|

|

【MYCRON 5087 交流专区】麦克伦钢铁

[复制链接]

|

|

|

发表于 26-8-2015 08:20 PM

|

显示全部楼层

发表于 26-8-2015 08:20 PM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2015 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2015 | 30 Jun 2014 | 30 Jun 2015 | 30 Jun 2014 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 158,836 | 98,743 | 518,343 | 447,956 | | 2 | Profit/(loss) before tax | 20,653 | -14,621 | 10,510 | -14,146 | | 3 | Profit/(loss) for the period | 20,012 | -10,366 | 11,863 | -9,228 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 25,971 | -7,248 | 17,822 | -6,110 | | 5 | Basic earnings/(loss) per share (Subunit) | 7.08 | -5.82 | 5.81 | -5.19 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.0800 | 1.4500

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 25-11-2015 12:51 AM

|

显示全部楼层

发表于 25-11-2015 12:51 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2015 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2015 | 30 Sep 2014 | 30 Sep 2015 | 30 Sep 2014 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 131,857 | 107,943 | 131,857 | 107,943 | | 2 | Profit/(loss) before tax | 4,262 | -2,661 | 4,262 | -2,661 | | 3 | Profit/(loss) for the period | 2,831 | -2,181 | 2,831 | -2,181 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 2,831 | -2,181 | 2,831 | -2,181 | | 5 | Basic earnings/(loss) per share (Subunit) | 1.00 | -1.23 | 1.00 | -1.23 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.0900 | 1.0800

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 2-12-2015 03:41 AM

|

显示全部楼层

发表于 2-12-2015 03:41 AM

|

显示全部楼层

麥克倫鋼鐵冀政府 勿通過美嘉鋼鐵保障請願

2015年11月30日

(吉隆坡30日訊)麥克倫鋼鐵(MYCRON,5087,主要板工業)希望政府在來臨的12月8日(週二)不會通過保障請願,以增加熱軋鋼卷(HRC)進口稅,從15%至55%。

該公司總執行長阿茲蘭阿都拉指出:“一旦通過上述請願,將等同于‘謀殺’這個行業,進口商需要支付55%進口稅,高得太離譜了。”

他希望政府作出對整個行業都公平的決定,並確保整個行業能生存,而不是只看單方面(美嘉鋼鐵)。

他今日出席麥克倫鋼鐵常年股東大會后,向記者發表談話。

國際貿易及工業部在8月份接獲由美嘉鋼鐵發出的保障請願書后,已決定對進口的熱軋鋼卷展開調查,調查期間將就這些進口產品征稅。

阿茲蘭阿都拉指出,美嘉鋼鐵,即國內最大的熱軋鋼卷生產商,希望通過調高進口稅,以避免各等級的熱軋鋼卷(片狀與鐵礦性質)進入我國。

他認為,國內根本就沒有鐵礦性質的熱軋鋼卷生產商,根本無需為此上調進口稅,反而一旦落實將傷及我國的競爭力。

根據請願,國內進口的熱軋鋼卷在2012年至2014年不斷增加,嚴重打擊國內業者。美嘉鋼鐵要求政府對熱軋鋼卷採取保障措施,對現有15%進口稅額外征稅40%,並在隨后4年逐步降低。【中国报财经】 |

|

|

|

|

|

|

|

|

|

|

|

发表于 25-2-2016 02:22 AM

|

显示全部楼层

发表于 25-2-2016 02:22 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2015 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2015 | 31 Dec 2014 | 31 Dec 2015 | 31 Dec 2014 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 144,129 | 135,000 | 275,986 | 242,943 | | 2 | Profit/(loss) before tax | 7,351 | -4,618 | 11,613 | -7,279 | | 3 | Profit/(loss) for the period | 5,336 | -4,248 | 8,167 | -6,429 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 5,336 | -4,248 | 8,167 | -6,429 | | 5 | Basic earnings/(loss) per share (Subunit) | 1.89 | -2.39 | 2.89 | -3.61 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.1100 | 1.0800

