|

|

【MATRIX 5236 交流专区】金群利集团

[复制链接]

[复制链接]

|

|

|

发表于 11-6-2015 01:41 AM

|

显示全部楼层

发表于 11-6-2015 01:41 AM

|

显示全部楼层

金群利冀更多投资者进驻芙蓉科技园

财经 2015年06月10日

(吉隆坡10日讯)房地產发展商--金群利集团(MATRIX,5236,主板產业股)希望可以吸引更多投资者,到其位于芙蓉达城科技谷(Sendayan Tech Valley,STV)及达城科技园(Sendayan Tech Park,STP)设立製造厂。

金群利集团主席拿督莫哈末哈斯拉表示,该公司预计若有大量的高科技人才涌入,届时將带动达城(Bandar Sri Sendayan)的房產需求。「公司正在努力推广我们的工业地產,以吸引更多来自本地和国外的公司前来投资。」

他也指出,自2010年以来,该公司已经取得40亿令吉的外来直接投资额。主要是该工业区地点具策略性、基建设施卓越和价格相对具吸引力。

莫哈末哈斯拉是出席今日在芙蓉主办的股东大会后,向媒体发表谈话。

莫哈末哈斯拉指出,对于达城的住宅和商业地產而言,隨著越来越多的著名企业进驻其工业园,將带动当地的住宅和商业地產的需求。目前,达城科技谷已经吸引18家来自全球的投资商进驻当地。它们分別来自日本、英国、法国、德国、丹麦和中国。其中有6家企业已开始投入运作。

金群利集团正在为佔地66.37公顷的达城科技园建构基建设施,並预计將在明年上半年推出。达城科技谷及达城科技园的合共发展总值为5亿5000万令吉,发展面积为125.45公顷。【东方网财经】 |

|

|

|

|

|

|

|

|

|

|

|

发表于 16-6-2015 01:23 AM

|

显示全部楼层

发表于 16-6-2015 01:23 AM

|

显示全部楼层

Date of change | 13 Jun 2015 | Name | Puan SALMAH BINTI SHARIF | Age | 54 | Nationality | Malaysia | Designation | Non Executive Director | Directorate | Independent and Non Executive | Type of change | Demised | Qualifications | Bachelor of Law from Universiti Teknology MARA (UiTM) | Working experience and occupation | Puan Salmah was appointed to the Board on 19 November 2013. She held the position of Chairperson of the Remuneration Committee and a Member of the Audit Committee and Risk Management Committee. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 20-6-2015 01:17 AM

|

显示全部楼层

发表于 20-6-2015 01:17 AM

|

显示全部楼层

本帖最后由 icy97 于 20-6-2015 11:00 PM 编辑

韩春锦林贵福任金群利董事

财经新闻 财经 2015-06-20 12:23

(芙蓉19日讯)金群利集团(MATRIX,5236,主板产业股)宣布,委任教育部前副部长拿督韩春锦及拿督林贵福为董事。

该公司向马交所报备,林贵福受委执行董事,而韩春锦则任独立非执行董事,即日生效。

林贵福34年经验

金群利董事经理拿督李典和说,董事部对两人的加入深感荣幸,并深信他们能提升金群利的实力,帮助业务发展及提供风险解决方案。

现年59岁的林贵福,拥有逾34年产业发展经验,是特许建造学会会员(Chartered Institute of Building,UK),曾任职国际不动产联合会(FIABCI),5月才卸下马星集团(MAHSING,8583,主板产业股)执行董事一职。

李典和指出,林贵福过往的绩效斐然,曾助多家知名产业发展商,实现跨跃式的进展,领导及敬业精神值得学习。

67岁的韩春锦,活跃于政经商文教界,1999年担任我国教育部副部长。

他也曾任州议员、州行政议员及国会议员,曾是马华森美兰州联委会主席。

他目前也是比德生科(PLABS,0171,创业板)董事兼非执行主席。

李典和说,金群利新人事变动,是希望借重两位杰出人士的智慧与经验,结合双方的全面性思维,共同参与公司整体经营与决策。

他坚信,借由两人于业界及学界的专长与丰富经验,定能以超然客观的立场,维护公司利益并强化董事局的制约机制,提高经营品质,保障各种投资者权益。【南洋网财经】

Date of change | 19 Jun 2015 | Name | Dato LIM KIU HOCK | Age | 59 | Nationality | Malaysia | Designation | Executive Director | Directorate | Executive | Type of change | Appointment | Qualifications | Bachelor of Science in Housing, Building and Planning from University Sains Malaysia. He is a member of the Chartered Institute of Building, UK (CIOB) and has also served on the National Committee of the International Real Estate Federation (FIABCI) | Working experience and occupation | Dato' Lim Kiu Hock has more than 30 years of experience in property development . His last appointment was the Executive Director of Mah Sing Group, a position which he held from year 2006 until May 2015 |

