|

|

发表于 25-7-2018 02:03 AM

|

显示全部楼层

发表于 25-7-2018 02:03 AM

|

显示全部楼层

本帖最后由 icy97 于 25-7-2018 04:46 AM 编辑

SUMMARY OF KEY FINANCIAL INFORMATION

31 May 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 May 2018 | 31 May 2017 | 31 May 2018 | 31 May 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 129,347 | 119,499 | 508,270 | 459,957 | | 2 | Profit/(loss) before tax | 6,313 | 5,596 | 29,566 | 21,953 | | 3 | Profit/(loss) for the period | 6,350 | 5,012 | 23,324 | 16,789 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 5,868 | 4,360 | 18,560 | 13,130 | | 5 | Basic earnings/(loss) per share (Subunit) | 2.70 | 2.00 | 8.53 | 6.03 | | 6 | Proposed/Declared dividend per share (Subunit) | 5.00 | 3.00 | 5.00 | 3.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.6600 | 0.6000

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 25-7-2018 02:45 AM

|

显示全部楼层

发表于 25-7-2018 02:45 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | Caring Pharmacy Group Berhad ("CPG" or "the Company") A final dividend of 5 sen per ordinary share, tax exempt under single-tier system in respect of the financial year ended 31 May 2018 | The Board of Directors of CPG wishes to announce that the Directors had on 24 July 2018 proposed a final dividend of 5 sen per ordinary share, tax exempt under single-tier system ("Dividend") in respect of the financial year ended 31 May 2018 to the shareholders of the Company subject to the shareholders’ approval at the forthcoming Annual General Meeting of the Company.

The entitlement date and date of payment in respect of the Dividend will be determined and announced by CPG in due course.

This announcement is dated 24 July 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 16-8-2018 01:04 AM

|

显示全部楼层

发表于 16-8-2018 01:04 AM

|

显示全部楼层

本帖最后由 icy97 于 16-8-2018 01:07 AM 编辑

Date of change | 15 Aug 2018 | Name | DATIN RASHIDAH BINTI MOHD SIES | Age | 54 | Gender | Female | Nationality | Malaysia | Designation | Non-Independent Director | Directorate | Non Independent and Non Executive | Type of change | Resignation | Reason | Change of job portfolio in Ministry of Finance and requiring resignation as Perbadanan National Berhad's Nominee Director in Caring Pharmacy Group Berhad | Details of any disagreement that he/she has with the Board of Directors | No | Whether there are any matters that need to be brought to the attention of shareholders | No | Qualifications | Datin Rashidah Binti Mohd Sies is the holder of Master in Bachelor Administration (MBA) from US International University California United States of America. She obtained he bachelor in Business Administration (Finance) from Idaho State University, United States of America. She also holds a Diploma in Public Administration from National Institute of Public Administration (INTAN), Malaysia. | Working experience and occupation | Datin Rashidah Binti Mohd Sies has been appointed as the Director of Perbadanan Nasional Berhad with effect from 01 December 2016. She is currently the Deputy Secretary (Commercial Sector) at the Government Investment Companies Division, Ministry of Finance and was attached to the Ministry of Finance since 1989, holding various position in the Ministry of Finance including in the Investment Section, Privatization Section and Economic Sector of Finance Division.Datin Rashidah also a Director of Global Maritime Ventures Berhad, Express Rail Link Sdn Bhd and Johor Port Berhad. |

