|

|

发表于 23-11-2017 02:58 AM

|

显示全部楼层

发表于 23-11-2017 02:58 AM

|

显示全部楼层

本帖最后由 icy97 于 23-11-2017 05:05 AM 编辑

星报媒体市况影响广告收入

2017年11月22日

分析:安联星展研究

目标价:1.41令吉

最新进展:

星报媒体(STAR,6084,主板贸服股)因脱售子公司新加坡城贸控股(Cityneon Holdings)而取得2亿686万令吉收益,带动截至9月30日第三季净利年升19.37倍,至2亿3029万令吉或每股31.21仙。

营业额却按年减少14.8%至1亿3089万令吉,主要因为印刷业务的营业额贡献减少。

合计首九个月,净利按年激增2.48倍至2亿4544万令吉,或每股33.26仙;营业额则下跌17.96%至3亿9139万令吉。

行家建议:

虽然盈利表现在未来可能会持续低迷,但我们相信,作为国内第一大英文报章业者,以及拥有强稳的资产负债表,星报媒体能够维持表现。

脱售新加坡城贸控股后,意味着该公司的盈利主要来自印刷业务。对于该公司加入随选影片(VOD)市场的战局,我们不感乐观,因为这业务的筹备期长,且市场竞争非常激烈。

此外,大部分营业额来自深受市场情绪左右的广告收入(ADEX),我们认为,若要上修星报媒体的估值,市场情绪改善是必要的条件。

有鉴于派发30仙的特别股息后,股价显著下跌,我们上调评级至“守住”;派发股息后,我们调整目标价至1.41令吉。

【e南洋】

拥4亿现金储备 星报派息率吸引

財经 最后更新 2017年11月21日

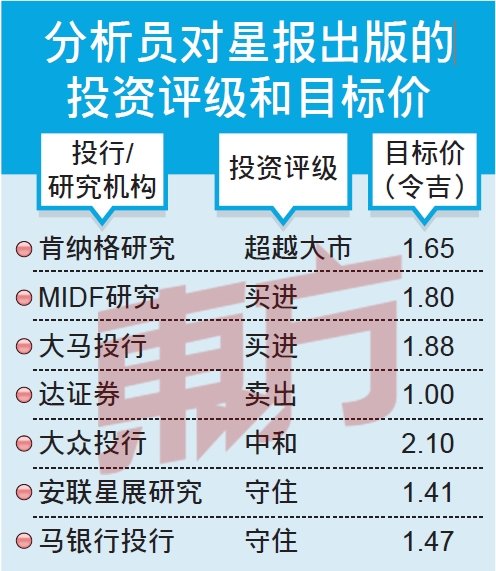

(吉隆坡21日讯)由于认为星报出版(STAR,6084,主板贸服股)派息率仍具吸引力,分析员纷纷上调其投资评级和目標价。

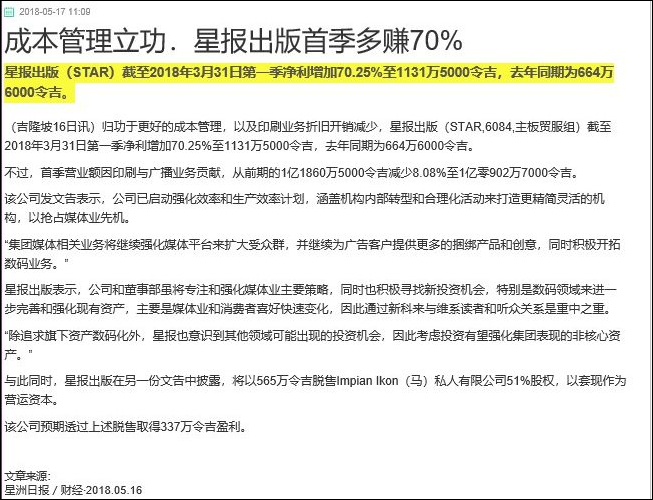

星报出版周一公佈2017財政年第3季(截至9月30日止)业绩,因出售新加坡子公司城贸控股52.51%股权,取得一次性特別盈利2亿零690万令吉,带动净利飆升,第3季净利飆涨19倍,至2亿3029万令吉;营业额则按年下滑15%,至1亿3089万令吉。

首9个月净利按年上涨248%,至2亿4544万令吉;营业额则按年减少18%,至3亿9139万令吉。

MIDF研究分析员表示,星报出版第3季现金储备猛增41.1%,至7亿零500万令,归功于脱售城贸控股股权。除却支付首次中期和特別股息后,其现金储备依然相当可观,为4亿3940万令吉或每股59.5仙,有能力持续派息。