Date of change | 19 Jun 2015 | Name | Dato' HON CHOON KIM | Age | 67 | Nationality | Malaysia | Designation | Independent Director | Directorate | Independent and Non Executive | Type of change | Appointment | Qualifications | Dato' Hon Choon Kim graduated with a Bachelor of Social Sciences (Econ) in 1976 from University Sains Malaysia . | Working experience and occupation | Dato' Hon Choon Kim started his career in the government's statistical department in 1977. Later, in 1986, he was elected as state assemblyman and was appointed as a state executive councilor of Negeri Sembilan. He was then elected to be a member of the Parliament in 1995 and was appointed as the Deputy Minister of Education from 1999 until 2008. | Directorship of public companies (if any) | Dato' Hon Choon Kim currently is the director and also the Non-Executive Chairman of Peterlab Holdings Berhad | Family relationship with any director and/or major shareholder of the listed issuer | Nil | Any conflict of interests that he/she has with the listed issuer | Nil | Details of any interest in the securities of the listed issuer or its subsidiaries | Dato' Hon Choon Kim currently holds 6,000 shares in Matrix Concepts Holdings Berhad via his spouse pursuant to Section 134(12) (c) of the Companies Act,1965 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 30-6-2015 04:27 AM

|

显示全部楼层

发表于 30-6-2015 04:27 AM

|

显示全部楼层

Type | Announcement | Subject | NEW ISSUE OF SECURITIES (CHAPTER 6 OF LISTING REQUIREMENTS)

BONUS ISSUES | Description | (I) BONUS ISSUE OF SHARES; AND(II) BONUS ISSUE OF WARRANTS.(COLLECTIVELY REFERRED TO AS THE PROPOSALS) | We refer to the announcements dated 15 April 2015, 22 April 2015, 12 May 2015, 18 May 2015 and 10 June 2015 in relation to the Proposals. All capitalised terms herein shall have the same meanings as those used in the abovementioned announcements unless stated otherwise.

On behalf of the Board, Kenanga IB wishes to announce that the Board has on 29 June 2015 fixed the exercise price for the Warrants at RM2.40 per Warrant.

The exercise price of RM2.40 per Warrant represents a discount of approximately RM0.31 or 11.4% to the theoretical ex-all price of MCHB Shares (after adjusting for the Proposed Bonus Issue of Shares) of RM2.71 per MCHB Share, based on the five (5)-day VWAMP of MCHB Shares of RM3.165 per MCHB Share, up to and including 26 June 2015, being the last traded day for MCHB Shares prior to the price-fixing by the Board.

This announcement is dated 29 June 2015. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 30-6-2015 04:29 AM

|

显示全部楼层

发表于 30-6-2015 04:29 AM

|

显示全部楼层

EX-date | 14 Jul 2015 | Entitlement date | 16 Jul 2015 | Entitlement time | 05:00 PM | Entitlement subject | Bonus Issue | Entitlement description | Bonus issue of up to 77,832,315 new ordinary shares of RM1.00 each in Matrix Concepts Holdings Berhad (MCHB) (Bonus Shares) to be credited as fully paid-up on the basis of one (1) Bonus Share for every six (6) existing MCHB Shares held by the shareholders of MCHB as at 5.00 p.m. on 16 July 2015 ("Entitlement Date") ("Entitled Shareholders") ("Bonus Issue of Shares"); and Bonus issue of up to 77,832,315 free warrants in MCHB (Warrants) on the basis of one (1) Warrant for every six (6) existing MCHB Shares held on the Entitlement Date (Bonus Issue of Warrants). | Period of interest payment | to | Financial Year End | 31 Dec 2015 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | BINA MANAGEMENT (M) SDN BHD (.)Lot 10, The Highway CentreJalan 51/20546050Petaling JayaTel:0377843922Fax:0377841988 | Payment date |

| | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 16 Jul 2015 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Ratio | Ratio | 1 : 6 | Rights Issue/Offer Price |

| | Par Value | Malaysian Ringgit (MYR) 1.000 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 5-7-2015 03:21 PM

|

显示全部楼层

发表于 5-7-2015 03:21 PM

|

显示全部楼层

你有买这股?

|

|

|

|

|

|

|

|

|

|

|

|

发表于 6-7-2015 05:47 PM

|

显示全部楼层

发表于 6-7-2015 05:47 PM

|

显示全部楼层

森州政府修改可负担房屋政策 金群利认为有利可图

二零一五年七月五日 晚上七时二十六分

森美兰州政府决定修改其可负担房屋政策,及提高新住宅计划的土著配额从30%至50%,使得观察家和产业专业人士纷纷指这项行动为‘限制性’。

不过,利基发展商金群利集团有限公司(MATRIX,5236,产业组)却认为,政策的改变将为其计划带来12%至15%的总发展值增长,并且成为其收支平衡的驱动力。

金群利集团创办人兼集团董事经理拿督李典和说:“人民最终将会受惠,因将有更多的可负担房屋,而发展商也可获得盈利。”

