|

|

发表于 31-12-2015 04:49 PM

|

显示全部楼层

发表于 31-12-2015 04:49 PM

|

显示全部楼层

| PENTAMASTER CORPORATION BERHAD |

| 1. Details of Corporate Proposal | Involve issuance of new type/class of securities ? | No | Types of corporate proposal | Private Placement | Details of corporate proposal | PROPOSED PRIVATE PLACEMENT OF UP TO 10% OF THE ISSUED AND PAID-UP SHARE CAPITAL OF PENTAMASTER ("PLACEMENT SHARES"), TO THIRD PARTY INVESTOR(S) TO BE IDENTIFIED AND AT AN ISSUE PRICE TO BE DETERMINED LATER | No. of shares issued under this corporate proposal | 3,997,300 | Issue price per share ($$) | Malaysian Ringgit (MYR) 0.6700 | Par Value ($$) | Malaysian Ringgit (MYR) 0.500 | | Latest issued and paid up share capital after the above corporate proposal in the following | Units | 137,240,350 | Currency | Malaysian Ringgit (MYR) 68,620,175.000 | Listing Date | 31 Dec 2015 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 21-1-2016 11:48 AM

|

显示全部楼层

发表于 21-1-2016 11:48 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 3-2-2016 06:56 PM

|

显示全部楼层

发表于 3-2-2016 06:56 PM

|

显示全部楼层

新手

好奇问一下各位前辈

全年季度报告显示都有在赚钱

可是看回记录 都没派息

其实这样是正常的吗?

也想问一下 最新的季度报告是不是快出了呢?

谢谢 |

|

|

|

|

|

|

|

|

|

|

|

发表于 23-2-2016 11:18 PM

|

显示全部楼层

发表于 23-2-2016 11:18 PM

|

显示全部楼层

本帖最后由 icy97 于 23-2-2016 11:27 PM 编辑

| 7160 | | Quarterly rpt on consolidated results for the financial period ended 31/12/2015 | | Quarter: | 4th Quarter | | Financial Year End: | 31/12/2015 | | Report Status: | Unaudited | | Submitted By: |

|

|

| Current Year Quarter | Preceding Year Corresponding Quarter | Current Year to Date | Preceding Year Corresponding Period |

| 31/12/2015 | 31/12/2014 | 31/12/2015 | 31/12/2014 |

| RM '000 | RM '000 | RM '000 | RM '000 | | 1 | Revenue | 19,256 | 22,293 | 83,604 | 81,047 | | 2 | Profit/Loss Before Tax | 2,411 | 3,109 | 14,682 | 7,352 | | 3 | Profit/Loss After Tax and Minority Interest | 1,482 | 2,114 | 11,953 | 4,532 | | 4 | Net Profit/Loss For The Period | 1,648 | 2,527 | 12,290 | 6,043 | | 5 | Basic Earnings/Loss Per Shares (sen) | 1.11 | 1.59 | 8.97 | 3.40 | | 6 | Dividend Per Share (sen) | 0.00 | 0.00 | 0.00 | 0.00 |

|

|

| As At End of Current Quarter | As At Preceding Financial Year End | | 7 | Net Assets Per Share (RM) |

|

| 0.5540 | 0.4612 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 24-2-2016 04:35 PM

|

显示全部楼层

发表于 24-2-2016 04:35 PM

|

显示全部楼层

本帖最后由 icy97 于 24-2-2016 04:47 PM 编辑

斤经济较:Penta是去是留?

TUESDAY, 23 FEBRUARY 2016

http://moonitez89.blogspot.my/2016/02/penta.html

刚刚Penta出了季报,

总共包含了3大特点,

1预期1悲1喜

预期的部分在于

Automated equipment 的revenue稍微下跌,

主要是因为有一部分的业绩defer去下一个季度,

已经有两个季度的业绩defer去下一个季度,

如果属实那么下个季度就会爆发。

悲的部分在于

Automated manufacturing solution又在由盈转亏,

这个部门其实margin比automated equipment高,

本来对它蛮有希望的,

但是这一季的业绩太失望了。

喜的部分在于

新的部门Smart Control Solution System竟然大有斩获,

Revenue虽然才RM2.9m,

PBT却有RM2.2m,

Profit margin非常高,

如果可以继续成长,

应该蛮有前途。

季报里面提到:

“The Smart Manufacturing System is based on Internet

of Things, vision technologies and automated robotic system to radically

improve efficiency and visibility in manufacturing.”

