|

|

发表于 21-10-2017 06:09 AM

|

显示全部楼层

发表于 21-10-2017 06:09 AM

|

显示全部楼层

EX-date | 02 Nov 2017 | Entitlement date | 06 Nov 2017 | Entitlement time | 05:00 PM | Entitlement subject | First and Final Dividend | Entitlement description | First and final single-tier dividend of 2 sen per share for the financial year ended 31 March 2017 | Period of interest payment | to | Financial Year End | 31 Mar 2017 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | SYMPHONY SHARE REGISTRARS SDN BHDLevel 6, Symphony HousePusat Dagangan Dana 1Jalan PJU 1A/4647301 Petaling JayaSelangor Darul EhsanTel: +603-7849 0777Fax: +603-7841 8151/8152 | Payment date | 23 Nov 2017 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 06 Nov 2017 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.02 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 5-12-2017 05:25 AM

|

显示全部楼层

发表于 5-12-2017 05:25 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2017 | 30 Sep 2016 | 30 Sep 2017 | 30 Sep 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 69,498 | 60,821 | 143,482 | 124,539 | | 2 | Profit/(loss) before tax | 3,355 | -9,453 | 4,424 | 18,606 | | 3 | Profit/(loss) for the period | 3,161 | -9,634 | 4,015 | 18,350 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 3,161 | -9,634 | 4,015 | 18,350 | | 5 | Basic earnings/(loss) per share (Subunit) | 1.85 | -5.64 | 2.35 | 10.74 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.8700 | 0.8400

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 14-12-2017 04:26 AM

|

显示全部楼层

发表于 14-12-2017 04:26 AM

|

显示全部楼层

本帖最后由 icy97 于 16-12-2017 02:17 AM 编辑

入股9.27%设联营公司

中国中车晋毅成大股东

2017年12月5日

(吉隆坡4日讯)毅成(IREKA,8834,主板建筑股)与世界最大的车厢制造商——中国中车签署谅解备忘录,结为专属策略联盟;同时,中国中车将认购毅成9.27%股权,崛起成为后者的大股东之一。

毅成向马交所报备,将和中国中车旗下中车城市交通有限公司成立联营公司。

毅成持股51%

双方将探讨一同在大马和东南亚地区内的铁路、城市交通、旅游业、基建项目、物流、建材贸易和一带一路相关项目上合作。

上述合作备忘录有效期为24个月,在期内毅成将会是中车城市交通在大马的独家商业合作伙伴。

而双方成立的新联营公司股权架构,将会是毅成和中车城市交通分别各持有51%和49%股权。

同时,毅成将发售1583万6000新股,或相等于已发行股量的9.27%。

中车城市交通将以每股57.95仙认购全数股权,晋身成大股东,而毅成将从中筹得917万6962令吉。

根据文告,发售新股所得,将用做双方合作项目的营运资金。【e南洋】

Type | Announcement | Subject | MULTIPLE PROPOSALS | Description | IREKA CORPORATION BERHAD ("IREKA" OR THE "COMPANY")(I) MEMORANDUM OF UNDERSTANDING; AND(II) PROPOSED SUBSCRIPTION (COLLECTIVELY REFERRED TO AS THE "PROPOSALS") | On behalf of the Board of Directors of Ireka, UOB Kay Hian Securities (M) Sdn Bhd wishes to announce that the Company had on 4 December 2017 entered into the following:- - a Memorandum of Understanding with CRRC Urban Traffic Co. Ltd. for the collaboration in rail, urban traffic solution, tourism and infrastructure projects in Malaysia and South East Asia; and

- a conditional subscription agreement with CRRC Urban Traffic (Europe) Co Ltd (“CRRC Europe”) for the proposed subscription by CRRC Europe of 15,836,000 new ordinary shares in Ireka (“Subscription Share(s)”), representing approximately 9.27% of the total number of issued shares in Ireka, at an issue price of RM0.5795 per Subscription Share.

Details of the Proposals are set out in the attachment enclosed.