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 31-5-2016 01:01 AM

|

显示全部楼层

发表于 31-5-2016 01:01 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2016 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2016 | 31 Mar 2015 | 31 Mar 2016 | 31 Mar 2015 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 142,494 | 116,564 | 418,480 | 359,507 | | 2 | Profit/(loss) before tax | 8,434 | -2,864 | 20,047 | -10,143 | | 3 | Profit/(loss) for the period | 6,675 | -1,720 | 14,842 | -8,149 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 6,675 | -1,720 | 14,842 | -8,149 | | 5 | Basic earnings/(loss) per share (Subunit) | 2.36 | -0.97 | 5.25 | -4.58 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.1400 | 1.0800

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 1-9-2016 02:37 AM

|

显示全部楼层

发表于 1-9-2016 02:37 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2016 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2016 | 30 Jun 2015 | 30 Jun 2016 | 30 Jun 2015 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 148,330 | 158,836 | 566,810 | 518,343 | | 2 | Profit/(loss) before tax | 12,354 | 20,653 | 32,401 | 10,510 | | 3 | Profit/(loss) for the period | 9,336 | 19,832 | 24,178 | 11,683 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 9,336 | 19,832 | 24,178 | 11,683 | | 5 | Basic earnings/(loss) per share (Subunit) | 3.30 | 7.02 | 8.56 | 5.72 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.1900 | 1.0800

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 1-9-2016 02:39 AM

|

显示全部楼层

发表于 1-9-2016 02:39 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | MYCRON STEEL BERHAD (MSB OR THE GROUP) - REVALUATION OF PROPERTY, PLANT AND EQUIPMENT | 1. INTRODUCTION Pursuant to Paragraph 9.19(46) of the Main Market Listing Requirements of Bursa Malaysia Securities Berhad, the Board of Directors of MSB (“the Board”) wishes to announce that MSB had undertaken a revaluation exercise on the land, buildings, plant, machinery and electrical installation held by the Group. The Board had at its meeting held on 29 August 2016 approved the valuation reports and the incorporation of the revaluation surplus arising from the revaluation in the fourth quarter unaudited financial results of MSB for the financial year ended 30 June 2016.

2. PURPOSE The revaluation was carried out in accordance with the Group’s accounting policy to determine the fair value of the Group’s property, plant and equipment comprising the land, building, plant, machinery and electrical installation periodically, with sufficient regularity.

3. REVALUATION SURPLUS The details of the revaluation surplus are set out below: Location of the Property, Plant and Equipment | Type of Property, Plant and Equipment | Valuer/Valuation date | Market Value (RM) | Revaluation Surplus (RM) |

Lot 53, Persiaran Selangor 40200 Shah Alam, Selangor

|

Plant, machinery

|

C H Williams Talhar & Wong Sdn Bhd 30 June 2016 |

8,339,000 |

(47,492) |

No.49, Jalan Utas 15/7, 40200 Shah Alam Selangor |

Plant, machinery |

C H Williams Talhar & Wong Sdn Bhd 30 June 2016

|

7,342,000 |

11,337 |

Lot 10, Persiaran Selangor, 40200 Shah Alam Selangor |

Plant, machinery

|

C H Williams Talhar & Wong Sdn Bhd 30 June 2016

|

20,528,000 |

(88,955) |

Lot 16, Jalan Pengapit 15/19, 40200 Shah Alam, Selangor

|

Plant, machinery |

C H Williams Talhar & Wong Sdn Bhd 30 June 2016

|

2,981,000 |

15,874 |

Lot 717, Jalan Sungai Rasau, Seksyen 16, 40200 Shah Alam, Selangor

|

Industrial land and factory cum office building (Freehold)

|

C H Williams Talhar & Wong Sdn Bhd 30 June 2016

|

108,700,000 |

5,514,391 | Plant, machinery & electrical installation | C H Williams Talhar & Wong Sdn Bhd 30 June 2016 |

158,928,000 |

(765,208) |

|

|

| 306,818,000 | 4,639,947 |

NOTE : Land and building comprise of: RM - upward revaluation 5,514,391 Revaluation Surplus

