|

|

【SCIENTX 4731 交流专区】森德综合

[复制链接]

|

|

|

发表于 11-7-2018 12:58 AM

|

显示全部楼层

发表于 11-7-2018 12:58 AM

|

显示全部楼层

icy97 发表于 20-12-2017 06:12 AM

森德2.8亿柔买地

拟发展综合产业

2017年12月16日

(吉隆坡16日讯)森德(SCIENTX,4731,主板工业产品股)宣布,以2亿8418万9256令吉收购新山蒲莱(Pulai)一块面积约335.5686英亩的永久农业土地,并计划发 ...

Type | Announcement | Subject | OTHERS | Description | PROPOSED ACQUISITION OF ALL THAT PIECE OF FREEHOLD LAND HELD UNDER GERAN 488391 LOT 64189 IN THE MUKIM OF PULAI, DISTRICT OF JOHOR BAHRU, STATE OF JOHOR MEASURING APPROXIMATELY 335.5686 ACRES BY AMBER LAND BERHAD FOR A TOTAL PURCHASE CONSIDERATION OF RM284,189,256.00 ("PROPOSED ACQUISITION") | The terms used herein, unless the context otherwise stated, bear the same meanings as those defined in the earlier announcement in relation to the Proposed Acquisition.

We refer to our earlier announcement dated 15 December 2017 in relation to the Proposed Acquisition.

The Board of Directors of Scientex wishes to announce that all conditions precedent as set out in the Agreement have been satisfied in accordance with the terms and conditions of the Agreement and the payment of Balance Purchase Price has been made to the Vendor on 10 July 2018, hence marking the completion of the Proposed Acquisition.

This announcement is dated 10 July 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 16-8-2018 12:41 AM

|

显示全部楼层

发表于 16-8-2018 12:41 AM

|

显示全部楼层

本帖最后由 icy97 于 16-8-2018 05:34 AM 编辑

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

NON RELATED PARTY TRANSACTIONS | Description | SCIENTEX BERHADPROPOSED ACQUISITION OF TWO (2) PIECES OF FREEHOLD AGRICULTURE LANDS HELD UNDER GRN 41764 LOT NO. 2883 AND GRN 22740 LOT NO. 3267, ALL SITUATED IN MUKIM DURIAN TUNGGAL, DAERAH ALOR GAJAH IN THE STATE OF MELAKA MEASURING NET AGGREGATE AREA OF 208.9 ACRES BY SCIENTEX HEIGHTS SDN BHD FOR A TOTAL PURCHASE CONSIDERATION OF RM68,247,630.00 | The Board of Directors of Scientex Berhad (“Company”) wishes to announce that Scientex Heights Sdn Bhd (Company No. 170255-V), a wholly‑owned subsidiary of Scientex Quatari Sdn Bhd, which is a wholly‑owned subsidiary of the Company, has on 15 August 2018 entered into a Sale and Purchase Agreement with Real Golden Development Sdn Bhd (Company No. 891710-U) for the proposed acquisition of two contiguous pieces of freehold agriculture lands held under GRN 41764 Lot No. 2883 and GRN 22740 Lot No. 3267 respectively, all in the Mukim of Durian Tunggal, District of Alor Gajah, State of Melaka, measuring an aggregate net area of 208.9 acres for a total purchase consideration of Ringgit Malaysia Sixty Eight Million Two Hundred Forty Seven Thousand Six Hundred and Thirty (RM68,247,630.00) only (“Proposed Acquisition”).

For further details of the Proposed Acquisition, please refer to the attachment.

This announcement is dated 15th day of August 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5884401

