|

|

发表于 26-11-2016 12:22 AM

|

显示全部楼层

发表于 26-11-2016 12:22 AM

|

显示全部楼层

本帖最后由 icy97 于 27-11-2016 06:59 AM 编辑

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2016 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2016 | 30 Sep 2015 | 30 Sep 2016 | 30 Sep 2015 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 18,264 | 16,792 | 18,264 | 0 | | 2 | Profit/(loss) before tax | 1,508 | 5,855 | 1,508 | 0 | | 3 | Profit/(loss) for the period | 1,318 | 5,388 | 1,318 | 0 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 1,318 | 5,388 | 1,318 | 0 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.19 | 0.76 | 0.19 | 0.00 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.4511 | 0.4414

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 17-2-2017 03:23 AM

|

显示全部楼层

发表于 17-2-2017 03:23 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2016 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2016 | 31 Dec 2015 | 31 Dec 2016 | 31 Dec 2015 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 21,472 | 24,921 | 39,736 | 0 | | 2 | Profit/(loss) before tax | -387 | 353 | 1,121 | 0 | | 3 | Profit/(loss) for the period | -595 | -170 | 723 | 0 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -595 | -170 | 723 | 0 | | 5 | Basic earnings/(loss) per share (Subunit) | -0.08 | -0.02 | 0.10 | 0.00 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.4453 | 0.4414

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 24-5-2017 09:33 PM

|

显示全部楼层

发表于 24-5-2017 09:33 PM

|

显示全部楼层

本帖最后由 icy97 于 25-5-2017 02:53 AM 编辑

| 4081 PMCORP PAN MALAYSIA CORPORATION BHD | | Quarterly rpt on consolidated results for the financial period ended 31/03/2017 | | Quarter: | 3rd Quarter | | Financial Year End: | 30/06/2017 | | Report Status: | Unaudited | | Submitted By: |

|

| | | Current Year Quarter | Preceding Year Corresponding Quarter | Current Year to Date | Preceding Year Corresponding Period | | | 31/03/2017 | 31/03/2016 | 31/03/2017 | 31/03/2016 | | | RM '000 | RM '000 | RM '000 | RM '000 | | 1 | Revenue | 17,288 | 16,927 | 56,660 | 0 | | 2 | Profit/Loss Before Tax | 2,301 | (2,011) | 3,422 | 0 | | 3 | Profit/(loss) attributable to ordinary equity holders of the parent | 2,388 | (2,194) | 3,111 | 0 | | 4 | Net Profit/Loss For The Period | 2,388 | (2,194) | 3,111 | 0 | | 5 | Basic Earnings/Loss Per Shares (sen) | 0.34 | (0.31) | 0.44 | 0.00 | | 6 | Dividend Per Share (sen) | 0.00 | 0.00 | 0.00 | 0.00 | | | | | As At End of Current Quarter | As At Preceding Financial Year End | | 7 | Net Assets Per Share (RM) | | | 0.4506 | 0.4414 |

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 31-8-2017 02:05 AM

|

显示全部楼层

发表于 31-8-2017 02:05 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2017 | 30 Jun 2016 | 30 Jun 2017 | 30 Jun 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 17,188 | 15,659 | 73,848 | 0 | | 2 | Profit/(loss) before tax | -15,506 | 10,366 | -12,084 | 0 | | 3 | Profit/(loss) for the period | -15,521 | 9,528 | -12,410 | 0 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -15,521 | 9,528 | -12,410 | 0 | | 5 | Basic earnings/(loss) per share (Subunit) | -2.19 | 1.35 | -1.75 | 0.00 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.4271 | 0.4414

