|

|

发表于 16-11-2016 04:55 AM

|

显示全部楼层

发表于 16-11-2016 04:55 AM

|

显示全部楼层

Date of change | 15 Nov 2016 | Name | DATO' SRI NG AH CHAI | Age | 54 | Gender | Male | Nationality | Malaysia | Designation | Managing Director | Directorate | Executive | Type of change | Appointment | Qualifications | Secondary Education | Working experience and occupation | Dato' Sri Ng Ah Chai ("Dato' Sri Ng") has over 30 years of experience in timber and furniture industries. His involvement in the timber trade started in 1985 with a sawmilling business. In 1991, he expanded his business into tropical wood furniture manufacturing for the local market. He ceased his sawmilling business in 1993 and co-founded Seng Yip Furniture Sdn Bhd. Under Dato' Sri Ng's leadership, coupled with his extensive background and experience in timber and furniture business, Seng Yip Furniture Sdn Bhd has expanded from a kiln drying and timber processing business into a manufacturer of furniture components and semi-furnished parts in 1995. In 1998, he further ventured into finished wood furniture business. Currently, Dato' Sri Ng is the Executive Chairman and Chief Executive Officer of SYF Resources Berhad, a position he has held since 28 September 2005. | Directorships in public companies and listed issuers (if any) | SYF Resources Berhad | Family relationship with any director and/or major shareholder of the listed issuer | Dato' Sri Ng is a substantial shareholder of the Company with direct interest in 119,217,865 ordinary shares of RM1.00 each in MIECO as at 14 November 2016. | Any conflict of interests that he/she has with the listed issuer | None | Details of any interest in the securities of the listed issuer or its subsidiaries | Direct interest in 119,217,865 ordinary shares of RM1.00 each in MIECO as at 14 November 2016. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 26-11-2016 12:13 AM

|

显示全部楼层

发表于 26-11-2016 12:13 AM

|

显示全部楼层

本帖最后由 icy97 于 28-11-2016 12:22 AM 编辑

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2016 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2016 | 30 Sep 2015 | 30 Sep 2016 | 30 Sep 2015 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 91,025 | 86,060 | 231,714 | 268,731 | | 2 | Profit/(loss) before tax | 4,226 | 6,166 | 36,237 | 16,122 | | 3 | Profit/(loss) for the period | 4,226 | 6,166 | 36,237 | 16,122 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 4,226 | 6,166 | 36,237 | 16,122 | | 5 | Basic earnings/(loss) per share (Subunit) | 2.01 | 2.94 | 17.26 | 7.68 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.5600 | 1.3900

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 31-12-2016 04:22 AM

|

显示全部楼层

发表于 31-12-2016 04:22 AM

|

显示全部楼层

Date of change | 30 Dec 2016 | Name | MR KAJENDRA A/L PATHMANATHAN | Age | 42 | Gender | Male | Nationality | Malaysia | Type of change | Redesignation | Previous Position | Executive Director | New Position | Non-Independent Director | Directorate | Non Independent and Non Executive | Qualifications | Bachelor of Commerce, University of MelbourneBachelor of Law, University of MelbourneMember of Institute of Chartered Accountants, Australia | Working experience and occupation | Mr Kajendra A/L Pathmanathan ("Mr Kajendra") was appointed as Executive Director on 25 February 2016. He started his career with Ernst & Young, Kuala Lumpur in 1999 in the Corporate Recovery & Insolvency department and moved to Ernst & Young, London in 2008. While with Ernst & Young, he has had a very broad range of experience on a wide variety of clients across various industries in Asia and Europe. He has extensive experience in leading strategic independent business reviews and in advising stakeholders on significant restructurings of public companies and private companies. In October 2013, Mr Kajendra joined BRDB Developments Sdn Bhd as General Manager, Compliance and on 1 June 2014, he took up the position of Chief Operating Officer of Mieco Chipboard Berhad. Mr Kajendra also sits on the boards of several subsidiaries in the Mieco Chipboard Berhad Group. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 4-1-2017 04:35 AM

