|

|

【MATRIX 5236 交流专区】金群利集团

[复制链接]

[复制链接]

|

|

|

发表于 3-2-2018 08:13 AM

|

显示全部楼层

发表于 3-2-2018 08:13 AM

|

显示全部楼层

icy97 发表于 13-3-2015 03:07 AM

金群利2754万芙蓉买地

财经 2015年03月12日

(吉隆坡12日讯)金群利集团(MATRIX,5236,主板產业股)宣布,旗下子公司--BSS发展私人有限公司与独立地主签署一项买卖协议,以总值2754万6296令吉,收购位於森美 ...

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

NON RELATED PARTY TRANSACTIONS | Description | COMPLETION OF THE PROPOSED ACQUISITION OF VACANT AGRICULTURE LANDS HELD UNDER SEPARATE TITLES, LOCATED WITHIN MUKIM LABU, DAERAH SEREMBAN, NEGERI SEMBILAN DARUL KHUSUS BY BSS DEVELOPMENT SDN BHD | Reference is made to the earlier announcement dated 12 March 2015 (Ref: MC-150216-62953) pertaining to the Sale and Purchase Agreements entered with individual land owners for the proposed acquisition of 15 parcels of vacant agriculture lands located in Mukim Labu, Daerah Seremban, Negeri Sembilan ( "said Acquisition").

Matrix Concepts Holdings Berhad ("the Company") has on 2 February 2018 received notification from its solicitors, that the registration of the Memorandum of Transfer for all the 15 parcels of land are finalised and henceforth, the Board of Directors of the Company is pleased to announce the full completion of the said Acquisition.

This announcement is dated 2 February 2018 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 13-2-2018 05:22 AM

|

显示全部楼层

发表于 13-2-2018 05:22 AM

|

显示全部楼层

本帖最后由 icy97 于 13-2-2018 05:51 AM 编辑

金群利集團提早達標 截至1月錄11.5億收益

2018年2月12日

(芙蓉12日訊)金群利集團董事經理拿督李典和指出,集團截至今年3月的財政年,原本預計的收益目標為10億5000萬令吉,可喜的是,截至今年1月集團已取得11億5000萬令吉收益,提前2個月突破目標。

他說,集團會把發展計劃延伸至巴生谷一帶,並在吉隆坡中區推介住宅式公寓,相信將是集團的另一重要里程碑。

他說,2017年是該集團的挑戰年,在經濟放緩且馬幣疲弱的情況下,已對房地產行業造成一定的影響。

12大發展商之一

“雖然許多發展商都面對嚴峻考驗,但我們的產業需求依然強勁。”

李典和昨晚出席金群利集團週年晚宴時,如是指出。他說,雖然取得輝煌成績,但集團不會鬆懈,仍會繼續提供良好且有素質的產品予客戶。

他指出,該集團目前受肯定為一家發展健全的產業發展商,更在去年榮獲2017年“The Edge”10億令吉俱樂部大獎的兩項獎項,即“公司連續3年最高獲利”金牌獎和“股東連續3年最高回酬”銀牌獎。

他說,上述兩項獎項對上市只有4年歷史的該集團而言,具有非凡意義,除了得到市場的肯定和尊重,也足以與其他主要的產業發展商相提並論。

“我們目前已是全國12大發展商之一,並在去年與日本公司合作,引入新科技到旗下建設工程,即工業化建築系統,預計可在2019年起,開始引用該系統。”

李典和說,在引入該技巧后,該集團的建設時間將會縮短,還會提升其建設效率,減少浪費資源。

著力發展教育業務

李典和指出,集團將著力發展教育領域,已在金群利環球院校推動許多發展計劃,更與2所中國教育機構合作,相信到了今年9月,學生人數從現有的800人增至逾千名。

他說,在過去3年,集團已在芙蓉達城獻地建校,當中建有國小、華小和淡小,3所小學的興建工程耗資逾3000萬令吉。

他說,除了教育,集團也在芙蓉達城耗資1200萬令吉,興建可容納超過1500人的清真寺,而且另興建2間祈禱室和民眾會堂。

“我們也有興建興都廟,以及捐獻兩間店面充當基督團體的膜拜場所。”