Plant, machinery & electrical installation comprise of: RM - downward revaluation (1,057,174) Charged to profit or loss as impairment losses

- upward revaluation 182,730 Revaluation Surplus

4. EFFECT ON NET ASSETS PER SHARE Based on the fourth quarter unaudited financial results of MSB for the financial year ended 30 June 2016, the net assets value per share of MSB will be increased by RM0.02 to RM1.19 upon incorporation of the revaluation surplus, net of deferred tax, of RM 5,374,812. 5. DOCUMENTS AVAILABLE FOR INSPECTION The valuation reports of the property, plant and equipment are available for inspection at the Registered Office of MSB at Suite 12.03, 12th Floor, No.566, Jalan Ipoh, 51200 Kuala Lumpur during normal business hours from Monday to Friday (except for Public Holidays) for a period of three (3) months from the date of this announcement.

This announcement is dated 29 August 2016. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 7-9-2016 04:55 AM

|

显示全部楼层

发表于 7-9-2016 04:55 AM

|

显示全部楼层

麦克伦钢铁今日持续飙涨逾20% 末季业绩公布后

By Kamarul Anwar / theedgemarkets.com | September 6, 2016 : 3:56 PM MYT

(吉隆坡6日讯)麦克伦钢铁(Mycron Steel Bhd)被选为theedgemarkets.com今日的动能股(Stocks with Momentum),股价因而飙涨20.34%至逾5年的最高水平。

这家冷轧钢(CRC)制造商近期宣布成功转亏为盈,该股仍以低于其账面价值交易。

截至下午3时57分,麦克伦钢铁回吐部分涨幅,仍劲扬10.5仙或17.8%,报69.5仙,一共有2245万4900股易手。

然而,与全日最高位72仙相比,此价位仍相形见绌,目前股价也是该股自2011年5月31日录得的最高位72.5仙以来的最高水平。

麦克伦钢铁8月29日宣布,2016财政年末季(截至2016年6月30日)的净利按年暴跌52.92%至934万令吉。

然而,净利暴跌主要因为该集团上财年末季廉价买入Melewar Steel Tube私人有限公司,因而录得一次性收益2128万令吉。

剔除这笔一次性收益后,麦克伦钢铁末季营运盈利翻了3.63倍至2324万令吉,而总盈利也翻逾一倍至3049万令吉。

该集团表示,营运盈利激增是因为冷轧钢和钢管的原料价格与售价之间的较高赚幅价差。

“上财年末季收购钢管公司录得的收益、成本合理化措施,以及部分外围正面发展为集团带来较高的赚幅。”

总结2016财年的业绩表现,麦克伦钢铁全年净赚2418万股令吉,或每股8.56仙,涨幅高达106.95%;营业额则年增9.35%至5亿6681万令吉。

截至截稿前,麦克伦钢铁是大马交易所的第七大热门股,而theedgemarkets.com的动能股计算法也发现该股势头已落入负值区。

该股股价自上周起不断走升,从9月1日的49仙闭市价攀高42.86%至目前价位。

(编译:倪嫣鴽) |

|

|

|

|

|

|

|

|

|

|

|

发表于 1-11-2016 07:22 AM

|

显示全部楼层

发表于 1-11-2016 07:22 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 1-11-2016 07:27 AM

|

显示全部楼层

发表于 1-11-2016 07:27 AM

|

显示全部楼层

本帖最后由 icy97 于 1-11-2016 02:43 PM 编辑

关于 Mycron 一二事: 工厂加班,销售火热

Author: Chong Nam Kui | Publish date: Wed, 5 Oct 2016, 08:47 AM

http://klse.i3investor.com/blogs/BursaInsider/105702.jsp

前几天和一班朋友去 Bandar Utama Centre Point 喝酒,才知道其中一个老友进入了Mycron的销售部门,已经在那里工作好半年了。

如果不是最近非常火热的钢铁股,我也不知道有这间公司的存在。两杯下肚后,就问他一些有关Mycron的销售情况和现在的市场状况。

因为他才进入半年,而且职位也不是很高,所以也就没有什么内幕消息可以爆,但据他所说,他们现在这个部门这几个月都非常忙碌,忙得透不过气来,增加了一些人手也还不是很够。

