|

|

发表于 14-12-2017 01:49 AM

|

显示全部楼层

发表于 14-12-2017 01:49 AM

|

显示全部楼层

本帖最后由 icy97 于 16-12-2017 02:12 AM 编辑

许甲明获1680万建材合约

2017年12月5日

(吉隆坡4日讯)许甲明(KKB,9466,主板贸服股)获颁一张合约和两张建材供应订单,总值近1680万令吉。

许甲明向马交所报备,于11月28日,获得福平实业私人有限公司颁发合约,为后者在砂拉越木胶计划打造的巴陵造煤厂,供应、制造、运送和安装钢结构、屋顶、墙面覆层和相关配件。

根据文告,许甲明计划会在2018财年第三季,完成上述合约工作内容。

另外,公司也接获来自LP Capital建筑有限公司以及MKM Wira (大马)私人有限公司的两张订单。

许甲明将为两家公司共有软钢建材,并预计可在明年上半年之内完成任务。

许甲明预计,上述的合约和订单将会积极贡献公司2018财年的净利和净资产。【e南洋】

Type | Announcement | Subject | OTHERS | Description | LETTER OF AWARDS | The Board of Directors (“the Board”) of KKB Engineering Berhad (“KKB”) is pleased to announce that KKB has received a Letter of Award from Hock Peng Realty Sdn Bhd (“HPRSB”) on 28 November 2017 for the Supply, Fabrication, Delivery and Installation of Steel Structures and Installation of Roof Covering and Wall Cladding and Accessories for The Proposed Balingian Coal Stockyard, Mukah, Sarawak.

KKB has also received a Purchase Order from LP Capital Construction Sdn Bhd (“LPCC”) for the Supply of Mild Steel Pipes and Fittings for the Projek Bekalan Air Luar Bandar (BALB), Serian, Sarawak and additionally, a Purchase Order from MKM Wira (M) Sdn Bhd (“MKM”) for the Supply of the Mild Steel Concrete Lined (MSCL) Pipes and Fittings.

The total combined contract sum for the abovementioned contract/orders is worth approximately RM16.8 million (Ringgit Malaysia: Sixteen Million Eight Hundred Thousand Only).

The completion date for HPRSB is scheduled within the third quarter of 2018 (3Q2018), LPCC and MKM within the first half 2018 (1H2018).

To the best of our knowledge, none of the Directors or major shareholders or person connected with them has any interest, direct or indirect in the abovementioned three (3) awards. The Board is of the opinion that the abovementioned awards are in the best interest of KKB and its Group.

The above awards are expected to contribute positively to the earnings and net assets of the KKB Group for the financial year ending 31 December 2018.

This announcement is dated 4 December 2017. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 3-1-2018 02:18 AM

|

显示全部楼层

发表于 3-1-2018 02:18 AM

|

显示全部楼层

本帖最后由 icy97 于 3-1-2018 04:06 AM 编辑

许甲明获1270万合约

2018年1月3日

(吉隆坡2日讯)许甲明(KKB,9466,主板贸服股)宣布获颁两项合约,总值1270万令吉。

许甲明向交易所报备,去年12月29日获颁的两项合约,分别是为NGC能源私人有限公司供应新的C14液压缸,以及为国油贸易(PETDAG,5681,主板贸服股)制造及修复液化石油气液压缸。

其中,前者预计会在首季完成,而后者则预计会为期一年,另有延长一年的选择权。

两个合约总值1270万令吉,相信能贡献2018财年的净利和净资产。【e南洋】

Type | Announcement | Subject | OTHERS | Description | LETTER OF AWARDS | The Board of Directors (“the Board”) of KKB Engineering Berhad (“KKB”) is pleased to announce that KKB has on 29 December 2017 accepted the following Letters of Award:

i) NGC Energy Sdn Bhd (“NGC”) for the Supply of New C14 Cylinders. The completion date for NGC shall be within first quarter of 2018 (1Q2018).

ii) Petronas Dagangan Berhad (“PETRONAS”) for Price Agreement for the Fabrication and Reconditioning of LPG Cylinders for a period of one (1) year with an Option to Extend for another one (1) year with effect from 18 December 2017.

