|

|

【AMBANK 1015 交流专区】大马投资银行 (前名AMMB)

[复制链接]

[复制链接]

|

|

|

发表于 5-3-2018 02:07 AM

|

显示全部楼层

发表于 5-3-2018 02:07 AM

|

显示全部楼层

本帖最后由 icy97 于 6-3-2018 04:56 AM 编辑

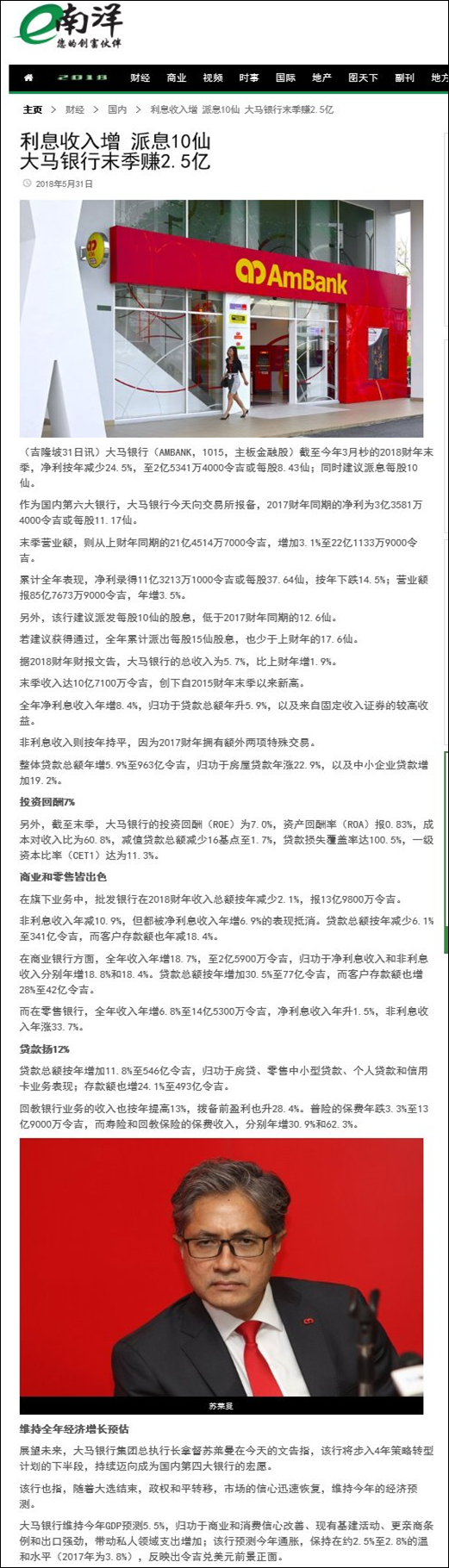

贷款减值.大马银行第三季净赚2.2亿

(吉隆坡28日讯)贷款减值拖累,大马银行(AMBANK,1015,主板金融组)截至去年12月31日第三季净利跌30.08%,至2亿1897万8000令吉;9个月也走低11.13%,至8亿7871万7000令吉。

该公司核心业务表现稳定,第三季营业额增加9.19%,至21亿5962万9000令吉;9个月营业额也上扬3.66%,至63亿6540万令吉。

大马银行集团首席执行员拿督苏莱曼在文告中说,公司9个月净利息赚幅从1.96%扩至1.98%,相关收入也增加8.8%,至1亿4900万令吉,带动总收入提高5.4%,至29亿零840万令吉。

去年3月以来的一年内,大马银行的贷款及融资成长4.1%,至947亿令吉。其中房贷增长16.4%,至255亿令吉;中小企业贷款也提高12.4%,至17亿令吉;信用卡贷款走扬13.3%,至19亿令吉。

