|

|

【PANTECH 5125 交流专区】鹏达集团

[复制链接]

[复制链接]

|

|

|

发表于 27-7-2017 01:58 AM

|

显示全部楼层

发表于 27-7-2017 01:58 AM

|

显示全部楼层

EX-date | 27 Sep 2017 | Entitlement date | 29 Sep 2017 | Entitlement time | 05:00 PM | Entitlement subject | First Interim Dividend | Entitlement description | 1. First Interim Single Tier Dividend of 0.5 sen per ordinary share 2. Special interim single tier dividend of 0.5 sen per ordinary share | Period of interest payment | to | Financial Year End | 28 Feb 2018 | Share transfer book & register of members will be | 29 Sep 2017 to 29 Sep 2017 closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | MEGA CORPORATE SERVICES SDN BHDLevel 15-2, Bangunan Faber Imperial CourtJalan Sultan Ismail50250Kuala LumpurTel:0326924271Fax:0327325388 | Payment date | 24 Oct 2017 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 29 Sep 2017 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.01 | Par Value (if applicable) | Malaysian Ringgit (MYR) 0.000 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 28-7-2017 06:40 AM

|

显示全部楼层

发表于 28-7-2017 06:40 AM

|

显示全部楼层

本帖最后由 icy97 于 1-8-2017 05:21 AM 编辑

鹏达首季业绩亮眼.前景看俏

(吉隆坡27日讯)鹏达集团(PANTECH,5125,主板贸服组)首季业绩亮眼,分析员普遍看好该公司前景,目标价与评级齐上调。

截至2017年5月31日止首季,鹏达集团营业额与净利报1亿5149万6000令吉及1396万3000令吉,各涨22.23%及72.62%。

艾毕斯研究表示,首3个月的营业额与净利表现相等于全年财测的30%及35%,该公司未来的业绩表现仍能持续改善。

艾毕斯补充,2017财政年的第四季的营运盈利从11.6%提高至12.8%,净赚幅从6.8%提高至8.8%,归功于善用税务奖掖。

肯纳格研究表示,除了岸外业务使用率仍未营运外,不锈钢及碳素钢厂的使用率各为90%及70%,位于英国的Nautic钢铁制造厂使用率也从60%提高至65%。

此外,管理层也期望产量达4万8000吨的电镀厂,2018财政年的使用率可达到50%,并期望2019年,产能可全面运用。

安联星展研究补充,新的电镀厂仍在亏损中,主要是刚设立的成本影响之故,但预期下半年赚幅可获得改善。

肯纳格与艾毕斯看好该公司前景,因此上调评级与目标价。

肯纳格补充,未来海内外有更多的钢铁需求,因此上调2018及2019财政年的盈利预测,预期未来2年的盈利预测为4720万令吉及5040万令吉。

艾毕斯则上调6%及5.5%的盈利预测。

文章来源:

星洲日报‧财经‧报道:谢汪潮‧2017.07.27

鹏达集团2年财测上调14%

2017年8月1日

分析:肯纳格投行

目标价:75仙

最新进展:

贸易和制造业务表现杰出,鹏达集团(PANTECH,5125,主板贸服股)截至5月杪首季,净赚1396万3000令吉,按年增72.62%,并派息每股1仙。

行家建议:

首季核心净利扬73%,录得1400万令吉,符合预期,占我们和市场全年预测的34%。

目前,不锈钢和碳钢厂房营运使用率已达90%。尽管岸外业务依然低迷,惟英国制造厂房(Nautic钢铁)使用率改善,从上财年60%提升至65%。

至于产能达4万8000公吨的镀锌厂,该公司设下本财年使用率达到50%的目标正如期实现。

同时,放眼下财年,镀锌厂全面投产,贡献额外收入来源;同时,不需外包运输管、阀门及管件(PVF)镀锌工作。

国内外需求持续、贸易业务较高赚幅,及不锈钢和碳钢厂房使用率改善,我们将今明财年的净利预测上调14%,分别至4720万令吉和5040万令吉。上调鹏达集团评级至“超越大市”,目标价为75仙。

【e南洋】

|

|

|

|

|

|

|

|

|

|

|

|

发表于 10-8-2017 04:17 AM

|

显示全部楼层

发表于 10-8-2017 04:17 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | PANTECH GROUP HOLDINGS BERHAD ("PANTECH" OR "THE COMPANY")- Subscription of shares in subsidiary, PANTECH GALVANISING SDN. BHD. | The Board of Directors of PANTECH wishes to announce that the Company has on 9 August 2017, subscribed for an additional 2,550,000 ordinary shares in its subsidiary, PANTECH GALVANISING SDN. BHD. (1162100 W) (“PGSB") for a total cash consideration of RM2,550,000.00 (“the Subscription”).

