|

|

发表于 4-3-2017 06:18 AM

|

显示全部楼层

发表于 4-3-2017 06:18 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2016 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2016 | 31 Dec 2015 | 31 Dec 2016 | 31 Dec 2015 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 113,205 | 160,237 | 498,546 | 654,736 | | 2 | Profit/(loss) before tax | 15,685 | 28,418 | 75,174 | 101,237 | | 3 | Profit/(loss) for the period | 11,765 | 21,674 | 56,458 | 76,198 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 11,746 | 21,674 | 56,422 | 76,198 | | 5 | Basic earnings/(loss) per share (Subunit) | 2.14 | 3.94 | 10.27 | 13.87 | | 6 | Proposed/Declared dividend per share (Subunit) | 1.40 | 1.40 | 2.40 | 2.40 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.2759 | 1.1972

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 8-3-2017 02:23 AM

|

显示全部楼层

发表于 8-3-2017 02:23 AM

|

显示全部楼层

本帖最后由 icy97 于 10-3-2017 03:49 AM 编辑

福胜利获3.33亿污水工程

2017年3月4日

(吉隆坡3日讯)福胜利(HSL,6238,主板建筑股)宣布,获得砂拉越污水处理服务部(Jabatan Perkhidmatan Pembentungan)颁发价值约3亿3307万3143令吉的合约。

福胜利今日向马交所报备,已接获砂拉越污水处理服务部的得标书,为美里的污水处理厂和下水道网络进行工程。

上述工程涵盖土方工程、建设和调试污水处理厂、下水道网络、中间泵站等相关工程,为期4年,将于本月30日施工。

上述合约,预计不会对福胜利的股本和股权有任何影响,并将对净利和净资产带来正面贡献。

末季净利跌46%

闭市时,福胜利以1.71令吉挂收,起5仙或3%,成交量有54万2900股。

早前福胜利宣布业绩,基于产业发展及建筑业务贡献减少,截至去年底末季,净利按年下跌45.81%至1174万6000令吉,上财年同期为2167万4000令吉。

该公司向马交所报备,末季营业额则按年跌29.35%,报1亿1320万5000令吉,上财年同期为1亿6023万7000令吉。

另外,福胜利也建议派发每股1.4仙的股息。

合计全年,净利按年下跌25.95%至5642万2000令吉;营业额则减少23.86%,至4亿9854万6000令吉。

董事经理拿督余志和在文告指,基于公司强劲的订单,拥有大型项目直到2020年,相信公司未来的净利能见度依然是高的。

此外,他也放眼获得砂拉越再生能源走廊(SCORE)及发电厂的其他基建工程。

“若有机会,我们也会竞标可负担房屋、水供、防洪、污水渠工程、道路、桥梁,以及房屋建造合约。”

他说,虽然经济前景不稳定,不过公司的负债率低及拥有大量的现金储备,有能力承接更多项目。【e南洋】

Type | Announcement | Subject | OTHERS | Description | LETTER OF ACCEPTANCE | The Board of Directors of Hock Seng Lee Berhad (“HSL”) is pleased to announce that HSL has on 3 March 2017 received the Letter of Acceptance from Jabatan Perkhidmatan Pembentungan Sarawak for the wastewater treatment plant and sewer networks project in Miri, known as “Loji Rawatan Kumbahan Serantau Dan Rangkaian Paip Pembetungan Miri (Fasa 1) : Pakej A – Rangkaian Paip Pembetungan” (“the Project”) worth Ringgit Malaysia Three Hundred Thirty Three Million Seventy Three Thousand One Hundred and Forty Two and Sen Seventy Six Only (RM333,073,142.76), through open tender exercise.

The scope of works for HSL includes earthworks, construction and commissioning of the wastewater treatment plant, sewer networks, intermediate pump station including associated works and property connections.

The contract period for the Project is forty-eight (48) months commencing 30 March 2017. The Contract is expected to contribute positively to the earnings and net assets of HSL Group as the Project progresses during the contract period. However, the transaction will not have any effect on the share capital and substantial shareholdings of HSL. None of the directors and/or major shareholders of HSL or persons connected to them have any interest, direct or indirect, in the above contract. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 12-3-2017 01:33 AM

|

显示全部楼层

发表于 12-3-2017 01:33 AM

|

显示全部楼层

本帖最后由 icy97 于 12-3-2017 05:39 AM 编辑

福胜利

新合约达全年目标83%

2017年3月7日

分析:丰隆投行研究

目标价:2.00令吉

最新进展:

