|

|

发表于 2-10-2015 01:39 AM

|

显示全部楼层

发表于 2-10-2015 01:39 AM

|

显示全部楼层

EX-date | 15 Oct 2015 | Entitlement date | 19 Oct 2015 | Entitlement time | 05:00 PM | Entitlement subject | Subdivision | Entitlement description | Share split involving the subdivision of every one existing ordinary share of RM1.00 each held in Lii Hen Industries Bhd (LHIB) (LHIB Share(s)) into two ordinary shares of RM0.50 each in LHIB (Subdivided Shares). (Share Split) | Period of interest payment | to | Financial Year End | 31 Dec 2015 | Share transfer book & register of members will be | 19 Oct 2015 to 19 Oct 2015 closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | PLANTATION AGENCIES SDN BERHAD3rd Floor, Standard Chartered Bank Chambers2, Leboh Pantai10300Tel:042625333Fax:042622018 | Payment date |

| | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 19 Oct 2015 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Ratio | Ratio | 2 : 1 | Rights Issue/Offer Price |

| | Par Value | Malaysian Ringgit (MYR) 0.000 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 22-10-2015 10:56 AM

|

显示全部楼层

发表于 22-10-2015 10:56 AM

|

显示全部楼层

本帖最后由 icy97 于 22-10-2015 03:17 PM 编辑

浅谈LIIHEN

Thursday, October 22, 2015

转帖: http://bblifediary.blogspot.tw/2015/10/liihen.html

LIIHEN(利兴工业,7089,主板消费产品股),于2000年4月25日上市大马交易所第二板,之后2002年8月28日转至主板。

总部设于麻坡的LIIHEN是一家控股公司,主要业务是家具制造,为国内业界领先制造商之一,属于一家综合性木制家具制造商。

产品包括卧室家具、婴儿床、沙发、餐座椅、折叠柜和旋转凳等;为有效控制生产过程以及增强产品质量管理,集团也涉及木材加工业务而不限于家具制造和成品包装。

说到LIIHEN,它其实给很多投资人一个不太好的印象,炒股一只。

当年还在第二板的LIIHEN,有一个拥有拿督勋衔的前股票经纪,于2004年3月26日至10月28日期间,利用42个中央存票系统(CDS)户头,制造LIIHEN在股票市场交投活跃现象。

使得其股价从1令吉水平,狂涨至6.60令吉的水平,结果被交易所列为指定股造成股价暴跌,也导致很多散户亏损,而该名拿督级的前股票经纪最后也被提控。

此外,也有一些小股东认为大股东处事不透明而杠上大股东,并且批评公司管理层有诚信问题。

当然,谁是谁非我们无法做出评论,但是如果撇开以上这两个不太好的事故不谈,LIIHEN其实从业务到财务方面来看,都是一家不错的公司。

我国的家具股大都以出口为主,LIIHEN也不例外。该公司所生产的家具有接近90%供出口,而且超过50个国家,当中包括欧洲、非洲、亚洲、澳洲和大马,以及贡献最大的美国市场。

该公司的业务一向都很稳定,此外在派息方面也还算慷慨。

自从迈入2014年第4季开始,该公司的营业额和净利已经连续3个季度出现增长,这也归功于强势美元。以目前美元兑马币继续走强的情况来看,下个季度的盈利继续出现增长机会很高。

该公司最近刚完成2送1红股,以及将每1股LIIHEN拆息成2股。

至于财务状况,更加无需担心,该公司拥有5588万令吉的净现金,相等于每股31仙。

以公司最新的业绩来看以及它的净现金,我个人给予它的合理价是RM3.12。

免责声明:

以上投资分析,纯属本人个人意见和观点。

在买进一家公司的股份前,请先做功课并了解该公司,任何人因看此文章而造成任何投资损失,本人恕不负责。切记,买卖自负! |

|

|

|

|

|

|

|

|

|

|

|

发表于 23-11-2015 07:25 PM

|

显示全部楼层

发表于 23-11-2015 07:25 PM

|

显示全部楼层

本帖最后由 icy97 于 24-11-2015 12:01 AM 编辑

Lii Hen up 5.6% after reporting improved 3Q as USD strengthens

By Supriya Surendran / theedgemarkets.com | November 23, 2015 : 3:24 PM MYT

http://www.theedgemarkets.com/my/article/lii-hen-56-after-reporting-improved-3q-usd-strengthens

KUALA LUMPUR (Nov 23): Furniture manufacturer Lii Hen Industries Bhd ( Valuation: 2.10, Fundamental: 2.50), which reported a near tripling in its latest quarterly net profit last Friday, saw its shares rise as much as 16 sen or 5.5% this morning to RM3.03.

In its third quarter ended Sept 30, 2015, Lii Hen said its net profit came in 2.7 times higher at RM15.5 million from RM5.8 million in the same quarter last year, while revenue rose 41.8% to RM144.25 million, largely due to the strengthening of the US dollar and higher contribution from bedding products.

This brought its net profit for the nine-month period (9MFY15) to RM38.9 million, up 89.8% from RM20.5 million in 9MFY14, while its revenue strengthened 33.8% to RM394.6 million from RM295 million.

The share price spike also came amid the continued strengthening of the US dollar against the ringgit. At the time of writing, the ringgit had weakened 0.36% to 4.3010 against the greenback.

About 80% of Lii Hen's products are exported to America — its single largest market. Its second largest market is Asia, contributing about 13% of sales.

According to Reuters, the ringgit fell as sliding crude oil prices underscored worries about Malaysia's falling oil and gas revenues.

