|

|

发表于 20-2-2017 06:46 PM

|

显示全部楼层

发表于 20-2-2017 06:46 PM

|

显示全部楼层

本帖最后由 icy97 于 21-2-2017 03:19 AM 编辑

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2016 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2016 | 31 Dec 2015 | 31 Dec 2016 | 31 Dec 2015 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 27,267 | 25,106 | 81,281 | 61,354 | | 2 | Profit/(loss) before tax | 3,125 | 4,749 | 7,813 | 2,875 | | 3 | Profit/(loss) for the period | 2,853 | 3,739 | 7,429 | 3,050 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 2,853 | 3,739 | 7,429 | 3,050 | | 5 | Basic earnings/(loss) per share (Subunit) | 1.19 | 1.58 | 3.10 | 1.29 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.1900 | 0.1500

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 21-2-2017 08:49 PM

|

显示全部楼层

发表于 21-2-2017 08:49 PM

|

显示全部楼层

本帖最后由 icy97 于 22-2-2017 12:32 AM 编辑

KRONO 亚洲 – FY16Q4盈利背后的隐忧

KRONO是今天 (2/21) 股价上涨幅度最大的股票之一,上涨6仙收市在38仙,相等于约19%的涨幅。其股价走高主要源自于最新出炉的业绩。

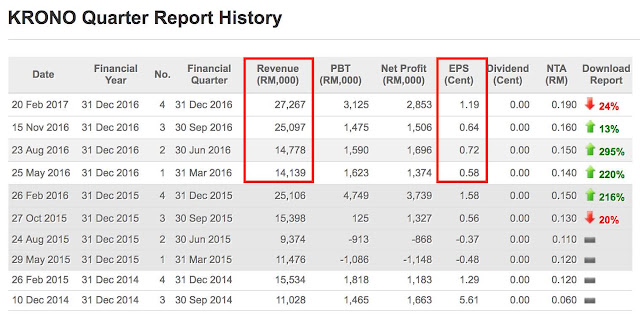

KRONO在昨日发布FY16Q4业绩,其盈利按年下滑24%,按季则增长89%,超出市场的预期。为何说超出市场预期呢?回顾去年10月,KRONO完成收购印度【QUANTUM】的80%股权,后者正式成为KRONO的独资子公司。因此,KRONO于FY16Q4开始纳入印度【QUANTUM 】的盈利贡献。

这项收购为KRONO在印度市场的EDM领域扩展铺路,同时也附带附带盈利保证。印度【QUANTUM】保证将在FY16和FY17分别贡献USD1m的税后盈利。以USD/MYR = 4.40计算,这子公司可为KRONO带来额外RM4.3m的盈利,相等于每个季度平均RM1.1m的盈利。翻看KRONO未完成收购前的近三个季度,其平均盈利为RM1.5m。因此,本专页早前估计KRONO的盈利大约在RM2.5m左右。RM2.8m的税后盈利可算是超出预期。

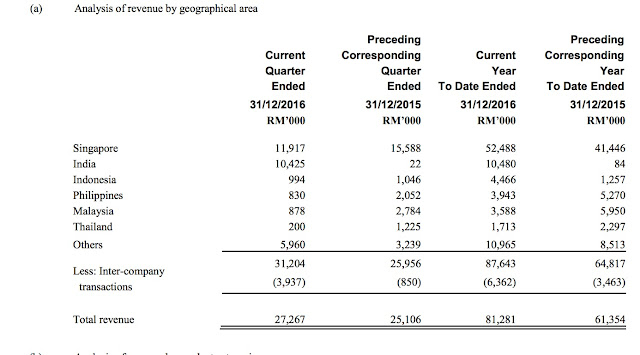

参考KRONO最新季度的营业额,新加坡依然是集团的最大贡献市场,但是收入却按年按季分别下滑了24%和42%。此外,KRONO的印尼、菲律宾和大马市场的贡献也全线下滑。收入获得扶持主要归功于新子公司印度市场的贡献。整体来说,KRONO的业务似乎在东南亚国家面临困境,不是个好的迹象。

大家可以观察KRONO近两个季度的业绩表现。其FY16Q3营业额为RM25m,FY16Q4营业额为RM27m。但是为何其FY16Q3盈利只有RM1.5m,而FY16Q4却高达RM2.9m,差距如此大呢?