|

|

|

|

|

|

|

|

|

|

|

|

发表于 17-8-2018 06:42 AM

|

显示全部楼层

发表于 17-8-2018 06:42 AM

|

显示全部楼层

本帖最后由 icy97 于 17-8-2018 07:11 AM 编辑

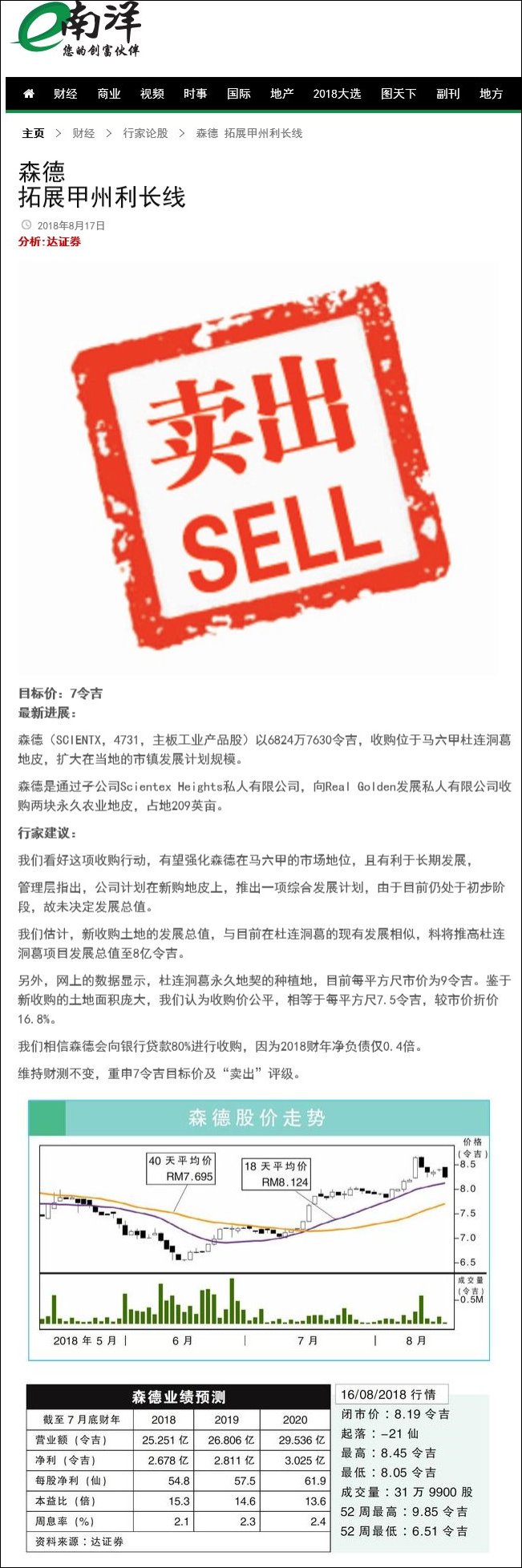

购地中和展望不变 森德盘中急跌4.2%

財经 最后更新 2018年08月16日 20时51分

(吉隆坡16日讯)由于在马六甲的购地行动不会对短期盈利带来显著影响,分析员维持森德公司(SCIENTX,4731,主板工业股)的財测和投资评级;但是,该公司股价在今天呈跌,全天挫跌21仙或2.5%,以8.19令吉掛收,是全场第6大下跌股。该股盘中一度挫35仙或4.2%,至8.05令吉。

森德公司週三(15日)宣佈斥资6825万令吉,收购2片位于马六甲Durian Tunggal的永久產权农业用地,作为综合產业项目发展用途。

这2片土地总面积为208.9英亩,因此收购价相等于每平方英呎7.50令吉。

肯纳格研究分析员指出,对森德在马六甲增购地皮的举动感到意外,不过,他中和看待此项收购,因为不会显著影响森德短期盈利,而长期影响也略为正面。

达证券分析员则表示,长期而言,此项收购正面,因为预计可加强森德在马六甲身为產业发展商的地位。

维持评级財测

无论如何,两名分析员皆维持森德的盈利预测和投资评级。达证券分析员称,网上资料显示,目前该州的永久產权农业地的售价为每平方呎9.50令吉,意味森德的收购价比市场便宜16.8%。售价便宜,相信是因为土地面积大。

肯纳格研究分析员表示,由于过去的参考资料非常少,因此无法找到与该土地直接可比的数据。不过,马六甲混合土地所有权(即农业、工业和商业土地的结合体)的过往交易价格为每平方呎23令吉至49令吉。

该土地位于森德现有的Durian Tunggal项目对面,十分靠近主要高速大道,以及几个热门旅游景点。有关產业项目的发展总值尚未確定,该项目的发展成本、动工和完工日期也有待探討。

肯纳格分析员以可负担房屋和综合发展项目作为参考,每英亩12个单位的价格为每个单位40万令吉,假设土地成本对发展总值的比例为6.8%,预测该项目的发展总值为10亿令吉,估计该项目將在2020至2021年推出。