Most emerging Asian currencies slid on Monday as the dollar hit a seven-month peak against major currencies with expectations of further easing in Europe, while slumping commodity prices indicate sluggish global demand.

At 3pm, Lii Hen shares were trading at RM3, still up 13 sen or 4.5%, after some 1.45 million shares were traded, giving it a market capitalisation of RM538.2 million.

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2015 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2015 | 30 Sep 2014 | 30 Sep 2015 | 30 Sep 2014 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 144,249 | 101,746 | 394,606 | 294,950 | | 2 | Profit/(loss) before tax | 18,923 | 7,620 | 50,250 | 27,145 | | 3 | Profit/(loss) for the period | 15,462 | 5,760 | 38,867 | 20,474 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 15,462 | 5,760 | 38,867 | 20,474 | | 5 | Basic earnings/(loss) per share (Subunit) | 8.59 | 3.20 | 21.59 | 11.37 | | 6 | Proposed/Declared dividend per share (Subunit) | 3.00 | 1.17 | 7.33 | 3.67 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.2068 | 1.0592 |

| Remarks : | | The above Basic Earning per Share, Proposed/Declared Dividend per Share and Net Assets per Share have been computed/restated based on enlarged share capital of 179,999,988 ordinary shares of RM0.50 each. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 24-11-2015 12:01 AM

|

显示全部楼层

发表于 24-11-2015 12:01 AM

|

显示全部楼层

本帖最后由 icy97 于 25-11-2015 12:21 AM 编辑

EX-date | 08 Dec 2015 | Entitlement date | 10 Dec 2015 | Entitlement time | 04:00 PM | Entitlement subject | Interim Dividend | Entitlement description | Third interim single tier dividend of 3 sen per ordinary share of RM0.50 each in respect of the financial year ending 31 December 2015 | Period of interest payment | to | Financial Year End | 31 Dec 2015 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | PLANTATION AGENCIES SDN BERHAD3rd Floor, Standard Chartered Bank Chambers2, Leboh Pantai10300Tel:042625333Fax:042622018 | Payment date | 28 Dec 2015 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 10 Dec 2015 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.0300 | Par Value | Malaysian Ringgit (MYR) 0.500 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 14-12-2015 10:58 PM

|

显示全部楼层

发表于 14-12-2015 10:58 PM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | CORPORATE GUARANTEE | Reference to the announcement made on 9 June 2015 (Reference No. GA1-12052015-00067), the Board of Directors of Lii Hen Industries Bhd ("LHIB or the Company") wishes to inform that: 1) PPL Plantation Sdn Bhd ("PPLP") a subsidiary of the Company has by today received a letter from Forest Plantation Development Sdn Bhd informing the cancellation of term loan facility granted to PPLP as Perbadanan Islam Johor ("PIJ") is not agreeable to PPLP's request for the execution of the Deed of Assignment prior to the execution of Facility Agreement for the said term loan. Hence, the Board of Directors of LHIB regards the Corporate Guarantee of RM22.5 million as cancelled.

2) The plantation infrastructure development expenditure of PPLP are through internally generated funds of LHIB's Group.

3) The cancellation of above term loan will not have any significant effect on the earnings per share, net assets per share, share capital and substantial shareholders' shareholdings of the Company for the current financial year. |

Type | Announcement | Subject | OTHERS | Description | CORPORATE GUARANTEE FOR JOINT VENTURE IN PLANTING OF RUBBER WOOD TREES | Further to the announcement made on 10 December 2015 (reference no. GA1-10122015-00028), the Board of Directors of Lii Hen Industries Bhd (LHIB) wishes to highlight the following: a) As announced on 22 July 2009 (reference no. CC-090722-62864 ), the LHIB Group, through its subsidiary companies, Lii Hen Plantation Sdn Bhd and PPL Plantations Sdn Bhd (PPLP), have entered into Joint Venture Agreement and Sub-Development Agreement respectively with Perbadanan Islam Johor ("PIJ") for the right of use over approximately 3,473 hectares permanent reserve forest land in the State of Johor Darul Takzim for planting and/or cultivation of rubber wood trees.

b) As stated in the Chairman’s Statement in the Annual Report 2014, the official launching of land clearing was carried out on 2 September 2014 by the Mersing Forest Officer for the first plot measuring approximately 1,000 acres. The clearing and stacking works completed at the end of February 2015 and approximately 750 acres were planted as at 28 March 2015.

c) On 9 June 2015, the Board of PPLP had agreed to accept a term loan facility of RM22.5 million from Forest Plantation Development Sdn Bhd (FPDSB), a wholly owned subsidiary of Lembaga Perindustrian Development Sdn Bhd, subject to provide a Corporate Guarantee from LHIB, an announcement (reference no. GA1-12052015-00067) of which was made on 9 June 2015. The said term loan is also subject to a First Party Deed of Assignment of "Sub-Development Agreement between PIJ Holding Sdn Bhd and PPL Plantations Sdn Bhd dated 8 September 2009" prior to the execution of Facility Agreement and the loan is to finance PPLP’s rubber trees planting expenditure in the 2,500 hectares plantation of Hevea Brasiliensis (Latex Timber Cone).

d) As announced on 10 December 2015, PPLP received a letter from FPDSB informing the cancellation of term loan facility granted to PPLP as PIJ is not agreeable to PPLP's request for the execution of the Deed of Assignment prior to the execution of Facility Agreement for the said term loan. Hence, the Board of Directors of LHIB regards the Corporate Guarantee of RM22.5 million as cancelled.

e) As at the date of this announcement, PPLP has planted 1072 acres (434 hectares). The balance of plantation land is pending taking vacant possession of the site and awaiting approvals from the relevant authorities to carry out the planting and/or cultivation of rubber wood trees.

f) As announced on 10 December 2015, the plantation infrastructure development expenditure of PPLP are through internally generated funds of LHIB's Group. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 28-1-2016 02:47 AM

|

显示全部楼层

发表于 28-1-2016 02:47 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | INCORPORATION OF SUBSIDIARY | INCORPORATION OF SUBSIDIARY 1.0 The Board of Directors of Lii Hen Industries Bhd., ("LHIB") wishes to announce that LHIB has on 27 January 2016 submitted the documents for incorporation of 60%-owned subsidiary, LSG FURNITURE SDN. BHD. ("LSG") as a private limited company under the Companies Act, 1965.