KRONO大部分的营收都是以美金计算。同时,收购印度【QUANTUM】后,它在印度拥有三个办事处。因此,美金兑马币走势对于KRONO的影响不小。KRONO在FY16Q4录得RM1.42m的显著外汇收益,是集团盈利暴涨的主要因素,而非来自核心业务的增长。值得一提,KRONO在这个季度之前的外汇收益不明显。

若剔除这非核心收益后,KRONO的FY16Q4实际盈利只有RM1.43m,甚至还低于未收购完成的FY16Q2和FY16Q3盈利表现。

因此,本专页认为KRONO这个季度的表现有运气的成分,股价走高纯粹是市场对于KRONO的FY16Q4缺乏详细的了解。在下个业绩出炉前的3个月,预计市场对于它的期望更大,毕竟KRONO最新季度的每股盈利为1.19仙,为市场提供非常大的想象空间。从市场的角度去想,假设KRONO在未来3个季度交出相同的盈利,其一整年每股盈利将会是4.76仙。以标准10倍PE推算,它的潜在每股价值为RM0.475。

值得一提,本专页是KRONO的股东之一,受惠于市场盲目根据盈利推高股价。根据技术走势,相信KRONO有很大可能突破40仙大关。然而,在未来三个月内,相信将依据进行部分甚至是全部套利。

KRONO是本专页于去年10月为订阅者发布的分析报告,因此买入的价格也相对的低,目前纸上盈利为55%。

RH Research |

|

|

|

|

|

|

|

|

|

|

|

发表于 2-4-2017 01:51 AM

|

显示全部楼层

发表于 2-4-2017 01:51 AM

|

显示全部楼层

| 1. Details of Corporate Proposal | Involve issuance of new type/class of securities ? | No | Types of corporate proposal | Acquisitions | Details of corporate proposal | Acquisition by Kronologi Asia Berhad ("KAB") of the remaining 80% of the enlarged number of issued share of Quantum Storage (India) Pte. Ltd. ("QSI") comprising 1,120,000 ordinary shares in QSI currently held by Quantum Storage (India) Limited, for a purchase consideration of up to RM26,000,000, to be satisfied via a combination of the issuance of up to 55,641,420 new ordinary shares in KAB ("Consideration Shares") at the issue price of RM0.1941 per Consideration Share and cash payment of up to RM15,200,000 ("Acquisition") | No. of shares issued under this corporate proposal | 22,256,568 | Issue price per share ($$) | Malaysian Ringgit (MYR) 0.1941 | Par Value ($$) | Malaysian Ringgit (MYR) 0.000 | | Latest issued and paid up share capital after the above corporate proposal in the following | Units | 270,372,852 | Currency | Malaysian Ringgit (MYR) 0.000 | Listing Date | 03 Apr 2017 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 8-4-2017 05:00 AM

|

显示全部楼层

发表于 8-4-2017 05:00 AM

|

显示全部楼层

Notice of Interest Sub. S-hldr (29A)Particulars of Substantial Securities HolderName | QUANTUM STORAGE (INDIA) LIMITED | Address | Akara Building, 24 De Castro Street

Wickhams Cay 1

Road Town Tortola

Virgin Islands, British. | Company No. | 1685889 | Nationality/Country of incorporation | Virgin Islands, British | Descriptions (Class & nominal value) | Ordinary shares | Name & address of registered holder | AFFIN HWANG NOMINEES (ASING) SDN BHD EXEMPT AN FOR DBS VICKERS SECURITIES (SINGAPORE) PTE LTD (CLIENTS)Akara Building, 24 De Castro Street, Wickhams Cay 1,Road Town, Tortola, British Virgin Islands |

| Date interest acquired & no of securities acquired | Currency |

| | Date interest acquired | 31 Mar 2017 | No of securities | 22,256,568 | Circumstances by reason of which Securities Holder has interest | Allotment of shares as part of the consideration paid by Kronologi Asia Berhad for the acquisition of the remaining 80% of the issued and paid-up share capital of Quantum Storage (India) Pte. Ltd. | Nature of interest | Direct | Price Transacted ($$) |

|

| | Total no of securities after change | Direct (units) | 22,256,652 | Direct (%) | 8.232 | Indirect/deemed interest (units) |

| | Indirect/deemed interest (%) |

| | Date of notice | 31 Mar 2017 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 16-4-2017 01:17 AM

|

显示全部楼层

发表于 16-4-2017 01:17 AM

|

显示全部楼层

本帖最后由 icy97 于 16-4-2017 01:59 AM 编辑

(Tradeview 2017) Value Pick No. 7 : Kronologi Asia Bhd. (0176)

Author: tradeview | Publish Date: 15 Apr 2017, 5:55 PMhttp://www.malaysiastock.biz/Blog/BlogArticle.aspx?tid=6119

Dear fellow readers,

This is my No. 7 Value Pick for 2017.

Once again, these writings are just my humble highlights (not recommendation), feel free to have some intellectual discourse on this.

Kronologi Asia Berhad (Initial Valuation RM 0.45)

Following the superb performance of Scope Industries Bhd, which moved from 16 sens to 27 sens in 1 month (68% gain since released of article), there were many request by my readers to focus my writing on more small cap stocks. Let me clarify beforehand, this is not adhering to the request but rather I came across this counter after a friend highlighted the strong growth since their IPO 2 years back.