达证券分析员则认为,该项目的发展总值將与现有的Durian Tunggal项目相近。预测现有项目的发展总值为4亿令吉,有2亿令吉尚未发展。加入了这个新项目后,该公司在Durian Tunggal的產业项目发展总值將提高至8亿令吉。

值得一提的是,若土地被重新归类(从农业地转为商业地),土地价格可能会增加。预计项目推出后,森德2019年的凈负债率將从0.14倍,上升至0.15倍。2018年的负债率预计为0.19倍。

整体而言,肯纳格研究分析员和达证券维持森德「跑输大市」和「卖出」投资评级。

考虑到房地產业务的估值,肯纳格研究分析员將目標价从6.40令吉,调高至7.40令吉;而达证券分析员维持目標价在7令吉。该股当前的股价已经比以上目標价高。【东方网财经】

|

|

|

|

|

|

|

|

|

|

|

|

发表于 12-9-2018 02:14 AM

|

显示全部楼层

发表于 12-9-2018 02:14 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 22-9-2018 01:49 AM

|

显示全部楼层

发表于 22-9-2018 01:49 AM

|

显示全部楼层

本帖最后由 icy97 于 23-9-2018 01:34 AM 编辑

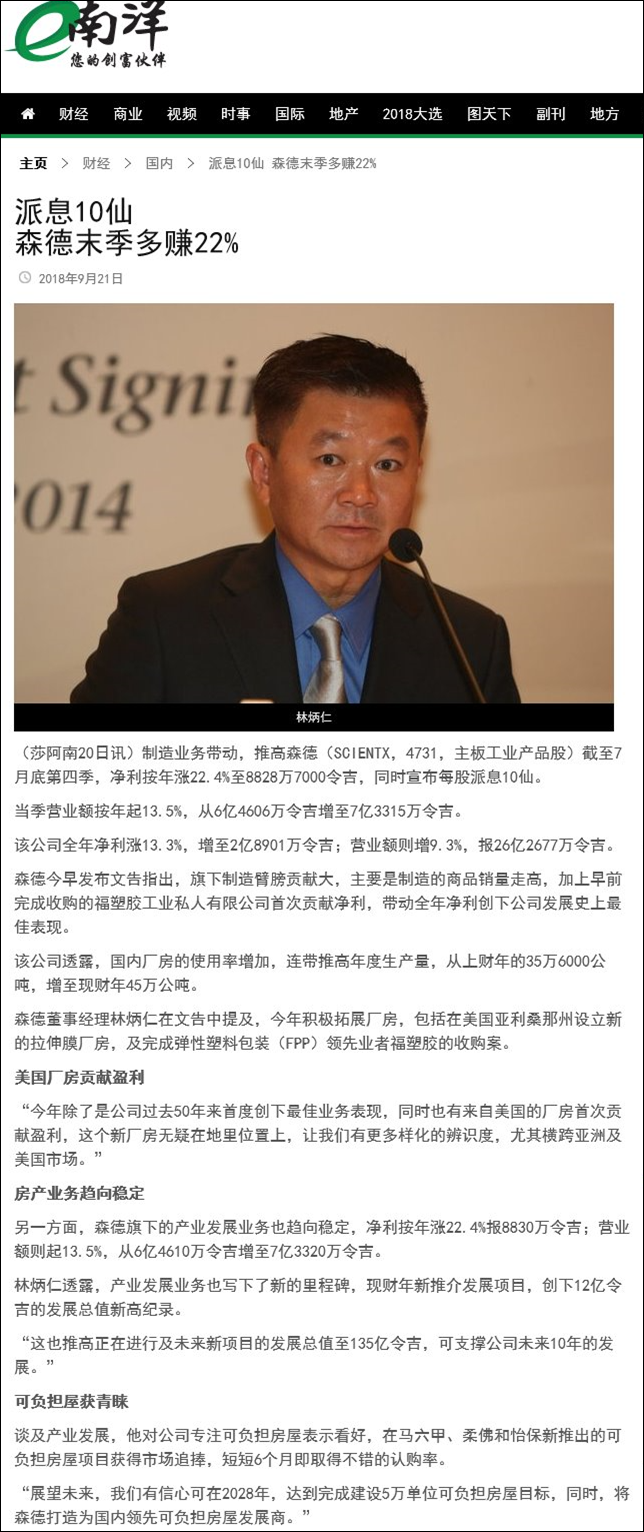

SUMMARY OF KEY FINANCIAL INFORMATION

31 Jul 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Jul 2018 | 31 Jul 2017 | 31 Jul 2018 | 31 Jul 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 733,154 | 646,065 | 2,626,767 | 2,403,151 | | 2 | Profit/(loss) before tax | 106,897 | 84,283 | 361,658 | 317,968 | | 3 | Profit/(loss) for the period | 89,233 | 73,214 | 294,034 | 259,941 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 88,287 | 72,127 | 289,806 | 255,873 | | 5 | Basic earnings/(loss) per share (Subunit) | 18.06 | 15.02 | 59.59 | 54.83 | | 6 | Proposed/Declared dividend per share (Subunit) | 10.00 | 10.00 | 20.00 | 16.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 3.6100 | 3.1800

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 22-9-2018 01:50 AM

|

显示全部楼层

发表于 22-9-2018 01:50 AM

|

显示全部楼层

EX-date | 26 Dec 2018 | Entitlement date | 28 Dec 2018 | Entitlement time | 05:00 PM | Entitlement subject | Final Dividend | Entitlement description | Single Tier Final Dividend of 10 sen per ordinary share | Period of interest payment | to | Financial Year End | 31 Jul 2018 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | SYMPHONY SHARE REGISTRARS SDN BHDLevel 6, Symphony HousePusat Dagangan Dana 1Jalan PJU 1A/4647301 Petaling JayaSelangor Darul EhsanTel No.: 03-78490777 | Payment date | 18 Jan 2019 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 28 Dec 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit | 26 Dec 2018 | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.1 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 23-9-2018 02:02 AM