The Subscription was funded by internally generated funds.

Following the Subscription, PANTECH’s equity interest in PGSB has increased from 51% to 56.54%. The balance of 43.46% is held by Euromech Machinery Sdn. Bhd. (1014146 D).

The Subscription will not have any significant effect on the earnings and net assets per share or gearing of the Company for the financial year ending 28 February 2018.

The Subscription is not subject to the approval of the shareholders and the relevant authorities.

None of the Directors or major shareholders of the Company, or persons connected with them, has any direct or indirect interest in the Subscription.

The Board of Directors of the Company is of the opinion that the Subscription is in the best interest of PANTECH.

This announcement is dated 9 August 2017. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 12-10-2017 01:07 AM

|

显示全部楼层

发表于 12-10-2017 01:07 AM

|

显示全部楼层

本帖最后由 icy97 于 12-10-2017 02:26 AM 编辑

浅谈PANTECH

Thursday, September 28, 2017

http://bblifediary.blogspot.my/2017/09/pantech.html

业务

- 导管、装配和流量控制产品(PPF)供应

- 贸易

PANTECH(鹏达集团,5125,主板贸服股)成立于1987年,并于2007年2月15日上市大马交易所主板。

其业务主要分为两大类:

- 制造业

- 贸易

制造业

PANTECH是国内其中一间最大的一站式导管、装配和流量控制产品(PPF)供应商,专门提供PPF予石油及天然气、生物柴油、海事及重型机械等领域 。

贸易该公司拥有超过2万种产品销售到世界各地,并在新加坡、柔佛巴西古当、莎阿南、关丹及巴生西港设有仓库。

目前,其制造业贡献了40%的营业额约40%,以及25%的净利;至于贸易领域则贡献来60%的营业额,以及75%的净利。

会看上PANTECH的主要原因,是在油气领域的低迷时期,该公司最近依然交出亮丽的业绩。其次,PANTECH是一家每个季度都有派息的公司,也算是一直养息股。

我们先来看看PANTECH的年度与季度业绩:

PANTECH在2017年末季的业绩其实已经相当出色,但是由于受到前三个季度的拖累,导致2017财政年净利只有3088万令吉,比前一年下滑720万令吉或18.9%。

然而来到2018年首季,该公司的净利更上一层楼,达到1396万令吉,这个净利已经达到2017年全年净利的45%。

此外,2018年虽然只是过了一季,但其净利已经是2017年的45%。由此可见,现财政年净利要大幅超越2017年应该不是什么大问题。

PANTECH近期的业绩如此出色,主要归功于RAPID计划需求推高所致,加上该公司的贸易业务贡献也持续走高。 此外,该公司在季报里透露,需求的增加不仅限于国内,国外需求也跟着提高。因此,相信该公司未来的业绩表现仍然能够持续改善。

此外,最近的国际原油价格也开始走高,市场对油气股情绪也逐渐走高,相信对PANTECH这种优质股也会带来不错的效益。

另外值得一提的,是该公司近期的派息已经从原本的0.5仙提高至1仙。PANTECH一直以来在派息方面都非常慷慨,如果其净利持续走强的话,每季1仙的中期股息相信可以维持下去。如此一来,其周息率(DY)将可达到5.8%。