Date of change | 15 Aug 2018 | Name | ENCIK MAZLAN BIN IBRAHIM | Age | 50 | Gender | Male | Nationality | Malaysia | Designation | Non-Independent Director | Directorate | Non Independent and Non Executive | Type of change | Appointment | Qualifications | Encik Mazlan Bin Ibrahim completed his Chartered Institute of Management Accountants (CIMA) in 1993. | Working experience and occupation | Encik Mazlan joined Ban Hin Lee Bank as Credit and Marketing Officer.His career in Entrepreneur and Business Development started in 1995 with Perbadanan Usahawan Nasional Berhad and has spend almost 22 years involving small and medium organizational and business development, equity investment, merger and acquisition, financial management and franchising.In 2004, Encik Mazlan was appointed as the Head of Franchise Development Department with the main responsibilities overseeing the implementation of the Franchise Development Program entrusted by the Government to Perbadanan Nasional Berhad ("PNS"). In 2013, he leads Corporate Strategic Division until May 2015 before his current position as Head of PNS Investment Division.Encik Mazlan was nominated as Board Member to several PNS Associate Companies and was a Non-Executive Nominee Director to one of listed companies. Encik Mazlan is also as graduate Institute of Professional Managers and Administrators (IPMA UK) as certified professional trainer. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 28-9-2018 05:21 AM

|

显示全部楼层

发表于 28-9-2018 05:21 AM

|

显示全部楼层

| CARING PHARMACY GROUP BERHAD |

EX-date | 12 Oct 2018 | Entitlement date | 16 Oct 2018 | Entitlement time | 04:00 PM | Entitlement subject | Final Dividend | Entitlement description | A final tax-exempt single-tier dividend of 5 sen per ordinary share in respect of the financial year ended 31 May 2018 | Period of interest payment | to | Financial Year End | 31 May 2018 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | BERJAYA REGISTRATION SERVICES SDN BHDLot 10-04A & 10-04B Level 10 West Berjaya Times Square No. 1 Jalan Imbi 55100 Kuala Lumpur Wilayah Persekutuan MalaysiaTel:03 -21450533Fax:03 -21459702 | Payment date | 14 Nov 2018 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 16 Oct 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.05 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 3-11-2018 05:44 AM