相较之下,该公司的客户贷款提高6.4%,至999亿令吉。其中,来往储蓄户头增长0.8%,占总存款的20%。

随着贷款减值恢复正常,回拨率也减少,大马银行9个月减记3290万令吉贷款,前期则是净回拨1亿7950万令吉。该公司贷款成本报0.04%,贷款损失覆盖率提高到101.6%,累积减值贷款率也从1.86%降至1.77%。

单位信托收入年增20.7%

该公司单位信托收入按年增加20.7%,其他收入更大起90.1%。

该公司9个月开销增加7.3%,主要是受到零售业务一次过亏损、投资额增加、人士成本提高8.5%,至7320万令吉等影响。该公司成本收入比从第二季的57.2%扩至58.2%。

苏莱曼预期,在房贷、中小企业贷款和信用卡贷款保持增长之下,净利息收入将继续贡献该公司主要收入。

他认为,虽然投资银行和货币市场业务展望欠佳,但财富管理、企业及商业银行表现稳定,相信可推动非利息收入走高。

“我们预期贷款减值拨备和贷款成长将保持一致,回拨率也会跟着降低,让贷款成本逐步恢复正常。”

他表示,大马银行正推进4年策略转型大计,并在1月提出自愿互惠遣散计划(MSS),而这项计划不仅能够加强公司架构,长期而言,更可以节省开销和提高效率。

裁1123人

花1.28亿

大马银行在另一份文告公布,至今已批准1123份离职申请,占员工总数的12%,预期MSS开销达1亿2800万令吉。

该公司称,将在6月前逐步发放离职名单,以完成交接工作。

文章来源:

星洲日报‧财经‧2018.03.01

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2017 | 31 Dec 2016 | 31 Dec 2017 | 31 Dec 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 2,159,629 | 1,977,925 | 6,365,400 | 6,140,604 | | 2 | Profit/(loss) before tax | 301,740 | 408,910 | 1,183,025 | 1,360,446 | | 3 | Profit/(loss) for the period | 230,099 | 317,447 | 951,752 | 1,052,093 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 218,978 | 313,167 | 878,717 | 988,793 | | 5 | Basic earnings/(loss) per share (Subunit) | 7.28 | 10.42 | 29.22 | 32.89 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 5.00 | 5.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 5.4100 | 5.3200

|

Type | Announcement | Subject | OTHERS | Description | AMBANK MUTUAL SEPARATION SCHEME (MSS) EXERCISE | AmBank Group has completed its Mutual Separation Scheme (MSS) exercise. The scheme was made available to all eligible permanent employees within the Group. The MSS was voluntary in nature and was introduced as part of AmBank’s Top Four Strategy, to enhance efficiency and productivity within the Group. To aid employees with this transition, career transition programmes, workshops and on-ground job search support continues to be provided.

A total of 1123 applications were approved, representing 12% of the Group’s permanent workforce. Employees whose applications were accepted will be released in batches between January and June 2018 in order to ensure a smooth transition process. Payout for the MSS is estimated at RM128 million. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 5-3-2018 05:35 AM

|

显示全部楼层

发表于 5-3-2018 05:35 AM

|

显示全部楼层

下季纳入1.28亿裁员费.大马银行财测大砍

(吉隆坡1日讯)大马银行(AMBANK,1015,主板金融组)减值贷款增加,第三季净利下挫30%,加上高达1亿2800万令吉裁员费用将在下季度认列,分析员一致大幅下调公司财测及目标价。

马银行研究指出,该公司第三季核心净利下跌24%。在考虑了净利息赚幅(NIM)成长走低和信贷成本高后,马银行下调未来3年财测,各降低10%。

净利息赚幅未改善

丰隆研究认为,大马银行早前定下在2020年成为国内前4大银行,可以看得出有些进展。中小企业贷款按年成长19%。不过,净利息赚幅却缺乏改善迹象,主要定存存款向来往储蓄户头(CASA)转移速度缓慢。