The total combined contract sum for the abovementioned contracts in 2018 is worth approximately RM12.7 million (Ringgit Malaysia: Twelve Million Seven Hundred Thousand Only).

To the best of our knowledge, none of the Directors or major shareholders or person connected with them has any interest, direct or indirect in the abovementioned two (2) awards. The Board is of the opinion that the abovementioned awards are in the best interest of KKB and its Group.

The above awards are expected to contribute positively to the earnings and net assets of the KKB Group for the financial year ending 31 December 2018.

This announcement is dated 2 January 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 6-2-2018 01:37 AM

|

显示全部楼层

发表于 6-2-2018 01:37 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | ANNOUNCEMENT ON NEW SUBSIDIARY | The Board of Directors of KKB Engineering Berhad (“KKB” or “the Company”) wishes to annouce that KKB has subscribed 5,000,000 new ordinary shares in the share capital of OceanMight Sdn. Bhd. (“OMSB”), an associate company of KKB. The approval to the said subscription of new shares was approved on 24 January 2018. Following the said subscription of new shares, OMSB became a 60.81% owned subsidiary of the Company.

None of the Directors or major shareholders or persons connected with them has any interest, direct and indirect, in the said subscription of new shares. It does not have any material impact on the net assets and earnings per share of KKB Group for the financial year ending 31 December 2018.

This announcement is dated 5 February 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 10-2-2018 03:45 AM

|

显示全部楼层

发表于 10-2-2018 03:45 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | (1) Recommendation of First and Final Single Tier Dividend(2) Proposed Renewal of Shareholder Mandate for Recurrent Related Party Transactions of a Revenue or Trading Nature ("RRPT") ("Proposed Shareholder Mandate") | The Board of Directors ("Board") of KKB Engineering Berhad ("KKB") wishes to announce that the Board has on 9 February 2018:

(i) recommended a First and Final Single Tier Dividend of 2 sen per ordinary share in respect of the financial year ended 31 December 2017, payable on 12 June 2018 to depositors whose names appear in the Record of Depositors on 21 May 2018, for approval by shareholders at the forthcoming Forty-Second Annual General Meeting of the Company (“ 42nd AGM”). The notice of dividend entitlement and payment shall be advertised at a later date.

The date of the 42nd AGM will be announced at a later date.

(ii) proposed to seek shareholder mandate for the existing RRPT by way of an ordinary resolution at the 42nd AGM. A Circular to Shareholders seeking for shareholders' approval on the Proposed Shareholder Mandate is currently being prepared.

The existing shareholder mandate was obtained at the 41st AGM of KKB held on 18 May 2017. In accordance with the Main Market Listing Requirements of Bursa Malaysia Securities Berhad, the existing shareholder mandate shall lapse at the conclusion of the 42nd AGM, unless renewal is obtained.

This announcement is dated 9 February 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 10-2-2018 04:14 AM

|

显示全部楼层

发表于 10-2-2018 04:14 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2017 | 31 Dec 2016 | 31 Dec 2017 | 31 Dec 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 70,169 | 26,123 | 209,271 | 103,111 | | 2 | Profit/(loss) before tax | 10,297 | -6,640 | 6,404 | -9,141 | | 3 | Profit/(loss) for the period | 6,196 | -4,312 | 3,296 | -5,743 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 5,343 | -4,063 | 1,639 | -5,780 | | 5 | Basic earnings/(loss) per share (Subunit) | 2.07 | -1.58 | 0.64 | -2.24 | | 6 | Proposed/Declared dividend per share (Subunit) | 2.00 | 0.00 | 2.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.1100 | 1.1100

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 14-2-2018 06:03 AM

|

显示全部楼层

发表于 14-2-2018 06:03 AM

|

显示全部楼层

去年转亏为盈.许甲明财测上调

(吉隆坡12日讯)许甲明工程(KKB,9466,主板工业产品组)2017财政年成功转亏为盈,表现胜于预期,让大众研究喜出望外,并上调其2018和2019财政年财测5至11%。

盈利表现胜预期,带动许甲明工程周一高开高走,开盘即跳开4仙或4.55%至92仙,盘中最高见96仙,起8仙或9.09%,但后涨势遭套利活动稀释,最终收在91.5仙,涨3.5仙或3.98%。