工厂就一直加班和加人手,但因为订单一直进来,生产来不及应付,结果有一些订单不能准时运送给顾客,虽然只是迟一个星期,但还是害到他们这些销售人员两面不讨好,顾客又骂又催,完了还要看工厂面色,希望工厂先把他的单子交货先。

根据他的说法,他们公司现在就是跟入口商竞争,现在卖的价钱比入口商还便宜,他们公司的价钱就大概是每吨2200左右。

问他怎么不是和中钢抢市场?他说中钢是大哥,他们公司的价钱其实就是跟着中钢跑的。听说中钢工厂也是一直加班赶工。

听做久了的同事说,老板从三月起就一直叫公司员工买公司股票,虽然现在已经起了一倍,但还叫他们不要现在卖。他也偷偷跟着买了一点,虽然不多,但赚一倍还是很爽。问他卖了没有,他说想再看看,因为很多同事也是还没卖,虽然他不是很懂股市,但看到公司这么忙,应该还会再起吧。

问他现在公司原料是从哪里来的?他说现在都是从巴生港口进来的,都是来自中国的。什么价钱他就不知道了。

随后我们就骂我们这个老友有这么好的康头也不跟我们讲,他就说怕给错料,害大家亏钱就不好。

昨天我们一班老友就赶快买了Mycron这个股,要不要信就看你自己了,我只是把听来的分享给大家听。大家共勉之。 |

|

|

|

|

|

|

|

|

|

|

|

发表于 1-11-2016 07:31 AM

|

显示全部楼层

发表于 1-11-2016 07:31 AM

|

显示全部楼层

冷眼前輩..

|

|

|

|

|

|

|

|

|

|

|

|

发表于 2-12-2016 04:15 AM

|

显示全部楼层

发表于 2-12-2016 04:15 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2016 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2016 | 30 Sep 2015 | 30 Sep 2016 | 30 Sep 2015 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 167,497 | 131,857 | 167,497 | 131,857 | | 2 | Profit/(loss) before tax | 13,583 | 4,262 | 13,583 | 4,262 | | 3 | Profit/(loss) for the period | 10,081 | 2,831 | 10,081 | 2,831 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 10,081 | 2,831 | 10,081 | 2,831 | | 5 | Basic earnings/(loss) per share (Subunit) | 3.56 | 1.00 | 3.56 | 1.00 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.2200 | 1.1900

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 19-12-2016 06:53 AM

|

显示全部楼层

发表于 19-12-2016 06:53 AM

|

显示全部楼层

预期钢价回稳.麦克伦扩大海外业务

(吉隆坡8日讯)预期钢铁维持稳定价格至明年2月的麦克伦钢铁(MYCRON,5087,主板工业产品组),有意扩大海外业务贡献,伺机进军美国与英国。

麦克伦钢铁执行主席东姑耶谷在股东大会后表示,过去数个月,钢铁价格明显高开,有利于钢铁领域,预期钢价走势将稳定至明年2月,钢价接下来的走势则取决中国的需求。

“需求决定了钢价走势,而中国是全球钢铁最大的需求国。”

东姑耶谷也表示,该公司目前冷轧钢卷(CRC)的每月产能为20万5000吨,最高可达至25万吨,因此有意将旗下产品如钢桩(Steel Pile)出口至美国、英国与新兴国家,惟目前尚在观察当中。

东姑耶谷说,基于在大马生产热轧钢卷(HRC)成本高,因此该公司已经转型至冷轧钢卷制造。

“公司生产的冷轧钢卷只是向客户收取处理费用,因此但成本高开之时,可直接转嫁客户,维持稳定的赚幅。”

美丽华工业超预算致亏损

东姑耶谷也是美丽华工业(MELEWAR,3778,主板工业产品组)的执行主席,询及该公司首季亏损一事时,他表示,美丽华工业的工程业务其中一项合约成本超出预算,以致亏损。