2.0 DETAILS OF THE INCORPORATION OF SUBSIDIARY

2.1 INFORMATION OF LSG

The authorised share capital of LSG is RM500,000.00 divided into 500,000 ordinary shares of RM1.00 each and the issued and paid-up share capital is RM100.00 divided into 100 ordinary shares of RM1.00 each.

The subscribers of LSG are | Name of Subscribers | Number of shares | Percentage (%) | | i) | Lii Hen Industries Bhd | 60 | 60 | | ii) | Sia Chee Shong | 20 | 20 | | iii) | Koh Ben Guan | 20 | 20 |

The proposed issued and paid-up share capital of LSG would be increased to RM500,000.00 by an allotment of 499,900 ordinary shares of RM1.00 each by cash as working capital purposes. The proposed principal activity of LSG is in manufacturing and designing of upholstery furniture products.

2.2 RATIONALE

The objective of setting up the above subsidiary is to expand the product range to upholstery furniture products and to secure new revenue streams of LHIB Group.

SOURCE OF FINANCING

The total subscription of RM60/- and proposed increased paid up share capital of RM299,940 are wholly financed by internal generated funds of LHIB Group.

FINANCIAL IMPACT The percentage ratio is insignificant in respect of the investment consideration in LSG compared with that of LHIB Group's net assets that stood at approximately RM190,653,892/- as at 31 December 2014.

DIRECTORS' AND SUBSTANTIAL SHAREHOLDERS' INTEREST

None of the directors and persons connected to the directors of LHIB have any interest, direct or indirect in the said transaction. To the best knowledge of the directors, none of the substantial shareholders or persons connected to the substantial shareholders of LHIB has any interest, direct or indirect in the said investment.

STATEMENT BY THE BOARD OF DIRECTORS

The Board is of the opinion that the incorporation of LSG is in the best interest of the LHIB Group and is not expected to have a material effect on the earnings or net assets of LHIB Group.

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 3-2-2016 12:05 AM

|

显示全部楼层

发表于 3-2-2016 12:05 AM

|

显示全部楼层

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

NON RELATED PARTY TRANSACTIONS | Description | Execution of a Tenancy Agreement between Favourite Design Sdn. Bhd. (264374-K) and Domain Partners Sdn. Bhd. (644189-P) to rent a block of single storey factory building for a total monthly rental of RM26,054.00. | The Board of Directors of Lii Hen Industries Bhd. (" LHIB" or "the Company") wishes to announce that Favourite Design Sdn. Bhd. (264374-K )("FD" or "the Tenant" ), a wholly-owned subsidiary of LHIB has on 1 February 2016 entered into a Tenancy Agreement (" Agreement ") with Domain Partners Sdn. Bhd. (644189-P) ("DPSB" or "the Landlord") to rent a block of single storey factory building held under Lot 1906, GM 1792, of Mukim Sungai Raya, District of Muar, State of Johor measuring an area of about 54,279 sq. ft. ('the Building") for a total monthly rental of RM26,054.00 ("the Rental"), calculated at monthly rate of RM0.48 per sq. ft. (hereinafter referred to as ""the Transaction").

2. BACKGROUND INFORMATION

Information on DPSB and the Building DPSB, the Landlord of the Building was incorporated in Malaysia on 2 March 2004. It has an authorised share capital of RM500,000.00 comprising five hundred thousand (500,000) ordinary shares of RM1.00 each with all the five hundred thousand (500,000) ordinary shares issued and fully paid-up. DPSB's principal business is property investment. The Directors of DPSB as at the date of this announcement are Chua Lee Seng (NRIC No. 500927-01-5015), Tok Heng Leong (NRIC No. 570901-01-6523) and Neoh Cher Leong (NRIC No. 580215-01-5001). And Chua Yong Haup (NRIC No. 670407-01-5283) and Tan Bee Eng (NRIC No. 581005-01-5331) are substantial shareholders of DPSB. The Rental of RM26,054.00 was arrived at based on a prevailing market rate after taking into account of the following: The present market rental of the Buildings is RM26,054.00 as appraised by the Company's appointed professional valuer, Messrs. Jordan Lee & Jaafar (M’cca) Sdn. Bhd. via its report dated 27 January 2016 and the Building is located adjoining to FD’s main plant. It is rented as new warehouse of finished goods and as premises of manufacturing of furniture of FD.

3. SALIENT TERMS OF THE TRANSACTION (a) The Tenant shall upon the signing of the Agreement pay the Landlord a sum of Ringgit Malaysia Seventy Eight Thousand One Hundred And Sixty Two (RM78,162.00) only as security deposit for the due observance and performance by the terms, conditions and stipulations of the Transaction.