This announcement is dated 4 December 2017. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5625801

|

|

|

|

|

|

|

|

|

|

|

|

发表于 14-12-2017 05:01 AM

|

显示全部楼层

发表于 14-12-2017 05:01 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 21-12-2017 02:35 AM

|

显示全部楼层

发表于 21-12-2017 02:35 AM

|

显示全部楼层

| 1. Details of Corporate Proposal | Involve issuance of new type/class of securities ? | No | Types of corporate proposal | Private Placement | Details of corporate proposal | SUBSCRIPTION BY CRRC URBAN TRAFFIC (EUROPE) CO LTD OF 15,836,000 NEW ORDINARY SHARES IN IREKA ("SUBSCRIPTION SHARE(S)"), REPRESENTING APPROXIMATELY 9.27% OF THE TOTAL NUMBER OF ISSUED SHARES IN IREKA CORPORATION BERHAD, AT AN ISSUE PRICE OF RM0.5795 PER SUBSCRIPTION SHARE | No. of shares issued under this corporate proposal | 15,836,000 | Issue price per share ($$) | Malaysian Ringgit (MYR) 0.5795 | Par Value($$) (if applicable) |

| | Latest issued share capital after the above corporate proposal in the following | Units | 186,708,050 | Issued Share Capital ($$) | Malaysian Ringgit (MYR) 180,049,012.000 | Listing Date | 20 Dec 2017 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 21-12-2017 06:27 AM

|

显示全部楼层

发表于 21-12-2017 06:27 AM

|

显示全部楼层

Notice of Interest Sub. S-hldr (Section 137 of CA 2016)Particulars of Substantial Securities HolderName | CRRC URBAN TRAFFIC (EUROPE) CO. LTD. | Address | 1075 Budapest, Károly körút 11.2.em.

Hungary. | Company No. | 01-09-284231 | Nationality/Country of incorporation | Hungary | Descriptions (Class) | Ordinary Shares | Name & address of registered holder | DB (Malaysia) Nominee (Asing) Sdn Bhd (317329W)Exempt AN for Bank of Singapore LimitedLevel 20, Menara IMCNo. 8, Jalan Sultan Ismail50250 Kuala Lumpur |

| Date interest acquired & no of securities acquired | Date interest acquired | 15 Dec 2017 | No of securities | 15,836,000 | Circumstances by reason of which Securities Holder has interest | Subscription of shares pursuant to a subscription agreement entered into between Ireka Corporation Berhad and CRRC Urban Traffic (Europe) Co. Ltd. on 4 December 2017 | Nature of interest | Direct Interest |  | | Total no of securities after change | Direct (units) | 15,836,000 | Direct (%) | 8.48 | Indirect/deemed interest (units) |

| | Indirect/deemed interest (%) |

| | Date of notice | 15 Dec 2017 | Date notice received by Listed Issuer | 15 Dec 2017 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 24-1-2018 04:22 AM

|

显示全部楼层

发表于 24-1-2018 04:22 AM

|

显示全部楼层

擬引進中資締盟 毅成建築暫停交易

2018年1月23日

(吉隆坡23日訊)配合企業宣布,毅成建築(IREKA,8834,主要板建築)將在明日(24日)暫停交易1日。

毅成建築向馬證交所報備,馬證交所批准公司于明日早上9時開始暫停交易,直到下午5時。

不過,該公司發出媒體邀請函,明早將與中車城市有限公司(CRRC Urban Traffic Co., Ltd)達成策略合作,聯手召開記者會。

毅成建築與中車城市去年12月,簽署股權認購協議和諒解備忘錄(MOU),讓中車城市投資毅成建築;中車城市已認購毅成建築約8.48%股權。

同時,雙方公司將組聯營,以探索城市交通解決方案、物流、建築和建材貿易,及鐵路和基礎設施建設方面的商機。【中国报财经】 |

|

|

|

|

|

|

|

|

|

|

|

发表于 25-1-2018 01:06 AM

|

显示全部楼层

发表于 25-1-2018 01:06 AM

|

显示全部楼层

本帖最后由 icy97 于 25-1-2018 05:08 AM 编辑

偕中车城交与申通快递

毅成设物流枢纽攻东盟

2018年1月25日

(吉隆坡24日讯)毅成(IREKA,8834,主板建筑股)继上月和中国中车城市交通有限公司协议联营后,双方今日再与申通快递公司签署了解备忘录,合作在我国设立物流枢纽,放眼打入东盟市场。