“公司已经和相关客户商谈,可向对方索取相关损失,不过,有关程序需在明年4月完成。

美丽华工业首季营业额成长39.19%至1亿8760万3000令吉,亏损报809万3000令吉,前期净利为147万9000令吉。

东姑耶谷强调,上述亏损只是美丽华工业一次性的亏损,撇除该亏损,该公司预期全年可保持盈利状态。

文章来源:

星洲日报/财经‧2016.12.09 |

|

|

|

|

|

|

|

|

|

|

|

发表于 23-2-2017 05:48 PM

|

显示全部楼层

发表于 23-2-2017 05:48 PM

|

显示全部楼层

本帖最后由 icy97 于 24-2-2017 02:09 AM 编辑

5087

| | Quarterly rpt on consolidated results for the financial period ended 31/12/2016 | | Quarter: | 2nd Quarter | | Financial Year End: | 30/06/2017 | | Report Status: | Unaudited | | Submitted By: |

|

|

| Current Year Quarter | Preceding Year Corresponding Quarter | Current Year to Date | Preceding Year Corresponding Period |

| 31/12/2016 | 31/12/2015 | 31/12/2016 | 31/12/2015 |

| RM '000 | RM '000 | RM '000 | RM '000 | | 1 | Revenue | 180,695 | 144,129 | 348,192 | 275,986 | | 2 | Profit/Loss Before Tax | 12,556 | 7,351 | 26,139 | 11,613 | | 3 | Profit/Loss After Tax and Minority Interest | 9,528 | 5,336 | 19,609 | 8,167 | | 4 | Net Profit/Loss For The Period | 9,528 | 5,336 | 19,609 | 8,167 | | 5 | Basic Earnings/Loss Per Shares (sen) | 3.36 | 1.89 | 6.92 | 2.89 | | 6 | Dividend Per Share (sen) | 0.00 | 0.00 | 0.00 | 0.00 |

|

|

| As At End of Current Quarter | As At Preceding Financial Year End | | 7 | Net Assets Per Share (RM) |

|

| 1.2600 | 1.1900 |

|

| | |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 26-2-2017 05:20 AM

|

显示全部楼层

发表于 26-2-2017 05:20 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2016 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2016 | 31 Dec 2015 | 31 Dec 2016 | 31 Dec 2015 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 180,695 | 144,129 | 348,192 | 275,986 | | 2 | Profit/(loss) before tax | 12,556 | 7,351 | 26,139 | 11,613 | | 3 | Profit/(loss) for the period | 9,528 | 5,336 | 19,609 | 8,167 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 9,528 | 5,336 | 19,609 | 8,167 | | 5 | Basic earnings/(loss) per share (Subunit) | 3.36 | 1.89 | 6.92 | 2.89 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.2600 | 1.1900

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 22-5-2017 08:01 PM

|

显示全部楼层

发表于 22-5-2017 08:01 PM

|

显示全部楼层

本帖最后由 icy97 于 23-5-2017 01:00 AM 编辑

MYCRON STEEL - potential hints?

