|

|

【AWANTEC 5204 交流专区】(前名 PRESBHD )

[复制链接]

[复制链接]

|

|

|

发表于 31-3-2018 03:17 AM

|

显示全部楼层

发表于 31-3-2018 03:17 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 17-5-2018 06:02 AM

|

显示全部楼层

发表于 17-5-2018 06:02 AM

|

显示全部楼层

本帖最后由 icy97 于 22-5-2018 03:32 AM 编辑

SKIN项目带动 Prestariang首季净利增加一倍

Syahirah Syed Jaafar/theedgemarkets.com

May 15, 2018 21:06 pm +08

(吉隆坡15日讯)Prestariang Bhd截至3月杪首季净利从322万令吉,增加一倍至651万令吉。

这一大幅增长归功于该集团科技业务,尤其是国家移民监控系统(SKIN)项目的特许营业额。

首季营业额从同期的4389万令吉,大涨66%至7275万令吉。每股盈利为1.35仙,同期为0.66仙。

自大选后股价重挫近33%的Prestariang宣布派发每股0.50仙的单层中期股息,将于7月4日支付。

该集团今日在文告指出:“从SKIN确认的收入乃根据期内完成的阶段计算。季度营业额也获得软件与服务业务的强劲贡献,该业务保持稳定。”

SKIN在本季度贡献了营业额的36.7%,而软件许可与分销业务占57.5%。余下则来自培训与认证及大选业务。

加上预定执行的所有手头项目,该集团预计2018财年的表现将更佳。

“展望未来,Prestariang对Prestariang 5.0转型计划的执行充满信心。该计划将推动集团在变革环境中持续增长和获利。”

该集团今日另外报备说,正在就3月8日与高等教育基金(PTPTN)签署的谅解备忘录(MoU),进行条款与条件协商。

至于与阿里云(Alibaba Cloud)及Conversant签署的MoU,Prestariang表示,各方目前正在敲定合作伙伴经销协议及教育市场的商业计划。

(编译:陈慧珊)

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2018 | 31 Mar 2017 | 31 Mar 2018 | 31 Mar 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 72,751 | 43,894 | 72,751 | 43,894 | | 2 | Profit/(loss) before tax | 13,089 | 3,821 | 13,089 | 3,821 | | 3 | Profit/(loss) for the period | 9,016 | 3,216 | 9,016 | 3,216 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 6,512 | 3,216 | 6,512 | 3,216 | | 5 | Basic earnings/(loss) per share (Subunit) | 1.35 | 0.66 | 1.35 | 0.66 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.50 | 0.75 | 0.50 | 0.75 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.3523 | 0.3389

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 17-5-2018 06:03 AM

|

显示全部楼层

发表于 17-5-2018 06:03 AM

|

显示全部楼层

EX-date | 04 Jun 2018 | Entitlement date | 06 Jun 2018 | Entitlement time | 05:00 PM | Entitlement subject | Interim Dividend | Entitlement description | Interim single tier dividend of 0.50 sen per ordinary share | Period of interest payment | to | Financial Year End | 31 Dec 2018 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | Level 6, Symphony HousePusat Dagangan Dana 1Jalan PJU 1A/4647301Petaling JayaTel:0378490777Fax:0378418151 | Payment date | 04 Jul 2018 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 06 Jun 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.005 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 21-5-2018 07:29 AM

|

显示全部楼层

发表于 21-5-2018 07:29 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 22-5-2018 03:35 AM