该投行把2017和2018財政年盈利预测上修至3740万令吉及4210万令吉。

与此同时,肯纳格研究分析员指出,成本上升影响整体广告开销(ADEX),加上消费者情绪疲弱,导致印刷和数码收入收窄19%;经济低迷也促使广播收入下滑2%。

「电视业务收入按年下跌7%;活动业务收入则因参展商数量减少,而降低24%。」

此外,该公司于9月下旬引入互惠离职计划(MSS),旨在裁退200多名员工,主要是来自印刷业务,並预期在2017年末季完成。

新业务料填补损失

不仅如此,星报出版也放眼新企业来填补出售子公司后的损失,並可能投资其他领域或非核心业务。

儘管如此,达证券分析员却不看好星报出版的前景,虽然该公司料收购非媒体相关资產,有助多元化收入,但进军新和陌生领域,也会產生新风险。

该分析员也说,星报出版將重点放在数码化转型策略,以减少对广告开销的依赖。其OTT服务平台--「点心」(DIMSUM)取得令人鼓舞的数据。惟未来仍可预见会造成损失。

因此,达证券分析员维持「卖出」投资评级,目標价为1令吉不变。

肯纳格研究、MIDF研究及大马投行分析员皆上调投资评级,至「超越大市」及「买进」。

【东方网财经】 |

|

|

|

|

|

|

|

|

|

|

|

发表于 30-11-2017 02:59 AM

|

显示全部楼层

发表于 30-11-2017 02:59 AM

|

显示全部楼层

“瘦身计划”首轮不理想

《星报》次轮拟遣散500人

2017年11月25日

报道:王顺荣

(槟城25日讯)国内最畅销英文日报《星报》通过首轮“互惠离职计划”及“提早退休选择”计划下,目标为削减约220名员工,但获公司接纳申请者只达70人,成绩不理想,将启动次轮的“瘦身计划”中。

次轮的“瘦身计划”同样将通过“互惠离职计划”及“提早退休选择”遣散500名员工。

范围概括各个部门

消息说,《星报》媒体集团管理层对第一轮“互惠离职计划”及“提早退休选择”所涉及的人数未臻理想,而发出指示再做第二轮的遣散计划;而此次的计划目标为500人,涉及范围概括报馆的各个部门。

消息透露,此次《星报》的“互惠离职计划”及“提早退休选择”,是根据上一次的通知为准,没有再发出新的通知。这一轮是让员工通过口头或短讯向上司申请和汇报后,再交由总部审理,一旦获准后,就会以书面通知申请者。

据知,“互惠离职计划”提供的离职款项可谓优惠,所提供的金额,按服务年资计算,即每服务一年提供相等于薪金半个月、一个月至一个月半的金额不等,胥视个人服务年资而定;其中,服务逾20年者可获得每年一个月半的离职款额。

在“提早退休选择”计划下获准离职的员工,则可享有服务年资每年两个月或以上的离职款额,而在“互惠离职计划”中成功获批的员工,薪金若少过5000令吉,也同样可获得服务年份每年两个月的离职款额。

《星报》早前刚于今年9月杪进行第一轮的“互惠离职计划”及“提早退休选择”计划,遣散约220名员工。

《日经市场》早前报道,《星报》集团内部发函声称因集团在业绩方面面对挑战,才推出“互惠离职计划”及“提早退休选择”。

据了解,有关内部函件是由该集团董事经理兼总执行长拿督斯里黄振威于9月26日签发。【e南洋】 |

|

|

|

|

|

|

|

|

|

|

|

发表于 21-2-2018 02:17 AM

|

显示全部楼层

发表于 21-2-2018 02:17 AM

|

显示全部楼层

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

NON RELATED PARTY TRANSACTIONS | Description | STAR MEDIA GROUP BERHAD ("STAR" or "the Company")-Proposed Disposal of the Company's Land Known As H.S. (D) 259880, No. Lot PT 16 Seksyen 13, Bandar Petaling Jaya, Daerah Petaling, Negeri Selangor to JAKS Island Circle Sdn Bhd | (Unless otherwise defined, the abbreviations used throughout this announcement shall have the same meanings as defined in the announcement dated 19 August 2011)

We refer to the announcement dated 19 August 2011 in relation to the Proposed Disposal and wish to inform that the deadline for the delivery of vacant possession of Tower A had expired on 15 February 2018 following the latest extension agreed between Star and JAKS.

As JAKS had failed to deliver vacant possession of Tower A by the stipulated deadline, the Company had in accordance with its rights under the SPA and terms of the Bank Guarantees pledged as security made a demand on the Bank Guarantees from the financial institutions amounting to RM50.0 million.

This announcement is dated 20 February 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 1-3-2018 05:30 AM

|

显示全部楼层

发表于 1-3-2018 05:30 AM

|

显示全部楼层

本帖最后由 icy97 于 4-3-2018 03:58 AM 编辑

末季亏1.6亿

星报派息6仙

2018年2月28日

(吉隆坡27日讯)印刷业务贡献走低,加上单次开销,星报媒体(STAR,6084,主板贸服股)截至12月杪末季,净亏1亿5514万9000令吉或每股21.02仙,但仍派息6仙。

