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 18,470 | 8,557 | 73,343 | 53,683 | | 2 | Profit/(loss) before tax | -5,300 | -10,257 | -14,795 | -5,495 | | 3 | Profit/(loss) for the period | -5,535 | -10,108 | -15,036 | -8,441 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -5,535 | -10,099 | -15,036 | -8,421 | | 5 | Basic earnings/(loss) per share (Subunit) | -0.66 | -1.20 | -1.78 | -1.00 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.0600 | 0.0800

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 2-1-2019 07:51 AM

|

显示全部楼层

发表于 2-1-2019 07:51 AM

|

显示全部楼层

Date of change | 01 Dec 2018 | Name | ENCIK KAMARUDDIN BIN ABD KARIM | Age | 58 | Gender | Male | Nationality | Malaysia | Type of change | Others | Designation | Chief Operating Officer | Description | Encik Kamaruddin Bin Abd Karim to resume his earlier position in the Company with effect from 1 December 2018 |

Qualifications| No | Qualifications | Major/Field of Study | Institute/University | Additional Information |

| | | Working experience and occupation | He has more than thirty (30) years experience in construction management. He started his career with Maraputra Sdn Bhd in 1985. Between 1990 and 1996, he served Percon Corporation Sdn Bhd and has held various managerial positions. He later joined Kenneison Brother Sdn Bhd as General Manager in 1996. He then assumed the position of Managing Director of Sureman Sdn Bhd in 1999 before joining HRA Teguh Sdn Bhd in 2004 as Senior Project Manager. He has been with Zelan Berhad ("Zelan" or "Company") since 2009 and had held various positions within Zelan Group. He was assigned as Head of Planning & Monitoring, Head of Business Development and General Manager, Special Projects before he assumed the position of Chief Operating Officer of the Company. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 2-1-2019 07:52 AM

|

显示全部楼层

发表于 2-1-2019 07:52 AM

|

显示全部楼层

Date of change | 01 Dec 2018 | Name | PUAN INTAN NURULFAIZA BINTI YANG RAZALI | Age | 42 | Gender | Female | Nationality | Malaysia | Type of change | Appointment | Designation | Chief Operating Officer |

Qualifications| No | Qualifications | Major/Field of Study | Institute/University | Additional Information | | 1 | Masters | LL.M (Masters of Laws) | University of Malaya | | | 2 | Degree | LL.B (Hons) – Bachelor in Law (Honours) | University of Technology Mara (UiTM) Shah Alam | |

| | | Working experience and occupation | Intan Nurulfaiza Binti Yang Razali started her career in legal field and had been with several law firms since 2003. In 2006, she left the legal practice to serve Telekom Malaysia as Corporate Counsel until 2008. She then joined Malaysian Communications and Multimedia Commission and Multimedia Development Corporation, prior to joining Zelan Berhad in 2010. During her tenure in Zelan Berhad, she held various positions with her last position as Head of Legal, Zelan Berhad in 2014. She subsequently joined Tradewinds Corporation Berhad as the Assistant Director, Legal from August 2014 until May 2018, prior to rejoining Zelan Berhad as Head of Legal Department. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 16-1-2019 04:27 AM

|

显示全部楼层

发表于 16-1-2019 04:27 AM

|

显示全部楼层

Expiry/Maturity of the securities

Instrument Category | Securities of PLC | Instrument Type | Warrants | Type Of Expiry | Expiry/Maturity of the securities | Mode of Satisfaction of Exercise/Conversion price | Cash | Exercise/ Strike/ Conversion Price | Malaysian Ringgit (MYR) 0.2500 | Exercise/ Conversion Ratio | 1:1 | Settlement Type / Convertible into | Physical (Shares) | Last Date & Time of Trading | 08 Jan 2019 05:00 PM | Date & Time of Suspension | 09 Jan 2019 09:00 AM | Last Date & Time for Transfer into Depositor's CDS a/c | 17 Jan 2019 04:00 PM | Date & Time of Expiry | 25 Jan 2019 05:00 PM | Date & Time for Delisting | 28 Jan 2019 09:00 AM |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/6013329

|

|

|

|

|

|

|

|

|

|

|

|

发表于 11-3-2019 04:25 AM

|

显示全部楼层

发表于 11-3-2019 04:25 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2018 | 31 Dec 2017 | 31 Dec 2018 | 31 Dec 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 11,713 | 17,228 | 85,056 | 70,911 | | 2 | Profit/(loss) before tax | 7,421 | -65,898 | -7,374 | -71,393 | | 3 | Profit/(loss) for the period | 4,579 | -65,817 | -10,457 | -74,258 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 4,590 | -65,650 | -10,446 | -74,071 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.54 | -7.77 | -1.24 | -8.77 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.0700 | 0.0800

