|

|

楼主 |

发表于 16-10-2009 03:28 PM

|

显示全部楼层

没有人和我分享,我就无私奉献。

我手上还有一些股的分析。

不过我不打算放上来了。 |

|

|

|

|

|

|

|

|

|

|

|

发表于 16-10-2009 03:58 PM

|

显示全部楼层

发表于 16-10-2009 03:58 PM

|

显示全部楼层

SKPRES 7155

FY 31/03/09

NA/Share : RM0.22

EPS : RM0.051

P/E : 34x

你对这股有什么看法? 今天成交量大大提升,股价也一度起到52 week 新高。 |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 16-10-2009 04:33 PM

|

显示全部楼层

回复 43# Kelvinkcm 的帖子

看起来像是庄家对倒吧了.

炒过后要面对很长时间的冷清期.

短线就可以. 现在卖的量似乎比买的多, 不好hold |

|

|

|

|

|

|

|

|

|

|

|

发表于 17-10-2009 11:55 PM

|

显示全部楼层

发表于 17-10-2009 11:55 PM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 18-10-2009 08:21 PM

|

显示全部楼层

发表于 18-10-2009 08:21 PM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 10-3-2010 10:30 PM

|

显示全部楼层

由于2009Q4财报不理想,股价振兴不起来。

我想这一两天可以观察一下,上一次来不及出逃的,现在可以关注一下,寻找机会脱困。

下一个财报在5月份. |

|

|

|

|

|

|

|

|

|

|

|

发表于 1-6-2011 12:09 AM

|

显示全部楼层

发表于 1-6-2011 12:09 AM

|

显示全部楼层

OKA机构

本帖最后由 yatlokfatt 于 1-6-2011 12:10 AM 编辑

最近在报纸读到这家公司的新闻,才发现到这公司已经在这几年来有所稍微进步而且股价有点落后于它的真正价值。可以称得上小而美的股只。

(吉隆坡23日讯)OKA机构(OKA,7140,主板工业产品股)截至2011年3月杪财年末季,净利暴涨2.09倍至314万1000令吉,上财年仅录得101万5000令吉。

单季营业额也从上财年的2604万7000令吉,扬升5.44%至2746万6000令吉。

公司截至2010年3月31日止财年献议派发每股3仙的第一期和终期股息,股息已于去年11月26日派发。 |

|

|

|

|

|

|

|

|

|

|

|

发表于 1-6-2011 12:34 PM

|

显示全部楼层

发表于 1-6-2011 12:34 PM

|

显示全部楼层

OKA机构截至2011年3月,全年净利高涨45%至5.62Mil,上财年仅录得3.874Mil。

2011财政年度的营业额也从上财年的103.04Mil,扬升8.05%至RM111.33Mil。

以现在的58sen的股价计算,每股净利(EPS)=9.36sen。本益比大约才6.2倍,而且每年都有3sen的股息,DY=5.17%再加上低债务,所以我说它是只超值得累积的好股。唯一的弱点是它平时的成交量很低,必须要有耐心与经常跟进它的财务报告。 |

|

|

|

|

|

|

|

|

|

|

|

发表于 1-6-2011 03:17 PM

|

显示全部楼层

发表于 1-6-2011 03:17 PM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 1-6-2011 11:54 PM

|

显示全部楼层

发表于 1-6-2011 11:54 PM

|

显示全部楼层

本帖最后由 penangist 于 2-6-2011 12:06 AM 编辑

每股净财产(NTA)=RM1.37。 |

|

|

|

|

|

|

|

|

|

|

|

发表于 2-6-2011 11:33 AM

|

显示全部楼层

发表于 2-6-2011 11:33 AM

|

显示全部楼层

OKA机构的公司背景:

OKA Concrete Industries Sdn Bhd

THE RANGE OF CONCRETE PRODUCTS

OKA Concrete Industries Sdn Bhd was established in 1981 and is one of the largest manufacturer of precast concrete products in Malaysia.

The OKA Group obtained MS ISO 9002 Certification in 1998 and was upgraded to ISO 9001:2000 and ISO 9001:2008 in 2003 and 2010 respectively. Furthermore, a wide range of OKA products have attained product certifications by SIRIM QAS, IKRAM QA and UKAS.

OKA Group is a major supplier of concrete pipes, concrete spigot & socket pipes, jacking pipes, box culverts, L-shape retaining wall units, U-shape drain, concrete porous subsoil pipes, readymixed concrete, concrete septic tanks, precast manhole components, reinforced and prestressed concrete square piles, Arch Bridge System, prestressed beam, IBS components, jetty components and other concrete products to cater for the Malaysian infrastructure, sewerage, construction and highway industry.

The head office of the OKA Group remains in Ipoh, Perak and the factory operations are located at:

1. Batu Gajah, Perak

2. Senai, Johor

3. Nilai, Negeri Sembilan

4. Gambang, Pahang

5. Sungai Petani, Kedah

It is managed by a team of Professional and Civil Engineers. As a result, the products manufactured are of high quality and consistency.