他說,集團也秉持企業社會責任,並成為森州籃球隊和森州足球隊的主要贊助商。

他透露,坐落在芙蓉達城的馬來西亞皇家空軍學校也將在今年開始運作。【中国报财经】 |

|

|

|

|

|

|

|

|

|

|

|

发表于 14-2-2018 05:04 AM

|

显示全部楼层

发表于 14-2-2018 05:04 AM

|

显示全部楼层

李典和黄金60年

低调行善振兴篮运

2018年2月13日

报道·郑德伟 摄影·戴桐源

岁月是把无情刀,从三十而立之龄创业,时光流逝,进入耳顺之年的李典和,狗年也是他庆祝60岁的本命年,他最大的心愿是希望集团更趋蓬勃发展,给股东赚更多钱。

笑言安稳活到60岁是最大目标,金群利集团董事经理李典和凭着赚到400万令吉的第一桶金,延续金群利辉煌20年,抚今追昔,20年犹如做梦一场。

李典和笑言,母亲说人要活到一甲子60岁,他实现活到60岁;年轻时设下的目标都能一一实现,而且还超越目标,他对此甚感欣慰。

1997年,他在39岁时创立金群利,在金融风暴时逆袭而上,首项建屋发展计划就是马口花园,为公司赚到400万令吉,2004年与柔佛政府联营在居銮发展“金峦镇”。

2005年,金群利与森美兰州政府合作,联营发展占地5000多英亩的芙蓉达城(Bandar Sri Sendayan),给金群利最辉煌的黄金10年。

“我初始的创业目标其实很简单,就是要赚到百万令吉,让家人生活好些,这些计划随着公司规模越来越大; 也让我有更多机会与柔佛、森美兰的州政府合作。”

每季派发40%盈利

2013年5月28日,是金群利集团最重要的日子,李典和跟母亲刘岳婵,一起在大马证券交易所主持敲钟上市,正式成为一间挂牌公司。集团上市至今保持每季派发40%盈利予股东,这是其他上市公司没法做到的记录。

“很多人退休后过着无所事事的生活,我觉得在事业有成时应该充分编排时间,做更多自己要做的事,不能每天睡醒就要休闲,去打高尔夫球,人生似乎失去目标,倒不如继续工作。”

他说,只有在入土为安那一刻才是真正的退休,否则都应该继续工作,即使年纪较大时都要做能力所及的事, 让生意能继续发展下去。

热心公益 拒绝名衔

李典和热心公益慈善,资助华教及赞助推动篮运,他希望能借此抛砖引玉,吸引到更多人关心华教及篮运发展。

著名潜能导师斯蒂芬·科维(Stephen R.Covey)在《高效能人士的7个习惯》中说,“你留下得越多,你的生命才越有价值;你对社会贡献得越多,你的生命才越有意义”。

拒绝社团职位

李典和就只愿做雪中送炭的人。很多华社组织及社团都在筹款,而他会有选择性及目标性的捐款,例如森华堂是华团最高领导机构,要筹建大厦,因此他全力支持;森美兰华人接生院濒临关闭时,他义不容辞接下担子。

华总筹钱兴建华总大厦,华总主席丹斯里方天兴向他募捐,还有森州芦骨华小为筹款扩建校舍,他却一概婉拒。

“筹建华总大厦时,有很多华裔领袖响应捐钱;芦骨华小于过去数十年也培养很多人才,都是中小型企业的老板,只要他们联合起来就能凑足500万令吉,我不如捐款给那些更需要得到援助的人或团体。”

他自问问心无愧,不存有任何私心,及坚持拒绝担任任何社团职位,目前只担任森美兰华人接生院理事会的主席。

“我是在极紧急的情况下,决定接任接生院的主席职,因为它涉及巨额大资金,也是一项责任,我最终还是答应,这是我唯一担任的社团组织领导职。”

提升运动员福利

对前女篮国手吴春仪凄惨的晚年,也激起李典和振兴大马篮运的决心,他慷慨捐资,给篮球运动员提供更好的薪金福利。

他豪掷千金犒赏球员,“森州金群利队”实现在大马元首杯二连冠的佳绩,他奖赏教练及运动员8万令吉的轿车及10万令吉款项,而且还承诺,假如能赢得三连冠,将犒赏球员22万令吉的公寓。