从最新的每股净利来看,PANTECH的合理价应该值得RM1.13。

|

|

|

|

|

|

|

|

|

|

|

|

发表于 25-10-2017 04:57 AM

|

显示全部楼层

发表于 25-10-2017 04:57 AM

|

显示全部楼层

本帖最后由 icy97 于 26-10-2017 12:59 AM 编辑

鹏达次季净利翻1.29倍

2017年10月25日

(吉隆坡24日讯)贸易及制造业务的销售表现佳,带动鹏达集团(PANTECH,5125,主板贸服股)截至8月31日次季,净利按年激增1.29倍。

集团次季净赚1175万1000令吉或每股1.59仙,上财年同季达513万6000令吉或每股0.7仙。

当季营业额从1亿381万令吉,按年上升51.33%至1亿5710万令吉。

鹏达集团合计上半年净利,按年涨94.44%至2571万5000令吉,或每股3.48仙;营业额则上扬35.5%,至3亿860万令吉。

派息0.5仙

集团指出,营业额和净利增加,主要是因为边佳兰炼油与石油化工综合发展项目(RAPID)项目及海外市场,促使贸易及制造业务的销售需求增加。

同时,该集团今日宣布派发每股0.5仙第二次中期单层股息,除权日落在12月27日。【e南洋】

SUMMARY OF KEY FINANCIAL INFORMATION

31 Aug 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Aug 2017 | 31 Aug 2016 | 31 Aug 2017 | 31 Aug 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 157,099 | 103,809 | 308,595 | 227,752 | | 2 | Profit/(loss) before tax | 14,452 | 6,581 | 31,495 | 16,906 | | 3 | Profit/(loss) for the period | 11,011 | 5,032 | 24,272 | 13,048 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 11,751 | 5,136 | 25,715 | 13,225 | | 5 | Basic earnings/(loss) per share (Subunit) | 1.59 | 0.70 | 3.48 | 1.80 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.50 | 0.50 | 1.50 | 1.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.7300 | 0.7100

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 25-10-2017 06:39 AM

|

显示全部楼层

发表于 25-10-2017 06:39 AM

|

显示全部楼层

EX-date | 27 Dec 2017 | Entitlement date | 29 Dec 2017 | Entitlement time | 05:00 PM | Entitlement subject | Second interim dividend | Entitlement description | Second Interim Single Tier Dividend of 0.5 sen per ordinary share in respect of the financial year ending 28 February 2018. | Period of interest payment | to | Financial Year End | 28 Feb 2018 | Share transfer book & register of members will be | 29 Dec 2017 to 29 Dec 2017 closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | TRICOR INVESTOR & ISSUING HOUSE SERVICES SDN BHDUnit 32-01, Level 32, Tower A,Vertical Business Suite, Avenue 3, Bangsar South,No. 8, Jalan Kerinchi59200Kuala LumpurTel:0327839299Fax:0327839222 | Payment date | 19 Jan 2018 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 29 Dec 2017 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.005 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 26-10-2017 04:43 AM

|

显示全部楼层

发表于 26-10-2017 04:43 AM

|

显示全部楼层

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

NON RELATED PARTY TRANSACTIONS | Description | PROPOSED ACQUISITION OF 9,800,000 ORDINARY SHARES REPRESENTING REMAINING 43.46% EQUITY INTEREST IN PANTECH GALVANISING SDN BHD BY PANTECH GROUP HOLDINGS BERHAD | The Board of Directors of Pantech Group Holdings Berhad (“the Company”) wishes to announce that the Company, has on 25 October 2017 entered into a share sale agreement (“SSA”) with Euromech Machinery Sdn Bhd (Company No. 1014146-D) for the acquisition of the remaining 9,800,000 ordinary shares representing 43.46% equity interest in Pantech Galvanising Sdn Bhd (Company No. 1162100-W) for a total purchase consideration of Ringgit Malaysia Seven Million Sixteen Thousand (RM7,016,000) only to be entirely satisfied in cash subject to the terms and conditions as stipulated in the SSA (“Proposed Acquisition”).

Please refer to the attachment for details of the announcement.

This announcement is dated 25 October 2017. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5581405

|

|

|

|

|

|

|

|

|

|

|

|

发表于 26-10-2017 05:23 AM

|

显示全部楼层

发表于 26-10-2017 05:23 AM

|

显示全部楼层

本帖最后由 icy97 于 26-10-2017 05:54 AM 编辑

鹏达集团

可维持派息率

2017年10月26日

分析:达证券

目标价:69仙

最新进展:

鹏达集团(PANTECH,5125,主板贸服股)截至8月杪次季,净赚1175万1000令吉或每股1.59仙,按年激增1.29倍;并派息每股0.5仙。

当季营业额按年上升51.33%,至1亿5710万令吉,归功边佳兰炼油与石油化工综合发展项目(RAPID)项目及海外市场,促使贸易及制造业务的销售需求增加。

行家建议:

鹏达集团首半年核心净利按年大涨99.1%至2560万令吉,我们认为符合预期,因预期下半年盈利走低,归根于赚幅趋向正常水平,及RAPID订单较少。

RAPID全年订单为1亿5000万令吉,上半年已入账8000万令吉。

受到RAPID需求支撑,我们认为,鹏达集团的按年扩张趋势会持续,且制造产品的需求维持强劲,未来几个季度的净利可能大幅攀升。

另外,集团手持现金达9770万令吉,加上每季度约2500万令吉的营运现金流,能让集团在2018至2020财年维持3.9%至4.6%的良好派息率。

不过,我们认为当前股价已经相当合理,在11.6倍的本益比交易,高于历史本益比中值的9.4%,今年股价也已涨了60%,所以建议卖出该股。

【e南洋】

利好反映.鹏达评级下调

(吉隆坡25日讯)鹏达集团(PANTECH,5125,主板贸服组)首半年净利符合市场预测,预料未来业务表现仍有望保持稳健,惟由于今年内的股价大幅度走高,使分析员普遍下调其评级。

肯纳格研究认为,鹏达集团2018财政年首半年净利符合预测。该公司持有51%股权的新电镀工厂于去年12月开始投产,年产能达4万8000公吨,2018年首半年使用率达30至40%,料第四季使用率可达50%无盈亏水平。

新电镀工厂投产

净利年增800万

一旦新电镀工厂全面投产,肯纳格研究认为,将使公司每年净利额外增加800万令吉,并辅助现有业务,即其主要产品如钢管、配件、阀门的电镀工作将不需外包给第三方。

肯纳格研究指出,鹏达集团潜在利好包括盈利赚幅复苏、健全的资产负债表(净负债仅为0.4倍)及较高的订单透明度,即从3个月提升至5个月。

达证券指出,预料鹏达集团2018财政年全年盈利成长持续,特别是边佳兰综合炼油中心(RAPID)订单持续流入、产品赚幅走高、产能扩张及工厂使用率改善等利好推动。

艾毕斯研究指出,鹏达集团2018财政年首6个月净利符合预测,占该行全年净利预测的60%。该行维持其2018及2019财政年财测,预期获得国油新山石油提炼及石化综合中心(RAPID)工程计划及新电镀工厂的启业亏损减少的两大利好支持。

艾毕斯研究指出,鹏达集团派发每股0.5仙第二次中期股息,使至今为止股息达1.5仙,该行预料其全年每股股息可达2.5仙,或等于周息率3.8%。达证券则认为,预料该公司2018至2020年的周息率可达3.9至4.6%之间。

艾毕斯研究认为,随着鹏达集团股价最近走高,该行将其评级,从之前的“买进”下调至“守住”,惟目标价保持在70仙,或是其2018财政年预测本益比13倍。

文章来源:

星洲日报‧财经‧报道:李文龙‧2017.10.25 |

|

|

|

|

|

|

|

|

|

|

|

发表于 24-1-2018 02:32 AM

|

显示全部楼层

发表于 24-1-2018 02:32 AM

|

显示全部楼层

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

RELATED PARTY TRANSACTIONS | Description | DISPOSAL OF PROPERTY BY NAUTIC STEELS (HOLDINGS) LIMITED, UK | The Board of Directors of Pantech Group Holdings Berhad (“the Company”) wishes to announce that Nautic Steels (Holdings) Limited, a wholly owned subsidiary of the Company had entered into an Agreement on 19 January 2018 with Mr Jairus Tan Vern Hsien for the disposal of a 2-Storey detached house bearing the postal address of 6 Fasson Close, Tamworth B77 IGJ, Staffordshire, United Kingdom for a consideration of GBP280,000.00 equivalent to RM1,528,044.00 (“the Disposal”).

Please refer to the attachment for details of the announcement.

This announcement is dated 23 January 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5673521

|

|

|

|

|

|

|

|

|

|

|

|

发表于 27-1-2018 05:34 AM

|

显示全部楼层

发表于 27-1-2018 05:34 AM

|

显示全部楼层

| PANTECH GROUP HOLDINGS BERHAD |

EX-date | 28 Mar 2018 | Entitlement date | 30 Mar 2018 | Entitlement time | 05:00 PM | Entitlement subject | Interim Dividend | Entitlement description | Third Interim Single Tier Dividend of 0.5 sen per ordinary share in respect of the financial year ending 28 February 2018. | Period of interest payment | to | Financial Year End | 28 Feb 2018 | Share transfer book & register of members will be | 30 Mar 2018 to 30 Mar 2018 closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | TRICOR INVESTOR & ISSUING HOUSE SERVICES SDN BHDUnit 32-01, Level 32, Tower AVertical Business Suite, Avenue 3, Bangsar SouthNo. 8, Jalan Kerinchi, 59200 Kuala LumpurTel : 03-2783 9299Fax : 03-2783 9222 | Payment date | 20 Apr 2018 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 30 Mar 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.005 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 27-1-2018 05:36 AM