该公司今日向交易所报备,营业额按年减18%,至1亿2634万2000令吉。

累计全年,净利与营业额双双按年降18%,分别录得9029万4000令吉和5亿1773万4000令吉。

尽管如此,星报媒体宣布派发每股6仙中期股息,除权日与享有权益日,分别落在3月28日及30日。

董事部会持续专注与强化在媒体领域的主要策略,捍卫印刷领域的同时,打造其他媒体平台。

星报媒体积极扩展至电子业务,并在该领域寻找新投资机会,来与现有资产互补。【e南洋】

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2017 | 31 Dec 2016 | 31 Dec 2017 | 31 Dec 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 126,342 | 153,375 | 517,734 | 630,432 | | 2 | Profit/(loss) before tax | -187,654 | 40,428 | 39,817 | 122,972 | | 3 | Profit/(loss) for the period | -157,101 | 41,818 | 87,444 | 116,909 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -155,149 | 39,441 | 90,294 | 109,911 | | 5 | Basic earnings/(loss) per share (Subunit) | -21.02 | 5.34 | 12.24 | 14.89 | | 6 | Proposed/Declared dividend per share (Subunit) | 6.00 | 9.00 | 42.00 | 18.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.1800 | 1.5300

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 4-3-2018 04:06 AM

|

显示全部楼层

发表于 4-3-2018 04:06 AM

|

显示全部楼层

EX-date | 28 Mar 2018 | Entitlement date | 30 Mar 2018 | Entitlement time | 04:00 PM | Entitlement subject | Second interim dividend | Entitlement description | Second Interim Single Tier Dividend of 6.0 sen per ordinary share for the Financial Year Ended 31 December 2017 | Period of interest payment | to | Financial Year End | 31 Dec 2017 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | TRICOR INVESTOR & ISSUING HOUSE SERVICES SDN BHDUnit 32-01, Level 32, Tower AVertical Business Suite, Avenue 3, Bangsar SouthNo.8, Jalan Kerinchi, 59200 Kuala LumpurTel: 03 27839299Fax: 03 27839222 | Payment date | 18 Apr 2018 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 30 Mar 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.06 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 12-3-2018 02:27 AM

|

显示全部楼层

发表于 12-3-2018 02:27 AM

|

显示全部楼层

本帖最后由 icy97 于 13-3-2018 02:01 AM 编辑

重组转型.星报料重点拓数码业

(吉隆坡7日讯)星报出版(STAR,6084,主板贸服组)委任国际顾问公司以探讨进行重组计划,分析员相信新业务方向料以数码为主,并将增聘相关领域专才。

达证券研究指出,星报出版计划进行重组计划,预计转型计划将包含新的可售数码产品和聘请更多相关领域专才。

肯纳格研究指出,星报出版已委任国际顾问公司,以探讨集团业务架构及业务方向。

肯纳格预计报告将在近期出炉,并可在未来3个月内进行,报告预料将涵盖新企业方向和成本合理化计划。星报出版一直表态有意拓展业务触角以止损,甚至不排除投资在其他领域或非核心业务上。

MIDF研究补充,星报出版寻求顾问意见,是为了使集团业务更精益和能够永续进行,且目前在寻找拥有数码相关技能的员工,以备拓展及加强数码业务之用。

整顿员工印刷设备

大马投行认为,星报出版盈利逐步复苏,惟不排除将进行“扫除”

活动,包括整顿员工和印刷设备。

目前,星报出版在雪州沙亚南拥有4条印刷生产线,仅有50%在营运,另有两条印刷生产线位于槟州峇六拜,仅有40%使用率。

大马投行相信,在印刷厂使用率不足的情况下,该集团可选择关闭当中的2至3条印刷线,这也能够降低该集团的折旧费用。不过,产业、工厂及器材(PPE)减值也使得该集团难以转售印刷设备。

大马投行相信该集团广告开销在2018财政年上半年有望获得推高,主要获全国大选、冬季奥运会和2018年FIFA世界杯增加广告活动。

大马投行探悉,快速消费产品业者也预计在今年上半年,更积极的进行更多的广告活动。

整体而言,大马投行相信星报出版在2018财政年将能录得更好的核心盈利表现。

自愿离职料年省4000万

星报出版在近期进行互惠离职计划减退250名员工及暂停Li TV营运,大马投行料可为该集团在2018财政年节省3000万至4000万令吉。

MIDF则指出,星报出版目前在等待13区Tower A完成建设工作,完成后将把广播和dimsum营运迁移至该处,预计可按年节省100万令吉租金成本。

MIDF认为,短期来看,星报出版进行成本优化,将能支撑2018财政年净利表现。

大马投行认为星报出版长期前景依然严峻,归咎于纸媒受到数码内容的冲击、消费情绪疲弱打击广告开销及脱售城贸控股后,缺乏增长动力。

达证券在下调星报出版广告开销预测6.8%后,下修2018至2019财政年财测7.8%和11.8%,同时预计2020财政年可录得4380万令吉盈利。

达证券也预计,星报出版2018、2019及2020财政年将分别下跌37.5%、4.4%及增加0.1%,同时认为股息将下跌至每股9仙。

文章来源:

星洲日报/财经 ‧ 报道:刘玉萍 ‧2018.03.07

星报媒体

9%周息率吸引购兴

2018年3月8日

分析:肯纳格投行研究

目标价:1.60令吉

最新进展

星报媒体(STAR,6084,主板贸服股)已委任一家国际咨询公司,为公司结构和业务方向进行研究,预计会在几周内完成,并计划三个月内执行。

这料将为公司指引有关新业务及成本合理化计划的业务方向。

另外,针对星报媒体与捷硕资源(JAKS,4723,主板建筑股)的纠纷,法庭将在3月7日听审。

行家建议

尽管今年首两个月广告收入情绪维持疲软,但管理层仍对即将带来的两大活动抱有希望,分别是大选和国际足联世界杯,能为广告市场提供动力。

我们同意管理层的观点,并将今年总广告收入(除了支付电视)增长预测,维持在按年增长4.5%。

虽然该公司没有正式的派息政策,但相信公司继续回馈股东。该公司在2017财年派息42仙,虽然整体广告收入前景备受挑战,但仍预计该公司在明后财年继续派息12仙。

脱售子公司新加坡城贸控股后,星报媒体放眼寻求新业务,以填补撤资的净利损失。

近期催化剂缺乏,股价疲软,加上诱人派息率超过9%,相信能提供一些逢低吸购机会。

【e南洋】 |

|

|

|

|

|

|

|

|

|

|

|

发表于 13-3-2018 07:57 AM

|

显示全部楼层

发表于 13-3-2018 07:57 AM

|

显示全部楼层

星報不承認JAKS資源仲裁通知

2018年3月08日

(吉隆坡8日訊)針對與JAKS資源(JAKS,4723,主要板建築)的仲裁糾紛,星報(STAR,6084,主要板貿服)接獲源自JAKS資源代表律師發出的信件,根本不足以構成仲裁通知。

星報向馬證交所報備,JAKS資源發出仲裁信件表示兩家公司在接洽買賣協議時有出入,但星報代表律師稱JAKS資源從未提出所謂的爭議或分歧,更不會影響銀行擔保。

因此,星報認為所謂的爭議意圖事件不明確,也言之過早,甚至不能構成仲裁通知。【中国报财经】

Type | Announcement | Subject | OTHERS | Description | STAR MEDIA GROUP BERHAD ("STAR" or "the Company")- Proposed Disposal of the Company's Land Known As H.S. (D) 259880, No. Lot PT 16 Seksyen 13, Bandar Petaling Jaya, Daerah Petaling, Negeri Selangor to JAKS Island Circle Sdn Bhd | [Unless otherwise defined, the abbreviations used throughout this announcement shall have the same meanings as defined in the announcements dated 19 August 2011, 20 February 2018 and 28 February 2018 (hereinafter referred to as the “Announcements”)]

The Board of Directors of Star wishes to inform that the Company had on 6 March 2018 received a purported notice of arbitration dated 6 March 2018 from JAKS’s solicitors (hereinafter referred to as “the said Letter”) to resolve the disputes between the two parties by way of arbitration.

The Company’s solicitors had on 8 March 2018 responded to JAKS’s solicitors disagreeing with JAKS’s contentions in paragraph 3 of the said Letter as to “disputes or differences which have therefore arisen between Star and JAKS in connection with the SPA” when at all material times, JAKS had never raised such alleged disputes or differences during the performance of their obligations under the SPA. Such alleged disputes or differences does not in any way affect the Company’s call on the Bank Guarantees which terms clearly provide that the performance of the Bank Guarantees shall not be prevented by any contestation, protestation or arbitration.

In the said Letter, JAKS had requested to waive the procedural step of panel resolution pursuant to Clause 19.1 of the SPA which the Company is not agreeable to waive.

The Company views that the said Letter does not and cannot amount to a notice of arbitration particularly when it is premature and does not even state or particularise JAKS’s alleged dispute intended to be referred to arbitration.

This announcement is dated 8 March 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 18-5-2018 03:22 AM

|

显示全部楼层

发表于 18-5-2018 03:22 AM

|

显示全部楼层

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

NON RELATED PARTY TRANSACTIONS | Description | STAR MEDIA GROUP BERHAD ("Star or the Company")Proposed disposal of 2,091,000 Ordinary Shares, representing the entire equity interest of Impian Ikon (M) Sdn Bhd, the wholly-owned subsidiary of Star in Leaderonomics Sdn Bhd to Leaderonomics Capital Sdn Bhd | 1. INTRODUCTION We wish to announce that Impian Ikon (M) Sdn Bhd (“Impian Ikon”), a wholly-owned subsidiary of Star has on 16 May 2018, entered into a Share Sale Agreement (“SSA”) with Leaderonomics Capital Sdn Bhd (“LCSB”) to dispose 2,091,000 ordinary shares representing 51% equity interest (“Sale Shares”) in Leaderonomics Sdn Bhd (“Leaderonomics”) for a total cash consideration of RM5.65 million (“Consideration”), subject to the terms and conditions as stipulated in the SSA (“Disposal”). Upon completion of the Disposal, Leaderonomics will cease to be a direct subsidiary of Impian Ikon and a sub-subsidiary of Star. Accordingly, the subsidiaries of Leaderonomics namely Leaderonomics Media Sdn Bhd, Leaderonomics International Sdn Bhd and Leaderonomics Good Monday Sdn Bhd shall also cease to be subsidiaries of Star.