|

显示全部楼层

发表于 22-5-2018 03:35 AM

|

显示全部楼层

CEO:Prestariang冀18财年表现更好

Wong Ee Lin/theedgemarkets.com

May 16, 2018 15:24 pm +08

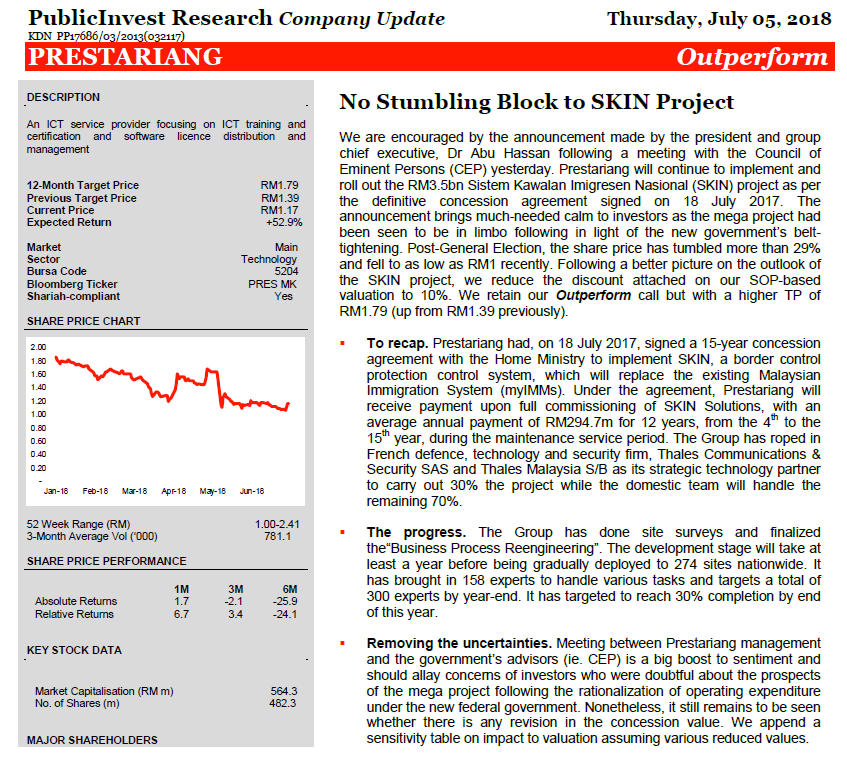

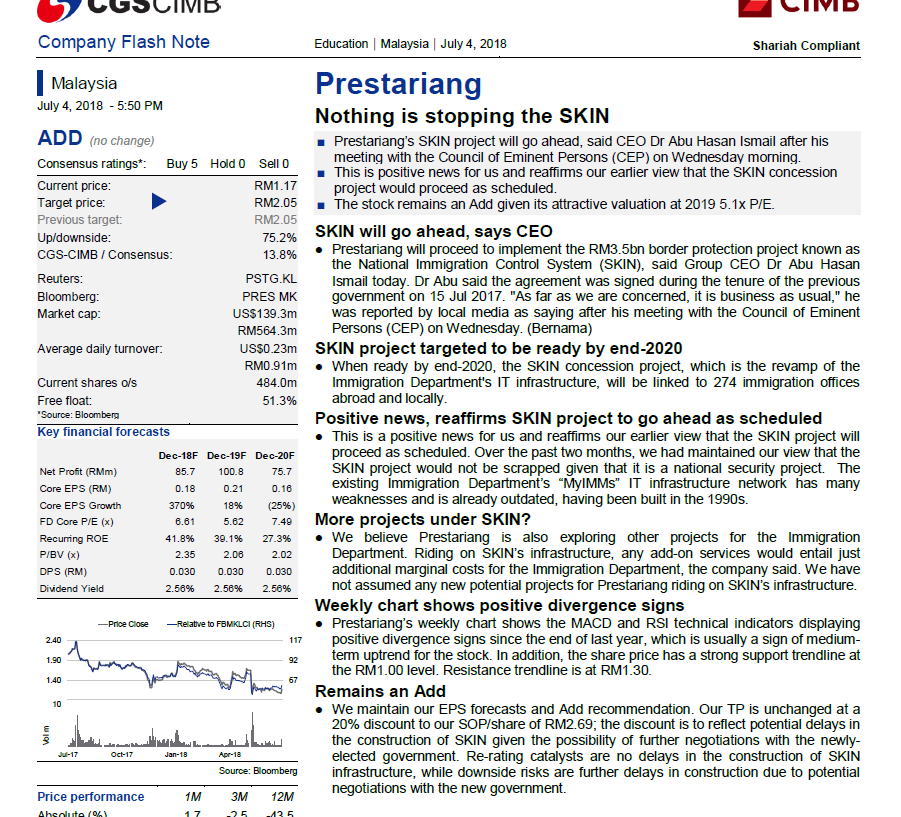

(吉隆坡16日讯)Prestariang Bhd预计,可在截至今年12月31日止财年(2018财年)取得更好的表现,主要推动力来自现有项目及5.0转型计划。

总裁兼集团总执行长Abu Hasan Ismail出席股东常年大会后,向记者表示:“我们将把重点放在我们可以控制的事情上,而我们可以控制的事情就是我们的业务:营业额、净利。如你所知,现在存在很多不确定性,但我们无能为力。”

