|

查看: 1395|回复: 52

|

FCPO & FKLI赢家交易系统-将输家变赢家!!! (免费分享)

[复制链接]

|

|

|

本帖最后由 VTTS 于 11-4-2019 10:06 AM 编辑

FCPO & FKLI 日内交易信息和系统

有兴趣者,请安装Telegram (Android/Apple) 软件和按下面连接以加入channel.

https://t.me/joinchat/AAAAAFEkkLC3iYLuqmOmrA

本人也是—位拥有超过十年的交易经验期货和股票经记。

有兴趣学习交易朋友者,愿免费分享我们的赢家交易系统。没有收费,志在建立长期的交易伙伴团队

欢迎有兴趣—起讨论和交易的朋友,可以私底下联络我.

请大家多多指教!! 谢谢

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 21-3-2019 10:33 PM

|

显示全部楼层

本帖最后由 VTTS 于 23-3-2019 09:38 AM 编辑

[img] [/img] [/img]

Victory Trade System 赢家交易糸统

这套交易策略,主要是顺势,找转拆点(turning point) 进出场,假如出现背离,就斩仓,跟主趋势方向做单。

卖点1: 主趋势:尽量避免跟主趋势唱反调(太多的交易者为了捉高和底,跟主趋势唱了反调也不知道)

卖点2: VT Cloud/Trend (经过改良的Ichimoku)次趋势的碌色和红色线(云), 让我们直接从蜡烛图看到a) 跌破支撑 b) 冲破阻力

因而得益于捕捉到70-80%机率的高点和底点。当背离出现时,并且将损失减至最底。

卖点3: VT Stochastic (经过改良的Stochastic), 保持了原有的迅速反应,同时减少一些缺陷的讯息。提醒我们准备进场买在底点,卖在高点.

卖点4: VT Momentum (经过改良的MACD/Awesome Oscillator), 将原有的"慢速"功能提升至最快速,也完全去除了之前因为快速而出现的错误讯号.让我们看到价钱的动力转强和转弱,而选择进出场。

这些新的指标,都是用BursaStation 语言编写的"新的方程式",这使我们在一般交易软件上跳出了只能更改"参数 (Parameter)"的限制。

用原有的方程式,使我们面对了,用了太敏捷的参数,面对太多的错误讯号。改去不太敏捷的参数,又面对错失进出场的好时机。就这样我也跟大多数的交易者一样,花了多年的时间不断的更换参数和指标。结果,在"live" 交易里还是没找到须要的东西.

最后,再强调技术指标为次,交易策略为主.

技术指标是死的(方程式), 但价钱波动是活的,只有好的交易策略才能应对随时出现的突发歨势。

本人也是—位拥有超过十年的交易经验期货和股票经记。

欢迎有兴趣—起讨论和交易的朋友,可以私底下联络我.

请大家多多指教!

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 22-3-2019 10:19 PM

|

显示全部楼层

本帖最后由 VTTS 于 22-3-2019 10:23 PM 编辑

[img]%5Burl=https://postimages.org/%5D [/url][/img] [/url][/img]

系统在19&20日,捕捉到FKLI 可能回调,没想到下跌那么够力!

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 24-3-2019 11:35 AM

|

显示全部楼层

本帖最后由 VTTS 于 24-3-2019 11:44 AM 编辑

1) Main Trend (主趋势)�Red span with dot line : Down trend (下跌)

2) Secondary Trend (次趋势)�Red span: Down trend (下跌)

3) VT Stoc (36):�Continue going down(下跌)

4) VT Momentum :�Price going down strength continue. Continue monitor the divergence (下跌)

Disclaimers: All the above information Not the recommendations to buy or sell and for education only. Trade at your own risk.

免责声明:以上所有讯息纯粹为教育,不含任何买卖建议。买卖后果自负。

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 28-3-2019 09:09 AM

|

显示全部楼层

本帖最后由 VTTS 于 28-3-2019 09:20 AM 编辑

FCPO Jun daily chart

1) Main Trend (主趋势):Red span with dot line : Down trend (下跌)

2) Secondary Trend (次趋势):Red span: Down trend (下跌)

3) VT Stoc (58): Continue going down (下跌)

4) VT Momentum: Price going down strength continue. Continue monitor the divergence

(下跌)

Disclaimers: All the above information Not the recommendations to buy or sell and for education only. Trade at your own risk.