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 19-9-2017 03:33 AM

|

显示全部楼层

发表于 19-9-2017 03:33 AM

|

显示全部楼层

Date of change | 18 Sep 2017 | Name | MADAM WONG SHUK FUEN | Age | 47 | Gender | Female | Nationality | Malaysia | Type of change | Appointment | Designation | Chief Financial Officer | Qualifications | Madam Wong Shuk Fuen is a qualified accountant of 23 years experience and a member of the Chartered Institute of Management Accountants - ACMA, CGMA, United Kingdom and Malaysian Institute of Accountants - Chartered Accountant, Malaysia. | Working experience and occupation | Madam Wong Shuk Fuen started her accounting career as an Accounts Officer at Guolene Plastic Products Sdn Bhd before moving on to various senior accounting and financial position in Kenneison Brothers Group. She was also the Group Accountant and Vice President of AlloyMtd Group. She joined the MUI Group as the Financial Controller since October 2014 and was subsequently appointed as the Group Financial Controller on 18 September 2017. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 22-11-2017 05:54 AM

|

显示全部楼层

发表于 22-11-2017 05:54 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2017 | 30 Sep 2016 | 30 Sep 2017 | 30 Sep 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 18,428 | 18,264 | 18,428 | 18,264 | | 2 | Profit/(loss) before tax | 48 | 1,508 | 48 | 1,508 | | 3 | Profit/(loss) for the period | -29 | 1,318 | -29 | 1,318 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -29 | 1,318 | -29 | 1,318 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.00 | 0.19 | 0.00 | 0.19 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.4256 | 0.4271

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 11-1-2018 04:34 AM

|

显示全部楼层

发表于 11-1-2018 04:34 AM

|

显示全部楼层

Date of change | 10 Jan 2018 | Name | MR WONG NYEN FAAT | Age | 60 | Gender | Male | Nationality | Malaysia | Type of change | Redesignation | Previous Position | Executive Director | New Position | Director | Directorate | Non Independent and Non Executive | Qualifications | First Class Honours Bachelor's Degree in Science (Mathematics) with Education from University of Malaya and a Master's Degree in Business Management from Asian Institute of Management. | Working experience and occupation | Mr Wong Nyen Faat sits on the Boards of Pan Malaysian Industries Berhad, Pan Malaysia Holdings Berhad, Pan Malaysia Capital Berhad, Metrojaya Berhad, Laura Ashley Holdings plc and Corus Hotels Limited. He is the Chief Operating Officer of the MUI Group. He had served as Executive Director of Morning Star Resources Limited in Hong Kong. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 11-1-2018 04:35 AM

|

显示全部楼层

发表于 11-1-2018 04:35 AM

|

显示全部楼层

Date of change | 10 Jan 2018 | Name | MR ANDREW KHOO BOO YEOW | Age | 45 | Gender | Male | Nationality | Australia | Designation | Executive Director | Directorate | Executive | Type of change | Appointment | Qualifications | (a) Barrister-At-Law, Lincolns Inn, United Kingdom(b) AHMA Hotel Diploma Major in Sales & Marketing, London Hotel School, United Kingdom(c) Degree in Law, Master of Arts, Cambridge University, United Kingdom(d) Master of Business Administration, Seattle Pacific University, United States of America(e) Bachelor of Arts Major in Political Science, University of Victoria, Canada | Working experience and occupation | (a) 2016 - 2017: Chief Operating Officer of Swensens and Director of Group Business Development in ABR Holdings Ltd, Singapore.(b) 2012 2015: Director, Food & Beverage Division in ABR Holdings Ltd, Singapore.(c) 2009 - 2012: Non-Independent Non-Executive Director of Malayan United Industries Berhad, Malaysia.(d) 2009 - 2012: Non-Independent Non-Executive Director of Pan Malaysia Corporation Berhad, Malaysia.(e) 2009 2012: Executive Director of Network Foods International Ltd, Singapore. (f) 2004 - 2009: President of Cambridge Alliance Holdings Ltd, Victoria, Canada.(g) 2002 2003: Director of Corporate Affairs and Special Assistant to CEO in Laura Ashley Holdings plc, London.(h) 2002 2003: Special Assistant to CEO in Corus Hotels Limited, Milton Keynes, United Kingdom.(i) 2001: General Manager in County Hotel Epping Forrest, London, United Kingdom. | Directorships in public companies and listed issuers (if any) | Malayan United Industries Berhad MUI Properties Berhad Federal International (2000) Ltd | Family relationship with any director and/or major shareholder of the listed issuer | Mr Andrew Khoo Boo Yeow is the son of Tan Sri Dato Khoo Kay Peng, a deemed substantial shareholder of the Company with a deemed interest of 66.51% of the issued and paid-up share capital of the Company. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 28-2-2018 01:41 AM

|

显示全部楼层

发表于 28-2-2018 01:41 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2017 | 31 Dec 2016 | 31 Dec 2017 | 31 Dec 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 22,695 | 21,472 | 41,123 | 39,736 | | 2 | Profit/(loss) before tax | -422 | -387 | -374 | 1,121 | | 3 | Profit/(loss) for the period | -1,215 | -595 | -1,244 | 723 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -1,215 | -595 | -1,244 | 723 | | 5 | Basic earnings/(loss) per share (Subunit) | -0.17 | -0.08 | -0.18 | 0.10 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.4237 | 0.4271