据他透露,一项计划的发展值将随着新政策而提高因只有15%房屋订价为8万令吉以下,不像之前至少30%单位须属于廉价房屋(4万令吉)。这意味着15%的单位现可以更高的价格出售。

在上述于6月9日生效的新政策下,15%住宅单位必须订价8万令吉以下,另外15%则将以8万1令吉和25万令吉出售,及至少另外20%属于25万1令吉至40万令吉之间。

虽然为土著买家拨出更多单位将增加发展商的成本,但李典和认为,新政策对公众、产业发展商及州政府都是双赢。

“当州政府宣布新政策时,许多发展商抱怨,流动资金将因为未出售土著单位而受到影响。对金群利集团而言,我们不存在出售这些单位的问题。”

他补充,该公司并不会面对旧有30%土著配额的问题。

“我的目标族群是土著,但现在我们的城镇已经开始成熟,更多非土著会在当地置产。”

成立于1997年,以芙蓉为基地的金群利集团,已售出超过2万1000住宅和商业产业,总发展值达24亿令吉。其旗舰城镇是占地5000英亩的达城,距离芙蓉只有7公里。它也在森美兰叻务和拉沙拥有500英亩土地。

“当达城开售时,首5000单位是介于40万令吉以下。以现有的价格水平,我们仍可获得良好的利润。”

他续称,该公司约90%的廉价单位是由土著购买。

在50万令吉以上的产业方面,李典和预测,买家将包括土著(40%)、华裔(40%)和印裔(10%至20%)。整体上,金群利集团的买家组合是50%土著和50%非土著。

“我们在布城的巡回吸引了许多土著社会,尤其是当地的公务员。”

普遍上,土著会在有关计划迈入成熟时才对这项发展了解。

李典和承认,释放未出售土著单位的机制应该简化,而批准期限也应该由目前的6至12个月,缩短至一个月左右。

分析师指出,金群利集团在森美兰拥有优势,因其土地成本低廉。达城是以每平方尺3令吉买下,而该城镇毗邻的工业园达城科技谷,买价则为每平方尺9令吉,包括基建成本。

分析师称:“政策修正的净影响将相当中和,因达城预料将成为当地买家的选择。”

达城位于芙蓉和吉隆坡国际机场之间的策略性地点。大马皇家空军地面训练设备从新街场迁移到达城,也将为该城镇带来新的动力。

惟金群利集团太过专注于森美兰地库为一个忧虑,因其命运将完全连接该州的经济发展。

因此,金群利集团也已开始投资在巴生谷。举例而言,它已支付9500万令吉收购了蒲种Setia Walk广场附近的5.76英亩地段。它将在该地发展一项高档住宅计划,预测发展值达5亿令吉。

在吉隆坡,它计划收购一幅位于双威太子广场和太子世界贸易名心之间的土地。分析师预测,这项发展的价值约为3亿令吉。

上述2项计划将在未来4至6年内建竣。

询及该集团在森美兰以外的地库时,李典和表示,鉴于产业领域的疲软展望,该集团将更谨慎地作出选择。

“产业市场现在非常缓慢,因此我们不愿在难以出售我们计划的情况下买入土地。所以我们将物色可用作可负担房屋计划的土地,因其需求仍然超过供应量。”

金群利集团的负债水平只有0.04倍,使它处于优势以迎合艰辛时刻。截至3月杪,其未记账销售企于3亿9200万令吉,比2014年12月杪的4亿2930万令吉来得低,而进行中计划则达到11亿8000万令吉的总发展值。【光华日报财经】 |

|

|

|

|

|

|

|

|

|

|

|

发表于 17-7-2015 02:11 AM

|

显示全部楼层

发表于 17-7-2015 02:11 AM

|

显示全部楼层

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

RELATED PARTY TRANSACTIONS | Description | SALE OF PROPERTIES TO RELATED PARTIES | The Board of Directors of Matrix Concepts Holdings Berhad wishes to announce that its wholly-owned subsidiary companies, BSS Development Sdn Bhd and Matrix Concepts Sdn Bhd have on 15 July 2015, entered into separate Sale and Purchase Agreement for the sale of properties to related parties, the details of which are as described in the attachment below. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/4803977

|

|

|

|

|

|

|

|

|

|

|

|

发表于 20-7-2015 12:46 PM

|

显示全部楼层

发表于 20-7-2015 12:46 PM

|

显示全部楼层

|

请问6送1红股已经派了吗?股价调整从RM3.2到现在的RM2.67+-,我系统显示亏了15%,手上持股也是一样,请问是怎么回事呢?我持股好几个月了 |

|

|

|

|

|

|

|

|

|

|

|

发表于 24-7-2015 03:30 AM

|

显示全部楼层

发表于 24-7-2015 03:30 AM

|

显示全部楼层

本帖最后由 icy97 于 24-7-2015 03:39 AM 编辑

MATRIX - ISSUANCE OF 77,325,585 FREE WARRANTS ("WARRANT(S)") ON THE BASIS OF ONE (1) WARRANT FOR EVERY SIX (6) EXISTING ORDINARY SHARES OF RM1.00 EACH IN MATRIX ("BONUS ISSUE OF WARRANTS")| MATRIX CONCEPTS HOLDINGS BERHAD |