2. INFORMATION ON IMPIAN IKON, LEADERONOMICS AND LCSB 2.1 Impian Ikon Impian Ikon was incorporated in Malaysia on 30 April 2008 with a total issued and paid-up share capital of RM2.00. Impian Ikon is a wholly-owned subsidiary of Star. The existing directors of Impian Ikon are Datuk Seri Wong Chun Wai and Datuk Kan King Seong. The principal activity of Impian Ikon is investment holding. 2.2 Leaderonomics Leaderonomics was incorporated in Malaysia on 15 February 2007 and its issued and paid-up share capital is RM4,100,000 comprising 4,100,000 ordinary shares. The directors of Leaderonomics are Datuk Seri Wong Chun Wai, Datuk Kan King Seong, Mr Ragesh Rajendran, Datuk Goh Lee Yen, Mr Roshan Thiran, Ms Ang Hui Ming and Mr Tan Boo Hean as well as Ms Laura Yee Huimei as the alternate director for Ms Ang Hui Ming and Mr Tan Boo Hean. The shareholders are Impian Ikon and Leaderonomics Holdings Sdn Bhd, each holding 2,091,000 and 2,009,000 ordinary shares or 51% and 49% equity interests in Leaderonomics respectively. The principal business activity of Leaderonomics is provision of human capital development services including training and consultancy.

2.3 LCSB LCSB was incorporated in Malaysia on 28 December 2017 and its issued and paid-up share capital is RM2.00 comprising 2 ordinary shares of RM1.00 each. The directors of LCSB are Mr Roshan Thiran and Ms Ang Hui Ming. The principal activity of LCSB is investment holding. The directors and major shareholders of LCSB are Mr Roshan Thiran and Ms Ang Hui Ming.

3. DETAILS OF THE PROPOSED DISPOSAL The Consideration is satisfied in the following manners:

a) LCSB shall upon execution of the SSA pay to Impian Ikon a sum of RM565,000 only being 10% of the Consideration by way of deposit and part payment towards the Consideration. b) LCSB shall pay the balance of the Consideration amounting to RM5,085,000 only (“Balance Consideration”) to Impian Ikon within 90 (90) days from the date of the SSA or any extension thereof as both parties may mutually agree in writing. c) Subject to the full payment of the Consideration to Impian Ikon, the Sale Shares shall be acquired free from all liens, charges and encumbrances, together with all rights, benefits and entitlements attaching to them. Further, there will be no liabilities to be assumed by Star pursuant to the Disposal.

4. BASIS OF CONSIDERATION The consideration of RM5.65 million was arrived at after taking into account the net assets of Leaderonomics of RM4,422,272 based on its unaudited financial statements as at 31 March 2018.

5. RATIONALE FOR THE DISPOSAL The Disposal is in line with the Company's intention to divest assets that do not contribute significantly to the group's financials.

6. EXPECTED GAIN/LOSS OF DISPOSAL The unaudited estimated gain to the Group as at 31 March 2018 is approximately RM3.37 million.

7. PROPOSED UTILISATION OF THE CONSIDERATION The proceeds from the disposal will mainly be used for working capital.

8. APPROVAL REQUIRED The Disposal does not require the approval of shareholders of Star or government authorities.

9. EFFECT OF THE DISPOSAL The Disposal is not expected to have any material effect on the earnings per share, net assets per share and gearing of Star, and it has no effect on Star’s share capital and substantial shareholders’ shareholding.

10. DIRECTORS AND/OR MAJOR SHAREHOLDERS’ INTERESTS None of the directors and/or major shareholders of Star or persons connected with them has any interest, whether direct or indirect, in the Disposal.

11. HIGHEST PERCENTAGE RATIO The highest percentage ratio applicable to the Disposal pursuant to Paragraph 10.02(g) of the Main Market Listing Requirements of Bursa Malaysia Securities Berhad is 0.70% based on the latest audited financial statements of the Company for the year ended 31 December 2017.

12. STATEMENT BY BOARD OF DIRECTORS The Board of Directors of the Company is of the opinion that the Disposal is in the best interest of Star.

13. ESTIMATED TIMEFRAME FOR COMPLETION The Disposal is expected to be completed within 3 months from the date of this announcement.

14. Document available for inspection A copy of the SSA is available for inspection at the Registered Office of Star at Level 15, Menara Star, 15 Jalan 16/11, 46350 Petaling Jaya, Selangor Darul Ehsan during normal business hours from Mondays to Fridays (excluding public holidays) within 3 months from the date of this announcement.

