|

|

发表于 26-5-2018 06:45 AM

|

显示全部楼层

发表于 26-5-2018 06:45 AM

|

显示全部楼层

本帖最后由 icy97 于 2-6-2018 07:04 AM 编辑

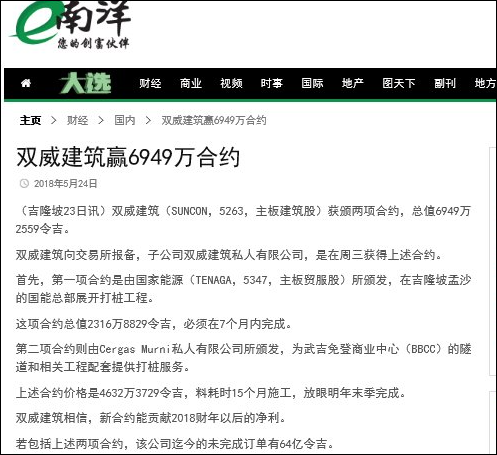

Type | Announcement | Subject | OTHERS | Description | SUNWAY CONSTRUCTION GROUP BERHAD ("SUNCON") - LETTER OF ACCEPTANCE ISSUED BY TENAGA NASIONAL BERHAD - LETTER OF AWARD ISSUED BY CERGAS MURNI SDN BHD | The Board of Directors of SunCon is pleased to announce that Sunway Construction Sdn Bhd (“SCSB”), a subsidiary of SunCon, and Sunway Geotechnics (M) Sdn Bhd (“SunGeo”), a subsidiary of SCSB, have on 23 May 2018, accepted the following Letter of Acceptance and Letter of Award:

(a) Letter of Acceptance issued by Tenaga Nasional Berhad SCSB has accepted a Letter of Acceptance issued by Tenaga Nasional Berhad in respect of the piling works for the project known as “TNB HQ Campus Development (Phase IIB) – Project Platinum Piling Works for the Construction and Completion of TNB Campus, at part of Lot 490 and Lot 6266, Jalan Bangsar, Kuala Lumpur” for a total contract sum of RM23,168,829.60 (“TNB Campus Piling Project”). The TNB Campus Piling Project shall be completed within 7 months from the date of commencement to be agreed upon between the parties.

(b) Letter of Award issued by Cergas Murni Sdn Bhd SunGeo has accepted a Letter of Award issued by Cergas Murni Sdn Bhd for the bored pile, micropile, soldier pile, deep soil mixing, temporary strutting system, temporary steel capping beam, temporary steel decking system for the Proposed Tunnel and Associated Works Package IF2 (Along Jalan Galloway, Jalan Hang Tuah and Jalan Changkat Thambi Dollah) in respect of the project known as “Proposed Mixed Development Comprising Shopping Centre, Office Space, Hotel, Entertainment Centre and Serviced Apartment on Lot PT152, PT153, PT154, PT155 and PT156 (formerly known as Lot PT143), Seksyen 56 at Jalan Hang Tuah/Jalan Pudu, Wilayah Persekutuan Kuala Lumpur for BBCC Development Sdn Bhd” for a total contract sum of RM46,323,729.62 (“BBCC Piling Project”). The BBCC Piling Project is for a period of 15 months and is expected to be completed by the fourth quarter of 2019.

The TNB Campus Piling Project and BBCC Piling Project (collectively referred to as the “Projects”) are expected to contribute positively to the earnings of SunCon Group from the financial year ending 31 December 2018 onwards.

Upon the award of the Projects, SunCon Group’s outstanding order book as at to-date amounts to RM6.4 billion.

The Projects are subject to normal construction risk of materials price fluctuation. However, with the past experiences and expertise of SCSB and SunGeo in construction and bore piling projects, this risk could be mitigated.

None of the directors or major shareholders of SunCon or persons connected to them has any interest, whether direct or indirect, in the Projects.