(b) The period of the tenancy is three years commencing from 1 February 2016 and expiring on 31 January 2019. (c) The Tenant shall pay all sum, charges and outgoings in respect of electricity and water which shall be consumed or supplied on or to the Building. (d) The Tenant shall not assign or underlet the Building or any part thereof. (e) If the Building or any part thereof shall be destroyed or damaged by fire (except where such fire has been caused by the default or negligence of the Tenant) or in any way rendered unfit for use or occupation so as to be unfit for use for a period greater than thirty (30) days from the occurrence of destruction or damaged, then the rent hereby covenanted to be paid or a fair proportion thereof according to the nature and extent of the damages sustained shall be suspended until the Building shall again be rendered fit for habitation and use and if the Building or any part thereof is not rendered fit for occupation or use within sixty (60) days the Tenant may determine the tenancy by giving one (1) month's notice in writing and thereupon the same and the covenants herein contained shall cease as from the date of occurrence of such destruction or damage but without prejudice to the rights and remedies of either party against the other in respect of any antecedent claim or breach of covenant PROVIDED THAT nothing in this clause shall render it obligatory on the Landlord to restore reinstate or rebuild the Building or any part thereof if the Landlord in his absolute discretion does not desire to do so in which event the Landlord shall be entitled to terminate this tenancy by one (1) month's notice in writing to the Tenant and upon such termination neither party shall have any claim against the other save and except in respect of any antecedent claim or breach of covenant. (f) The Landlord shall pay all quit rent, rates and assessments which now are or are hereinafter during the tenancy imposed or assessed upon the Building. (g) The term created shall absolutely determine and vacant possession of the Building shall be delivered by the Tenant to the Landlord if and when the land on which the Building now stands shall be acquired by the Government compulsorily and neither party thereto shall have any claim against the other.

4. FINANCIAL EFFECTS OF THE TRANSACTION (a) Share Capital There is no effect on the issued and paid-up share capital of LHIB as the Transaction is entirely by cash. (b) Earnings The Transaction is not expected to have any material effect on the consolidated earnings of the LHIB Group for the financial year ending 31 December 2016. (c) Substantial Shareholders' Shareholdings The Transaction is not expected to have any effect on the substantial shareholders' shareholdings of LHIB.

(d) Net Assets The Transaction is not expected to have any material impact on the net assets of LHIB Group for the financial year ending 31 December 2016.

5. PERCENTAGE RATIO

The highest percentage ratio applicable to the Transaction by FD based on the latest audited consolidated financial statements of LHIB Group for the financial year ended 31 December 2014 as per Paragraph 10.02(g)(iii) of Chapter 10 of the Main Market Listing Requirements is 0.49%.

6. APPROVALS OF SHAREHOLDERS AND THE RELEVANT GOVERNMENT AUTHORITIES The Transaction is not subject to the approval of shareholders as it is regarded as an Exempted Transactionunder Paragraph 10.08(11)(h) of Chapter 10 of the Main Market Listing Requirements and to the best knowledge of the Directors of LHIB, the Transaction has not departed from the Securities Commission's Policies and Guidelines on Issue/Offer of Securities.

7. INTEREST OF DIRECTORS, SUBSTANTIAL SHAREHOLDERS AND PERSONS CONNECTED TO THEM

Saved as Chua Lee Seng, Tok Heng Leong, Neoh Cher Leong, Tan Bee Eng and Chua Yong Haup, are deemed interested in the Transaction by virtue of their directorship and/or shareholdings in DPSB, none of the Directors, substantial shareholders and/or persons connected to the Directors and substantial shareholders of LHIB, have any interest, direct or indirect, in the Transaction.

The interested directors have abstained from deliberations and voting at the Board of Directors’ meeting for the Transaction.

8. STATEMENT BY DIRECTORS AND AUDIT COMMITTEE The Board of Directors of LHIB, with interested directors of LHIB having abstained from deliberation and voting at the meeting of the Board of Directors of LHIB, having considered all aspects of the Transaction, is of the opinion that Transaction is in the best interest of the LHIB Group.

The Audit Committee is of the view that the Transaction: a. is in the best interest of the LHIB Group; b. is fair, reasonable and on normal commercial terms; and c. is not detrimental to the interest of the minority shareholders as FD needs the Building for warehousing of finished goods and manufacture of furniture. Moreover, it is easy for management as the Building is adjoining to FD’s main plant.

9. DOCUMENTS FOR INSPECTION

The Agreement and Valuation Document are available for inspection at the registered office of LHIB at 67, 3rd Floor, Jalan Ali, 8400 Muar, Johor Darul Takzim during normal office hours from Mondays to Fridays (except public holidays) for a period of three (3) months from the date of the announcement. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 24-2-2016 05:30 PM

|

显示全部楼层

发表于 24-2-2016 05:30 PM

|

显示全部楼层

本帖最后由 icy97 于 24-2-2016 05:32 PM 编辑

| 7089 LIIHEN LII HEN INDUSTRIES BHD | | Quarterly rpt on consolidated results for the financial period ended 31/12/2015 | | Quarter: | 4th Quarter | | Financial Year End: | 31/12/2015 | | Report Status: | Unaudited | | Submitted By: |

|

|

| Current Year Quarter | Preceding Year Corresponding Quarter | Current Year to Date | Preceding Year Corresponding Period |

| 31/12/2015 | 31/12/2014 | 31/12/2015 | 31/12/2014 |

| RM '000 | RM '000 | RM '000 | RM '000 | | 1 | Revenue | 152,216 | 102,978 | 546,822 | 397,928 | | 2 | Profit/Loss Before Tax | 21,734 | 8,420 | 71,984 | 35,696 | | 3 | Profit/Loss After Tax and Minority Interest | 18,313 | 7,531 | 57,180 | 28,266 | | 4 | Net Profit/Loss For The Period | 18,313 | 7,531 | 57,180 | 28,125 | | 5 | Basic Earnings/Loss Per Shares (sen) | 10.17 | 4.18 | 31.77 | 15.70 | | 6 | Dividend Per Share (sen) | 6.00 | 1.17 | 13.33 | 4.83 |