MIDF研究指出,对该公司定期存款成长速度超越CASA一事感到失望,前者按年成长17.7%至799亿令吉,后者仅成长7%至200亿令吉,相信将会进一步使净利息赚幅承压。

针对该公司坏账拨备情况,MIDF指出第三季的拨备走扬至8090万令吉,但当中5000万令吉已经在今年1月偿还,将以回拨方式入账。

达证券在纳入1亿2800万令吉互惠离职方案(MMS)成本考量后,认为该公司2018和2019财年净利将分别减少21.5%和14.7%。

肯纳格研究也调低该公司2018年财测8%,主要是是基于信贷成本走高4个基点以及庞大裁员费用等。

不过,MIDF认为,虽然离职方案费用将会在下个季度认列,但预计每年该公司将省下8000万令吉。

联昌研究则表示,大马银行资产素质出现改善,毛减值贷款从上季度1.88%,走低至1.77%。此外,贷款损失覆盖率也企于100%以上,当中包括监管储备。

达证券保守地认为,金融市场依然充满挑战,大马银行面对挑战包括信贷成本高涨、贷款回拨利好消失以及营运成本走扬等挑战。

文章来源:

星洲日报‧财经‧报道:傅文耀‧2018.03.01 |

|

|

|

|

|

|

|

|

|

|

|

发表于 13-3-2018 04:56 AM

|

显示全部楼层

发表于 13-3-2018 04:56 AM

|

显示全部楼层

傳大馬投銀領導層有變動

2018年3月11日

(吉隆坡11日訊)有消息指出,大馬投銀控股(AMBANK,1015,主要板金融)旗下投資銀行臂膀料迎來新的領導層,集團董事局也有幾個空缺有待填補。

根據財經週刊《The Edge》引述消息指出,大馬投資銀行的集團資本市場執行副總裁蘇秀漢(譯音)將被推薦出任大馬投資銀行總執行長,目前已在該集團服務約15年。他目前也是投資銀行集團資本市場執行副總裁。

“他的委任有待國家銀行批准。”

蘇秀漢將取代目前的大馬投銀總執行長,也是躉售銀行董事經理的拉惹鄭麥慕納拉惹阿都阿茲的職務。

這項調整使拉惹鄭麥慕納拉惹阿都阿茲專注于躉售銀行職務,也是大馬投銀控股的核心業務之一,涵蓋企業和商業銀行、圈球市場、投資銀行和基金管理。

大馬投銀控股發言人通過電郵回應:“我們估計大馬投資銀行將有些變動,一旦完成將作出相關宣布。所有的重組將加強集團架構,迎合我們成為國內4大銀行的目標。”

作為轉型計劃的一部份,大馬投銀控股在8家本土銀行中屬第6大銀行,旨在2020年成四大銀行之一,包括市值、營業額成長和資本回酬的衡量。 |

|

|

|

|

|

|

|

|

|

|

|

发表于 15-3-2018 07:50 AM

|

显示全部楼层

发表于 15-3-2018 07:50 AM

|

显示全部楼层

大马银行

2年财测下修

2018年3月14日

分析:大华继显研究

目标价:4.26令吉

最新进展

大马银行(AMBANK,1015,主板金融股)管理层预计,影响2018财年第三季的主要课题将在2018财年末季和2019财年部分恢复正常,归咎于企业贷款拨备和营运成本压力。

接下来,商业和中小型银行将是该银行主要的增长领域,尤其营业额在5000万令吉以下的中小型企业。

和平离职方案(MSS)已在最近完成,该行也有信心维持净利息赚幅在第三季6.7%的增长率。

行家建议

稳定的净利息赚幅及稳健的贷款增长率,加上MSS后所节省的成本,将推动大马银行2019财年的成本对收入比到55%。

无论如何,净信贷成本恢复扬势,加上更谨慎拨备后的重新入账较低,所以2019财年的核心盈利增长将趋平。

基于较高的信贷成本,我们下修了大马银行2019和2020财年的盈利预测,分别为5%和3%。且预计该行短期内投资回酬也将受较低的重新入账冲击。

【e南洋】 |

|

|

|

|

|

|

|

|

|

|

|

发表于 7-4-2018 06:45 AM

|

显示全部楼层

发表于 7-4-2018 06:45 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 21-4-2018 01:41 AM