Author: FutureEyes | Publish date: Sun, 21 May 2017, 03:17 AM

http://klse.i3investor.com/blogs/Insight1/123207.jsp

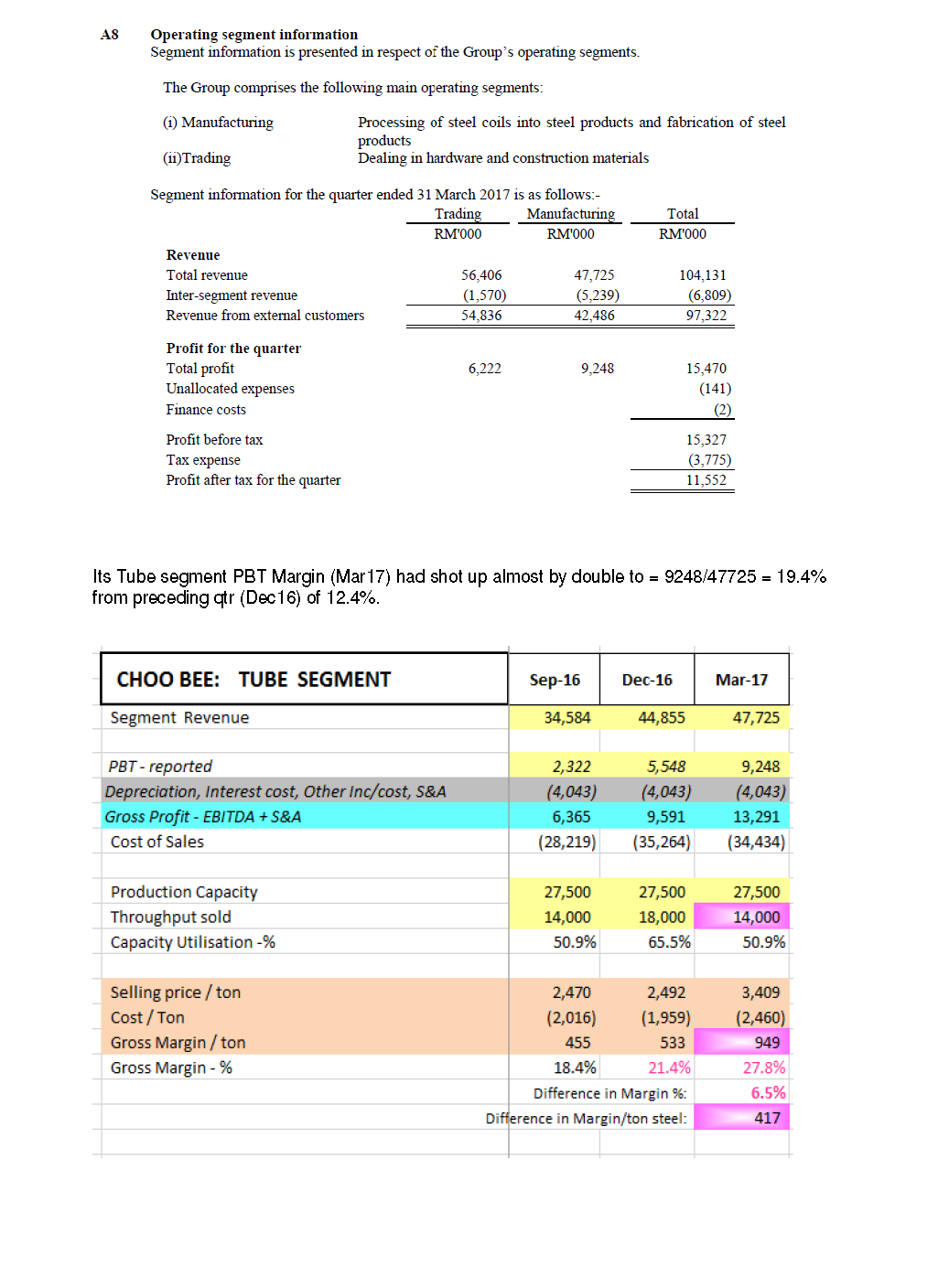

Throughput of Choo Bee is ~ 50% of its capacity = 14,000 ton / qtr, meaning improvement on Margin is about RM400 per ton throughput. Note that I was forced to use a reduced throughput sold as higher figures will cause the Selling price compared to preceding qtr Dec16 not in line with news below:

http://www.klsescreener.com/v2/news/view/223985

“This, said UOB Kay Hian, was mainly on account of the 30% improvement in its manufacturing division's average selling price, which was up by 30.4% to RM3,000 per tonne in 1Q17 from RM2,300 in 4Q16.”