免责声明:以上所有讯息纯粹为教育,不含任何买卖建议。买卖后果自负 |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 28-3-2019 09:46 AM

|

显示全部楼层

本帖最后由 VTTS 于 28-3-2019 09:47 AM 编辑

FKLI Daily chart as on 20190328,9.30a.m

1) Main Trend (主趋势)�Red span with dot line : Down trend (下跌)

2) Secondary Trend (次趋势)�Red span: Down trend (下跌)�Candlestick cross over Red Span and now red span become support

3) VT Stoc (-0.194): Continue going up (上升): Divergence, and refer VT Momentum

4) VT Momentum :Going up (上升) : �divergence, need wait for cross over value 0 to confirm

Disclaimers: All the above information Not the recommendations to buy or sell and for education only. Trade at your own risk.

免责声明:以上所有讯息纯粹为教育,不含任何买卖建议。买卖后果自负

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 28-3-2019 11:20 PM

|

显示全部楼层

本帖最后由 VTTS 于 30-3-2019 11:18 AM 编辑

1) Main Trend (主趋势):Red span with dot line : Down trend (下跌) Become resistance zone for the price

2) Secondary Trend (次趋势) Red span: Down trend (下跌) Candlestick cross over Red Span and now red span become support

3) VT Stoc (-0.194): Continue going up (上升)

4) VT Momentum : Going up (上升)

Disclaimers: All the above information Not the recommendations to buy or sell and for education only. Trade at your own risk.

免责声明:以上所有讯息纯粹为教育,不含任何买卖建议。买卖后果自负 |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 28-3-2019 11:22 PM

|

显示全部楼层

1) Main Trend (主趋势) Red span with dot line : Down trend (下跌) Become resistance zone for the price

2) Secondary Trend (次趋势) Red span: Down trend (下跌) Become resistance zone for the price

3) VT Stoc (45): Continue going down (下跌)

4) VT Momentum : Price going down strength continue. Continue monitor the divergence

(下跌)

Disclaimers: All the above information Not the recommendations to buy or sell and for education only. Trade at your own risk.

免责声明:以上所有讯息纯粹为教育,不含任何买卖建议。买卖后果自负 |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 1-4-2019 11:24 PM

|

显示全部楼层

FCPO Jun19

1) Main Trend (主趋势)Red span with dot line : Down trend (下跌),Become resistance zone for the price

2) Secondary Trend (次趋势)�Red span: Down trend (下跌),But become Support zone for the price

3) VT Stoc (28):�Continue going down (下跌)

4) VT Momentum : Go up (上升)

Disclaimers: All the above information Not the recommendations to buy or sell and for education only. Trade at your own risk.

免责声明:以上所有讯息纯粹为教育,不含任何买卖建议。买卖后果自负

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 2-4-2019 02:07 PM

|

显示全部楼层

FKLI Apr

1) Main Trend (主趋势)�Red span with dot line : Down trend (下跌)�Become resistance zone for the price

2) Secondary Trend (次趋势)�Neutral: Sideway(横摆)�Candlestick cross over Red Span and now Neutral Span become support

3) VT Stoc (8.6):�Continue going down (下跌)

4) VT Momentum : Going up (上升), Divergence (背离)

Disclaimers: All the above information Not the recommendations to buy or sell and for education only. Trade at your own risk.

免责声明:以上所有讯息纯粹为教育,不含任何买卖建议。买卖后果自负

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 3-4-2019 10:21 AM

|

显示全部楼层

FCPO Jun19

1) Main Trend (主趋势)Red span with dot line : Down trend (下跌)Become resistance zone for the price

2) Secondary Trend (次趋势) – VT Trend�Red span: Up trend (上升)But become Support zone for the price

3) VT Stoc (20): Continue going up (上升)

4) VT Momentum : Go up (上升)

Disclaimers: All the above information Not the recommendations to buy or sell and for education only. Trade at your own risk.