|

|

| As At End of Current Quarter | As At Preceding Financial Year End | | 7 | Net Assets Per Share (RM) |

|

| 1.2769 | 1.0592 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 24-2-2016 05:30 PM

|

显示全部楼层

发表于 24-2-2016 05:30 PM

|

显示全部楼层

本帖最后由 icy97 于 24-2-2016 05:33 PM 编辑

| 7089 LIIHEN LII HEN INDUSTRIES BHD | | Special Single Tier Dividend 6 Sen |

| | Entitlement Details: | Special single tier dividend of 6 sen per ordinary share of RM0.50 each in

respect of the financial year ended 31 December 2015 |

| | Entitlement Type: | Special Dividend | | Entitlement Date and Time: | 11/03/2016 04:00 AM | | Year Ending/Period Ending/Ended Date: | 31/12/2015 | | EX Date: | 09/03/2016 | | To SCANS Date: |

| | Payment Date: | 25/03/2016 | | Interest Payment Period: |

| | Rights Issue Price: | 0.000

| | Trading of Rights Start On: |

| | Trading of Rights End On: |

| | Stock Par Value: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 25-2-2016 02:13 AM

|

显示全部楼层

发表于 25-2-2016 02:13 AM

|

显示全部楼层

本帖最后由 icy97 于 25-2-2016 02:14 AM 编辑

Type | Announcement | Subject | OTHERS | Description | PROPOSED FINAL SINGLE TIER DIVIDEND | The Board of Directors of Lii Hen Industries Bhd. has proposed a final single-tier dividend of 4 cent for the financial year ended 31 December 2015. The proposed final dividend is subject to the approval by the shareholders at the forthcoming Annual General Meeting. The date of entitlement and date of payment in respect of the aforesaid proposed final dividend will be determined and announced in due course. |

Type | Announcement | Subject | OTHERS | Description | Globetronics Technology Bhd ("GTB" or "the Company")Variation On The Rate Of Dividend Declared Compared To Corresponding Period In Previous Financial Year | The Board of GTB is pleased to declare a single tier interim dividend of 4% and a single tier special dividend of 14% per ordinary share of RM0.50 each for the financial year ending 31 December 2016.

The rate of the single tier special dividend declared is higher by 2% when compared with the rate of the special dividend declared for the corresponding period in previous financial year ended 31 December 2015 mainly due to the encouraging financial and cash flow position of the Group.

This announcement is dated 24 February 2016. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 25-2-2016 02:17 AM

|

显示全部楼层

发表于 25-2-2016 02:17 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | PROGRAMME OF RUBBER TREES PLANTING OVER FOREST RESERVE LAND | Further to the announcements made on 21 May 2012, 25 July 2012 and 27 December 2013 the Board of Directors of Lii Hen Industries Bhd ("LHIB") wishes to inform that the subsidiary of the Company, PPL Plantations Sdn Bhd ("PPL") has received a letter from Joint Venture partner, PIJ Plantation & Agriculture Sdn Bhd informing PPL that the remaining portion of undeveloped forest land of 3,069 hectares out of total 3,473 hectares are excluded from the rubber trees planting programme as decided by Majlis Mesyuarat Kerajaan.

The Board of PPL has lodged an appeal by today. However, as matter of prudence, the Board of LHIB has taken step to provide the impairment of Right of Use over permanent reserve forest land in relation to the undeveloped portion of land amounting RM4,253,228 in the profit and loss for the period ended 31 December 2015. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 28-3-2016 04:08 PM

|

显示全部楼层

发表于 28-3-2016 04:08 PM

|

显示全部楼层

|

Directors are disposing.. Any comments? |

|

|

|

|

|

|

|

|

|

|

|

发表于 28-4-2016 05:35 PM

|

显示全部楼层

发表于 28-4-2016 05:35 PM

|

显示全部楼层

EX-date | 08 Jul 2016 | Entitlement date | 12 Jul 2016 | Entitlement time | 04:00 PM | Entitlement subject | Final Dividend | Entitlement description | A final single tier dividend of 4 cent per ordinary share in respect of the financial year ended 31 December 2015 | Period of interest payment | to | Financial Year End | 31 Dec 2015 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | PLANTATION AGENCIES SDN BERHAD3rd Floor, Standard Chartered Bank Chambers2, Leboh Pantai 10300Tel: 042625333Fax: 042622018 | Payment date | 26 Jul 2016 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 12 Jul 2016 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.0400 | Par Value | Malaysian Ringgit (MYR) 0.500 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 17-5-2016 02:40 PM

|

显示全部楼层

发表于 17-5-2016 02:40 PM

|

显示全部楼层

kongsenger 发表于 2-6-2015 05:50 PM

Liihen 7089 RM4.50 进场,未来丰衣足食。

1)公司于5月的Q1 2015 业绩很好,赚了 1074万,Eps=17.9sen ,nta=rm3.32

若下来Q2,Q3,Q4都有720万(EPS=12SEN),则全年可赚3234万(EPS=53.9SEN)

现RM4.50只是PE=8.3 ...

