|

|

【AIRPORT 5014 交流专区】大馬机场

[复制链接]

[复制链接]

|

|

|

发表于 23-2-2018 06:56 AM

|

显示全部楼层

发表于 23-2-2018 06:56 AM

|

显示全部楼层

耗巨资提升机场.大马机场前景明朗

(吉隆坡22日讯)尽管大马机场(AIRPORT,5014,主板贸服组)斥巨资提升首都两大机场,以应对新的服务架构,但分析员认为该公司国内外业务皆稳定增长,整体展望依然明朗。

虽然该公司2017财政年核心净利暴增超过10倍至1亿8000万令吉,却仅达到市场全年预测的68%,归因于土耳其业务的折旧开销高于预期。幸而董事部宣布派发每股8仙股息,全年达13仙,超过市场预期。

该公司管理层披露,在提高土耳其萨比哈格克琴机场(ISG)的资本开销后,该公司的经营权延长两年至2032年,如果进一步增加资本开销,经营权有望再延长两年。

拨7亿提升短程列车

行李运送系统和厕所

此外,航空委员会(MAVCOM)第三季将落实服务素质(QoS)架构,第一批名单包括吉隆坡国际机场(KLIA)和吉隆坡第二国际机场(KLIA2),若无法达标,最多可罚取5%航空收入,而大马机场为了加强服务,计划今年拨出6亿至7亿令吉提升短程列车、行李运送系统和厕所。

肯纳格研究表示,随着马印航空和马航减少国内航班,加上马币升值降低国内旅游竞争优势,相信国内机场客流量增长将减缓,预期增幅将从2017年的8.5%放缓到8%,而土耳其机场客流量则有望增长10%。

肯纳格认为,该公司2018财政年土耳其折旧开销将超过当初预测,预期由4亿6800万令吉涨至5亿2800万令吉,促使该行下调现财政年盈利预测21%。

该行将市账率预测从1.74倍降至1.72倍后,下修大马机场的目标价。

不过,该行认为,大马机场股价近期下跌后,上涨空间扩增,决定调高评级,从“落后大市”升至“符合大市”。

MIDF研究认为,国内机场的外国乘客比重从2016财政年的48.7%扩至2017财政年的51.2%,为了争取这些愿意花钱的乘客,相信大马机场将开发更多土地,以提升零售和租赁收入。

艾芬黄氏研究指出,大马机场将以2亿9500万令吉脱售印度机场的11%股权,纳进这笔资金后,决定上修2018财政年盈利预测66%,并在调整基础年份至2018年后,调高目标价。

文章来源:

星洲日报‧财经‧报道:王宝钦‧2018.02.22 |

|

|

|

|

|

|

|

|

|

|

|

发表于 14-3-2018 05:08 AM

|

显示全部楼层

发表于 14-3-2018 05:08 AM

|

显示全部楼层

本帖最后由 icy97 于 15-3-2018 07:19 AM 编辑

农历新年假期带动

大马机场2月搭客增7%

2018年3月13日

(吉隆坡12日讯)大马机场(AIRPORT,5014,主板贸服股)2月国内外机场总搭客流量,按年攀升7.1%至1010万人次;累积12个月,按年增7.9%至1亿2930万人次。

该公司今日发布文告,2月国际搭客流量按年增11.5%至480万人次;国内搭客则起3.3%至520万人次。

仅算在2月来访大马的国际搭客,就已增10.8%,录得410万人次。

大马机场指出,这是新纪录,虽然2月只有28天,但正遇上农历新年季节。

土耳其伊斯坦布尔撒比哈国际机场国际搭客流和国内搭客量,分别按年大涨15.8%和15.4%。

总的来看,该机场的总搭客流量按年增15.5%,继续录得双位数增长。

2月整体航班次数按年起2.6%,报8万1686班次,其中,国际航班有3万2746班次,按年攀12%;国内航班却按年减2.9%,至4万8940班次。

大马机场指出,2月的搭客流量增长主要由国际环节推动。

南亚、东北亚、东南亚和中东环节都录得了正面增长。在农历新年期间,中国籍搭客人数更暴增了39.1%。

【e南洋】

Type | Announcement | Subject | OTHERS | Description | MALAYSIA AIRPORTS HOLDINGS BERHAD ("Malaysia Airports")- Passenger Traffic Snapshot, February 2018 | Malaysia Airports is pleased to announce the passenger traffic snapshot at airports operated by Malaysia Airports Group for the month of February 2018, as attached therewith.