|

显示全部楼层

发表于 27-1-2018 05:36 AM

|

显示全部楼层

本帖最后由 icy97 于 27-1-2018 06:06 AM 编辑

鹏达第三季净利增57%

2018年1月27日

(吉隆坡26日讯)鹏达集团(PANTECH,5125,主板贸服股)截至11月30日第三季,净利激增57.4%至1005万2000令吉;宣布派息0.5仙。

当季营业额扩大58%,报1亿5662万1000令吉。

累计首9个月,净利飙涨82.4%至3576万6000令吉;营业额扬升42.3%,报4亿6521万6000令吉。

鹏达集团向交易所报备,当季表现标青归功于贸易和制造业务的需求殷切,造成销售增加,进而录得更高的盈利。

随着油价突破每桶60美元,该公司仍谨慎乐观看待油气工业领域逐步增加的活动及发展。

未来,公司将持续专注于扩大现有创造收入的业务,并放眼扩大海内外的业务。

如无意外,鹏达集团相信,本财年仍能交出称心业绩。【e南洋】

SUMMARY OF KEY FINANCIAL INFORMATION

30 Nov 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Nov 2017 | 30 Nov 2016 | 30 Nov 2017 | 30 Nov 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 156,621 | 99,080 | 465,216 | 326,832 | | 2 | Profit/(loss) before tax | 12,432 | 7,930 | 43,926 | 24,836 | | 3 | Profit/(loss) for the period | 10,048 | 6,112 | 34,319 | 19,160 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 10,052 | 6,385 | 35,766 | 19,610 | | 5 | Basic earnings/(loss) per share (Subunit) | 1.36 | 0.87 | 4.83 | 2.66 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.50 | 0.30 | 2.00 | 1.30 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.7300 | 0.7100

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 30-1-2018 03:21 AM

|

显示全部楼层

发表于 30-1-2018 03:21 AM

|

显示全部楼层

鹏达集团

周息率料达4.9%

2018年1月30日

分析:达证券

目标价:69仙

最新进展:

鹏达集团(PANTECH,5125,主板贸服股)截至11月30日第三季,净利激增57.4%至1005万2000令吉,营业额扩大58%至1亿5662万1000令吉,同时宣布派息0.5仙。

累计首9个月,净利飙涨82.4%至3576万6000令吉;营业额扬升42.3%至4亿6521万6000令吉。

行家建议:

鹏达集团在首9个月的表现,符合我们和市场预期。不过我们认为,由于末季正逢农历新年,公司国内厂房将休假,料造成末季盈利表现疲软。

另外,第三季盈利按季萎缩10.3%,这符合我们早期预测,即正常化至历史水平。我们预计这将延续至末季。

另外,我们预计该公司能在今明两财年,从RAPID项目中获得约2亿令吉订单;而国外需求也有望保持稳健。

目前,旗下不锈钢和碳钢厂房使用率已达90%,我们不排除该公司会有另一轮扩充产能的可能性。

另外,集团手持现金达7410万令吉,加上每季度约2500万令吉的营运现金流,能让集团在2018至2020财年,维持4.4%至4.9%的周息率。

上调投资评级至“买入”,维持69仙的目标价。

【e南洋】 |

|

|

|

|

|

|

|

|

|

|

|

发表于 23-4-2018 02:40 AM

|

显示全部楼层

发表于 23-4-2018 02:40 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 4-5-2018 02:23 AM

|

显示全部楼层

发表于 4-5-2018 02:23 AM

|

显示全部楼层

本帖最后由 icy97 于 5-5-2018 03:58 AM 编辑

SUMMARY OF KEY FINANCIAL INFORMATION

28 Feb 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 28 Feb 2018 | 28 Feb 2017 | 28 Feb 2018 | 28 Feb 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 149,466 | 152,517 | 614,682 | 479,349 | | 2 | Profit/(loss) before tax | 14,105 | 14,259 | 58,031 | 39,095 | | 3 | Profit/(loss) for the period | 11,203 | 9,248 | 45,522 | 28,408 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 11,203 | 10,108 | 46,969 | 29,718 | | 5 | Basic earnings/(loss) per share (Subunit) | 1.51 | 1.37 | 6.33 | 4.03 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.50 | 0.50 | 2.50 | 1.80 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.7400 | 0.7100