|

显示全部楼层

发表于 4-1-2017 04:35 AM

|

显示全部楼层

Date of change | 03 Jan 2017 | Name | YAM TENGKU PUTERI SERI KEMALA PAHANG TENGKU AISHAH BINTI SULTAN HAJI AHMAD SHAH | Age | 59 | Gender | Female | Nationality | Malaysia | Designation | Non Executive Chairman | Directorate | Independent and Non Executive | Type of change | Appointment | Qualifications | Diploma in Business Administration from Dorset Institute, UK. | Working experience and occupation | Y.A.M. Tengku Puteri Seri Kemala Pahang Tengku Aishah Binti Sultan Haji Ahmad Shah ("YAM Tengku Aishah") has been a Director of TAS Industries Sdn. Bhd. since 15 August 1990. TAS Industries Sdn. Bhd. is an investment holding and property development company in Kuala Lumpur. Y.A.M. Tengku Aishah is also an Independent Non-Executive Chairperson of Inari Amertron Berhad (Formerly known as Inari Berhad) and Chairman of Insas Berhad. | Directorships in public companies and listed issuers (if any) | Inari Amertron Berhad (Formerly known as Inari Berhad)Insas Berhad |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 7-2-2017 04:32 AM

|

显示全部楼层

发表于 7-2-2017 04:32 AM

|

显示全部楼层

Date of change | 06 Feb 2017 | Name | MR WONG WENG KWONG | Age | 53 | Gender | Male | Nationality | Malaysia | Type of change | Resignation | Designation | Chief Financial Officer | Reason | Due to personal circumstances | Details of any disagreement that he/she has with the Board of Directors | No | Whether there are any matters that need to be brought to the attention of shareholders | No | Qualifications | Malaysia Association of Certified Public Accountant (MACPA), Malaysia - Professional Examination 1 | Working experience and occupation | Mr. Wong has over 20 years of working experience in auditing, accounting and finance. He started his career as a Senior Audit Assistant with an accounting firm. He then joined MIECO in 1990 as an executive and subsequently assumed the role of Senior Finance Manager. He progressed to hold the position of Senior Materials Manager, where he oversaw the procurement and general store operations. In 2006, he left MIECO to venture into consultancy and training on finance and accounting as consultant and public trainer. Mr Wong re-joined MIECO in January 2010 as Senior Manager Finance & MIS. He has been holding the position of Financial Controller of MIECO since December 2012. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 27-2-2017 11:27 PM

|

显示全部楼层

发表于 27-2-2017 11:27 PM

|

显示全部楼层

本帖最后由 icy97 于 28-2-2017 02:04 AM 编辑

| 5001 MIECO MIECO CHIPBOARD BHD | | Interim Single-tier T.E. Dividend 10 Sen |

| | Entitlement Details: | Interim single-tier tax exempt dividend of 10 sen per ordinary share in

respect of the financial year ended 31 December 2016

|

| | Entitlement Type: | Interim Dividend | | Entitlement Date and Time: | 14/03/2017 05:00 PM | | Year Ending/Period Ending/Ended Date: | 31/12/2016 | | EX Date: | 10/03/2017 | | To SCANS Date: |

| | Payment Date: | 24/03/2017 |

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 4-3-2017 05:40 AM

|

显示全部楼层

发表于 4-3-2017 05:40 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2016 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2016 | 31 Dec 2015 | 31 Dec 2016 | 31 Dec 2015 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 92,382 | 86,257 | 324,096 | 354,988 | | 2 | Profit/(loss) before tax | 36,282 | 2,521 | 72,519 | 18,643 | | 3 | Profit/(loss) for the period | 46,441 | 2,521 | 82,678 | 18,643 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 46,441 | 2,521 | 82,678 | 18,643 | | 5 | Basic earnings/(loss) per share (Subunit) | 22.11 | 1.20 | 39.37 | 8.88 | | 6 | Proposed/Declared dividend per share (Subunit) | 10.00 | 0.00 | 10.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.7900 | 1.3900