This announcement is dated 23 May 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 2-6-2018 07:39 AM

|

显示全部楼层

发表于 2-6-2018 07:39 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 4-6-2018 05:45 AM

|

显示全部楼层

发表于 4-6-2018 05:45 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 23-6-2018 05:31 AM

|

显示全部楼层

发表于 23-6-2018 05:31 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 21-7-2018 02:57 AM

|

显示全部楼层

发表于 21-7-2018 02:57 AM

|

显示全部楼层

本帖最后由 icy97 于 22-7-2018 02:04 AM 编辑

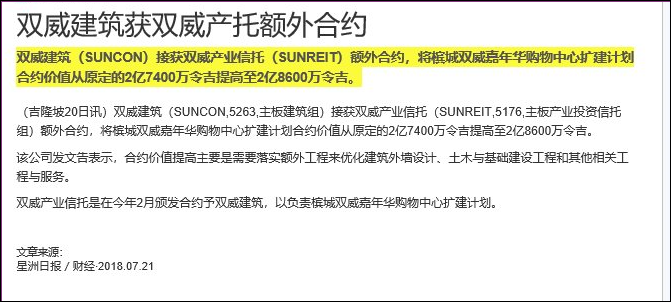

Type | Announcement | Subject | OTHERS | Description | SUNWAY CONSTRUCTION GROUP BERHAD ("SUNCON") - SUPPLEMENTAL LETTER OF AWARD BY SUNWAY REAL ESTATE INVESTMENT TRUST ("SUNWAY REIT") IN RELATION TO THE EXPANSION OF SUNWAY CARNIVAL SHOPPING MALL | We refer to our announcement dated 27 February 2018 (“Announcement”) in relation to the letter of award (“LOA”) by SA Architects Sdn Bhd (“SAA”), on behalf of Sunway REIT Management Sdn Bhd which acts as the Manager for Sunway REIT, appointing Sunway Construction Sdn Bhd ("SCSB"), a wholly-owned subsidiary of SunCon, as the project delivery partner for the Project. Unless otherwise stated, all definitions and terms used in this announcement shall have the same meaning as defined in the Announcement.

The Board of Directors of SunCon is pleased to announce that SCSB has on 20 July 2018, received a supplemental letter of award from SAA in respect of the Project whereby both parties have mutually agreed that the provisional contract sum of the Project be revised from RM274 million to RM286 million arising from the additional scope of works to further enhance the design of the external façade of the building, civil and infrastructure works and other related works and services. Save for the abovementioned amendment, all other terms and conditions of the LOA of the Project shall remain valid and in full force and effect.

This announcement is dated 20 July 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 28-7-2018 04:24 AM

|

显示全部楼层

发表于 28-7-2018 04:24 AM

|

显示全部楼层

本帖最后由 icy97 于 29-7-2018 02:00 AM 编辑

icy97 发表于 31-1-2018 01:07 AM

双威建筑与新加坡上市公司联手标地

Emir Zainul/theedgemarkets.com

January 30, 2018 20:21 pm +08

(吉隆坡30日讯)双威建筑(Sunway Construction Group Bhd)与新加坡上市的丰隆亚洲有限公司(Hong Leong A ...

Type | Announcement | Subject | OTHERS | Description | SUNWAY CONSTRUCTION GROUP BERHAD ("SUNCON")- LETTER OF AWARD FROM THE BUILDING AND CONSTRUCTION AUTHORITY OF SINGAPORE TO HL-SUNWAY JV PTE LTD | We refer to our announcement dated 30 January 2018 in relation to the establishment of a joint venture company, namely HL-Sunway JV Pte Ltd (“HL-Sunway JV”), by Sunway Concrete Products (S) Pte Ltd (“SCPS”) (49%), an indirect wholly-owned subsidiary of SunCon, and HL Building Materials Pte Ltd (51%), a subsidiary of Hong Leong Asia Ltd, for the purpose of tendering for a lease of land in Singapore from the Building and Construction Authority of Singapore (“BCA”).

The Board of Directors of SunCon is pleased to announce that HL-Sunway JV has, on 27 July 2018, won the bid for the lease of land (the “Land”) for the development of the Integrated Construction Prefabrication Hub (“ICPH”) from BCA. The Land is located at Pulau Punggol Barat and is approximately 38,421.8 square meters. The lease term for the Land is 30 years started from July 2018. The total consideration for the Land is approximately SGD25.7 million comprising the land price and administrative fees. The said consideration will be borne by the joint venture parties proportionately.

The plans are to build a fully mechanized, state of the art integrated precast plant (the “Plant”), on the Land, with an expected annual production capacity of 100,000 cubic meters of concrete products. The construction of the Plant is expected to commence in August 2018, subject to the approval of the relevant authorities.

The investment in the Land and the construction of the Plant (“Investment”) will fully mechanize SunCon’s precast facility, improve productivity and reduce reliance on foreign workers. The Investment ensures SunCon’s precast division’s continued presence in Singapore and is also in line with the Singapore Government’s goal of enhanced mechanization to improve productivity.

SCPS expects to fund the Investment by a combination of internal funds and bank borrowings.