同时,随着国家移民监控系统(SKIN)项目的特许经营生效,并于4月25日正式启动,Abu Hasan透露,Prestariang现在的重点是执行合约,并确保Prestariang符合其对合约的义务。

截至今年3月杪首季(2018财年首季),SKIN贡献了36.7%营业额。

尽管更换了政府,但Abu Hasan并没有看见SKIN项目存在任何风险。

另外,Prestariang与高等教育基金(PTPTN)在3月8日签署了谅解备忘录(MoU),目前双方仍在商讨条款与条件。

Abu Hasan说:“我们取得了很大的进展。它已经启动,并已经开始为我们带来收入。”

然而,他拒绝透露任何数据。

Prestariang与PTPTN合作为贷款学生提供一个工作匹配平台,将他们与适合其个人资料的工作相匹配,并随后为他们提供就业前培训。

至于与阿里云(Alibaba Cloud)及Conversant签署MoU开发EduCloud一事,Abu Hasan表示,该计划已经进行了一半。

他续称:“这项工作将与我们的全球合作伙伴,如微软(Microsoft)和亚马逊

(Amazon)合作完成。我们正在引入全球合作伙伴来帮助我们向大马消费者提供这种体验。”

Prestariang及另外两个单位目前正在敲定合作伙伴经销协议及教育市场的商业计划。

Prestariang的2018财年首季净利倍增至651万令吉,上财年同期为322万令吉,归功于集团的科技业务,尤其是来自SKIN项目的特许经营收入。

营业额则从2017财年首季的4389万令吉,按年劲弹66%至现财年同季的7275万令吉。每股盈利也从2017财年首季的0.66仙,增至现财年首季的1.35仙。

(编译:魏素雯) |

|

|

|

|

|

|

|

|

|

|

|

发表于 23-5-2018 12:49 PM

|

显示全部楼层

发表于 23-5-2018 12:49 PM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 12-6-2018 03:52 AM

|

显示全部楼层

发表于 12-6-2018 03:52 AM

|

显示全部楼层

icy97 发表于 6-9-2017 02:35 AM

必达量入股狮城OpenLearning

2017年9月6日

(吉隆坡5日讯)必达量(PRESBHD,5204,主板贸服股)购入新加坡OpenLearning全球(简称OGPL)的500万股新“A”股,及306万9578股可转换优先股(CPS),进军区域的高 ...

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

NON RELATED PARTY TRANSACTIONS | Description | PRESTARIANG BERHAD ("PRESTARIANG" or "the Company") - PROPOSED INVESTMENT VIA SUBSCRIPTION AGREEMENT ENTERED INTO BETWEEN PRESTARIANG CAPITAL SDN BHD, OPENLEARNING GLOBAL PTE LTD AND ADAM MAURICE BRIMO - Execution of Supplemental Deeds and Deed of Adherence | 1. INTRODUCTION We refer to our announcement made on 5 September 2017 in relation to the proposed investment via Subscription Agreement entered into between Prestariang Capital Sdn Bhd (“Prestariang Capital”) a wholly-owned subsidiary of the Company, OpenLearning Global Pte Ltd (“OGPL”), and Adam Maurice Brimo (“Adam”).

As announced earlier, Prestariang Capital had subscribed for 5,000,000 A Ordinary Shares (“A Shares”) and 3,069,578 convertible preference shares (“CPS") in the capital of OGPL at the total subscription price of AUD5,000,001 (Five Million and One Australian Dollars) based upon terms and conditions of the Subscription Agreement dated 5 September 2017 (“Subscription Agreement”). Concurrently, Prestariang Capital, OGPL and OLG Australia Investor Pte Ltd (“OLG Australia”), had executed a Shareholder’s Agreement dated 5 September 2017 (“Shareholder’s Agreement”) to govern their relationships as shareholders inter se of OGPL and its subsidiary companies based upon the terms and conditions contained therein.