总的来说,

投资于Penta的风险很大,

全部都集中在管理层的能力和诚信,

下一季的业绩就是关键,

成的话大涨,

败的话就大跌,

我就守着票看管理层的表演。。 |

|

|

|

|

|

|

|

|

|

|

|

发表于 22-3-2016 03:58 AM

|

显示全部楼层

发表于 22-3-2016 03:58 AM

|

显示全部楼层

Type | Announcement | Subject | NEW ISSUE OF SECURITIES (CHAPTER 6 OF LISTING REQUIREMENTS)

FUND RAISING | Description | PENTAMASTER CORPORATION BERHAD ("PENTAMASTER" OR "COMPANY")PROPOSED PRIVATE PLACEMENT OF UP TO 10% OF THE ISSUED AND PAID-UP SHARE CAPITAL OF PENTAMASTER, TO THIRD PARTY INVESTOR(S) TO BE IDENTIFIED AND AT AN ISSUE PRICE TO BE DETERMINED LATER | We refer to the announcements made on 9 September 2015, 15 September 2015, 8 October 2015 and 29 December 2015 in relation to the Proposed Private Placement (“Announcements”). Unless otherwise defined, the definitions set out in the Announcements shall apply herein.

On behalf of the Board of Pentamaster, Affin Hwang IB wishes to announce that the Board has on 21 March 2016 (“Price-fixing Date”) fixed the issue price for the second tranche of the Proposed Private Placement comprising 5,329,700 Placement Shares at RM0.546 per Placement Share (“Issue Price”).

The Issue Price represents a discount of approximately RM0.0598 or 9.87% to the five (5)-day volume weighted average market price of the Pentamaster Shares up to and including 18 March 2016, being the last market day immediately preceding the Price-fixing Date of RM 0.6058 per Pentamaster Share.

This announcement is dated 21 March 2016. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 29-3-2016 03:56 AM

|

显示全部楼层

发表于 29-3-2016 03:56 AM

|

显示全部楼层

| PENTAMASTER CORPORATION BERHAD |

| 1. Details of Corporate Proposal | Involve issuance of new type/class of securities ? | No | Types of corporate proposal | Private Placement | Details of corporate proposal | PROPOSED PRIVATE PLACEMENT OF UP TO 10% OF THE ISSUED AND PAID-UP SHARE CAPITAL OF PENTAMASTER ("PLACEMENT SHARES"), TO THIRD PARTY INVESTOR(S) TO BE IDENTIFIED AND AT AN ISSUE PRICE TO BE DETERMINED LATER | No. of shares issued under this corporate proposal | 5,329,700 | Issue price per share ($$) | Malaysian Ringgit (MYR) 0.5460 | Par Value ($$) | Malaysian Ringgit (MYR) 0.500 | | Latest issued and paid up share capital after the above corporate proposal in the following | Units | 142,570,050 | Currency | Malaysian Ringgit (MYR) 71,285,025.000 | Listing Date | 29 Mar 2016 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 8-4-2016 02:53 AM

|

显示全部楼层

发表于 8-4-2016 02:53 AM

|

显示全部楼层

Type | Announcement | Subject | NEW ISSUE OF SECURITIES (CHAPTER 6 OF LISTING REQUIREMENTS)

FUND RAISING | Description | PENTAMASTER CORPORATION BERHAD ("PENTAMASTER" OR "COMPANY")PROPOSED PRIVATE PLACEMENT OF UP TO 10% OF THE ISSUED AND PAID-UP SHARE CAPITAL OF PENTAMASTER, TO THIRD PARTY INVESTOR(S) TO BE IDENTIFIED AND AT AN ISSUE PRICE TO BE DETERMINED LATER | We refer to the announcements made on 9 September 2015, 15 September 2015, 8 October 2015, 29 December 2015, 21 March 2016 and 23 March 2016 in relation to the Proposed Private Placement ("Announcements"). Unless otherwise defined, the definitions set out in the Announcements shall apply herein.

On behalf of the Board of Pentamaster, Affin Hwang IB wishes to announce that Bursa Securities has approved the application for an extension of time of six (6) months from 7 April 2016 until 6 October 2016 to complete the implementation of the Proposed Private Placement. Further announcements in relation to the above will be made in due course in accordance with the Listing Requirements.