福胜利(HSL,6238,主板建筑股)获得砂拉越排污局约3亿3307万3143令吉的合约。

该公司接获得标书,为美里的污水处理厂和下水道进行工程。

这项工程涵盖土方工程、建设和调试污水处理厂、下水道网络、中间泵站等相关工程,合约为期4年,本月30日施工。

行家建议:

这是福胜利本财年接获的首个合约,估计福胜利目前订单,总值为24亿令吉。

我们预设福胜利本财年获4亿令吉新订单,如今目标已达到83%,相信净利有更大上扬潜力。

福胜利资产负债表维持稳健,净现金8850万令吉,或每股16仙。

维持2令吉的目标价,建议买入。

【e南洋】

攫合约能力强.福胜利值得期待

2017-03-06 17:49

http://www.sinchew.com.my/node/1620960/

|

|

|

|

|

|

|

|

|

|

|

|

发表于 13-3-2017 06:36 AM

|

显示全部楼层

发表于 13-3-2017 06:36 AM

|

显示全部楼层

福胜利上市连赚20年.去年27亿合约创新高

“对砂拉越海事工程与基本设施企业福胜利(HSL,6238,主板建筑组)来说,2016年是里程碑年,那是公司1996年在主板建筑组上市至今,第20个成功经营、每季赚取盈利的年头。”

福胜利董事经理拿督余志和说:“不只是公司上市已经20年,这也是集团工程合约价值创新高的一年,达27亿令吉,主要合约分别是泛婆罗洲高速大道部份工程,以及古晋中央废水处理系统第二项配套计划。”

他说,截至2016年12月31日,福胜利订单有26亿令吉,集团营业额达到4亿9855万令吉,税前盈利得7517万令吉,税前赚幅介于15%,比业界平均水平高;反观截至2015年12月31日的营业额则有6亿5474万令吉,税前盈利得1亿零124万令吉。

共派息12%

“过去一年,集团克服营运挑战,包括劳工、器材成本上扬,以及马币汇率下跌的冲击,鉴于业绩表现不错,董事局建议分发终期单层、免税股息,每股派发7%,加上之前的单层、每股5%中期免税股息,集团的股息派发共12%。”

福胜利在2016年总共攫取14项建筑合约,价值18亿6000万令吉,除了两项大型计划,集团在砂拉越再生能源走廊,也赢取新的合约。

在沙玛拉朱,福胜利取得林荫大道计划,以及变压站合约价值1亿2200万令吉,现有计划的进展保持稳健,公司在2016年持续投标、完成价值5亿9000万令吉的合约,包括砂拉越再生能源走廊3个成长中城镇的计划。

此外,在丹绒马尼斯,福胜利完成抽水站、河岸过滤系统,以及通往清真中心道路的工程,在沙玛拉朱,集团完成基本设施工程,以及沙玛拉朱工业园的政府计划。

与此同时,在木胶,福胜利完成Tingkas吸取原水第二配套计划,以及通往UiTM新校园的道路,在砂拉越再生能源走廊以外地区,已完成的计划包括民都鲁及斯里阿曼、古晋Petanque大厦等计划。

产业营收扬80%

另一方面,集团旗下产业发展领域也是里程碑年,按年比营业额上扬80%,子公司福胜利建筑私人有限公司,推出价值8400万令吉的新计划,该领域截至2016年12月31日营业额,从前期的3216万令吉,增至5798万令吉。

子公司推8400万新计划

集团产业组营业额所得归因于一项占地200英亩的旗舰综合产业计划,就在古晋─三玛拉汉高速大道附近;自2015年杪推出后,该项围篱住宅产业计划获得不错的订购率,销售价值接近1亿令吉。

其他卖得不错的产业计划包括:沙玛凉阿曼2最新一期产业,共有84个单位的双层排屋,至于双层半独立洋房将在2017年内推出。

此外,还有一些进行中的商业与工业产业计划,位于古晋的Vista工业园第二和第三栋,共有55个单位的工业产业,价值6800万令吉,第一栋于2016年推出,大约出售60%。

余志和表示:“尽管政府采取的冷却产业市场措施,降低产业市场的温度,不过,公司持续寻求发展首要地点、卖得出的产业计划,以及在设计与房产概念上力求革新,让产业买家认为物有所值。”

放眼未来,手上拥有大型基设计划的庞大订单延至2020年,福胜利集团盈利展望保持乐观,其他的发展机会包括:砂拉越再生能源走廊更多的基设计划,供当地市场对能源发电的需求。