"Choo Bee expects its manufacturing division's growth to moderate in 2017 to a high single digit," the stockbroking firm said. Note that Mycron’s Steel Tube products are of a different class suitable for International API petrochemicals standards. Refer Mycron and Choo Bee tube catalogs here: Thus, it makes more sense for them to potentially explore foreign market as reported here even more than Choo Bee’s potential: “In the previous days when Megasteel was still around, we had to buy all our raw materials from Megasteel. It was very expensive, making us uncompetitive when it comes to exporting. “Since they have stopped operations, we can now begin to consider exporting pipes as we can purchase HRC at competitive prices and hence sell at competitive prices,” he said following Mycron and Melewar Industrial Group Bhd’s annual general meeting yesterday. Melewar is the holding company of Mycron. He said the company is also looking to export CRC” “According to Tan, Megasteel will normally charge RM400 to RM500 premium per tonne for HRC over international prices. Raw materials are Choo Bee’s biggest cost, which accounts for about 85% of the group’s operating expenses. As of now, the group has started to source 80% of its raw materals from other Asian countries since Megasteel, the country’s sole HRC maker, has stopped production. This may in turn help Choo Bee resume its export business to the US and Australia after the third quarter this year, according to Tan.”

|

|

|

|

|

|

|

|

|

|

|

|

发表于 27-5-2017 05:54 AM

|

显示全部楼层

发表于 27-5-2017 05:54 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2017 | 31 Mar 2016 | 31 Mar 2017 | 31 Mar 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 192,139 | 142,494 | 540,331 | 418,480 | | 2 | Profit/(loss) before tax | 10,796 | 8,434 | 36,935 | 20,047 | | 3 | Profit/(loss) for the period | 7,363 | 6,675 | 26,972 | 14,842 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 7,363 | 6,675 | 26,972 | 14,842 | | 5 | Basic earnings/(loss) per share (Subunit) | 2.60 | 2.36 | 9.52 | 5.25 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.2800 | 1.1900

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 24-8-2017 06:11 AM

|

显示全部楼层

发表于 24-8-2017 06:11 AM

|

显示全部楼层

本帖最后由 icy97 于 27-8-2017 05:55 AM 编辑

麦克伦5配1发附加股

再2送1凭单

2017年8月27日

(吉隆坡26日讯)麦克伦钢铁(MYCRON,5087,主板工业产品股)建议,以5配1比例,发出最多5670万9091股附加股,同时再以2送1比例,送出最多2835万4546张凭单。

假设发售价为每股50仙,附加股活动可让麦克伦钢铁筹得1080万至2836万令吉,视情况而定,大部分将作为资本开销和营运资本。

麦克伦钢铁日前向交易所报备,有意利用最多1500万令吉的所得,为旗下麦克伦钢铁CRC私人有限公司融资,以修补老旧的连续式酸洗作业线及打造一个新的酸再生厂房。

虽然钢铁领域十分竞争,且受到全球供需异常的重大影响,但公司仍正面看待业务前景。

麦克伦钢铁相信,公司严谨控制营运成本并监督效率的能力,可以贡献业绩表现。【e南洋】

Type | Announcement | Subject | NEW ISSUE OF SECURITIES (CHAPTER 6 OF LISTING REQUIREMENTS)

FUND RAISING | Description | MYCRON STEEL BERHAD ("MYCRON" OR THE "COMPANY") PROPOSED RIGHTS ISSUE OF SHARES WITH WARRANTS | On behalf of the Board of Directors of Mycron, TA Securities Holdings Berhad wishes to announce that the Company proposes to undertake a renounceable rights issue of up to 56,709,091 shares in Mycron (“Mycron Shares”)(“Rights Shares”) on the basis of one (1) Rights Share for every five (5) Mycron Shares held, together with up to 28,354,546 free detachable warrants (“Warrants”) on the basis of one (1) Warrant for every two (2) Rights Shares subscribed at an entitlement date to be determined later (“Proposed Rights Issue of Shares with Warrants”)

Please refer to the attachment for further details.