免责声明:以上所有讯息纯粹为教育,不含任何买卖建议。买卖后果自负

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 4-4-2019 10:03 AM

|

显示全部楼层

FCPO Jun19

1) Main Trend (主趋势)Red span with dot line : Down trend (下跌)Red span Become Support zone for the price

2) Secondary Trend (次趋势) – VT TrendGreen Span: Up trend (上升) But become Support zone for the price

3) VT Stoc (51) ontinue going up (上升) ontinue going up (上升)

4) VT Momentum : Go up (上升)

Disclaimers: All the above information Not the recommendations to buy or sell and for education only. Trade at your own risk.

免责声明:以上所有讯息纯粹为教育,不含任何买卖建议。买卖后果自负 |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 5-4-2019 10:07 AM

|

显示全部楼层

FCPO Jun19

1) Main Trend (主趋势)Red span with dot line : Down trend (下跌)Red span Become Support zone for the price

2) Secondary Trend (次趋势) – VT TrendGreen Span: Up trend (上升)But become Support zone for the price

3) VT Stoc (78) ontinue going up (上升) ontinue going up (上升)

4) VT Momentum : Go up (上升)

Anyone interested to open the Future trading account or get the best commission rate and my whatsApp me/Telegram contact: 011-5899 4667

假如读者有兴趣想要交易期货或寻找更便宜的交易佣金,可以联络我的WhatsApp/Telegram 011-5899 4667

Disclaimers: All the above information Not the recommendations to buy or sell and for education only. Trade at your own risk.

免责声明:以上所有讯息纯粹为教育,不含任何买卖建议。买卖后果自负

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 6-4-2019 11:37 PM

|

显示全部楼层

FCPO Jun19, as on 5 Apr

1) Main Trend (主趋势) Green span with dot line : Up trend (上升) Green span become Strong Support zone for the price

2) Secondary Trend (次趋势) – VT Trend : Green Span: Up trend (上升) – Price close inside green cloud. Top of green cloud become resistance & bottom green cloud become support

3) VT Stoc (98):�Continue going up (上升), with pull back risk or divergence

4) VT Momentum : Go up (上升)

假如读者有兴趣想要交易期货或寻找更便宜的交易佣金,可以联络我的WhatsApp/Telegram 011-5899 4667

If anyone interested to open the Future trading account or looking for the cheaper commission rate offer and please text my whatsApp /Telegram contact: 011-5899 4667

Disclaimers: All the above information Not the recommendations to buy or sell and for education only. Trade at your own risk.

免责声明:以上所有讯息纯粹为教育,不含任何买卖建议。买卖后果自负 |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 8-4-2019 04:45 PM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 8-4-2019 11:17 PM

|

显示全部楼层

PREVIEW-Malaysia March palm oil stocks to come in at 5-mth low -Reuters survey

* March stocks expected down 6.4 pct at 2.85 mln T -survey

* Output to show a 6.8 pct rise to 1.65 mln T -survey

* Exports estimated up 23.4 pct at 1.63 mln T -survey

* Malaysian Palm Oil Board data due on April 10

By Emily Chow

KUALA LUMPUR, April 5 (Reuters) - Malaysia's palm oil stockpiles likely dropped during March to less than 3 million tonnes and the lowest mark in five months, according to a Reuters survey, as a hefty jump in exports outpaced production

gains.

March inventories in Malaysia, the world's second-largest palm oil producer and exporter, are expected to have fallen 6.4 percent from February to 2.85 million tonnes, the lowest since October 2018, based on the median estimate of eight planters, traders and analysts polled by Reuters. MYPOMS-TPO

A confirmed dip in the stockpiles would support benchmark palm oil prices, which hit a three-month low in March before recovering on expectations of firmer demand.

Palm prices closed 1.3 percent higher on Thursday, at 2,204 ringgit ($540.06) a tonne at the close of trade.

The expected ease in inventories was attributed to stocking activities and demand ahead of Ramadan, the Muslim fasting month that begins in early May this year and which sees devotees break day-long fasts with communal feasting. This increases palm oil use for food and cooking.

Importers typically stock up on the edible oil one to two months ahead of the festival.