他说,吴春仪是最优秀的篮球运动员,只是早期运动员缺乏稳定收入,黄金10年的运动生涯,他们的收入还未能改善生活,最终晚年凄凉,他给森州篮总提供资助,是希望让运动员有更好的福利。

他给运动员丰厚的奖励,是想鼓励其他州的企业家也能效仿,并制定一套保护篮球运动员的制度,给他们享有福利的保障,有固定收入,让他们能专心打球,及创造佳绩。

“森州借出5名球员参与猛龙队出赛东南亚职业篮球赛,比起以往扮演绿叶,今次本土球员反而扮演重要角色,证明本土球员在高水准篮球赛也有作为,也验证在我们的重赏及努力下,就能振兴大马篮运。”【e南洋】 |

|

|

|

|

|

|

|

|

|

|

|

发表于 5-3-2018 01:54 AM

|

显示全部楼层

发表于 5-3-2018 01:54 AM

|

显示全部楼层

本帖最后由 icy97 于 6-3-2018 04:07 AM 编辑

营收增34% 派息3.5仙

金群利第三季多赚40%

2018年3月1日

(吉隆坡28日讯)受到产业发展销售提振,金群利集团(MATRIX,5236,主板产业股)截至去年12月杪第三季,净利按年增长39.86%,并派息每股3.5仙。

金群利集团今日向交易所报备,除权日和享有权益日,分别落在3月21日和23日,支付日则在4月11日。

第三季净赚7055万7000令吉,或每股9.52仙,高于上财年同期的5044万8000令吉,或每股8.83仙,主要来自工业产业的销售,贡献较高营业额及加强赚幅。

营业额则从1亿9800万令吉,按年提升34.43%,报2亿6616万8000令吉,归功于销售所有产业发展类型的收入增加,包括住宅、商业和工业产业。

投资产业业务也表现优秀,Marix Global Schools和d’Tempat Country Club,带来900万令吉营业额贡献,按年提高8.4%。

该季税前盈利取得9742万9000令吉,按年增长33.6%。

截至去年12月31日,金群利集团总未发展地库达约1600英亩,预计未来发展总值达67亿令吉。

销售可破10亿

累计9个月,净利年升12.83%至1亿6793万5000令吉;营业额则年增3.69%,达6亿4192万2000令吉。

主席拿督哈斯拉通过文告说:“集团的项目多年来一直引起极大兴趣,因为我们一直致力于为买家提供卓越的价值。”

截至去年杪,该集团进行中项目的总值达25亿令吉,且未入账销售增至11亿令吉,为未来几年净利提供强劲支撑。

该集团还说,尽管市场环境备受挑战,该集团仍有信心本财年销售能取得双位数增长,超过前一年的10亿令吉。

展望未来,哈斯拉说,随着达城(Bandar Sri Sendayan)日益普及人口不断增长,该集团准备进一步进行扩大计划。

“凭借进行中项目的庞大数量,及增长计划,我们不仅有信心可取得良好盈利,还可以持续将全年净利的40%派发给股东。”【e南洋】

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2017 | 31 Dec 2016 | 31 Dec 2017 | 31 Dec 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 266,168 | 198,000 | 641,922 | 619,077 | | 2 | Profit/(loss) before tax | 97,429 | 72,928 | 230,430 | 206,184 | | 3 | Profit/(loss) for the period | 70,557 | 50,448 | 167,935 | 148,839 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 70,557 | 50,448 | 167,935 | 148,839 | | 5 | Basic earnings/(loss) per share (Subunit) | 9.52 | 8.83 | 26.26 | 26.22 | | 6 | Proposed/Declared dividend per share (Subunit) | 3.50 | 3.50 | 10.00 | 10.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.5900 | 1.7800

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 6-3-2018 04:10 AM

|

显示全部楼层

发表于 6-3-2018 04:10 AM

|

显示全部楼层

EX-date | 21 Mar 2018 | Entitlement date | 23 Mar 2018 | Entitlement time | 05:00 PM | Entitlement subject | Interim Dividend | Entitlement description | Single Tier Third Interim Dividend of 3.50 Sen Per Ordinary Share | Period of interest payment | to | Financial Year End | 31 Mar 2018 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | BINA MANAGEMENT (M) SDN BHDLot 10, The Highway CentreJalan 51/20546050 Petaling JayaTel:0377843922Fax:0377841988 | Payment date | 11 Apr 2018 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 23 Mar 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.035 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 6-3-2018 05:08 AM

|

显示全部楼层

发表于 6-3-2018 05:08 AM

|

显示全部楼层

icy97 发表于 2-3-2017 06:11 AM

偕台湾彰化基督教医院

金群利达城建医疗中心

2017年3月1日

(芙蓉1日讯)金群利集团(MATRIX,5236,主板产业股)今日与台湾彰化基督教医院签署了解备忘录,在芙蓉达城(Bandar Sri Sendayan)兴建金群利环球 ...