The Investment will not have any effect on the share capital and substantial shareholders’ shareholding of SunCon as it does not involve any allotment or issuance of new shares by SunCon.

The Investment is not expected to have any immediate material effect on the earnings per share, net assets per share and gearing of SunCon for the financial year ending 31 December 2018. However, the Investment is expected to contribute positively to the future earnings of SunCon Group upon completion of the Investment in 3 years’ time.

None of the directors or major shareholders of SunCon or persons connected to them has any interest, whether direct or indirect, in the Investment.

This announcement is dated 27 July 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 31-7-2018 05:27 AM

|

显示全部楼层

发表于 31-7-2018 05:27 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 3-8-2018 12:45 AM

|

显示全部楼层

发表于 3-8-2018 12:45 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | SUNWAY CONSTRUCTION GROUP BERHAD ("SUNCON")- TARGETED DATE OF RELEASE OF UNAUDITED FINANCIAL RESULTS FOR THE SECOND QUARTER ENDED 30 JUNE 2018 | We wish to announce that SunCon targets to release its unaudited financial results for the second quarter ended 30 June 2018 after 5.00 p.m. on Thursday, 16 August 2018.

This announcement is dated 2 August 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 8-8-2018 03:05 AM

|

显示全部楼层

发表于 8-8-2018 03:05 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 17-8-2018 03:06 AM

|

显示全部楼层

发表于 17-8-2018 03:06 AM

|

显示全部楼层

本帖最后由 icy97 于 17-8-2018 06:40 AM 编辑

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2018 | 30 Jun 2017 | 30 Jun 2018 | 30 Jun 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 544,275 | 417,232 | 1,073,503 | 836,763 | | 2 | Profit/(loss) before tax | 45,168 | 41,902 | 88,872 | 85,201 | | 3 | Profit/(loss) for the period | 35,878 | 35,832 | 71,701 | 69,613 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 35,857 | 35,897 | 71,707 | 69,691 | | 5 | Basic earnings/(loss) per share (Subunit) | 2.78 | 2.78 | 5.55 | 5.39 | | 6 | Proposed/Declared dividend per share (Subunit) | 3.50 | 3.00 | 3.50 | 3.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.4400 | 0.4200

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 17-8-2018 05:03 AM

|

显示全部楼层

发表于 17-8-2018 05:03 AM

|

显示全部楼层

EX-date | 05 Sep 2018 | Entitlement date | 07 Sep 2018 | Entitlement time | 05:00 PM | Entitlement subject | First Interim Dividend | Entitlement description | First interim single tier dividend of 3.5 cents per ordinary share for the financial year ending 31 December 2018 | Period of interest payment | to | Financial Year End | 31 Dec 2018 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | SUNWAY MANAGEMENT SDN BHDLevel 16, Menara SunwayJalan Lagoon TimurBandar Sunway47500 Subang JayaSelangor Darul EhsanTel: 03-56398889Fax: 03-56399507 | Payment date | 27 Sep 2018 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 07 Sep 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.035 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 18-8-2018 06:32 AM

|

显示全部楼层

发表于 18-8-2018 06:32 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 4-10-2018 02:44 AM

|

显示全部楼层

发表于 4-10-2018 02:44 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | SUNWAY CONSTRUCTION GROUP BERHAD ("SUNCON" OR "COMPANY") - TERMINATION OF SUNWAY GEOTECHNICS (M) SDN BHD - BAUER (MALAYSIA) SDN BHD JOINT VENTURE | 1. INTRODUCTION The Board of Directors of SunCon wish to announce that Sunway Geotechnics (M) Sdn Bhd (“SunGeo”), a wholly owned subsidiary of Sunway Construction Sdn Bhd, which in turn is a wholly owned subsidiary of the Company has on 2 October 2018, signed a letter of termination (“Termination Letter”) with Bauer (Malaysia) Sdn Bhd (“Bauer”) to terminate its unincorporated joint venture with Bauer, namely Sunway Geotechnics (M) Sdn Bhd – Bauer (Malaysia) Sdn Bhd Joint Venture (“SunGeo-Bauer JV”). This is in view of the completion of the works known as the Bored Piling Works, Installation of Plunge in Column and associated ancillary works forming part of “Package 2 : Construction and Completion of Piling and Sub-Structure Works and Associated Works for the Proposed Mixed Commercial Development for Lot 185 and Lot 167(K) at Persiaran KLCC, Kuala Lumpur City Centre” (“Works”).