|

显示全部楼层

发表于 3-11-2018 05:44 AM

|

显示全部楼层

本帖最后由 icy97 于 10-11-2018 06:43 AM 编辑

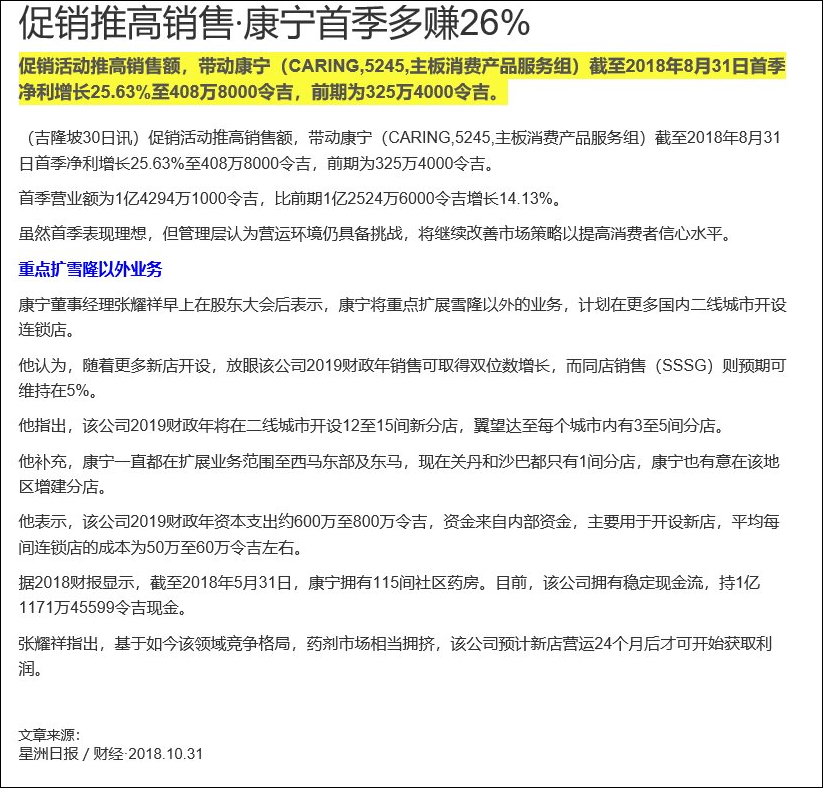

SUMMARY OF KEY FINANCIAL INFORMATION

31 Aug 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Aug 2018 | 31 Aug 2017 | 31 Aug 2018 | 31 Aug 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 142,941 | 125,246 | 142,941 | 125,246 | | 2 | Profit/(loss) before tax | 6,500 | 5,935 | 6,500 | 5,935 | | 3 | Profit/(loss) for the period | 4,745 | 4,332 | 4,745 | 4,332 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 4,088 | 3,254 | 4,088 | 3,254 | | 5 | Basic earnings/(loss) per share (Subunit) | 1.88 | 1.49 | 1.88 | 1.49 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.6800 | 0.6600

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 9-2-2019 02:06 AM

|

显示全部楼层

发表于 9-2-2019 02:06 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Nov 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Nov 2018 | 30 Nov 2017 | 30 Nov 2018 | 30 Nov 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 139,302 | 123,449 | 282,243 | 248,695 | | 2 | Profit/(loss) before tax | 9,734 | 7,172 | 16,234 | 13,107 | | 3 | Profit/(loss) for the period | 7,106 | 5,236 | 11,851 | 9,568 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 5,740 | 4,274 | 9,828 | 7,528 | | 5 | Basic earnings/(loss) per share (Subunit) | 2.64 | 1.96 | 4.51 | 3.46 | | 6 | Proposed/Declared dividend per share (Subunit) | 5.00 | 3.00 | 5.00 | 3.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.6500 | 0.6600

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 17-3-2019 07:49 AM

|

显示全部楼层

发表于 17-3-2019 07:49 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | CARING PHARMACY GROUP BERHAD- Incorporation of New Wholly-Owned Subsidiary | The Board of Directors of Caring Pharmacy Group Berhad (“CPG” or “the Company”) is pleased to announce that Caring Pharmacy Retails Management Sdn. Bhd., a wholly-owned subsidiary of the Company, had on 27 February 2019 incorporated a new wholly-owned subsidiary company with the name “CARING T & T SDN. BHD.” (“Caring T & T”) with the initial issued share capital of RM2.00 only.

Caring T & T is currently dormant and the intended principal activity of Caring T & T is to engage in the operation of community pharmacy including retailing of pharmaceutical, healthcare and personal care products.

The incorporation of Caring T & T is not expected to have any material effects on the earnings per share, net assets per share, gearing, share capital and substantial shareholders’ shareholdings of the Company for the financial year ending 31 May 2019.

None of the Directors and major shareholders or persons connected to the Directors or major shareholders of the Company has any interests, direct or indirect, in the incorporation of Caring T & T.

This announcement is dated 5 March 2019.

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 12-4-2019 05:26 AM

|

显示全部楼层

发表于 12-4-2019 05:26 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | CARING PHARMACY GROUP BERHAD ("CPG" OR "THE COMPANY")- JOINT VENTURE AGREEMENT ENTERED BY CARING PHARMACY RETAIL MANAGEMENT SDN BHD | The Board of Directors of CPG is pleased to announce that Caring Pharmacy Retails Management Sdn. Bhd. (“CPRM”), a wholly-owned subsidiary of the Company, had on 1 April 2019 entered into Joint Venture Agreement (“JVA”) with See Choon Keong (“SCK”) and Tan Yee May (“TYM”) for the purpose of carrying out the joint venture contemplated therein and regulating the relationship inter se as shareholders and conduct of the business and affairs of Caring T & T Sdn. Bhd. (“Caring T & T”) (“Transaction”).