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 4-4-2017 04:46 AM

|

显示全部楼层

发表于 4-4-2017 04:46 AM

|

显示全部楼层

本帖最后由 icy97 于 5-4-2017 04:26 AM 编辑

美固木合板拟2股拆为5股

By Adam Aziz / theedgemarkets.com | April 3, 2017 : 8:43 PM MYT

(吉隆坡3日讯)美固木合板(Mieco Chipboard Bhd)今日建议,将每2股分拆为5股,以提高交易流通。

该公司指出,该活动将使已发行股从2亿1000万股,增至5亿2500万股。

该公司补充,股票数量增加将使股价调整至更吸引的市场价格,从而吸引更广泛的投资者群。

美固木合板预计,这项计划将在第三季完成,惟仍有待股东和大马交易所的批准。

(编译:陈慧珊)

Type | Announcement | Subject | SUBDIVISION / CONSOLIDATION OF SHARES (CHAPTER 13 OF LISTING REQUIREMENTS) | Description | MIECO CHIPBOARD BERHAD ("MIECO" OR THE "COMPANY") PROPOSED SHARE SPLIT INVOLVING THE SUBDIVISION OF EVERY TWO (2) EXISTING ORDINARY SHARES IN MIECO ("MIECO SHARE(S)" OR "SHARE(S)") INTO FIVE (5) ORDINARY SHARES IN MIECO ("SPLIT SHARE(S)") HELD ON AN ENTITLEMENT DATE TO BE DETERMINED AND ANNOUNCED LATER ("PROPOSED SHARE SPLIT") | On behalf of the Board of Directors of MIECO, RHB Investment Bank Berhad wishes to announce that the Company proposes to undertake a share split involving the subdivision of every two (2) existing MIECO Shares into five (5) Split Shares held on an entitlement date to be determined and announced later.

Further details of the Proposed Share Split are set out in the attachment.

This announcement is dated 3 April 2017. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5384993