大众研究表示,许甲明工程2017财政年第四季净利按年大涨231%至530万令吉,带动全年录得160万令吉净利,比较前期为净亏损580万令吉,归功于油井平台制造工程改善,以及联号公司盈利好转。

建筑臂膀(特别是泛婆罗洲大道工程)则是营业额最大动力来源,其中制造与工程业务贡献许甲明工程总营业额的79%,钢铁制造业务则因主要工程几近竣工年减38%。

该行补充,许甲明工程现竞标约3亿2200万令吉合约,其中多数为石油与天然气,以及工程与制造合约,而现有工程则达10亿令吉,可确保公司持续忙碌至2020年第四季。

综合上述原因,以及入账预期,大众研究决定上调许甲明工程2018和2019财政年盈利目标11%和5%,但维持“中和”评级和95仙目标价不变。

文章来源:

星洲日报‧财经‧2018.02.13 |

|

|

|

|

|

|

|

|

|

|

|

发表于 31-3-2018 03:04 AM

|

显示全部楼层

发表于 31-3-2018 03:04 AM

|

显示全部楼层

本帖最后由 icy97 于 1-4-2018 06:51 AM 编辑

Type | Announcement | Subject | OTHERS | Description | AWARD OF CONTRACT FOR PROVISION OF ENGINEERING, PROCUREMENT, CONSTRUCTION AND COMMISSIONING OF WELLHEAD PLATFORMS FOR D18 PHASE 2 PROJECT AND D28 PHASE 1 PROJECT (CONTRACT NO: CHO/2017/D18/1002) | 1. INTRODUCTION The Board of Directors (“the Board”) of KKB Engineering Berhad (“KKB”) is pleased to announce that its subsidiary company, OceanMight Sdn Bhd (“OMSB”) (approved PETRONAS Licensed Company for Offshore Facilities Const-Major Fabrication-Offshore Facilities) has been awarded a contract on 14 March 2018 from PETRONAS Carigali Sdn Bhd (“PETRONAS Carigali”) for the Provision of Engineering, Procurement, Construction and Commissioning of Wellhead Platforms for D18 Phase 2 Project and D28 Phase 1 Project (“the Contract”).

2. DURATION OF CONTRACT The Contract duration is approximately 21 months, in which 9 months are for the work execution for D28 Phase 1 Project while another 12 months are the warranty period. The Contract will commence in March 2018.

The scope for D28 Phase 1 Project shall be Engineering, Procurement, Construction, Transportation, Installation and Commissioning. The detailed scope of works is specified in the Contract document between OMSB and PETRONAS Carigali.

3. FINANCIAL EFFECTS The Contract will have no effect on the Issued and Paid-up Capital of the Company and is expected to contribute positively towards the earnings and net assets of the Company for the duration of the Contract.

4. RISK FACTORS Risk factors affecting the award include execution risks such as changes in the basis of design, availability of skilled manpower, delays in material deliveries, changes in prices of materials, changes in political, economic and regulatory conditions.

5. DIRECTORS’ AND MAJOR SHAREHOLDERS’ INTERESTS None of the Directors and/or major shareholders and/or person connected with them has any interest, direct or indirect in the abovementioned Contract.

6. DIRECTORS’ STATEMENT The Board is of the opinion that the abovementioned Contract is in the best interest of KKB and its Group.

This announcement is dated 30th March 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 6-4-2018 06:38 AM

|

显示全部楼层

发表于 6-4-2018 06:38 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 11-4-2018 02:45 AM

|

显示全部楼层

发表于 11-4-2018 02:45 AM

|

显示全部楼层

EX-date | 17 May 2018 | Entitlement date | 21 May 2018 | Entitlement time | 04:00 PM | Entitlement subject | First and Final Dividend | Entitlement description | A First and Final Single Tier Dividend of two (2) sen per ordinary share | Period of interest payment | to | Financial Year End | 31 Dec 2017 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | SYMPHONY SHARE REGISTRARS SDN BHDLevel 6, Symphony HousePusat Dagangan Dana 1Jalan PJU 1A/4647301 Petaling JayaSelangor Darul EhsanTel:0378418000Fax:0378418151 | Payment date | 12 Jun 2018 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 21 May 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.02 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 17-5-2018 04:00 AM