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 17-4-2019 04:18 AM

|

显示全部楼层

发表于 17-4-2019 04:18 AM

|

显示全部楼层

本帖最后由 icy97 于 18-4-2019 04:42 AM 编辑

Type | Announcement | Subject | OTHERS | Description | CONCESSION FOR THE DEVELOPMENT OF CENTRE FOR FOUNDATION STUDIES (PHASE 3), INTERNATIONAL ISLAMIC UNIVERSITY MALAYSIA, GAMBANG CAMPUS IN PAHANG | Reference is made to the earlier announcements made by Zelan Berhad (“Company”) dated 2 November 2011, 5 July 2012 and 3 January 2013 respectively in respect of the Concession Agreement dated 5 July 2012 (“Concession Agreement”) entered into between the Government of Malaysia, International Islamic University Malaysia (“IIUM”) and Konsesi Pusat Asasi Gambang Sdn Bhd (“Concession Company”), a wholly owned subsidiary of the Company, for the development and management of Centre for Foundation Studies (Phase 3), International Islamic University Malaysia, Gambang Campus in Pahang (“Project”).

The Company wishes to announce that the Concession Company has on 5 April 2019 received the Certificate of Acceptance (“COA”) issued by IIUM in respect of the Project. Based on the COA, IIUM confirms the acceptance of the availability of the Facilities and Infrastructure of the Project with effect from 1 December 2018.

IIUM further confirms that the following payments shall be on the date of signing of the Supplemental Agreement to the Concession Agreement and Sub-Lease Agreement thereto:

(i) the payment for the road electrical works (“IIUM Initial Payment”);

(ii) the sub-lease rental for the availability of the Facilities and Infrastructure (“Availability Charges”); and

(iii) the payment for the provision of the asset management services (“AMS Charges”).

IIUM further affirms that the asset management services period will commence retrospectively from 1 December 2018 until the balance on concession period of approximately 17 years.

The issuance of COA by IIUM which giving effect to the commencement of the Availability Charges and the provision of the asset management services by the Concession Company is expected to contribute positively towards the financial position of the Company for the financial year ending 31 December 2019.

This amended announcement is made to correct the description of IIUM Initial Payment which should refer to 'road electrical works' instead of 'road and electrical' as previously announced on 5 April 2019.

This Announcement is dated 8 April 2019.

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 18-5-2019 07:39 AM

|

显示全部楼层

发表于 18-5-2019 07:39 AM

|

显示全部楼层

Date of change | 17 Apr 2019 | Name | PUAN INTAN NURULFAIZA BINTI YANG RAZALI | Age | 42 | Gender | Female | Nationality | Malaysia | Type of change | Others | Designation | Chief Operating Officer | Description | Appointment |

Qualifications| No | Qualifications | Major/Field of Study | Institute/University | Additional Information | | 1 | Masters | LL.M (Masters of Laws) | University of Malaya | | | 2 | Degree | LL.B (Hons) – Bachelor in Law (Honours) | University of Technology Mara (UiTM) Shah Alam | |

| | | Working experience and occupation | Puan Intan Nurulfaiza Binti Yang Razali started her career in legal field and had been with several law firms since 2003. In 2006, she left the legal practice to serve Telekom Malaysia as Corporate Counsel until 2008. She then joined Malaysian Communications and Multimedia Commission and Multimedia Development Corporation, prior to joining Zelan Berhad in 2010. During her tenure in Zelan Berhad, she held various positions with her last position as Head of Legal, Zelan Berhad in 2014. She subsequently joined Tradewinds Corporation Berhad as the Assistant Director, Legal from August 2014 until May 2018, prior to rejoining Zelan Berhad as Head of Legal Department. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 9-6-2019 05:34 AM

|

显示全部楼层

发表于 9-6-2019 05:34 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | ZELAN BERHADDEVIATION OF 10% OR MORE BETWEEN THE ANNOUNCED UNAUDITED FINANCIAL STATEMENTS AND THE AUDITED FINANCIAL STATEMENTS FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2018 | In compliance with Paragraph 9.19(35) of the Main Market Listing Requirements of Bursa Securities, the Board of Directors of Zelan Berhad wishes to announce that there is a negative variance of more than 10% between Zelan Berhad’s audited results for the financial period ended 31 December 2018 (AFS) and unaudited results for the 4Q FYE2018 which was announced on 28 February 2019, in respect of the net loss after tax of Zelan Berhad of RM23.6 million in the AFS as compared to RM10.5 million as announced in the unaudited results.