Once again, we will give an upfront warning, as this is a small cap stock, this stock has higher risk compared to our other value picks. So for those who have low risk tolerance, you can skip this.

Kronologi Asia Bhd, is in the business of Data Storage and Recovery Solutions & Technology. In layman terms, Krono provide Data Backup, Consultation, Server Maintenance, Recovery services to companies. Think of them as your office work data archiver / gatekeeper.

The company consist of a team of IT professionals with substantial experience in their respective fields. From how I look at it, the team running the company is very professional. Just to name a few, the Executive Director / CEO /CTO, Mr Teo has over 20 years of experience in storage solutions, software programming and network architecture. Executive Director / Director of Operations, Mr Tan brings with him a wealth of IT experiences having worked for a HK listed IT firm and US based 3Com, both in their Singapore operations. He was also one of the pioneers of a successful regional IT System Integration company, Sandz Solutions. In short, the management of Krono knows what they are doing.

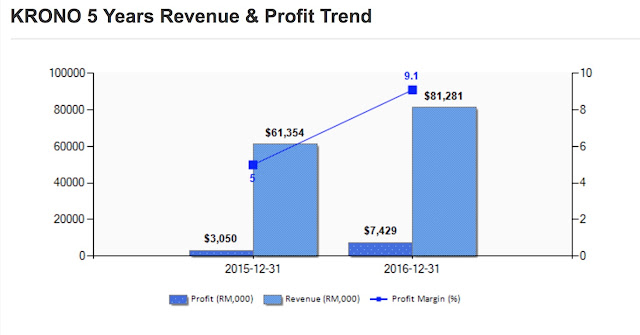

As Krono is a relatively new company, looking at the 2 years profit trend, Krono has shown steady increase both top and bottomline from RM61 to RM81 million in revenue and RM3 to RM7.4 million in net profit. Profit margin almost doubled from 5% to 9.1%. All indicators point towards continuous growth. However, it is imperative to understand the reason behind the growth.

Back in August 2016, Krono acquired the remaining 80% stake in Quantum Storage (India) Pte Ltd for RM26mil. This is one of the key reason for the growth of Krono. With a new subsidiary and board members / management level, Krono has been improving. The key sector for Krono is to tap on the burgeoning data storage and management business in Asia. It is reported that Krono is a long-term partner of US-based Quantum Corp which in turn is a global player in data protection and data management - promoting Quantum products, solutions and branding in South Asia.

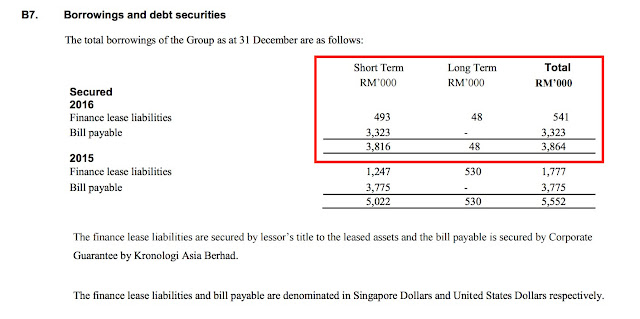

Krono acquisition of Quantum Storage for RM26mil, was satisfied by new shares and RM15.2mil in cash on a staggered payment basis. The acquisition was to capitalise on big data, and India's growth in the sector of data storage. Ex: 4K ultra HD technology, Satellite imagery, CCTV etc. The pivot towards Digital cities, Smart Cities and to boost IT usage in businesses and organisations will help the company grow in the long term. This acquisition comes with a profit after tax guarantee of US$1mil (RM4mil) each year of financial years 2016 and 2017. The RM15.2mil cash portion of the acquisition is being funded from RM6mil of IPO proceeds and a further RM9.2mil from internally generated cash. The company has RM8.7mil in cash as at Dec 31, 2016 with a reducing debt position. Additionally, Krono's balance sheet is relatively strong compared to many other tech stocks out there. It is a net cash company despite having gone through an acquisition.

We like Krono for many reason. Firstly, it has a change in management / board members which turned the business around. Secondly, it is in a tech sector of growth which is easy to understand and shows actual revenue and profit growth. Thirdly, the company have a good mix of revenue from various geographical location which shows demand in various countries outside of the home country. Hence, we believe the future prospect is intact. We are cautiously optimistic for it to maintain its profitability in the coming QR. If Krono successfully pull it off, there may be a rerating to the stock.

The 2017 prospects by Krono looks promising as well. Given the management confidence of being able to deliver a positive performance to FY 2017, I think it is worthwhile to consider investing in the company for the long term basis.