In addition, on behalf of the Board of Pentamaster, Affin Hwang IB also wishes to announce that the Board has on 7 April 2016 ("Price-fixing Date") fixed the issue price for the third tranche of the Proposed Private Placement comprising 1,997,283 Placement Shares at RM0.560 per Placement Share ("Issue Price").

The Issue Price represents a discount of approximately RM0.062 or 9.97% to the five (5)-day volume weighted average market price of the Pentamaster Shares up to and including 6 April 2016, being the last market day immediately preceding the Price-fixing Date of RM 0.622 per Pentamaster Share.

This announcement is dated 7 April 2016. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 15-4-2016 12:41 AM

|

显示全部楼层

发表于 15-4-2016 12:41 AM

|

显示全部楼层

| PENTAMASTER CORPORATION BERHAD |

| 1. Details of Corporate Proposal | Involve issuance of new type/class of securities ? | No | Types of corporate proposal | Private Placement | Details of corporate proposal | PROPOSED PRIVATE PLACEMENT OF UP TO 10% OF THE ISSUED AND PAID-UP SHARE CAPITAL OF PENTAMASTER ("PLACEMENT SHARES"), TO THIRD PARTY INVESTOR(S) TO BE IDENTIFIED AND AT AN ISSUE PRICE TO BE DETERMINED LATER | No. of shares issued under this corporate proposal | 1,997,283 | Issue price per share ($$) | Malaysian Ringgit (MYR) 0.5600 | Par Value ($$) | Malaysian Ringgit (MYR) 0.500 | | Latest issued and paid up share capital after the above corporate proposal in the following | Units | 144,567,333 | Currency | Malaysian Ringgit (MYR) 72,283,666.500 | Listing Date | 15 Apr 2016 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 19-4-2016 02:04 AM

|

显示全部楼层

发表于 19-4-2016 02:04 AM

|

显示全部楼层

Type | Announcement | Subject | NEW ISSUE OF SECURITIES (CHAPTER 6 OF LISTING REQUIREMENTS)

FUND RAISING | Description | PENTAMASTER CORPORATION BERHAD ("PENTAMASTER" OR "COMPANY")PROPOSED PRIVATE PLACEMENT OF UP TO 10% OF THE ISSUED AND PAID-UP SHARE CAPITAL OF PENTAMASTER, TO THIRD PARTY INVESTOR(S) TO BE IDENTIFIED AND AT AN ISSUE PRICE TO BE DETERMINED LATER | We refer to the announcements made on 9 September 2015, 15 September 2015, 8 October 2015, 29 December 2015, 21 March 2016, 23 March 2016 and 7 April 2016 in relation to the Proposed Private Placement ("Announcements"). Unless otherwise defined, the definitions set out in the Announcements shall apply herein.

On behalf of the Board of Pentamaster, Affin Hwang IB wishes to announce that the Board has on 18 April 2016 ("Price-fixing Date") fixed the issue price for the fourth tranche of the Proposed Private Placement comprising 2,000,000 Placement Shares at RM0.555 per Placement Share ("Issue Price").

The Issue Price represents a discount of approximately RM0.0615 or 9.98% to the five (5)-day volume weighted average market price of the Pentamaster Shares up to and including 15 April 2016, being the last market day immediately preceding the Price-fixing Date of RM 0.6165 per Pentamaster Share.

This announcement is dated 18 April 2016. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 21-4-2016 11:29 PM

|

显示全部楼层

发表于 21-4-2016 11:29 PM

|

显示全部楼层

本帖最后由 icy97 于 21-4-2016 11:51 PM 编辑

| 7160 | | Quarterly rpt on consolidated results for the financial period ended 31/03/2016 | | Quarter: | 1st Quarter | | Financial Year End: | 31/12/2016 | | Report Status: | Unaudited | | Submitted By: |

|

|

| Current Year Quarter | Preceding Year Corresponding Quarter | Current Year to Date | Preceding Year Corresponding Period |

| 31/03/2016 | 31/03/2015 | 31/03/2016 | 31/03/2015 |

| RM '000 | RM '000 | RM '000 | RM '000 | | 1 | Revenue | 28,599 | 19,351 | 28,599 | 19,351 | | 2 | Profit/Loss Before Tax | 4,238 | 1,424 | 4,238 | 1,424 | | 3 | Profit/Loss After Tax and Minority Interest | 3,169 | 1,751 | 3,169 | 1,751 | | 4 | Net Profit/Loss For The Period | 3,402 | 1,423 | 3,402 | 1,423 | | 5 | Basic Earnings/Loss Per Shares (sen) | 2.31 | 1.31 | 2.31 | 1.31 | | 6 | Dividend Per Share (sen) | 0.00 | 0.00 | 0.00 | 0.00 |