余志和补充:“我们也投标可负担房屋、水供、防洪、排污、道路、桥梁及建筑工程等合约,虽然经济前景不明朗,但集团负债率低、拥有充裕现金储备,相信接下来有能力承接更多工程。”

文章来源:

星洲日报‧投资致富‧企业故事‧文:郑碧娥‧2017.03.12 |

|

|

|

|

|

|

|

|

|

|

|

发表于 28-4-2017 03:03 AM

|

显示全部楼层

发表于 28-4-2017 03:03 AM

|

显示全部楼层

EX-date | 07 Jun 2017 | Entitlement date | 09 Jun 2017 | Entitlement time | 04:00 PM | Entitlement subject | Final Dividend | Entitlement description | Final single tier exempt dividend of 1.4 sen per ordinary share each in respect of the financial year ended 31 December 2016 | Period of interest payment | to | Financial Year End | 31 Dec 2016 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | TRICOR INVESTOR & ISSUING HOUSE SERVICES SDN BHDUnit 32-01, Level 32, Tower A,Vertical Business Suite, Avenue 3, Bangsar South,No. 8, Jalan Kerinchi59200Kuala LumpurTel:0327839299Fax:0327839222 | Payment date | 23 Jun 2017 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 09 Jun 2017 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.014 | Par Value | Malaysian Ringgit (MYR) 0.000 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 17-5-2017 12:33 AM

|

显示全部楼层

发表于 17-5-2017 12:33 AM

|

显示全部楼层

泛婆大道进度如期‧福胜利前景稳健

(吉隆坡12日讯)福胜利(HSL,6238,主板建筑组)的泛婆罗洲大道工程进度如期,并将竞标大型政府基建合约,分析员看好该公司手上合约订单将捎来可观盈利。

大马投行最近走访福胜利管理层后表示,泛婆罗洲大道建筑进度如期,目前已完成6%工程,管理层预计,在基础工程完成后,进度可大步加速。

因泛婆罗洲大道的建筑共需要约400公吨的碎石料,该公司将从其目前采用率为20%的采石场,生产碎石料,料每年产量为200万公吨。

污水管理系统(WMS)服务方面,福胜利将在古晋及美里再展开两项污水处理系统,项目价值分别为5亿6300万令吉及3亿3300万令吉,目前仍处于初步阶段,营收预计于2018年进一步入账。

大马投行研究指出,该公司也已接获砂拉越排污服务局(SSDS)合约,且因砂拉越政府仍有15亿5000令吉的项目合约未颁发,该公司料将继续竞标道路及桥梁建筑项目合约。

该行认为,福胜利订单达21亿令吉,可忙碌3至4年,未来盈利清晰可见,加上泛婆罗洲大道、港口、水力发电厂、污水管理设备等建筑工程料将捎来可观盈利,因此将福胜利合理价由1令吉80仙,上调至2令吉15仙,并维持“买进”评级。

文章来源:

星洲日报/财经·文:陈学颖·2017.05.12 |

|

|

|

|

|

|

|

|

|

|

|

发表于 30-5-2017 04:39 AM

|

显示全部楼层

发表于 30-5-2017 04:39 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2017 | 31 Mar 2016 | 31 Mar 2017 | 31 Mar 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 105,179 | 142,259 | 105,179 | 142,259 | | 2 | Profit/(loss) before tax | 15,045 | 21,541 | 15,045 | 21,541 | | 3 | Profit/(loss) for the period | 11,291 | 16,255 | 11,291 | 16,255 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 11,271 | 16,255 | 11,271 | 16,255 | | 5 | Basic earnings/(loss) per share (Subunit) | 2.05 | 2.96 | 2.05 | 2.96 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.2964 | 1.2759

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 3-6-2017 01:05 AM

|

显示全部楼层

发表于 3-6-2017 01:05 AM

|

显示全部楼层

福胜利

24亿订单未入账

2017年5月27日

分析:大马投资银行

目标价:2.15令吉

最新进展:

福胜利(HSL,6238,主板建筑股)截至3月杪首季,净利按年跌30.66%,取得1127万1000令吉或每股2.05仙。

营业额录得1亿517万9000令吉,按年减26.1%,其中建筑和产业发展业务,个别贡献87%和13%。

建筑和产业发展业务营业额,分别按年走低25%和33.8%,归咎于主要项目仍在初步阶段及古晋产业市场疲软。

行家建议:

福胜利首季净利,虽然仅占我们和市场全年预测的18%及15%,但仍符合预期,因为估计主要建筑项目在接下来季度会推动增长。

首季营业额可见度强稳,主要因为一些小型项目将完成,尤其是砂拉越再生能源走廊(SCORE)基建工程。

还有大型项目,如泛婆罗洲大道和污水处理厂,推动增长。

我们认为,福胜利前景依然强劲,因首季取得总值3亿4600万令吉的新合约,目前订单高达28亿令吉,其中未入账订单企于24亿令吉,可忙碌3至4年。

我们继续看好福胜利,主因是稳健的订单,以及长期净利可见度强劲,由大型基础设施发展项目推动。

【e南洋】 |

|

|

|

|

|

|

|

|

|

|

|

发表于 30-6-2017 01:27 AM

|

显示全部楼层

发表于 30-6-2017 01:27 AM

|

显示全部楼层

本帖最后由 icy97 于 30-6-2017 04:29 AM 编辑

福胜利股东罢黜4名董事失败收场

Sangeetha Amarthalingam/theedgemarkets.com

June 29, 2017 19:00 pm MYT

(吉隆坡29日讯)福胜利(Hock Seng Lee Bhd)股东欲罢黜董事经理拿督余志和及另外3名董事的行动宣告失败。

这家建筑与工程集团今日向大马交易所报备,古晋高等法庭今日驳回福胜利股东Yii Chee Ming提出的罢黜申请,前者欲罢黜余志和、执行董事Tony Yu Yuong Wee和Lau Kiing Kang,以及非执行董事Lau Kiing Yiing。

然而,Yii Chee Ming却成功使古晋高庭下达命令,促4名董事披露有关买卖福胜利和控股公司Hock Seng Lee Enterprise私人有限公司股权的事宜。

去年12月,Yii Chee Ming就4名董事向有关当局披露“有关自己或其配偶买卖Hock Seng Lee Enterprise股权”的事宜提出诉讼。

福胜利表示,高庭驳回罢黜上述4名董事的决定“完全证明这些董事的清白”,因高庭认定没有足够的资料证明Yii Chee Ming的指控。

不过,福胜利对高庭下达的披露指令并不满意,并将提出上诉。该集团已口头提出申请,而高庭已在明日就此事的正式申请聆讯前给予暂缓令(interim stay)。

“董事部将咨询法律顾问,以决定下一步的行动。”

(编译:倪嫣鴽)

Type | Announcement | Subject | MATERIAL LITIGATION | Description | INVOLVING YII CHEE MING (PLAINTIFF) AGAINST DATO YU CHEE HOE, TONY YU YUONG WEE, LAU KIING KANG, LAU KIING YIING AND HOCK SENG LEE BERHAD (DEFENDANTS) | Further to the announcements made on 21 April 2017, 3 May 2017, 11 May 2017 and 19 June 2017, the Board of Directors of Hock Seng Lee Berhad wishes to inform that the High Court in Kuching had on 29 June 2017 dismissed the prayer in the Originating Summons (OS) by the Plaintiff seeking the removal of the four directors. The Court decision is a full vindication of the four present Board members namely Dato Yu Chee Hoe (1st Defendant), Tony Yu Yuong Wee (2nd Defendant), Lau Kiing Kang (3rd Defendant) and Lau Kiing Yiing (4th Defendant) in the OS and proof that the allegations made by the Plaintiff were baseless given the fact that the Court had concluded that there were insufficient materials to support the plaintiff’s allegation.

The High Court has at the same time ordered the Defendants to make disclosures concerning the acquisition and disposal of shares in Hock Seng Lee Berhad and Hock Seng Lee Enterprise Sdn Bhd, the holding Company of Hock Seng Lee Berhad. The Board welcomes the decision of the High Court in dismissing the prayer for the removal of the 4 directors, however, as advised, the Board is not satisfied with the decision of the High Court in ordering the prayers for disclosure and will appeal against the said decision in regards to disclosure. Upon the pronouncement of the decision in respect of disclosure, an oral application for stay was made and the Court ordered for formal application to be filed and heard at 2:30 pm on 30.06.2017. In the meantime, the Court had granted an interim stay of the said decision in respect of disclosure pending determination of the formal stay application.

The Board wishes to reiterate that since the beginning and during the whole time of this litigation period, the Board has remained focused on the business of the Company and continued to strive to deliver the best results to its shareholders and stakeholders.

The Board will take counsel from our legal advisors to decide on its next course of action.