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 24-5-2018 02:56 AM

|

显示全部楼层

发表于 24-5-2018 02:56 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2018 | 31 Mar 2017 | 31 Mar 2018 | 31 Mar 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 16,490 | 17,288 | 57,613 | 56,660 | | 2 | Profit/(loss) before tax | -3,631 | 2,301 | -4,005 | 3,422 | | 3 | Profit/(loss) for the period | -3,273 | 2,388 | -4,517 | 3,111 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -3,273 | 2,388 | -4,517 | 3,111 | | 5 | Basic earnings/(loss) per share (Subunit) | -0.46 | 0.34 | -0.64 | 0.44 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.4179 | 0.4271

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 31-8-2018 06:29 AM

|

显示全部楼层

发表于 31-8-2018 06:29 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2018 | 30 Jun 2017 | 30 Jun 2018 | 30 Jun 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 16,138 | 17,358 | 73,751 | 73,654 | | 2 | Profit/(loss) before tax | 339 | -15,506 | -3,666 | -12,084 | | 3 | Profit/(loss) for the period | 1,369 | -15,521 | -3,148 | -12,410 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 1,369 | -15,521 | -3,148 | -12,410 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.19 | -2.19 | -0.44 | -1.75 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.4198 | 0.4271

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 22-9-2018 04:04 AM

|

显示全部楼层

发表于 22-9-2018 04:04 AM

|

显示全部楼层

本帖最后由 icy97 于 23-9-2018 04:53 AM 编辑

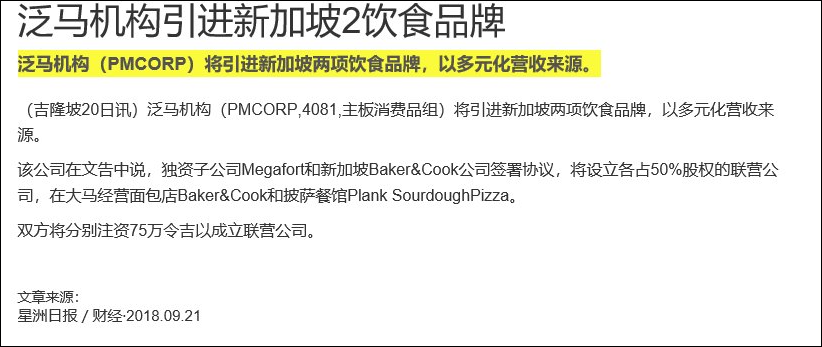

Type | Announcement | Subject | OTHERS | Description | PAN MALAYSIA CORPORATION BERHAD (PMC OR COMPANY)JOINT VENTURE AND SHAREHOLDERS AGREEMENT BETWEEN MEGAFORT SDN BHD AND BAKER & COOK PTE LTD | PMC wishes to announce that its wholly-owned subsidiary, Megafort Sdn Bhd has on 20 September 2018 entered into a joint venture and shareholders agreement with Baker & Cook Pte Ltd for the purpose of forming a Joint Venture Company in Malaysia.

Please refer to the attached announcement for further details.

This announcement is dated 20 September 2018.

|

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5918437

|

|

|

|

|

|

|

|

|

|

|

|

发表于 25-9-2018 05:32 AM

|

显示全部楼层

发表于 25-9-2018 05:32 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | PAN MALAYSIA CORPORATION BERHAD (4920-D) (PMC OR COMPANY)JOINT VENTURE AND SHAREHOLDERS AGREEMENT BETWEEN MEGAFORT SDN BHD AND BAKER & COOK PTE LTD- INCORPORATION OF JOINT VENTURE COMPANY | Further to the announcement dated 20 September 2018, PMC wishes to inform that a joint venture company under the name of Baker & Cook (Malaysia) Sdn Bhd (1296339-M) (“B&C Malaysia”) has been incorporated on 24 September 2018.