Caring T & T is a private limited company incorporated in Malaysia with initial issued share capital of RM2.00 only. The intended principal activity of Caring T & T is to engage in the operation of community pharmacy including retailing of pharmaceutical, healthcare and personal care products. Caring T & T is a wholly-owned subsidiary of CPRM.

Pursuant to the JVA, the total issued share capital of Caring T & T will be increased from 2 ordinary shares to 100,000 ordinary shares as follows:

Name of Shareholders | No. of Shares held | % | CPRM | 60,000 | 60 | SCK | 20,000 | 20 | TYM | 20,000 | 20 | Total | 100,000 | 100 |

Upon completion of the Transaction, the total equity held by CPRM in Caring T & T is 60,000 ordinary shares, resulting it becoming a 60% subsidiary of CPRM.

The Transaction will not have any effect on the share capital and shareholdings of the major shareholders of CPG.

The Transaction is not expected to have any material effect on the gearing, consolidated earnings per share and net assets of the CPG for the financial year 31 May 2019.

The Board is not aware of any material risk factors arising from the Transaction other than the normal market and business risks associated with the CPG Group’s current operation.

None of the directors or major shareholders of CPG or persons connected to them has any interest, direct or indirect, in the Transaction.

This announcement is dated 1 April 2019.

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 21-4-2019 06:31 AM

|

显示全部楼层

发表于 21-4-2019 06:31 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | CARING PHARMACY GROUP BERHAD- Incorporation of New Wholly-Owned Subsidiary | The Board of Directors of Caring Pharmacy Group Berhad (“CPG” or “the Company”) is pleased to announce that Caring Pharmacy Retails Management Sdn. Bhd., a wholly-owned subsidiary of the Company, had on 11 April 2019 incorporated a new wholly-owned subsidiary company with the name “CARING LINK SDN. BHD.” (“Caring Link”) with the initial issued share capital of RM2.00 only.

Caring Link is currently dormant and the intended principal activity of Caring Link is to engage in the operation of community pharmacy including retailing of pharmaceutical, healthcare and personal care products.

The incorporation of Caring Link is not expected to have any material effects on the earnings per share, net assets per share, gearing, share capital and substantial shareholders’ shareholdings of the Company for the financial year ending 31 May 2019.

None of the Directors and major shareholders or persons connected to the Directors or major shareholders of the Company has any interests, direct or indirect, in the incorporation of Caring Link.

This announcement is dated 11 April 2019.

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 4-6-2019 06:44 AM

|

显示全部楼层

发表于 4-6-2019 06:44 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

28 Feb 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 28 Feb 2019 | 28 Feb 2018 | 28 Feb 2019 | 28 Feb 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 143,363 | 130,483 | 425,606 | 379,178 | | 2 | Profit/(loss) before tax | 10,983 | 10,146 | 27,218 | 23,253 | | 3 | Profit/(loss) for the period | 8,017 | 7,406 | 19,869 | 16,974 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 5,673 | 5,164 | 15,502 | 12,692 | | 5 | Basic earnings/(loss) per share (Subunit) | 2.61 | 2.37 | 7.12 | 5.83 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 5.00 | 3.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.6800 | 0.6600

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 21-7-2019 09:01 AM

|

显示全部楼层

发表于 21-7-2019 09:01 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | CARING PHARMACY GROUP BERHAD ("CPG" OR "THE COMPANY")- JOINT VENTURE AGREEMENT ENTERED BY CARING PHARMACY RETAIL MANAGEMENT SDN BHD | The Board of Directors of CPG is pleased to announce that Caring Pharmacy Retails Management Sdn. Bhd. (“CPRM”), a wholly-owned subsidiary of the Company, had on 3 July 2019 entered into a Joint Venture Agreement (“JVA”) with Yap Sze Yin (“YSY”) and Tee Siew What (“TSW”) for the purpose of carrying out the joint venture contemplated therein and regulating the relationship inter se as shareholders and conduct of the business and affairs of Caring Link Sdn. Bhd. (“Caring Link”) (“Transaction”).