|

显示全部楼层

发表于 21-4-2018 01:41 AM

|

显示全部楼层

本帖最后由 icy97 于 23-4-2018 05:26 AM 编辑

Type | Announcement | Subject | OTHERS | Description | Settlement Agreement | With reference to the announcement made by Alliance Bank Malaysia Berhad on 19 April 2018, AMMB Holdings Berhad (AMMB) wishes to confirm that by way of this announcement, the Civil Suit under reference has been amicably settled and there were no financial obligations or implications arising from the settlement on AmBank (M) Berhad (AmBank), a wholly owned subsidiary of AMMB. It also did not cause nor result in any operational impact to AmBank.

This announcement is dated 20 April 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 21-5-2018 03:13 AM

|

显示全部楼层

发表于 21-5-2018 03:13 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 11-6-2018 01:16 AM

|

显示全部楼层

发表于 11-6-2018 01:16 AM

|

显示全部楼层

本帖最后由 icy97 于 15-6-2018 07:21 AM 编辑

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2018 | 31 Mar 2017 | 31 Mar 2018 | 31 Mar 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 2,211,339 | 2,145,147 | 8,576,739 | 8,285,751 | | 2 | Profit/(loss) before tax | 359,688 | 440,744 | 1,542,713 | 1,801,190 | | 3 | Profit/(loss) for the period | 302,072 | 356,683 | 1,253,824 | 1,408,776 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 253,414 | 335,814 | 1,132,131 | 1,324,607 | | 5 | Basic earnings/(loss) per share (Subunit) | 8.43 | 11.17 | 37.64 | 44.06 | | 6 | Proposed/Declared dividend per share (Subunit) | 10.00 | 12.60 | 15.00 | 17.60 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 5.4800 | 5.3200

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 16-6-2018 03:27 AM

|

显示全部楼层

发表于 16-6-2018 03:27 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 29-6-2018 02:37 AM

|

显示全部楼层

发表于 29-6-2018 02:37 AM

|

显示全部楼层

EX-date | 09 Aug 2018 | Entitlement date | 13 Aug 2018 | Entitlement time | 05:00 PM | Entitlement subject | Final Dividend | Entitlement description | Final single-tier dividend of 10.0 sen per ordinary share for the financial year ended 31 March 2018. | Period of interest payment | to | Financial Year End | 31 Mar 2018 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | SYMPHONY SHARE REGISTRARS SDN BHDLevel 6, Symphony HousePusat Dagangan Dana 1Jalan PJU 1A/4647301Petaling JayaTel:0378490777Fax:0378418151 | Payment date | 28 Aug 2018 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 13 Aug 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.1 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 19-7-2018 06:17 AM

|

显示全部楼层

发表于 19-7-2018 06:17 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 1-8-2018 05:39 AM

|

显示全部楼层

发表于 1-8-2018 05:39 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 22-8-2018 01:36 AM

|

显示全部楼层

发表于 22-8-2018 01:36 AM

|

显示全部楼层

本帖最后由 icy97 于 22-8-2018 05:00 AM 编辑

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2018 | 30 Jun 2017 | 30 Jun 2018 | 30 Jun 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 2,171,291 | 2,080,747 | 2,171,291 | 2,080,747 | | 2 | Profit/(loss) before tax | 493,841 | 449,105 | 483,841 | 449,105 | | 3 | Profit/(loss) for the period | 383,256 | 364,544 | 383,256 | 364,544 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 347,594 | 328,273 | 347,594 | 328,273 | | 5 | Basic earnings/(loss) per share (Subunit) | 11.56 | 10.92 | 11.56 | 10.92 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 5.6000 | 5.4800