|

显示全部楼层

发表于 17-5-2018 04:00 AM

|

显示全部楼层

本帖最后由 icy97 于 20-5-2018 05:05 AM 编辑

Type | Announcement | Subject | OTHERS | Description | Letter of Award (LOA) from SAPURA FABRICATION SDN BHD (SFSB) for the Provision of Procurement and Construction for Wellhead Deck, Piles and Conductors | INTRODUCTION The Board of Directors (“the Board”) of KKB Engineering Berhad (“KKB”) is pleased to announce that its subsidiary company, OceanMight Sdn Bhd has accepted and signed a Letter of Award (“LOA)”from SAPURA FABRICATION SDN BHD (“SFSB”) for the Provision of Procurement and Construction for Wellhead Deck, Piles and Conductors AND subject to Terms and Conditions pending the signing of the Sub-Contract Agreement.

INFORMATION ON THE CONTRACT This LOA is part of the SFSB’s engineering, procurement, construction, installation and commissioning (“EPCIC”) for the Pegaga Development Project (Mubadala Petroleum) in Block SK320, offshore waters of Sarawak. The said Sub-Contract shall commence in April 2018.

FINANCIAL EFFECTS The above award is expected to contribute positively to the earnings and net assets of the KKB Group for the financial years ending 31 December 2018 to 31 December 2019.

RISK FACTORS Risk factors affecting the Sub-Contract include execution risks such as availability of skilled manpower and materials, changes in pricing, weather conditions and/or political, economic and/or regulatory conditions.

DIRECTORS’ AND MAJOR SHAREHOLDERS’ INTERESTS To the best of our knowledge, none of the Directors or major shareholders or person connected with them has any interest, direct or indirect in the abovementioned award. The Board is of the opinion that the abovementioned award is in the best interest of KKB and its Group.

This announcement is dated 15 May 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 17-5-2018 06:03 AM

|

显示全部楼层

发表于 17-5-2018 06:03 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2018 | 31 Mar 2017 | 31 Mar 2018 | 31 Mar 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 64,558 | 42,924 | 64,558 | 42,924 | | 2 | Profit/(loss) before tax | 2,422 | -1,489 | 2,422 | -1,489 | | 3 | Profit/(loss) for the period | 1,371 | -1,228 | 1,371 | -1,228 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 1,345 | -1,475 | 1,345 | -1,475 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.52 | -0.57 | 0.52 | -0.57 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.1200 | 1.1100

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 20-5-2018 05:31 AM

|

显示全部楼层

发表于 20-5-2018 05:31 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 7-8-2018 02:39 AM