This announcement is dated 16 May 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 18-5-2018 03:24 AM

|

显示全部楼层

发表于 18-5-2018 03:24 AM

|

显示全部楼层

本帖最后由 icy97 于 21-5-2018 07:11 AM 编辑

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2018 | 31 Mar 2017 | 31 Mar 2018 | 31 Mar 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 109,027 | 118,605 | 109,027 | 118,605 | | 2 | Profit/(loss) before tax | 17,589 | 6,433 | 17,589 | 6,433 | | 3 | Profit/(loss) for the period | 11,389 | 9,269 | 11,389 | 9,269 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 11,315 | 6,646 | 11,315 | 6,646 | | 5 | Basic earnings/(loss) per share (Subunit) | 1.53 | 0.90 | 1.53 | 0.90 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.1400 | 1.1800

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 20-5-2018 06:10 AM

|

显示全部楼层

发表于 20-5-2018 06:10 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 22-5-2018 02:05 AM

|

显示全部楼层

发表于 22-5-2018 02:05 AM

|

显示全部楼层

本帖最后由 icy97 于 22-5-2018 03:28 AM 编辑

主席:VSS将是Star Media成本削减措施的最后选项

Billy Toh/theedgemarkets.com

May 15, 2018 16:00 pm +08

(吉隆坡15日讯)由马华(MCA)控有的Star Media Group Bhd主席拿督胡亚桥表示,自愿离职计划(VSS)将作为成本削减措施最后一个考虑的选项。

胡亚桥今日出席股东常年大会后,向theedgemarkets.com说:“VSS将是我们的最后选项。我们只会在必要时作出考虑。董事部将作出最终决定……我们必须看管理层向董事部提供的数据和建议。”

他指出,管理层和董事部正在讨论成本削减计划,一旦有决定将作出公布。

他补充,自去年以来一直致力于削减不同方面的成本如营运成本,而员工成本是其中最大的一部分。据他说,去年采取的VSS只会是截至12月杪本财政年的最后选项。

胡亚桥表示,作为一家负责任的公司,由于营业额下降,因而需要采取措施降低成本。他称,为股东带来更好获利的关键因素包括削减成本和增加收入。

“目前正在实施一系列的成本削减措施,其中包括印刷厂营运,开始一些管理方面的变化,这将有助于降低成本。”

在未来收入增长方面,他说,重点将放在Star Online这个数字平台,该集团将重新调整内容并加以改进,以及增加数字资产的收入。

电台业务自去年经历一些重组之后,正在取得积极成果,而Dimsum的收入料改善,尽管这可能不会立即为净利作出贡献。

胡亚桥补充,在活动与展览业务上加大力度,以提高盈利。

他还否认最大股东马华有干涉,并称这只是他人的看法。马华持有Star Media的42.46%股权。

“就管理和编采而言,股东(马华)没有干预。”

他也希望Star Media和JAKS资源(JAKS Resources Bhd)之间的法庭裁决将很快得到解决。随着11日(周五)是公共假期,法庭裁决已推迟至待定。

(编译:陈慧珊) |

|

|

|

|

|

|

|

|

|

|

|

发表于 24-5-2018 01:39 AM

|

显示全部楼层

发表于 24-5-2018 01:39 AM

|

显示全部楼层

本帖最后由 icy97 于 2-6-2018 05:09 AM 编辑

Type | Announcement | Subject | OTHERS | Description | STAR MEDIA GROUP BERHAD ("STAR" or "the Company")- Proposed Cessation of Printing Operations in Penang | The Board of Directors of Star wishes to announce that the Company will cease all its printing activities at Star Northern Hub (“SNH”) in September 2018 (“Proposed Cessation”) in line with its efforts to centralise nationwide printing as part of its ongoing cost rationalization exercise.

The Proposed Cessation will involve staff redundancies, consideration of future utilization of the land and building at SNH and disposal of the pressline. The Proposed Cessation does not amount to a cessation of the major business of the Group as the Company will still continue with its print business and all newspapers will be printed at the Star Media Hub located in Shah Alam, Selangor. In this respect, the Group does not expect any significant adverse impact to its newspaper circulation in the northern region.

The Proposed Cessation will not have any effect on the Group’s share capital and substantial shareholders’ shareholdings. It will also not have any material effect on the gearing, consolidated earnings, earnings per share and net assets per share of the Group for the financial year ending 31 December 2018. There is no further impairment on the assets following the Proposed Cessation as this has been taken into account in the financials for the year ended 31 December 2017.

None of the Directors and/or major shareholders and/or any persons connected with the Directors or major shareholders has any interest, direct or indirect, in the Proposed Cessation.

The Proposed Cessation is not subject to the approval of the shareholders and any relevant government authorities.

The Board of Directors of Star, after having considered all aspects of the Proposed Cessation, is of the opinion that the Proposed Cessation is in the best interest of the Group.