This Announcement is dated 23 August 2017. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5524093

|

|

|

|

|

|

|

|

|

|

|

|

发表于 30-8-2017 11:47 PM

|

显示全部楼层

发表于 30-8-2017 11:47 PM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2017 | 30 Jun 2016 | 30 Jun 2017 | 30 Jun 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 185,865 | 148,330 | 726,196 | 566,809 | | 2 | Profit/(loss) before tax | 9,436 | 12,354 | 46,371 | 32,400 | | 3 | Profit/(loss) for the period | 6,927 | 9,336 | 33,899 | 24,178 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 6,927 | 9,336 | 33,899 | 24,178 | | 5 | Basic earnings/(loss) per share (Subunit) | 2.44 | 3.30 | 11.96 | 8.56 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.3200 | 1.1900

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 30-8-2017 11:48 PM

|

显示全部楼层

发表于 30-8-2017 11:48 PM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | MYCRON STEEL BERHAD ("MSB" OR "THE GROUP")- REVALUATION OF PROPERTY, PLANT AND EQUIPMENT | 1. INTRODUCTION Pursuant to Paragraph 9.19(46) of the Main Market Listing Requirements of Bursa Malaysia Securities Berhad, the Board of Directors of MSB (“the Board”) wishes to announce that MSB had undertaken a revaluation exercise on the land, buildings, plant, machinery and electrical installation held by the Group. The Board had at its meeting held on 28 August 2017 approved the valuation reports and the incorporation of the revaluation surplus arising from the revaluation in the fourth quarter unaudited financial results of MSB for the financial year ended 30 June 2017.

2. PURPOSE The revaluation was carried out in accordance with the Group’s accounting policy to determine the fair value of the Group’s property, plant and equipment comprising the land, building, plant, machinery and electrical installation periodically, with sufficient regularity.

3. REVALUATION SURPLUS The details of the revaluation surplus are set out below:

Location of the Property, Plant and Equipment | Type of Property, Plant and Equipment | Valuer/Valuation date | Market Value (RM) | Revaluation Surplus (RM) |

Lot 53, Persiaran Selangor 40200 Shah Alam, Selangor

|

Plant, machinery

|

PA International Property Consultants (KL) Sdn Bhd 30 June 2017 |

7,636,000 |

(383,204) |

No.49, Jalan Utas 15/7, 40200 Shah Alam Selangor |

Plant, machinery |

PA International Property Consultants (KL) Sdn Bhd 30 June 2017 |

6,594,000 |

(420,625) |

Lot 10, Persiaran Selangor, 40200 Shah Alam Selangor |

Plant, machinery

|

PA International Property Consultants (KL) Sdn Bhd 30 June 2017 |

18,793,000 |

(539,723) |

Lot 16, Jalan Pengapit 15/19, 40200 Shah Alam, Selangor

|

Plant, machinery |

PA International Property Consultants (KL) Sdn Bhd 30 June 2017 |

2,519,000 |

(301,794) |

Lot 717, Jalan Sungai Rasau, Seksyen 16, 40200 Shah Alam, Selangor

|

Industrial land and factory cum office building (Freehold)

|

PA International Property Consultants (KL) Sdn Bhd 30 June 2017 |

110,000,000 |

3,070,076 |

Plant, machinery & electrical installation |

PA International Property Consultants (KL) Sdn Bhd 30 June 2017 |

150,595,000 |

(836,047) |

|

|

| 296,137,000 | 588,683 |

NOTE Land and building comprise of: RM - upward revaluation 3,070,076 Revaluation surplus

Plant, machinery & electrical installation comprise of: RM - downward revaluation (2,319,535) Charge to profit or loss as impairment loss

- downward revaluation (161,858) Reduce revaluation surplus brought forward

4. EFFECT ON NET ASSETS PER SHARE Based on the fourth quarter unaudited financial results of MSB for the financial year ended 30 June 2017, the net assets value per share of MSB will be increased by RM0.01 to RM1.32 upon incorporation of the revaluation surplus, net of deferred tax, of RM 2,989,246.

5. DOCUMENTS AVAILABLE FOR INSPECTION The valuation reports of the property, plant and equipment are available for inspection at the Registered Office of MSB at Suite 12.03, 12th Floor, No.566, Jalan Ipoh, 51200 Kuala Lumpur during normal business hours from Monday to Friday (except for Public Holidays) for a period of three (3) months from the date of this announcement.

This announcement is dated 29 August 2017. |

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|