Kindly be advised that MATRIX’s 77,325,585Warrants issued pursuant to the Bonus Issue of Warrants will be admitted to the Official List of Bursa Malaysia Securities Berhad and the listing of and quotation for the Warrants on the Main Market will be granted with effect from 9.00 a.m., Friday, 24 July 2015.

The Stock Short Name, Stock Number and ISIN Code of the Warrants are "MATRIX-WA", "5236WA" and "MYL5236WAU73” respectively.

Profile for Securities of PLC| MATRIX CONCEPTS HOLDINGS BERHAD |

Instrument Category | Securities of PLC | Instrument Type | Warrants | Description | Free warrants issued pursuant to the bonus issue of 77,325,585 free warrants in MCHB ("Warrants") on the basis of one (1) Warrant for every six (6) existing MCHB Shares held by the shareholders of MCHB as at 5.00 p.m. on 16 July 2015 ("Entitlement Date") |

Listing Date | 24 Jul 2015 | Issue Date | 21 Jul 2015 | Issue/ Ask Price | Not Applicable | Issue Size Indicator | Unit | Issue Size in Unit | 77,325,585 | Maturity | Mandatory | Maturity Date | 20 Jul 2020 | Revised Maturity Date |

| | Name of Guarantor | Not Applicable | Name of Trustee | Not Applicable | Coupon/Profit/Interest/Payment Rate | Not Applicable | Coupon/Profit/Interest/Payment Frequency | Not Applicable | Redemption | Not Applicable | Exercise/Conversion Period | 5.00 Year(s) | Revised Exercise/Conversion Period | Not Applicable | Exercise/Strike/Conversion Price | Malaysian Ringgit (MYR) 2.4000 | Revised Exercise/Strike/Conversion Price | Not Applicable | Exercise/Conversion Ratio | 1 : 1 | Revised Exercise/Conversion Ratio | Not Applicable | Mode of satisfaction of Exercise/ Conversion price | Cash | Settlement Type/ Convertible into | Physical (Shares) |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 24-7-2015 03:34 AM

|

显示全部楼层

发表于 24-7-2015 03:34 AM

|

显示全部楼层

| MATRIX CONCEPTS HOLDINGS BERHAD |

| 1. Details of Corporate Proposal | Involve issuance of new type/class of securities ? | No | Types of corporate proposal | Bonus Issue | Details of corporate proposal | Bonus Issue of 77,325,585 new MCHB shares to be credited as fully paid-up on the basis of one (1) bonus share for every six (6) existing MCHB Shares held by the shareholders of MCHB as at the 5.00 p.m. on 16 July 2015. | No. of shares issued under this corporate proposal | 77,325,585 | Issue price per share ($$) | Malaysian Ringgit (MYR) 0.0000 | Par Value ($$) | Malaysian Ringgit (MYR) 1.000 | | Latest issued and paid up share capital after the above corporate proposal in the following | Units | 541,279,096 | Currency | Malaysian Ringgit (MYR) 541,279,096.000 | Listing Date | 24 Jul 2015 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 24-7-2015 07:01 PM

|

显示全部楼层

发表于 24-7-2015 07:01 PM

|

显示全部楼层

多推可负担房屋 金群利7亿销售在望

财经新闻 财经 2015-07-24 11:14

(吉隆坡23日讯)金群利集团(MATRIX,5236,主板产业股)主席拿督莫哈末哈斯拉指出,今年可达到7亿令吉的销售目标。

他向《The Edge》表示,在7亿令吉的销售目标中,6亿令吉来自住宅项目销售,1亿令吉则来自工业房产的销售。

虽然产业市场放缓,但该集团采取前瞻性的策略,即针对市况缓慢或暂停推介高档房产,转而推介更多可负担房屋。

“明年,我们计划推介3000间可负担房屋。”

不过,集团所推出的“高档房产”,其实多位于森美兰芙蓉,因此价位其实与巴生谷的中档住宅相去不远,有70%的住宅单位价格低于50万令吉。

目前,金群利集团坐拥2300英亩的地库,一半地库坐落于芙蓉达城(Bandar Sri Sendayan)。

续寻购更多地库

“当前手持地库可让我们忙至2022年。

当然,会持续寻购更多地库,也不会局限在森州。”