With the latest QR, it is now trading at a narrow band. Since middle of 2015, Krono has fallen from 40+ sens to a low of 10 sens before rebounding to recent high of 39.5 sens. If Krono can maintain their growth, there is no reason it cannot challenge it's historical high. Currently at 35 sens, it is trading at a multiple of 13x. It's NTA stands at 19 sens with ROE of 14.5% for the past years. We believe in the long term growth trajectory of Krono and estimate the coming Q with EPS between 0.7 to 1 sen. Should that happens, the full year EPS will be around 3 sen and applying a multiple of 15x (factor in the net cash position and tech sector), there is a possibility that Krono can move towards 45 sens. For now, this will be the initial TP pending observations of coming quarter results |

评分

-

查看全部评分

|

|

|

|

|

|

|

|

|

|

|

发表于 26-4-2017 08:00 PM

|

显示全部楼层

发表于 26-4-2017 08:00 PM

|

显示全部楼层

本帖最后由 icy97 于 26-4-2017 11:02 PM 编辑

Kronologi Asia optimistic on FY17, to expand presence in India, SEA

Adam Aziz/theedgemarkets.com

April 26, 2017 16:05 pm MYT

http://www.theedgemarkets.com/article/kronologi-asia-optimistic-fy17-expand-presence-india-sea

KUALA LUMPUR (April 26): Kronologi Asia Bhd is optimistic on a better FY17, as it looks to deepen its penetration of the Indian market and widen its presence in Southeast Asia (SEA).

It revealed this in an announcement on its new three-pronged growth strategy on Bursa Malaysia today, after acquiring full control of Quantum Storage (India) Pte Ltd (QSI) last October, which comes with an annual profit guarantee of US$1 million in FY16 and FY17.

QSI contributed three months of the group's revenue and profit in FY16 and was a factor for the 32.5% increase in total revenue that year to RM81.3 million and the 172% increase in profit before tax to RM7.8 million, it noted.

"The financial performance of FY17 is expected to be more optimistic than FY16, in view of the full consolidation of revenue and profit of QSI," it said, adding the size and expansion rate of India's economy will continue to offer healthy growth potential for the group.

Beyond the demand from SMEs for dedicated storage solutions, two sub-sectors, namely the development of smart cities and the management of media content in India, have and will continue to propel Kronologi Asia's growth in the country, it said.

The two other parts to its new growth strategy are the development of a transnational infrastructure across Asia for storage solutions and increase in emphasis on managed services and dedicated storage back-up across multiple locations.

"The group will explore options to fund the capital expenditure needed for the establishment of this transnational infrastructure which it intends to roll out over the medium term," it added.

The group now has operation centres operating out of Singapore and Malaysia, and plans to add Hong Kong as a third physical point of presence soon. It intends to make Malaysia the main operations hub for the region eventually.

The establishment of the transnational infrastructure will also accelerate the group's higher-margin managed services business. The group intends to double this business' contribution to group revenue, which is currently less than 10%, in the mid-term.

"The enhanced infrastructure will position the group to tap the growing shift towards platform-as-a-service whereby payment modes by enterprise customers are based on pay-per-use operating expenditure instead of previously incurring fixed capital expenditure," it said.

Besides offering data protection as a service, the group will look at expanding its offering to include enterprise file sharing-as-a-service, archive-as-a-service, disaster recovery-as-a-service and e-vaulting, which will allow customers to store their tape backups within Kronicle's infrastructure and allow for quicker restoration of the data, it added.

Kronologi Asia's share price has been on an upward trend in the past year and gained 90% since. At 4pm today, the counter was trading at 37.5 sen, up half sen or 1.35% from yesterday's close, valuing it at RM102.7 million. |

|

|

|

|

|

|

|

|

|

|

|

发表于 27-4-2017 06:02 PM

|

显示全部楼层

发表于 27-4-2017 06:02 PM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 27-4-2017 07:42 PM

|

显示全部楼层

发表于 27-4-2017 07:42 PM

|

显示全部楼层

本帖最后由 icy97 于 27-4-2017 08:51 PM 编辑

KRONO拟扩印度东南亚业务

http://www.sinchew.com.my/node/1637990/

(吉隆坡27日讯)KRONO科技(KRONO,0176,创业板科技组)2017财政年展望乐观,料进一步渗透印度及扩大东南亚市场业务。

3新成长策略

该公司在去年10月全面收购Quantum Storage(印度)私人有限公司(QSI)后,发文告宣布3项新成长策略。

2016及2017财政年,QSI提供该公司100万美元的年度盈利保障。2016财政年贡献该公司3个月营业额及盈利,推动总营业额成长32.5%,至8130万令吉;税前获利走扬172%,至780万令吉。该公司看好,在QSI营业额及获利全面整合支撑下,2017财政年表现料比2016财政年更乐观。

同时,该公司也认为,印度经济规模、成长率及中小型企业储存方案需求料为该公司带来成长潜能。

另外,其他两个新策略包括发展亚洲储存方案的跨国基础设施、增加管理服务及各地点的存储后备系统,同时也将探讨于短期内推行的跨国基建设施资本开销融资选项。

拟港设第三家营运中心

目前该公司在新加坡及大马设有营运中心,料即将在香港设立第三家中心,并有意逐步把大马打造成区域运作中心。

该公司预计,跨国基建设施将推高其管理服务利润,短期内营业额贡献有望从现有的不及10%倍增。

除了提供数据保护服务,该公司也放眼拓展企业文件分享、取得、灾难修复及电子评估服务。

文章来源:

星洲日报‧财经‧2017.04.27 |

|

|

|

|

|

|

|

|

|

|

|

发表于 27-4-2017 11:53 PM

|

显示全部楼层

发表于 27-4-2017 11:53 PM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 28-4-2017 03:04 AM

|

显示全部楼层

发表于 28-4-2017 03:04 AM

|

显示全部楼层

本帖最后由 icy97 于 28-4-2017 05:11 AM 编辑

KRONO拟扩印度东南亚业务

(吉隆坡27日讯)KRONO科技(KRONO,0176,创业板科技组)2017财政年展望乐观,料进一步渗透印度及扩大东南亚市场业务。

3新成长策略

该公司在去年10月全面收购Quantum Storage(印度)私人有限公司(QSI)后,发文告宣布3项新成长策略。

2016及2017财政年,QSI提供该公司100万美元的年度盈利保障。2016财政年贡献该公司3个月营业额及盈利,推动总营业额成长32.5%,至8130万令吉;税前获利走扬172%,至780万令吉。该公司看好,在QSI营业额及获利全面整合支撑下,2017财政年表现料比2016财政年更乐观。

同时,该公司也认为,印度经济规模、成长率及中小型企业储存方案需求料为该公司带来成长潜能。

另外,其他两个新策略包括发展亚洲储存方案的跨国基础设施、增加管理服务及各地点的存储后备系统,同时也将探讨于短期内推行的跨国基建设施资本开销融资选项。

拟港设第三家营运中心

目前该公司在新加坡及大马设有营运中心,料即将在香港设立第三家中心,并有意逐步把大马打造成区域运作中心。

该公司预计,跨国基建设施将推高其管理服务利润,短期内营业额贡献有望从现有的不及10%倍增。

除了提供数据保护服务,该公司也放眼拓展企业文件分享、取得、灾难修复及电子评估服务。

文章来源:

星洲日报‧财经‧2017.04.27

Type | Announcement | Subject | OTHERS | Description | KRONOLOGI ASIA BERHAD - CORPORATE AND BUSINESS UPDATE | The Board of Directors (the “Board”) of Kronologi Asia Berhad (“Kronologi” or the “Group”) wishes to provide a corporate and business update following a recent strategic review. This review follows the release on 20 February 2017 of the unaudited financial results for the financial year ended 31 December 2016 (“FY2016”).

Kindly refer to the attachment for further details.

This announcement is dated 26 April 2017.

|

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5406941

|

|

|

|

|

|

|

|

|

|

|

|

发表于 27-5-2017 06:14 AM

|

显示全部楼层

发表于 27-5-2017 06:14 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2017 | 31 Mar 2016 | 31 Mar 2017 | 31 Mar 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 25,185 | 14,139 | 25,185 | 14,139 | | 2 | Profit/(loss) before tax | 1,635 | 1,623 | 1,635 | 1,623 | | 3 | Profit/(loss) for the period | 2,044 | 1,374 | 2,044 | 1,374 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 2,044 | 1,374 | 2,044 | 1,374 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.77 | 0.58 | 0.77 | 0.58 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.1900 | 0.1900

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 2-6-2017 05:14 AM

|

显示全部楼层

发表于 2-6-2017 05:14 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 12-6-2017 06:48 AM

|

显示全部楼层

发表于 12-6-2017 06:48 AM

|

显示全部楼层

Type | Announcement | Subject | NEW ISSUE OF SECURITIES (CHAPTER 6 OF LISTING REQUIREMENTS)

FUND RAISING | Description | KRONOLOGI ASIA BERHAD ("KAB" OR THE "COMPANY")PROPOSED PRIVATE PLACEMENT OF NEW ORDINARY SHARES IN KAB, REPRESENTING UP TO 10% OF THE TOTAL NUMBER OF ISSUED SHARES IN KAB (EXCLUDING TREASURY SHARES, IF ANY) ("PROPOSED PRIVATE PLACEMENT") | On behalf of the Board of Directors of KAB, TA Securities Holdings Berhad wishes to announce that the Company proposes to undertake the Proposed Private Placement. Please refer to the attachment for further details.