2. INFORMATION ON SUNGEO, BAUER AND SUNGEO-BAUER JV 2.1 SunGeo SunGeo is a company incorporated in Malaysia and having its registered office at Level 16, Menara Sunway, Jalan Lagoon Timur, Bandar Sunway, 47500 Subang Jaya, Selangor Darul Ehsan. The total share capital of SunGeo is RM2,909,602.00 comprising 2,500,001 ordinary shares. 2.2 Bauer Bauer is a company incorporated in Malaysia and having its registered office at No. 43 (First Floor), Jalan Sarikei Off Jalan Pahang, Kuala Lumpur, 53000 Wilayah Persekutuan. The total share capital of Bauer is RM66,764,400.00 comprising 66,764,400 ordinary shares. 2.3 SunGeo-Bauer JV SunGeo-Bauer JV was established pursuant to a Joint Venture Agreement dated 26 July 2013 (“JV Agreement”) entered into between SunGeo and Bauer to jointly carry out the Works.

3. BACKGROUND OF JOINT VENTURE AGREEMENT SunGeo had on 26 July 2013 entered into the JV Agreement with Bauer to form an unincorporated joint venture, namely SunGeo-Bauer JV, to jointly carry out the Works. Upon completion of the Works, the parties have fulfilled all their duties, obligations and undertakings under the JV Agreement.

4. RATIONALE FOR THE TERMINATION In view of the completion of the Works, the parties have mutually agreed to terminate the JV Agreement.

5. EFFECTS OF THE TERMINATION The termination of the JV Agreement has no material effect on SunCon’s earnings per share and net assets per share. There will be no effect on the share capital and substantial shareholders’ shareholding of SunCon.

6. APPROVAL REQUIRED The termination of the JV Agreement does not require approval from the shareholders of SunCon or any authorities.

7. DIRECTORS’ AND MAJOR SHAREHOLDERS’ INTERESTS Insofar as the Directors are aware, none of the Directors or major shareholders of SunCon or persons connected with them has any interest, whether direct or indirect, in the termination of the JV Agreement.

This announcement is dated 2 October 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 18-10-2018 05:18 AM

|

显示全部楼层

发表于 18-10-2018 05:18 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | SUNWAY CONSTRUCTION GROUP BERHAD ("SUNCON") - INTERNAL REORGANISATION OF GROUP STRUCTURE | We wish to announce that pursuant to Chapter 9, Paragraph 9.19(5) of the Main Market Listing Requirements of Bursa Malaysia Securities Berhad, Sunway Construction Sdn Bhd (“SCSB”), a wholly-owned subsidiary of the Company had on 9 October 2018, acquired 100,000 ordinary shares, representing 100% of the total issued and paid-up share capital of Sunway SK Sdn Bhd (“SSSB”) from Sunway Machineries Services Sdn Bhd (“SMSSB”), which in turn is a wholly-owned subsidiary of SCSB, for a total cash consideration of RM1/- (“Internal Reorganisation”). SCSB has only received the Exemption Certificate dated 9 October 2018 issued by the Inland Revenue Board of Malaysia today.

SCSB was incorporated on 26 April 1976 and its issued and paid-up share capital is RM232,469,000 comprising 193,954,000 ordinary shares. The principal activities of SCSB are turnkey, construction related design and build, civil engineering and building works, and transporation agent.

SSSB was incorporated on 11 January 1997 and its issued and paid-up share capital is RM1,405,700/- comprising 100,000 ordinary shares and 1,180,000 non-cumulative redeemable preference shares. The principal activities of SSSB are construction of building and civil works.

SMSSB was incorporated on 3 February 1994 and its issued and paid-up share capital is RM1,500,000/- comprising 1,500,000 ordinary shares. The principal activity of SMSSB is investment holding.

Upon completion of the Internal Reorganisation, SSSB has become a direct subsidiary of SCSB.

The Internal Reorganisation is not expected to have any effect on the issued and paid-up capital of the Company or the Company’s substantial shareholders’ shareholdings or any material effect on the earnings, net assets or gearing of the Company on a consolidated basis.

None of the directors or major shareholders of the Company or persons connected with them has any interest, whether direct or indirect in the Internal Reorganisation.

This announcement is dated 17 October 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 22-10-2018 05:13 AM

|

显示全部楼层

发表于 22-10-2018 05:13 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 17-11-2018 08:08 AM

|

显示全部楼层

发表于 17-11-2018 08:08 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | SUNWAY CONSTRUCTION GROUP BERHAD ("SUNCON")- TARGETED DATE OF RELEASE OF UNAUDITED FINANCIAL RESULTS FOR THE THIRD QUARTER ENDED 30 SEPTEMBER 2018 | We wish to announce that SunCon targets to release its unaudited financial results for the third quarter ended 30 September 2018 after 5.00 p.m. on Monday, 19 November 2018.