他也强调,森州的房市前景良好,未来将有更多基建计划开跑,如隆新高铁和其他高速大道,将会加强交通便利,增添集团在当地的产业吸引力。

另外,坐落于芙蓉达城的金群利国际学校,不仅可为产业计划增值,及能带来持续收入。

目前,该学校拥有426位学生,冀望在明年末季可收1000学生,达到收支平衡。【南洋网财经】 |

|

|

|

|

|

|

|

|

|

|

|

发表于 10-8-2015 03:39 PM

|

显示全部楼层

发表于 10-8-2015 03:39 PM

|

显示全部楼层

本帖最后由 icy97 于 10-8-2015 11:13 PM 编辑

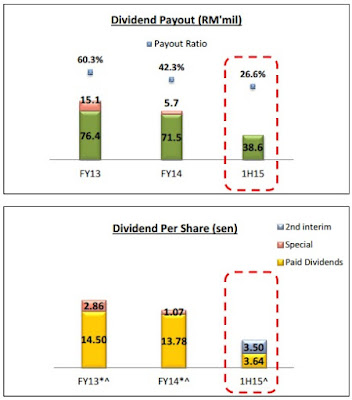

金群利集团次季净利挫29.7% 派息3.5仙

By Gho Chee Yuan / theedgemarkets.com | August 10, 2015 : 3:13 PM MYT

http://www.theedgemarkets.com/my/article/金群利集团次季净利挫297-派息35仙?type=News

(吉隆坡10日讯)金群利集团(Matrix Concept Holdings Bhd ( Financial Dashboard))截至6月30日的次季净利按年跌挫29.7%至2985万令吉,上财年同季净赚4245万令吉,因向来可带来较高赚幅的工业产业销售营业额下降所致。

次季营业额下跌26.4%至1亿2044万令吉,上财年同季营业额报1亿6375万令吉。

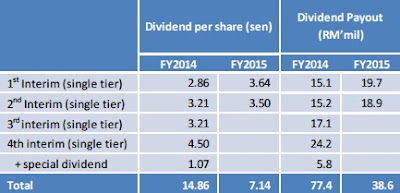

尽管盈利减少,该产业发展商宣布在截至今年12月31日的财年,派发每股3.5仙的第二次中期股息(2014财年次季派息3.75仙),派发日定于10月9日。

这意味着,金群利集团迄今为止一共派发每股7.75仙的股息,2014财年总共派息每股8.75仙。

综合现财年上半年的业绩表现,金群利集团合共两季净利飙涨79.4%,高达1亿4530万令吉,2014财年上半年净赚8099万令吉。

合计两季营业额则劲扬46.78%至4亿3805万令吉,高于上财年同期的2亿9845万令吉。

金群利集团今日向大马交易所报备,该公司目前专注于发展其在森美兰芙蓉的达城(Bandar Sri Sendayan),以及柔佛居銮的金銮镇(Bandar Seri Impian)的城镇发展计划。

“我们也在达城推介了Hijayu 2-Resort Hone (首阶段)和 Hijayu 3B,以及在金銮镇的Impiana Bayu 2 (首阶段)发展计划。

“我们放眼在2015财年下半年推介位于芙蓉的Suriaman (首阶段)和Residensi SIGC发展计划。”

有鉴于此,金群利集团有信心可通过推介发展计划,以及持续销售已推介的发展计划,来维持利润。

该集团也补充,Matrix Global Schools以及d’Tempat Country Club的营运料可为公司贡献盈利。此外,其他利好因素也包括,在该范围内的未来发展计划具备有更大的适销性。

金群利集团(基本面:2.15;估值:1.2)股价在早盘交易结束时,下跌10仙或4.26%,以2.25令吉暂收,半日成交量高达98万9200万股。

(编译:曾薛霏)

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2015 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2015 | 30 Jun 2014 | 30 Jun 2015 | 30 Jun 2014 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 120,438 | 163,747 | 438,047 | 298,447 | | 2 | Profit/(loss) before tax | 41,352 | 58,550 | 196,736 | 112,508 | | 3 | Profit/(loss) for the period | 29,851 | 42,447 | 145,300 | 80,997 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 29,851 | 42,447 | 145,300 | 80,997 | | 5 | Basic earnings/(loss) per share (Subunit) | 6.50 | 14.00 | 31.60 | 26.70 | | 6 | Proposed/Declared dividend per share (Subunit) | 3.50 | 3.75 | 7.75 | 8.75 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.6700 | 1.4500