|

|

|

|

|

|

|

|

|

|

|

|

发表于 17-4-2017 04:38 AM

|

显示全部楼层

发表于 17-4-2017 04:38 AM

|

显示全部楼层

本益比5.5倍 美固板估值低於同業

2017年4月16日

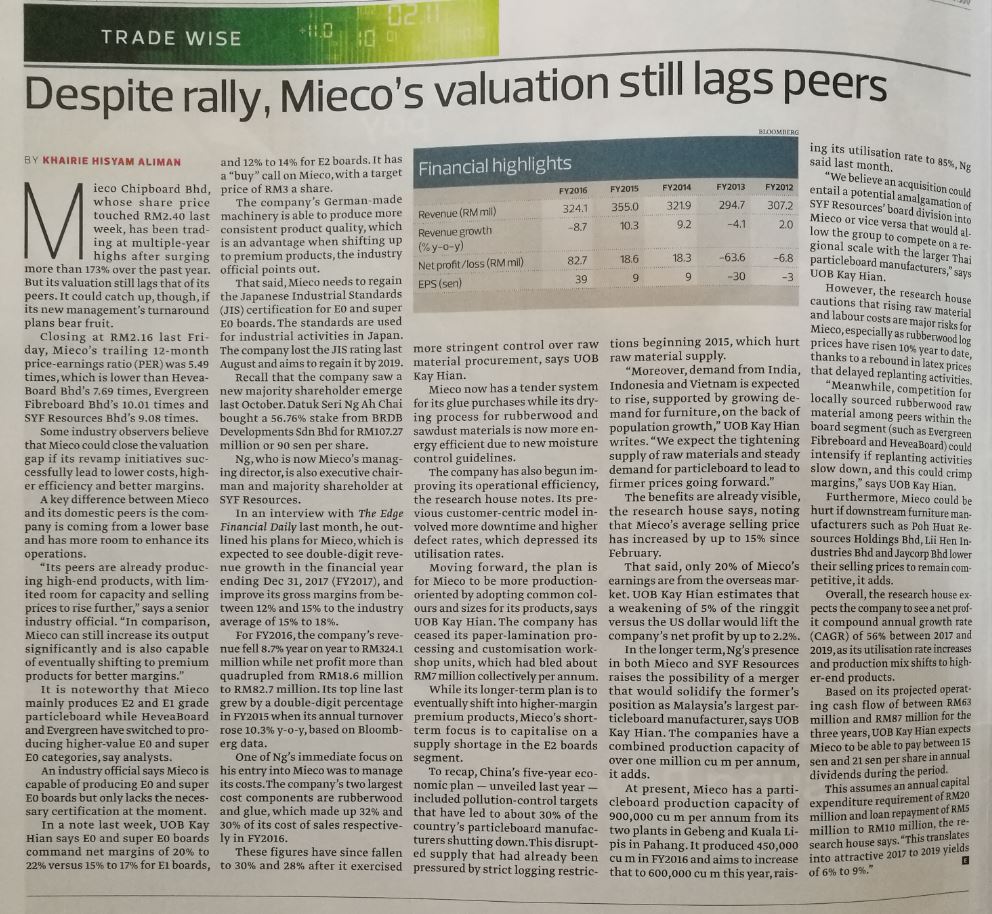

(吉隆坡16日訊)美固板(MIECO,5001,主要板工業)股價雖然漲上2005年高位,但估值仍低于同業,市場觀察人士認為,該公司若成共改革邁向低成本、高效率和高賺幅,便能縮小其與同業間的估值差距。

美固板上週五(14日)收報2.16令吉,本益比(PER)5.49倍,低于億維雅(HEVEA,5095,主要板工業)的7.69倍、常青纖維板(EVERGRN,5101,主要板工業)的10.01倍,及成業資源(SYF,7082,主要板消費)的9.08倍。

財經週刊《The Edge》報導引述觀察人士的話指出:“美固板的同行已經在生產高端產品,它們的產能和銷售價格都難再提升。”

“相比之下,美固板還可以顯著提升它的產量,也有能力轉向(生產)高級產品,獲得更好的賺幅。”【中国报财经】 |

|

|

|

|

|

|

|

|

|

|

|

发表于 26-4-2017 12:52 AM

|

显示全部楼层

发表于 26-4-2017 12:52 AM

|

显示全部楼层

本帖最后由 icy97 于 26-4-2017 05:31 AM 编辑

The EDGE Mieco Bullsh*t

Author: insulter3 | Publish date: Sun, 23 Apr 2017, 03:36 PM https://klse.i3investor.com/blogs/getreal/121300.jsp

Print media is in cahoots with Sydicates and "goreng" experts. This is nothing new, as early as the financial industry has existed, they have been utilizing print media to use fulfil their dirty work. I generally do not have a problem with that. Those who are lazy and believe what the newspaper or analyst writes deserve to lose money.

However, this Mieco article by the Edge last weekend was over the top for me. Author KHAIRIE HISYAM ALIMAN or more specifically the EDGE's bullsh*t was too strong for me to ignore. My main problem was that they were too SLOTHFUL. They were too lazy in their attempts to hoodwink the public in this article.

I have been watching Mieco being manipulated for a long time. I thought that their earnings will eventually show, but up till the latest result, nothing has changed.

However what really pisses me off is how lazy the EDGE is in their journalism.

Mieco's valuation still lags peers?

Give me a break! Can you even call what Khairie wrote a valuation?

I have specifically cut out the valuation part of the article. Everything else is basically borrowing from UOB's article which I think is false, but at least they did it with a lot of effort. If you read UOB's Report, they have some lofty forward PE and attach a blanket PE10 for a TP of RM3. They use soft non-concrete reasons such as

- New blood - new chairman

- Cost rationalisation exercise (please, you should've done this years ago)

- Possible merger with SYF (facts please not possibilities)

- Gain JIS certification by 2019 (your forward PE is 2018, why are you telling me about a 2019 story?)

That's enough about UOB. I'm not talking about them.