The Company will make the necessary announcements on further developments on this matter in due course. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 22-8-2017 10:14 PM

|

显示全部楼层

发表于 22-8-2017 10:14 PM

|

显示全部楼层

本帖最后由 icy97 于 23-8-2017 06:15 AM 编辑

工程業務貢獻減 福勝利次季淨利跌21%

2017年8月22日

(吉隆坡22日訊)砂拉越基建公司福勝利(HSL,6238,主要板建築)截至今年6月底次季,營業額按年跌0.62%至1億639萬令吉,淨利跌21%至953萬令吉,每股派息1仙。

福勝利向馬證交所報備,截至今年6月底首半年,營業額按年滑落15%至2億1157萬令吉,淨利下跌27%至2080萬令吉。

該公司指出,收入主要來自建築及房地產開發活動,今年次季,建築業貢獻營業額84%或8964萬令吉,房地產開發業務則貢獻16%或1675萬令吉。

福勝利指出,次季建築業務營業額下滑是因為進行中的主要工程正處執行的最初階段,當季來自工程的利潤貢獻相對較低。

訂單總值破30億

至于房地產開發業務,當季因推出新項目,包括Vista工業園第二期項目及Samariang Aman 2第6期項目,新項目銷售量推升房產業務收入,利潤也相對穩定。

福勝利董事經理拿督余志和透過文告指出:“今年迄今公司新增訂單達5億5800萬令吉,當中概括美里廢水處理項目、木膠技能發展中心(PPKS)、砂拉越民都魯沙馬拉祖連絡道路(Collector Road)及美里一所學校。”

迄今福勝利的訂單總值已達到30億令吉,刷新史上紀錄;截至今年6月底,上述30億令吉訂單中有26億令吉尚未入賬。【中国报财经】

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2017 | 30 Jun 2016 | 30 Jun 2017 | 30 Jun 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 106,389 | 107,054 | 211,568 | 249,313 | | 2 | Profit/(loss) before tax | 12,777 | 16,132 | 27,822 | 37,673 | | 3 | Profit/(loss) for the period | 9,537 | 12,081 | 20,828 | 28,336 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 9,525 | 12,080 | 20,796 | 28,335 | | 5 | Basic earnings/(loss) per share (Subunit) | 1.73 | 2.20 | 3.78 | 5.16 | | 6 | Proposed/Declared dividend per share (Subunit) | 1.00 | 1.00 | 1.00 | 1.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.2997 | 1.2759

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 22-8-2017 10:15 PM

|

显示全部楼层

发表于 22-8-2017 10:15 PM

|

显示全部楼层

EX-date | 15 Sep 2017 | Entitlement date | 19 Sep 2017 | Entitlement time | 04:00 PM | Entitlement subject | First Interim Dividend | Entitlement description | First Interim Single Tier Tax Exempt Dividend of 1 sen per ordinary share each in respect of the financial year ending 31 December 2017 | Period of interest payment | to | Financial Year End | 31 Dec 2017 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | TRICOR INVESTOR & ISSUING HOUSE SERVICES SDN BHDUnit 32-01, Level 32, Tower A,Vertical Business Suite, Avenue 3, Bangsar South,No. 8, Jalan Kerinchi59200Kuala LumpurTel:0327839299Fax:0327839222 | Payment date | 10 Oct 2017 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 19 Sep 2017 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.01 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 9-9-2017 05:17 AM

|

显示全部楼层

发表于 9-9-2017 05:17 AM

|

显示全部楼层

业绩低预期.福胜利财测下调

(吉隆坡8日讯)福胜利(HSL,6238,主板建筑组)次季净利下跌21.15%,至952万5000令吉,低于市场预期,促使分析员多调低今后两年财测9至19%之间。

工程进展进账缓慢

尽管订单创新高至30亿令吉,工程进展进账还是缓慢;大众研究预期庞大计划开动和如火如荼进行时,未来几季盈利前景清晰可期。

大众指出,未完成订单占2016财政年营收的5倍,维持财测。产业贡献20%营收,目前正进行计划总发展值3亿4000万令吉。

MIDF研究认为,未来几季盈利将有更高进账,盈利可逐步趋正常,因此维持财测。

MIDF说,为力证其对未来营收增长和显示信心,福胜利派发1仙股息,截至6月有6880万令吉现金。

基于业绩低于预期,丰隆研究调低2017至2019财政年财测22%、16%与11%;主要是因土地问题导致7亿5000万令吉古晋排污系统计划延宕推展。

丰隆认为,目前该公司正与砂州政府会商,未来盈利前景胥视这项计划的进展。

肯纳格研究调低今明两财政年财测20%与8%,尽管替补订单由4亿增至6亿令吉;预期泛婆罗洲大道工程赚益低,目标价亦由1令吉50仙调低。

26亿未进账订单

马银行研究调低今明两财政年财测25%与10%,尽管有26亿令吉未进账订单,然而进账仍呈波动;目标价相应由1令吉82仙调低。次季的亮点是产业因有新计划推展,次季产业的税前盈利按年飙80%至600万令吉。