This announcement is dated 29 May 2017. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5443049

|

|

|

|

|

|

|

|

|

|

|

|

发表于 19-6-2017 04:45 AM

|

显示全部楼层

发表于 19-6-2017 04:45 AM

|

显示全部楼层

本帖最后由 icy97 于 20-6-2017 05:11 PM 编辑

KRONO科技大股东售33.43%予2董事

(吉隆坡14日讯)KRONO科技(KRONO,0176,创业板科技组)股权出现变动;大股东陈英铭(Piti Pramotedham)脱售33.43%股权予公司两名执行董事张昌明菲立多米尼及陈杰明,分别占12.94%及20.39%的股权。

在上述显著股权交易中,该公司执行董事、代首席执行员兼首席科技员张昌明菲立多米尼,于2017年6月13日以1680万令吉代价,在场外市场收购公司的3500万股股票,或是12.94%,使他的持股增加至13.04%。

与此同时,该公司的执行董事陈杰明,则以2646万2288.64令吉代价,从场外市场收购公司的5512万9768股的股票,或是20.39%股权。

该公司文告指出,该公司认可其两名执行董事以个人决定收购公司的显著股权。

文章来源:

星洲日报‧财经‧2017.06.15

Name | MR PITI PRAMOTEDHAM | Nationality/Country of incorporation | Singapore | Descriptions (Class) | Ordinary Shares |

Details of changesNo | Date of change | No of securities | Type of Transaction | Nature of Interest | | 1 | 13 Jun 2017 | 90,129,768 | Disposed | Direct Interest | Name of registered holder | PITI PRAMOTEDHAM | Address of registered holder | 25 Balmoral Park, #11-02, Singapore 259854 | Description of "Others" Type of Transaction | |

Circumstances by reason of which change has occurred | Off market disposal | Nature of interest | Direct Interest | Direct (units) | 35,548,200 | Direct (%) | 13.15 | Indirect/deemed interest (units) |

| | Indirect/deemed interest (%) |

| | Total no of securities after change | 35,548,200 | Date of notice | 13 Jun 2017 | Date notice received by Listed Issuer | 13 Jun 2017 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 19-6-2017 04:46 AM

|

显示全部楼层

发表于 19-6-2017 04:46 AM

|

显示全部楼层

Notice of Interest Sub. S-hldr (Section 137 of CA 2016)Particulars of Substantial Securities HolderName | MR TEO CHONG MENG PHILIP DOMINIC | Nationality/Country of incorporation | Singapore | Descriptions (Class) | Ordinary Shares | Name & address of registered holder | TEO CHONG MENG PHILIP DOMINICBlk 123, Tampines Street 11, #08-364,Singapore 521123 |

| Date interest acquired & no of securities acquired | Date interest acquired | 13 Jun 2017 | No of securities | 35,000,000 | Circumstances by reason of which Securities Holder has interest | Off market acquisition | Nature of interest | Direct Interest |  | | Total no of securities after change | Direct (units) | 35,250,000 | Direct (%) | 13.04 | Indirect/deemed interest (units) |

| | Indirect/deemed interest (%) |

| | Date of notice | 13 Jun 2017 | Date notice received by Listed Issuer | 13 Jun 2017 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 19-6-2017 04:46 AM

|

显示全部楼层

发表于 19-6-2017 04:46 AM

|

显示全部楼层

Notice of Interest Sub. S-hldr (Section 137 of CA 2016)Particulars of Substantial Securities HolderName | MR TAN JECK MIN | Nationality/Country of incorporation | Singapore | Descriptions (Class) | Ordinary Shares | Name & address of registered holder | TAN JECK MINBlk 161, Bishan Street 13, #22-150 Singapore 570161 |

| Date interest acquired & no of securities acquired | Date interest acquired | 13 Jun 2017 | No of securities | 55,129,768 | Circumstances by reason of which Securities Holder has interest | Off market acquisition | Nature of interest | Direct Interest |  | | Total no of securities after change | Direct (units) | 55,129,768 | Direct (%) | 20.39 | Indirect/deemed interest (units) |

| | Indirect/deemed interest (%) |

| | Date of notice | 13 Jun 2017 | Date notice received by Listed Issuer | 13 Jun 2017 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 19-6-2017 06:07 AM

|

显示全部楼层

发表于 19-6-2017 06:07 AM

|

显示全部楼层

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

RELATED PARTY TRANSACTIONS | Description | BUMI ARMADA BERHAD (BUMI ARMADA OR COMPANY)ESTABLISHMENT OF A JOINT VENTURE COMPANY IN GHANA |

1. INTRODUCTION

The Board of Directors (“Board”) of Bumi Armada wishes to announce that its wholly owned subsidiary, Bumi Armada Marine Holdings Limited (“BAMHL”), has, together with Shapoorji Pallonji Oil and Gas Private Limited (“SPOG”), a wholly owned subsidiary of Shapoorji Pallonji And Company Private Limited (“SPCL”) and Cypress Energy Company Limited (“CECL”) established a joint venture (“JV”) company known as Bumi Armada Shapoorji Pallonji Ghana Limited (“BASPG”), on 5 June 2017 in Ghana. The certificate of incorporation of BASPG was received by the Company on 10 June 2017.