This announcement is dated 12 Mac 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5720461

|

|

|

|

|

|

|

|

|

|

|

|

发表于 16-3-2018 01:14 AM

|

显示全部楼层

发表于 16-3-2018 01:14 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 16-3-2018 02:56 AM

|

显示全部楼层

发表于 16-3-2018 02:56 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 16-3-2018 02:57 AM

|

显示全部楼层

发表于 16-3-2018 02:57 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 25-3-2018 06:22 AM

|

显示全部楼层

发表于 25-3-2018 06:22 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 28-3-2018 03:41 AM

|

显示全部楼层

发表于 28-3-2018 03:41 AM

|

显示全部楼层

本帖最后由 icy97 于 31-3-2018 08:12 AM 编辑

售GMIAL股权 大马机场控股退出马尔代夫机场业务

Samantha Ho/theedgemarkets.com

March 27, 2018 19:46 pm +08

(吉隆坡27日讯)大马机场控股(Malaysia Airports Holdings Bhd)以730万美元(2850万令吉)悉数脱售GMR Male International Airport Ltd(GMIAL)的23%股权,退出马尔代夫的机场业务。

大马机场控股预计从中获得730万美元的收益,因GMIAL的总账面价值已于2014年全面减值。

这笔23%股权的总投资额为690万美元。GMIAL持有25年的特许经营权,在马尔代夫营运Ibrahim Nasir International Airport。

大马机场控股今日向大马交易所报备,独资子公司Malaysia Airports(纳闽)私人有限公司(MALPL)于3月14日与GMR Holdings私人有限公司签订一份股票购买协议,向GMR脱售GMIAL的881万股或23%股权。

GMR Holdings目前持有GMIAL的余下77%股权。

大马机场控股表示,售股计划预计不会对集团发行与缴足股本或大股东持股有任何影响。

2012年11月27日,马尔代夫政府连同Maldives Airports有限公司(MACL)宣布,于2010年颁发予GMIAL的特许协议从开始便已经无效。

根据特许协议规定的争议解决机制,此纠纷带上仲裁庭。而仲裁庭宣布,特许协议有效且具约束力,并非自始无效。

仲裁庭进一步宣布,马尔代夫政府和MACL须因错误中断协议而对GMIAL造成的损失作出赔偿。

2016年11月16日,马尔代夫政府向GMIAL支付2亿7100万美元。这笔钱预计将用于偿还GMIAL的银行贷款、债权人和其他应计开支。

(编译:陈慧珊)

Type | Announcement | Subject | OTHERS | Description | PROPOSED DISPOSAL BY MALAYSIA AIRPORTS (LABUAN) PRIVATE LIMITED (MALPL) OF ITS ENTIRE INTEREST IN GMR MALE INTERNATIONAL AIRPORT LIMITED (GMIAL) (PROPOSED DISPOSAL) | The Board of Directors (Board) of Malaysia Airports Holdings Berhad (MAHB) wishes to announce that its wholly-owned subsidiary, MALPL, has on 14 March 2018 entered into a Share Purchase Agreement (SPA) with (GMR Holdings or the Purchaser) for the disposal of all of the 8,812,190 equity shares, which represents 23% of the total issued and paid-up share capital of GMIAL to GMR Holdings, receivables and loans for a cash consideration of USD7.3 million (approximately RM28.5 million) subject to the terms and conditions contained in the SPA (Transaction).

The Proposed Disposal was agreed with GMR Holdings (the majority shareholder with 77% shareholding in GMIAL) subsequent to the following events announced and disclosed previously: - GMIAL was incorporated in the Republic in Maldives on 9 August 2010 to operate, maintain, expand, rehabilitate and modernise the Ibrahim Nasir Airport for a period of 25 years. MALPL has invested a total equity of USD6.9 million (equivalent to RM26.9 million) for the 23% shares in GMIAL.

- On 27 November 2012, the Government of Maldives together with the Maldives Airports Company Limited (MACL) declared that the concession agreement with GMIAL which was awarded in 2010, as void ab initio.

- The dispute was brought to an arbitration tribunal as per the dispute resolution mechanics stipulated under the concession agreement. The arbitration tribunal declared that the concession agreement was valid and binding and was not void ab initio. The arbitration tribunal further declared that the Government of Maldives and MACL were liable in damages to GMIAL for loss caused by wrongful repudiation of the agreement.

- On 16 November 2016, the Government of Maldives had paid a total sum of approximately USD271 million (equivalent to RM1,058 million) being the damages to GMIAL. These funds are expected to be utilised for settlement of GMIAL’s bank borrowings, creditors and other accrual expenses.

The Proposed Disposal is not expected to have any effect on MAHB’s issued and paid-up share capital and/or MAHB’s substantial shareholders’ shareholding in MAHB.