|

显示全部楼层

发表于 23-9-2018 02:02 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 15-10-2018 04:30 AM

|

显示全部楼层

发表于 15-10-2018 04:30 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 8-11-2018 02:30 AM

|

显示全部楼层

发表于 8-11-2018 02:30 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 28-11-2018 05:43 AM

|

显示全部楼层

发表于 28-11-2018 05:43 AM

|

显示全部楼层

本帖最后由 icy97 于 14-12-2018 06:38 AM 编辑

每股1.60令吉折价39仙.森德2.225亿换股购耐慕志42%

http://www.sinchew.com.my/node/1812545/

Type | Announcement | Subject | MULTIPLE PROPOSALS | Description | SCIENTEX BERHAD ("SCIENTEX" OR THE "COMPANY")HEADS OF AGREEMENT IN RELATION TO THE PROPOSED ACQUISITION OF 139,062,766 ORDINARY SHARES IN DAIBOCHI BERHAD (FORMERLY KNOWN AS DAIBOCHI PLASTIC AND PACKAGING INDUSTRY BERHAD) ("DAIBOCHI") | On behalf of the Board of Directors of Scientex, RHB Investment Bank Berhad is pleased to announce that the Company is proposing to enter into a Heads of Agreement ("HOA") with certain shareholders of Daibochi (collectively be referred to as the “Vendor(s)”) for the proposed acquisition of 139,062,766 ordinary shares in Daibochi ("Sale Share(s)"), representing 42.41% of the total number of issued shares in Daibochi from the Vendors for a total purchase consideration of RM222,500,425.60, (equivalent to RM1.60 per Sale Share) to be satisfied entirely by issuance of new ordinary shares in Scientex ("Proposed Acquisition").

Please refer to the attached announcement for details of the HOA.

This announcement is dated 14 November 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5973273

|

|

|

|

|

|

|

|

|

|

|

|

发表于 15-12-2018 06:18 AM

|

显示全部楼层

发表于 15-12-2018 06:18 AM

|

显示全部楼层

收购案互惠互利 森德飆涨耐慕志急挫

財经 最后更新 2018年11月15日 22时42分

http://www.orientaldaily.com.my/s/267766

(吉隆坡15日讯)森德公司(SCIENTX,4731)以换股方式收购耐慕志(DAIBOCI,8125)42%股权的计划,获得分析员一致看好,让森德公司与耐慕志互惠互利。

周三(14日)停牌的森德公司和耐慕志今日恢復交易,股价呈一起一跌局面。

森德公司以8.88令吉高开,受投资者青睞盘中触及9令吉的全天最高,最终以8.84令吉闭市,全天上涨17仙或1.96%,共有54万2900股易手,位居全场上升股第11名。