|

显示全部楼层

发表于 7-8-2018 02:39 AM

|

显示全部楼层

本帖最后由 icy97 于 7-8-2018 05:35 AM 编辑

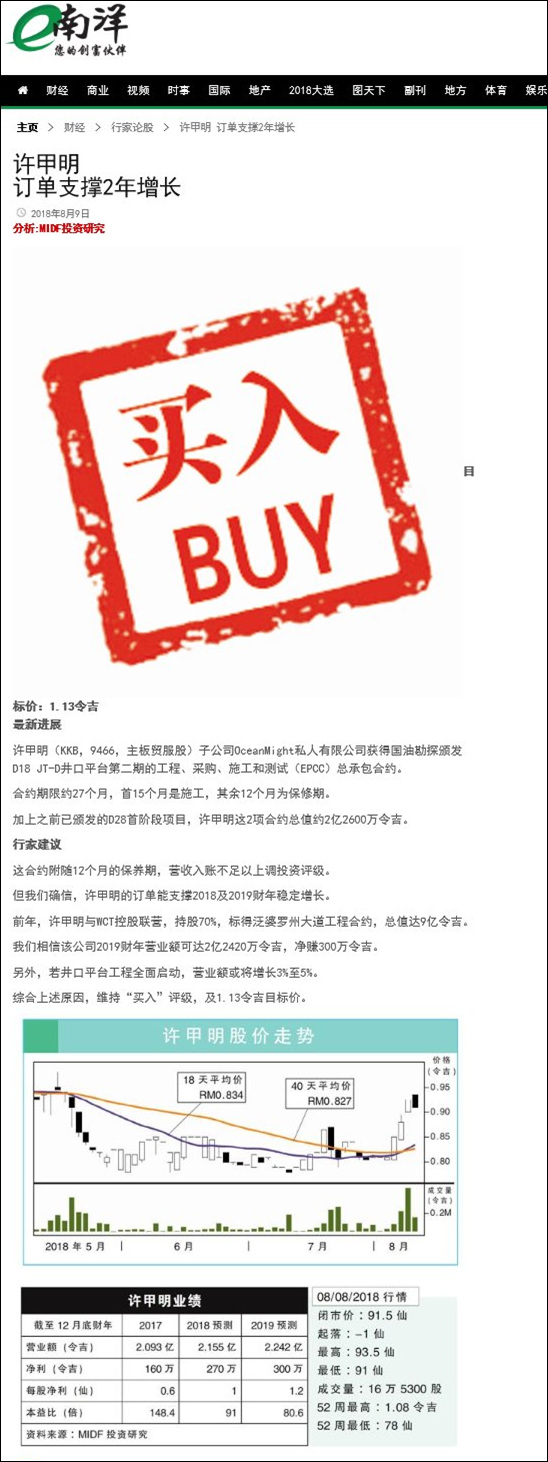

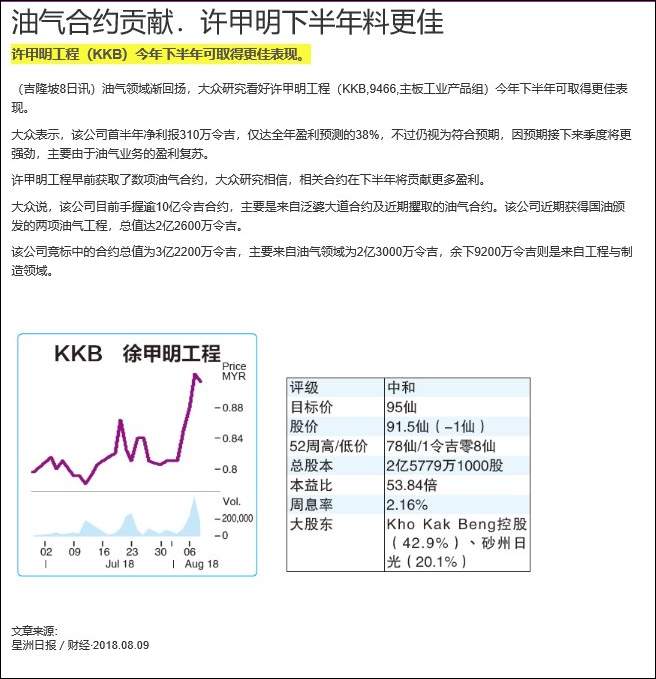

Type | Announcement | Subject | OTHERS | Description | AWARD OF CONTRACT FOR THE PROVISION OF ENGINEERING, PROCUREMENT, CONSTRUCTION, COMMISSIONING OF WELLHEAD PLATFORMS FOR D18 PHASE 2 PROJECT AND D28 PHASE 1 PROJECT (CONTRACT NO.: CHO/2017/D18/1002) | 1. INTRODUCTION Further to the announcement made on 30 March 2018, the Board of Directors (“the Board”) of KKB Engineering Berhad (“KKB”) is pleased to announce that PETRONAS Carigali Sdn Bhd (“PETRONAS Carigali”) has awarded OceanMight Sdn Bhd (“OMSB”), a subsidiary of KKB, an award of contract for the Provision of Engineering, Procurement, Construction, Commissioning of Wellhead Platforms for D18 Phase 2 project via a Letter of Award dated 19 July 2018 (“the Contract”).

OMSB is an approved PETRONAS Licensed Company for Offshore Facilities Construction - Major Fabrication - Offshore Facilities.

2. DURATION OF CONTRACT The Contract duration is approximately 27 months, in which 15 months are for work execution for D18 Phase 2 Project while the other 12 months are the warranty period. The Contract has commenced in July 2018.

The scope for the Contract shall be Engineering, Procurement, Construction, Transportation, Installation and Commissioning of D18 JT-D Wellhead Platform. The detailed scope of works is specified in the Contract documentation between OMSB and PETRONAS Carigali.