Caring Link is a private limited company incorporated in Malaysia with initial issued share capital of RM2.00 only. The intended principal activity of Caring Link is to engage in the operation of community pharmacy including retailing of pharmaceutical, healthcare and personal care products. Caring Link is a wholly-owned subsidiary of CPRM.

Pursuant to the JVA, the total issued share capital of Caring Link will be increased from 2 ordinary shares to 100,000 ordinary shares as follows:

Name of Shareholders | No. of Shares held | % | CPRM | 60,000 | 60 | YSY | 10,000 | 10 | TSW | 30,000 | 30 | Total | 100,000 | 100 |

Upon completion of the Transaction, the total equity held by CPRM in Caring Link is 60,000 ordinary shares, resulting it becoming a 60% subsidiary of CPRM.

The Transaction will not have any effect on the share capital and shareholdings of the major shareholders of CPG.

The Transaction is not expected to have any material effect on the gearing, consolidated earnings per share and net assets of the CPG for the financial year ended 31 May 2019.

The Board is not aware of any material risk factors arising from the Transaction other than the normal market and business risks associated with the CPG Group’s current operation.

None of the directors or major shareholders of CPG or persons connected to them has any interest, direct or indirect, in the Transaction.

This announcement is dated 3 July 2019.

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 22-7-2019 05:30 AM

|

显示全部楼层

发表于 22-7-2019 05:30 AM

|

显示全部楼层

| CARING PHARMACY GROUP BERHAD |

Particulars of substantial Securities HolderName | TAN SRI DATO' SERI VINCENT TAN CHEE YIOUN | Nationality/Country of incorporation | Malaysia | Descriptions (Class) | Ordinary Shares |

Details of changesNo | Date of change | No of securities | Type of Transaction | Nature of Interest | | 1 | 02 Jul 2019 | 3,107,000 | Acquired | Deemed Interest | Name of registered holder | MIDF AMANAH INVESTMENT NOMINEES (TEMPATAN) SDN BHD FOR U TELEMEDIA SDN BHD | Address of registered holder | 11th & 12th Floor, Menara MIDF, 82 Jalan Raja Chulan, 50200 Kuala Lumpur | Description of "Others" Type of Transaction | |

Circumstances by reason of which change has occurred | Acquisition of shares by U Telemedia Sdn Bhd via direct business transaction | Nature of interest | Deemed Interest | Direct (units) | 0 | Direct (%) | 0 | Indirect/deemed interest (units) | 18,372,780 | Indirect/deemed interest (%) | 8.44 | Total no of securities after change | 18,372,780 | Date of notice | 02 Jul 2019 | Date notice received by Listed Issuer | 04 Jul 2019 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 22-7-2019 05:31 AM

|

显示全部楼层

发表于 22-7-2019 05:31 AM

|

显示全部楼层

Name | PERBADANAN NASIONAL BERHAD | Address | Level 16, Menara PNS Tower 7

Avenue 7, Bangsar South City

No. 8 Jalan Kerinchi

Kuala Lumpur

59200 Wilayah Persekutuan

Malaysia. | Company No. | 9157-K | Nationality/Country of incorporation | Malaysia | Descriptions (Class) | Ordinary Shares |

Details of changesNo | Date of change | No of securities | Type of Transaction | Nature of Interest | | 1 | 02 Jul 2019 | 3,107,000 | Disposed | Direct Interest | Name of registered holder | PERBADANAN NASIONAL BERHAD | Address of registered holder | LEVEL 16, MENARA PNS TOWER 7, AVENUE 7, BANGSAR SOUTH CITY, NO. 8 JALAN KERINCHI, 59200 KUALA LUMPUR | Description of "Others" Type of Transaction | |