至于耐慕志,则大跌29仙或14.57%,收报1.70令吉,共有85万2800股易手,位居全场下跌股第4名。

森德公司是以2亿2250万令吉或每股1.60令吉,收购耐慕志的1亿3906万2766股或42.41%股权。

这项收购將以换股方式进行,即耐慕志的5.5股换取森德1股。

该公司收购耐慕志是为了进一步壮大其拉伸膜包装业务规模,打造一家区域包装业巨头。

分析员看好上述收购可为森德公司带来协同效应,並认为森德的出价合理。

达证券分析员指出,这项收购將令森德公司更接近实现2028年的长期目標,也就是100亿令吉营业额。

同时,大华继显分析员也认同地说,这符合森德公司为期10年的扩张计划,將其產能从目前的45万公吨提高至100万公吨。

「虽然换股可能造成盈利稀释效应,但这项收购將为两家公司带来协同效应。」

而肯纳格研究分析员则认为,虽然收购价偏高,但这不会影响森德公司的盈利。该公司之所以高价收购耐慕志,因为后者拥有不少大规模的跨国公司客户。

「假如一切顺利,这项收购將在2019年7月完成,並对森德公司2020財政年的盈利作出全面贡献。」

肯纳格研究將森德公司2020財政年的核心净利预测上修5%,並將其「落后大市」评级上调至「与大市同步」,目標价为8.50令吉。

达证券也上调其2019至2021財政年的盈利预测2.2%至4.7%,评级从「守住」上修至「买进」,目標价为9.87令吉。

至于大华继显则维持「买进」投资评级,目標价为10.41令吉。 |

|

|

|

|

|

|

|

|

|

|

|

发表于 17-1-2019 05:12 AM

|

显示全部楼层

发表于 17-1-2019 05:12 AM

|

显示全部楼层

森德结合现金与发股-购耐慕志剩余57.6%

http://www.enanyang.my/news/20181211/森德结合现金与发股br-购耐慕志剩余57-6/

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

NON RELATED PARTY TRANSACTIONS | Description | SCIENTEX BERHAD ("SCIENTEX" OR THE "COMPANY")(I) PROPOSED ACQUISITION; AND(II) PROPOSED MGO | We refer to the announcement dated 14 November 2018 in relation to the signing of a heads of agreement in respect of the Proposed Acquisition (as defined below).

On behalf of the Board of Directors of Scientex, RHB Investment Bank Berhad is pleased to announce that Scientex had, on 10 December 2018, entered into a conditional share sale agreement with certain shareholders of Daibochi Berhad (formerly known as Daibochi Plastic and Packaging Industry Berhad) (“Daibochi”) (collectively be referred to as the “Vendor(s)”) for the proposed acquisition of 139,062,766 ordinary shares in Daibochi ("Sale Share(s)"), representing approximately 42.41% of the total number of issued shares in Daibochi from the Vendors for a total purchase consideration of RM222,500,425.60, (equivalent to RM1.60 per Sale Share) to be satisfied entirely by the issuance of new ordinary shares in Scientex (“Proposed Acquisition”).

Scientex is obliged to extend a mandatory take-over offer to acquire all the remaining shares and warrants in Daibochi not already owned by Scientex and its persons acting in concert pursuant to the Rule 4.01(a) of the Rules on Take-Overs, Mergers and Compulsory Acquisitions upon the Proposed Acquisition becoming unconditional (“Proposed MGO”).

(The Proposed Acquisition and Proposed MGO are collectively known as the “Proposals”).

Further details on the Proposals are set out in the attachment below.

This announcement is dated 10 December 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/6001685

|

|

|

|

|

|

|

|

|

|

|

|

发表于 25-1-2019 06:21 AM

|

显示全部楼层

发表于 25-1-2019 06:21 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Oct 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Oct 2018 | 31 Oct 2017 | 31 Oct 2018 | 31 Oct 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 713,639 | 655,014 | 713,639 | 655,014 | | 2 | Profit/(loss) before tax | 72,538 | 92,566 | 72,538 | 92,566 | | 3 | Profit/(loss) for the period | 55,342 | 73,395 | 55,342 | 73,395 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 53,666 | 72,402 | 53,666 | 72,402 | | 5 | Basic earnings/(loss) per share (Subunit) | 10.98 | 14.97 | 10.98 | 14.97 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 3.7300 | 3.6100