Subsequent to the Subscription Agreement, OGPL has completed its fund-raising exercise whereby an additional AUD3,550,007 (Three Million Five Hundred Fifty Thousand and Seven Australian Dollars) fund was raised through the subscription of ordinary shares and CPS by the follow-on investors comprising of Magna Intelligent Sdn Bhd (“Magna”) and “B” shares subscribers (“Other Investors”). Pursuant to the execution of the respective subscription agreements between Magna, Other Investors, OGPL and Adam, the issued and paid-up share capital of OGPL is increased to AUD13,739,486.94 (Thirteen Million Seven Hundred Thirty Nine Thousand Four Hundred Eighty Six Australian Dollars and Cents Ninety Four).

2. EXECUTION OF SUPPLEMENTAL DEEDS The Company is pleased to announce that Prestariang Capital had today, completed the following agreements: - (a) a supplemental deed to the Subscription Agreement (“Supplemental Deed 1”) dated 28 May 2018 made between OGPL, Prestariang Capital and Adam for the purposes of supplementing and amending the terms and conditions of the Subscription Agreement arising from the subscription of shares by Magna and Other Investors;

(b) a supplemental deed to the Shareholders’ Agreement dated 28 May 2018 made between OLG Australia, Prestariang Capital, Other Investors and OGPL for the purposes of supplementing and amending the terms and conditions of the Shareholders’ Agreement arising from the subscription of shares in OGPL by Other Investors (“Supplemental Deed 2”); and

(c) a deed of adherence to the Shareholders’ Agreement dated 1 June 2018 made between OLG Australia, Prestariang Capital, Magna, Other Investors and OGPL arising from and in connection with the subscription of shares in OGPL by the follow-on investors (“Deed of Adherence”).

Pursuant to the Supplemental Deed 1, Prestariang Capital shall subscribe for an additional 194,153 CPS at an aggregate consideration of AUD1.00 only.

Upon the subscription of shares in OGPL by Magna and Other Investors, and the entry and execution of the Supplemental Deed 1, the Supplemental Deed 2 and the Deed of Adherence, the final shareholding in OGPL shall be as follows: Shareholder | Nature and number of shares held in OGPL | Shareholding Percentage | OLG Australia | 25,000,000 Ordinary Shares | 74.52% | Prestariang | 5,000,000 A Shares | 3,263,731 CPS | 14.90% | Magna | 2,500,000 A Shares | 1,631,866 CPS | 7.45% | Other Investors | 1,050,000 B Shares | 685,385 CPS | 3.13% | Total | 100% |

3. DOCUMENTS AVAILABLE FOR INSPECTION A copy each of the Supplemental Deed 1, the Supplemental Deed 2 and the Deed of Adherence will be made available for inspection at the Company’s registered office at Level 7, Menara Milenium, Jalan Damanlela, Pusat Bandar Damansara, Damansara Heights, 50490 Kuala Lumpur, Wilayah Persekutuan during normal business hours from Monday to Friday (except public holidays) for a period of three (3) months from the date of this announcement.

This announcement is dated 1 June 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 6-7-2018 01:34 AM

|

显示全部楼层

发表于 6-7-2018 01:34 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 27-7-2018 12:40 AM

|

显示全部楼层

发表于 27-7-2018 12:40 AM

|

显示全部楼层

本帖最后由 icy97 于 28-7-2018 07:14 AM 编辑

icy97 发表于 10-3-2018 06:50 AM

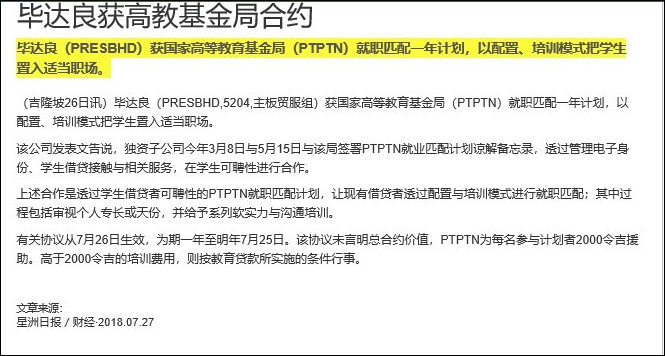

必达量联手高教基金

再培训助贷款者就业

2018年3月10日

(吉隆坡9日讯)必达量(PRESBHD,5204 ,主板贸服股)今天与大马高教基金(PTPTN)达成了解备忘录,推出“Job Matching”计划。

必达量向交易所报备 ...