你好,你用的指标图“App"是从那下載的,可以给我知道吗?谢谢.

|

|

|

|

|

|

|

|

|

|

|

|

发表于 17-5-2016 02:41 PM

|

显示全部楼层

发表于 17-5-2016 02:41 PM

|

显示全部楼层

kongsenger 发表于 2-6-2015 05:50 PM

Liihen 7089 RM4.50 进场,未来丰衣足食。

1)公司于5月的Q1 2015 业绩很好,赚了 1074万,Eps=17.9sen ,nta=rm3.32

若下来Q2,Q3,Q4都有720万(EPS=12SEN),则全年可赚3234万(EPS=53.9SEN)

现RM4.50只是PE=8.3 ...

你好,你用的指标图“App"是从那下載的,可以给我知道吗?谢谢.

|

|

|

|

|

|

|

|

|

|

|

|

发表于 23-5-2016 01:35 AM

|

显示全部楼层

发表于 23-5-2016 01:35 AM

|

显示全部楼层

本帖最后由 icy97 于 27-5-2016 04:43 AM 编辑

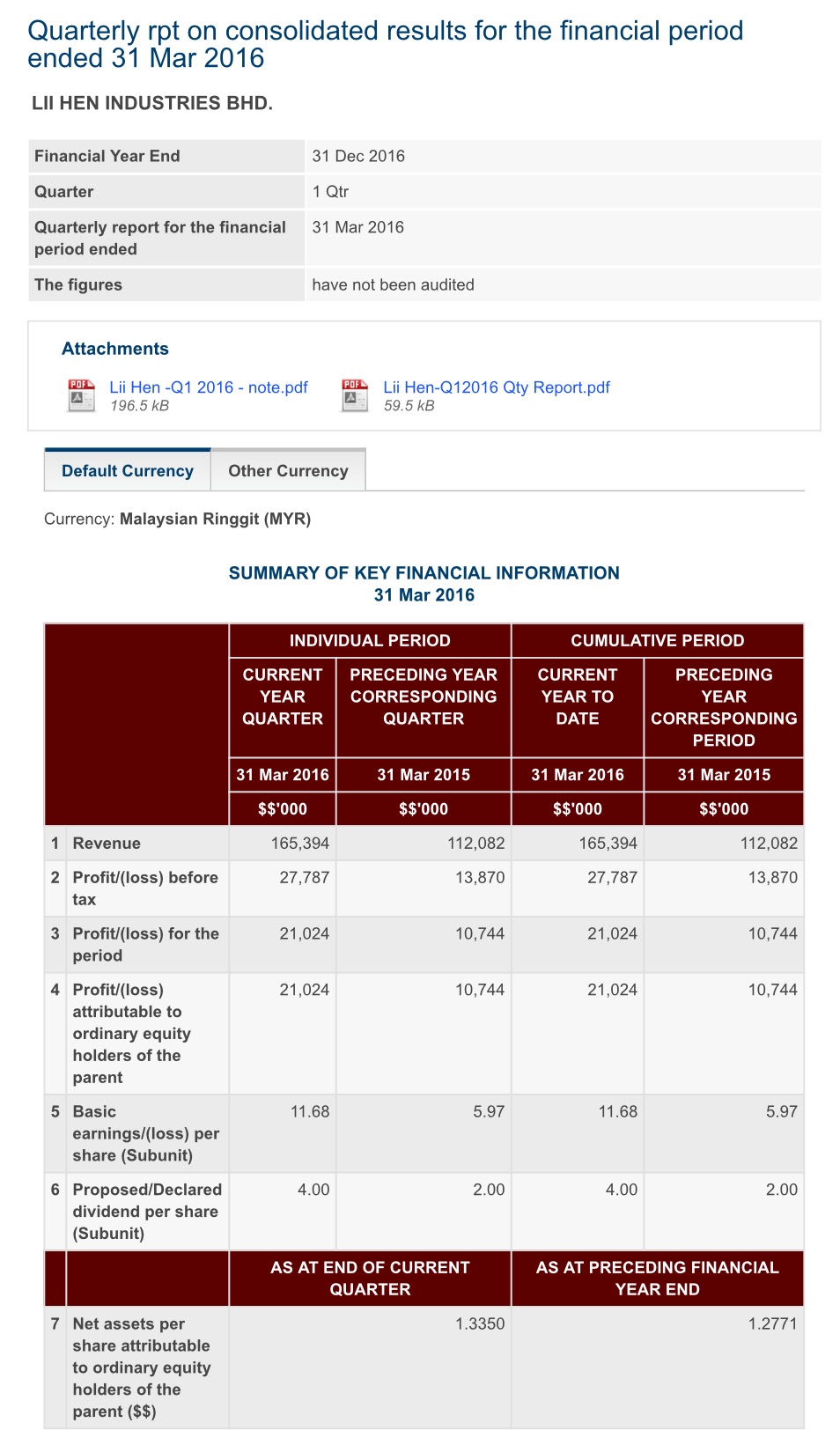

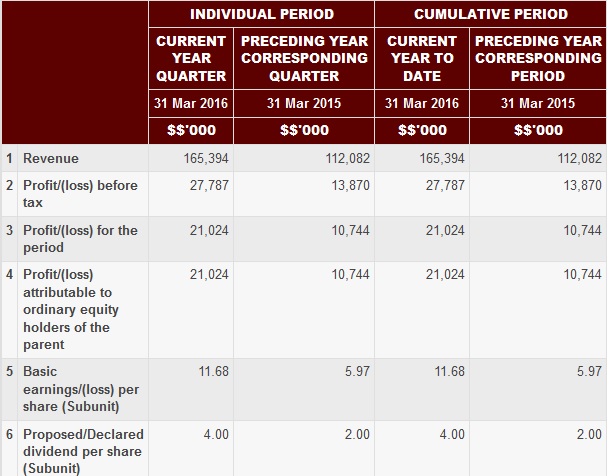

利兴工业首季表现亮眼

By Supriya Surendran / theedgemarkets.com | May 23, 2016 : 10:29 AM MYT

(吉隆坡23日讯)家具制造商利兴工业(Lii Hen Industries Bhd)交出亮眼的首季表现。

截至3月杪首季,利兴工业净利从上财年同期的1074万令吉,增长近一倍至2102万令吉,因营业额走高,以及更好的美元转换率。

首季营业额扬47.6%至1亿6539万令吉,同期是1亿1208万令吉。

该集团还宣布派发每股4仙的中期单层股息,除权为6月10日,并将于6月28日支付。

(编译:陈慧珊)