毅成董事经理拿督赖文翰在记者会上指出,今日,三方签署的谅解备忘录,是中车城交以大马作为第一站,向东盟输入创新技术的策略。

毅成是上月和全球最大的车厢制造商中国中车缔结专属策略联盟,和中车城交成立联营公司,中车也同意认购毅成的9.27%股权。

而申通快递是中国最大的一体化物流服务公司,去年共递送了50亿个包裹,净利达14亿人民币(8.54亿令吉)。

赖文翰希望能在一年内落实最终协议,毅成将负责为申通快递物色地点,打造物流中心。

“我们的合作涉及基建层面。我们已向陆路公共交通委员会展示中车的创新技术,包括智能轨道快运系统,这系统成本比单轨火车低25%。”

中车城交考虑增持

三方需要3至6个月的时间进行市场调查,中车城交和申通快递目前尚未决定在我国的投资规模。

出席者包括毅成主席拿督赖昭华、集团副董事经理赖玟妃、投资总监陈子健、中车城交主席顾一峰,以及申通快递主席陈德军。

顾一峰指出,我国周边国家拥有高达1亿的人口,希望在我国站稳脚步的同时,了解和熟悉东盟市场,再和本地企业一起开拓更大的市场。

“能和马企合作和入股,是明智的选择。若市场反应良好,我们也会考虑增持毅成股权。”

陈德军则表示,中国目前每个包括的平均费用为5至6人民币(3.05至3.66令吉),可在2.5天内送达。

他有信心能在我国启动合作后,半年内就可达到在5令吉成本、1.5天内送达的目标。

“大马不是很大、人口也不是很多,薪资和消费水平也和中国主要城市相差不大。我非常有信心能达标。”

伦敦Aseana售马越资产

赖玟妃指出,毅成持股23%的伦敦上市公司Aseana产业,计划逐步脱售马越估值高达1.8亿美元(7.07亿令吉)的资产,有可能会派发特别股息。

她说,毅成不会再加码投资Aseanna产业,后者也正逐步脱售在大马和越南的资产。

所有资产套现后,会考虑派发特别股息。

过去,公司几乎所有的发展项目由Aseana产业负责,未来将转由毅成负责。

目前,建筑业务仍是核心业务,占营业额90%。

当前未入账订单有4亿令吉。【e南洋】

Type | Announcement | Subject | MEMORANDUM OF UNDERSTANDING | Description | Memorandum of Understanding between CRRC Urban Traffic Co. Ltd., Shentong Express Co. Ltd. and Ireka Corporation Berhad | The Board of Directors of Ireka Corporation Berhad (“ICB” or “the Company”) is pleased to announce that the Company has on 24 January 2018 entered into a Memorandum of Understanding (“MoU) with CRRC Urban Traffic Co. Ltd. (“CRRC”) and Shentong Express Co. Ltd. (“STO”) to establish a formal working relationship by exploring logistics businesses focusing on:

Investment and development of logistics warehouses, distribution centers and other ancillary real estate facilities to support the business expansion of STO in Malaysia and South East Asia; and Investment and supply of infrastructure and equipment including logistics, commercial and special-purpose vehicles to support the business expansion of STO in Malaysia and South East Asia.

(Collectively “Logistics Businesses”)

(ICB, CRRC and STO are collectively referred to as “Parties” and individually referred to as “Party”)

The Parties shall work together to prepare a comprehensive business plan for the Logistics Businesses within 3 months from the date of the MoU.

Salient Terms of the MoU

The Parties shall engage exclusively with each other for a duration of 24 months from the date of the MoU to discuss the various commercial possibilities arising from the Logistics Businesses with further decisions and agreement regarding the formalisation of the working relationship being subjected to diligence and approval from the respective Party’s board of directors and/or shareholders during the exclusivity period. The exclusivity period shall be extendable for a further period to be mutually agreed between the Parties.

Information on CRRC

CRRC Group is the world’s largest manufacturer of rolling stock and rail related products and systems. CRRC, being part of the CRRC Group, is a leading player in providing investments, engineering technology and construction solutions in the rail and urban transportation sectors.

Information on STO

STO is China’s leading integrated logistics services company, focusing on express delivery of municipal, inter-provincial and international courier items. STO presently operates its business internationally in countries including China, Korea, United States, Australia, United Kingdom and Japan. STO is listed on the Shenzhen Stock Exchange.

Declaration of Interest

None of the Directors and/or major shareholders of ICB or persons connected with them, have any interest, direct or indirect, in the MoU.