Type | Announcement | Subject | MEMORANDUM OF UNDERSTANDING | Description | PRESTARIANG BERHAD ("PRESTARIANG" OR "COMPANY") - JOBMATCHING PTPTN PROGRAM IMPLEMENTATION AGREEMENT ENTERED INTO BETWEEN PERBADANAN TABUNG PENDIDIKAN TINGGI NASIONAL AND PRESTARIANG SYSTEMS SDN BHD ("PSSB") | 1. INTRODUCTION Further to our announcements dated 8 March 2018 and 15 May 2018, the Company is pleased to announce that following the Memorandum of Understanding (“MOU”) entered between the Company and Perbadanan Tabung Pendidikan Tinggi Nasional (“PTPTN”) on 8 March 2018, PSSB, a wholly-owned subsidiary of the Company had on today, entered into a JobMatching PTPTN Program Implementation Agreement (“the Agreement”) with PTPTN. (PTPTN and PSSB shall hereinafter be collectively referred to as “Parties” and individually referred to as “Party”).

2. DETAILS OF THE AGREEMENT 2.1 BACKGROUND As announced by the Company on 8 March 2018, Prestariang and PTPTN had entered into the MOU with regards to cooperation and collaboration in relation to students engagement and employability; in particular for the management of digital ID, student borrowers engagement and related services. The collaboration will be through a pilot borrowers’ employability programme called “JobMatching PTPTN” (“the Programme”) targeted at upskilling current PTPTN borrowers to the job market through “Place and Train” model. The ‘Place & Train’ model will include job matching to industry requirements through talent profiling and a series of soft skills and communications training. The Agreement is entered into between the Parties to record the Parties' mutual agreement with respect to the implementation of the Programme and shall supersede the MOU.

2.2 SALIENT TERMS 2.2.1 Pursuant to the Agreement, PTPTN appoints PSSB to perform the following: - i) communicate and engage with PTPTN’s existing and targeted student borrowers to drive the success of the Programme; ii) organise the identified upskilling trainings by utilising EduCloud, an Integrated Education Platform (IEP) owned by Prestariang as the digital talent platform to assist PTPTN to engage their student borrowers and other stakeholders to drive engagement and employability; iii) liaise with key industry players on their requirements, training coordination, monitoring and evaluation; iv) conduct screening of candidates to participate as Programme participants and perform profiling, placement and training of Programme participants; v) arrange suitable soft skill and/or technical skills trainings to Programme participants to ensure that the training programme under the Programme can be delivered in accordance with the terms and conditions of the Agreement; vi) to assist and match Programme participants in securing employment; vii) the management of PTPTN borrower’s digital ID and engagement and related services. 2.2.2 The tenure of the Agreement shall be one (1) year commencing from 26 July 2018 and shall expire on 25 July 2019, unless earlier terminated. The Agreement may be extended by mutual agreement in writing of both Parties. 2.2.3 The Agreement does not specify the total contract price. PTPTN shall grant financial assistance up to RM2,000.00 to each eligible Programme participants. For the training which fees exceeding RM2,000.00, the granting of educational loans to the Programme participants will be considered subject to the terms and conditions as imposed by PTPTN.

3. EFFECTS ON FINANCIAL, SHARE CAPITAL AND SUBSTANTIAL SHAREHOLDERS’ SHAREHOLDINGS The Agreement is expected to contribute positively to the future earnings, net tangible assets and gearing of Prestariang Group. The Agreement will not have any effect on the share capital and substantial shareholders’ shareholding of Prestariang.

4. RISKS The Agreement will be subjected to the usual project and termination risks. However, the Board and the management of Prestariang endeavour to take the necessary steps to minimise or mitigate any risks that may arise pursuant to the Agreement as and when it occurs.

5. DIRECTORS’ AND/OR SUBSTANTIAL SHAREHOLDERS’ INTEREST None of the Directors and/or substantial shareholders or any person connected to the Directors and/or substantial shareholders of Prestariang has any interest, either direct or indirect in the Agreement.