|

|

| As At End of Current Quarter | As At Preceding Financial Year End | | 7 | Net Assets Per Share (RM) |

|

| 0.5759 | 0.5540 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 26-4-2016 02:30 AM

|

显示全部楼层

发表于 26-4-2016 02:30 AM

|

显示全部楼层

| PENTAMASTER CORPORATION BERHAD |

| 1. Details of Corporate Proposal | Involve issuance of new type/class of securities ? | No | Types of corporate proposal | Private Placement | Details of corporate proposal | PROPOSED PRIVATE PLACEMENT OF UP TO 10% OF THE ISSUED AND PAID-UP SHARE CAPITAL OF PENTAMASTER ("PLACEMENT SHARES"), TO THIRD PARTY INVESTOR(S) TO BE IDENTIFIED AND AT AN ISSUE PRICE TO BE DETERMINED LATER | No. of shares issued under this corporate proposal | 2,000,000 | Issue price per share ($$) | Malaysian Ringgit (MYR) 0.5550 | Par Value ($$) | Malaysian Ringgit (MYR) 0.500 | | Latest issued and paid up share capital after the above corporate proposal in the following | Units | 146,567,333 | Currency | Malaysian Ringgit (MYR) 73,283,666.500 | Listing Date | 26 Apr 2016 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 14-7-2016 10:43 AM

|

显示全部楼层

发表于 14-7-2016 10:43 AM

|

显示全部楼层

已經0.90了,可能今天會破0.90..

|

|

|

|

|

|

|

|

|

|

|

|

发表于 15-7-2016 09:17 AM

|

显示全部楼层

发表于 15-7-2016 09:17 AM

|

显示全部楼层

本帖最后由 icy97 于 15-7-2016 11:59 PM 编辑

PENTA 乘胜追击

Thursday, July 14, 2016

http://bblifediary.blogspot.my/2016/07/penta.html

业务

- 自动化设备器材(automated equipment)

- 自动化生产解决方案(automated manufacturing solutions)

PENTA(腾达科技,7160,主板科技股),成立于2002年2月26日,并于2003年7月23日上市大马交易所第二板,之后转至主板。

PENTA有两大核心业务,分别是设计和生产自动化设备器材(automated equipment)和自动化生产解决方案(automated manufacturing solutions),这些设备主要提供给半导体领域。

半导体领域目前占了PENTA总营业额的最大比重。

由于该领域的周期性明显, 而且竞争剧烈,因此为了缓冲半导体市场波动所带来的冲击, 该公司也积极探讨及开拓新产品, 如家居智能解决方案系统。

除了开发新产品,该公司也积极开发新市场,如汽车、药剂、医药、饮食、消费电子等。

在需求的增加,以及公司积极开法新产品和新市场下,终于看到了一些成果。

从公司过去几个季度的业绩来看,似乎每季净利已经可以保持在300万令吉。

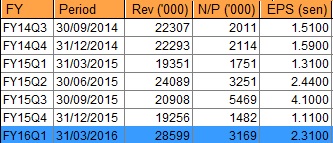

| 注:FY15Q3有一笔260万的一次性商誉收入,实际收入是286万令吉。 |

再来看其年度业绩:

PENTA自2013年转亏为盈后,其营业额和净利已经连续两年走高。

2015年财政年来到了最高峰,创下1195万令吉。在扣除了一笔260万的一次性商誉收入后,实际收入依然有935万令吉,仍然比2014年财政年(465万令吉)高出一倍。