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 23-2-2019 04:33 AM

|

显示全部楼层

发表于 23-2-2019 04:33 AM

|

显示全部楼层

| 1. Details of Corporate Proposal | Involve issuance of new type/class of securities ? | No | Types of corporate proposal | Others | Details of corporate proposal | Issuance and allotment of 25,124,249 ordinary shares in Scientex Berhad, being the purchase consideration of the acquisition of 42.41% equity interest in Daibochi Berhad (formerly known as Daibochi Plastic and Packaging Industry Berhad) pursuant to the Conditional Share Sale Agreement dated 10 December 2018 | No. of shares issued under this corporate proposal | 25,124,249 | Issue price per share ($$) | Malaysian Ringgit (MYR) 8.8000 | Par Value($$) (if applicable) |

| | Latest issued share capital after the above corporate proposal in the following | Units | 514,357,749 | Issued Share Capital ($$) | Malaysian Ringgit (MYR) 677,822,213.000 | Listing Date | 20 Feb 2019 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 4-4-2019 06:11 PM

|

显示全部楼层

发表于 4-4-2019 06:11 PM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Jan 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Jan 2019 | 31 Jan 2018 | 31 Jan 2019 | 31 Jan 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 766,585 | 630,684 | 1,480,224 | 1,285,698 | | 2 | Profit/(loss) before tax | 100,044 | 85,377 | 172,582 | 177,943 | | 3 | Profit/(loss) for the period | 75,768 | 68,908 | 131,110 | 142,303 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 73,745 | 67,981 | 127,411 | 140,383 | | 5 | Basic earnings/(loss) per share (Subunit) | 15.08 | 14.05 | 26.06 | 29.02 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 3.7700 | 3.6100

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 18-5-2019 07:37 AM

|

显示全部楼层

发表于 18-5-2019 07:37 AM

|

显示全部楼层

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

NON RELATED PARTY TRANSACTIONS | Description | SCIENTEX BERHADPROPOSED ACQUISITION OF TWO (2) PIECES OF FREEHOLD AGRICULTURE LANDS HELD UNDER GRN 41764 LOT NO. 2883 AND GRN 22740 LOT NO. 3267, ALL SITUATED IN MUKIM DURIAN TUNGGAL, DAERAH ALOR GAJAH IN THE STATE OF MELAKA MEASURING NET AGGREGATE AREA OF 208.9 ACRES BY SCIENTEX HEIGHTS SDN BHD FOR A TOTAL PURCHASE CONSIDERATION OF RM68,247,630.00 | The terms used herein, unless the context otherwise stated, bear the same meanings as those defined in the earlier announcement in relation to the Proposed Acquisition.

We refer to our earlier announcements dated 15 August 2018 and 14 January 2019 in relation to the Proposed Acquisition.

The Board of Directors of Scientex wishes to announce that the full payment of the balance purchase price has been made to the Vendor on 17 April 2019, marking the completion of the Proposed Acquisition.

This announcement is dated 17 April 2019.

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 21-6-2019 07:50 AM

|

显示全部楼层

发表于 21-6-2019 07:50 AM

|

显示全部楼层

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

NON RELATED PARTY TRANSACTIONS | Description | SCIENTEX BERHAD ("SCIENTEX" OR "THE COMPANY")PROPOSED ACQUISITION BY SCIENTEX PARK (M) SDN BHD, A WHOLLY-OWNED SUBSIDIARY OF SCIENTEX, OF THE LANDS IN THE STATE OF SELANGOR MEASURING IN AGGREGATE OF APPROXIMATELY 673,718.70 SQUARE METERS FOR A TOTAL PURCHASE CONSIDERATION OF RM123,280,288.56 ("PROPOSED ACQUISITION") | The Board of Directors of Scientex Berhad (“Company”) wishes to announce that Scientex Park Sdn Bhd (Company No. 265710-D), a wholly‑owned subsidiary of the Company, had on 13 May 2019 entered into two (2) conditional sale and purchase agreements in relation to the Proposed Acquisition with the following vendors: -

(i) a sale and purchase agreement with Swan Lake City Sdn Bhd (Company No. 121146-X) for the acquisition of lands in the State of Selangor measuring in aggregate of approximately 607,735.70 square meters for a purchase consideration of RM111,207,591.00; and

(ii) a sale and purchase agreement with Fair City Sdn Bhd (Company No. 738602-U) for the acquisition of lands in the State of Selangor measuring in aggregate of 65,983.00 square meters for a purchase consideration of RM12,072,697.56.