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 10-8-2015 11:13 PM

|

显示全部楼层

发表于 10-8-2015 11:13 PM

|

显示全部楼层

EX-date | 22 Sep 2015 | Entitlement date | 25 Sep 2015 | Entitlement time | 05:00 PM | Entitlement subject | Second interim dividend | Entitlement description | SINGLE TIER SECOND INTERIM DIVIDEND OF 3.50 SEN PER ORDINARY SHARE OF RM1.00 EACH | Period of interest payment | to | Financial Year End | 31 Dec 2015 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | BINA MANAGEMENT (M) SDN BHD Lot 10, The Highway CentreJalan 51/20546050 Petaling JayaTel:0377843922Fax:0377841988 | Payment date | 09 Oct 2015 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 25 Sep 2015 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.0350 | Par Value | Malaysian Ringgit (MYR) 1.000 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 12-8-2015 02:40 AM

|

显示全部楼层

发表于 12-8-2015 02:40 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | INCORPORATION OF COMPANY- MATRIX HEALTHCARE SDN BHD | Pursuant to Paragraph 9.19(23) of the Main Market Listing Requirements of Bursa Malaysia Securities Berhad, the Board of Directors of Matrix Concepts Holdings Berhad ("MCHB") wishes to announce that, MCHB has incorporated a company in Malaysia, namely Matrix Healthcare Sdn Bhd ("MHSB") on 10 August 2015. MHSB is incorporated with an issued and paid-up share capital of RM3.00 divided into 3 ordinary shares of RM1.00 each. The intended principal business of MHSB shall be the provision of healthcare services .

The incorporation of MHSB is not expected to have any material effect on the earnings and net tangible assets of MCHB for the financial year ending 31 December 2015.

Other than the directors' respective interests through MCHB, none of the directors and/or major shareholders and/or persons connected to them, has any interest, whether direct or indirect in MHSB.

This announcement is dated 11 August 2015. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 13-8-2015 01:43 AM

|

显示全部楼层

发表于 13-8-2015 01:43 AM

|

显示全部楼层

金群利集团 5.4亿销售未入账

财经 行家论股 2015-08-12 10:43

目标价:2.46令吉

最新进展

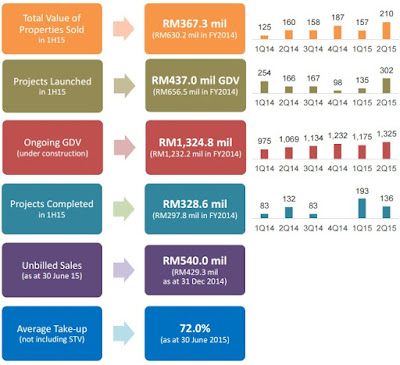

住宅和工业房地产销售亮眼,金群利集团(MATRIX,5236,主板产业股)首半年净利扬79.4%,达1亿4530万令吉。

同期营业额也按年扬46.8%,从2亿9840万令吉,提升至4亿3804万7000令吉。

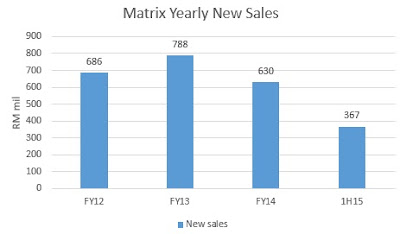

另外,在首半年共取得3亿6700万令吉的销售额。

行家建议

金群利集团首半年的净利,分别占我们及市场全年预测的76%和74%,因投资者趁消费税未落实前,纷纷抢购住宅和工业房地产,估计接下来的季度将放缓。

至于销售额方面,则符合全年预期的53%。

截至次季,该公司未入账销售额达5亿4000万令吉,足以支撑未来1至1年半盈利。

再者,该公司计划今年推出发展总值11亿令吉的住宅和商业产业。

我们将现财年部分的销售预期推至下财年,因此,将现财年的销售额预估下修10%至6亿2500万令吉,并将下财年的销售额预估上调5%,为7亿2800万令吉。

维持现财年财测,下财年的净利预估则上修4%,维持“符合大市”投资评级。

肯纳格投行

【南洋网财经】 |

|

|

|

|

|

|

|

|

|

|

|

发表于 13-8-2015 06:39 PM

|

显示全部楼层

发表于 13-8-2015 06:39 PM

|

显示全部楼层

|

Matrix Concepts’ unbilled sales surge to RM540m in 2Q

By RHB Research / digitaledge Daily | August 12, 2015 : 10:27 AM MYT

Matrix Concepts Holdings Bhd

(Aug 11, RM2.23)

Maintain buy with an unchanged target price of RM2.73. Matrix Concepts Holdings’ (Matrix Concepts) second-quarter financial year 2015 (2QFY15) earnings were within our and market expectations. First half FY15 (1HFY15) earnings made up 69% of our full-year forecast.

But the quarter-on-quarter (q-o-q) drop in earnings was not a surprise, as we had previously highlighted that the spike in 1QFY15 earnings will not be recurring. This was because it was largely frontloaded due to the accelerated payments by industrial land buyers to settle the transactions before the goods and services tax in April.

Of the total revenue of RM438 million for 1HFY15, property development and industrial land sales contributed RM338 million and RM95 million respectively.

The new school and clubhouse operations, meanwhile, contributed RM5.5 million, but the bottom line was, however, affected by the operating loss of RM4.7 million due to start-up expenses.

A 3.5 sen single-tier dividend per share was declared for the quarter.