大马投行下调今后3年财测9%、19%至30%之间,其亮点是2017年增5亿5800万令吉新建筑订单,使总订单增至30亿令吉(26亿未进账)。

基于新订单继续涌进,加上160亿令吉泛婆罗洲砂州大道、128亿令吉婆罗洲沙巴部份大道、港口、基建乃至发电等设施发酵,大马投行建议“买进”福胜利,惟目标价由2令吉15仙调低。

文章来源:

星洲日报/财经 ‧ 报道:张启华 ‧ 2017.09.08 |

|

|

|

|

|

|

|

|

|

|

|

发表于 21-9-2017 06:20 AM

|

显示全部楼层

发表于 21-9-2017 06:20 AM

|

显示全部楼层

福胜利董事部纠纷落幕

Emir Zainul/theedgemarkets.com

September 20, 2017 20:43 pm MYT

(吉隆坡20日讯)福胜利(Hock Seng Lee Bhd)今日指出,自去年12月以来集团和余氏家族的一系列诉讼,在双方同意下结束。

“经各方同意,上诉庭下令撤销先前高庭于6月29日颁布的庭令。”

该集团今日向大马交易所报备说:“上诉被撤回并相应解除。”

在6月29日,古晋高庭驳回这家建筑与工程集团一名大股东Yii Chee Ming的申请,以罢黜4名董事部成员,即其胞兄,公司董事经理拿督余志和、执行董事Tony Yu Yuong Wee和Lau Kiing Kang,以及非执行董事Lau Kiing Yiing。

然而,Yii Chee Ming却成功获古晋高庭下达命令,促4名董事披露有关买卖福胜利和控股公司Hock Seng Lee Enterprise私人有限公司股权的事宜。

不过,福胜利董事部对高庭下达的披露指令并不满意,并提出上诉。

(编译:陈慧珊)

Type | Announcement | Subject | MATERIAL LITIGATION | Description | INVOLVING YII CHEE MING (PLAINTIFF) AGAINST DATO YU CHEE HOE, TONY YU YUONG WEE, LAU KIING KANG, LAU KIING YIING AND HOCK SENG LEE BERHAD (DEFENDANTS) | Further to the announcements made on 21 April 2017, 3 May 2017, 11 May 2017, 19 June 2017, 29 June 2017, 30 June 2017, 1 August 2017, 2 August 2017, 4 August 2017 and 8 August 2017, the Board of Directors of Hock Seng Lee Berhad wishes to inform that on 20 September 2017, the Court of Appeal had, by consent of parties, granted an Order to set aside the Order of the High Court previously granted on 29 June 2017. The appeal was thereafter withdrawn and struck out accordingly.

Furthermore, the Board of Directors of Hock Seng Lee Berhad wishes to inform that, along with this announcement, the series of litigation matters involving Hock Seng Lee Berhad and the Yu/Yii family is concluded. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 19-11-2017 06:20 AM

|

显示全部楼层

发表于 19-11-2017 06:20 AM

|

显示全部楼层

余志和及余志亮家族共同掌舵.福胜利家族纠纷落幕

(吉隆坡15日讯)福胜利(HSL,6238,主板建筑组)家族纠纷落幕,董事经理拿督余志和及已故余志亮遗族将共同掌舵。

福胜利在文告中说,大股东福胜利企业(HSLE)昨日告知董事部,余志和与执行董事余永维,以及拿督余志豪与余志明的家族争执已圆满解决。

HSLE披露,这宗始于2013年11月的家族纠纷,已在上周三(8日)达成多方协议,解决HSLE及福胜利集团属下其他公司的持股争议,股权转移也已顺利完成。

根据多方协议,余志和直接持有HSLE的41.6%股权,与已故余志亮遗族相同,其余16.7%股权则由余志成(人名译音)掌握。余志亮家族将透过余志亮园丘、TangSN控股和余志亮父子公司间接控制41.6%股权。