Circumstances by reason of which change has occurred | Disposal of shares via direct business transaction | Nature of interest | Direct Interest | Direct (units) | 20,920,000 | Direct (%) | 9.61 | Indirect/deemed interest (units) | 0 | Indirect/deemed interest (%) | 0 | Total no of securities after change | 20,920,000 | Date of notice | 03 Jul 2019 | Date notice received by Listed Issuer | 04 Jul 2019 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 26-7-2019 07:17 AM

|

显示全部楼层

发表于 26-7-2019 07:17 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 May 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 May 2019 | 31 May 2018 | 31 May 2019 | 31 May 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 153,128 | 129,347 | 599,234 | 508,270 | | 2 | Profit/(loss) before tax | 6,746 | 6,313 | 33,965 | 29,566 | | 3 | Profit/(loss) for the period | 5,779 | 6,350 | 25,649 | 23,324 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 5,225 | 5,868 | 20,728 | 18,560 | | 5 | Basic earnings/(loss) per share (Subunit) | 2.40 | 2.70 | 9.52 | 8.53 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 5.00 | 3.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.7000 | 0.6600

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 26-7-2019 07:18 AM

|

显示全部楼层

发表于 26-7-2019 07:18 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | CARING PHARMACY GROUP BERHAD - Proposed Final Single Tier Tax Exempt Dividend for the Financial Year Ended 31 May 2019 | The Board of Directors of Caring Pharmacy Group Berhad ("CPG") has proposed the payment of a Final Single Tier Tax Exempt Dividend of 6.0 sen per share in respect of the financial year ended 31 May 2019, subject to the approval of CPG’s shareholders at the forthcoming Annual General Meeting.

The entitlement date and date of payment shall be finalised and announced in due course.

This announcement is dated 25 July 2019.

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 12-10-2019 08:00 AM

|

显示全部楼层

发表于 12-10-2019 08:00 AM

|

显示全部楼层

| CARING PHARMACY GROUP BERHAD |

EX-date | 21 Oct 2019 | Entitlement date | 22 Oct 2019 | Entitlement time | 04:00 PM | Entitlement subject | Final Dividend | Entitlement description | Final Single Tier Tax Exempt Dividend of 6.0 sen per share in respect of the financial year ended 31 May 2019 | Period of interest payment | to | Financial Year End | 31 May 2019 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | BERJAYA REGISTRATION SERVICES SDN BHDLot 06-03, Level 6, East WingBerjaya Times SquareNo. 1, Jalan Imbi55100Kuala LumpurTel:0321450533Fax:0321459702 | Payment date | 20 Nov 2019 | a.Securities transferred into the Depositor's Securities Account before 4:30 pm in respect of transfers | 22 Oct 2019 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.06 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 15-12-2019 08:40 AM

|

显示全部楼层

发表于 15-12-2019 08:40 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Aug 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Aug 2019 | 31 Aug 2018 | 31 Aug 2019 | 31 Aug 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 163,256 | 149,970 | 163,256 | 149,970 | | 2 | Profit/(loss) before tax | 6,778 | 6,500 | 6,778 | 6,500 | | 3 | Profit/(loss) for the period | 5,016 | 4,745 | 5,016 | 4,745 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 4,181 | 4,088 | 4,181 | 4,088 | | 5 | Basic earnings/(loss) per share (Subunit) | 1.92 | 1.88 | 1.92 | 1.88 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.7100 | 0.7000

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 26-3-2020 08:21 AM

|

显示全部楼层

发表于 26-3-2020 08:21 AM

|

显示全部楼层

Notice of Interest Sub. S-hldr (Section 137 of CA 2016)| CARING PHARMACY GROUP BERHAD |