Type | Announcement | Subject | MEMORANDUM OF UNDERSTANDING | Description | EXPIRATION OF THE MEMORANDUM OF UNDERSTANDING (MOU) BETWEEN MATRIX CONCEPTS HOLDINGS BERHAD AND CHANGHUA CHRISTIAN HOSPITAL, REPUBLIC OF CHINA (TAIWAN) | Reference is made to the earlier announcements dated 1 March 2017 and 30 August 2017 ( Reference no. GA1-0103201700005 and GA1--28082017-00125 ) pertaining to the above MOU. Unless otherwise defined, the terms and abbreviations used herein shall have the same meaning as defined in the aforesaid announcements.

The Board of Directors of Matrix Concepts Holdings Berhad wishes to announce that the validity of the MOU has expired on 28 February 2018 and the parties hereto have no intention of extending the MOU. Henceforth, the MOU shall cease to have any effect from the date hereof.

This announcement is dated 28 February 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 17-5-2018 03:34 AM

|

显示全部楼层

发表于 17-5-2018 03:34 AM

|

显示全部楼层

本帖最后由 icy97 于 20-5-2018 05:03 AM 编辑

Type | Announcement | Subject | MEMORANDUM OF UNDERSTANDING | Description | MEMORANDUM OF UNDERSTANDING BETWEEN MATRIX CONCEPTS HOLDINGS BERHAD AND PT BANGUN KOSAMBI SUKSES AND PT NIKKO SECURITAS INDONESIA | The Board of Directors of Matrix Concepts Holdings Berhad wishes to inform that it has on 14 May 2018, entered into a Memorandum of Understanding ("MOU") with PT Bangun Kosambi Sukses and PT Nikko Securitas Indonesia for the joint development of an Islamic Financial District in Pantai Indah Kapuk 2, Jakarta, Indonesia. Kindly refer to the attachment below for details of the MOU. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5789325

|

|

|

|

|

|

|

|

|

|

|

|

发表于 20-5-2018 05:30 AM

|

显示全部楼层

发表于 20-5-2018 05:30 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 26-5-2018 04:38 AM