This announcement is dated 24 January 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5673841

|

|

|

|

|

|

|

|

|

|

|

|

发表于 7-3-2018 04:38 AM

|

显示全部楼层

发表于 7-3-2018 04:38 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2017 | 31 Dec 2016 | 31 Dec 2017 | 31 Dec 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 87,905 | 78,785 | 231,387 | 203,324 | | 2 | Profit/(loss) before tax | 2,302 | -471 | 6,726 | 18,135 | | 3 | Profit/(loss) for the period | 2,451 | 29 | 6,466 | 18,379 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 2,451 | 29 | 6,466 | 18,379 | | 5 | Basic earnings/(loss) per share (Subunit) | 1.36 | 0.02 | 3.59 | 10.76 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.8700 | 0.8400

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 2-4-2018 05:00 AM

|

显示全部楼层

发表于 2-4-2018 05:00 AM

|

显示全部楼层

Date of change | 01 Apr 2018 | Name | MR CHAN CHEE KIAN | Age | 41 | Gender | Male | Nationality | Malaysia | Designation | Executive Director | Directorate | Executive | Type of change | Appointment | Qualifications | Master of Engineering in Civil Engineering with First Class Honours from University of Bristol, United Kingdom | Working experience and occupation | Mr. Chan Chee Kian joined Ireka Corporation Berhad on 1 March 2006 as Manager, Strategy & Corporate Development and subsequently promoted to Senior Manager on 1 April 2007 and Director on 1 August 2009. He was appointed as Chief Investment Officer of Ireka Development Management Sdn Bhd since 1 January 2011 and assumes the leadership and instrumental role for the Ireka Group in all investments, corporate finance, corporate development and investor relations activities.He was previously a management and strategy consultant with Accenture in Kuala Lumpur and worked across Asia Pacific, including Singapore, Bangkok, Brisbane and New Delhi, advising a broad range of clients including large multi-national companies, Government linked agencies and local enterprises on strategic and operational issues. He is also an Advisory Committee Member for Asia Pacific Hotel Investment Conference since 2016. | Directorships in public companies and listed issuers (if any) | Nil | Family relationship with any director and/or major shareholder of the listed issuer | - Nephew of Datuk Lai Siew Wah and Datin Liw Yoke Yin- Nephew of Datuk Lai Jaat Kong @ Lai Foot Kong- Son of Mr. Chan Soo Har @ Chan Kay Chong and Mdm. Lai Man Moi |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 2-4-2018 05:01 AM

|

显示全部楼层

发表于 2-4-2018 05:01 AM

|

显示全部楼层

Date of change | 31 Mar 2018 | Name | MADAM LAI MAN MOI | Age | 70 | Gender | Female | Nationality | Malaysia | Designation | Executive Director | Directorate | Executive | Type of change | Retirement |

Date of change | 31 Mar 2018 | Name | MR CHAN SOO HAR @ CHAN KAY CHONG | Age | 72 | Gender | Male | Nationality | Malaysia | Designation | Executive Director | Directorate | Executive | Type of change | Retirement |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 10-4-2018 08:14 PM