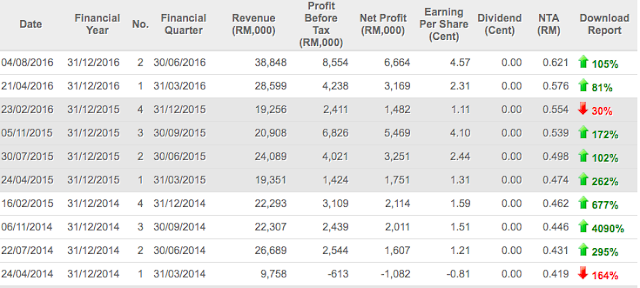

2016年首季,公司单季业绩依旧非常出色,营业额和净利分别达到2860万令吉和317万令吉净利。

如果公司接下来3个季度的净利都可维持在300万令吉或更高,那么2016年的全年的净利将会突破1267万令吉,肯定更胜2015年财政年。

相信在公司会乘胜追击,在积极争取大订单之下,这一个愿景将可以实现。

假设PENTA全年净利真的可以达到1267万令吉,那么其每股净利将有9.2仙。

此外,根据PENTA以往的业绩来看,其第二和第三季业绩通常会比第一季来得更好。

而我个人预测,PENTA的全年每股净利应该可达到13仙左右。再给予它10倍本益比的估值,那么其股价有望去到RM1.30。

免责声明:

以上投资分析,纯属本人个人意见和观点。

在买进一家公司的股份前,请先做功课并了解该公司,任何人因看此文章而造成任何投资损失,本人恕不负责。切记,买卖自负!

|

|

|

|

|

|

|

|

|

|

|

|

发表于 4-8-2016 09:45 PM

|

显示全部楼层

发表于 4-8-2016 09:45 PM

|

显示全部楼层

本帖最后由 icy97 于 6-8-2016 02:19 AM 编辑

腾达科技次季净利翻倍

2016年8月6日

http://www.enanyang.my/news/20160806/腾达科技次季净利翻倍/

(吉隆坡5日讯)受到营业额激励,加上更好的产品组合,腾达科技(PENTA,7160,主板科技股)截至6月底次季,净利大涨1倍多,录得666万4000令吉,上财年同期为325万1000令吉。

该公司向马交所报备,机械化器材和机械化制造方案,2大业务的销售额增长,推高营业额涨幅,达61.27%,报3884万8000令吉,上财年同期为2408万9000令吉。

该公司补充,智能监控系统的贡献也激励营业额表现。

累积首半年,腾达科技净利涨近1倍,报983万3000令吉;营业额涨幅达55.3%,录得6744万7000令吉。

基于现有订单,该公司乐观看待今年下半年的前景。

排除外围和宏观经济因素,腾达科技相信今年表现将持续正面增长。

7160

| | Quarterly rpt on consolidated results for the financial period ended 30/06/2016 | | Quarter: | 2nd Quarter | | Financial Year End: | 31/12/2016 | | Report Status: | Unaudited | | Submitted By: |

|

|

| Current Year Quarter | Preceding Year Corresponding Quarter | Current Year to Date | Preceding Year Corresponding Period |

| 30/06/2016 | 30/06/2015 | 30/06/2016 | 30/06/2015 |

| RM '000 | RM '000 | RM '000 | RM '000 | | 1 | Revenue | 38,848 | 24,089 | 67,447 | 43,440 | | 2 | Profit/Loss Before Tax | 8,554 | 4,021 | 12,792 | 5,445 | | 3 | Profit/Loss After Tax and Minority Interest | 6,664 | 3,251 | 9,833 | 5,002 | | 4 | Net Profit/Loss For The Period | 7,245 | 3,159 | 10,647 | 4,582 | | 5 | Basic Earnings/Loss Per Shares (sen) | 4.57 | 2.44 | 6.94 | 3.75 | | 6 | Dividend Per Share (sen) | 0.00 | 0.00 | 0.00 | 0.00 |

|

|

| As At End of Current Quarter | As At Preceding Financial Year End | | 7 | Net Assets Per Share (RM) |

|

| 0.6209 | 0.5540 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 5-8-2016 03:59 PM