6. DIRECTORS’ STATEMENT The Board is of the opinion that the Agreement is in the best interest of Prestariang Group.

The announcement is dated 26 July 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 28-7-2018 07:39 PM

|

显示全部楼层

发表于 28-7-2018 07:39 PM

|

显示全部楼层

只供参考之用,买卖自负..

|

|

|

|

|

|

|

|

|

|

|

|

发表于 31-8-2018 06:03 AM

|

显示全部楼层

发表于 31-8-2018 06:03 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2018 | 30 Jun 2017 | 30 Jun 2018 | 30 Jun 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 55,924 | 55,211 | 128,675 | 99,105 | | 2 | Profit/(loss) before tax | 6,912 | 7,264 | 20,001 | 11,085 | | 3 | Profit/(loss) for the period | 2,614 | 5,902 | 11,630 | 9,118 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 529 | 5,817 | 7,041 | 9,033 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.11 | 1.20 | 1.45 | 1.87 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.20 | 1.00 | 0.70 | 1.75 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.3435 | 0.3389

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 31-8-2018 06:04 AM

|

显示全部楼层

发表于 31-8-2018 06:04 AM

|

显示全部楼层

EX-date | 14 Sep 2018 | Entitlement date | 19 Sep 2018 | Entitlement time | 05:00 PM | Entitlement subject | Interim Dividend | Entitlement description | Interim single-tier dividend of 0.20 sen per ordinary share | Period of interest payment | to | Financial Year End | 31 Dec 2018 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | SYMPHONY SHARE REGISTRARS SDN BHDLevel 6, Symphony HousePusat Dagangan Dana 1Jalan PJU 1A/4647301 Petaling JayaTel:0378490777Fax:0378418151 | Payment date | 17 Oct 2018 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 19 Sep 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.002 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 7-9-2018 07:57 AM

|

显示全部楼层

发表于 7-9-2018 07:57 AM

|

显示全部楼层

本帖最后由 icy97 于 9-9-2018 05:35 AM 编辑

Type | Announcement | Subject | OTHERS | Description | PRESTARIANG BERHAD ("PRESTARIANG" OR "THE COMPANY") - AGREEMENT BETWEEN PRESTARIANG SYSTEMS SDN BHD ("PSSB") AND THE GOVERNMENT OF MALAYSIA ("GOVERNMENT") FOR THE SUPPLY OF MICROSOFT SOFTWARE LICENCES, PRODUCTS AND SERVICES UNDER THE MASTER LICENSING AGREEMENT (MLA) 3.0 TO ALL GOVERNMENT AGENCIES AND INSTITUT LATIHAN AWAM IN MALAYSIA ("THE EXTENSION OF CONTRACT") | Reference is made to the Company's announcement dated 29 January 2018, wherein its wholly-owned subsidiary, PSSB had received the Letter of Award (“LOA”) dated 29 January 2018 from the Ministry of Finance (“MOF”) for the extension of Contract to supply of Microsoft software licences, products and services under the MLA 3.0 to all Government Agencies and Institut Latihan Awam in Malaysia.

Further to the announcement dated 29 January 2018, the Company is pleased to announce that PSSB had on today, entered into an agreement with the Government as represented by the MOF for the implementation of MLA 3.0. As mentioned in our earlier announcement, the Extension of Contract is for a period of three (3) years commencing from 1 February 2018 until 31 January 2021 at an estimated total value of RM222,600,000/-. The Extension of Contract under MLA 3.0 is an enhancement of MLA 2.0 that includes the Institut Latihan Awam as our new customer base with new added scope of services.

This announcement is dated 4 September 2018.

|

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5905645

|

|

|

|

|

|

|

|

|

|

|

|

发表于 30-9-2018 06:29 AM

|

显示全部楼层

发表于 30-9-2018 06:29 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | PRESTARIANG BERHAD ("PRESBHD" or "THE COMPANY") - TAWARRUQ FINANCING FACILITY AMOUNTING TO RM109,000,000 FOR PRESTARIANG SERVICES SDN BHD AND TAWARRUQ FINANCING FACILITY AMOUNTING TO RM869,377,000 FOR PRESTARIANG SKIN SDN BHD FROM BANK PEMBANGUNAN MALAYSIA BERHAD | We refer to the announcements made on 20 November 2015, 24 November 2015, 26 November 2015, 18 November 2016, 13 July 2017, 18 July 2017, 8 February 2018 and 10 April 2018 in relation to the implementation of an integrated and comprehensive core immigration system known as ‘Sistem Kawalan Imigresen Nasional’ (“SKIN”).