Please refer to the attachment for the full text of the announcement.

This Announcement is dated 30 April 2019. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/6148677

|

|

|

|

|

|

|

|

|

|

|

|

发表于 8-7-2019 07:41 AM

|

显示全部楼层

发表于 8-7-2019 07:41 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2019 | 31 Mar 2018 | 31 Mar 2019 | 31 Mar 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 36,442 | 20,513 | 36,442 | 20,513 | | 2 | Profit/(loss) before tax | -1,090 | -2,677 | -1,090 | -2,677 | | 3 | Profit/(loss) for the period | -1,502 | -3,342 | -1,502 | -3,342 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -1,501 | -3,342 | -1,501 | -3,342 | | 5 | Basic earnings/(loss) per share (Subunit) | -0.18 | -0.40 | -0.18 | -0.40 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.0500 | 0.0500

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 1-8-2019 09:05 AM

|

显示全部楼层

发表于 1-8-2019 09:05 AM

|

显示全部楼层

本帖最后由 icy97 于 2-8-2019 05:41 AM 编辑

终止合约合法·吉朗获赔2.98亿

https://www.sinchew.com.my/content/content_2092969.html

(吉隆坡31日讯)吉朗(ZELAN,2283,主板建筑组)宣布,国际仲裁法庭国际商会作出判决,旗下独资子公司——吉朗建筑(马)有限公司终止合约合法,将获得米纳控股有限公司(Meena)赔偿2亿6460万迪拉姆(约2亿9760万令吉)。

该公司文告指出,吉朗建筑(马)有限公司2016年8月16日入禀国际仲裁法庭,以指控米纳控股有限公司在阿联酋阿布扎比的米纳大厦工程的合约中违法。

文告指出,吉朗建筑(马)有限公司7月29日接获国际仲裁法庭的判决,宣判吉朗建筑(马)有限公司终止合约是合法的。与此同时,米纳控股有限公司对过时包层及防热原料、输送原料及MEP原料等削减款额也是错误的。

米纳控股有限公司对中期付款证书及数项非遵守报告的转变,也是不合法及错误,吉朗建筑(马)有限公司的展延期至2015年10月1日,以进行底层修正工程也没有实施延期成本。

该公司正在寻求律师意见以执行法庭判决,以便收回获得颁予的款项及其他额外费用款项。

文章来源 : 星洲日报 2019-08-01

Type | Announcement | Subject | MATERIAL LITIGATION | Description | ARBITRATION BETWEEN ZELAN HOLDINGS (M) SDN BHD (AS CLAIMANT) AND MEENA HOLDINGS LLC (AS RESPONDENT) IN THE INTERNATIONAL COURT OF ARBITRATION, INTERNATIONAL CHAMBER OF COMMERCE | Reference is made to the announcements on 19 August 2016, 7 October 2016, 4 August 2017 and 13 November 2017 in relation to the arbitration initiated by a wholly-owned subsidiary of Zelan Berhad (“Company”), Zelan Holdings (M) Sdn Bhd (“ZHSB”) against Meena Holdings LLC (“MH”) as the employer pursuant to the Building Contract for Procurement, Construction and Completion of Package 2 Main Construction Package of Meena Plaza Mixed Use Development Project, Abu Dhabi, United Arab Emirates between MH and ZHSB (“Contract”).

The Company would like to announce that ZHSB has in the evening of 29 July 2019, received a decision from the International Court of Arbitration, International Chamber of Commerce via Final Award dated 25 July 2019 (“Arbitration Award”) declaring inter-alia, as follows:

i) ZHSB’s termination of Contract is valid. ii) The contract of Muqawala made between the parties has terminated for the purpose of Article 892 of the UAE Civil Code of Contract. iii) MH’s deduction of sums in respect of obsolete cladding & thermal insulation material, conveying materials and MEP material were wrongful. iv) MH’s reversal of Interim Payment Certificate (IPC) no.51 by issuing IPC 51R is invalid and wrongfully issued. v) The NCRs no.98,119,121,122, 123 (as qualified) and 97 (to the extent the remedial works do not relate to Basement B1 slabs) were invalid and/or wrongfully issued by MH. vi) ZHSB is due an extension of time to 1 October 2015 for basement rectification works with no prolongation cost.