|

显示全部楼层

发表于 5-8-2016 03:59 PM

|

显示全部楼层

本帖最后由 icy97 于 5-8-2016 04:42 PM 编辑

PENTA 业绩检讨

Friday, August 5, 2016

http://bblifediary.blogspot.my/2016/08/penta.html

PENTA终于在昨天公布了第二季业绩。

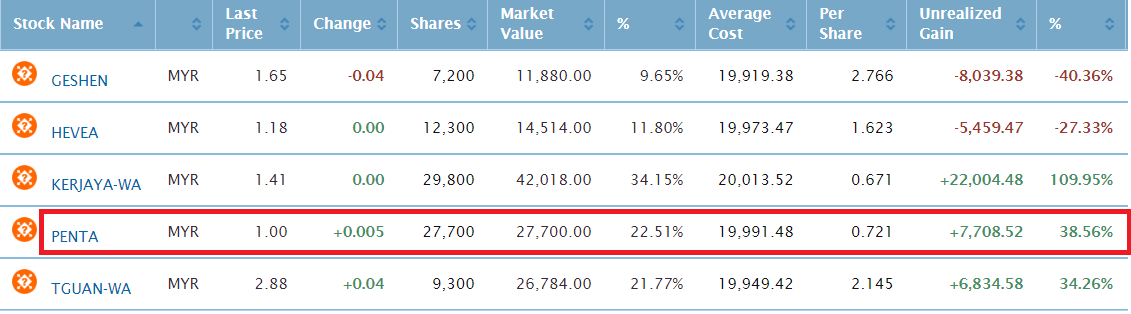

单季营业额达到3885万令吉,净利666万令吉。 半年营业额6745万令吉,净利983万令吉。 再来看看其营业额和净利的YoY和QoQ对比:

营业额:YoY 增加61.27%,QoQ 增加35.84% 净利:YoY 增加104.98%,QoQ 增加110.29% 从营业额到净利,不管是去年同期还是上一季作比较都全面提升。 而做出最多营业额和净利贡献的,依然是两个核心业务:

- Automated Equipment(自动化设备器材)

- Automated Manufacturing Solution(自动化生产解决方案)

公司解释是应为销售增加而推高营业额,因此连带净利也跟着提高。

截至2016年6月30日,公司手握2596万令吉现金,而银行借贷只有区区53万令吉,拥有2543万净现金,相当于每股17仙。

假设PENTA在未来几个季度的每股净利都可以达到4.57仙或更高,以10倍本益比来估值,再加上其每股17仙的净现金,个人认为PENTA的合理价应该在RM1.99。

RM1.99是它未来有可能的估值,前提是其EPS必须维持下去。

但是考虑到EPS或许无法一直维持在4.57仙,以首半年的业绩表现来估值,那么现在的估值也应该有RM1.54。

免责声明:

以上投资分析,纯属本人个人意见和观点。

在买进一家公司的股份前,请先做功课并了解该公司,任何人因看此文章而造成任何投资损失,本人恕不负责。切记,买卖自负!

|

|

|

|

|

|

|

|

|

|

|

|

发表于 5-8-2016 11:02 PM

|

显示全部楼层

发表于 5-8-2016 11:02 PM

|

显示全部楼层

本帖最后由 icy97 于 6-8-2016 12:35 AM 编辑

个股追踪 Pentamaster (7160)

符合市场预期,季度报告亮眼,好戏才刚开始吗?

现在PE=8.69

如果接下来两个季度EPS可以维持3cent,用PE=10来计算,应该还有30%的上涨空间。耐心等待回调!

|

|

|

|

|

|

|

|

|

|

|

|

发表于 7-8-2016 03:14 PM

|

显示全部楼层

发表于 7-8-2016 03:14 PM

|

显示全部楼层

本帖最后由 icy97 于 7-8-2016 08:01 PM 编辑

腾达科技 PENTAMASTER – 分享投资过程

Author: RicheHo | Publish date: Sat, 6 Aug 2016, 10:53 PM

http://klse.i3investor.com/blogs/rhinvest/101572.jsp

腾达科技 PENTAMASTER – 分享投资过程

PENTA是一家在槟城的投资控股公司,主要提供综合创新服务,包括自动化和半自动化生产机械和配备、设计和生产精密机械部件,以及设计、装配和安装电脑化的系统和设备。简短来说,他提供先进的科技方案与服务,以协助客户在各自的工业领域精益求精、应付生产挑战及维持竞争力。

早在2013-2014年,PENTA非常依赖于电子和半导体领域,当时这领域的贡献是60-70%。因此,这领域的淡季将直接影响PENTA所供应的测试处理设备和自动化设备的需求。基于半导体领域过于波动,PENTA在2015年采取了多元化策略至具有抗跌力的手套、医疗器材、流动设备、汽车和LED领域,并逐渐减少对半导体业务的依赖。

在2015年3月,PENTA在BATU KAWAN工业区以RM5.02m,购买了一块面积达3.23英亩的土地。根据PENTA的通告,由于生产活动增加,公司需要更大的空间作为产品组装与测试地点。目前,PENTA的建筑工程依然还没完成。一旦完成后,PENTA预计在未来几年,会100%全面提升产能!这对于PENTA的股东来说是值得兴奋的。