|

显示全部楼层

发表于 10-4-2018 08:14 PM

|

显示全部楼层

本帖最后由 icy97 于 11-4-2018 07:10 AM 编辑

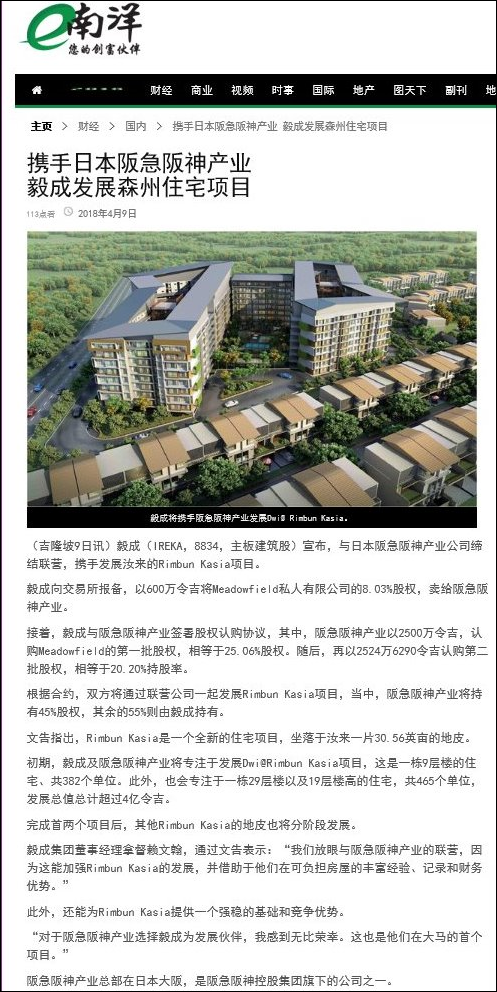

Type | Announcement | Subject | MULTIPLE PROPOSALS | Description | IREKA CORPORATION BERHAD ("Ireka")(I) PROPOSED DISPOSAL OF 8.03% EQUITY INTEREST IN MEADOWFIELD SDN BHD TO HANKYU HANSHIN PROPERTIES CORP ("HANKYU")(II) PROPOSED SUBSCRIPTION OF SHARES BY HANKYU(III) PROPOSED SHAREHOLDERS' AGREEMENT WITH HANKYU | The Board of Directors of Ireka Corporation Berhad (“Ireka” or the “Company”) wishes to announce that the Company had on 9 April 2018 entered into the following agreements:

a share purchase agreement with Hankyu Hanshin Properties Corp. (“Hankyu”) for the proposed disposal of 2,307,363 issued and fully-paid ordinary shares in the capital of Meadowfield Sdn Bhd (“Meadowfield”), a wholly-owned subsidiary of Ireka, to Hankyu representing 8.03% of the total number of issued shares in Meadowfield for a total consideration of RM6,000,000.00 (“Share Disposal”); a share subscription agreement with Hankyu and Meadowfield for the subscription of first tranche of 9,614,011 new shares in the capital of Meadowfield by Hankyu, representing 25.06% of the post-subscription share capital of Meadowfield at a consideration of RM25,000,000.00 and the subscription of second tranche of 9,708,724 new shares in the capital of Meadowfield by Hankyu, representing 20.20% of the post-subscription share capital of Meadowfield at a consideration of RM25,246,290.00 (“Share Subscription”); and a shareholders’ agreement with Hankyu and Meadowfield to regulate the affairs of Meadowfield, the vehicle of the joint venture between Ireka and Hankyu to carry out the Rimbun Kasia project, which upon completion of the Share Disposal and Share Subscription will be held 55% by Ireka, and 45% by Hankyu.

(Collectively referred to as the “Proposals”)

Further details of the Proposals are set out in the attachment

This announcement is dated 9 April 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5751377

|

|

|

|

|

|

|

|

|

|

|

|

发表于 16-4-2018 02:42 AM

|

显示全部楼层

发表于 16-4-2018 02:42 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 1-5-2018 05:52 AM

|

显示全部楼层

发表于 1-5-2018 05:52 AM

|

显示全部楼层

本帖最后由 icy97 于 5-5-2018 02:38 AM 编辑

Type | Announcement | Subject | OTHERS | Description | CADANGAN TAMBAHAN 1 TINGKAT BASEMEN & 8 TINGKAT HOSPITAL SERTA UBAHSUAI BANGUNAN HOSPITAL SEDIA ADA BESERTA BILIK MEKANIKAL DAN ELEKTRIKAL DI ATAS LOT GM 263 LOT 2417 DAN GM 2887 LOT 9302 (LOT LAMA HSM 3442 LOT PT 5552), MUKIM BUKIT BARU, DAERAH MELAKA TENGAH, HANG TUAH JAYA, MELAKA- LETTER OF AWARD FOR FASA 2A - PANTAI HOSPITAL AYER KEROH, MELAKA | The Board of Ireka Corporation Berhad (“ICB”) is pleased to announce that its wholly-owned subsidiary company, Ireka Engineering & Construction Sdn Bhd, has on 26 April 2018 accepted a Letter of Award from Pantai Hospital Ayer Keroh for the “Proposed construction of additional 1-storey basement and 8-storey hospital and refurbishment of existing hospital building including the mechanical and electrical rooms at Lot GM 263 Lot 2417 and GM 2887 Lot 9302 (old Lot HSM 3442 Lot PT 5552), Mukim Bukit Baru, Daerah Melaka Tengah, Hang Tuah Jaya, Melaka - Phase 2A - Pantai Hospital Ayer Keroh, Melaka” (“the Contract”).