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2016 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2016 | 31 Mar 2015 | 31 Mar 2016 | 31 Mar 2015 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 165,394 | 112,082 | 165,394 | 112,082 | | 2 | Profit/(loss) before tax | 27,787 | 13,870 | 27,787 | 13,870 | | 3 | Profit/(loss) for the period | 21,024 | 10,744 | 21,024 | 10,744 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 21,024 | 10,744 | 21,024 | 10,744 | | 5 | Basic earnings/(loss) per share (Subunit) | 11.68 | 5.97 | 11.68 | 5.97 | | 6 | Proposed/Declared dividend per share (Subunit) | 4.00 | 2.00 | 4.00 | 2.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.3350 | 1.2771 |

| Remarks : | | The preceding year's EPS and Declared dividend per share were restated to reflect the retrospective adjustments arising from the bonus issue and share split. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 23-5-2016 01:36 AM

|

显示全部楼层

发表于 23-5-2016 01:36 AM

|

显示全部楼层

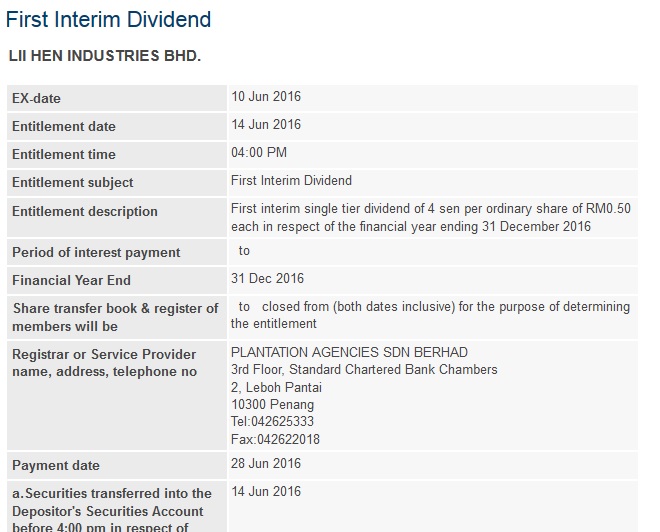

EX-date | 10 Jun 2016 | Entitlement date | 14 Jun 2016 | Entitlement time | 04:00 PM | Entitlement subject | First Interim Dividend | Entitlement description | First interim single tier dividend of 4 sen per ordinary share of RM0.50 each in respect of the financial year ending 31 December 2016 | Period of interest payment | to | Financial Year End | 31 Dec 2016 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | PLANTATION AGENCIES SDN BERHAD3rd Floor, Standard Chartered Bank Chambers2, Leboh Pantai10300 Penang Tel:042625333Fax:042622018 | Payment date | 28 Jun 2016 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 14 Jun 2016 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.0400 | Par Value | Malaysian Ringgit (MYR) 0.500 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 23-5-2016 11:23 PM

|

显示全部楼层

发表于 23-5-2016 11:23 PM

|

显示全部楼层

本帖最后由 icy97 于 24-5-2016 12:47 AM 编辑

LIIHEN DOUBLED ITS CAPACITY - GREAT RESULTS, MORE TO COME!

Lii Hen Industries, a public company that has several divisions producing furniture for the U.S. and other markets, has seen its sales quadruple in the past five years to about $115 million in 2014. Officials attribute this to the strength of the company’s Muar-based divisions, which produce wood categories from bedroom and dining to accent and office furniture. The company also manages its own timberland and processes wood components used in finished product. The company also has expanded its production facilities, including a new 210,000-square-foot plant at its Favourite Design bedroom division that roughly doubled its capacity.

http://www.furnituretoday.com/article/524139-malaysian-furniture-producers-poised-more-us-sales

16. Review of performance

The first quarter of Group’s revenue for 2016 registered at RM165 million, rose 48% as compared to the corresponding quarter of last year. The increases were mainly contributed from the increased in orders of the Group’s products by 27% and the strengthening of the US Dollar against RM.

In spite of forex loss, net profit more than doubled! Dividend doubled to 4 Sen per share!

Annualised EPS 47 Sen. At 2.51, PER is only 5 times!!

Using Kenanga Research average Fwd PER of 10.6x for furniture players^, target price for Lii Hen is RM4.90!! 98% Upside from current stock price of RM2.51!