So this is the lazy part from the EDGE. How dare Khairie use the headline "Despite rally, Mieco's valuation still lags peers" and use PE of 5.5 versus Hevea and Evergreen. Hevea is on a different level by the way.

Also, the PE of 5.5 is completely bullsh*t.

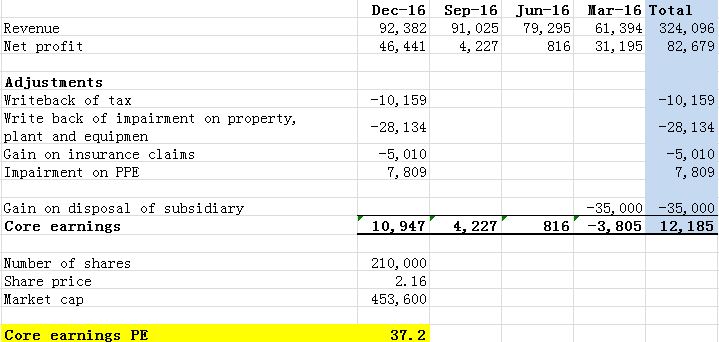

By just doing some quick math you can calculate that the core earnings is 37.2.

The 5.5PE is based on unadjusted earnings of RM82mil which consist of gain of subsidiary, writeback of impariment of PPE, etc.

Lagging peers my butt. Mieco is lightyears ahead of its peers in terms of PE of 37.2 versus 7.7 (Hevea) and 10 (Evergreen).

Ok that's all from me and this will be my only post. I just cannot bear to see such SLOTHFUL journalism in my local paper trying to deceive retail investors to buy such a trashy company.

Please think about what you are doing with your life Khairie but more importantly THE EDGE.

|

|

|

|

|

|

|

|

|

|

|

|

发表于 25-5-2017 04:56 AM

|

显示全部楼层

发表于 25-5-2017 04:56 AM

|

显示全部楼层

本帖最后由 icy97 于 5-6-2017 04:11 AM 编辑

美固木合板首季净利挫82%

Syahirah Syed Jaafar/theedgemarkets.com

May 22, 2017 19:41 pm MYT

(吉隆坡22日讯)美固木合板(Mieco Chipboard Bhd)截至3月杪首季净利下挫82.3%至552万令吉,或每股2.63仙,上财年同期则为3120万令吉,或每股14.85仙。

该公司今日向大马交易所报备,去年同期因脱售独资子公司Mieco Wood Products私人有限公司,而获得3500万令吉的特殊收益。

首季营业额从6139万令吉,按年扬35%至8260万令吉,主要因为瓜拉立卑厂房的产量增加。

展望未来,美固木合板表示,通过对原料采购和主要原料使用的严格控制降低生产成本,对实现更可持续的表现持谨慎乐观态度。

(编译:陈慧珊)

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2017 | 31 Mar 2016 | 31 Mar 2017 | 31 Mar 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 82,599 | 61,394 | 82,599 | 61,394 | | 2 | Profit/(loss) before tax | 5,553 | 31,202 | 5,553 | 31,202 | | 3 | Profit/(loss) for the period | 5,521 | 31,195 | 5,521 | 31,195 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 5,521 | 31,195 | 5,521 | 31,195 | | 5 | Basic earnings/(loss) per share (Subunit) | 2.63 | 14.85 | 2.63 | 14.85 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.7200 | 1.7900