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 25-8-2018 01:15 AM

|

显示全部楼层

发表于 25-8-2018 01:15 AM

|

显示全部楼层

本帖最后由 icy97 于 25-8-2018 01:56 AM 编辑

|

|

|

|

|

|

|

|

|

|

|

|

发表于 2-12-2018 07:51 AM

|

显示全部楼层

发表于 2-12-2018 07:51 AM

|

显示全部楼层

本帖最后由 icy97 于 18-12-2018 03:45 AM 编辑

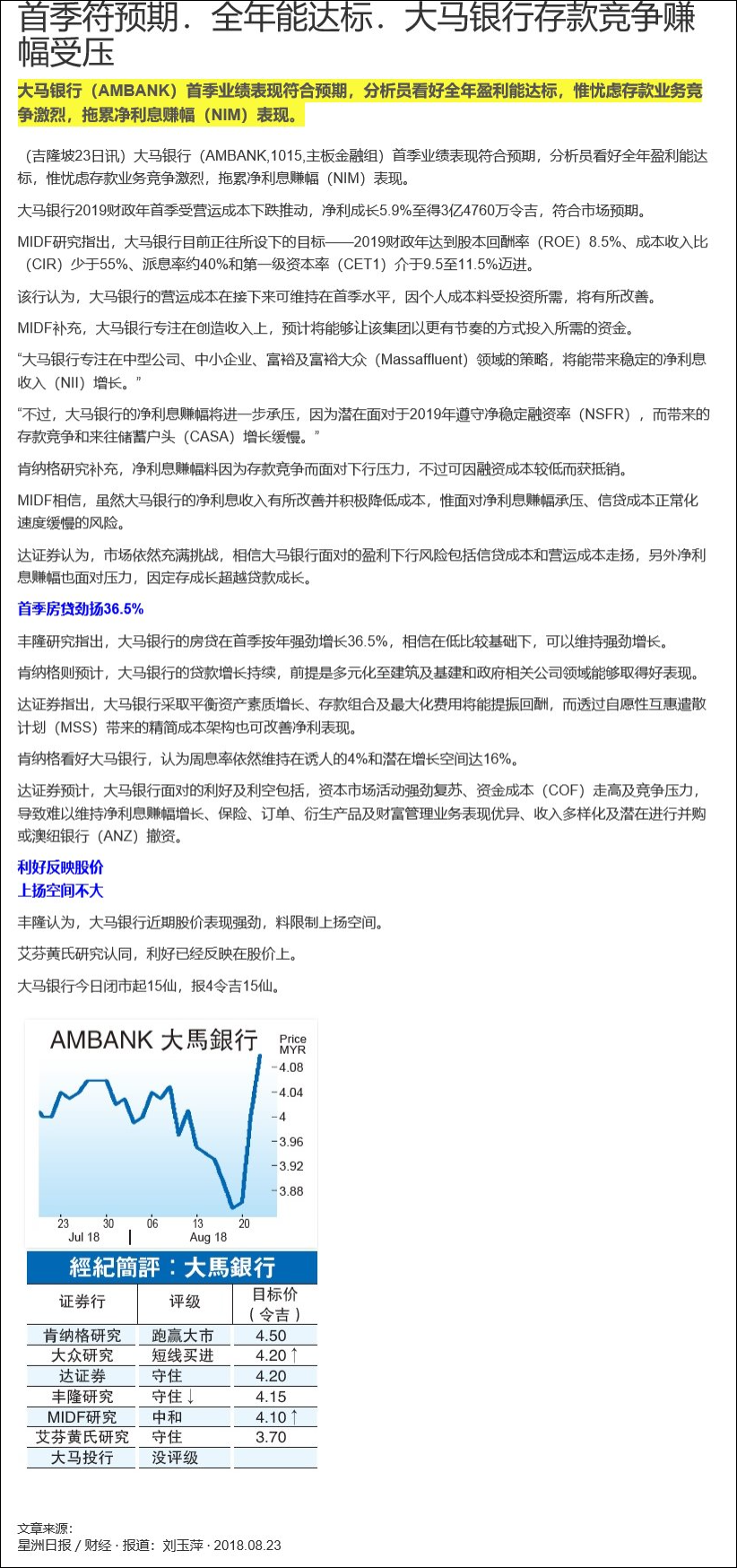

净利增5%-派息5仙-大马银行次季赚3.5亿

http://www.enanyang.my/news/20181122/净利增5-派息5仙-br-大马银行次季赚3-5亿/

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2018 | 30 Sep 2017 | 30 Sep 2018 | 30 Sep 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 2,313,966 | 2,125,024 | 4,485,257 | 4,205,771 | | 2 | Profit/(loss) before tax | 490,657 | 432,180 | 984,498 | 881,285 | | 3 | Profit/(loss) for the period | 378,456 | 357,109 | 761,712 | 721,653 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 348,153 | 331,466 | 695,747 | 659,739 | | 5 | Basic earnings/(loss) per share (Subunit) | 11.57 | 11.02 | 23.13 | 21.94 | | 6 | Proposed/Declared dividend per share (Subunit) | 5.00 | 5.00 | 5.00 | 5.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 5.6300 | 5.4800

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 2-12-2018 07:52 AM

|

显示全部楼层

发表于 2-12-2018 07:52 AM

|

显示全部楼层

EX-date | 13 Dec 2018 | Entitlement date | 17 Dec 2018 | Entitlement time | 05:00 PM | Entitlement subject | Interim Dividend | Entitlement description | Single tier interim dividend of 5.0 sen for the financial year ending 31 March 2019 | Period of interest payment | to | Financial Year End | 31 Mar 2019 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | SYMPHONY SHARE REGISTRARS SDN BHDLevel 6, Symphony HousePusat Dagangan Dana 1Jalan PJU 1A/4647301 Petaling JayaTel: 0378490777Fax: 0378418151 | Payment date | 28 Dec 2018 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 17 Dec 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.05 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 12-12-2018 08:39 AM