福胜利是HSLE的主要资产,成为争执重心,在去年12月19日接到传票,过去10个月一再陷于官司纠纷。福胜利9月20日公布,余志明与该公司的争执已结束。

福胜利董事部指出,随着纷争结束,该公司将专注发展旗下业务,为股东争取最佳回酬。

文章来源:

星洲日报‧财经‧2017.11.16 |

|

|

|

|

|

|

|

|

|

|

|

发表于 22-11-2017 04:49 AM

|

显示全部楼层

发表于 22-11-2017 04:49 AM

|

显示全部楼层

本帖最后由 icy97 于 23-11-2017 02:49 AM 编辑

福胜利标获5660万合约

2017年11月22日

(吉隆坡21日讯)福胜利(HSL,6238,主板建筑股)标得5659万8800令吉合约,在砂拉越古晋翻新与扩建X-FAB现有的三层行政建筑物。

该公司今日向交易所报备,昨日接获X-FAB Sarawak私人有限公司的得标书,工程范围包括打桩、建筑、翻新与装修现有建筑物,以及相关机电工程。

福胜利指出,该公司成功得标,归功于振动控制管理良好。这是因为施工期间同时进行高精密度制造活动,对周围的任何振动十分敏感。

该合约为期19个月,预计12月开工。【e南洋】

Type | Announcement | Subject | OTHERS | Description | LETTER OF ACCEPTANCE | The Board of Directors of Hock Seng Lee Berhad (“HSL”) is pleased to announce that HSL has on 20 November 2017 received the Letter of Acceptance from X-FAB Sarawak Sdn. Bhd. (“X-FAB”) for a building construction project in Kuching known as “The Construction and Completion of the Proposed Renovation and Extension to existing 3-story X-FAB Administration Building with Associated External Works on Part of Lot 1339, Block 12, Muara Tebas Land District, Sama Jaya Free Industrial Zone, Kuching Sarawak” (“the Project”) worth Ringgit Malaysia Fifty Six Million Five Hundred Ninety Eight Thousand and Eight Hundred Only (RM56,598,800.00), through open tender exercise.

X-FAB is the world's leading foundry group for analog/mixed-signal semiconductor applications, specialized in advanced analog and mixed-signal process technologies. It manufactures wafers for automotive, industrial, consumer, medical, and other applications in it six manufacturing sites in Germany, France, Malaysia and USA. X-FAB Sarawak Sdn. Bhd. is 93.6% owned by X-FAB Silicon Foundaries N.V (source: X-FAB web site and company search result from SSM).

HSL’s success in this open tender exercise was mainly premised on its superior vibration control management, which is critical in this project as the on-going manufacturing activities involved high precision and has very low tolerance to any vibration of the environment. The scope of works for HSL includes pilling, building works (both new construction and renovation and refurbishment of existing buildings) and the associated mechanical and electrical works.

This is a fast track project with contract period of Nineteen (19) months and is expected to commence in December 2017. The Contract is expected to contribute positively to the earnings and net assets of HSL Group as the Project progresses during the contract period. However, the transaction will not have any effect on the share capital and substantial shareholdings of HSL.

None of the directors and/or major shareholders of HSL or persons connected to them have any interest, direct or indirect, in the above contract. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 26-11-2017 07:00 AM

|

显示全部楼层

发表于 26-11-2017 07:00 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2017 | 30 Sep 2016 | 30 Sep 2017 | 30 Sep 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 126,329 | 136,028 | 337,897 | 385,341 | | 2 | Profit/(loss) before tax | 15,111 | 21,817 | 42,933 | 59,490 | | 3 | Profit/(loss) for the period | 11,093 | 16,358 | 31,921 | 44,694 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 11,062 | 16,342 | 31,858 | 44,677 | | 5 | Basic earnings/(loss) per share (Subunit) | 2.01 | 2.97 | 5.80 | 8.13 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 1.00 | 1.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.3198 | 1.2759

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 21-2-2018 02:21 AM

|

显示全部楼层

发表于 21-2-2018 02:21 AM

|

显示全部楼层

福胜利建筑净利迎头赶上

2018年2月21日

分析:马银行投行研究

目标价:1.61令吉

最新进展:

去年,福胜利(HSL,6238,主板建筑股)共取得约5亿7500万令吉合约,推高截至去年12月杪未完成订单至27亿令吉新高。

虽然订单强劲,惟受到主要项目进度缓慢拖累,首九个月净利表现低迷。

福胜利将在2月27日,公布2017财年业绩。

行家建议:

由于工作速度加快,预计建筑业务净利会在2018财年迎头赶上。

管理层也说,最糟糕的情况已经结束,经历连续两个季度下跌后,第三季的工程确认按季增10%,加上主要项目工程加速,这为2018财年净利复苏提供了可信度。

福胜利总值达7亿5000万令吉的古晋中央污水管理系统项目,截至去年杪工程进度为2%,因合同细节的最终敲定遭到延误。

泛婆罗洲大道(Pan-Borneo Highway)工程P7(17.1亿令吉),进展也慢于预期。

至于美里中央污水管理系统(3亿3300万令吉),正如期在2021年首季完成,整体进度为6%。

现阶段维持预测,先等福胜利公布业绩。我们现有的估计显示核心净利会在2018财年强扬68%,这包括将取得8亿令吉新订单的预测。

【e南洋】 |

|

|

|

|

|

|

|

|

|

|

|

发表于 3-3-2018 02:28 AM

|

显示全部楼层

发表于 3-3-2018 02:28 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2017 | 31 Dec 2016 | 31 Dec 2017 | 31 Dec 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 168,009 | 113,205 | 505,907 | 498,546 | | 2 | Profit/(loss) before tax | 19,696 | 15,685 | 62,629 | 75,174 | | 3 | Profit/(loss) for the period | 14,693 | 11,765 | 46,614 | 56,458 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 14,673 | 11,746 | 46,531 | 56,422 | | 5 | Basic earnings/(loss) per share (Subunit) | 2.67 | 2.14 | 8.47 | 10.27 | | 6 | Proposed/Declared dividend per share (Subunit) | 1.40 | 1.40 | 2.40 | 2.40 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.3365 | 1.2759

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 27-4-2018 02:36 AM

|

显示全部楼层

发表于 27-4-2018 02:36 AM

|

显示全部楼层

EX-date | 07 Jun 2018 | Entitlement date | 11 Jun 2018 | Entitlement time | 04:00 PM | Entitlement subject | Final Dividend | Entitlement description | Final single-tier exempt dividend of 1.4 sen per ordinary share each in respect of the financial year ended 31 December 2017 | Period of interest payment | to | Financial Year End | 31 Dec 2017 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | TRICOR INVESTOR & ISSUING HOUSE SERVICES SDN BHDUnit 32-01, Level 32, Tower A,Vertical Business Suite, Avenue 3, Bangsar South,No. 8, Jalan Kerinchi59200Kuala LumpurTel:0327839299Fax:0327839222 | Payment date | 25 Jun 2018 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 11 Jun 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.014 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 27-5-2018 04:43 AM

|

显示全部楼层

发表于 27-5-2018 04:43 AM

|

显示全部楼层

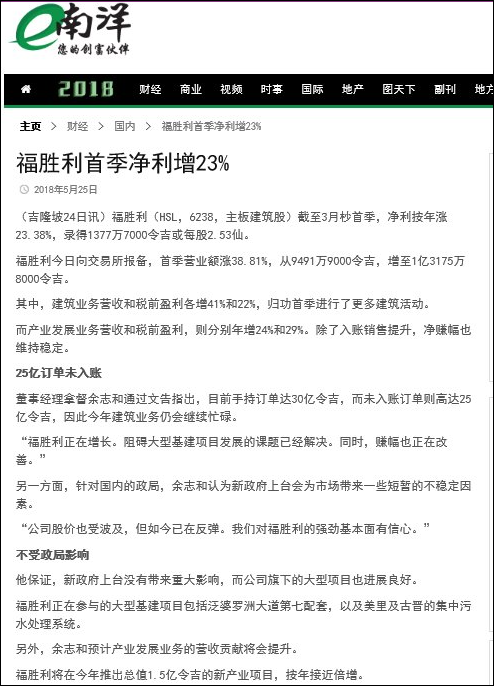

本帖最后由 icy97 于 2-6-2018 07:33 AM 编辑

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2018 | 31 Mar 2017 | 31 Mar 2018 | 31 Mar 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 131,758 | 94,919 | 131,758 | 94,919 | | 2 | Profit/(loss) before tax | 18,536 | 14,907 | 18,536 | 14,907 | | 3 | Profit/(loss) for the period | 13,800 | 11,186 | 13,800 | 11,186 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 13,777 | 11,166 | 13,777 | 11,166 | | 5 | Basic earnings/(loss) per share (Subunit) | 2.51 | 2.03 | 2.51 | 2.03 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.3623 | 1.3372

|

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|