With the award of D18 Phase 2 Project, the total combined contract sum for both D28 Phase 1 and D18 Phase 2 Projects is approximately RM226 million.

3. FINANCIAL EFFECTS The Contract will have no effect on the Issued and Paid-up Capital of the Company and is expected to contribute positively towards the earnings and net assets of the Company for the duration of the Contract.

4. RISK FACTORS Risk factors affecting the award include execution risks such as changes in the basis of design, availability of skilled manpower, delays in material deliveries, changes in prices of material, changes in political, economic and regulatory conditions.

5. DIRECTORS’ AND MAJOR SHAREHOLDERS’ INTERESTS None of the Directors and/or major shareholders and/or person connected with them has any interest, direct or indirect in the abovementioned Contract.

6. DIRECTORS’ STATEMENT The Board is of the opinion that the abovementioned Contract is in the best interest of KKB and its Group.

This announcement is dated 6 August 2018 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 8-8-2018 01:45 AM

|

显示全部楼层

发表于 8-8-2018 01:45 AM

|

显示全部楼层

本帖最后由 icy97 于 9-8-2018 05:17 AM 编辑

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2018 | 30 Jun 2017 | 30 Jun 2018 | 30 Jun 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 93,194 | 46,873 | 157,751 | 89,797 | | 2 | Profit/(loss) before tax | 3,294 | -9,240 | 5,716 | -10,730 | | 3 | Profit/(loss) for the period | 2,597 | -6,889 | 3,968 | -8,117 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 1,760 | -7,202 | 3,105 | -8,677 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.68 | -2.79 | 1.20 | -3.37 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.1000 | 1.1100

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 9-8-2018 04:08 AM

|

显示全部楼层

发表于 9-8-2018 04:08 AM

|

显示全部楼层

本帖最后由 icy97 于 10-8-2018 04:45 AM 编辑

|

|

|

|

|

|

|

|

|

|

|

|

发表于 1-12-2018 01:56 AM

|

显示全部楼层

发表于 1-12-2018 01:56 AM

|

显示全部楼层

本帖最后由 icy97 于 17-12-2018 06:52 AM 编辑

建筑和制钢业务带动-许甲明第三季劲扬39%

http://www.enanyang.my/news/20181120/建筑和制钢业务带动br-许甲明第三季劲扬39

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2018 | 30 Sep 2017 | 30 Sep 2018 | 30 Sep 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 112,183 | 49,305 | 269,935 | 139,102 | | 2 | Profit/(loss) before tax | 10,643 | 6,836 | 16,359 | -3,893 | | 3 | Profit/(loss) for the period | 8,587 | 5,217 | 12,555 | -2,900 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 6,932 | 4,973 | 10,036 | -3,704 | | 5 | Basic earnings/(loss) per share (Subunit) | 2.69 | 1.93 | 3.89 | -1.44 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.1300 | 1.1100

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 18-12-2018 05:13 AM

|

显示全部楼层

发表于 18-12-2018 05:13 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 15-1-2019 07:02 AM

|

显示全部楼层

发表于 15-1-2019 07:02 AM

|

显示全部楼层

本帖最后由 icy97 于 21-1-2019 06:51 AM 编辑

许甲明工程获4670万钢管供应补充合约

Syahirah Syed Jaafar/theedgemarkets.com

December 20, 2018 19:07 pm +08

http://www.theedgemarkets.com/article/许甲明工程获4670万钢管供应补充合约

(吉隆坡20日讯)许甲明工程(KKB Engineering Bhd)子公司获得供应和交付混凝土软钢管及机械耦合的补充合约,估计价值4670万令吉。

许甲明工程今日向大马交易所报备,子公司Harum Bidang私人有限公司获得Cahya Mata Sarawak Bhd(CMSB)子公司CMS Infra Trading私人有限公司(CMSIT)颁发的合约,向位于古晋Tanah Puteh的砂拉越公共工程局供应和交付钢管。

该集团表示,合约将根据CMSIT在必要时发出的采购订单,合约有效期至2020年8月31日。

该集团预计,这将为合约期内的盈利的净资产作出贡献。

(编译:陈慧珊)

Type | Announcement | Subject | OTHERS | Description | LETTER OF AWARD | The Board of Directors (“the Board”) of KKB Engineering Berhad (“KKB”) is pleased to announce that Harum Bidang Sdn Bhd, a subsidiary of KKB, has received a Supplementary Contract from CMS Infra Trading Sdn Bhd (“CMSIT”) for the Supply and Delivery of Concrete-Lined Mild Steel Pipes and Mechanical Couplings to JKR Central Unallocated Stores, Tanah Puteh, Kuching (On “As and When Required” basis).