|

显示全部楼层

发表于 12-12-2018 08:39 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 19-12-2018 06:39 AM

|

显示全部楼层

发表于 19-12-2018 06:39 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 11-1-2019 06:41 AM

|

显示全部楼层

发表于 11-1-2019 06:41 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 28-1-2019 08:57 AM

|

显示全部楼层

发表于 28-1-2019 08:57 AM

|

显示全部楼层

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

RELATED PARTY TRANSACTIONS | Description | AMMB HOLDINGS BERHAD ("AMMB" or the "Company")Proposed Disposal of Non-Performing Loans / Financing | The Board of Directors of AMMB wishes to announce that its wholly owned subsidiaries, AmBank (M) Berhad (“AmBank”) and AmBank Islamic Berhad (“AmBank Islamic”) are proposing to dispose of their respective non-performing loans/ financing together with all interest, rights, benefits and entitlement thereunder (the “Proposed Disposal”) pursuant to:

(a) a sale and purchase agreement (“SPA”) dated 3 January 2019 between AmBank and Aiqon Amanah Sdn Bhd (“Aiqon Amanah”); and

(b) a SPA dated 3 January 2019 between AmBank Islamic and Aiqon Islamic Sdn Bhd (“Aiqon Islamic”),

(both Aiqon Amanah and Aiqon Islamic are collectively referred to as “Aiqon SPVs”).

The Proposed Disposal is a related party transaction by virtue of the Aiqon SPVs being companies controlled by a person connected to a director and major shareholder of AMMB.

Please refer to the attachment for further details of the Proposed Disposal.

This announcement is dated 3 January 2019. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/6025953

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|