Palm oil shipments from Malaysia are pegged to come in at 1.63 million tonnes for March, a 23.4 percent rise from the previous month. The monthly gain, if confirmed by official data, would be the strongest in six months. MYPOME-PO

"The low crude palm oil price environment triggered major restocking – buyers realized CPO prices were undervalued versus

other edible oils," said William Simadiputra, an analyst at DBS Vickers Securities.

Benchmark palm oil prices averaged 2,124 ringgit a tonne in March, the lowest in three months.

Output in March is expected to have risen for its first gain after four months of declines. Survey respondents estimated that output rose 6.8 percent from February to 1.65 million tonnes.

This would be the highest for March for Malaysia in Refinitiv Eikon records back to January 2000. MYPOMP-CPOTT

"Our survey revealed that estates in Sarawak posted lower output on a month-on-month basis while Sabah and Peninsular Malaysia estates posted higher production," said Ivy Ng, regional head of plantations research at CIMB Investment Bank.

Official palm oil data will be published by the Malaysian Palm Oil Board ‪after 0430 GMT on April 10.

The median results from the Reuters survey put Malaysia's consumption in March at 270,493 tonnes.

Breakdown of March estimates (in tonnes):

Range Median

Production 1,571,000 - 1,684,000 1,650,000

Exports 1,550,000 - 1,760,000 1,630,000

Imports 50,000 - 75,000 55,000

Closing Stocks 2,713,000 - 2,900,000 2,850,000

* Official stocks of 3,045,493 tonnes in February plus the above estimated output and imports yield a total March supply of 4,750,493 tonnes. Based on the median of exports and closing stocks estimate, Malaysia's domestic consumption in March is

estimated to be 270,493 tonnes.

($1 = 4.0810 ringgit)

(Reporting by Emily Chow; Editing by Tom Hogue) |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 8-4-2019 11:20 PM

|

显示全部楼层

FCPO Jun19

1) Main Trend (主趋势) Green span with dot line : Up trend (上升) Green span become Strong Support zone for the price

2) Secondary Trend (次趋势) – VT Trend Green Span: Up trend (上升) – Price close below green cloud. Now green cloud become “resistance” of the price

3) VT Stoc (105): Slow down & will turn down (下跌), start pull back/Retrace

4) VT Momentum : Go down (下跌)

假如读者有兴趣想要交易期货或寻找更便宜的交易佣金,可以联络我的WhatsApp/Telegram 011-5899 4667

If anyone interested to open the Future trading account or looking for the cheaper commission rate offer and please text my whatsApp /Telegram contact: 011-5899 4667

Disclaimers: All the above information Not the recommendations to buy or sell and for education only. Trade at your own risk.

免责声明:以上所有讯息纯粹为教育,不含任何买卖建议。买卖后果自负

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 9-4-2019 10:10 AM

|

显示全部楼层

MPOA CPO Production 1-31 Mar vs. 1-28 Feb 2019

Peninsular Malaysia : + 2.19%

East Malaysia : +3.14%

Malaysia : + 2.53%

Palm Oil Analytics |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 9-4-2019 11:09 PM