1. INTRODUCTION The Company wishes to announce that today, the following subsidiaries of PRESBHD, have entered into facility agreements with Bank Pembangunan Malaysia Berhad for the facilities set out below (collectively “Facilities”): (i) Prestariang SKIN Sdn Bhd (“PSKIN”) for a Tawarruq Financing Facility amounting to RM869,377,000 (“PSKIN Facility”) comprising TWQ1 Facility of RM854,677,000 (“TWQ1”) and TWQ2 Facility of RM14,700,000 (“TWQ2”); and (ii) Prestariang Services Sdn Bhd (“PServices”) for a Tawarruq Financing Facility amounting to RM109,000,000 (“PServices Facility”).

2. DETAILS OF THE FACILITIES The PSKIN Facility will be used to finance the acquisition of assets for the planning, design, development, customisation, supply, delivery, installation, configuration, integration, interfacing, testing, commissioning, maintenance and transfer of SKIN pursuant to the Concession Agreement dated 9 August 2017 (“Concession Agreement”) executed between the Government of Malaysia (“Government”) and PSKIN (“Project”). The tenure of TWQ1 will be up to 13 years from the date of first disbursement of the PSKIN Facility, and the tenure of TWQ2 will be up to 4 ½ years from the date of first disbursement of the PSKIN Facility or upon receipt of reimbursable costs from the Government under the Concession Agreement, whichever is the earlier, subject to the terms and conditions as set out in the PSKIN Facility. The PServices Facility will be used to part finance PServices’ contribution towards the Project. The tenure of the PServices Facility will be up to 8 years from the date of first disbursement of the PServices Facility, subject to the terms and conditions as set out in the PServices Facility.

3. FINANCIAL EFFECT OF THE FACILITIES (a) Share Capital The Facilities will not have any effect on the share capital of PRESBHD and the shareholding of the substantial shareholders of PRESBHD. (b) Net Assets The Facilities will not have any material effect on the net assets of the PRESBHD and the Group based on its latest audited consolidated balance sheet as at 31 December 2017. (c) Earnings The Facilities will not have any material effect on the earnings of the PRESBHD and the Group for the financial year ending 31 December 2018. (d) Gearing The Facilities is expected to increase the gearing of the PRESBHD Group from 0.14 times to 6.10 times.

4. INTERESTS OF DIRECTORS, MAJOR SHAREHOLDERS AND PERSONS CONNECTED Dr. Abu Hasan Bin Ismail, who is a director and major shareholder of PRESBHD, is also interested in PServices and PSKIN by virtue of his interests in Halaman Kapital Sdn Bhd. Halaman Kapital Sdn Bhd is a shareholder of PServices. Save as disclosed above, none of the Directors and/or major shareholders of PRESBHD and/or persons connected with them has any interest, direct or indirect, in the Facilities.

5. DIRECTORS’ RECOMMENDATION The Board of Directors of PRESBHD, after having considered the Facilities, is of the opinion that the Facilities are in the best interest of the PRESBHD and the Group.

This announcement is dated 26 September 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 3-10-2018 03:48 AM

|

显示全部楼层

发表于 3-10-2018 03:48 AM

|

显示全部楼层

Date of change | 30 Sep 2018 | Name | PUAN NIK AMLIZAN BINTI MOHAMED | Age | 50 | Gender | Female | Nationality | Malaysia | Designation | Non Executive Director | Directorate | Non Independent and Non Executive | Type of change | Resignation | Reason | Due to her resignation as the Chief Investment Officer of Kumpulan Wang Persaraan (Diperbadankan)(KWAP) |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 3-10-2018 03:48 AM

|

显示全部楼层

发表于 3-10-2018 03:48 AM

|

显示全部楼层

本帖最后由 icy97 于 8-10-2018 02:27 AM 编辑

Type | Announcement | Subject | OTHERS | Description | PRESTARIANG BERHAD (Prestariang or the Company) - Extension of contract with the Ministry of Education | PRESTARIANG BERHAD (“Prestariang” or “the Company”) – Extension of contract with the Ministry of Education (“MOE”) for the supply of Microsoft software licenses to public higher education institutions in Malaysia by the wholly-owned subsidiary of Prestariang, Prestariang Systems Sdn Bhd (“PSSB”) under the “Managing University Software as an Enterprise” (“MUSE”) programme

1. INTRODUCTION Reference is made to the Company's announcements dated 2 August 2017, 26 June 2015 and 23 August 2011 respectively, wherein the Company’s wholly-owned subsidiary, PSSB had on 23 August 2011 entered into an agreement with the Government, represented by the Ministry of Higher Education (“MOHE”) in relation to the MUSE programme (“the said Contract”).