Particulars of Substantial Securities HolderName | TAN SRI DR LIM WEE CHAI | Nationality/Country of incorporation | Malaysia | Descriptions (Class) | Ordinary Shares | Name & address of registered holder | CIMSEC NOMINEES (TEMPATAN) SDN BHD CIMB FOR LIM WEE CHAI (PRIVATE BANKING)LEVEL 2, TROPICANA CITY OFFICE TOWER,NO. 3, JALAN SS20/27, 47400 PETALING JAYA, SELANGOR |

| Date interest acquired & no of securities acquired | Date interest acquired | 09 Dec 2019 | No of securities | 12,000,000 | Circumstances by reason of which Securities Holder has interest | Acquisition of shares | Nature of interest | Direct Interest |  | | Total no of securities after change | Direct (units) | 12,000,000 | Direct (%) | 5.51 | Indirect/deemed interest (units) | 0 | Indirect/deemed interest (%) | 0 | Date of notice | 12 Dec 2019 | Date notice received by Listed Issuer | 12 Dec 2019 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 1-4-2020 06:47 AM

|

显示全部楼层

发表于 1-4-2020 06:47 AM

|

显示全部楼层

| CARING PHARMACY GROUP BERHAD |

Particulars of substantial Securities HolderName | PERBADANAN NASIONAL BERHAD | Address | Level 16 Menara PNS Tower 7 Avenue 7 Bangsar South City No. 8 Jalan Kerinchi

Kuala Lumpur

59200 Wilayah Persekutuan

Malaysia. | Company No. | 9157-K | Nationality/Country of incorporation | Malaysia | Descriptions (Class) | Ordinary shares |

Details of changesNo | Date of change | No of securities | Type of Transaction | Nature of Interest | | 1 | 26 Dec 2019 | 4,510,000 | Disposed | Direct Interest | Name of registered holder | PERBADANAN NASIONAL BERHAD | Address of registered holder | LEVEL 16, MENARA PNS TOWER 7, AVENUE 7, BANGSAR SOUTH CITY, NO. 8 JALAN KERINCHI, 59200 KUALA LUMPUR | Description of "Others" Type of Transaction | | | 2 | 27 Dec 2019 | 500,000 | Disposed | Direct Interest | Name of registered holder | PERBADANAN NASIONAL BERHAD | Address of registered holder | LEVEL 16, MENARA PNS TOWER 7, AVENUE 7, BANGSAR SOUTH CITY, NO. 8 JALAN KERINCHI, 59200 KUALA LUMPUR | Description of "Others" Type of Transaction | |

Circumstances by reason of which change has occurred | Disposal of shares via off market transaction | Nature of interest | Direct Interest | Direct (units) | 11,910,000 | Direct (%) | 5.47 | Indirect/deemed interest (units) | 0 | Indirect/deemed interest (%) | 0 | Total no of securities after change | 11,910,000 | Date of notice | 27 Dec 2019 | Date notice received by Listed Issuer | 27 Dec 2019 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 8-4-2020 07:37 AM

|

显示全部楼层

发表于 8-4-2020 07:37 AM

|

显示全部楼层

Notice of Person Ceasing (Section 139 of CA 2016)| CARING PHARMACY GROUP BERHAD |

Particulars of Substantial Securities HolderName | PERBADANAN NASIONAL BERHAD | Address | Level 16 Menara PNS Tower 7 Avenue 7 Bangsar South City No. 8 Jalan Kerinchi

Kuala Lumpur

59200 Wilayah Persekutuan

Malaysia. | Company No. | 9157-K | Nationality/Country of incorporation | Malaysia | Descriptions (Class) | Ordinary Shares | Date of cessation | 06 Jan 2020 | Name & address of registered holder | PERBADANAN NASIONAL BERHADLEVEL 16 MENARA PNSTOWER 7 AVENUE 7 BANGSAR SOUTH CITYNO. 8 JALAN KERINCHI59200 KUALA LUMPUR |

No of securities disposed | 400,000 | Circumstances by reason of which a person ceases to be a substantial shareholder | Disposal of shares via off market transaction | Nature of interest | Direct Interest |  | Date of notice | 07 Jan 2020 | Date notice received by Listed Issuer | 07 Jan 2020 |

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|