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 15-6-2017 06:38 AM

|

显示全部楼层

发表于 15-6-2017 06:38 AM

|

显示全部楼层

EX-date | 03 Jul 2017 | Entitlement date | 05 Jul 2017 | Entitlement time | 05:00 PM | Entitlement subject | Subdivision | Entitlement description | Share split involving the subdivision of every two (2) existing ordinary shares in Mieco Chipboard Berhad ("MIECO" or the "Company") into five (5) ordinary shares in MIECO ("Split Share(s)") | Period of interest payment | to | Financial Year End | 31 Dec 2017 | Share transfer book & register of members will be | 05 Jul 2017 to 05 Jul 2017 closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | METRA MANAGEMENT SDN BHD30.02, 30th Floor, Menara Multi-PurposeCapital SquareNo. 8 Jalan Munshi Abdullah50100Kuala LumpurTel:0326983232Fax:0326980313 | Payment date |

| | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 05 Jul 2017 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Ratio | Ratio | 2 : 5 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 27-7-2017 01:15 AM

|

显示全部楼层

发表于 27-7-2017 01:15 AM

|

显示全部楼层

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

RELATED PARTY TRANSACTIONS | Description | MIECO CHIPBOARD BERHAD ("MIECO" OR THE "COMPANY")PROPOSED ACQUISITION BY MIECO OF THE ENTIRE ISSUED SHARE CAPITAL OF GREAT PLATFORM SDN BHD ("GREAT PLATFORM"), A WHOLLY-OWNED SUBSIDIARY COMPANY OF SYF RESOURCES BERHAD ("SYF" OR THE "VENDOR") COMPRISING 5,000,000 ORDINARY SHARES FROM SYF FOR A PURCHASE CONSIDERATION OF RM7,063,341 AND PROPOSED ASSUMPTION OF LIABILITIES OWING BY GREAT PLATFORM TO SYF OF RM51,528,809, TO BE SATISFIED ENTIRELY VIA CASH ("PROPOSED TRANSACTION") | On behalf of the board of Directors of MIECO ("Board"), RHB Investment Bank Berhad ("RHB Investment Bank") is pleased to announce that MIECO had, on 26 July 2017 entered into a conditional share sale agreement with SYF Resources Berhad for the proposed acquisition of the entire issued share capital of Great Platform Sdn Bhd ("Proposed Acquisition") and the proposed assumption of liabilities owing by Great Platform to SYF Resources Berhad ("Proposed Assumption of Liabilities") for a total purchase consideration of RM58,592,150, comprising a purchase consideration of RM7,063,341 for the Proposed Acquisition and RM51,528,809 for the Proposed Assumption of Liabilities, to be satisfied entirely via cash ("Proposed Transaction").

Please refer to the attachment for further details of the Proposed Transaction.

This announcement is dated 26 July 2017. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5497465

|

|

|

|

|

|

|

|

|

|

|

|

发表于 27-7-2017 01:59 AM

|

显示全部楼层

发表于 27-7-2017 01:59 AM

|

显示全部楼层

本帖最后由 icy97 于 28-7-2017 05:33 AM 编辑

美固木合板

次季净利翻逾15倍

2017年7月28日

(吉隆坡27日讯)浆料制砀纸板(plainboard)售价走高,加上生产效率提高,激励美固木合板(MIECO,5001,主板贸服股)截至6月杪次季,净利按年飙涨15.4倍至1341万7000令吉,相等于6.39仙。