The total carrying value of GMIAL in MAHB’s book has been fully impaired in 2014. As such, the gain arising from the Proposed Disposal is estimated to be USD7.3 million (equivalent to RM28.5 million).

This announcement is dated 27 March 2018.

Remarks: The exchange rate of the United States Dollar (USD) 1.00 : Ringgit Malaysia (RM) 3.9035 being the middle rates prevailing as at 17:00 on 14 March 2018 as published by Bank Negara Malaysia, have been applied in this announcement for illustration purposes. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 31-3-2018 01:25 AM

|

显示全部楼层

发表于 31-3-2018 01:25 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 3-4-2018 12:21 AM

|

显示全部楼层

发表于 3-4-2018 12:21 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 6-4-2018 07:39 AM

|

显示全部楼层

发表于 6-4-2018 07:39 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | UPDATES ON WRIT OF SUMMONS SERVED ON MALAYSIA AIRPORTS HOLDINGS BERHAD | In furtherance to the announcement made by Malaysia Airports Holdings Berhad (the Company) on 4 October 2017, we wish to announce that the Court of Appeal on 30 March 2018 had allowed Syarikat Pembinaan Anggerik Sdn Bhd’s (SPASB) appeal relating to the decision made by the High Court on 23 August 2017 in favour of the Company that granted the Company’s Stay Application in respect of SPASB’s claims against the Company at the High Court.

SPASB’s appeal was allowed on the ground, inter alia, that there is no arbitration agreement in the Contract within the meaning of section 9 of the Arbitration Act 2005 and therefore in essence, SPASB is right in commencing a legal action in court. The Court of Appeal further awarded costs of RM 20,000.00 for the application at the High Court and the appeal at the Court of Appeal.

Any further updates in respect of any material development of this case will be made from time to time.

This announcement is dated 3 April 2018.

Remarks : Further to the announcement made on 3 April 2018, the attachment pertaining to the Passenger Traffic Snapshot May 2015 was inadvertently attached and now has been removed accordingly. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 7-4-2018 03:15 AM

|

显示全部楼层

发表于 7-4-2018 03:15 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 7-4-2018 05:38 AM

|

显示全部楼层

发表于 7-4-2018 05:38 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 11-4-2018 04:32 AM

|

显示全部楼层

发表于 11-4-2018 04:32 AM

|

显示全部楼层

本帖最后由 icy97 于 11-4-2018 07:42 AM 编辑

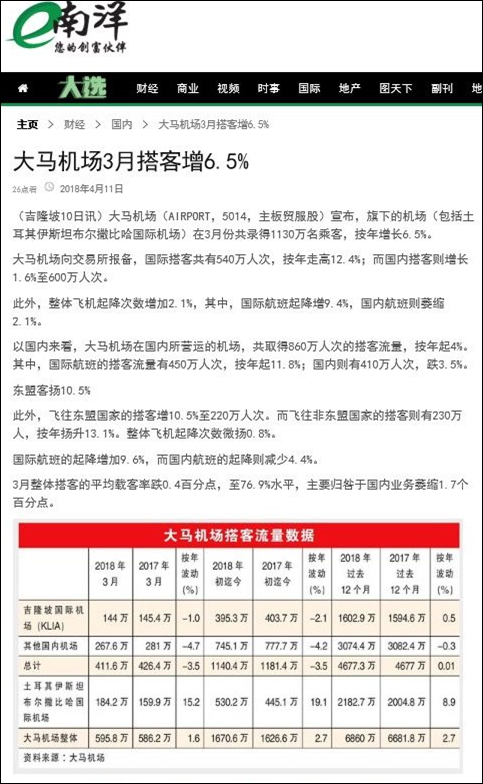

Type | Announcement | Subject | OTHERS | Description | MALAYSIA AIRPORTS HOLDINGS BERHAD (Malaysia Airports)- Passenger Traffic Snapshot, March 2018 | Malaysia Airports is pleased to announce the passenger traffic snapshot at airports operated by Malaysia Airports Group for the month of March 2018, as attached therewith.