This announcement is dated 5 November 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 27-11-2018 03:38 AM

|

显示全部楼层

发表于 27-11-2018 03:38 AM

|

显示全部楼层

本帖最后由 icy97 于 13-12-2018 08:23 AM 编辑

双威建筑获3.52亿合约-兴建伟乐2商业项目

http://www.enanyang.my/news/20181114/双威建筑获3-52亿合约br-兴建伟乐2商业项目/

Type | Announcement | Subject | OTHERS | Description | SUNWAY CONSTRUCTION GROUP BERHAD ("SUNCON") - AWARD OF PROJECT BY AKITEK AKIPRIMA SDN BHD ON BEHALF OF SUNWAY VELOCITY TWO SDN BHD | The Board of Directors of SunCon is pleased to announce that Sunway Construction Sdn Bhd (“SCSB”), a wholly-owned subsidiary of SunCon, has on 13 November 2018, accepted the Letter of Award issued by Akitek Akiprima Sdn Bhd on behalf of Sunway Velocity Two Sdn Bhd (“SVTSB”), in respect of the Main Building and Associated External Works for the Proposed Commercial Development of Sunway Velocity Two – Plot A Project which contains the followings: - Phase 1A - Serviced Apartment of 53 storeys (Block B1) and Podium Carpark;

- Phase 1B - Serviced Apartment of 53 storeys (Block B2); and

- Phase 1C - Office Block of 28 storeys (Block A1)

on Lot No. 135 (PT 486 & PT 487), Jalan Peel, Seksyen 90, Bandar Kuala Lumpur, Wilayah Persekutuan Kuala Lumpur, for a total contract sum of RM352,057,869.94 (“Project”). SVTSB is an indirect subsidiary of Sunway Berhad (“Sunway”), which in turn is a major shareholder of SunCon.

The Project is for a period of 37 months from the date of commencement, i.e. 15 November 2018, and is expected to be completed by 14 December 2021. The Project is expected to contribute positively to the earnings of SunCon from the financial year ending 31 December 2019 onwards.

Upon securing the Project, SunCon’s new order book secured to-date amounts to RM1.35 billion.

The Project is subject to normal construction risk of materials price fluctuation. However, with the past experiences and expertise of SCSB in construction projects, this risk could be mitigated.

The Project is a related party transaction by virtue of Evan Cheah Yean Shin being a Director and major shareholder of SunCon as well as director of several subsidiaries and major shareholder of Sunway. Tan Sri Dato’ Seri Dr Jeffrey Cheah Fook Ling, Puan Sri Datin Seri (Dr) Susan Cheah Seok Cheng, Sarena Cheah Yean Tih, Adrian Cheah Yean Sun, Sungei Way Corporation Sdn Bhd and Active Equity Sdn Bhd are major shareholders of both SunCon and Sunway as well as person connected to Evan Cheah Yean Shin. Dato’ Chew Chee Kin is a Director of both SunCon and Sunway.

SunCon has obtained its shareholders’ mandate for such recurrent related party transactions entered into or to be entered into by SunCon and its subsidiaries with Sunway and its group of companies at its last annual general meeting held on 20 June 2018.

This announcement is dated 13 November 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 1-12-2018 07:15 AM

|

显示全部楼层

发表于 1-12-2018 07:15 AM

|

显示全部楼层

本帖最后由 icy97 于 17-12-2018 06:57 AM 编辑

双威建筑q3净利涨8%

http://www.enanyang.my/news/20181120/双威建筑q3净利涨8/

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2018 | 30 Sep 2017 | 30 Sep 2018 | 30 Sep 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 557,317 | 491,360 | 1,630,820 | 1,328,123 | | 2 | Profit/(loss) before tax | 46,927 | 42,206 | 135,799 | 127,407 | | 3 | Profit/(loss) for the period | 36,501 | 33,612 | 108,202 | 103,225 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 36,413 | 33,720 | 108,120 | 103,411 | | 5 | Basic earnings/(loss) per share (Subunit) | 2.82 | 2.61 | 8.37 | 8.00 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 3.00 | 3.50 | 3.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.4300 | 0.4200

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 14-12-2018 03:01 AM

|

显示全部楼层

发表于 14-12-2018 03:01 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 17-12-2018 08:12 AM

|

显示全部楼层

发表于 17-12-2018 08:12 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|