The establishment of BASPG is regarded as a related party transaction under the Main Market Listing Requirements of Bursa Malaysia Securities Berhad (“LR”) as it involves the interests of a former Director of Bumi Armada, Mr. Shapoorji Pallonji Mistry (“Mr. Shapoor”) by virtue of him being a director of Bumi Armada within the preceding 6 months of the date on which BASPG was established. Further details of his interests are set out in section 6 below.

2. DETAILS OF THE JV

The JV arrangement is for the purpose of combining the capabilities and expertise of BAMHL, SPOG and CECL (collectively, "Parties") with the intention of ultimately securing the award of a floating, production, storage and offloading (“FPSO”) project in Ghana.

(i) Information on the Parties

a) BAMHL

BAMHL was incorporated as a BVI business company in British Virgin Islands under the BVI Business Companies Act, 2004 on 10 April 2015 under its present name and its principal activities is investment holding.

As at 14 June 2017, the authorised share capital of BAMHL is 50,000 shares with a par value of USD1.00 each. The issued and paid-up share capital of BAMHL is 10,000 shares of USD1.00 each.

b) SPOG

SPOG was incorporated in India under the laws of India on 14 August 2012 as Cosima Properties Private Limited. The name of the company has been changed from Cosima Properties Private Limited to Shapoorji Pallonji Oil and Gas Private Limited with effect from 19 May 2015.

Its principal activities consist of engineering, procurement, fabrication, construction, installation and commissioning services for offshore and onshore oil and gas exploration and production industry and for vessels/ facilities used for liquefaction of natural gas, storage, transportation and regasification of liquefied natural gas, to provide operation and maintenance services for floating vessels used for offshore oil and gas production, processing and storage, and for LNG carriers.

SPOG is a wholly owned subsidiary of SPCL, the ultimate beneficiary owners of which are Mr. Shapoor and his brother, Mr. Cyrus Pallonji Mistry. The SPCL Group of Companies is a large conglomerate with multiple business segments, with over 23,000 employees and an annual group turnover of USD4 billion.

As at 14 June 2017, the authorised share capital of SPOG is INR 2505,05,00,000 comprising 125,00,50,000 ordinary shares of INR 10 each and 1255,00,000 Preference Shares of INR 100 each. The issued and paid-up share capital of SPOG is INR 734,55,67,980 comprising 1,06,06,798 ordinary shares of INR 10 each and 7,23,95,000 Preference Shares of INR 100 each.

b) CECL

CECL was incorporated as a limited liability company in Ghana under the Ghana Companies Act 1963 (Act 179) on 26 March 2013 under its present name. As at 14 June 2017, the authorised shares of CECL is GHC 1,000,000 and the stated and paid up capital is GHC 200,000.

The principal activity of CECL is the marketing of offshore field and support services.

(ii) Information on BASPG

BASPG was incorporated as a limited liability company in Ghana under the Companies Act, 1963 (Act 179) on 5 June 2017.

The authorised shares of BASPG is 1,000,000 and its issued shares is 223,000. The stated capital of BASPG is GHS 1,003,500. BASPG is 45% held by BAMHL, 45% held by SPOG and 10% held by CECL.

The principal activities of BASPG is floating, production, storage and offloading development.

3. RATIONALE FOR THE ESTABLISHMENT OF BASPG

The JV arrangement will enable the Bumi Armada Group to expand and carry out its business, as well as mitigate its financial and project risk exposure in respect of any FPSO project awarded, by leveraging on the parties’ strong history and experience in fabrication and construction related activities and the local experience.

4. EFFECTS OF THE ESTABLISHMENT OF BASPG

The establishment of BASPG will not have any effects on the issued and paid-up share capital of Bumi Armada and the substantial shareholdings in Bumi Armada.

The establishment of BASPG will not have any material effects on the earnings per share, net assets per share and gearing of the Group for the year ending 31 December 2017.

5. APPROVALS REQUIRED

The establishment of BASPG is not subject to the shareholders of Bumi Armada’s approval and/or any regulatory authorities.

6. INTERESTS OF DIRECTORS, MAJOR SHAREHOLDERS AND/OR PERSONS CONNECTED WITH THEM

Save as disclosed below, none of the Directors, major shareholders or persons connected with them has any interest, direct or indirect, in the establishment of BASPG.

Mr. Shapoor was previously a Non-Independent Non-Executive Director of Bumi Armada. He resigned from the Board on 21 February 2017. He is also a director and major shareholder of SPCL. Therefore, Mr. Shapoor is deemed to be interested in the establishment of BASPG by virtue of his directorship in Bumi Armada within the preceding 6 months of the date on which BASPG was established. As at the date of this announcement, Mr. Shapoor does not have any direct and/or indirect interest in Bumi Armada shares.

Mr Shapoor had abstained from deliberations and voting on the establishment of BASPG at the relevant Board meetings of Bumi Armada when he was still a director of Bumi Armada.