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 4-5-2018 02:23 AM

|

显示全部楼层

发表于 4-5-2018 02:23 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | PANTECH GROUP HOLDINGS BERHAD- PROPOSED FINAL DIVIDEND | The Board of Directors of Pantech Group Holdings Berhad ("the Company") has proposed the payment of a Final Single Tier Dividend of 0.5 sen per ordinary share for the financial year ended 28 February 2018, subject to shareholders' approval at the forthcoming Annual General Meeting of the Company.

The entitlement date and date of payment of the dividend have yet to be determined.

Further announcement will be made at a later date upon finalising the entitlement and payment date.

This announcement is dated 27 April 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 28-6-2018 01:13 AM

|

显示全部楼层

发表于 28-6-2018 01:13 AM

|

显示全部楼层

| PANTECH GROUP HOLDINGS BERHAD |

EX-date | 31 Jul 2018 | Entitlement date | 02 Aug 2018 | Entitlement time | 05:00 PM | Entitlement subject | Final Dividend | Entitlement description | Final single tier dividend of 0.50 sen per ordinary share | Period of interest payment | to | Financial Year End | 28 Feb 2018 | Share transfer book & register of members will be | 02 Aug 2018 to 02 Aug 2018 closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | TRICOR INVESTOR & ISSUING HOUSE SERVICES SDN BHDUnit 32-01, Level 32, Tower AVertical Business Suite, Avenue 3, Bangsar SouthNo. 8, Jalan Kerinchi59200 Kuala LumpurTel:03-2783 9299Fax:03-2783 9222 | Payment date | 20 Aug 2018 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 02 Aug 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.005 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 27-7-2018 01:07 AM

|

显示全部楼层

发表于 27-7-2018 01:07 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 May 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 May 2018 | 31 May 2017 | 31 May 2018 | 31 May 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 178,385 | 151,496 | 178,385 | 151,496 | | 2 | Profit/(loss) before tax | 18,663 | 17,042 | 18,663 | 17,042 | | 3 | Profit/(loss) for the period | 14,123 | 13,260 | 14,123 | 13,260 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 14,123 | 13,963 | 14,123 | 13,963 | | 5 | Basic earnings/(loss) per share (Subunit) | 1.90 | 1.89 | 1.90 | 1.89 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 1.00 | 0.00 | 1.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.7600 | 0.7400