美固木合板昨天向交易所报备,上财年同期净利为81万6000令吉,相等于0.39仙。

次季营业额也上涨13.66%,从上财年同期的7929万5000令吉,增加至9012万7000令吉。

累计首半年,净利按年减少40.84%,至1893万8000令吉;同期营业额则上涨22.77%至1亿7272万6000令吉。

美固木合板对于维持目前业绩持谨慎乐观态度;该公司将通过严格控制原料采购及使用,进一步改善生产力及减少生产成本,以便业绩持续增长。

5859万购成业资源子公司

另一方面,美固木合板也宣布以现金5859万2150令吉,向成业资源(SYF,7082,主板消费产品股)买下Great Platform私人有限公司。

美固木合板昨天与成业资源签署有条件买卖协议,买下Great Platform的股权及继承该公司的债务。

当中的706万3341令吉是用来收购Great Platform的全部股权,而5152万8809令吉则是Great Platform欠下成业资源的债务。

Great Platform是成业资源的独资子公司,主要业务是刨花板和中密度纤维板的制造与贸易。

美固木合板表示,基于Great Platform的业务与公司业务相似,买下Great Platform后,能让公司即刻扩展生产力。

另外,这也让公司有机会渗透至Great Platform现有的客户群。

该公司将通过银行借贷及内部资金,来融资上述收购活动。

而成业资源则表示,脱售Great Platform,符合公司的策略业务重组活动。

成业资源认为,为了更有效地增长刨花板和中密度纤维板业务,公司需要一更大的平台、特殊技能,以及更多管理层,而这已超过公司的能力范围。

因此,公司决定退出刨花板和中密度纤维板业务,以把资源及资金分配给其他核心业务。【e南洋】

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2017 | 30 Jun 2016 | 30 Jun 2017 | 30 Jun 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 90,127 | 79,295 | 172,726 | 140,689 | | 2 | Profit/(loss) before tax | 13,443 | 809 | 18,996 | 32,011 | | 3 | Profit/(loss) for the period | 13,417 | 816 | 18,938 | 32,011 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 13,417 | 816 | 18,938 | 32,011 | | 5 | Basic earnings/(loss) per share (Subunit) | 6.39 | 0.39 | 9.02 | 15.24 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.7800 | 1.7900

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 14-10-2017 02:59 AM

|

显示全部楼层

发表于 14-10-2017 02:59 AM

|

显示全部楼层

Date of change | 13 Oct 2017 | Name | MR NG WEI PING | Age | 27 | Gender | Male | Nationality | Malaysia | Designation | Executive Director | Directorate | Executive | Type of change | Appointment | Qualifications | Bachelor of Commerce in Economics & Finance from University of Melbourne, Australia | Working experience and occupation | Mr Ng has over 6 years' experience with SYF Resources Berhad Group (SYF) in key areas of corporate development, investments and property development. With financial qualifications of a Bachelor of Commerce and subsequently completing the examinations of the Certified Financial Analyst Institute, he has contributed to the growth of SYF and was instrumental in spearheading SYF's successful diversification into property development.His involvement with Mieco Chipboard Berhad ("MIECO") commenced in January 2017 when he took on the role of General Manager overseeing business operations and investments.He is currently also a Director of SYF Resources Berhad and Group and several local private limited companies involved in property development. | Directorships in public companies and listed issuers (if any) | SYF Resources Berhad | Family relationship with any director and/or major shareholder of the listed issuer | He is the son of Dato' Sri Ng Ah Chai, Group Managing Director and the major shareholder of MIECO. | Any conflict of interests that he/she has with the listed issuer | None | Details of any interest in the securities of the listed issuer or its subsidiaries | He has no interest in the securities of MIECO, save for Dato' Sri Ng Ah Chai's shareholding of 298,045,137 ordinary shares in MIECO. | Due Date for MAP | 13 Feb 2018 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 21-11-2017 03:06 AM

|

显示全部楼层

发表于 21-11-2017 03:06 AM

|

显示全部楼层

本帖最后由 icy97 于 22-11-2017 02:26 AM 编辑

美固木合板第三季赚1562万

2017年11月21日

(吉隆坡20日讯)售价与生产效率改善,美固木合板(MIECO,5001,主板贸服股)截至九月杪第三季,净利按年大涨2.7倍至1562万2000令吉,或每股2.97仙。

该公司今日向交易所报备,营业额按年走高11.1%,至1亿113万2000令吉,归功于木合板售价依然强稳。

累计九个月,净利却按年跌4.6%至3456万令吉,原因是去年首季脱售Mieco Wood Products私人有限公司,取得3500万令吉单次盈利。

九个月营业额则按年攀升18.2%,录得2亿7385万8000令吉。【e南洋】

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2017 | 30 Sep 2016 | 30 Sep 2017 | 30 Sep 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 101,132 | 91,025 | 273,858 | 231,714 | | 2 | Profit/(loss) before tax | 15,641 | 4,226 | 34,637 | 36,237 | | 3 | Profit/(loss) for the period | 15,622 | 4,226 | 34,560 | 36,237 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 15,622 | 4,226 | 34,560 | 36,237 | | 5 | Basic earnings/(loss) per share (Subunit) | 2.97 | 0.80 | 6.58 | 6.90 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.7400 | 0.7200