在2015年7月,为了改善业务表现,PENTA脱售了旗下2家子公司,【PENTAMASTER ENGINEERING】 和【PENTAMASTER SOLUTIONS】。当时,这2家公司已经连续亏损了好几年,并直接拖累PENTA的财务表现。这2家公司在FY14的总合亏损高达RM3.24m!因此,脱售完成后,PENTA在接下来的业绩全面提升。

在2015年9月,PENTA以RM5.78m收购了【ORIGO VENTURES】100%的股权。这家公司是主要涉及产业管理,并拥有超过14年经验。当时,PENTA主要是想借【ORIGO】的产业管理管道,进军智能家居和建筑物方案市场。简短来说,这个智能家居科技可以让一家人更舒服的过生活。他们只需要一部智能手机在手,就能遥控家里的电视、保安系统、音响、冷气等等。此外,【ORIGO】当时手上还握有RM3m的订单。因此,笔者认为这业务非常有庞大潜能,收购肯定会对PENTA有利无弊。

日前,PENTA FY16Q2的业绩已经出炉了。PENTA的盈利相比去年同个季度和上个季度双双进步了超过100%! 它的3个业务自收购【ORIGO】以来,终于同步做出了正面的贡献。管理层也在季度报告里提到,对目前的市场和手上的订单保持乐观,有信心在今年继续稳定成长。从估值方面,目前PENTA的每股净利是12 cent。因此,以10倍PE推算,PENTA的潜在价值是每股RM1.20,依然还有20%上涨空间。值得一提的是,在未来当PENTA的BATU KAWAN新扩建设施完成后,它的产能将逐渐提升,业绩也预计会继续成长。

在2008全球陷入金融危机时,很多跨国公司撤出槟城,导致很多本地供应商受打击,一些甚至倒闭。PENTA也是受害者之一。当时,它在2008、2009、2010和2012年蒙受亏损,直到2014年业绩才开始稳定下来,持续赚钱。因此,PENTA在过去所打下的基础和积极改善业务,一步步走到现在确实不易。

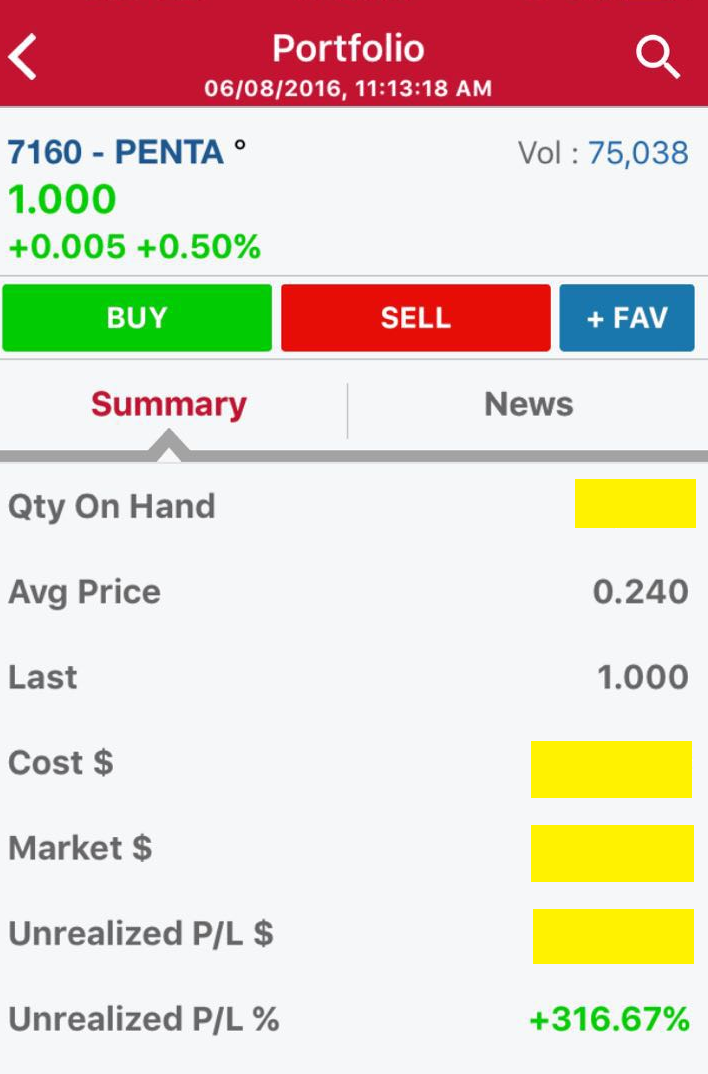

抓了2年,现在终于见证了基本面价值投资的稳定和成绩,于是想借此向大家分享拥有这个股的心路旅程和了解。

在股市里最幸福的事,莫过于陪股票一起成长。你,赞同吗?