|

显示全部楼层

发表于 26-5-2018 04:38 AM

|

显示全部楼层

本帖最后由 icy97 于 2-6-2018 06:57 AM 编辑

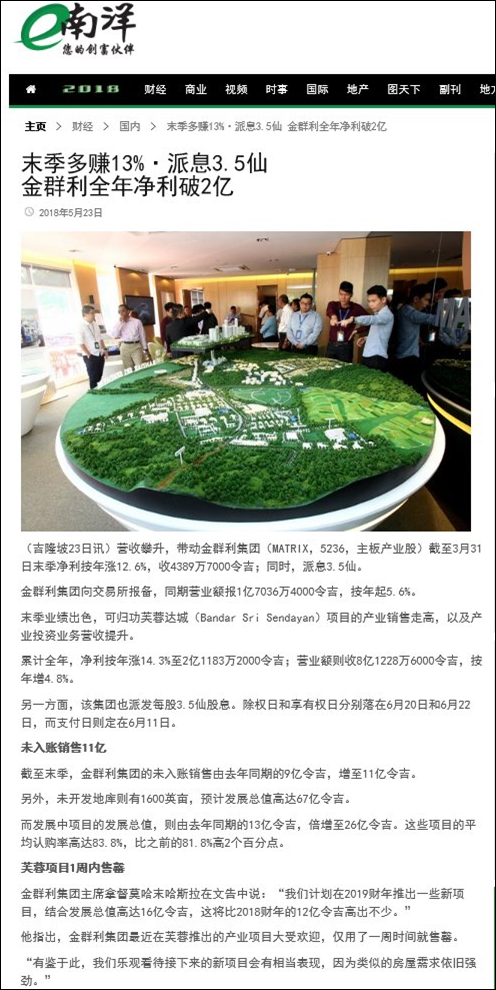

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2018 | 31 Mar 2017 | 31 Mar 2018 | 31 Mar 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 170,364 | 161,346 | 812,286 | 774,978 | | 2 | Profit/(loss) before tax | 63,639 | 55,100 | 294,069 | 260,312 | | 3 | Profit/(loss) for the period | 43,897 | 38,984 | 211,832 | 185,278 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 43,897 | 38,984 | 211,832 | 185,278 | | 5 | Basic earnings/(loss) per share (Subunit) | 5.88 | 6.00 | 31.81 | 28.67 | | 6 | Proposed/Declared dividend per share (Subunit) | 3.50 | 3.75 | 13.50 | 13.75 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.6100 | 1.7800

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 26-5-2018 04:40 AM

|

显示全部楼层

发表于 26-5-2018 04:40 AM

|

显示全部楼层

EX-date | 20 Jun 2018 | Entitlement date | 22 Jun 2018 | Entitlement time | 05:00 PM | Entitlement subject | Interim Dividend | Entitlement description | SINGLE TIER FOURTH INTERIM DIVIDEND OF 3.50 SEN PER ORDINARY SHARE | Period of interest payment | to | Financial Year End | 31 Mar 2018 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | BINA MANAGEMENT (M) SDN BHDLot 10, The Highway CentreJalan 51/20546050 Petaling JayaTel:03-77843922Fax:03-77841988 | Payment date | 11 Jul 2018 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 22 Jun 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.035 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 15-6-2018 03:12 AM

|

显示全部楼层

发表于 15-6-2018 03:12 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 21-6-2018 12:57 AM

|

显示全部楼层

发表于 21-6-2018 12:57 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | INCORPORATION OF SUBSIDIARIES IN AUSTRALIA | Pursuant to Paragraph 9.19(23) of the Main Market Listing Requirements of Bursa Malaysia Securities Berhad, the Board of Directors of Matrix Concepts Holdings Berhad (“MCHB”) wishes to announce that the following subsidiaries have been incorporated in Australia:-

No. | Subsidiaries | Share Capital | Shareholders | Intended Principal Activities | 1. | Matrix Development (Australia) Pty Ltd | AUD1,200.00 comprising 1,200 shares of AUD1.00 each | Matrix Concepts Holdings Berhad | Property development | 2. | Matrix Greenvale (Australia) Pty Ltd | AUD1,200.00 comprising 1,200 shares of AUD1.00 each | Matrix Development (Australia) Pty Ltd | Property development |

The incorporation of the above subsidiaries is not expected to have any material effect on the earnings and net assets of MCHB Group for the financial year ending 31 March 2019.

Other than the directors’ respective interests through MCHB, none of the directors and/or major shareholders and/or persons connected with a director or major shareholder of MCHB has any interest, direct and/or indirect in the subsidiaries.

This announcement is dated 14 June 2018.

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 23-6-2018 08:10 AM

|

显示全部楼层

发表于 23-6-2018 08:10 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 14-7-2018 02:46 AM

|

显示全部楼层

发表于 14-7-2018 02:46 AM

|

显示全部楼层

本帖最后由 icy97 于 16-7-2018 02:44 AM 编辑

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

RELATED PARTY TRANSACTIONS | Description | SALE OF PROPERTIES TO RELATED PARTIES | The Board of Directors of Matrix Concepts Holdings Berhad wishes to announce that its wholly-owned subsidiary companies, BSS Development Sdn Bhd and Matrix Concepts Sdn Bhd, had entered into separate Sale and Purchase Agreement for the sale of properties to related parties, the details of which are as described in the attachment herein. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5853865

|

|

|

|

|

|

|

|

|

|

|

|

发表于 14-8-2018 02:30 AM

|

显示全部楼层

发表于 14-8-2018 02:30 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 17-8-2018 07:17 AM

|

显示全部楼层

发表于 17-8-2018 07:17 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 28-8-2018 02:58 AM

|

显示全部楼层

发表于 28-8-2018 02:58 AM

|

显示全部楼层

本帖最后由 icy97 于 29-8-2018 02:13 AM 编辑

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2018 | 30 Jun 2017 | 30 Jun 2018 | 30 Jun 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 230,042 | 172,858 | 230,042 | 172,858 | | 2 | Profit/(loss) before tax | 67,950 | 61,991 | 67,950 | 61,991 | | 3 | Profit/(loss) for the period | 50,152 | 45,552 | 50,152 | 45,552 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 50,152 | 45,552 | 50,152 | 45,552 | | 5 | Basic earnings/(loss) per share (Subunit) | 6.67 | 7.89 | 6.67 | 7.89 | | 6 | Proposed/Declared dividend per share (Subunit) | 3.25 | 3.25 | 3.25 | 3.25 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.6400 | 1.6100