OKA's rapid expansion and modernization programme involves heavy investment in machineries and equipment so as to enhance both production capacity and capability to meet today's demand of large infrastructural projects from both the government and the private sectors.

|

|

|

|

|

|

|

|

|

|

|

|

发表于 2-6-2011 05:46 PM

|

显示全部楼层

发表于 2-6-2011 05:46 PM

|

显示全部楼层

以下是公司2011年度的表现评论:

1. Review of Performance

The Group’s total revenue recorded for the quarter under review was RM27.46 million as compared to RM26.05 million in the corresponding quarter of the preceding year. The Group’s profit before tax increased to RM3.85 million for the current quarter as compared to a profit before tax of RM0.88 million in the corresponding quarter of the previous year. The increase in the Group’s profit before tax was mainly due to the increase sales of speciality products and lower operating expenses for the current quarter.

2. Variation of Results Against Preceding Quarter

The Group recorded lower revenue of RM27.46 million for the current quarter as compared to RM28.03 million in the immediate preceding quarter. However, the Group’s profit before tax increased to RM3.85 million for the current quarter as compared to profit before tax of RM0.87 million in the preceding quarter due to the increase sales of speciality products and lower operating expenses for the current quarter.

3. Current Year Prospects

Barring any unforeseen circumstances, the Group is optimistic that construction activities will be positive in the year 2012.

|

|

|

|

|

|

|

|

|

|

|

|

发表于 6-6-2011 11:32 PM

|

显示全部楼层

发表于 6-6-2011 11:32 PM

|

显示全部楼层

OKA products have been widely used in many major infrastructure and construction projects throughout Malaysia. Some of the major projects which have utilized OKA products are as follows:

Putrajaya

Cyberjaya

Guthrie Corridor Expressway

Valencia Development

Kuala Lumpur International Airport

Formula One Circuit, Sepang

North South Highway

East West Highway

Karak Highway

Damansara - Puchong Highway

Kuala Lumpur Middle Ring Road

Light Rail Transit System

Westport Pulau Indah

Lumut Maritime Port

Lestari Perdana

East Coast Expressway

Ipoh - Rawang Double Track

Kompleks Belia & Kebudayaan Selangor

New Pantai Expressway

Western Traffic Dispersal Package C

Sungai Buluh New Township

Sungai Buaya New Township

Behrang 2020 New Township

Station 18 Township

Petronas Trengganu

JKR projects

Felda Trolak Settlement Scheme

Filmore Estate

Shah Alam Expressway

North South Central Link

Simpang Pulai - Cameron Highlands Highway

Smart Tunnel Flood Mitigation and etc.

|

|

|

|

|

|

|

|

|

|

|

|

发表于 9-6-2011 11:15 PM

|

显示全部楼层

发表于 9-6-2011 11:15 PM

|

显示全部楼层

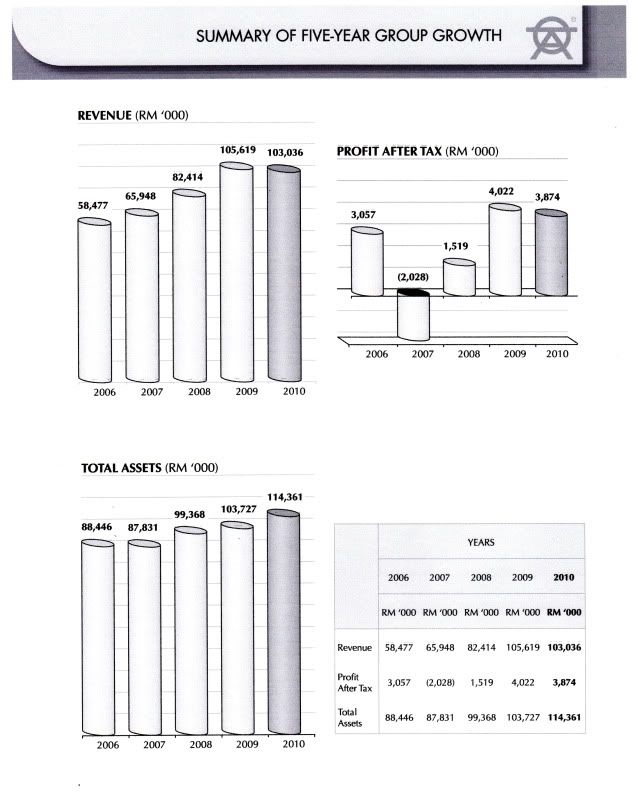

以下为OKA最近5年的成长摘要 :-

|

|

|

|

|

|

|

|

|

|

|

|

发表于 10-7-2011 11:41 PM

|

显示全部楼层

发表于 10-7-2011 11:41 PM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 27-8-2011 12:40 AM

|

显示全部楼层

发表于 27-8-2011 12:40 AM

|

显示全部楼层

本帖最后由 yatlokfatt 于 27-8-2011 12:47 AM 编辑

For the first quarter ended 30 June 2011

Review of Performance The Group’s total revenue recorded for the quarter under review was RM29.32 million as compared to RM28.20 million in the corresponding quarter of the preceding year. The Group’s profit before tax increased to RM1.65 million for the current quarter as compared to a profit before tax of RM0.49 million in the corresponding quarter of the previous year. The increase in the Group’s profit before tax was mainly due to the increase sales of speciality products and lower operating expenses for the current quarter.