This announcement is dated 10 April 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5754065

|

|

|

|

|

|

|

|

|

|

|

|

发表于 16-4-2018 06:31 AM

|

显示全部楼层

发表于 16-4-2018 06:31 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 22-4-2018 03:03 AM

|

显示全部楼层

发表于 22-4-2018 03:03 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 7-5-2018 01:01 AM

|

显示全部楼层

发表于 7-5-2018 01:01 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 10-5-2018 03:49 PM

|

显示全部楼层

发表于 10-5-2018 03:49 PM

|

显示全部楼层

| MALAYSIA AIRPORTS HOLDINGS BERHAD |

EX-date | 23 May 2018 | Entitlement date | 25 May 2018 | Entitlement time | 05:00 PM | Entitlement subject | Final Dividend | Entitlement description | Final single-tier dividend of 8 sen per ordinary share | Period of interest payment | to | Financial Year End | 31 Dec 2017 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | SECURITIES SERVICES (HOLDINGS) SDN BHDLevel 7, Menara MileniumJalan Damanlela, Pusat Bandar DamansaraDamansara Heights50490Kuala LumpurTel:0320849000Fax:0320949940 | Payment date | 06 Jun 2018 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 25 May 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.08 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 11-5-2018 02:02 AM

|

显示全部楼层

发表于 11-5-2018 02:02 AM

|

显示全部楼层

Type | Announcement | Subject | MATERIAL LITIGATION | Description | LEGAL ACTION AGAINST AIRASIA X BERHAD FOR THE OUTSTANDING AMOUNT DUE AND OWING TO MALAYSIA AIRPORTS (SEPANG) SDN BHD | The Board of Directors of Malaysia Airports Holdings Berhad (the Company) wishes to announce that Malaysia Airports (Sepang) Sdn Bhd (the Plaintiff), a wholly owned subsidiary of the Company, has on 27 April 2018, filed the Writ of Summons and Statement of Claim at the Shah Alam High Court on AirAsia X Berhad (the Defendant).

The claim is in the sum of RM34,884,695.96 being the outstanding airport charges, rent and late payment charges (the Outstanding Amount) pursuant to the relevant agreements entered into between the parties.

Despite numerous demands, the Defendant has refused and/or failed to pay the Outstanding Amount.

The Board of the Company is of the opinion that it is necessary for Malaysia Airports (Sepang) Sdn Bhd to pursue the civil suit to best protect its interest.

The civil suit is not expected to have any material impact on the financial and operational position of the Company.

Any further updates in respect of any material development will be made from time to time.

This announcement is dated 30 April 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 11-5-2018 03:10 AM

|

显示全部楼层

发表于 11-5-2018 03:10 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | MALAYSIA AIRPORTS HOLDINGS BERHAD (MAHB)SHAREHOLDERS AGREEMENT DATED 2 NOVEMBER 2017 BETWEEN CAINIAO SMART LOGISTICS NETWORK (HONG KONG) LIMITED (COMPANY NO. 2252146) (CAINIAO HK) AND MA ELOGISTICS SDN. BHD. (COMPANY NO. 1253685-H) (MA ELOGISTICS) IN RELATION TO CAINIAO KLIA AEROPOLIS SDN. BHD. (COMPANY NO. 1258491-V) (JV COMPANY), WHICH IS SUPPLEMENTED BY THE DEED OF ADHERENCE SIGNED BY THE JV COMPANY ON 14 MARCH 2018 (SHAREHOLDERS AGREEMENT) | We refer to our earlier announcement dated 3 November 2017 (Announcement) in relation to the Shareholders’ Agreement with Cainiao HK for the purpose of implementing and carrying out the development of a regional e-Commerce and logistics hub, comprising the development of cargo terminals, sorting centres, warehouses and fulfillment centres and other facilities for e-commerce industry, in the KLIA Aeropolis as part of the Digital Free Trade Zone (DFTZ) initiative in Malaysia. Unless otherwise stated, the terms used herein shall have the same meaning as defined in the Announcement.

The Board of Directors of MAHB (Board) wishes to announce that the SHA has come into effect today and accordingly, Cainiao HK and MA eLogistics have completed their subscription of shares in the JV Company in the proportion of 70% and 30% respectively.

The Board also wishes to announce that with the Shareholders’ Agreement becoming effective today, Malaysia Airports (Sepang) Sdn. Bhd. (Company No. 320480-D) (MA (Sepang)), a wholly-owned subsidiary of MAHB, has entered into a sublease annexure with the JV Company and Federal Lands Commissioner (Sublease) for a sublease to be granted by MA (Sepang) to the JV Company in respect of part of the land identified as H.S.(D) 7445 PT No. 29 Bandar Lapangan Terbang Antarabangsa Sepang, Daerah Sepang, Negeri Selangor, measuring approximately 60 acres for a term of 30 years commencing from 3 May 2018 and expiring on 2 May 2048 and under the terms of the sublease annexure, the sublease shall be automatically renewed until 10 February 2069.

This announcement is dated 3 May 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 12-5-2018 01:11 AM

|

显示全部楼层

发表于 12-5-2018 01:11 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|