_____________________

^Doing better than board makers? We peg the furniture players’ valuation at an average of 10.6x Fwd PER, based on applying 0%-20% premium to Malaysian board maker companies’ average Fwd. PER of 9.6x. We think the benchmark is fair as board makers have enjoyed similar margin expansion driven by USD appreciation, and furniture makers’ raw materials are partially derived from board makers as well.

http://klse.i3investor.com/blogs/kenangaresearch/89699.jsp

|

|

|

|

|

|

|

|

|

|

|

|

发表于 23-5-2016 11:28 PM

|

显示全部楼层

发表于 23-5-2016 11:28 PM

|

显示全部楼层

本帖最后由 icy97 于 23-6-2016 06:24 PM 编辑

5 reasons why I like LIIHEN

Author: FayeTan | Publish date: Mon, 23 May 2016, 09:09 AM

http://klse.i3investor.com/blogs/genzinvestor/96931.jsp

- Proxy to higher USD. The market is expecting at least one interest rate hike in US although when it will happen is still everyone’s guess. This should lead to stronger USD. After witnessing the volatile USDMYR movement in the past one year, I have learned to have a view longer than one year. And my view is now stronger USD is the trend for the next 3 years. Historically, we can see that despite the volatility, long term trend is for USD to appreciate against Ringgit.

- Strong 1Q result. You can see from this picture below as earnings grew 96% yoy to RM21.0m. I quote directly from their Bursa announcement – “The increases were mainly contributed from the increased in orders of the Group’s products by 27% and the strengthening of the US Dollar against RM. The average USD in 1Q16 was at 4.20 vs. 1Q15 3.55 (or +18%yoy). My take: I am impressed by the increase in orders by 27% which means that the Company is growing by itself and not only dependent on USD strength alone.

3. Strong balance sheet with net cash. Total cash is RM113.8m with total debt RM31.8m. So net cash is RM82m or 45.6 sen per share.

4. High dividend yield with dividend paid every quarter. The Company paid its dividend on a quarterly basis. My conservative assumption shows that the Company dividend yield is higher than 7.5% assuming USDMYR of more than 4.0 and pure order growth of more than 10% annually. The best thing is the next dividend is only one month away. Ex-date is 10-Jun while the payment date is 28-Jun.

5. Undervalued at PE less than 10x. The Company made RM57.6m in FY15 in which the USD rate was 3.87. For this year, I am assuming average USD rate of 4.00. Coupled with higher volume of orders expected for LIIHEN’s furniture, my simple calculation shows that LIIHEN is able to achieve at least RM62m. This means that market is only giving PE of 7.3x based on market price of RM2.51. As a result, I think his company is still undervalued.

My long term fair value for the Company is around RM3.50.

6. Short term risk is that Mr. Koon Yew Yin (KYY) is a substantial shareholder. Recently many bloggers and market participants are against any stock in which Mr KYY is a major shareholder. I do agree that Mr KYY should not disclose its change in buy/sell too late to Bursa. And in a fair market, Mr KYY can actually sell his shares to capitalize on the good earnings in 1Q16. So you better prepare for short term volatility.

But good company fundamental means long term share price appreciation is likely. As a result, I think that Mr. KYY negative impact on LIIHEN might persist in the short term but fundamental will prevail in the long run. Why? As more shareholder receive the quarterly dividend with increasing earnings, LIIHEN naturally will attract more pure investors and lead to higher share price.

For record purpose, at the time I write on LIIHEN the share price was RM2.51. USD is at 4.07.

|

|

|

|

|

|

|

|

|

|

|

|

发表于 23-6-2016 05:55 PM

|

显示全部楼层

发表于 23-6-2016 05:55 PM

|

显示全部楼层

本帖最后由 icy97 于 23-6-2016 07:05 PM 编辑

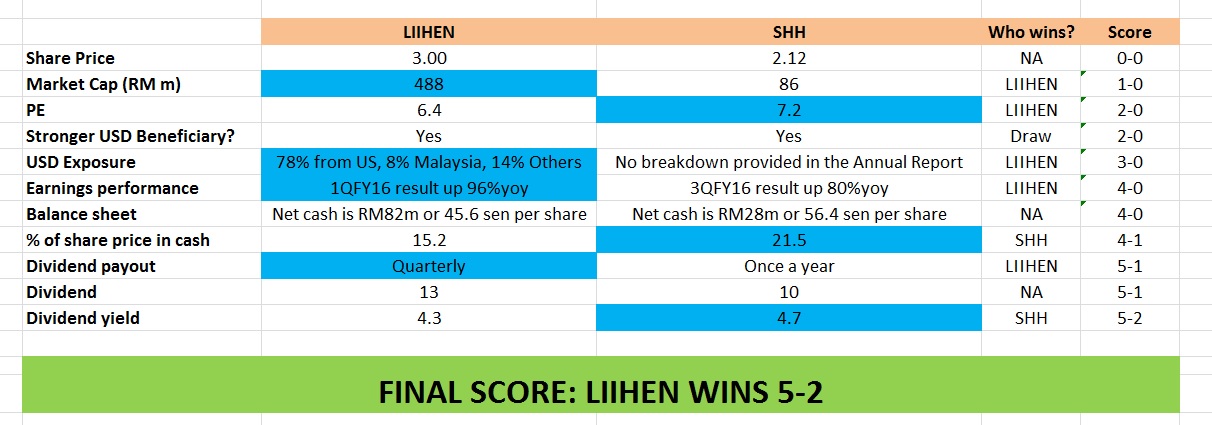

LIIHEN vs SHH (It is a 5-2 score if this is a WORLD CUP match)

Author: FayeTan | Publish date: Thu, 23 Jun 2016, 10:56 AM

http://klse.i3investor.com/blogs/genzinvestor/98888.jsp

The comparison above speaks for itself. LIIHEN is better in five areas:

i) Larger market cap

ii) Lower PE

iii) Better exposure to USD strength in the long term

iv) Earnings jump yoy is higher

v) Frequency dividend is at QUARTERLY basis.

SHH is better in only two areas:

i) Higher % of share price in cash at 21.5%

ii) Higher dividend yield at 4.7%

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|