Variation of Results Against Preceding Quarter

The Group recorded higher revenue of RM29.32 million for the current quarter as compared to RM27.46 million in the immediate preceding quarter. However, the Group’s profit before tax decreased to RM1.65 million for the current quarter as compared to profit before tax of RM3.85 million in the preceding quarter.

Current Year Prospects

Barring any unforeseen circumstances, the Group is optimistic that construction activities will be positive in the current financial year.  |

|

|

|

|

|

|

|

|

|

|

|

发表于 27-8-2011 02:55 PM

|

显示全部楼层

发表于 27-8-2011 02:55 PM

|

显示全部楼层

Review of PerformanceThe Group’s total revenue recorded for the quarter under review was RM29.32 ...

yatlokfatt 发表于 27-8-2011 12:40 AM

SUMMARY OF KEY FINANCIAL INFORMATION | 30/06/2011 |

| INDIVIDUAL PERIOD | CUMULATIVE PERIOD | | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | | 30/06/2011 | 30/06/2010 | 30/06/2011 | 30/06/2010 | | $$'000 | $$'000 | $$'000 | $$'000 | | 1 | Revenue | 29,320 | 28,201 | 29,320 | 28,201 | | 2 | Profit/(loss) before tax | 1,651 | 489 | 1,651 | 489 | | 3 | Profit/(loss) for the period | 1,407 | 301 | 1,407 | 301 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 1,407 | 301 | 1,407 | 301 | | 5 | Basic earnings/(loss) per share (Subunit) | 2.34 | 0.50 | 2.34 | 0.50 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

|

|

|

|

|

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.4000 | 1.3700

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 28-2-2012 01:04 AM

|

显示全部楼层

发表于 28-2-2012 01:04 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION | 31/12/2011 |

| INDIVIDUAL PERIOD | CUMULATIVE PERIOD | | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | | 31/12/2011 | 31/12/2010 | 31/12/2011 | 31/12/2010 | | $$'000 | $$'000 | $$'000 | $$'000 | | 1 | Revenue | 31,445 | 28,028 | 89,837 | 83,867 | | 2 | Profit/(loss) before tax | 1,144 | 865 | 3,721 | 2,905 | | 3 | Profit/(loss) for the period | 1,041 | 1,016 | 3,007 | 2,479 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 1,041 | 1,016 | 3,007 | 2,479 | | 5 | Basic earnings/(loss) per share (Subunit) | 1.73 | 1.69 | 5.01 | 4.13 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

|

|

|

|

|

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.3900 | 1.3700 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 25-5-2012 06:28 PM

|

显示全部楼层

发表于 25-5-2012 06:28 PM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION | 31/03/2012 |

| INDIVIDUAL PERIOD | CUMULATIVE PERIOD | | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | | 31/03/2012 | 31/03/2011 | 31/03/2012 | 31/03/2011 | | $$'000 | $$'000 | $$'000 | $$'000 | | 1 | Revenue | 31,270 | 27,464 | 121,107 | 111,331 | | 2 | Profit/(loss) before tax | 1,797 | 3,848 | 5,518 | 6,753 | | 3 | Profit/(loss) for the period | 2,005 | 3,141 | 5,012 | 5,620 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 2,005 | 3,141 | 5,012 | 5,620 | | 5 | Basic earnings/(loss) per share (Subunit) | 3.34 | 5.23 | 8.35 | 9.36 | | 6 | Proposed/Declared dividend per share (Subunit) | 3.00 | 3.00 | 3.00 | 3.00 |

|

|

|

|

|

|

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.4300 | 1.3700 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 31-7-2012 09:26 PM

|

显示全部楼层

发表于 31-7-2012 09:26 PM

|

显示全部楼层

| OKA CORPORATION BHD | | 31/07/2012 06:01:49 PM |

EX-date | 31/10/2012 | Entitlement date | 02/11/2012 | Entitlement time | 04:00:00 PM | Entitlement subject | First and Final Dividend | Entitlement description | A FIRST AND FINAL SINGLE-TIER DIVIDEND OF 3 SEN PER ORDINARY SHARE IN RESPECT OF THE FINANCIAL YEAR ENDED 31 MARCH 2012 | Period of interest payment | to | Financial Year End | 31/03/2012 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlements | Registrar's name ,address, telephone no | Tricor Investor Services Sdn. Bhd.

41, Jalan Medan Ipoh 6

Bandar Baru Medan Ipoh

31400 Ipoh Perak Darul Ridzuan

Telephone Number: 05-5451222 | Payment date | 21/11/2012 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 02/11/2012 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.03 |

| Remarks : | | This entitlement of Dividend is subject to the Shareholders' Approval at the forthcoming Twelfth Annual General Meeting to be held on 30 August 2012 |

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|