This announcement is dated 21 May 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 21-6-2018 04:00 AM

|

显示全部楼层

发表于 21-6-2018 04:00 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 13-7-2018 02:20 AM

|

显示全部楼层

发表于 13-7-2018 02:20 AM

|

显示全部楼层

本帖最后由 icy97 于 14-7-2018 05:55 AM 编辑

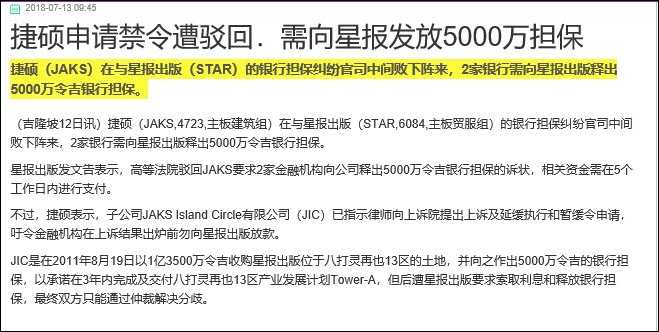

Type | Announcement | Subject | OTHERS | Description | STAR MEDIA GROUP BERHAD (STAR or the Company)- Proposed Disposal of the Company's Land Known As H.S. (D) 259880, No. Lot PT 16 Seksyen 13, Bandar Petaling Jaya, Daerah Petaling, Negeri Selangor to JAKS Island Circle Sdn Bhd | [Unless otherwise defined, the abbreviations used throughout this announcement shall have the same meanings as defined in the announcements dated 19 August 2011, 20 February 2018, 28 February 2018 and 8 March 2018 (hereinafter referred to as the “Announcements”)]

The Board of Directors of Star wishes to inform that the High Court had on 12 July 2018 dismissed the Originating Summons filed by JAKS to restrain the financial institutions from releasing the Bank Guarantees to Star amounting to RM50.0 million with costs. The High Court further ordered that the said financial institutions are required to release the Bank Guarantees to Star within five (5) working days from the said dismissal.

This announcement is dated 12 July 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 18-7-2018 03:05 AM

|

显示全部楼层

发表于 18-7-2018 03:05 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | STAR MEDIA GROUP BERHAD ("STAR" or "the Company")- Proposed Disposal of the Company's Land Known As H.S. (D) 259880, No. Lot PT 16 Seksyen 13, Bandar Petaling Jaya, Daerah Petaling, Negeri Selangor to JAKS Island Circle Sdn Bhd | [Unless otherwise defined, the abbreviations used throughout this announcement shall have the same meanings as defined in the announcements dated 19 August 2011, 20 February 2018, 28 February 2018, 8 March 2018, 12 July 2018 and 13 July 2018]

Reference is made to the announcement made by the Company on 13 July 2018 in relation to JAKS’s notices filed for the Stay of Execution​​ and Erinford Injunction to restrain the Banks from releasing the Bank Guarantees to the Company. The Company wishes to inform that the judge has today granted an Interim Erinford Injunction on the Banks until 23 July 2018 when the inter partes hearing of the ​application for the Erinford Injunction will be heard by the High Court on the said date. JAKS lawyers had also on even date withdrawn their application for Stay of Execution.

This announcement is dated 17 July 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 23-7-2018 11:35 PM

|

显示全部楼层

发表于 23-7-2018 11:35 PM

|

显示全部楼层

本帖最后由 icy97 于 24-7-2018 03:55 AM 编辑

高庭驳回暂缓令 捷硕资源提出上诉

Supriya Surendran/theedgemarkets.com

July 23, 2018 15:36 pm +08

(吉隆坡23日讯)吉隆坡高庭驳回了捷硕资源(JAKS Resources Bhd)子公司JAKS Island Circle私人有限公司(JIC)申请的暂缓令(Erinford Injunction)。

JIC申请暂缓令是为了阻止两家金融机构发放5000万令吉银行担保予Star Media Group Bhd。这5000万令吉银行担保是关于Star Media Group Bhd及捷硕资源所签署的协议,即后者于7月杪在八打灵再也13区一幅土地发展Pacific Star,并打造15层的“Tower A”。

根据捷硕资源发布的文告,JIC的董事已指示其律师立即向上诉庭申请暂缓令,以限制金融机构向Star Media发放款额。

“JIC进一步通过其律师通知发放款额的金融机构,有关向上诉庭申请暂缓令的待审。”

(编译:魏素雯)

Type | Announcement | Subject | OTHERS | Description | STAR MEDIA GROUP BERHAD ("STAR" or "the Company")- Proposed Disposal of the Company's Land Known As H.S. (D) 259880, No. Lot PT 16 Seksyen 13, Bandar Petaling Jaya, Daerah Petaling, Negeri Selangor to JAKS Island Circle Sdn Bhd | [Unless otherwise defined, the abbreviations used throughout this announcement shall have the same meanings as defined in the announcements dated 19 August 2011, 20 February 2018, 28 February 2018, 8 March 2018, 12 July 2018, 13 July 2018 and 17 July 2018]

Reference is made to the announcements made by the Company on 12th, 13th and 17th July 2018 in relation to JAKS’s notices filed for the Erinford Injunction to restrain the Banks from releasing the Bank Guarantees to the Company.

The Company wishes to inform that the High Court has today dismissed JAKS’s applications for the Erinford Injunction (“Erinford Judgement”). The High Court has ordered that payment of the Bank Guarantees be released by the Banks to the Company within five (5) working days from the date of the Erinford Judgement.