The contract sum shall be Fixed Price Lump Sum of RM91,959,907.60 (excluding Goods and Services Tax). The contract period shall be 24 months and to be completed on 15 April 2020.

The above Contract is expected to contribute positively to the earnings of ICB Group for the financial years ending 31 March 2019 onwards.

The Company does not foresee any exceptional risk other than normal operational risk associated with the Contract.

Barring unforeseen circumstances, the Board of ICB is of the opinion that the acceptance of the Contract is in the best interest of ICB Group.

None of the Directors or major shareholders of ICB, or persons connected with them, has any interest, direct or indirect, in the Contract.

This announcement is dated 26 April 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 12-6-2018 01:27 AM

|

显示全部楼层

发表于 12-6-2018 01:27 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2018 | 31 Mar 2017 | 31 Mar 2018 | 31 Mar 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 68,241 | 124,114 | 299,628 | 327,438 | | 2 | Profit/(loss) before tax | -696 | -13,806 | 6,030 | 4,329 | | 3 | Profit/(loss) for the period | -637 | -13,802 | 5,829 | 4,577 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -637 | -13,802 | 5,829 | 4,577 | | 5 | Basic earnings/(loss) per share (Subunit) | -0.34 | -8.08 | 3.32 | 2.68 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.8700 | 0.8400

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 14-7-2018 03:23 AM

|

显示全部楼层

发表于 14-7-2018 03:23 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | PROPOSED FIRST AND FINAL DIVIDEND | The Board of Directors proposes a first and final single-tier dividend of 2 sen per share in respect of the financial year ended 31 March 2018 subject to the approval by shareholders at the forthcoming 42nd Annual General Meeting.

This announcement is dated 13 July 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 3-8-2018 01:09 AM

|

显示全部楼层

发表于 3-8-2018 01:09 AM

|

显示全部楼层

本帖最后由 icy97 于 3-8-2018 02:04 AM 编辑

Type | Announcement | Subject | OTHERS | Description | Ireka Corporation Berhad ("ICB" or "the Company")Variation of Unaudited Results as announced on 31 May 2018 and the Audited Financial Statements for the financial year ended 31 March 2018 | The Board of Directors of the Company wishes to announce that the Company had on 31 May 2018 submitted its unaudited results for quarter ended 31 March 2018 ("4QFYE2018") to Bursa Malaysia Securities Berhad ("Bursa Securities").

In compliance with Paragraph 9.19(35) of the Main Market Listing Requirements of Bursa Securities, the Board wishes to inform that there is a deviation of more than 10% between the Group's profit after tax and minority interest for 4QFYE2018 announced on 31 May 2018 and Audited Financial Statements for the financial year ended 31 March 2018 ("AFS 2018"). The explanation and reconciliation for the deviation are attached herein.

This announcement is dated 2 August 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5874857

|

|

|

|

|

|

|

|

|

|

|

|

发表于 30-8-2018 07:27 AM

|

显示全部楼层

发表于 30-8-2018 07:27 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2018 | 30 Jun 2017 | 30 Jun 2018 | 30 Jun 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 82,874 | 73,984 | 82,874 | 73,984 | | 2 | Profit/(loss) before tax | 537 | 1,069 | 537 | 1,069 | | 3 | Profit/(loss) for the period | 502 | 854 | 502 | 854 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 533 | 854 | 533 | 854 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.30 | 0.50 | 0.30 | 0.50 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.02 | 0.02 | 0.02 | 0.02 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.0100 | 0.8700

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 4-9-2018 01:33 AM

|

显示全部楼层

发表于 4-9-2018 01:33 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 27-10-2018 05:33 AM

|

显示全部楼层

发表于 27-10-2018 05:33 AM

|

显示全部楼层

EX-date | 08 Nov 2018 | Entitlement date | 12 Nov 2018 | Entitlement time | 05:00 PM | Entitlement subject | First and Final Dividend | Entitlement description | First and final single-tier dividend of 2 sen per share for the financial year ended 31 March 2018 | Period of interest payment | to | Financial Year End | 31 Mar 2018 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | SYMPHONY SHARE REGISTRARS SDN BHDLevel 6, Symphony HousePusat Dagangan Dana 1Jalan PJU 1A/4647301 Petaling JayaSelangor Darul EhsanTel: +603-7849 0777Fax: +603-7841 8151/8152 | Payment date | 28 Nov 2018 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 12 Nov 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.02 |

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|