Mr Ravi Shankar Srinivasan who was the alternate director of Mr Shapoor, had also resigned from the Board on 21 February 2017, was also not involved in any deliberations and voting on the establishment of BASPG at the relevant Board meetings of Bumi Armada.

7. DIRECTORS’ STATEMENT

The Board (save for Mr Shapoor and Mr Ravi Shankar Srinivasan, who had abstained from all deliberations and voting on the establishment of BASPG), having considered all aspects of the establishment of BASPG, is of the opinion that the establishment of BASPG is in the best interest of Bumi Armada.

8. PERCENTAGE RATIO APPLICABLE TO THE ESTABLISHMENT OF THE JV COMPANY

The percentage ratio applicable to the establishment of BASPG pursuant to paragraph 10.02(g) of the LR is 0.008%, computed based on the audited consolidated financial statements of Bumi Armada for the financial year ended 31 December 2016.

This Announcement is dated 14 June 2017.

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 22-6-2017 05:31 AM

|

显示全部楼层

发表于 22-6-2017 05:31 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | KRONOLOGI ASIA BERHAD- PRESS RELEASE | We are pleased to attach a press release dated 21 June 2017 entitled “Kronologi Partners with ST Electronics to Establish Hong Kong Data Back-Up Centre and Extend Transnational Infrastructure".

This partnership between Kronologi and Singapore Technologies Electronics Limited (ST Electronics) to expand in Hong Kong as part of its strategy to deliver transnational (cross border) data backup solutions is made in the ordinary course of business of Kronologi.

None of the Directors and/or major shareholders of Kronologi and/or persons connected to them has any interest, direct or indirect, in this partnership.

This announcement is dated 21 June 2017. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5466541

|

|

|

|

|

|

|

|

|

|

|

|

发表于 28-7-2017 08:43 PM

|

显示全部楼层

发表于 28-7-2017 08:43 PM

|

显示全部楼层

本帖最后由 icy97 于 29-7-2017 06:58 AM 编辑

Krono亚洲次季净利飙涨逾一倍

Billy Toh/theedgemarkets.com

July 28, 2017 20:10 pm MYT

http://www.theedgemarkets.com/article/krono亚洲次季净利飙涨逾一倍

(吉隆坡28日讯)Krono亚洲(Kronologi Asia Bhd)截至2017年6月30日止的财政年次季(2017财年次季)净利跳涨逾一倍至410万令吉,相比上财年同季的170万令吉。

该集团次季营业额也从上财年同季的1480万令吉,飙涨227.1%至4830万令吉。

Krono亚洲代总执行长、技术总监兼执行董事张宗明表示:“业绩表现看涨归功于本集团成功收购Quantum Storage(印度)私人有限公司(QSI),外加近期遭受网络攻击后更加着重灾难复苏和业务连续性。我们将继续专注在亚洲推出跨国数据备份储存解决方案,为客户带来附加值,并协助他们减低业务中断的影响。”

Krono亚洲发布的一项新闻稿指出,即便当季的产品组合包含赚幅较低的产品,该集团的业绩增长持续受企业数据管理(EDM)基础建设业务的强劲活动所提振。

总结2017财年上半年的业绩表现,Krono亚洲的净利近乎翻倍至612万令吉,同期净赚307万令吉;营业额也从同期的2890万令吉,暴增154.3%至7350万令吉。

新加坡是该集团2017财年上半年的主要收入来源,占4680万令吉或63.6%的比重,其次是东南亚国家,一共占1070万令吉或14.6%的比重,而印度则为集团带来约810万令吉或11.1%的收入进账。

为了应付Krono亚洲的跨国数据备份解决方案推出的投资需求,该集团宣布私下配股计划,使集团能尽快筹措更多资金。

至于业务前景,Krono亚洲向大马交易所报备指,数据备份受电子邮件、员工、业务记录和法律文件等数据激增所推动。

“遵守更严格的条规和业务连续性需求,这些因素导致企业比以往任何时候都有需要保护他们的数据。”

鉴于上半年的业绩表现强稳,该集团预计,截至2017年12月31日止的财年(2017财年)业绩,或优于上财年的表现。

(编译:倪嫣鴽)

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2017 | 30 Jun 2016 | 30 Jun 2017 | 30 Jun 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 48,343 | 14,778 | 73,528 | 28,917 | | 2 | Profit/(loss) before tax | 4,918 | 1,590 | 6,553 | 3,213 | | 3 | Profit/(loss) for the period | 4,076 | 1,696 | 6,120 | 3,070 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 4,076 | 1,696 | 6,120 | 3,070 | | 5 | Basic earnings/(loss) per share (Subunit) | 1.54 | 0.72 | 2.31 | 1.30 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.2100 | 0.1900

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 30-7-2017 04:42 AM

|

显示全部楼层

发表于 30-7-2017 04:42 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|