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 28-8-2018 02:59 AM

|

显示全部楼层

发表于 28-8-2018 02:59 AM

|

显示全部楼层

EX-date | 19 Sep 2018 | Entitlement date | 21 Sep 2018 | Entitlement time | 05:00 PM | Entitlement subject | Interim Dividend | Entitlement description | SINGLE TIER FIRST INTERIM DIVIDEND OF 3.25 SEN PER ORDINARY SHARE | Period of interest payment | to | Financial Year End | 31 Mar 2019 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | BINA MANAGEMENT (M) SDN BHDLot 10, The Highway CentreJalan 51/20546050 Petaling JayaTel:03-77843922Fax:03-77841988 | Payment date | 10 Oct 2018 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 21 Sep 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.0325 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 28-8-2018 06:12 AM

|

显示全部楼层

发表于 28-8-2018 06:12 AM

|

显示全部楼层

Date of change | 01 Sep 2018 | Name | DATO LEE TIAN HOCK | Age | 60 | Gender | Male | Nationality | Malaysia | Type of change | Redesignation | Previous Position | Managing Director | New Position | Executive Deputy Chairman | Directorate | Executive | Qualifications | Degree in Housing, Building and Planning from Universiti Sains Malaysia | Working experience and occupation | Dato' Lee Tian Hock is the founder, director and major shareholder of Matrix Concepts Holdings Berhad (MCHB) Group. Dato' Lee is the Group Managing Director of MCHB Group since 2012 till current date. He shall be re-designated as Group Executive Deputy Chairman with effect from 1 September 2018. | Family relationship with any director and/or major shareholder of the listed issuer | NIL | Any conflict of interests that he/she has with the listed issuer | Dato' Lee Tian Hock has recurrent related party interests,of which shareholders' approval had been sought. The details of which are available in the circular dated 18 July 2018 (ref: DCS-16072018-00011) | Details of any interest in the securities of the listed issuer or its subsidiaries | Dato' Lee Tian Hock's shareholdings in MCHB as follows:-Ordinary shares- Direct interest ( own name) - 115,569,276 shares- Indirect interest - 166,301,535 shares #Warrants 2015/2020- Direct interest (own name ) - 260,342 warrants- Indirect interest - 8,503,643 warrants ##- deemed interested pursuant to Section 8 and/or Section 59(11)(c) of the Companies Act, 2016 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 28-8-2018 06:14 AM

|

显示全部楼层

发表于 28-8-2018 06:14 AM

|

显示全部楼层

Date of change | 01 Sep 2018 | Name | MR HO KONG SOON | Age | 51 | Gender | Male | Nationality | Malaysia | Type of change | Redesignation | Previous Position | Deputy Managing Director | New Position | Managing Director | Directorate | Executive | Qualifications | Bachelor of Engineering Degree from University of Malaya | Working experience and occupation | Mr Ho Kong Soon is the Group Deputy Managing Director of Matrix Concepts Holdings Berhad (MCHB) Group since 2012 till current date. His new designation as Group Managing Director takes effect from 1 September 2018. | Family relationship with any director and/or major shareholder of the listed issuer | NIL | Any conflict of interests that he/she has with the listed issuer | NIL | Details of any interest in the securities of the listed issuer or its subsidiaries | Mr Ho has interests in the ordinary shares of MCHB as follows:-Ordinary SharesDirect interest (Own name) - 8,270,411 sharesIndirect Interests - 29,162,043 shares #Warrants 2015/2020Direct interest (own name) - 803,215 warrantsIndirect interests - 4,166,006 warrants ##: Indirect interests held pursuant to Section 8 and/or Section 59(11) (c) of the Companies Act, 2016. |

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|