This announcement is dated 23 July 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 13-8-2018 11:59 PM

|

显示全部楼层

发表于 13-8-2018 11:59 PM

|

显示全部楼层

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

NON RELATED PARTY TRANSACTIONS | Description | STAR MEDIA GROUP BERHAD ("Star" or "the Company") - Proposed disposal of 2,091,000 Ordinary Shares, representing the entire equity interest of Impian Ikon (M) Sdn Bhd, a wholly-owned subsidiary of Star in Leaderonomics Sdn Bhd to Leaderonomics Capital Sdn Bhd | We refer to our announcement dated 16 May 2018 in relation to the disposal by Impian Ikon (M) Sdn Bhd, a wholly-owned subsidiary of Star, of 2,091,000 Ordinary Shares representing the entire equity interest in Leaderonomics Sdn Bhd to Leaderonomics Capital Sdn Bhd (“the Disposal”). Unless otherwise stated, the definitions used herein shall have the same meanings as set out in the said announcement.

The Company wishes to inform that the Disposal was completed on 13 August 2018. With the completion, Leaderonomics will cease to be a direct subsidiary of Impian Ikon and a sub-subsidiary company of Star. Accordingly, the existing subsidiaries of Leaderonomics, namely Leaderonomics International Sdn Bhd, Leaderonomics Media Sdn Bhd and Leaderonomics Good Monday Sdn Bhd shall cease to be subsidiaries of Star.

This announcement is dated 13 August 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 18-8-2018 05:08 AM

|

显示全部楼层

发表于 18-8-2018 05:08 AM

|

显示全部楼层

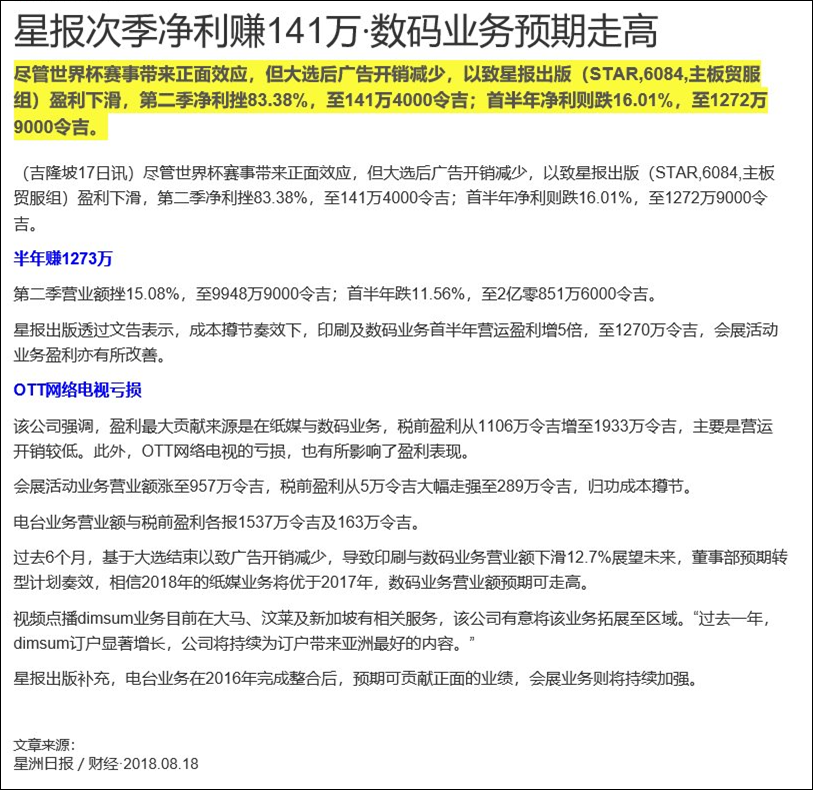

本帖最后由 icy97 于 19-8-2018 05:43 AM 编辑

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2018 | 30 Jun 2017 | 30 Jun 2018 | 30 Jun 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 99,489 | 117,157 | 208,516 | 235,762 | | 2 | Profit/(loss) before tax | 2,251 | 565 | 19,840 | 6,999 | | 3 | Profit/(loss) for the period | 1,448 | 17,079 | 12,837 | 26,348 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 1,414 | 8,509 | 12,729 | 15,155 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.19 | 1.15 | 1.73 | 2.05 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 36.00 | 0.00 | 36.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.1400 | 1.1800

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 8-11-2018 02:38 AM

|

显示全部楼层

发表于 8-11-2018 02:38 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 1-1-2019 07:58 AM

|

显示全部楼层

发表于 1-1-2019 07:58 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2018 | 30 Sep 2017 | 30 Sep 2018 | 30 Sep 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 91,123 | 119,111 | 299,639 | 354,873 | | 2 | Profit/(loss) before tax | 2,453 | 220,472 | 22,293 | 227,471 | | 3 | Profit/(loss) for the period | 1,576 | 218,197 | 14,413 | 244,545 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 1,596 | 230,288 | 14,325 | 245,443 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.21 | 31.21 | 1.94 | 33.26 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 36.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.1400 | 1.1800

|

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|