The principal activity of B&C Malaysia is to establish and operate the franchise business of retail food and beverage outlets operated and conducted under the trade names of "Baker & Cook" and "Plank Sourdough Pizza" subject to the terms and conditions of the Joint Venture and Shareholders Agreement dated 20 September 2018.

The current paid-up share capital of B&C Malaysia is RM1,500,000.00, comprising of 100,000 ordinary shares.

The Shareholders and their respective shareholding in B&C Malaysia are as follows:- a) Megafort Sdn Bhd - 50%; and b) Baker & Cook Pte Ltd - 50%.

This announcement is dated 24 September 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 5-12-2018 03:45 AM

|

显示全部楼层

发表于 5-12-2018 03:45 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2018 | 30 Sep 2017 | 30 Sep 2018 | 30 Sep 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 19,945 | 16,818 | 19,945 | 16,818 | | 2 | Profit/(loss) before tax | 5,474 | 62 | 5,474 | 62 | | 3 | Profit/(loss) for the period | 5,125 | -15 | 5,125 | -15 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 5,125 | -15 | 5,125 | -15 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.72 | 0.00 | 0.72 | 0.00 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.4229 | 0.4181

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 21-2-2019 05:27 AM

|

显示全部楼层

发表于 21-2-2019 05:27 AM

|

显示全部楼层

本帖最后由 icy97 于 21-2-2019 05:35 AM 编辑

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2018 | 31 Dec 2017 | 31 Dec 2018 | 31 Dec 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 25,358 | 20,486 | 45,303 | 37,304 | | 2 | Profit/(loss) before tax | 895 | -439 | 6,369 | -377 | | 3 | Profit/(loss) for the period | 131 | -1,232 | 5,256 | -1,247 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 131 | -1,232 | 5,256 | -1,247 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.02 | -0.18 | 0.74 | -0.18 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.4204 | 0.4183

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 24-4-2019 01:44 PM

|

显示全部楼层

发表于 24-4-2019 01:44 PM

|

显示全部楼层

Reply to Query

Proposed acquisition by Jomuda Sdn Bhd ("JSB"), a wholly-owned subsidiary ofPan Malaysian Corporation Berhad (PMC), of 11,200,000 ordinary sharesrepresenting 1.51% of the total issued and paid-up share capital of MUIProperties Berhad from Millionmart Sdn Bhd, a wholly-owned subsidiary ofMetrojaya Berhad, which is in turn a 98.21%-owned subsidiary of Malayan UnitedIndustries Berhad for a total cash consideration of RM2,240,000 (PurchaseConsideration) (Proposed Acquisition)PAN MALAYSIA CORPORATION BERHAD (PMC OR COMPANY)PROPOSED ACQUISITION BY JOMUDASDN BHD, A WHOLLY-OWNED SUBSIDIARY OF PMC, OF 11,200,000 ORDINARY SHARESREPRESENTING 1.51% OF THE TOTAL ISSUED AND PAID-UP SHARE CAPITAL OF MUIPROPERTIES BERHAD FROM MILLIONMART SDN BHD, A WHOLLY-OWNED SUBSIDIARY OFMETROJAYA BERHAD, WHICH IS IN TURN A 98.21%-OWNED SUBSIDIARY OF MALAYAN UNITEDINDUSTRIES BERHAD FOR A TOTAL CASH CONSIDERATION OF RM2,240,000You are advised to read the entire contents of the announcement or attachment.To read the entire contents of the announcement or attachment, please accessthe Bursa website at http://www.bursamalaysia.com