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 27-7-2018 01:10 AM

|

显示全部楼层

发表于 27-7-2018 01:10 AM

|

显示全部楼层

本帖最后由 icy97 于 28-7-2018 07:04 AM 编辑

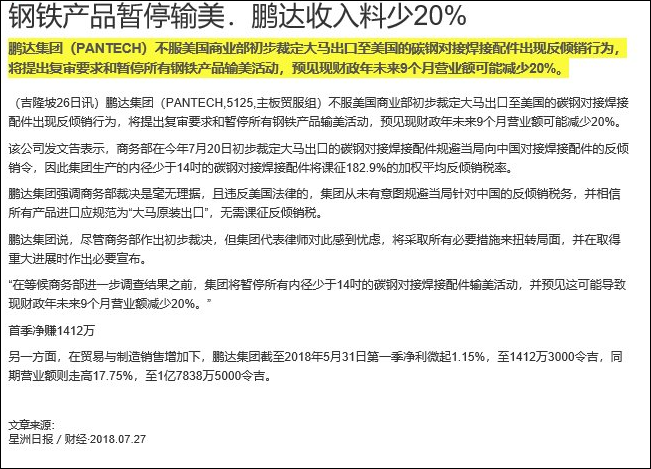

Type | Announcement | Subject | OTHERS | Description | PANTECH GROUP HOLDINGS BERHAD- PRELIMINARY AFFIRMATIVE DETERMINATION IN THE ANTI-CIRCUMVENTION INQUIRY ON THE ANTI-DUMPING DUTY ORDER ON CERTAIN CARBON STEEL BUTT-WELD FITTINGS FROM THE PEOPLE'S REPUBLIC OF CHINA | On July 20, 2018 the U.S. Department of Commerce (“DOC”) issued a preliminary affirmative anti-circumvention determination concerning carbon steel butt-weld fittings from Malaysia. The DOC preliminarily determined that Malaysian companies are circumventing the antidumping duty (AD) order on butt-weld fittings from China. As a result, carbon steel butt-weld fittings having an inside diameter of less than 14 inches exported by Pantech Steel Industries Sdn Bhd (“PSI”) to the United States are subject to a cash deposit rate for estimated AD duties of 182.90% ad valorem, based on the duty rate in effect on carbon steel butt-weld fittings from China.

DOC’s decision is a preliminary determination only. PSI is represented by legal counsel in the United States concerning this matter, and is taking all possible legal steps to reverse this preliminary determination. Pending further developments in the DOC investigation, PSI has suspended all shipments of carbon steel butt-weld fittings having an inside diameter of less than 14 inches to the US. It is estimated that there could be a 20% reduction in revenue to the Group for the remaining months of this financial year.

PSI strongly views this decision as unjustified and contrary to applicable U.S. law. PSI has never intentionally circumvented the antidumping duty order concerning China and believes that all of its fittings exported in Malaysia should be classified as originating in Malaysia and entered without AD duties. PSI has production facilities of approximately 32,000 square meters, including factories and warehouses, located on an approximately 50,000 square meters of land in Meru, Selangor, Malaysia. These well-established production facilities have been producing up to 21,000 metric tons of Made in Malaysia carbon steel butt-weld fittings per annum, which are exported internationally.

The Board would like to inform that the management team is working closely with the appointed legal counsel to challenge this unjustified DOC decision and will announce further major development as and when the information becomes available.

This announcement is dated 26 July 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 28-7-2018 06:59 AM

|

显示全部楼层

发表于 28-7-2018 06:59 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 26-10-2018 03:59 AM

|

显示全部楼层

发表于 26-10-2018 03:59 AM

|

显示全部楼层

本帖最后由 icy97 于 26-10-2018 05:31 AM 编辑

碳钢暂停输美 鹏达次季业绩疲弱

Tan Xue Ying/theedgemarkets.com

October 24, 2018 20:23 pm +08

(吉隆坡24日讯)鹏达集团(Pantech Group Holdings Bhd)将第二季净利按年下跌7.5%至1087万令吉,归因于暂停向美国出口碳钢,并警告日益加剧的贸易保护主义可能带来更多挑战。

截至8月杪2019财政年次季营业额为1亿4806万令吉,较去年同期的1亿5710万令吉,按年下跌5.8%。

该集团今日向大马交易所报备,暂停向美国出货源于美国对大马出口的碳钢产品发布一项初步反规避裁决,而目前还没有最终结果。这导致制造业务收入和税前盈利分别降28.15%和29.08%。

即便如此,贸易业务的销售需求和本地油气项目的交付有助于缓解疲软的制造业务。

鹏达宣布派发每股0.5仙的首个中期单层股息,将于明年1月18日支付。

截至2019财年首半年,净利近2500万令吉,按年跌2.8%;营业额则扬5.8%至3亿2645万令吉,相比同期的3亿860万令吉。

该集团预计,本财年的整体表现仍将令人满意。

“世界各地的贸易紧张局势正从贸易开放转为贸易保护主义,这对我们的出口业务构成重大挑战。目前,碳钢制造厂已停止向美国出货。”

“尽管如此,集团仍有机会从大马和东南亚上游油气活动中攫取更多订单。”该集团补充,计划扩大输送管、配件和阀门的产能。

(编译:陈慧珊)

SUMMARY OF KEY FINANCIAL INFORMATION

31 Aug 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Aug 2018 | 31 Aug 2017 | 31 Aug 2018 | 31 Aug 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 148,061 | 157,099 | 326,446 | 308,595 | | 2 | Profit/(loss) before tax | 14,920 | 14,452 | 33,583 | 31,495 | | 3 | Profit/(loss) for the period | 10,866 | 11,011 | 24,989 | 24,272 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 10,866 | 11,751 | 24,989 | 25,715 | | 5 | Basic earnings/(loss) per share (Subunit) | 1.46 | 1.59 | 3.37 | 3.48 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.50 | 0.50 | 0.50 | 1.50 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.7700 | 0.7400

|

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|