The estimated value of supply is worth approximately RM46.7 million (Ringgit Malaysia Forty Six Million Seven Hundred Thousand Only).

DURATION OF CONTRACT The supply and delivery will be based on issuance of Purchase Orders by CMSIT on a “As and When Required” basis. The expiry date for this Supplementary Contract is on 31 August 2020.

FINANCIAL EFFECTS The Contract will have no effect on the Share Capital of the Company and is expected to contribute positively towards the earnings and net assets of the Company and Group for the duration of the contract.

RISK FACTORS Risk factors affecting the Contract include execution risks such as availability of skilled manpower and materials, changes in pricing, weather conditions and/or political, economic and regulatory conditions.

DIRECTORS’ AND MAJOR SHAREHOLDERS’ INTEREST Cahya Mata Sarawak Berhad (“CMSB”) is a major shareholder of KKB. CMSIT is a subsidiary of CMSB and accordingly, CMSB is deemed interested in the award. Datuk Syed Ahmad Alwee Alsree is a Director of KKB while Encik Syed Hizam Alsagoff is an alternate director to Datuk Syed Ahmad Alwee Alsree in KKB. Datuk Syed Ahmad Alwee Alsree is also a Director of CMSB and both Datuk Syed Ahmad Alwee Alsree and Encik Syed Hizam Alsagoff are the nominees of CMSB and persons connected with CMSB and accordingly, they are deemed interested in the award.

KKB has obtained the Shareholder Mandate at its Annual General Meeting held on 16 May 2018. Immediate announcement will be made to the Exchange when the actual value of the transaction exceeds the estimated value as disclosed in the circular to shareholders by 10% or more.

Save as aforesaid above, none of the Directors and/or major shareholders and/or persons connected with them has any interest, direct or indirect in the abovementioned contract.

DIRECTORS’ STATEMENT The Board is of the opinion that the abovementioned contract is in the best interest of KKB and its Group.

This announcement is dated 20 December 2018.

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 19-1-2019 03:50 AM

|

显示全部楼层

发表于 19-1-2019 03:50 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 30-1-2019 04:04 AM

|

显示全部楼层

发表于 30-1-2019 04:04 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | LETTER OF AWARD | The Board of Directors (“the Board”) of KKB Engineering Berhad (“KKB”) is pleased to announce that its subsidiary, OceanMight Sdn Bhd (“OMSB”) has accepted and signed a Letter of Award of the PETRONAS Frame Agreement (“Contract”) for The Provision of Engineering, Procurement and Construction (EPC) of Fixed Offshore Structure Works (“Work”) by PETROLIAM NASIONAL BERHAD (“PETRONAS”).

With the award of the Frame Agreement by PETRONAS, OMSB will be qualified as one of PETRONAS’ Contractors to bid for the said Work. A formal contract shall be executed within Three (3) months from acceptance of the said Letter of Award.

DURATION OF CONTRACT The Contract is effective from 12 December 2018 and continue for a period of six (6) years, unless terminated earlier.

FINANCIAL EFFECTS The Contract will have no effect on the Share Capital of the Company and is expected to contribute positively towards the earnings and net assets of the Company and Group for the duration of the Contract.

RISK FACTORS Risk factors affecting the Contract include execution risks such as availability of skilled manpower and materials, changes in pricing, weather conditions and/or political, economic and regulatory conditions.

DIRECTORS’ AND MAJOR SHAREHOLDERS’ INTERESTS None of the Directors and/or major shareholders and/or person connected with them has any interest, direct or indirect in the abovementioned Contract.

DIRECTORS’ STATEMENT The Board is of the opinion that the abovementioned Contract is in the best interest of KKB and its Group.

This Announcement is dated 7 January 2019.

|

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|