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 27-2-2018 05:33 AM

|

显示全部楼层

发表于 27-2-2018 05:33 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2017 | 31 Dec 2016 | 31 Dec 2017 | 31 Dec 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 75,447 | 92,382 | 349,305 | 324,096 | | 2 | Profit/(loss) before tax | 13,388 | 36,282 | 48,026 | 72,519 | | 3 | Profit/(loss) for the period | 13,388 | 46,441 | 47,949 | 82,678 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 13,388 | 46,441 | 47,949 | 82,678 | | 5 | Basic earnings/(loss) per share (Subunit) | 2.55 | 8.85 | 9.13 | 15.75 | | 6 | Proposed/Declared dividend per share (Subunit) | 1.00 | 4.00 | 1.00 | 4.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.7700 | 0.7200

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 27-2-2018 05:38 AM

|

显示全部楼层

发表于 27-2-2018 05:38 AM

|

显示全部楼层

EX-date | 11 Apr 2018 | Entitlement date | 13 Apr 2018 | Entitlement time | 05:00 PM | Entitlement subject | Interim Dividend | Entitlement description | Interim single-tier dividend of 1 sen per ordinary share in respect of the financial year ended 31 December 2017 | Period of interest payment | to | Financial Year End | 31 Dec 2017 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | METRA MANAGEMENT SDN BHD30.02, 30th Floor, Menara Multi-PurposeCapital SquareNo. 8 Jalan Munshi Abdullah50100Kuala LumpurTel:0326983232Fax:0326980313 | Payment date | 27 Apr 2018 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 13 Apr 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.01 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 3-3-2018 03:45 AM

|

显示全部楼层

发表于 3-3-2018 03:45 AM

|

显示全部楼层

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

RELATED PARTY TRANSACTIONS | Description | PROPOSED ACQUISITION BY MIECO OF THE ENTIRE ISSUED SHARE CAPITAL OF GREAT PLATFORM SDN BHD ("GREAT PLATFORM"), A WHOLLY-OWNED SUBSIDIARY COMPANY OF SYF RESOURCES BERHAD ("SYF" OR THE "VENDOR") COMPRISING 5,000,000 ORDINARY SHARES FROM SYF FOR A PURCHASE CONSIDERATION OF RM7,063,341 AND PROPOSED ASSUMPTION OF LIABILITIES OWING BY GREAT PLATFORM TO SYF OF RM51,528,809, TO BE SATISFIED ENTIRELY VIA CASH ("PROPOSED TRANSACTION") | The terms used herein, unless the context otherwise stated, bear the same meaning as those defined in the earlier announcements in relation to the Proposed Transaction.

We refer to the announcements made on 26 July 2017, 30 November 2017, 19 December 2017 and 13 February 2018 in relation to the Proposed Transaction.

On behalf of the Board of Directors of MIECO, RHB Investment Bank Berhad is pleased to announce that the Balance Purchase Price and the amount of the Proposed Assumption of Liabilities as disclosed in the Circular have been received by the Vendor namely, SYF Resources Berhad on 27 February 2018. Accordingly, the Proposed Transaction has been completed on even date.

This announcement is dated 27 February 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 9-6-2018 02:35 AM

|

显示全部楼层

发表于 9-6-2018 02:35 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2018 | 31 Mar 2017 | 31 Mar 2018 | 31 Mar 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 80,605 | 82,599 | 80,605 | 82,599 | | 2 | Profit/(loss) before tax | -7,062 | 5,553 | -7,062 | 5,553 | | 3 | Profit/(loss) for the period | -7,143 | 5,521 | -7,143 | 5,521 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -7,143 | 5,521 | -7,143 | 5,521 | | 5 | Basic earnings/(loss) per share (Subunit) | -1.36 | 1.05 | -1.36 | 1.05 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.7500 | 0.7700

|

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|