New sales hit RM210 million in 2QFY15, from RM156.8 million in 1QFY15. The amount was solely from the property development segment (none from industrial land sales).

The 1HFY15 sales of RM367 million are on track to hit the management’s RM600 million target, on top of RM100 million to RM150 million in industrial land sales.

Despite the weak market, the take-up rate for new launches in 2QFY15 was still decent, such as Hijayu 3B (phase 1) at 37% and Hijayu Resorts Homes (phase 1A) at 35%.

Sales for projects launched earlier improved further, with Hijayu 3A (phase 3) at 86% as compared with 1QFY15’s 68%, and Hijayu 3A (phase 4) at 96% compared with 1Q15’s 32%.

We make no changes in our earnings forecast. Unbilled sales increased to RM540 million from RM392 million in 1QFY15. — RHB Research, Aug 11

http://www.theedgemarkets.com/my/article/matrix-concepts’-unbilled-sales-surge-rm540m-2q

|

|

|

|

|

|

|

|

|

|

|

|

发表于 13-8-2015 06:40 PM

|

显示全部楼层

发表于 13-8-2015 06:40 PM

|

显示全部楼层

金群利集团 5.4亿销售未入账 2015-08-12 10:43

目标价:2.46令吉 目标价:2.46令吉最新进展 住宅和工业房地产销售亮眼,金群利集团(MATRIX,5236,主板产业股)首半年净利扬79.4%,达1亿4530万令吉。 同期营业额也按年扬46.8%,从2亿9840万令吉,提升至4亿3804万7000令吉。 另外,在首半年共取得3亿6700万令吉的销售额。 行家建议 金群利集团首半年的净利,分别占我们及市场全年预测的76%和74%,因投资者趁消费税未落实前,纷纷抢购住宅和工业房地产,估计接下来的季度将放缓。 至于销售额方面,则符合全年预期的53%。 截至次季,该公司未入账销售额达5亿4000万令吉,足以支撑未来1至1年半盈利。 再者,该公司计划今年推出发展总值11亿令吉的住宅和商业产业。 我们将现财年部分的销售预期推至下财年,因此,将现财年的销售额预估下修10%至6亿2500万令吉,并将下财年的销售额预估上调5%,为7亿2800万令吉。 维持现财年财测,下财年的净利预估则上修4%,维持“符合大市”投资评级。

肯纳格投行

http://www.nanyang.com/node/717108?tid=462

|

|

|

|

|

|

|

|

|

|

|

|

发表于 13-8-2015 06:41 PM

|

显示全部楼层

发表于 13-8-2015 06:41 PM

|

显示全部楼层

本帖最后由 icy97 于 13-8-2015 06:52 PM 编辑

Matrix: A Little Surprise! Bursa Dummy by Bursa Dummy

Tuesday, 11 August 2015

http://bursadummy.blogspot.com/2015/08/matrix-little-surprise.html

Matrix Concepts FY15Q2 Financial Result

| MATRIX | FY15Q2 | FY15Q1 | FY14Q4 | FY14Q3 | FY14Q2 | | Revenue | 120.4 | 317.6 | 151.0 | 148.8 | 163.7 | | Gross Profit | 63.0 | 187.1 | 97.5 | 83.8 | 74.6 | | Gross% | 52.3 | 58.9 | 64.6 | 56.3 | 45.6 | | PBT | 41.4 | 155.4 | 73.8 | 58.5 | 58.6 | | PBT% | 34.4 | 48.9 | 48.8 | 39.3 | 35.8 | | PAT | 29.9 | 115.4 | 56.5 | 45.1 | 42.4 |

|

|

|

|

|

| | Prop Rev | 117.1 | 315.5 | 150.5 | 148.8 |

| | Prop OP | 45.2 | 158.4 | 77.6 | 61.2 |

| | Edu Rev | 1.2 | 1.4 | 0.5 | 0.0 |

| | Edu OP | -2.1 | -1.8 | -2.9 | -1.9 |

| | Club Rev | 2.1 | 0.8 | 0.0 | 0.0 |

| | Club OP | -0.2 | -0.6 | -0.4 | -0.4 |

|

|

|

|

|

|

| | Total Equity | 774.2 | 758.3 | 686.0 | 643.5 | 613.5 | | Total Assets | 1129.6 | 1154.6 | 996.2 | 1000.9 | 944.5 | | Trade Receivables | 149.4 | 192.6 | 79.5 | 174.9 | 160.0 | | Prop dev cost | 597.2 | 583.5 | 566.2 | 556.3 | 524.4 | | Inventories | 2.3 | 2.3 | 2.1 | 0.7 | 0.7 | | Cash -OD | 75.7 | 84.3 | 58.7 | 23.3 | 29.4 |