Accordingly, the Arbitral Tribunal of the International Court of Arbitration, International Chamber of Commerce has awarded ZHSB the following:

a) The sum of AED256,141,666.23 which sum includes interest up to 1 June 2019; b) Pre-award interest from 1 June 2019 until 25 July 2019 in the sum of AED52,963.71; c) Parties’ costs in the sum of AED8,403,936.69; d) ICC Costs of Arbitration in the sum of US$585,000; and e) Post-Award interest on items a), c) and d) at the rate of 9% per annum after the date of Arbitration Award until full payment by MH.

The Company is in the process of seeking advice from its solicitors on the enforcement of the Arbitration Award with the purpose of recovering the awarded sums.

This Announcement is dated 31 July 2019.

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 23-8-2019 06:52 AM

|

显示全部楼层

发表于 23-8-2019 06:52 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2019 | 30 Jun 2018 | 30 Jun 2019 | 30 Jun 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 19,967 | 34,360 | 56,409 | 54,873 | | 2 | Profit/(loss) before tax | 2,910 | -6,818 | 1,820 | -9,495 | | 3 | Profit/(loss) for the period | 2,216 | -6,519 | 714 | -9,501 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 2,209 | -6,159 | 708 | -9,501 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.26 | -0.73 | 0.08 | -1.12 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.0500 | 0.0500

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 20-3-2020 06:25 AM

|

显示全部楼层

发表于 20-3-2020 06:25 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2019 | 30 Sep 2018 | 30 Sep 2019 | 30 Sep 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 7,680 | 18,470 | 64,089 | 73,343 | | 2 | Profit/(loss) before tax | -814 | -5,300 | 1,006 | -14,795 | | 3 | Profit/(loss) for the period | 722 | -5,535 | 1,436 | -15,036 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 720 | -5,535 | 1,428 | -15,036 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.09 | -0.66 | 0.17 | -1.78 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.0500 | 0.0500

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 3-5-2020 08:29 AM

|

显示全部楼层

发表于 3-5-2020 08:29 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2019 | 31 Dec 2018 | 31 Dec 2019 | 31 Dec 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 16,676 | -820 | 80,765 | 72,523 | | 2 | Profit/(loss) before tax | 4,542 | -4,435 | 5,548 | -19,230 | | 3 | Profit/(loss) for the period | 1,233 | -8,566 | 2,699 | -23,602 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 1,233 | -8,555 | 2,661 | -23,591 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.15 | -1.01 | 0.31 | -2.79 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.0600 | 0.0500

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 11-5-2020 07:59 AM

|

显示全部楼层

发表于 11-5-2020 07:59 AM

|

显示全部楼层

Date of change | 16 Mar 2020 | Name | ENCIK HAZIMI BIN BAHARUM | Age | 52 | Gender | Male | Nationality | Malaysia | Type of change | Appointment | Designation | Chief Executive Officer |

Qualifications| No | Qualifications | Major/Field of Study | Institute/University | Additional Information | | 1 | Degree | Bachelor of Science in Civil Engineering | Lamar University, Texas, USA. | |

| | | Working experience and occupation | Encik Hazimi Bin Baharum joined Zelan Berhad ("Zelan") in March 2010 as Head of Special Projects and was promoted as Chief Operating Officer on 1 February 2012 before leaving Zelan to pursue other career opportunities on 7 September 2016. He was previously the General Manager leading the Building and Environment Business Unit at Opus International (M) Berhad ("Opus"). Prior to joining Opus, he has also worked as a Project Manager for Zainuddin Parson and Brinckerhoff Sdn Bhd and Telekom Malaysia Berhad. He is a Project Management Professional certified by the Project Management Institute, United State of America and holds a Bachelor of Science in Civil Engineering from Lamar University, Texas, United States of America. His professional career for the last 23 years has been mainly focused on project and construction management for which he has gained vast experience in project business development, design management, planning and contract administration. He has played vital roles in various projects of different complexity including some major and prestigious projects like Bukit Jalil National Sport Complex, KL Sentral, Ipoh-Rawang Electrified Double Tracking and National Heart Institute (IJN) Expension Project. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 9-10-2020 08:28 AM

|

显示全部楼层

发表于 9-10-2020 08:28 AM

|

显示全部楼层

本帖最后由 icy97 于 2-11-2020 09:20 AM 编辑

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2020 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2020 | 31 Mar 2019 | 31 Mar 2020 | 31 Mar 2019 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 13,114 | 36,442 | 13,114 | 36,442 | | 2 | Profit/(loss) before tax | 3,143 | -1,090 | 3,143 | -1,090 | | 3 | Profit/(loss) for the period | 2,533 | -1,502 | 2,533 | -1,502 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 2,572 | -1,501 | 2,572 | -1,501 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.30 | -0.18 | 0.30 | -0.18 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.0600 | 0.0600

|

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|