|

显示全部楼层

本帖最后由 VTTS 于 9-4-2019 11:10 PM 编辑

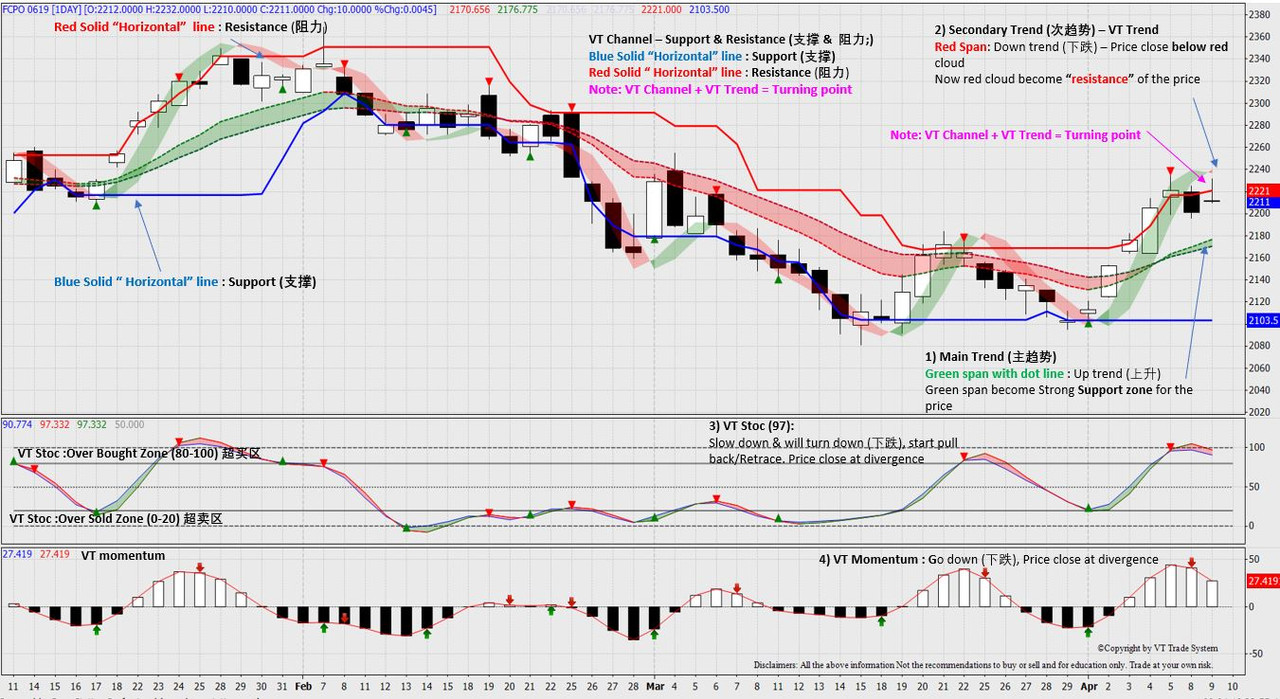

FCPO Jun19, 9 Apr

1) Main Trend (主趋势) Green span with dot line : Up trend (上升) Green span become Strong Support zone for the price

2) Secondary Trend (次趋势) – VT Trend. Red Span: Down trend (下跌) – Price close below red cloud. Now red cloud become “resistance” of the price

3) VT Stoc (97): Slow down & will turn down (下跌), start pull back/Retrace. Price close at divergence

4) VT Momentum : Go down (下跌), Price close at divergence

假如读者有兴趣想要交易期货或寻找更便宜的交易佣金,可以联络我的WhatsApp/Telegram 011-5899 4667

If anyone interested to open the Future trading account or looking for the cheaper commission rate offer and please text my whatsApp /Telegram contact: 011-5899 4667

Disclaimers: All the above information Not the recommendations to buy or sell and for education only. Trade at your own risk.

免责声明:以上所有讯息纯粹为教育,不含任何买卖建议。买卖后果自 |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 9-4-2019 11:26 PM

|

显示全部楼层

本帖最后由 VTTS 于 10-4-2019 09:47 PM 编辑

FKLI, 9 Apr

1) Main Trend (主趋势) Red span with dot line : down trend(下跌) Red spanbecome Strong Resistance zone forthe price 2) Secondary Trend (次趋势)– VT Trend RedSpan own trend (下跌) –Price closebelow redcloud Now red cloud become “resistance”ofthe price own trend (下跌) –Price closebelow redcloud Now red cloud become “resistance”ofthe price 3) VT Stoc (64):Slow down & will turn down (下跌), start pull back/Retrace

4) VT Momentum : Go down (下跌

假如读者有兴趣想要交易期货或寻找更便宜的交易佣金,可以联络我的WhatsApp/Telegram 011-5899 4667

If anyone interested to open the Future trading account or looking for the cheaper commission rate offer and please text my whatsApp /Telegram contact: 011-5899 4667

Disclaimers: All the above information Not the recommendations to buy or sell and for education only. Trade at your own risk.

免责声明:以上所有讯息纯粹为教育,不含任何买卖建议。买卖后果自负 |

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|