纯属分享!

这支股票也出现在我2016年STOCK PICK CHALLENGE 组合里。

|

|

|

|

|

|

|

|

|

|

|

|

发表于 8-8-2016 11:41 AM

|

显示全部楼层

发表于 8-8-2016 11:41 AM

|

显示全部楼层

本帖最后由 icy97 于 9-8-2016 12:23 AM 编辑

Stock With Momentum: Pentamaster Corp

By Asia Analytica / The Edge Financial Daily | August 8, 2016 : 10:38 AM MYT

http://www.theedgemarkets.com/my/article/stock-momentum-pentamaster-corp

This article first appeared in The Edge Financial Daily, on August 8, 2016.

Pentamaster Corp Bhd (-ve)

SHARES in Pentamaster Corp Bhd (fundamental: 3/3, valuation: 1.5/3) triggered our momentum algorithm last Friday as its share price gained by a half sen or 0.5% to RM1, after 7.5 million shares changed hands. At the current price, Pentamaster has a market capitalisation of RM146.57 million.Last Thursday, Pentamaster announced its net profit doubled to RM6.66 million in the second quarter ended June 30, 2016, from RM3.25 million a year ago, on higher revenue and better product mix.

The Penang-based automation solutions and service provider’s revenue surged 61.2% to RM38.85 million from RM24.09 million.

The higher revenue was mainly due to higher sales from both its automated equipment and automated manufacturing solution operating segments, and contribution from its smart control solution system. In the six months ended Dec 31, 2016 (1HFY16), net profit jumped 96.6% to RM9.83 million from RM5 million in 1HFY15, as revenue gained 55.3% to RM67.45 million from RM43.44 million. The group has a positive view of the market in 2HFY16 based on the current order book at hand. |

|

|

|

|

|

|

|

|

|

|

|

发表于 17-8-2016 01:27 AM

|

显示全部楼层

发表于 17-8-2016 01:27 AM

|

显示全部楼层

本帖最后由 icy97 于 17-8-2016 01:31 AM 编辑

HOW MUCH PENTA ACTUALLY WORTHS???

Tuesday, 16 August 2016

The latest quarter report had been significantly improved over the past few years.

The fair value of Penta worths at least RM 1.30. WHY?

1) The latest quarter reports of Penta made a really explosive result and it can be considered the best quarter result for the past 10 years.

2) Automated Equipment), some people might be still thinking what are Automated Equipment, Automated manufacturing Solution, and Smart Control Solution System?

Automated Equipment is a kind of control system that normally used in the operating system such as machinery, processes in factories, boiler, heat treating oven,steering and stabilization of ships and other applications with minimal of human intervention.

Automated manufacturing solution refers to the manufacturing production can be produced without much human intervention.

Smart Control Solution System refers to the manufacturing process or any pieces of equipment u can even control it by using your devices such as a smartphone,computer and so on.

3) Automated Equipment segment recorded increase about RM 9.0 million due to higher demand for the semiconductor market. we expect to see more revenue generate from the same segment.

4) Automated manufacturing solution made 2.0 million higher than the previous corresponding quarter as the demand from the customer had significantly increased.

5) In Smart Control Solution system, Penta had achieved a total revenue of 3.5 million from this segment.

6) The company has a very strong positive prospect for the company in the next second half year which will continue the improve its performance based on the current order book in hand.

7) Penta holds Net Cash of around RM25 million in hand.

8) Revenue doubles up more than 100% compared to the previous corresponding quarter report.

9) Short-term bank borrowing is only RM 530k

10) From all the current information, we believe that Penta will continue to achieve a better result due to the high demand for the new segment and current book order.

Lastly, RM 1.30 is only a fair price for Penta when PE ratio reaches 10.

I personally would give RM 1.70 as I strongly believe that Penta will be one of the shining stars in the coming years.

GOOD LUCK AND HAPPY TRADING

*All the information above is just for reference only, trade at your own risk.

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|