The Company wishes to inform that PSSB has received a letter of award dated 25 September 2018 from the MOE on the extension of the said Contract for the supply of Microsoft software licenses under the MUSE programme to all public higher education institutions including universities, polytechnics and community colleges under the Ministry of Higher Education (currently MOE). The extension is for a period of one (1) year commencing from 3 July 2018 until 2 July 2019 at a total value of RM11,627,070.97 (“the Extension of Contract”).

2. FINANCIAL EFFECTS The Extension of Contract is expected to contribute positively to the future earnings, net assets per share and gearing of Prestariang Group. The Extension of Contract will not have any effect on the share capital and substantial shareholders’ shareholding of Prestariang.

3. DIRECTORS' AND/OR SUBSTANTIAL SHAREHOLDERS' INTEREST None of the Directors and/or substantial shareholders or any person connected to the Directors and/or substantial shareholders of Prestariang has any interest, either direct or indirect in the above Extension of Contract.

4. DIRECTORS' STATEMENT The Board of Directors of Prestariang is of the opinion that the Extension of Contract is in the ordinary course of business and is in the best interests of the Company.

This announcement is dated 1 October 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 26-10-2018 04:32 AM

|

显示全部楼层

发表于 26-10-2018 04:32 AM

|

显示全部楼层

Particulars of substantial Securities HolderName | AIA BHD. | Address | LEVEL 29, MENARA AIA, 99 JALAN AMPANG,

KUALA LUMPUR

50450 Wilayah Persekutuan

Malaysia. | Company No. | 790895-D | Nationality/Country of incorporation | Malaysia | Descriptions (Class) | ORDINARY SHARES |

Details of changesNo | Date of change | No of securities | Type of Transaction | Nature of Interest | | 1 | 22 Oct 2018 | 15,195,300 | Disposed | Direct Interest | Name of registered holder | AIA BHD. | Address of registered holder | LEVEL 29, MENARA AIA, 99 JALAN AMPANG, 50450 KUALA LUMPUR | Description of "Others" Type of Transaction | | | 2 | 22 Oct 2018 | 203,000 | Disposed | Indirect Interest | Name of registered holder | AIA PUBLIC TAKAFUL BHD | Address of registered holder | LEVEL 29, MENARA AIA, 99 JALAN AMPANG, 50450 KUALA LUMPUR | Description of "Others" Type of Transaction | |

Circumstances by reason of which change has occurred | DISPOSAL OF SHARES | Nature of interest | Direct and Indirect Interest | Direct (units) | 26,301,600 | Direct (%) | 5.453 | Indirect/deemed interest (units) | 304,600 | Indirect/deemed interest (%) | 0.063 | Total no of securities after change | 26,606,200 | Date of notice | 24 Oct 2018 | Date notice received by Listed Issuer | 24 Oct 2018 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 26-10-2018 05:02 AM

|

显示全部楼层

发表于 26-10-2018 05:02 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 27-10-2018 06:50 AM

|

显示全部楼层

发表于 27-10-2018 06:50 AM

|

显示全部楼层

Notice of Person Ceasing (Section 139 of CA 2016)Particulars of Substantial Securities HolderName | AIA BHD. | Address | LEVEL 29, MENARA AIA, 99 JALAN AMPANG,

KUALA LUMPUR

50450 Wilayah Persekutuan

Malaysia. | Company No. | 790895-D | Nationality/Country of incorporation | Malaysia | Descriptions (Class) | ORDINARY SHARES | Date of cessation | 23 Oct 2018 | Name & address of registered holder | (1) AIA BHD.- LEVEL 29, MENARA AIA, 99 JALAN AMPANG, 50450 KUALA LUMPUR(2) AIA PUBLIC TAKAFUL BHD- LEVEL 29, MENARA AIA, 99 JALAN AMPANG, 50450 KUALA LUMPUR |

No of securities disposed | 7,698,900 | Circumstances by reason of which a person ceases to be a substantial shareholder | Ceased to be substantial shareholder as a result of the disposal of shares. In view of the above, the interest of the company has reduced to below 5%. | Nature of interest | Direct and Indirect Interest |  | Date of notice | 25 Oct 2018 | Date notice received by Listed Issuer | 25 Oct 2018 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 19-12-2018 06:48 AM

|

显示全部楼层

发表于 19-12-2018 06:48 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|