|

|

|

|

|

| | Total Liabilities | 355.4 | 396.4 | 310.2 | 357.4 | 331.1 | | Trade Payables | 141.0 | 171.8 | 195.7 | 274.7 | 253.7 | | ST Borrowings | 74.2 | 68.8 | 42.3 | 23.6 | 32.2 | | LT Borrowings | 75.8 | 82.3 | 35.8 | 21.4 | 1.5 |

|

|

|

|

|

| | Net Cash Flow | 17.3 | 25.8 | -10.1 | -45.5 | -39.4 | | Operation | 11.2 | -18.4 | 130.0 | 65.3 | 68.8 | | Investment | -33.4 | -22.9 | -93.2 | -63.9 | -55.7 | | Financing | 39.5 | 67.2 | -46.9 | -46.9 | -52.5 |

|

|

|

|

|

| | EPS | 6.50 | 25.20 | 12.40 | 10.50 | 14.00 | | NAS | 1.67 | 1.64 | 1.50 | 1.41 | 2.02 | | D/E Ratio | 0.09 | 0.09 | 0.03 | 0.03 | 0.01 |

Matrix's FY15Q2 revenue and PATAMI drop 62% & 74% respectively compared to preceding quarter of FY15Q1!

They are even lower YoY compared to FY14Q2!

I guess all investors who follow Matrix closely should not be surprised by this result right?

This kind of result is already widely expected in fact.

After the bonus issue last month, I did think of whether I should sell some Matrix shares first as its share price will probably drop after "bad" Q2 result announcement, and I can buy at lower price later if I want to.

Anyway I did not do that, simply because I consider myself a "business owner" of Matrix.

Why should I sell my shares in this great company to others?

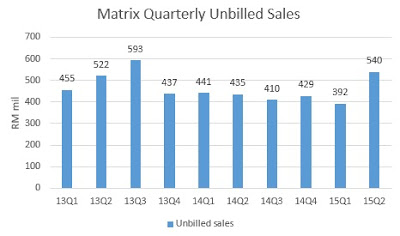

What actually surprise me a little is Matrix's latest unbilled sales.

Its unbilled sales stands at RM540mil at end of Q2 (Jun15), which is the highest level in 2 years.

The higher unbilled sales this time is due to more new sales achieved in FY15Q2 (RM210mil) and lower revenue recognition (RM120mil) in the same period of time.

The major contributor of this surging unbilled sales is from Bandar Seri Sendayan (BSS), in which the unbilled sales of projects there surge from RM264mil a quarter ago to RM427mil in FY15Q2.

No revenue recognition from land sales in current quarter though, as most have been rushed to be completed before GST last quarter.

New sales in 1H15 reaches RM367mil. So FY15 sales target of RM600mil (excluding industrial land sales) is well within reach.

Looks like Matrix's property is not too much affected by soft property market, just yet.

Matrix has launched RM437mil worth of new projects in the first half of 2015. It changed its plan to scale down targeted launch in FY15 from RM1.1bil to RM666mil. It will launch Residency SIGC with a GDV of RM229mil in Q3.

Planned project launch in 2016 include affordable housing project worth RM1bil in Kota Gadong Perdana next to Bandar Seri Sendayan.

This huge project comprises 3200 units of houses priced below RM400k, and should be able to help Matrix to sustain sales in FY16.

Both the school and clubhouse still register operating loss in this early stage of operation.

There are 450 students in Matrix Global School as at mid-2015, compared to 320 in the end of 2014. The figure has reached 500 in August. Matrix targets 800 student by year end.

Besides, Matrix has just incorporated a new company Matrix Healthcare Sdn Bhd, which is believed to provide healthcare services in BSS in the future.

Matrix declares a 2nd interim dividend of 3.5sen per share. It has a policy to pay out at least 40% of its net profit.

I expect at least 15sen dividend for FY15.

Matrix's PATAMI should be able to reach at least RM200mil for FY15. With about 542mil shares at the moment, its projected EPS will be 37sen.

Its forward PE and DY will be 6.0x and 6.7% at current share price of RM2.23.

Long term investors in Matrix should focus on its business, not its share price.

|

|

|

|

|

|

|

|

|

|

|

|

发表于 13-8-2015 10:32 PM

|

显示全部楼层

发表于 13-8-2015 10:32 PM

|

显示全部楼层

| MATRIX CONCEPTS HOLDINGS BERHAD |

| 1. Details of Corporate Proposal | Involve issuance of new type/class of securities ? | No | Types of corporate proposal | Exercise of Warrants | Details of corporate proposal | WARRANTS 2015/2020 | No. of shares issued under this corporate proposal | 9,000,000 | Issue price per share ($$) | Malaysian Ringgit (MYR) 2.4000 | Par Value ($$) | Malaysian Ringgit (MYR) 1.000 | | Latest issued and paid up share capital after the above corporate proposal in the following | Units | 550,279,096 | Currency | Malaysian Ringgit (MYR) 550,279,096.000 | Listing Date | 13 Aug 2015 |

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|