|

|

|

|

|

|

|

|

|

|

|

|

发表于 21-5-2019 02:26 AM

|

显示全部楼层

发表于 21-5-2019 02:26 AM

|

显示全部楼层

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

RELATED PARTY TRANSACTIONS | Description | PAN MALAYSIA CORPORATION BERHAD (PMC OR COMPANY)PROPOSED ACQUISITION BY JOMUDA SDN BHD, A WHOLLY-OWNED SUBSIDIARY OF PMC, OF 11,200,000 ORDINARY SHARES REPRESENTING 1.51% OF THE TOTAL ISSUED AND PAID-UP SHARE CAPITAL OF MUI PROPERTIES BERHAD FROM MILLIONMART SDN BHD, A WHOLLY-OWNED SUBSIDIARY OF METROJAYA BERHAD, WHICH IS IN TURN A 98.21%-OWNED SUBSIDIARY OF MALAYAN UNITED INDUSTRIES BERHAD FOR A TOTAL CASH CONSIDERATION OF RM2,240,000 | PMC wishes to announce that Jomuda Sdn Bhd (“JSB” or the “Purchaser”), a wholly-owned subsidiary of PMC, had on 22 April 2019 entered into a share sale agreement (“SSA”) with Millionmart Sdn Bhd (“MSB” or the “Vendor”), a wholly-owned subsidiary of Metrojaya Berhad (“MJB”), which is in turn a 98.21%-owned subsidiary of Malayan United Industries Berhad (“MUIB”) to acquire 11,200,000 ordinary shares representing 1.51% of the total issued and paid-up share capital of MUI Properties Berhad (“MPB”) (“MPB Shares”) for a total cash consideration of RM2,240,000 (“Purchase Consideration”) (“Proposed Acquisition”). PMC is a 66.51%-owned subsidiary of MUIB.

Please refer to the attachment for further details on the Proposed Acquisition.

This announcement is dated 22 April 2019. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/6133877

|

|

|

|

|

|

|

|

|

|

|

|

发表于 7-6-2019 02:46 AM

|

显示全部楼层

发表于 7-6-2019 02:46 AM

|

显示全部楼层

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

RELATED PARTY TRANSACTIONS | Description | PAN MALAYSIA CORPORATION BERHAD (PMC OR COMPANY)PROPOSED ACQUISITION BY JOMUDA SDN BHD, A WHOLLY-OWNED SUBSIDIARY OF PMC, OF 11,200,000 ORDINARY SHARES REPRESENTING 1.51% OF THE TOTAL ISSUED AND PAID-UP SHARE CAPITAL OF MUI PROPERTIES BERHAD FROM MILLIONMART SDN BHD, A WHOLLY-OWNED SUBSIDIARY OF METROJAYA BERHAD, WHICH IS IN TURN A 98.21%-OWNED SUBSIDIARY OF MALAYAN UNITED INDUSTRIES BERHAD FOR A TOTAL CASH CONSIDERATION OF RM2,240,000 | Unless otherwise stated, the definitions used in this announcement shall carry the same meanings as defined in the announcements dated 22 April 2019 and 24 April 2019 (“Announcements”).

Further to our Announcements on 22 April 2019 and 24 April 2019, PMC wishes to announce that the Proposed Acquisition has been completed on 29 April 2019 in accordance with the terms of the SSA in respect of the Proposed Acquisition.

This announcement is dated 29 April 2019.

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 28-6-2019 06:08 AM

|

显示全部楼层

发表于 28-6-2019 06:08 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2019 | 31 Mar 2018 | 31 Mar 2019 | 31 Mar 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 15,477 | 14,595 | 60,780 | 51,899 | | 2 | Profit/(loss) before tax | -670 | -3,624 | 5,699 | -4,001 | | 3 | Profit/(loss) for the period | -695 | -3,266 | 4,561 | -4,513 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -695 | -3,266 | 4,561 | -4,513 | | 5 | Basic earnings/(loss) per share (Subunit) | -0.10 | -0.46 | 0.64 | -0.64 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.4128 | 0.4183

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 31-8-2019 05:21 AM

|

显示全部楼层

发表于 31-8-2019 05:21 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2019 | 30 Jun 2018 | 30 Jun 2019 | 30 Jun 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 11,049 | 13,434 | 71,829 | 65,333 | | 2 | Profit/(loss) before tax | -10,149 | 265 | -4,450 | -3,736 | | 3 | Profit/(loss) for the period | -10,076 | 1,295 | -5,515 | -3,218 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -10,076 | 1,295 | -5,515 | -3,218 | | 5 | Basic earnings/(loss) per share (Subunit) | -1.42 | 0.18 | -0.78 | -0.45 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.4031 | 0.4180

|

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|