For further details of the Proposed Acquisition, please refer to the attachment.

This announcement is dated 13th day of May 2019. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/6159361

|

|

|

|

|

|

|

|

|

|

|

|

发表于 11-7-2019 07:34 AM

|

显示全部楼层

发表于 11-7-2019 07:34 AM

|

显示全部楼层

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

NON RELATED PARTY TRANSACTIONS | Description | SCIENTEX BERHAD ("SCIENTEX" OR "THE COMPANY")PROPOSED ACQUISITION BY SCIENTEX (SKUDAI) SDN BHD, A WHOLLY-OWNED SUBSIDIARY OF SCIENTEX, OF THE SIX (6) PARCELS OF FREEHOLD LANDS ALL SITUATED IN MUKIM 12, DAERAH SEBERANG PERAI UTARA, STATE OF PULAU PINANG MEASURING IN AGGREGATE AREA OF APPROXIMATELY 7,827,534.83 SQUARE FEET FOR A TOTAL PURCHASE CONSIDERATION OF RM109,585,487.60 | The Board of Directors of Scientex Berhad (“Company”) wishes to announce that Scientex (Skudai) Sdn Bhd (Company No. 216001-X), a wholly‑owned subsidiary of the Company, had on 10 June 2019 entered into a Sale and Purchase Agreement with Palma Indah Sdn Bhd (Company No. 1075261-H) for the proposed acquisition of the following six (6) parcels of freehold lands held under: - Geran (1st Grade) No. Hakmilik 131904 Lot 5688;

- Geran No. Hakmilik 5762 Lot 535;

- Geran (1st Grade) No. Hakmilik 5764 Lot 568;

- Geran (1st Grade) No. Hakmilik 115348 Lot 3262;

- Geran No. Hakmilik 115349 Lot 3263; and

- Geran Mukim (1st Grade) No. Hakmilik 7 Lot 567,

all situated in Mukim 12, Daerah Seberang Perai Utara, State of Pulau Pinang, measuring in aggregate area of approximately 7,827,534.83 square feet for a total purchase consideration of RM109,585,487.60 only (“Proposed Acquisition”).

For further details of the Proposed Acquisition, please refer to the attachment.

This announcement is dated 10th day of June 2019. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/6187221

|

|

|

|

|

|

|

|

|

|

|

|

发表于 17-7-2019 05:01 AM

|

显示全部楼层

发表于 17-7-2019 05:01 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Apr 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Apr 2019 | 30 Apr 2018 | 30 Apr 2019 | 30 Apr 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 828,457 | 596,415 | 2,308,681 | 1,882,113 | | 2 | Profit/(loss) before tax | 101,433 | 76,818 | 274,015 | 254,761 | | 3 | Profit/(loss) for the period | 76,181 | 62,498 | 207,291 | 204,801 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 72,884 | 61,136 | 200,295 | 201,519 | | 5 | Basic earnings/(loss) per share (Subunit) | 14.31 | 12.50 | 40.41 | 41.51 | | 6 | Proposed/Declared dividend per share (Subunit) | 10.00 | 10.00 | 10.00 | 10.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 4.1700 | 3.6100

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 17-7-2019 05:03 AM

|

显示全部楼层

发表于 17-7-2019 05:03 AM

|

显示全部楼层

EX-date | 15 Jul 2019 | Entitlement date | 16 Jul 2019 | Entitlement time | 05:00 PM | Entitlement subject | Interim Dividend | Entitlement description | Single Tier Interim Dividend of 10 sen per share | Period of interest payment | to | Financial Year End | 31 Jul 2019 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | BOARDROOM SHARE REGISTRARS SDN BHD(Formerly known as Symphony Share Registrars Sdn Bhd)Level 6, Symphony HousePusat Dagangan Dana 1Jalan PJU 1A/4647301 Petaling JayaSelangor Darul EhsanTel:03-78490777Fax:03-78418151 | Payment date | 23 Jul 2019 | a.Securities transferred into the Depositor's Securities Account before 4:30 pm in respect of transfers | 16 Jul 2019 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit | 15 Jul 2019 | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.1 |

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|